Live with Experts November Edition: Highlights

- The cocoa market is heading towards the end of 2025 in a process of fundamental adjustment, with global supply showing signs of recovery while demand remains weak in the main consuming regions.

- The combination of a partial recovery in production in relevant origins, a slowdown in grinding in Europe and Asia, and greater resilience in demand in the United States supports the expectation of a surplus for the 25/26 season and explains the recent trend of price correction.

- Even so, the market continues to operate in an environment of high sensitivity to weather, financial, and logistical variables, which keeps volatility high despite the improvement in the global balance.

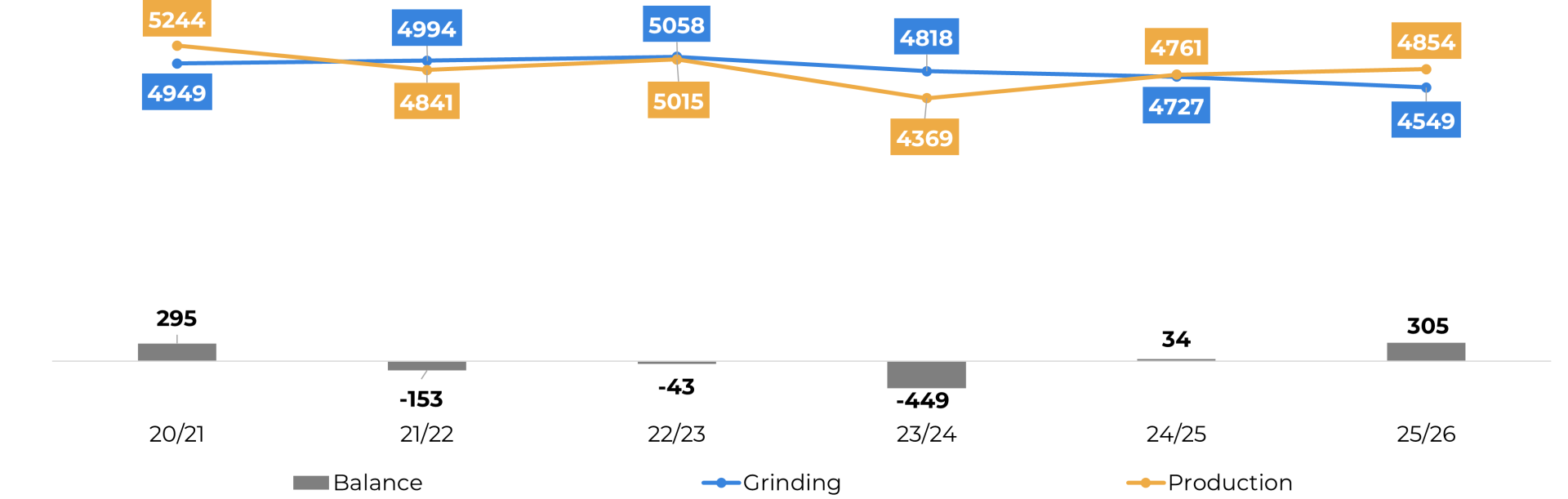

- We expect a surplus of around 305 kt in the 25/26 crop, reinforcing the bearish trend also observed in technical indicators such as the RSI.

- It is worth noting that the oversold level opens room for technical corrections, which may change market sentiment in the short term.

Live with Experts November Edition: Highlights

The cocoa market is moving towards the end of 2025 amid a process of rebalancing fundamentals. After two years marked by supply constraints, historically low stocks, and record prices, the 25/26 crop is beginning to take shape with expectations of a partial recovery in global production, while demand remains weak in the main consuming regions. This environment supports the surplus trend for the current season and recent price corrections, but volatility remains high as the market remains sensitive to factors that could affect key fundamentals. In this regard, Hedgepoint brought together the main current market points in the second edition of Live with Experts: Cocoa Market, summarized below.

