Impact of Tariffs on Cocoa Market

- The December 2025 cocoa contract ended the week at USD 7,978/t in NY (+5.6%) and GBP 5,409/t in London (+0.6%), reversing the initial weekly decline and maintaining volatility, influenced by supply fears and demand uncertainties.

- The new round of US tariffs, active since August 7, affects more than 50% of the country’s total imports, with the potential to put pressure on costs, inflation, and alter trade flows.

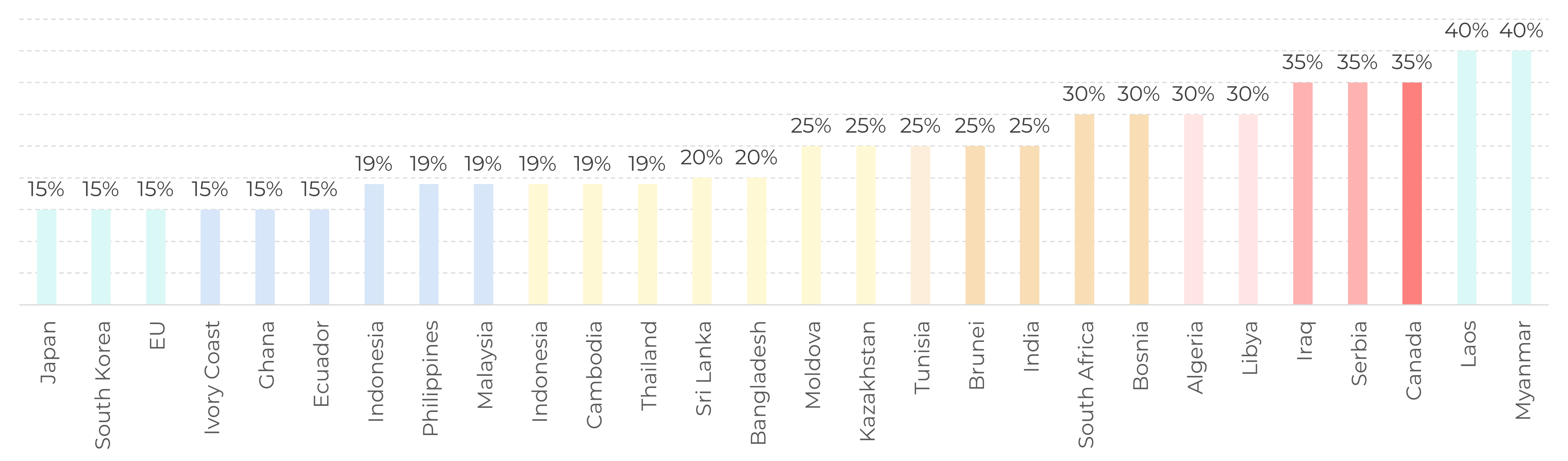

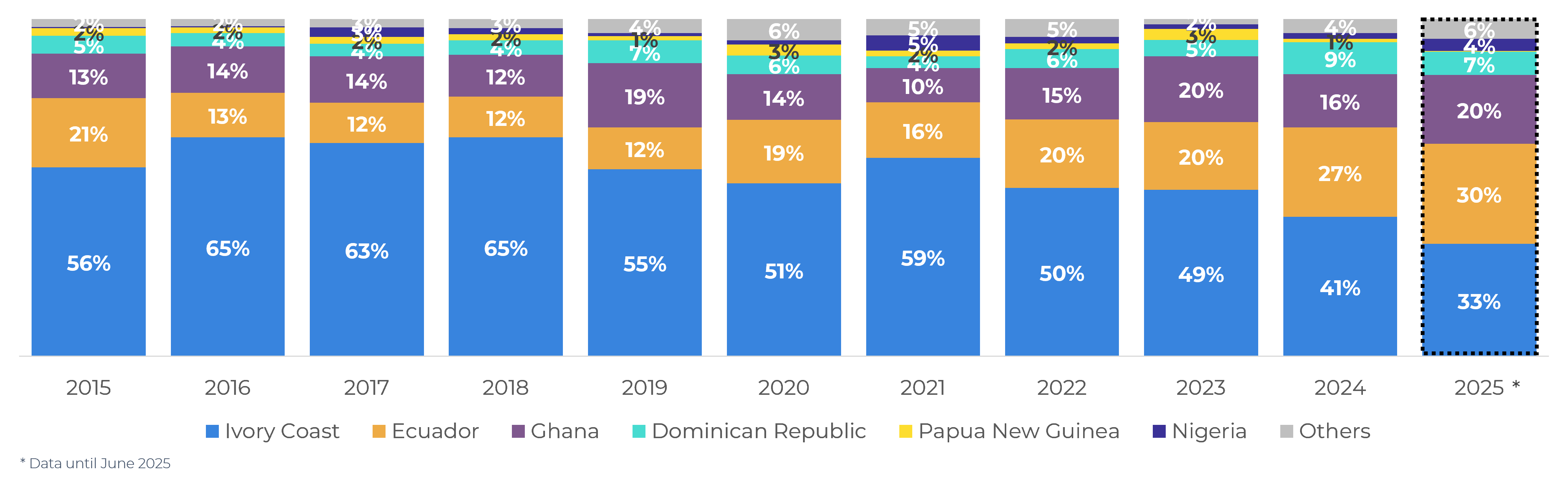

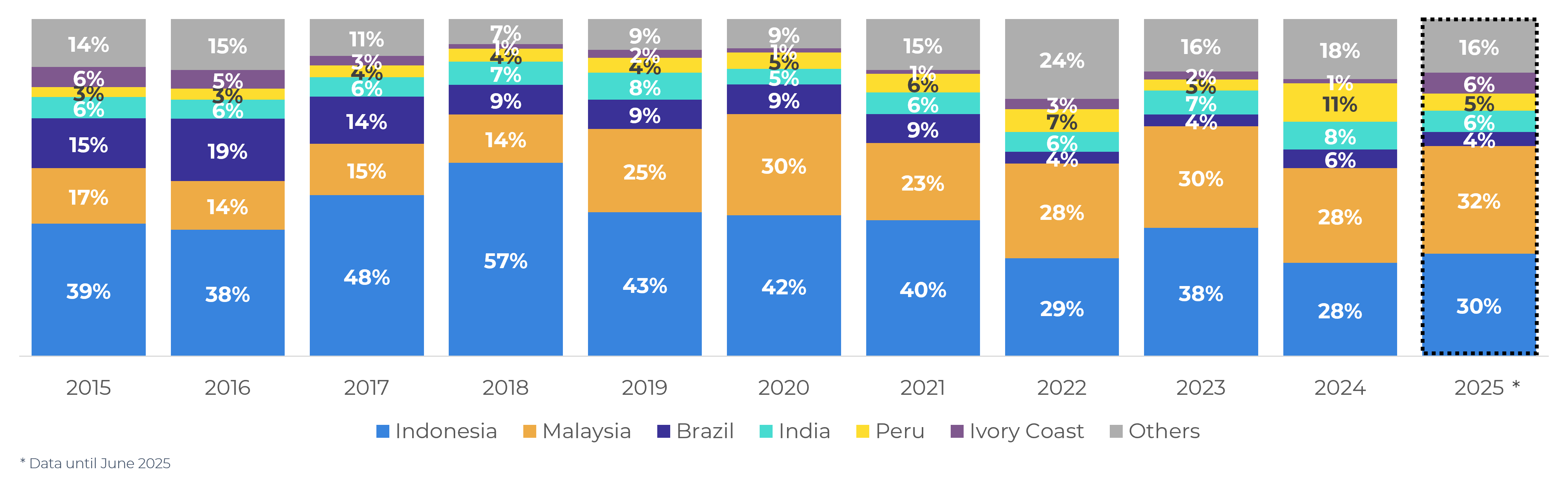

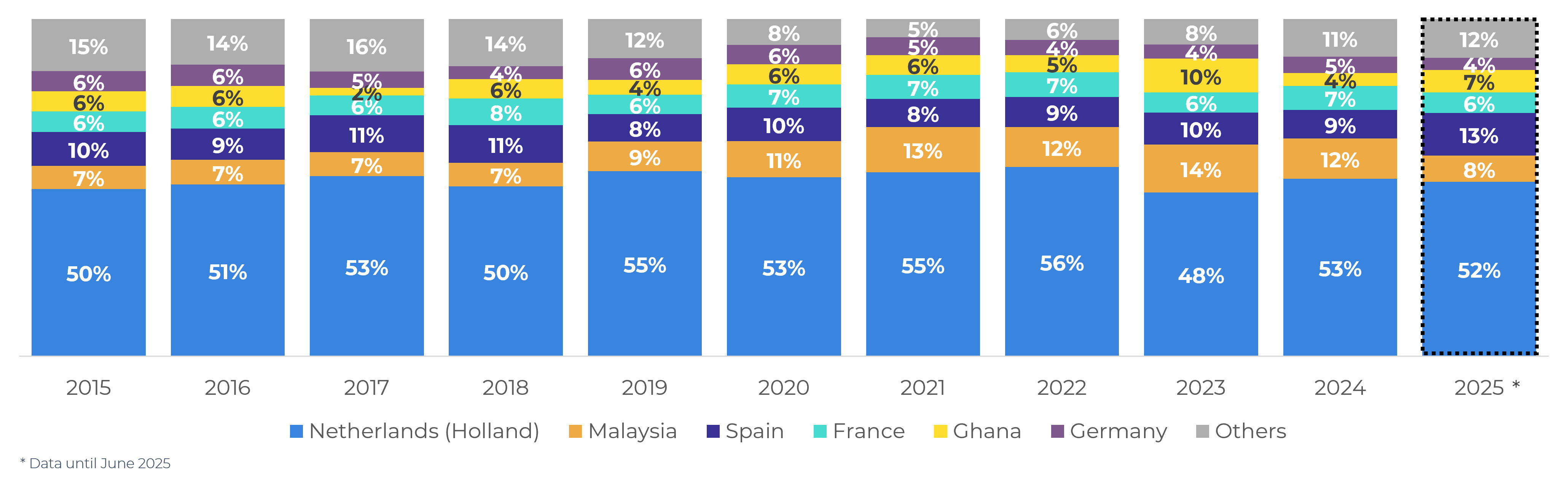

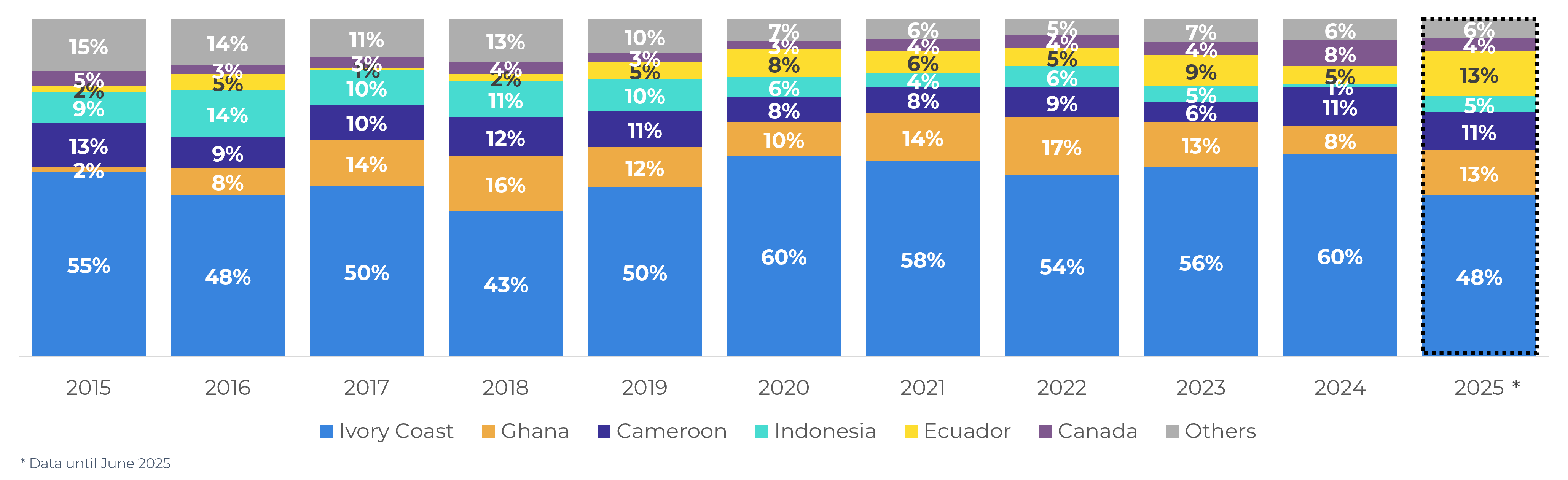

- US cocoa imports remain concentrated in beans (39%), butter (17%), powder (19%), and paste (25%), with Ivory Coast as the main supplier of beans (15% tariff) and Ecuador gaining ground. In the case of by-products, high tariffs on Malaysia, Indonesia, and India tend to increase input costs and put pressure on the US industry.

