Cocoa: technical factors dominate in the short term, with weather in focus

- Cocoa prices continue to fluctuate within recent ranges, reflecting a market driven mainly by technical factors in recent days.

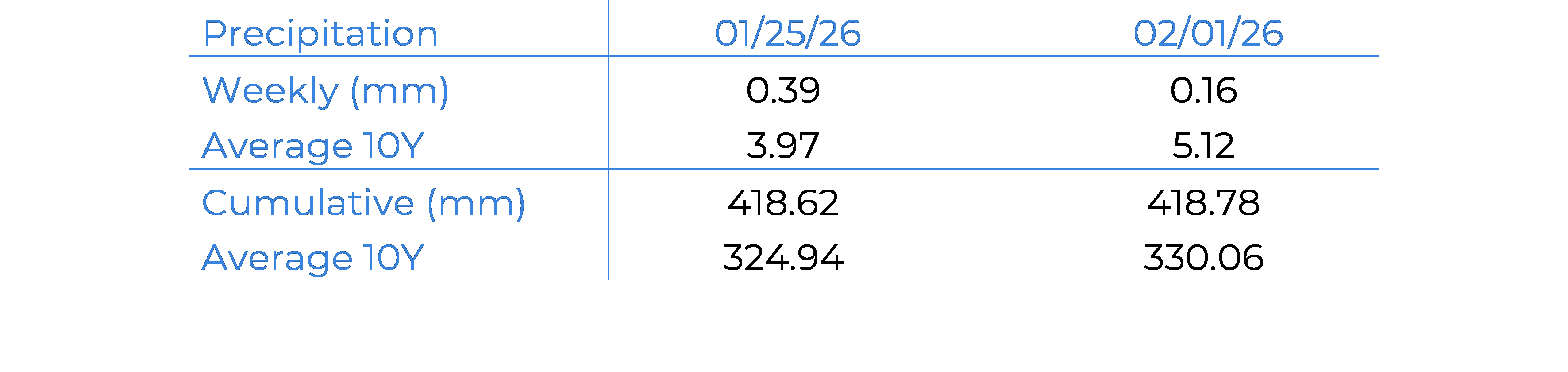

- In Ivory Coast, the recent reduction in rainfall contrasts with a slightly above-average cumulative, maintaining relatively favorable prospects for the 2025/26 season if the weather pattern continues.

- However, above-average temperatures in the country increase the risk of plant stress and the spread of diseases such as CSSV (Cacao Swollen Shoot Virus), which already threatens a significant portion of Ivory Coast's production.

- In Ghana, despite good cumulative rainfall, the recent decrease in precipitation keeps the weather on the market's radar given its importance for the development of the mid-crop.

