Declining grindings and position adjustments reinforce caution in the cocoa market

- Cocoa prices rose again in the week ending October 24, driven by reduced deliveries from Ivory Coast and discussions about the EUDR.

- Third-quarter grindings results showed declines in Asia and Europe, while North America recorded slight growth.

- Even with recent price corrections, the quarter still reflected compressed margins and limited consumption due to historically high prices.

- Funds increased their net short positions in London, reinforcing the more cautious sentiment in the futures market.

- The market awaits the financial results of major processors and chocolate manufacturers, which are likely to influence sentiment and volatility in the short term.

Declining grindings and position adjustments reinforce caution in the cocoa market

Cocoa prices have changed in recent days. The first contract closed the week of October 24 at USD 6,319/t in New York and GBP 4,518/t in London, accumulating weekly gains of 7.19% and 10.03%, respectively. The movement contrasts with that of previous weeks, when prices had fallen.

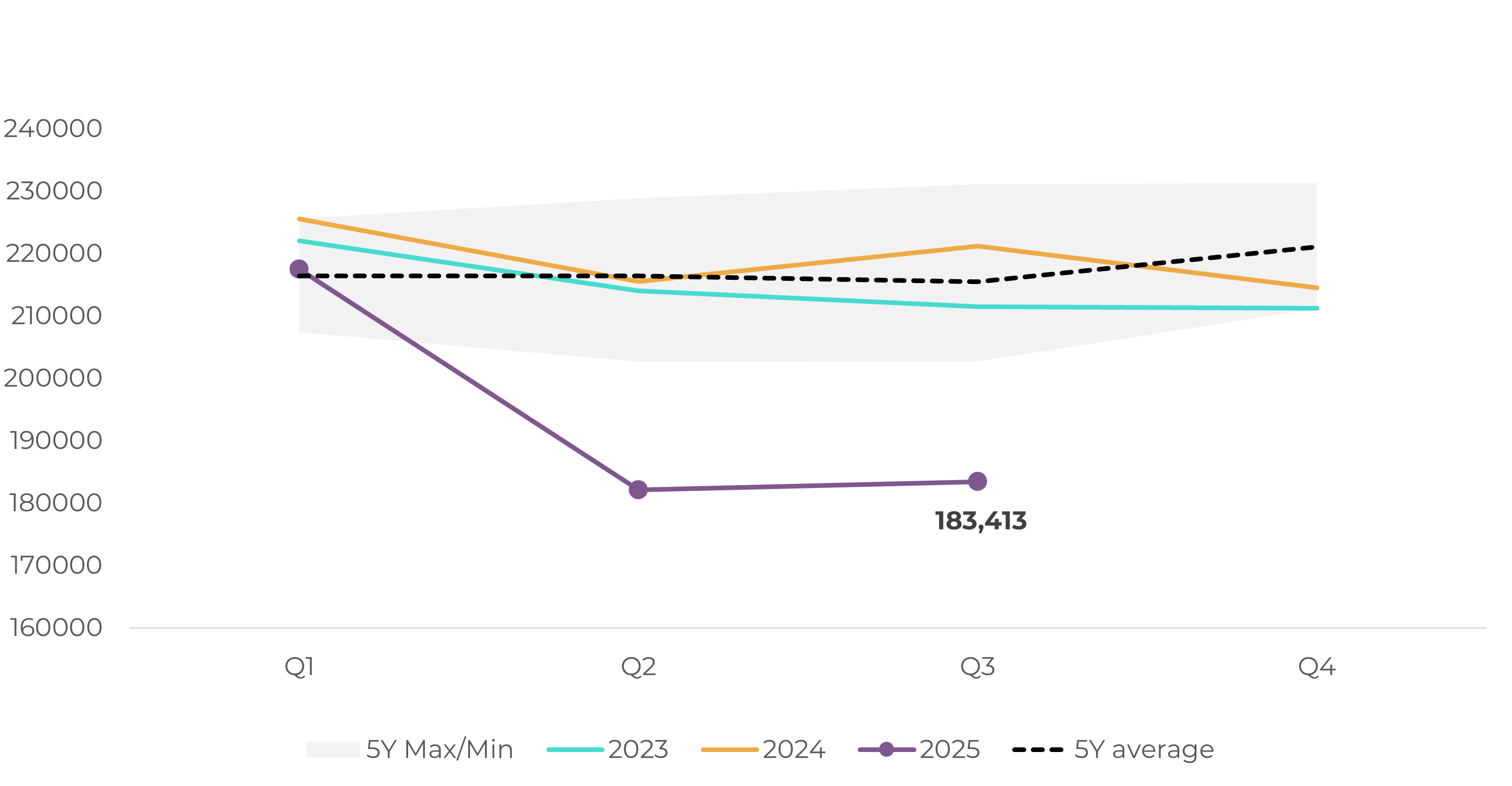

Part of the most recent fluctuations reflect the release of grinding data for the third quarter of 2025, the main indicator of global demand performance. The Cocoa Association of Asia (CAA) and the European Cocoa Association (ECA) reported a decline in activity during the period in question. In the case of the CAA, the decline was 17.08%, influenced mainly by the significant reduction observed in Malaysia, where the volume processed was 35.1% below that recorded in the same quarter of 2024. Even so, positive results in countries such as Indonesia and Singapore helped to soften the regional decline.

Cocoa grinding: Asia (‘000 mt)

Source: Cocoa Association of Asia (CAA)

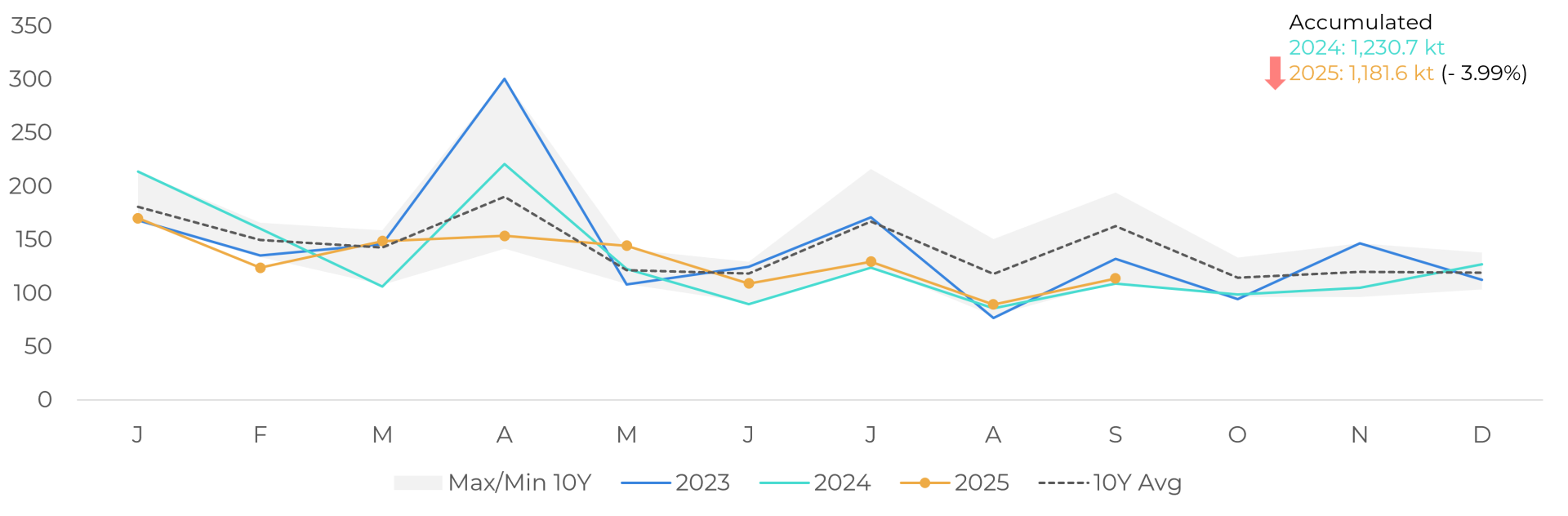

In Europe, the drop in processed volume was slightly less than the market had expected, a scenario we had already considered. The deficit in total net cocoa imports from January to September compared to the same period last year has been gradually decreasing, from over 10% at times to around 3.99% currently, indicating a slight recovery in activity throughout the year.