Macroeconomic Context

Assessing the economic scenario in the main markets, the European Central Bank kept interest rates unchanged for the third consecutive meeting, reflecting lower macroeconomic risk and the partial resilience of the eurozone economy. Inflation fell slightly and approached the two percent target, while factors such as the improved trade environment with the US, the ceasefire in Gaza, and reduced tariff tensions between the US and China contributed to a more constructive perception of global growth. Despite this, the market remains attentive to the performance of industrial indicators, the decline in the volume of European exports to the US, and the increase in Chinese products in the European market.

In the US, the market remains attentive to inflation and labor market data after the end of the government shutdown. Although the number of jobs increased in September, negative revisions from the previous month and the increase in the unemployment rate suggest caution in interpreting labor market conditions. Inflation remains without significant pressure, but the likely absence of some of the October data adds uncertainty to the Federal Reserve's decision at its December meeting, after two recent consecutive cuts.

Still on the US economy, some changes in US trade policy played an important role in the cocoa market. Among them was the removal of tariffs on products from Ecuador, including cocoa, which tends to intensify possible adjustments in the commodity's trade flows.

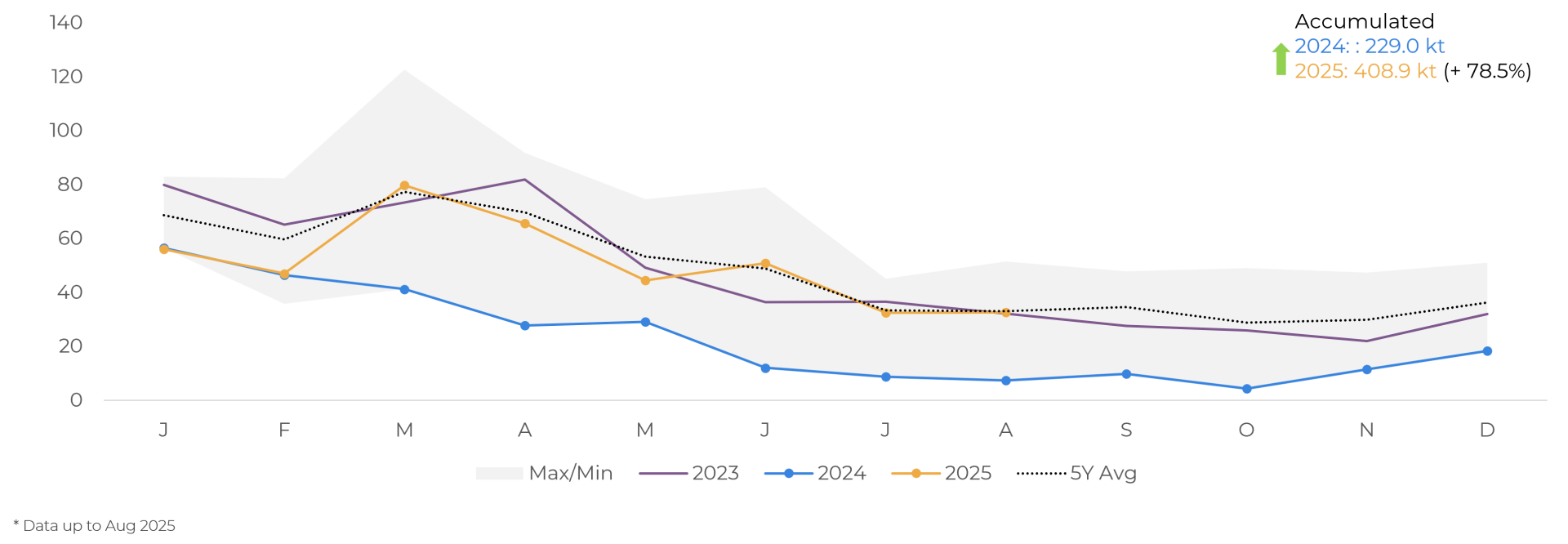

US Imports

In terms of demand, the US continues to show a more resilient outlook. Net cocoa imports returned to growth in August after the data interruption during the shutdown, remaining close to the historical average. In the year to August, volumes grew significantly compared to 2024, driven mainly by imports of beans, signaling continued stronger demand in North America.