- Net imports in June returned to average levels, influenced by higher volumes of by-products, possibly reflecting more resilient demand and anticipation of purchases before the impact of tariffs.

- Market remains attentive to the effects of tariffs on the US economy and inflation, as well as final data for the 2024/25 season and the start of 2025/26, which may keep volatility high.

Impact of Tariffs on Cocoa Market

The December 2025 cocoa contract closed on Friday, August 8, at USD 7,978/t in New York and GBP 5,415/t in London, accumulating weekly gains of 5.6% and 0.6%, respectively. This scenario differs from that seen at the beginning of the week, when commodity prices fell in futures, ensuring another period of volatility for cocoa, partly due to fears about supply and uncertainties about demand.

In this sense, this week's analysis focuses the possible impact of the most recent factor in global trade flows: US tariffs. The new round of tariffs, which came into effect on August 7, includes the US's main trading partners, accounting for more than 50% of all imports. As such, the trade policy may impact inflation in the country, adding uncertainty and potentially altering costs and international trade flows.

US: New Tariffs

Source: LSEG

The United States occupies a prominent position in the global cocoa market, being one of the main consumers of raw materials and exporters of chocolate and confectionery. To sustain this dynamic, the country depends on imports of cocoa beans and their derivatives, which are essential to supply its industry and meet domestic demand. In 2024, beans, butter, powder, and paste accounted for 39%, 17%, 19%, and 25% of the country's total net cocoa imports, respectively.

Looking at imports by origin and product type, the US's main partner for beans is Ivory Coast, which is taxed at 15%. Although the new tariff is lower than the 21% announced in April, US authorities have raised the possibility of seeking new markets that allow for better trade and competitiveness for Ivorian cocoa, which could lead to changes in the commodity's trade flows. In this context, Ecuador's share of US bean imports has increased in recent years.

US: cocoa beans imports by origin (%)

Source: United States International Trade Commission (USITC)

As for by-products, important countries such as Malaysia (19%), Indonesia (19% after negotiation), and India (25%) have tariffs that tend to make the raw material used by the US industry more expensive. It is estimated that the increase in production costs due to tariffs gives Canadian and Mexican manufacturers a competitive advantage over the US, due to trade agreements between the three countries, raising concerns about the sector in the country.

US: cocoa butter imports by origin (%)

Source: United States International Trade Commission (USITC)

US: cocoa powder imports by origin (%)

Source: United States International Trade Commission (USITC)

US: cocoa paste imports by origin (%)

Source: United States International Trade Commission (USITC)

In April, after the first round of tariffs, there was already discussion about the possibility of changes in cocoa processing and trade flows as an alternative to reduce costs in the face of US tariffs. Among the strategies evaluated was the diversion of beans to countries close to the United States with lower tariffs and grinding capacity, such as Canada, Mexico, Brazil, and Ghana, allowing US demand to be met from other sources. However, the current scenario has changed: Brazil, which currently imports beans because its processing capacity exceeds domestic production, now faces a 50% tariff on exports to the US, which makes this alternative unfeasible and has a significant impact, especially since the country is also a supplier of cocoa butter to the US market.

