Brazil and the Future of Cocoa: Challenges and Opportunities

- Ivory Coast and Ghana, the world's two largest cocoa producers, continue to face problems that have put pressure on global supplies.

- As a result, the cocoa market has begun to explore other beans sources. Similarly, other producing countries have started to invest in the crop.

- Brazil, once one of the world's largest producers and exporters of beans, has been conducting research and projects with the aim of regaining its prominent position in the global cocoa sector.

- From January to April of 2025, total net cocoa imports (beans, paste, butter, and powder) were about 62% higher than in the same period last year.

- The expansion of planting areas and the country's processing capacity provide Brazil with a window of opportunity in the cocoa market in the medium term.

Brazil and the Future of Cocoa: Challenges and Opportunities

The cocoa market faces a significant reduction in global bean supply, which has led to an increase in international commodity prices in 2024 and 2025. Ivory Coast and Ghana, the world's two largest cocoa producers, continue to grapple with the underlying issues that have contributed to this situation, and a swift resolution is not foreseeable in the short to medium term. Extreme weather events, the increase in crops affected by the CSSV disease (Cacao Swollen Shoot Virus), and aging trees with low productivity are some of the main reasons that have combined to result in the current scenario.

As a consequence, the cocoa market has started to look more closely at other sources of beans. Similarly, other producing countries have begun investing in the crop, both in production and processing capacity, given the market opportunities and attractive prices for the commodity, such as Ecuador and Nigeria, which are currently rank third and fourth in the world ranking of largest cocoa producers, respectively.

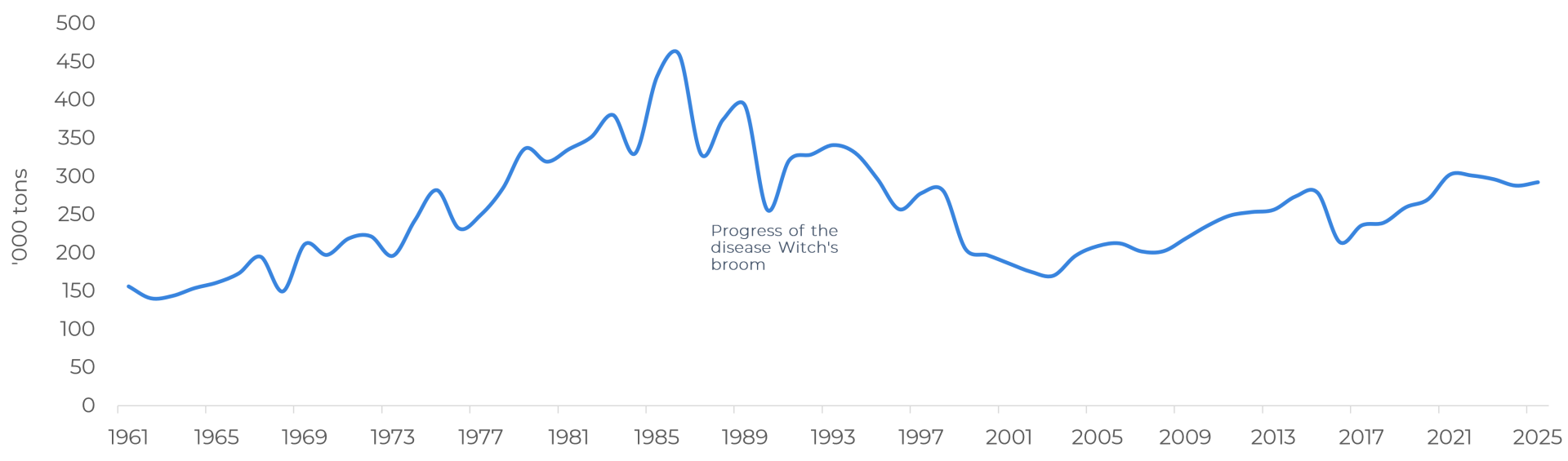

Brazil, which in the 23/24 season was the sixth largest cocoa producer in the world according to the ICCO, was once one of the world's largest producers and exporters of beans, but experienced a significant drop in production, mainly after the spread of the “witches' broom” disease in the main producing regions. Since then, several studies and projects have been developed in the country to regain its prominent position in the global cocoa sector, which has led to a recovery in Brazilian crop production in recent years.

