Aug 7

/

Lívea Coda

Sugar and Ethanol Weekly Report - 2023 08 07

Back to main blog page

"Prices might finally correct after the market reaches a consensus that Brazil does have plentiful cane. Given 23/24 realized figures so far, our model points out to 616Mt of cane. Considering expected weather improvement, TRS might also be higher than previously anticipated, at 139.5kg/t. Having an addition 2Mt availability, CS contributes directly to smoothing trade flows."

Brazilian CS crop revision

- Fields look beautiful and plentiful, Unica’s latest reports have confirmed an extremely positive trend. Not only do yields look good, but TRS has improved compared to previously expected, especially given the drying up of some weather forecast models.

- Our models suggest that TCH should end the season at 81.3 t/ha. With a 1.3% increase in area, it would be possible to crush 616.4Mt of cane. We also revised our TRS up from 137.7 to 139.5kg/t, which, combined with a 48% sugar mix leads us to 39.4Mt of sugar – nearly 2Mt improvement in availability.

- Prices might finally correct as Brazil is, once again, nearly bearing Northern Hemisphere availability reduction on its own.

- It remains essential to monitor rains and crop development in other countries such as India and Thailand to understand the complete picture, however, the sugar market seems to be breathing a little more easily.

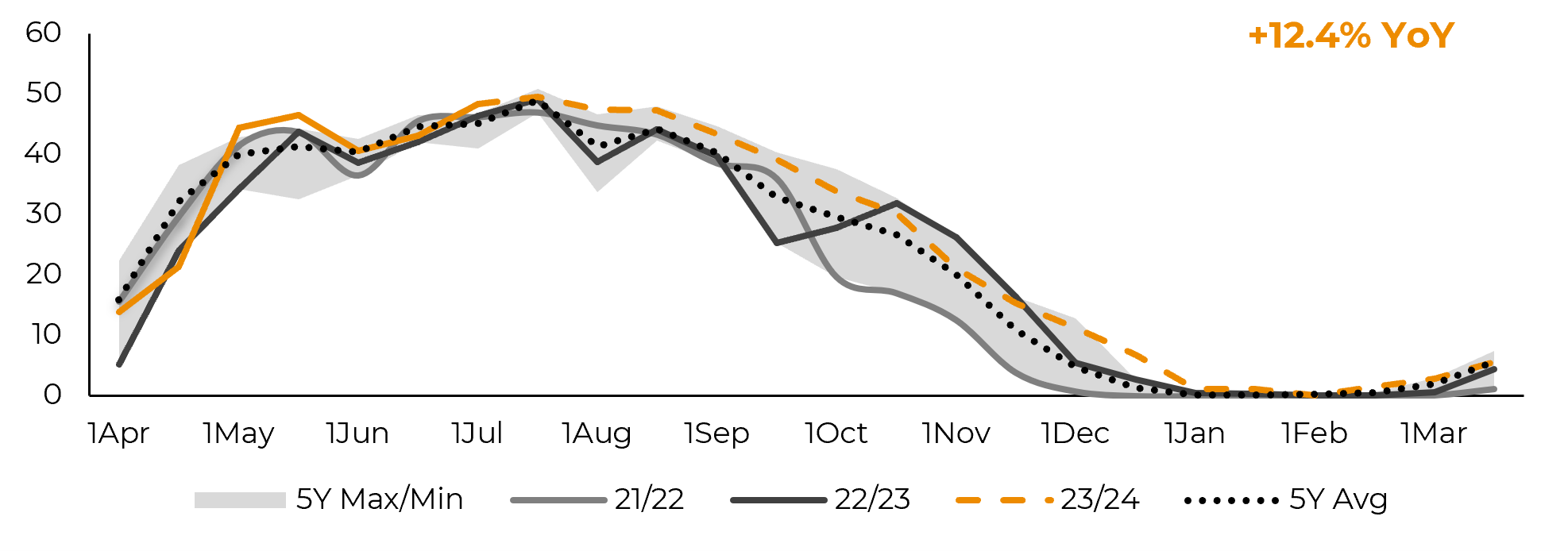

It seems to be a consensus that Brazil’s Center South (CS) does have more cane than previously anticipated. Unica’s latest reports confirmed this trend: crushing has already recovered more than 10% compared to last season.