US: Total net cocoa imports ('000 tons)

Source: United States International Trade Commission (USITC)

Assessing imports by origin, Ecuador significantly increased its share of US imports, reflecting both lower production in West Africa and the new tariff environment. This transformation is also reflected in the composition of ICE US certified stocks, which show a greater presence of Latin American origins.

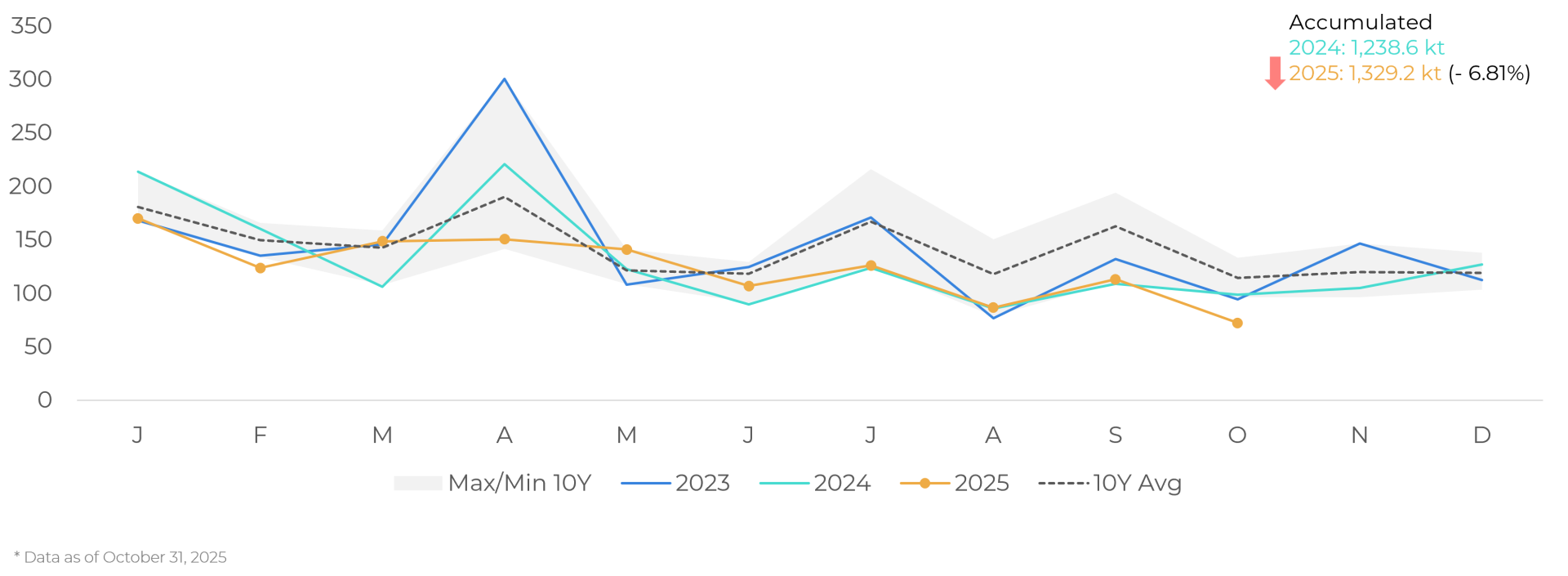

EU Imports

In the European Union, total imports declined again in October. In addition to weakened demand and still high prices, the slower pace of deliveries from Ivory Coast at the beginning of the current season may have contributed to this scenario, considering that the country accounts for almost half of the beans imported by the region.

