Total cocoa stocks are recovering

- Total cocoa stocks on the ICE US reached their highest level in nine months, reversing the historic low recorded at the beginning of the year.

- However, New York certified stocks (which are the stocks approved by the exchange for physical delivery under futures contracts) retracted. This trend may be related to use for physical delivery, the profile of stored origins, and commercial decisions influenced by costs and market conditions.

- The recovery in stocks, coupled with expectations of improved weather conditions in West Africa, is contributing to the bearish trend in cocoa prices in the short and medium term.

- The share of origins such as Ecuador, Colombia, Peru, and Venezuela increased, while Ivory Coast cocoa port arrivals slowed and presented quality issues.

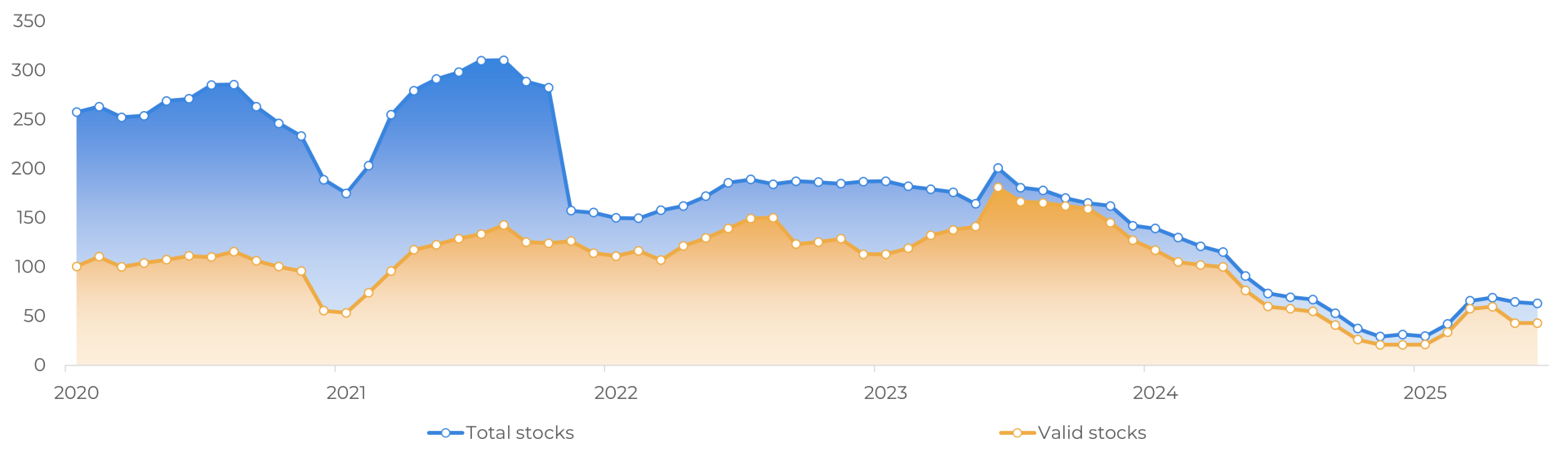

- ICE EU reported a decline in stocks in May, possibly reflecting differences in the classification structure between the two markets.

