Grinding results for 2025 first quarter were stronger than expected

- The rising price of cocoa has already affected the global chocolate sector, directly impacting the cost of production and the financial results of the main cocoa processing industries.

- Indicators show significant increases in the prices of cocoa-based products in Europe, the US, and Brazil, contributing to the expectation of reduced demand for cocoa, intensified after President Donald Trump's “Liberation Day”.

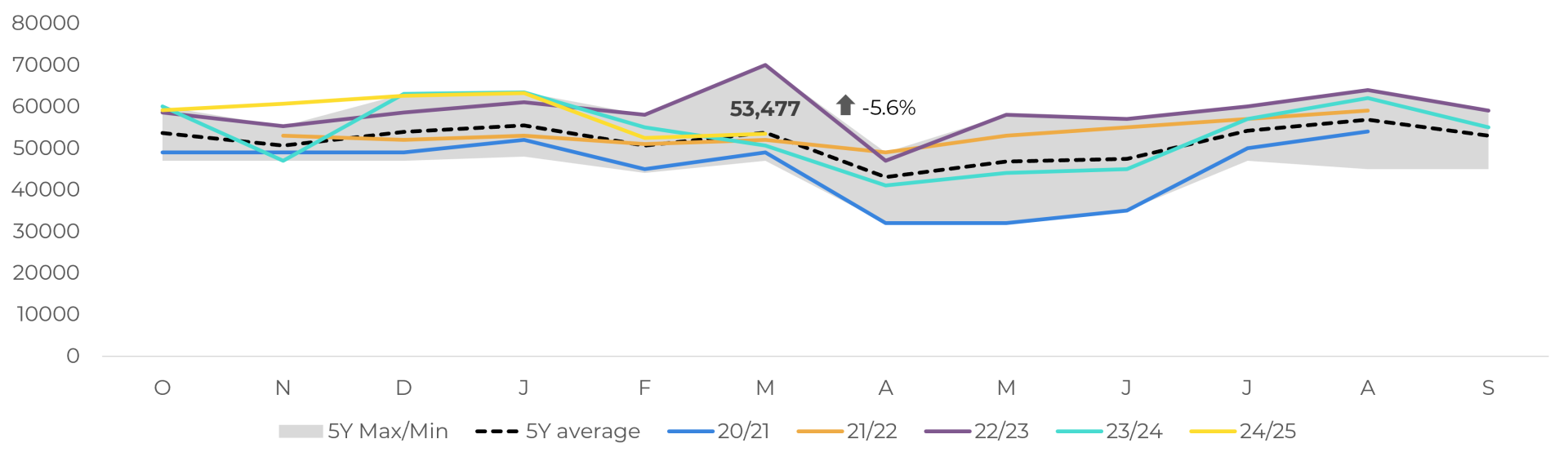

- However, the grinding results for the first quarter of 2025 were stronger than expected wich added to a 5.6% y/y increase in Ivory Coast's March grinding suggesting to the market a more resilient demand amid a challenging scenario.

- Despite the 90-day pause in reciprocal tariffs stipulated by the US, the trade war between the country and China could still have negative effects on global consumption.

- The market is monitoring the rainfall pattern in West Africa, which could influence the results of the intermediate crop and the start of the 25/26 crop in the Ivory Coast in the coming weeks.

Grinding results for 2025 first quarter were stronger than expected

The cocoa market has been very volatile in recent months. Commodity prices have reached historic highs due to the fall in Ivory Coast and Ghana production, the world's main producers of cocoa beans. The rise in the price of the raw material has already affected the global chocolate sector, with direct impacts on production costs and the financial results of the main cocoa processing industries, which have consequently passed on part of the increase in costs to the end consumer.