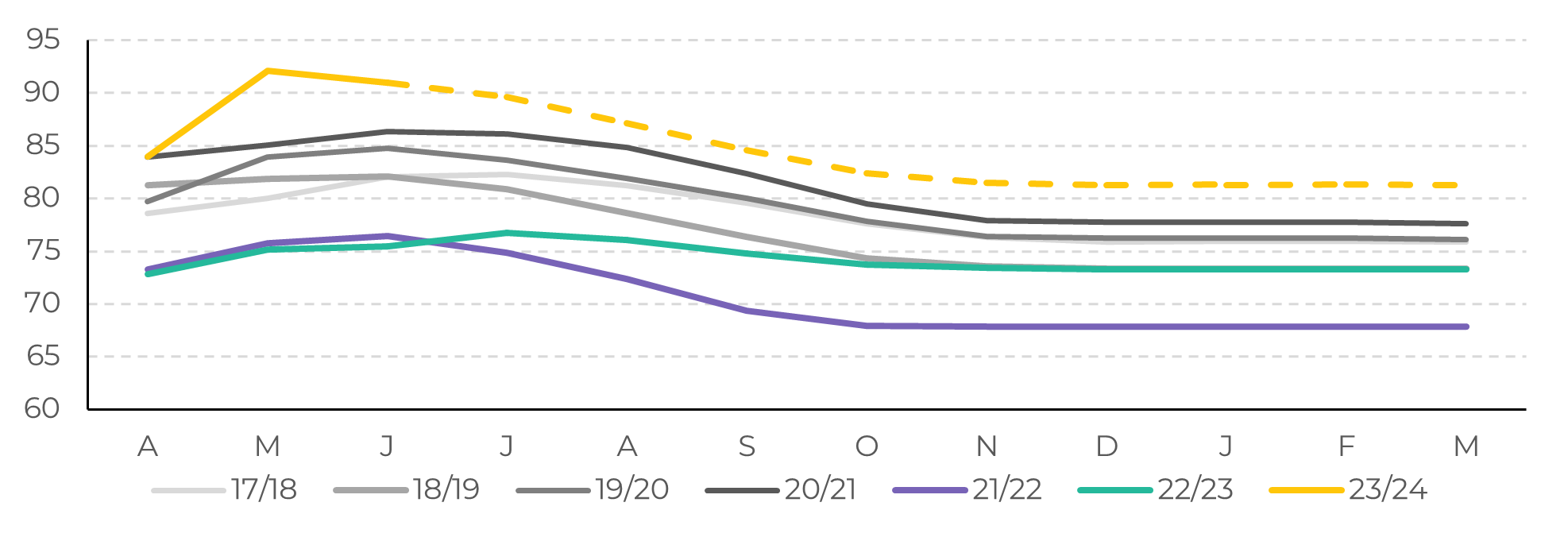

The fields look beautiful and plentiful! Cane yields have reached unprecedently high figures in May and have corrected little during June, remaining at 91 t/ha. Of course, one should consider that there is a higher participation of younger cane, as pointed out by Unica, being possible to maintain a more moderate gain over the next few months.

Not only that, but the rains forecast have dried up for August’s, meaning that the region might not face as much trouble as previously anticipated, at least during the first fortnight. The prospects of average precipitation leaves us with a bit more optimism regarding TRS.

Therefore, it becomes essential to re-evaluate our numbers. Our models suggest that TCH should end the season at 81.3 t/ha. With a 1.3% increase in area, it would be possible to crush 616.4Mt of cane.

Image 1: Cane Yield Estimates (t/ha)

Source: UNICA (Cana Zoom); hEDGEpoint

Image 2: Brazilian CS Crushing per Fortnight

Source: UNICA; hEDGEpoint

Although market is discussing 620Mt+, we believe that in order to reach that number everything needs to go well/perfect – and we always choose to remain rather conservative. Having average rains, which means higher precipitation than in the previous 3-4 years, mills might still face some difficulties in keeping the rapid pace up.

In terms of TRS, we also revised it up to 139.5 kg/t. Although mills are going fast and there has been some flowering, the weather has contributed to recent results and is expected to remain doing so in the coming months. Therefore, our previous 137.7 kg/t became outdated. The only unchanged figure remains the sugar mix, at 48%.