Total cocoa stocks are recovering

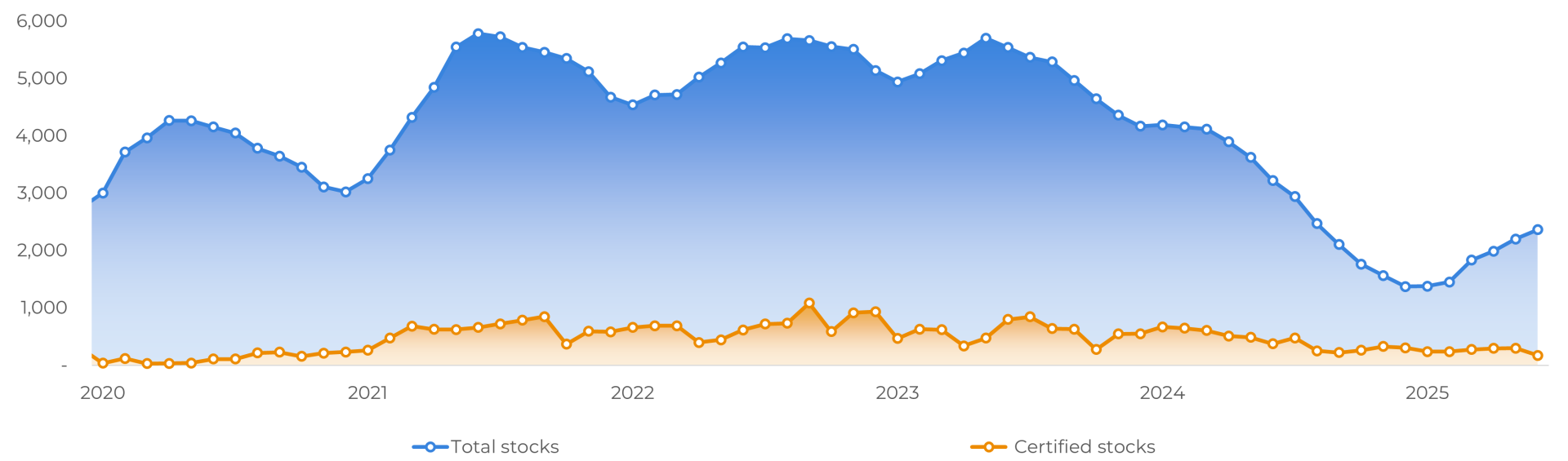

Total cocoa stocks on ICE US continue a recovery path. Last Wednesday, June 18, the total reported volume reached its highest level in nine months, a significant contrast to the beginning of 2025 when the lowest level in 21 years was recorded. This increase indicates greater availability of beans and is one of the factors, which, combined with better rainfall expectations for West Africa in the coming days, supports the bearish trend in cocoa prices in the short and medium term. Additionally, speculation about potential changes to U.S. trade policy, such as the reimposition of tariffs, may be prompting market participants to accelerate imports or exports in an effort to hedge against potential future trade-related expenses. The September 2025 contract followed the previous day's trend and closed June 18 at 8,803 USD/t in New York and 6,016 GBP /t in London, down 3.7% and 3.4%, respectively.