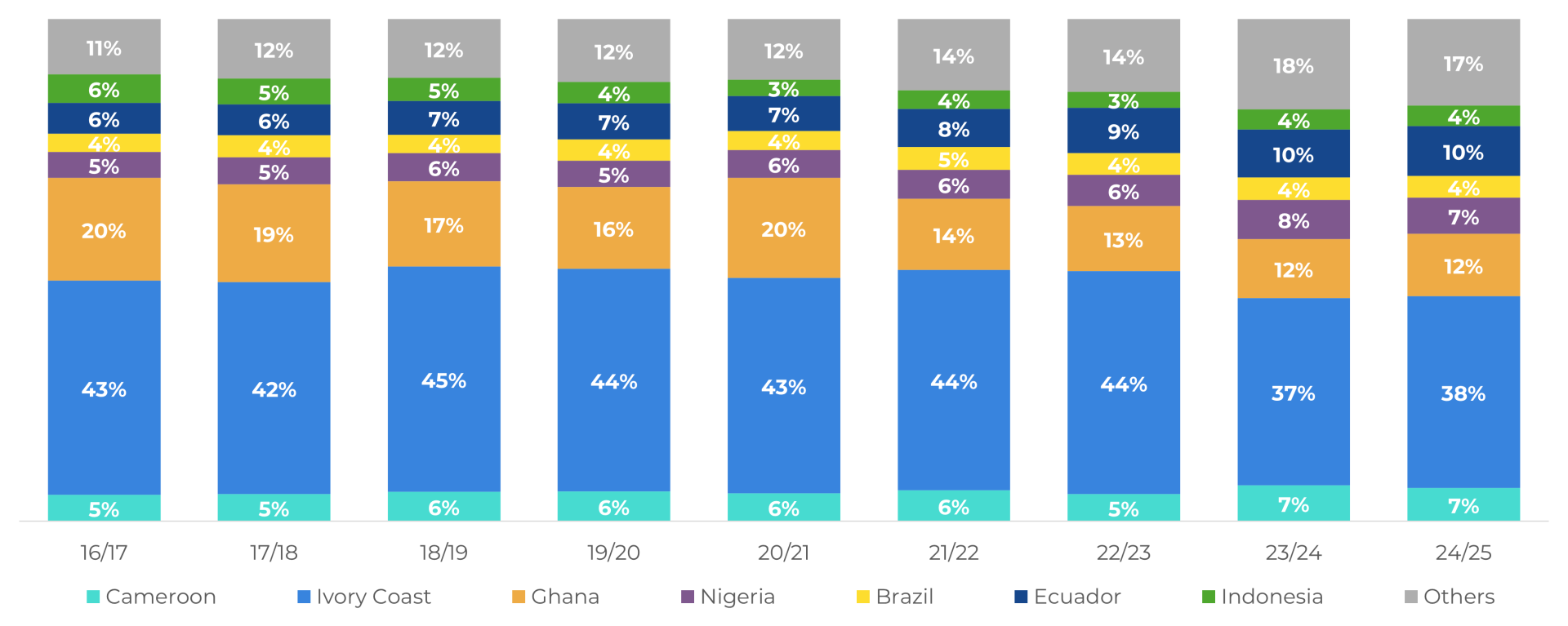

World Cocoa Production by Origin (% of total)

Source: ICCO

Brazil: History of Cocoa Production ('000 tons)