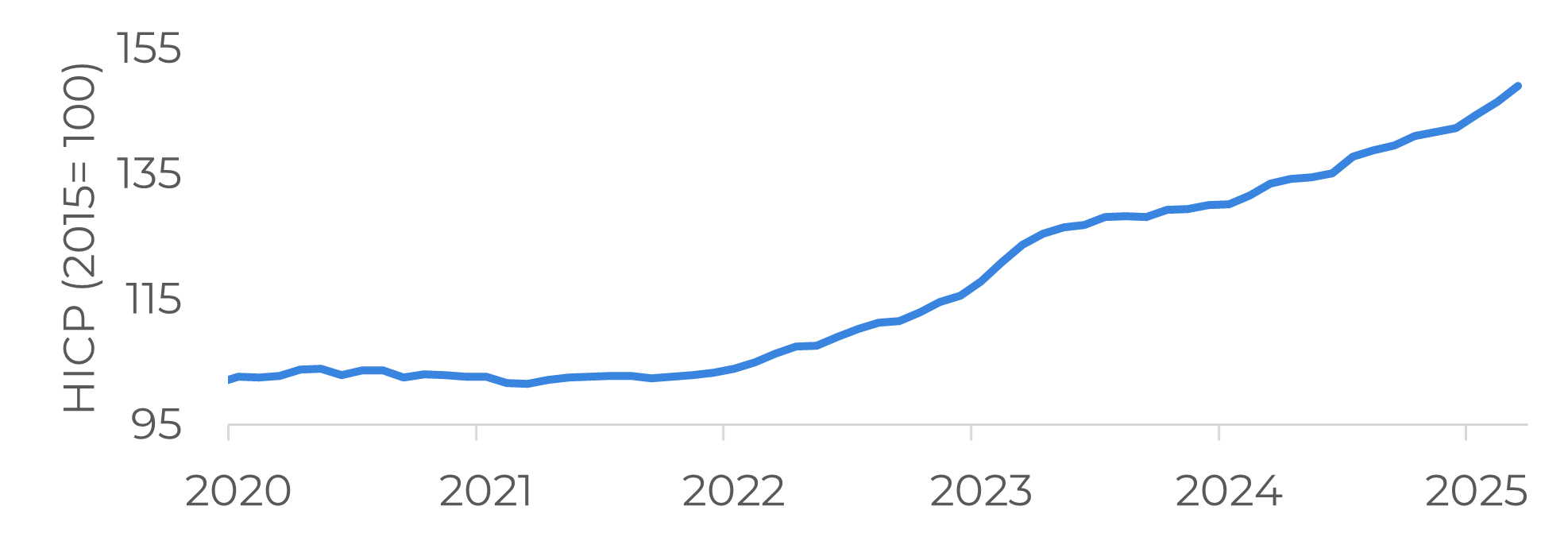

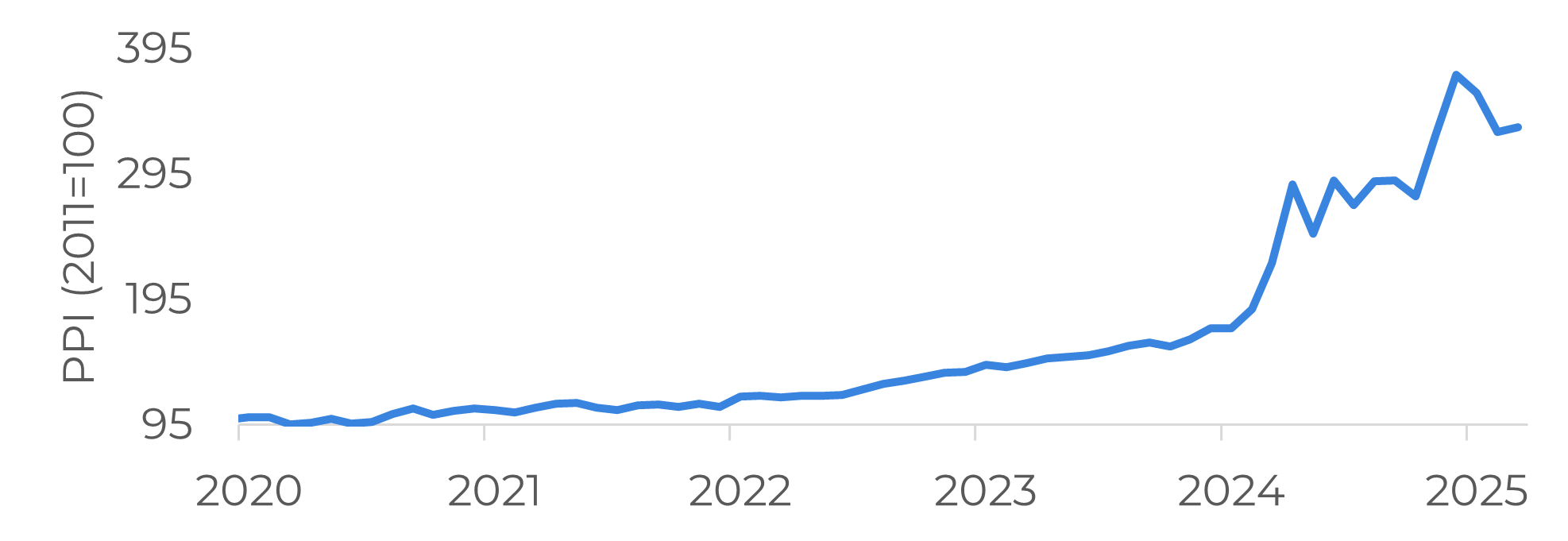

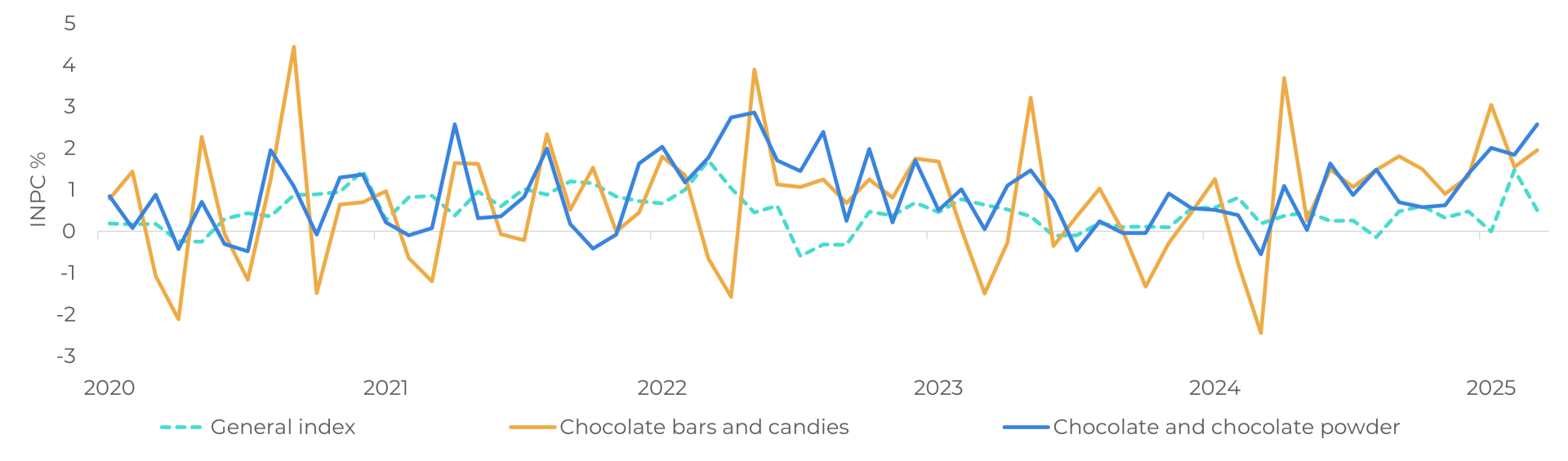

As a result, indicators such as the Harmonised Index of Consumer Prices (HICP) and the Producer Price Index by Industry (PPI), which indirectly reflect consumer prices, show significant increases in the prices of cocoa products in Europe and the US. In Brazil, chocolate became significantly more expensive in 2025. Products such as chocolate bars and cocoa powder presented a variation above the National Consumer Price Index (INPC).

Europe: Hamonised Index of Conumer Prices (HICP) for Cocoa and Powdered Chocolate

Source: Eurostat

US: Producer Price Index (PPI) for Chocolate and Confectionery Manufacturing

Source: Federal Reserve Economic Data

Brazil: National Consumer Price Index (INPC)

Source: IBGE

Therefore, a reduction in demand for cocoa was already expected by the market and was already a bearish factor in bean prices. This negative outlook was intensified after President Donald Trump's “Liberation Day”, where fears of a global recession and changes in trade flow due to tariffs applied to key markets weighed even more heavily on the expectation of a drop in demand, driving down commodity prices in the main markets.