Cocoa prices fall for another week

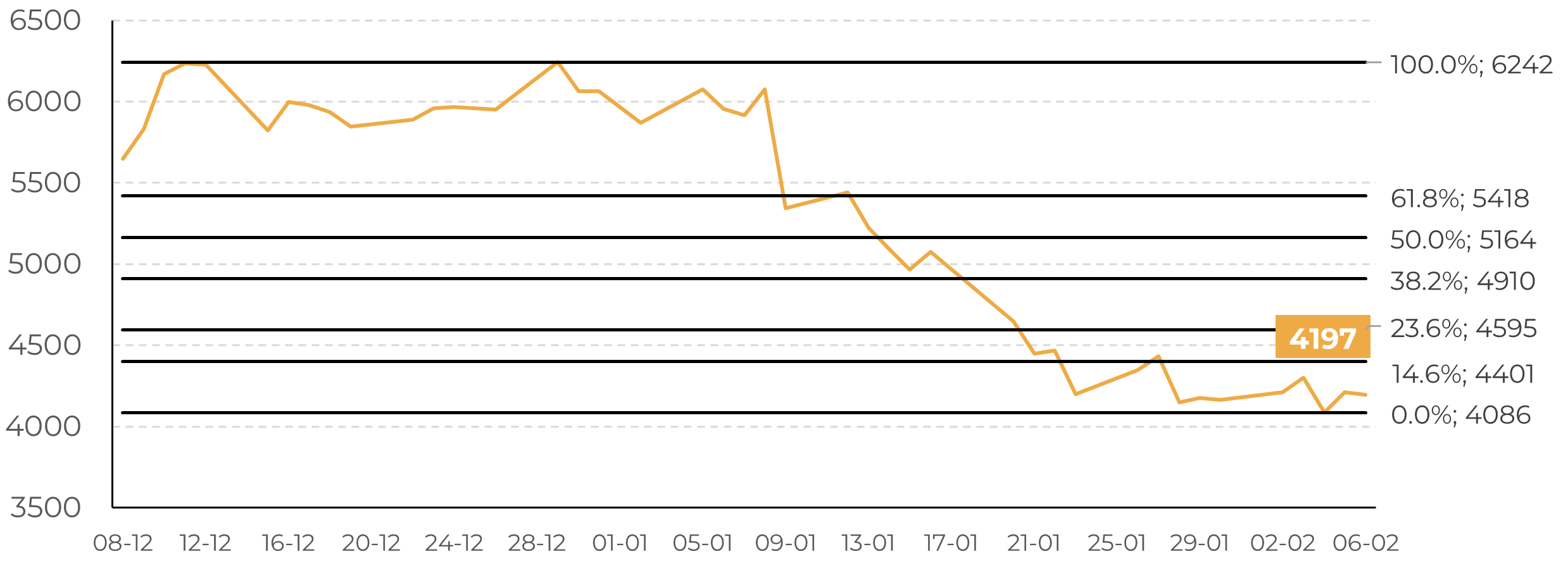

In a period still marked by volatility and technical adjustments, cocoa futures closed lower on Friday, February 6. With no significant changes in fundamentals, the attempted recovery seen in the previous session did not hold, with prices once again facing technical limitations. In this context, the market remained more sideways, with prices fluctuating within recently observed ranges, between 4,086 and 4,401 USD/t in New York and 2,885 and 3,129 GBP/t in London.