EU: Total net cocoa imports ('000 tons)

Souce: European Commission

Grinding data for the third quarter of 2025 reinforce a scenario of declining demand, although with different behaviors between regions. Asia again recorded a more intense decline, driven mainly by the drop in Malaysia. In Europe, the reduction was more moderate than initially expected, following the slight improvement in imports observed in the period, but which were still negative compared to 2024. In contrast, North America showed growth in industrial activity, sustained both by an increase in the number of processors participating in the survey and by an increase in net imports. Despite these regional differences, the financial results of the main processors and manufacturers continue to indicate pressure on volumes and margins, suggesting that high cocoa prices continue to limit global consumption.

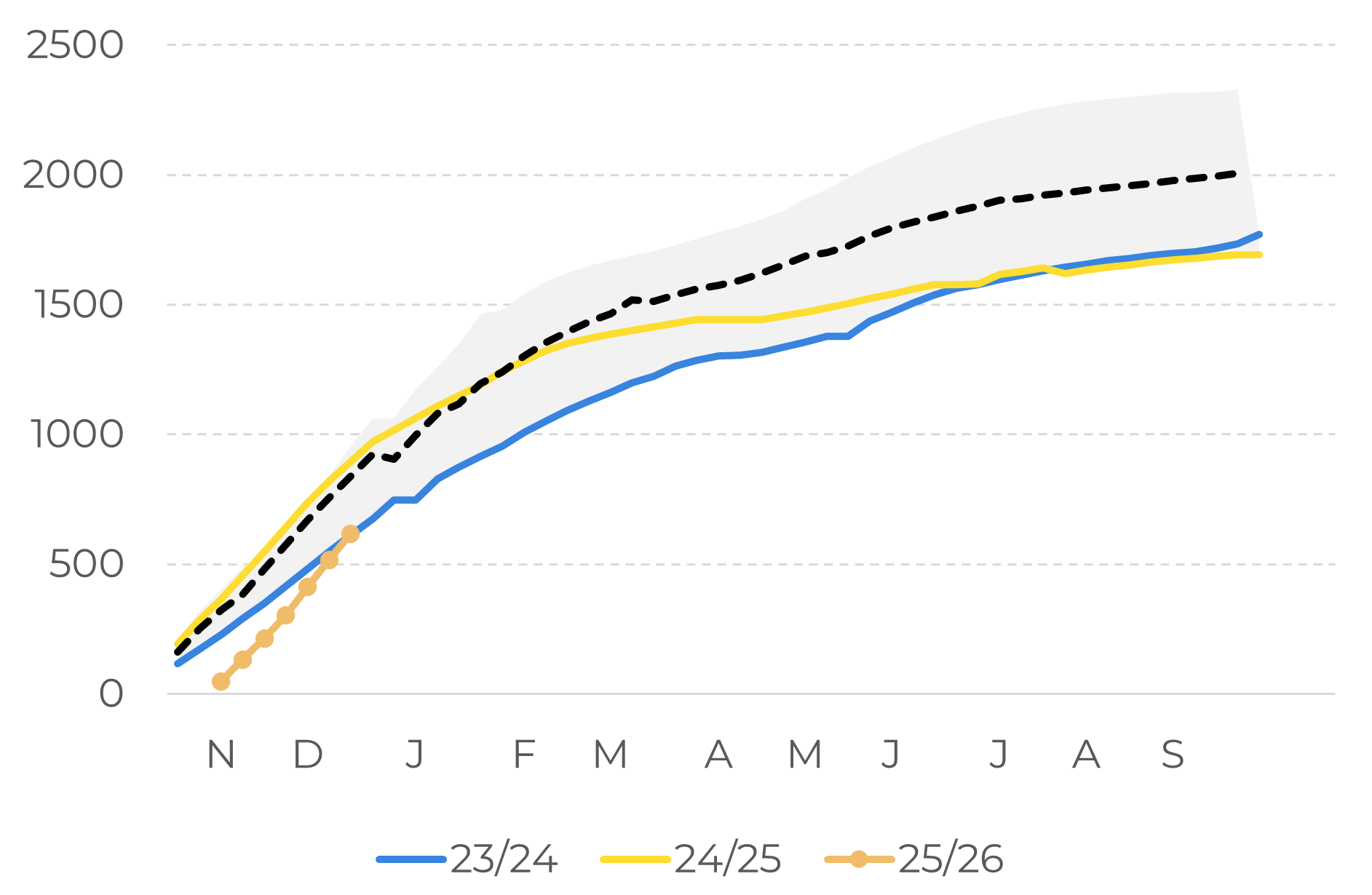

Supply and Weather

On the supply side, the 25/26 crop begins with signs of recovery in some regions, but still under significant weather influence. In Ivory Coast, the initial delay in arrivals is gradually being reversed, and the accumulated volume is approaching the level seen in the last crop. Even so, local authorities have highlighted concerns about weather patterns in the coming months, especially for the development of the mid-crop, noting that unfavorable conditions last season compromised volumes and quality. In Ghana, accumulated rainfall remains close to average, but there are risks associated with the high incidence of disease in aging crops.

Ivory Coast Port Arrivals (‘000 tons)