Source: FAO, IBGE

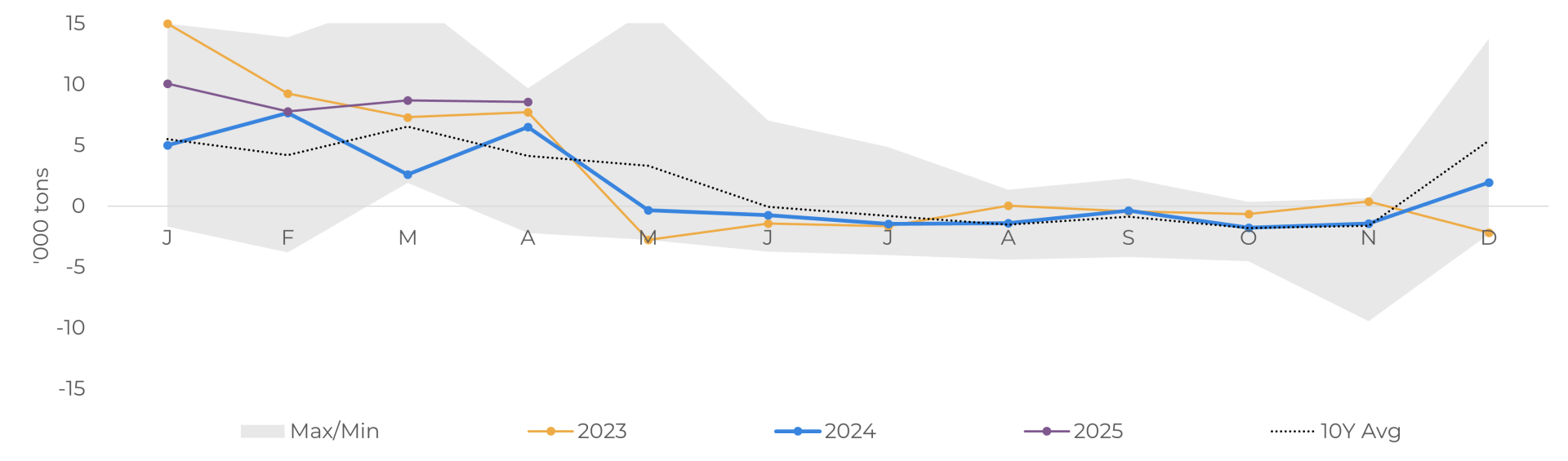

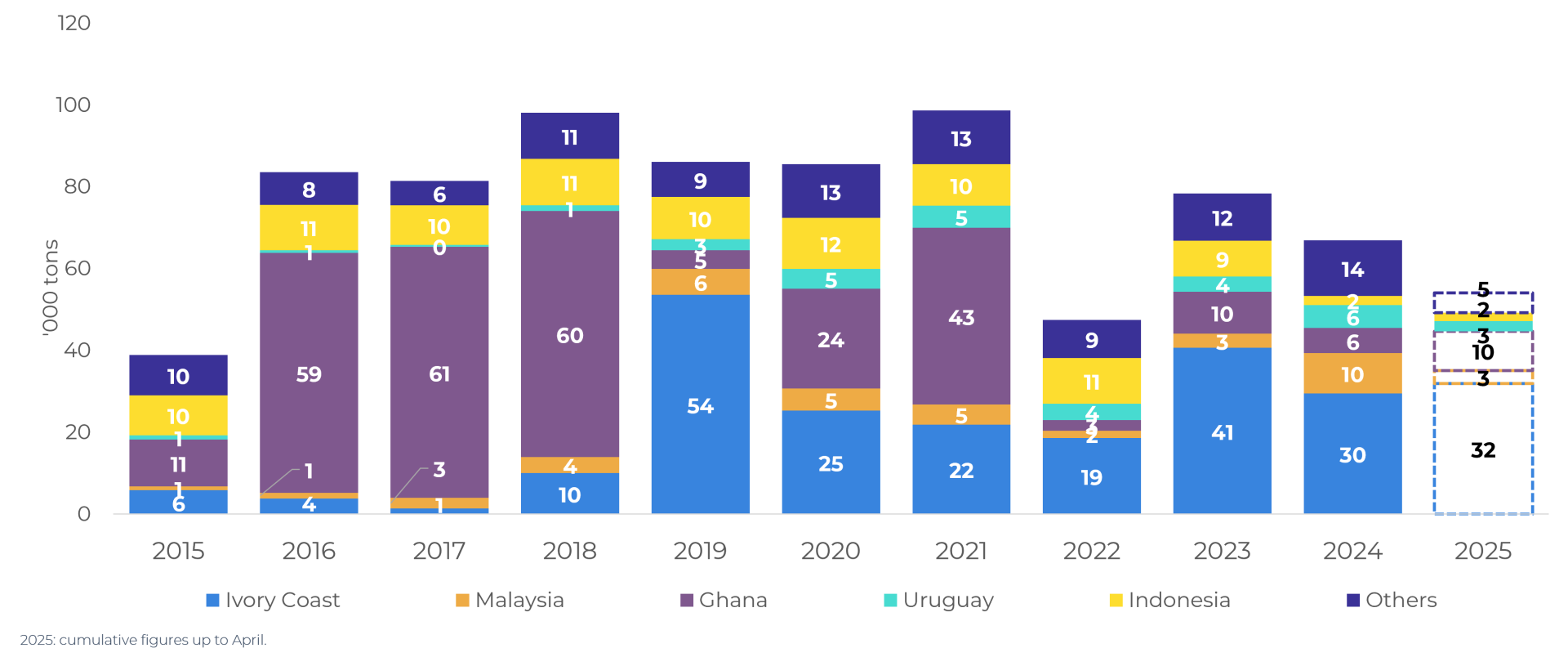

Investments were made not only in cocoa production, but also in beans processing in the country. To supply the large processing capacity, which currently stands at almost 300,000 tons – and is greater than national production, Brazil imports cocoa from other sources. Since the beginning of 2025, the total volume of net cocoa imports (imports - exports for beans, paste, butter, and powder) was about 62% higher than in the same period last year.

Brazil: Net Cocoa Imports (‘000 tons)