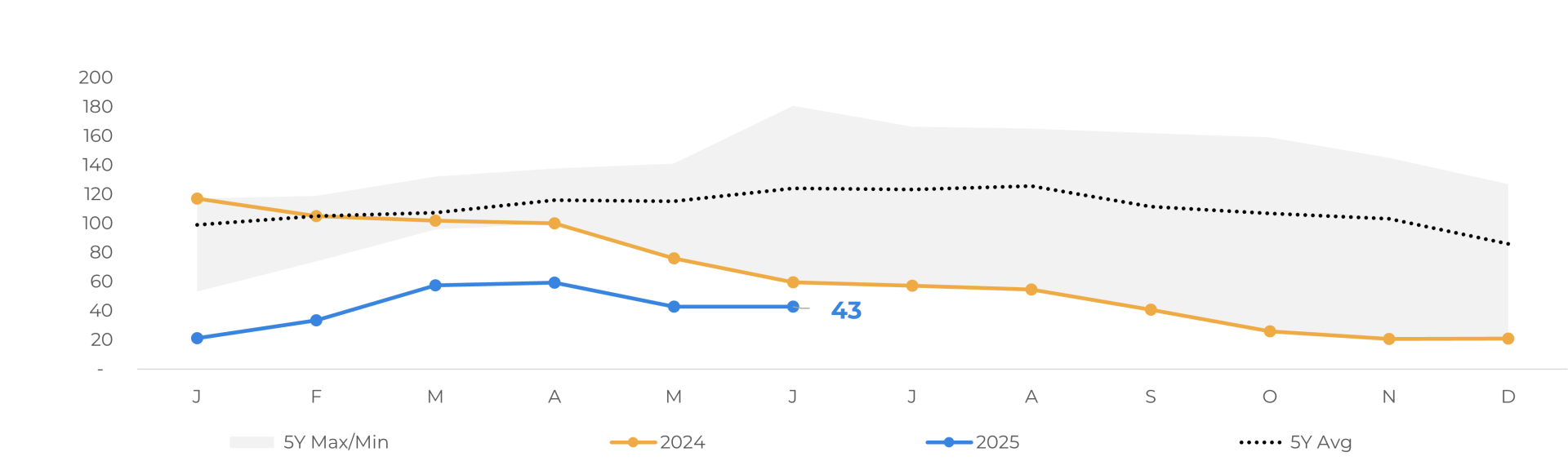

Cocoa total and certified stocks – ICE US (‘000 bags)

Source: ICE

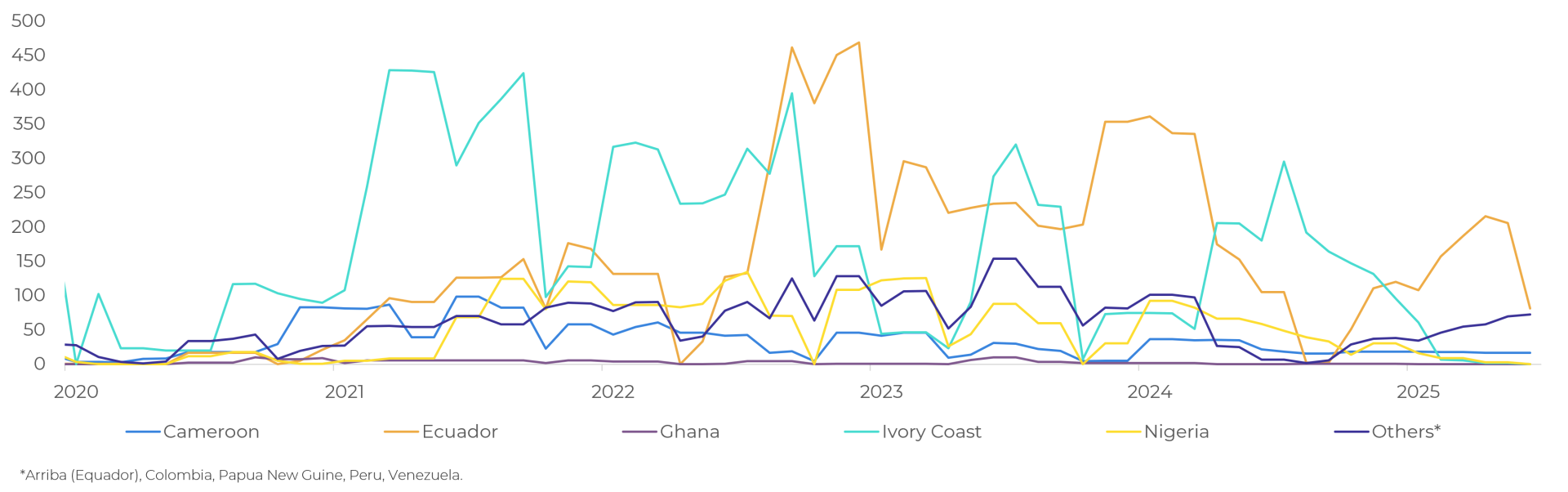

When analyzing stocks by origin, there is a notable increase in volume from countries such as Ecuador, Colombia, Peru, and Venezuela, in contrast to deliveries from the Ivory Coast. Although the pace of arrivals from Ivorian ports is still slightly above that recorded in the same period last year, there has been a recent slowdown, as well as reports of problems related to beans quality. This scenario may be contributing to the growth of shares from other origins in global stocks.

ICE US cocoa certified stocks by origin (‘000 bags)

Source: ICE

Despite the increase in total cocoa stocks in New York, certified volumes declined. This difference may be related to the use of certified beans for physical delivery, the change in the profile of origins currently in storage, and possible commercial decisions influenced by operating costs and market conditions. The scenario may indicate a rebuilding of physical stocks, while the certified volume reflects logistical, commercial, and quality factors.