Source: LSEG, Hedgepoint

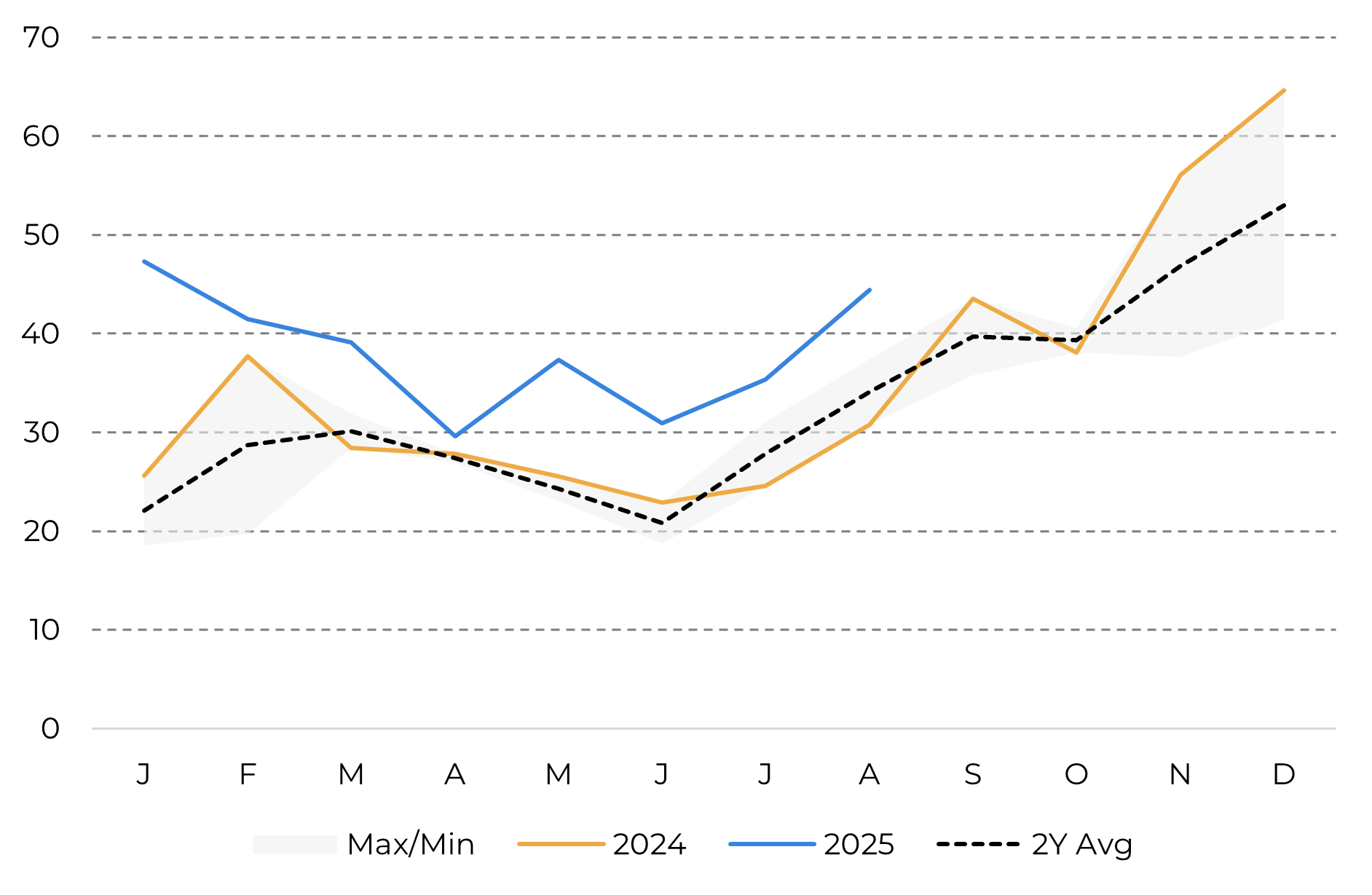

Ecuador remains one of the main drivers of global supply growth. Favorable weather conditions, productivity gains, and continued investment in the crop support a production forecast of around 570 kt, with an upward trend. Exports are expected to remain robust, in line with the country's expanding presence in US’s imports and other consumer markets.

Ecuador cocoa exports (‘000 tons)

Source: : Ministry of Agriculture and Livestock of Ecuador

Even with some recovery, global stocks remain below the historical average, sustaining volatility. The approaching expiration of the December contract should cause adjustments in certified volumes, in line with usual delivery movements. In New York, Ecuador's significant share of certified stocks is noteworthy, reinforcing the structural change in global flows.

Based on the current supply and demand scenario, our expectation, in line with the prevailing market view, is for a global surplus in the 25/26 season. Our current estimate points to a surplus of around 305,000 tons, resulting from the partial recovery of production in important origins, combined with the decline in grinding in the main consumer regions. This scenario reinforces the downward trend observed in prices, also evidenced by technical readings, with the RSI operating in oversold territory in both New York and London. At the same time, this level opens space for short-term correction movements, such as covering short positions, which may be reinforced by changes in fundamentals, especially related to weather behavior, as well as by new developments in the economic and commercial environment, such as the final decision on the implementation of the EUDR.

Global Supply and Demand for Cocoa (‘000 tons)

Source: ICCO, Hedgepoint

In Summary