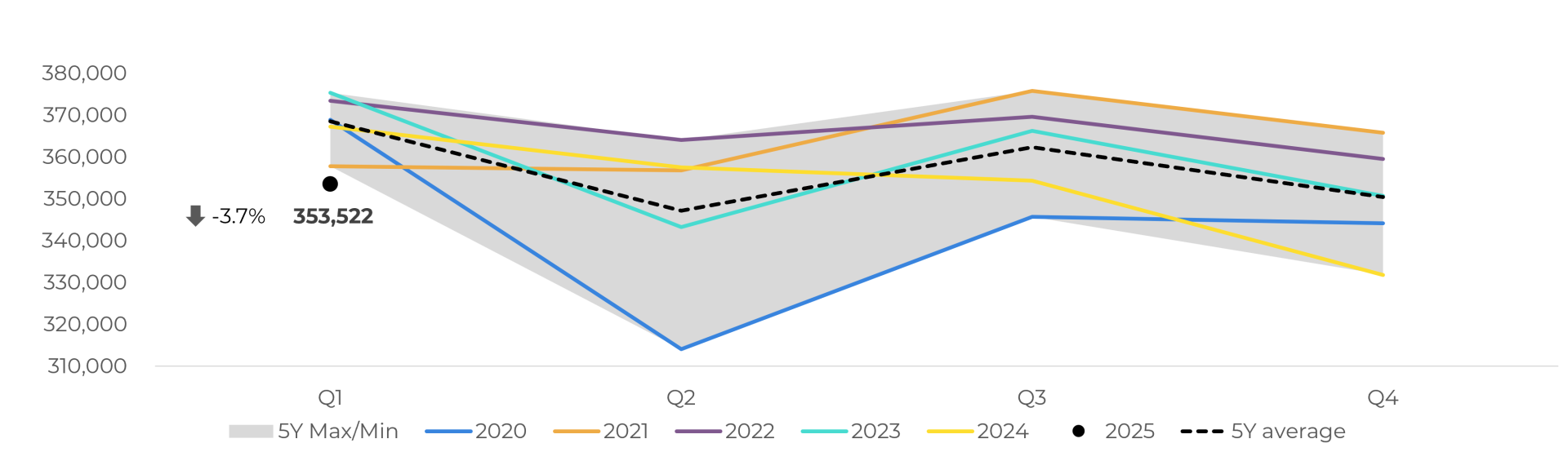

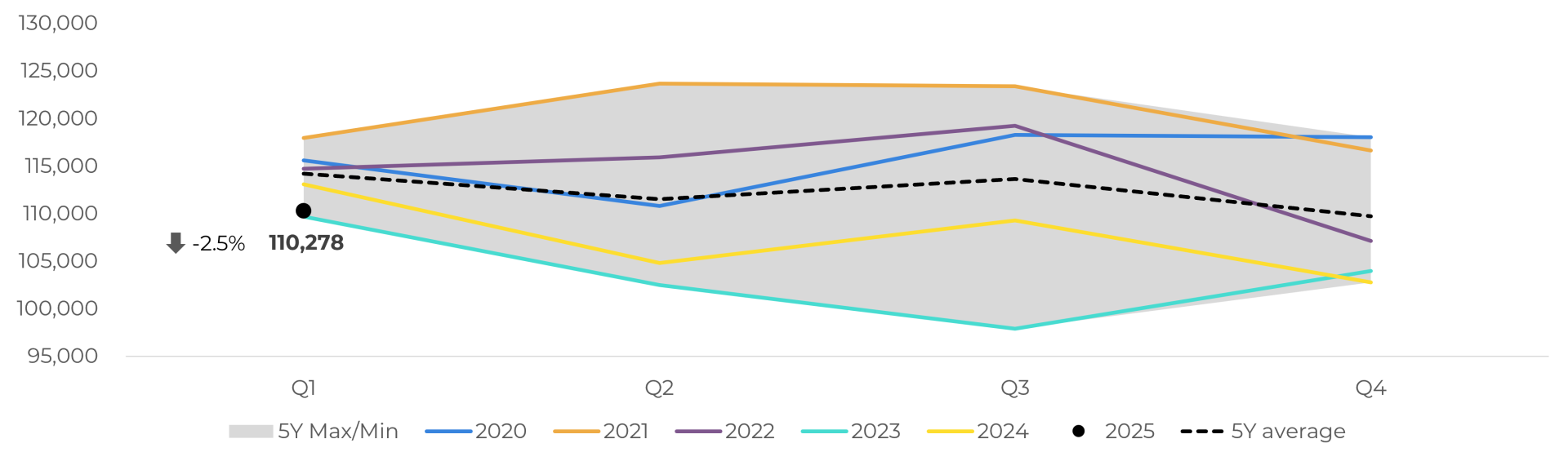

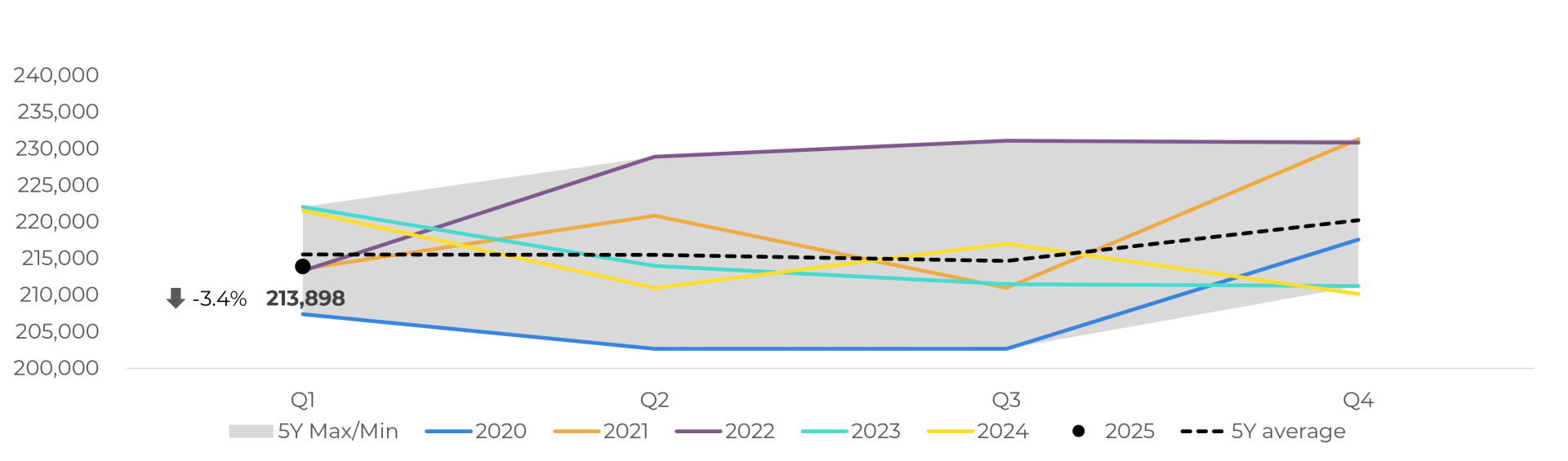

However, the recently released griding results were different from the market's expectations of a drop between 5% and 7%. At the end of last week, on the eve of the Easter holiday, which is traditionally the sweetest time of the year in countries like Brazil, where chocolate eggs are a popular tradition, the main cocoa processing industry associations released their grinding results, the main indicator indicator related to demand, for the first quarter of 2025. ECA, CAA, and NCA reported reductions of 3.7%, 3.4%, and 2.5% compared to the same period last year for Europe, Asia, and the US, respectively.

Cocoa grinding: Europe (mt)

Source: European Cocoa Association

Cocoa grinding: US (mt)

Source: National Confectioners Association

Cocoa grinding: Asia (mt)

Source: Cocoa Association of Asia

Ivory Coast Monthly Cocoa Grinds (mt)

Source: Hedgepoint, Refinitiv

The stronger-than-expected results, coupled with a 5.6% y/y increase in Ivory Coast's March grinding, suggested to the market a more resilient demand amid a challenging scenario. As a result, prices have recovered since the results were released, with July contracts closing last Tuesday up 4.8% in New York (USD 9,117/mt) and 6.4% in London (GBP 6,435/mt). However, the cocoa market remains volatile and ended Wednesday (24/04) down, showing that demand is still a monitoring point due to high prices.

Finally, despite the 90-day pause in reciprocal tariffs stipulated by the US, which also contributed to the price scenario described above, the trade war between the US and China could still have negative effects on global consumption. In addition, it's worth noting that the market is monitoring the rainfall pattern in West Africa, which in the coming weeks could influence the results of Ivory Coast's intermediate crop and the start of the 25/26 crop, reflecting on market prices.

In Summary