Source: Comex Stat, Hedgepoint

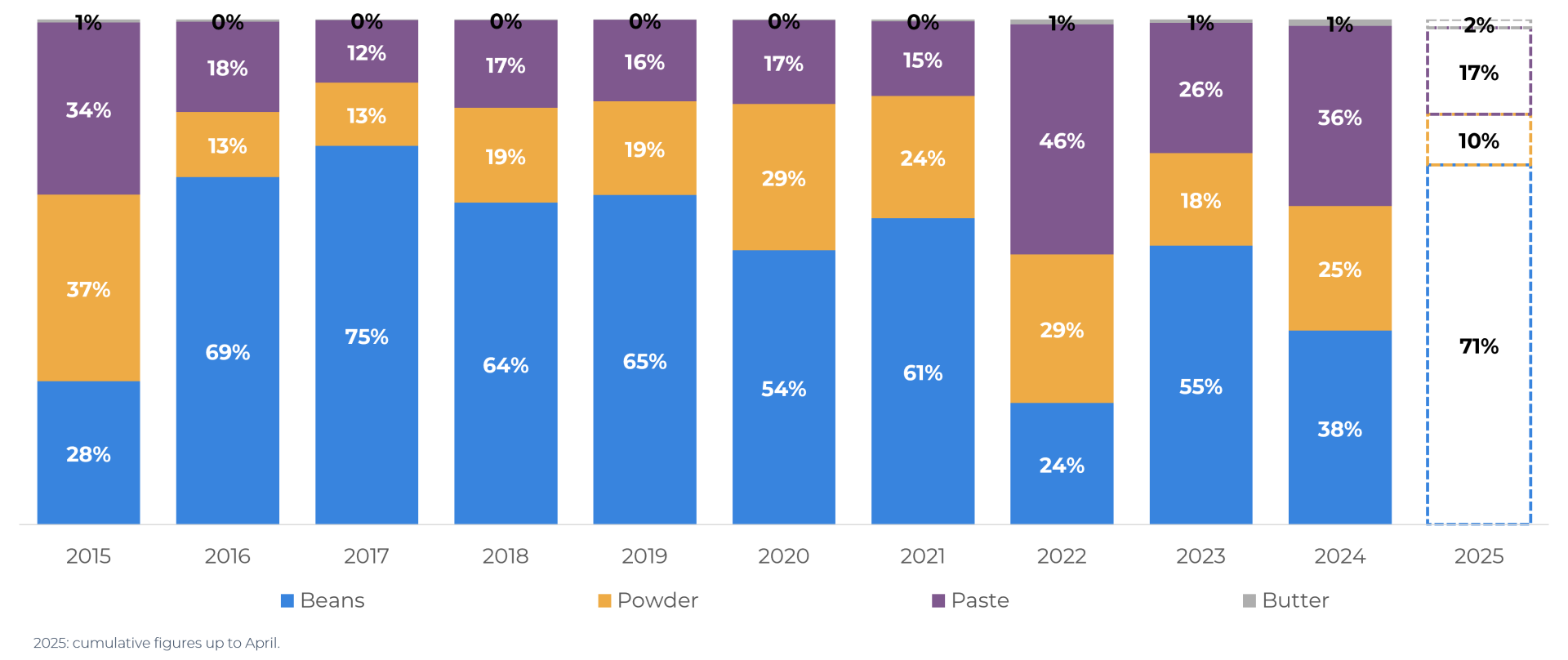

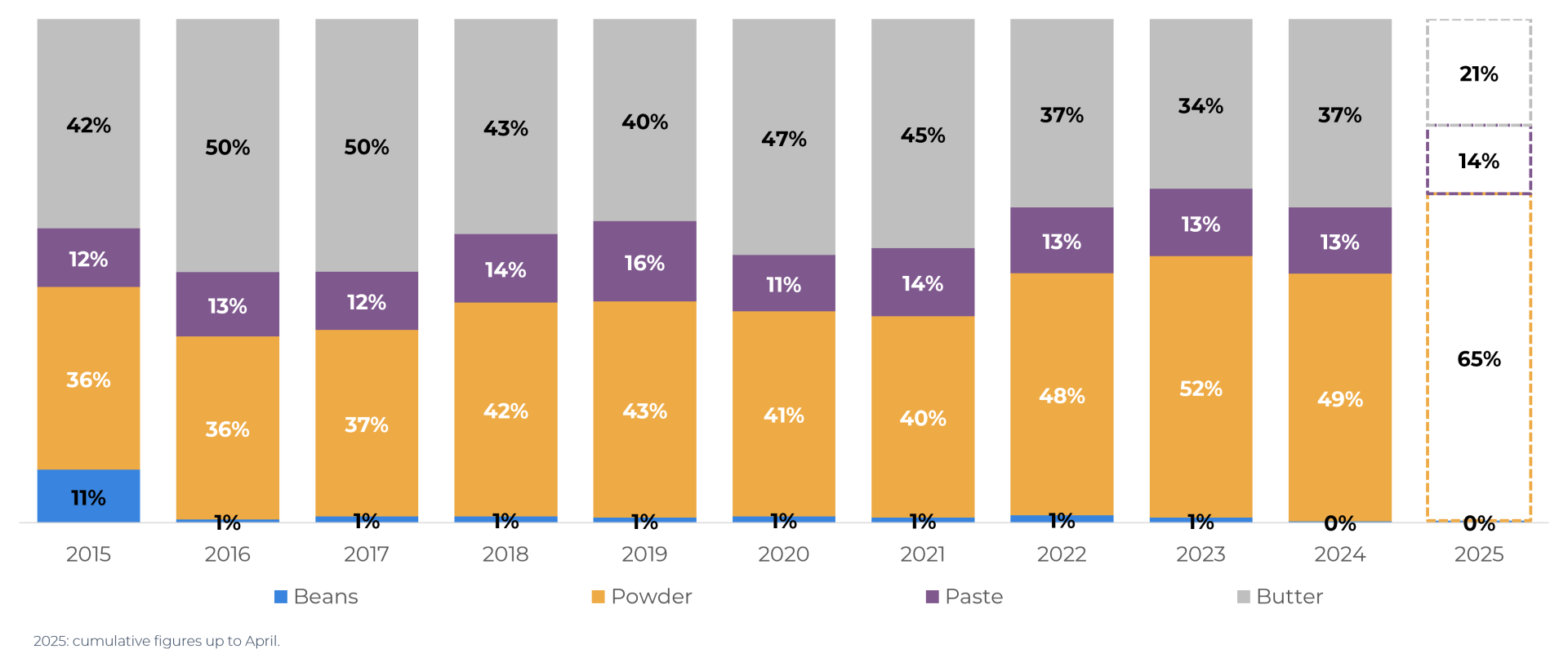

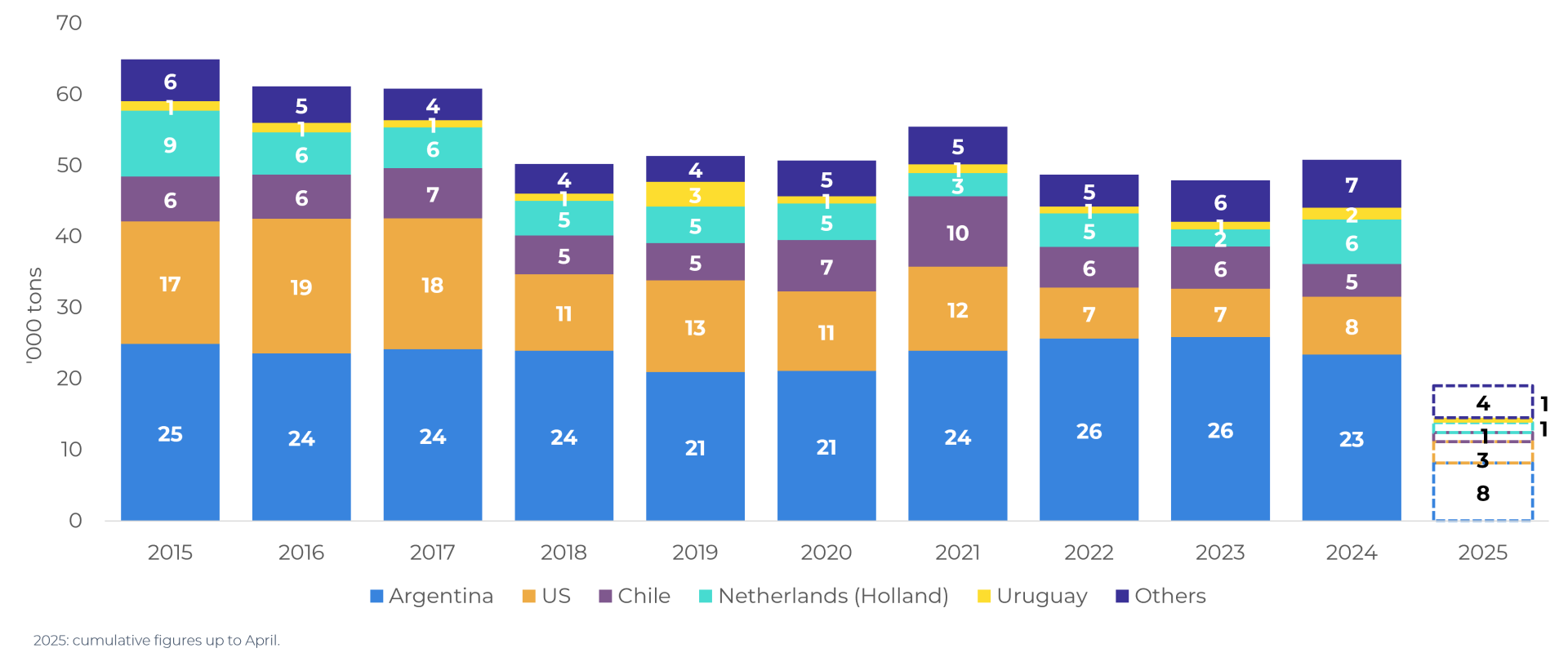

In recent years, most of the Brazilian imports of the sector have been major beans. Cocoa powder and butter, which have higher added value, lead exports, mainly to Argentina, reinforcing Brazil's important role in cocoa processing.

Brazil: Imports of Cocoa and Cocoa Products (% of total)

Source: Comex Stat, Hedgepoint

Brazil: Exports of cocoa and cocoa products (% of total)

Source: Comex Stat, Hedgepoint

Brazil: Cocoa Imports by Origin ('000 tons)

Source: Comex Stat, Hedgepoint

Brazil: Cocoa Exports by Origin ('000 tons)

Source: Comex Stat, Hedgepoint

Recently, several projects have focused on expanding cocoa areas in southeastern, northern, and northeastern Brazil, including the world's largest cocoa farm, using technology and clones with better agronomic performance. This, combined with the country's existing