Cocoa grinding: Europe (‘000 mt)

Source: European Cocoa Association (ECA)

EU: Total net cocoa imports ('000 tons)

Souce: European Commission

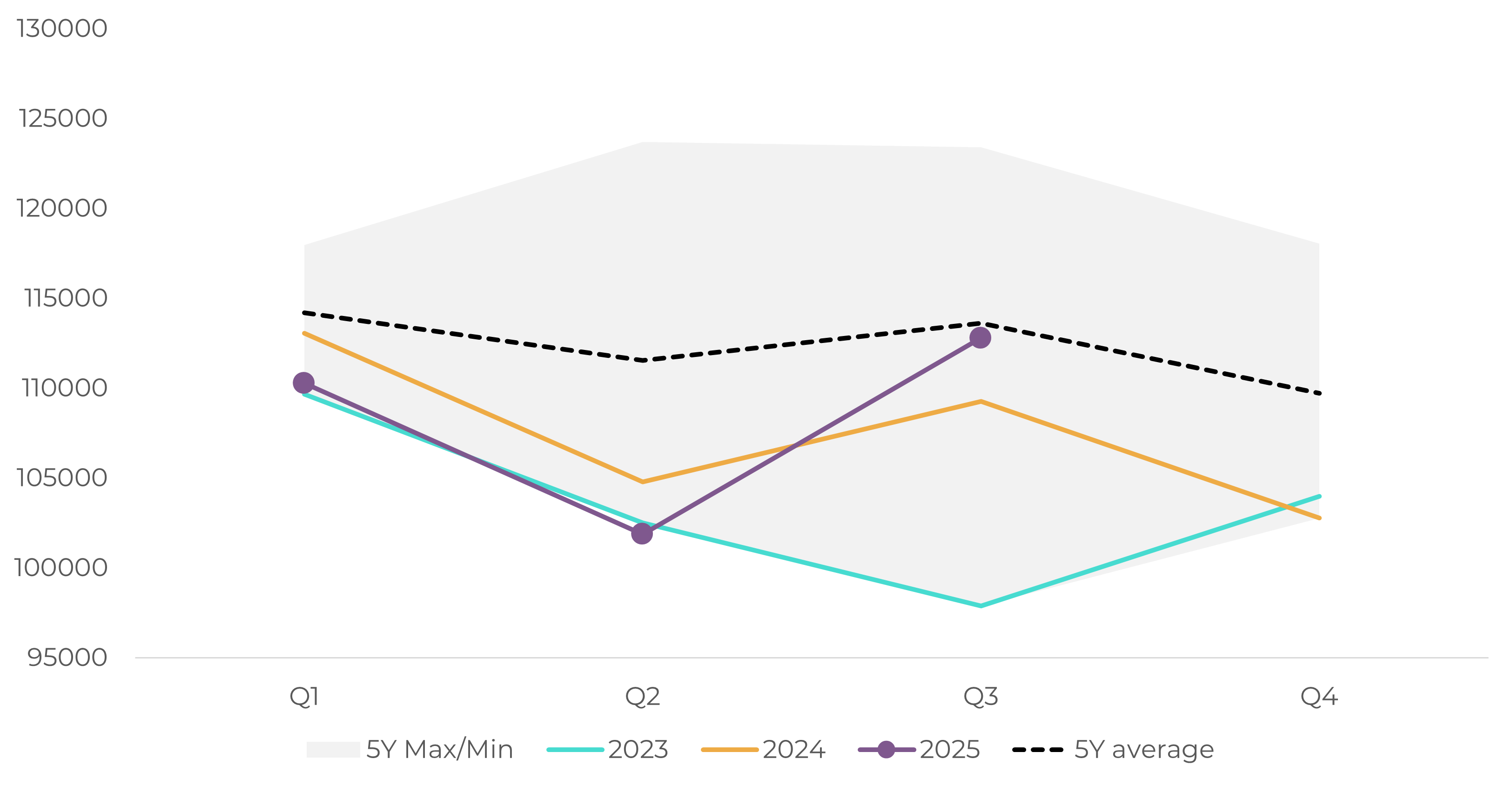

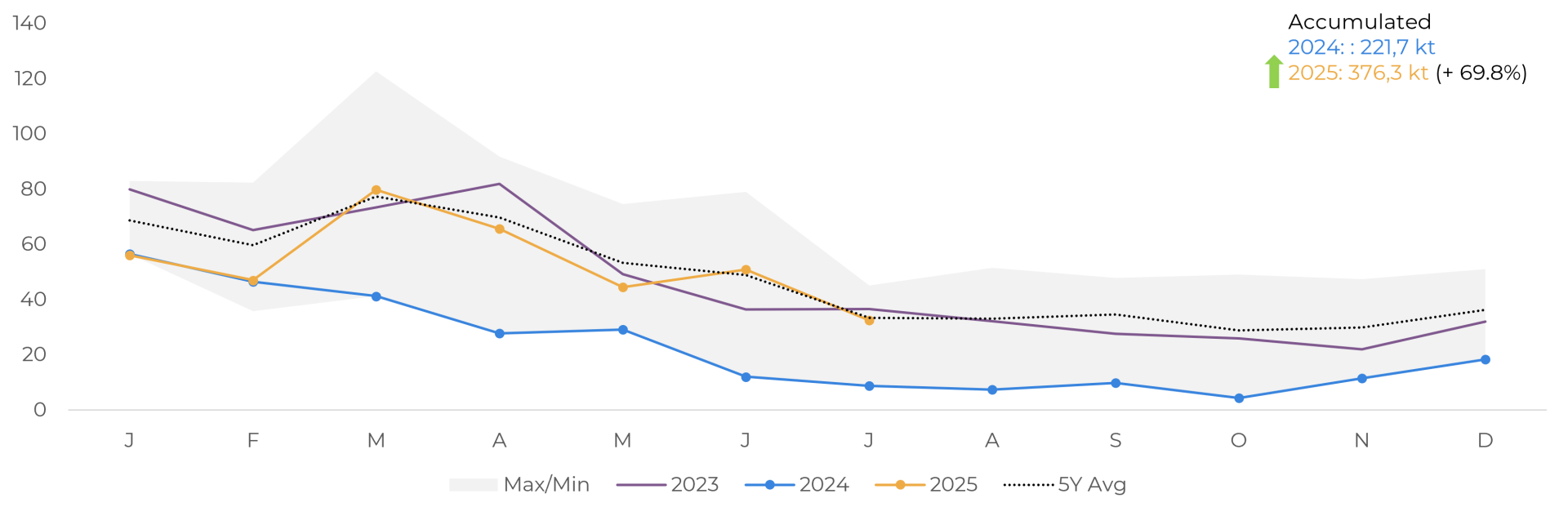

The National Confectioners Association (NCA), in turn, presented positive results, with an increase of 3.22% compared to the same period last year. The advance was partially explained by the inclusion of new participants in the survey, but it also reflected the significant increase in total net cocoa imports, which until July were almost 70% above the same period in 2024.

Cocoa grinding: North America (‘000 mt)

Source: National Confectioners Association (NCA)

US: Total net cocoa imports ('000 tons)

Source: United States International Trade Commission (USITC)