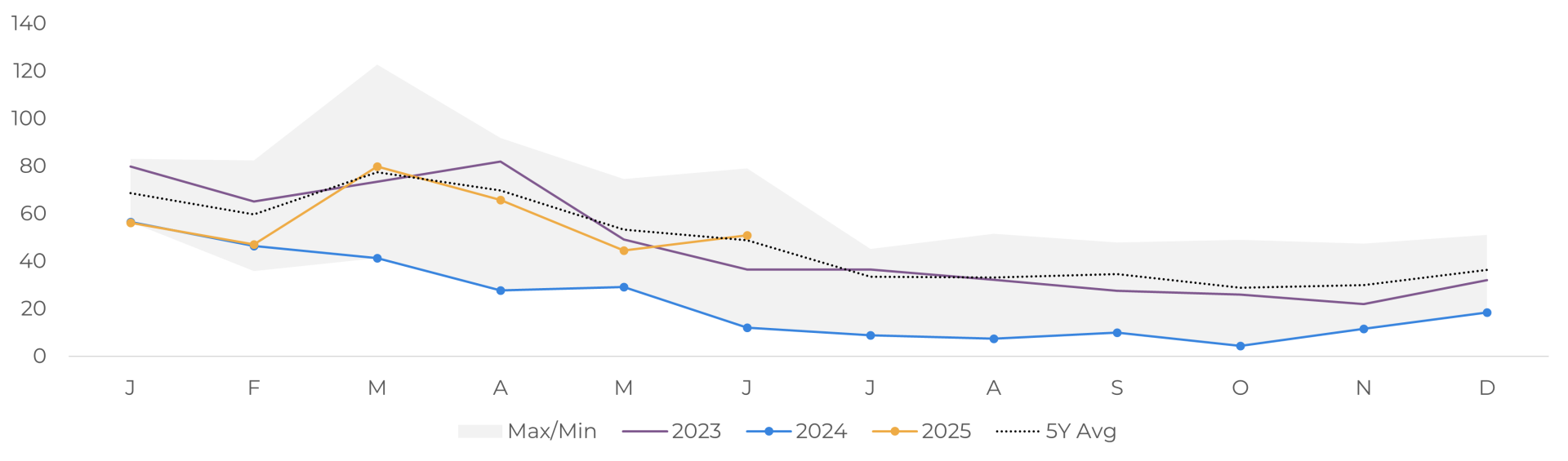

Despite fears, total net cocoa imports (beans, butter, powder, and paste) from the US returned to average levels in June, mainly due to higher volumes of imported by-products. In addition to seasonality, this movement may signal relatively more resilient demand, considering that the grinding result for the second quarter of 2025 for the region, according to an NCA report, showed a less pronounced decline than in Asia and Europe. Furthermore, the increase in purchases may also reflect anticipation of the tariffs that came into effect this week, with importers seeking to secure stocks before the direct impact on costs.

US: Net Cocoa Total Imports ('000 tons)

Source: United States International Trade Commission (USITC)

The market remains attentive to the developments of the new tariffs, not only because of their potential to alter trade flows and prices in the cocoa sector, but also because of their impact on inflation and the US economy. How these factors will combine is likely to influence market participants' behavior and contribute to the volatility that has characterized the market in the last years. At the same time, there are still expectations regarding the 2024/25 season results and the start of the 2025/26 crop, which adds another layer of uncertainty to the price outlook.

In Summary

December Cocoa future contracts in NY and LN ended this week on higher levels, reversing the declines from earlier in the week and maintaining market volatility, driven by supply concerns and uncertainty about demand. Attention is focused on the new round of US tariffs, in effect since August 7, which affect more than 50% of imported volume and could alter costs and trade flows. The US, a major consumer of cocoa and exporter of confectionery products, imports mainly from Ivory Coast (15% tariff), but also from countries such as Ecuador, Malaysia, Indonesia, and India, the latter with higher tariffs that make inputs more expensive and favor manufacturers in Canada and Mexico.

Despite fears, US net imports returned to average levels in June, sustained by increased imports of by-products, possibly reflecting both slightly more resilient demand and anticipation ahead of the impact of tariffs. The market remains attentive to the effects of this trade policy on inflation and the US economy, as well as the final results of the 2024/25 season and the beginning of 2025/26, which maintain the scenario of uncertainty and volatility.

Weekly Report — Cocoa

carolina.frança@hedgepointglobal.com

laleska.moda@hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without intending to create obligations or commitments to third parties. It is not intended to promote or solicit an offer for the sale or purchase of any securities, commodities interests, or investment products. Hedgepoint and its associates expressly disclaim any liability for the use of the information contained herein that directly or indirectly results in any kind of damages. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests, such as futures, options, and swaps, involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgment and/or consult advisors before entering into any transactions. Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately. Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only). Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets. “HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.