Cocoa certified stocks – ICE US (‘000 bags)

Source: ICE

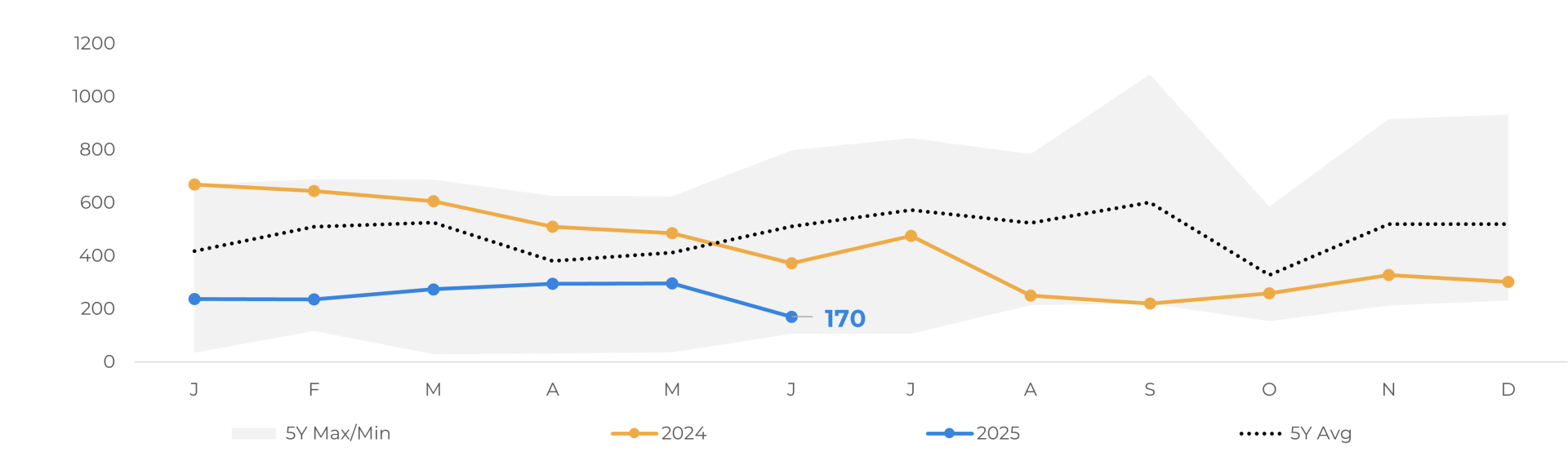

In the case of ICE Europe stocks, there is a different behavior compared to ICE US, with a drop recorded in May. According to the International Cocoa Organization (ICCO), the London market values Type 1 beans from West Africa. Type 2 beans, mainly from Latin America and Asia, are less valued and sometimes traded at a discount. In this context, the slowdown in Ivory Coast port arrivals, combined with the decline in bean quality, may be contributing to the difference in behavior between the ICE US and ICE EU markets.

Cocoa total and valid stocks – ICE EU (‘000 bags)

Source: ICE

Cocoa valid stocks – ICE EU (‘000 bags)

Source: ICE

In Summary

Total cocoa stocks on ICE US continue to recover, reaching their highest level in nine months in June. This contrasts with the beginning of the 2025 when stocks were at their lowest level in more than two decades. The recovery in stocks, coupled with expectations of improved weather conditions in West Africa, contributes to the bearish trend in cocoa prices in the short and medium term. At the same time, there has been a decline in certified stocks, possibly related to the use of beans for physical delivery, the greater presence of less traditional origins, and commercial decisions influenced by operating costs and demand patterns.

Weekly Report — Cocoa

carolina.frança@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without intending to create obligations or commitments to third parties. It is not intended to promote or solicit an offer for the sale or purchase of any securities, commodities interests, or investment products. Hedgepoint and its associates expressly disclaim any liability for the use of the information contained herein that directly or indirectly results in any kind of damages. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests, such as futures, options, and swaps, involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgment and/or consult advisors before entering into any transactions. Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately. Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only). Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets. “HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.