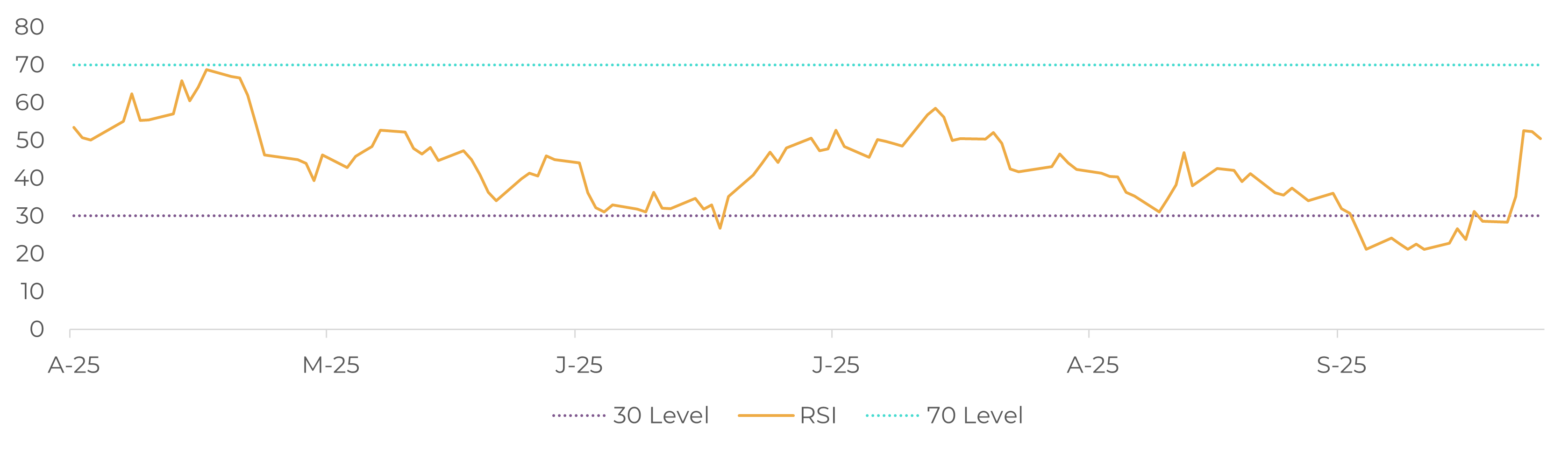

Despite the mixed results, the impact of high prices on consumption remains evident. Despite downward corrections in prices, some of which occurred more intensely later on and were not sufficient to alleviate costs during the quarter, pressure on the sector's margins remained. Thus, the results still reflect a scenario of historically high prices and squeezed margins in the industry. After the release of the figures, which reinforced expectations of a surplus for the current cycle, the market closed the week of October 17 at USD 5,895/t in New York and GBP 4,106/t in London. Prices remained under pressure in the oversold zone, increasing the probability of technical correction movements.

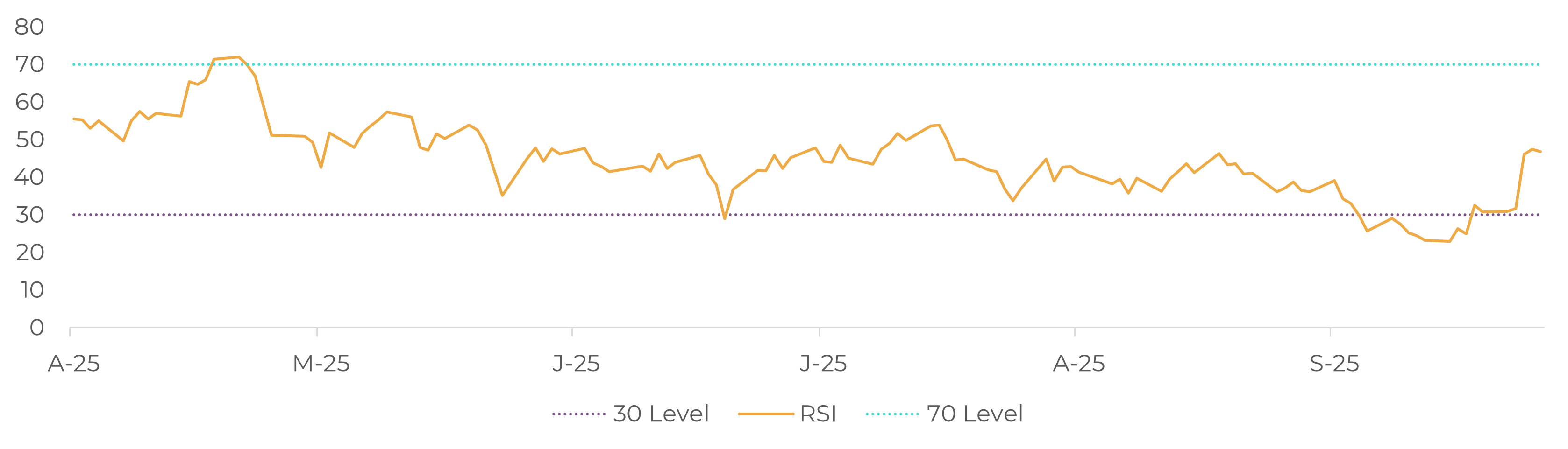

RSI cocoa New York December 25

Source: LSEG

RSI cocoa London December 25

Source: LSEG

In this sense, the following week, which ended on October 24, showed a different behavior. Prices rose again in both markets, in a technical movement sustained by the reduction in Ivory Coast cocoa arrivals and discussions about the expected entry into force of the European Union's Anti-Deforestation Regulation (EUDR).

According to the recent Cocoa Barometer report, about 40% of cocoa beans from Ivory Coast were traceable last season. This data reinforces the attention of the European market, which depends significantly on African sources for supply. As a result, there is growing expectation for possible adjustments to the EUDR requirements and greater clarity about their effects on global trade chains.