The rising price of cocoa has already affected the global chocolate sector, directly impacting the cost of production and the financial results of the main cocoa processing industries. Indicators show significant increases in the prices of cocoa-based products in Europe, the US, and Brazil, contributing to the expectation of reduced demand for cocoa, intensified after President Donald Trump's “Liberation Day”. However, the grinding results for the first quarter of 2025 released by the main processors' associations were stronger than expected, and coupled with a 5.6% y/y increase in Ivory Coast’s March grinding suggested to the market a more resilient demand amid a challenging scenario. Finally, despite the 90-day pause in reciprocal tariffs stipulated by the US, which also contributed to the price scenario described above, the trade war between the US and China could still have negative effects on global consumption. It's worth noting that the market is monitoring the rainfall pattern in West Africa, which in the coming weeks could influence the results of Ivory Coast's intermediate crop and the start of the 25/26 crop, reflecting on market prices.

Weekly Report — Cocoa

carolina.frança@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without intending to create obligations or commitments to third parties. It is not intended to promote or solicit an offer for the sale or purchase of any securities, commodities interests, or investment products. Hedgepoint and its associates expressly disclaim any liability for the use of the information contained herein that directly or indirectly results in any kind of damages. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests, such as futures, options, and swaps, involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgment and/or consult advisors before entering into any transactions. Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately. Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only). Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets. “HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.