processing capacity, provides Brazil with a window of opportunity in the cocoa market in the medium term. It is worth noting that the country already has a goal of exceeding 400,000 tons of production by 2030.

In Summary

Ivory Coast and Ghana, the world's two largest cocoa producers, still face problems that have put pressure on global cocoa supplies. As a result, the cocoa market has begun to look more closely at other sources of cocoa beans. Similarly, other producing countries have started to invest in the crop.

Brazil, once one of the world's largest producers and exporters of beans, has been conducting research and developing projects with the aim of regaining its prominent position in the global cocoa sector. Since the beginning of 2025, total net cocoa imports (beans, paste, butter, and powder) were about 62% higher than in the same period last year. The expansion of planting areas and the country's processing capacity provide Brazil with a window of opportunity in the cocoa market in the medium term.

Weekly Report — Cocoa

carolina.frança@hedgepointglobal.com

laleska.moda@hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without intending to create obligations or commitments to third parties. It is not intended to promote or solicit an offer for the sale or purchase of any securities, commodities interests, or investment products. Hedgepoint and its associates expressly disclaim any liability for the use of the information contained herein that directly or indirectly results in any kind of damages. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests, such as futures, options, and swaps, involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgment and/or consult advisors before entering into any transactions. Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately. Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only). Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets. “HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.