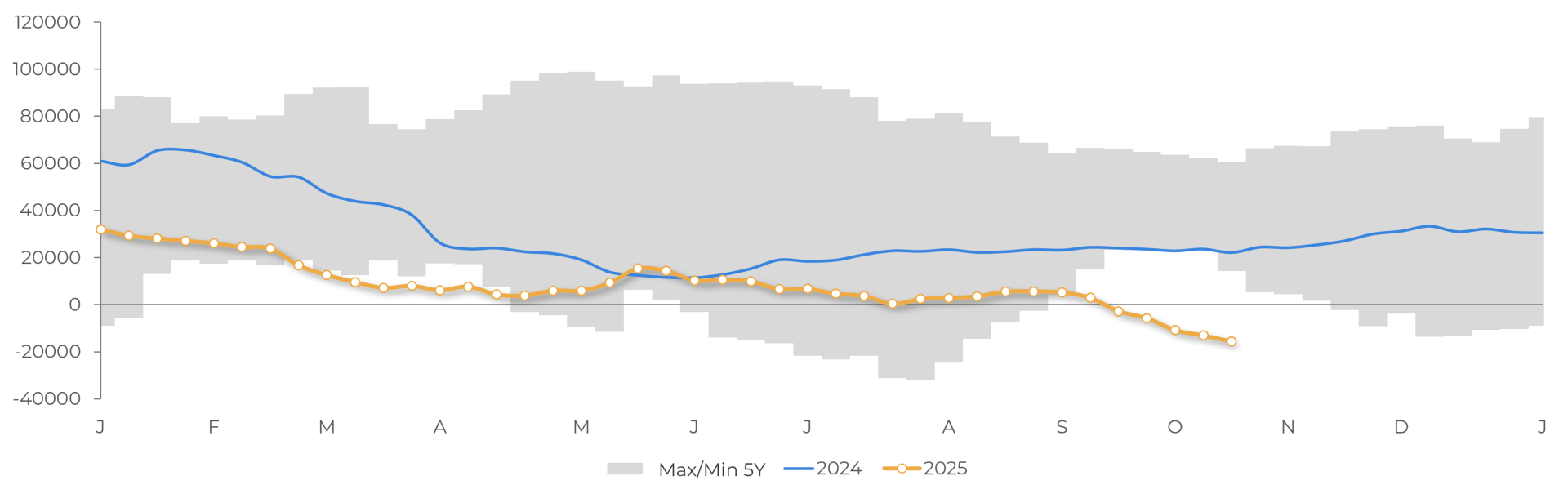

On Friday, October 24, the upward trend lost momentum, and prices fell slightly in both markets. According to the latest data from ICE Futures Europe, speculators increased their net short positions by 2,552 lots through October 21, totaling 15,609 lots. The increase in short positions reinforces the more cautious sentiment and bearish bias of funds toward the London market. In New York, data remains unavailable due to the temporary shutdown of the U.S. government.

ICE Europe – Net Speculative Position (lots)

Source: LSEG

The market remains attentive to the release of financial results from major chocolate processors and manufacturers in the coming weeks. These balance sheets should help set the tone for the market in the short term and are likely to keep volatility high as fundamentals continue to adjust at the start of the new 2025/26 crop year.

In Summary

Cocoa prices have been highly volatile in recent weeks. After consecutive declines, prices rose again in the week ending October 24, with the first contract closing at USD 6,319/t in New York and GBP 4,518/t in London, accumulating gains of 7.19% and 10.03%, respectively. The movement was sustained by the reduction in Ivory Coast cocoa arrivals and the progress of discussions on the European Union's Anti-Deforestation Regulation (EUDR), but remained more technical in nature.

The grinding results for the third quarter of 2025 reinforced the picture of more subdued demand. The CAA and ECA reported declines in activity, while the NCA showed slight growth, supported by an increase in net cocoa imports. Despite the mixed results, the data still reflects the impact of historically high prices on consumption and industry margins. The increase in net short positions sold by funds in London confirms the more cautious tone of the market, which is now turning its attention to the financial results of the main processors and chocolate manufacturers.

Weekly Report — Cocoa

carolina.frança@hedgepointglobal.com

luiz.roque@hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without intending to create obligations or commitments to third parties. It is not intended to promote or solicit an offer for the sale or purchase of any securities, commodities interests, or investment products. Hedgepoint and its associates expressly disclaim any liability for the use of the information contained herein that directly or indirectly results in any kind of damages. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests, such as futures, options, and swaps, involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgment and/or consult advisors before entering into any transactions. Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately. Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only). Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets. “HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.