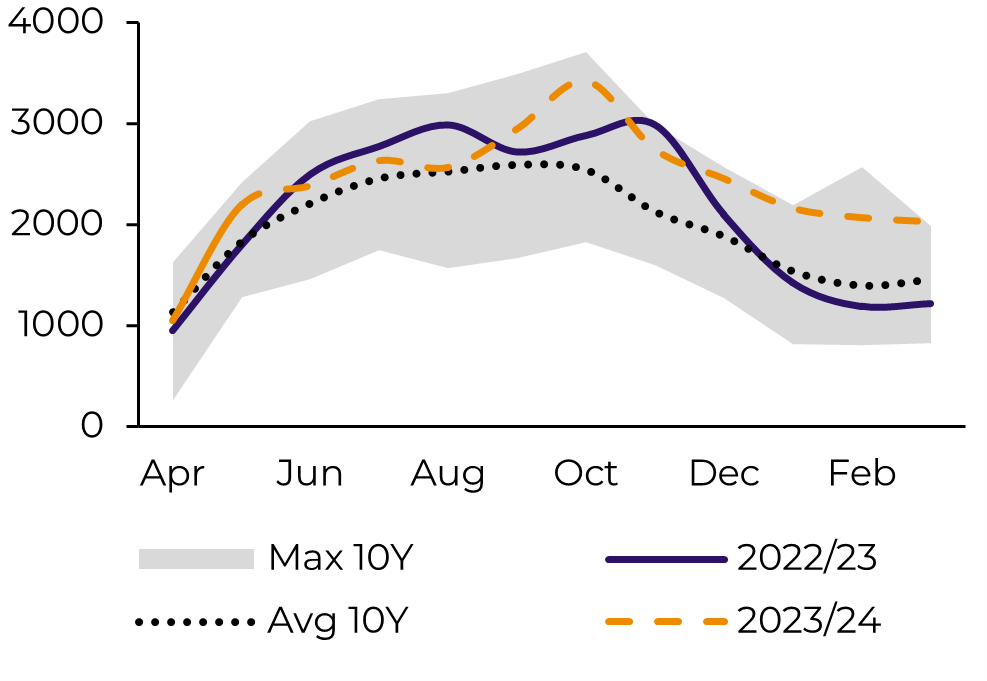

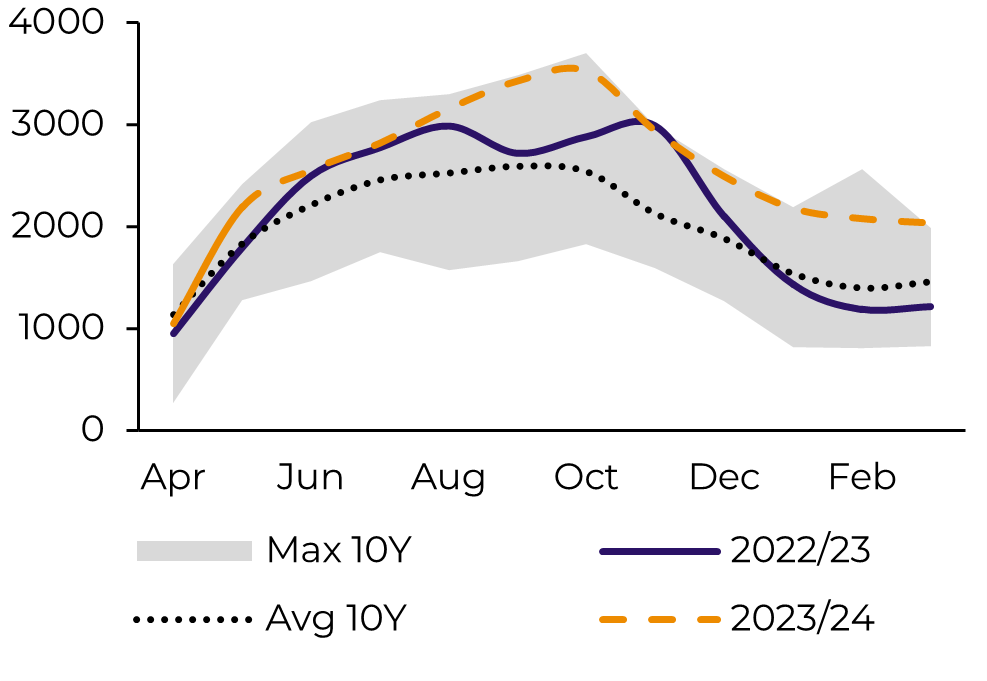

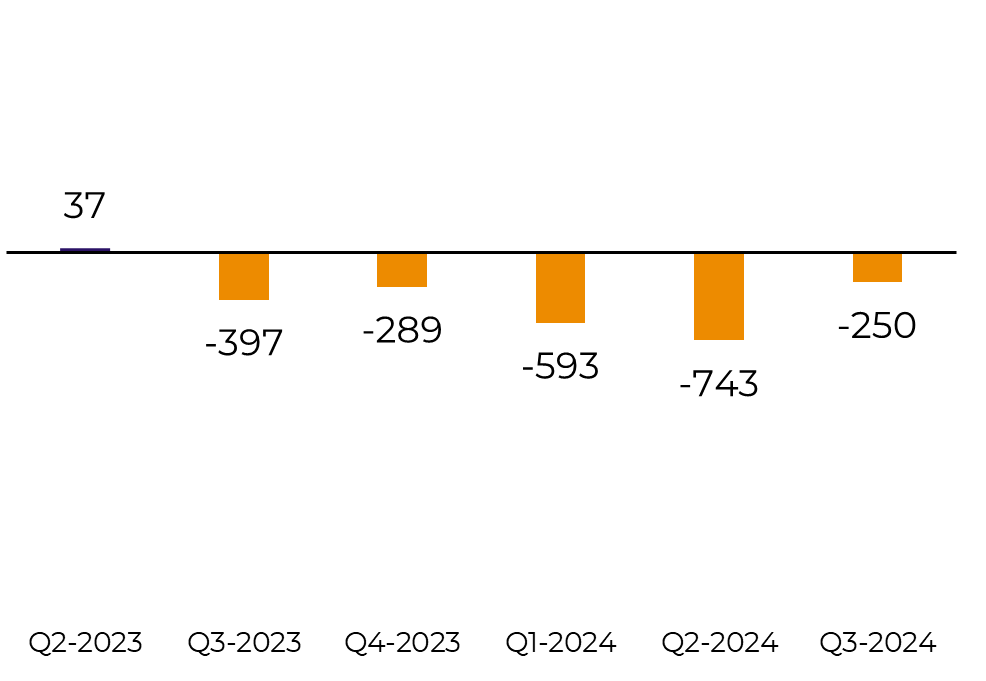

Adding all the changes up our sugar production for 23/24 increased by nearly 2Mt, from 37.6 to 39.4Mt. This addition was diverted to exports directly, increasing availability drastically in Q3/23 and Q4/23 and smoothing Northern Hemisphere’s reduction in Q1/24.

Image 3: CS Export Seasonality Before Update (‘000t)

Source: SECEX, Williams, UNICA, hEDGEpoint

Image 4: CS Export Seasonality AfterUpdate (‘000t)

Source: SECEX, Williams, UNICA, hEDGEpoint

Note that, as our first glance at 24/25 CS sugar production is highly dependent on 23/24 expectations, the recent update also pushed next year’s production up, contributing to higher availability during the rest of 2024.

Ethanol remains struggling at a lost battle, and although we revised our Otto Cycle growth up to 5.5%, biofuel participation remains reduced compared to previous years. Hydrous sales are still lagging behind average and previous year’s results, while anhydrous benefits from higher gasoline consumption.

Ethanol remains struggling at a lost battle, and although we revised our Otto Cycle growth up to 5.5%, biofuel participation remains reduced compared to previous years. Hydrous sales are still lagging behind average and previous year’s results, while anhydrous benefits from higher gasoline consumption.

In the end, the market is already debating higher cane figures from Brazil, and evidence points towards that end. Once again, Brazil might be the bearish driver for prices, as it is nearly bearing Northern Hemisphere availability reduction on its own.

Image 5: Trade Flows Before Brazil’s Update (‘000t)

Source: hEDGEpoint, Green Pool

Image 6: Trade Flows After Brazil’s Update (‘000t)

Source: hEDGEpoint, Green Pool

In Summary

Prices might finally correct after the market reaches a consensus that Brazil does have plentiful cane. Given 23/24 realized figures so far, our model points out to 616Mt of cane. Considering expected weather improvement, TRS might also be higher than previously anticipated, at 139.5kg/t. Having an addition 2Mt availability, CS contributes directly to smoothing trade flows.

Weekly Report — Sugar

Written by Lívea Coda

livea.coda@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Reviewed by Victor Arduin

victor.ardoin@hedgepointglobal.com

victor.ardoin@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.