The cocoa market ends 2025 in a process of adjustment of fundamentals, with global supply showing signs of recovery while demand remains weak in the main consuming regions. The combination of a partial recovery in production in relevant origins, a slowdown in grinding in Europe and Asia, and greater resilience in demand in the US supports the expectation of a surplus for the 25/26 crop and explains the recent trend of price correction. Even so, the market continues to operate in an environment of high sensitivity to weather, financial, and logistical variables, which keeps volatility high despite the improvement in the global balance.

Demand dynamics show significant contrasts. While the US has increased beans imports, which may be driven by tariff agreements and increased cocoa flows from Ecuador, the EU has seen a decline in imports, reflected in grinding results. On the supply side, Ivory Coast is moving toward a gradual recovery, although the climate remains a concern, similar to the situation in Ghana, and Ecuador is consolidating its role as one of the main drivers of global production expansion.

As a result, we expect a surplus of around 305 kt in the 25/26 season, reinforcing the downward trend also observed in technical indicators. It is worth noting that the oversold level opens room for technical corrections, which may change market sentiment in the short term.

Weekly Report — Cocoa

carolina.frança@hedgepointglobal.com

laleska.moda@hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without intending to create obligations or commitments to third parties. It is not intended to promote or solicit an offer for the sale or purchase of any securities, commodities interests, or investment products. Hedgepoint and its associates expressly disclaim any liability for the use of the information contained herein that directly or indirectly results in any kind of damages. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests, such as futures, options, and swaps, involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgment and/or consult advisors before entering into any transactions. Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately. Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only). Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets. “HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.