Cocoa – New York (1st contract): Fibonacci retracement levels

Source: LSEG

Cocoa – New York (1st contract): Fibonacci retracement levels

Source: LSEG

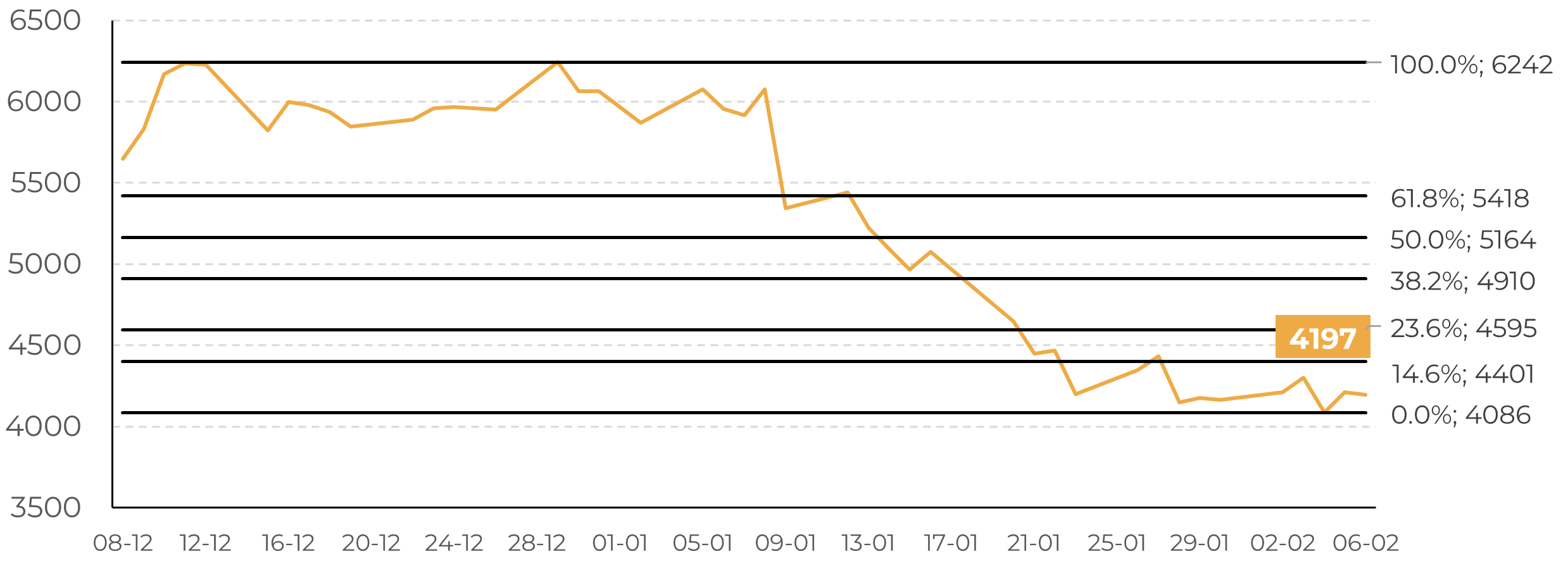

Although recent movements continue to be driven predominantly by technical factors, the weather remains a focus points for the market. In this analysis, we turn our attention to weather conditions, which continue to have the potential to influence price dynamics throughout the month. In Ivory Coast, the most recent picture has been marked by below-average rainfall, which raises concerns for the coming weeks regarding the need for adequate rainfall for the development of the mid-crop, which begins in April. Nevertheless, the cumulative rainfall since the beginning of the season remains slightly above average, contributing to a more favorable outlook for the 2025/26 cycle if this weather pattern continue.

Estimated cumulative rainfall for Ivory Coast’s cocoa-producing districts (mm)

Souce: CPC Gadas, Hedgepoint

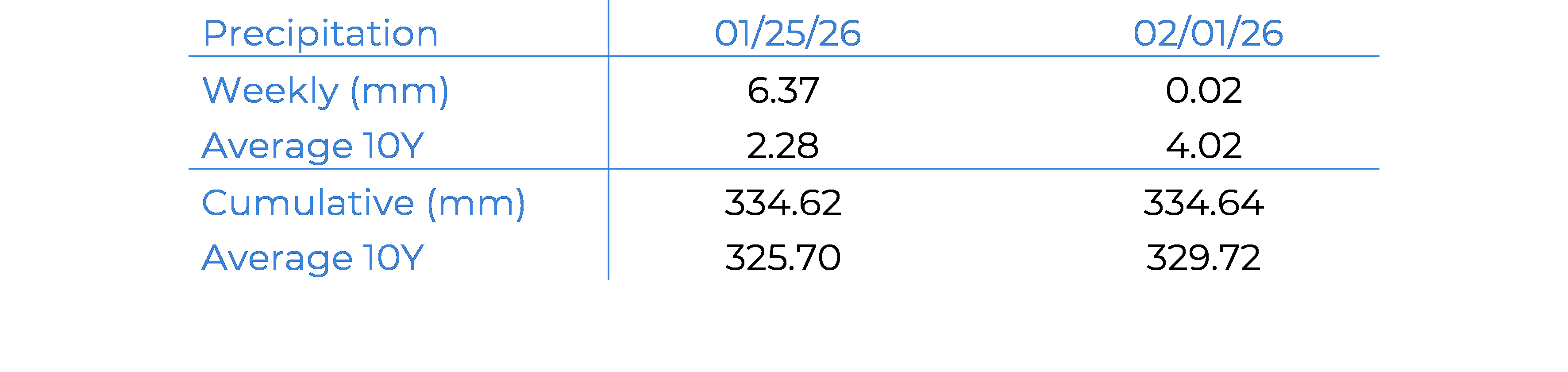

On the other hand, above-average temperatures recorded in recent weeks may intensify plant stress during drier periods or, when combined with high rainfall, favor the spread of diseases, a recurring concern in the region. In this context, a recent study by the non-profit organization Enveritas estimates that cocoa swollen shoot disease (CSSVD) has been spreading in the country, putting about 15% of Ivory Coast's cocoa production at risk.

Estimated average temperature for cocoa Ivory Coast’s producing districts (°C)

Souce: CPC Gadas, Hedgepoint

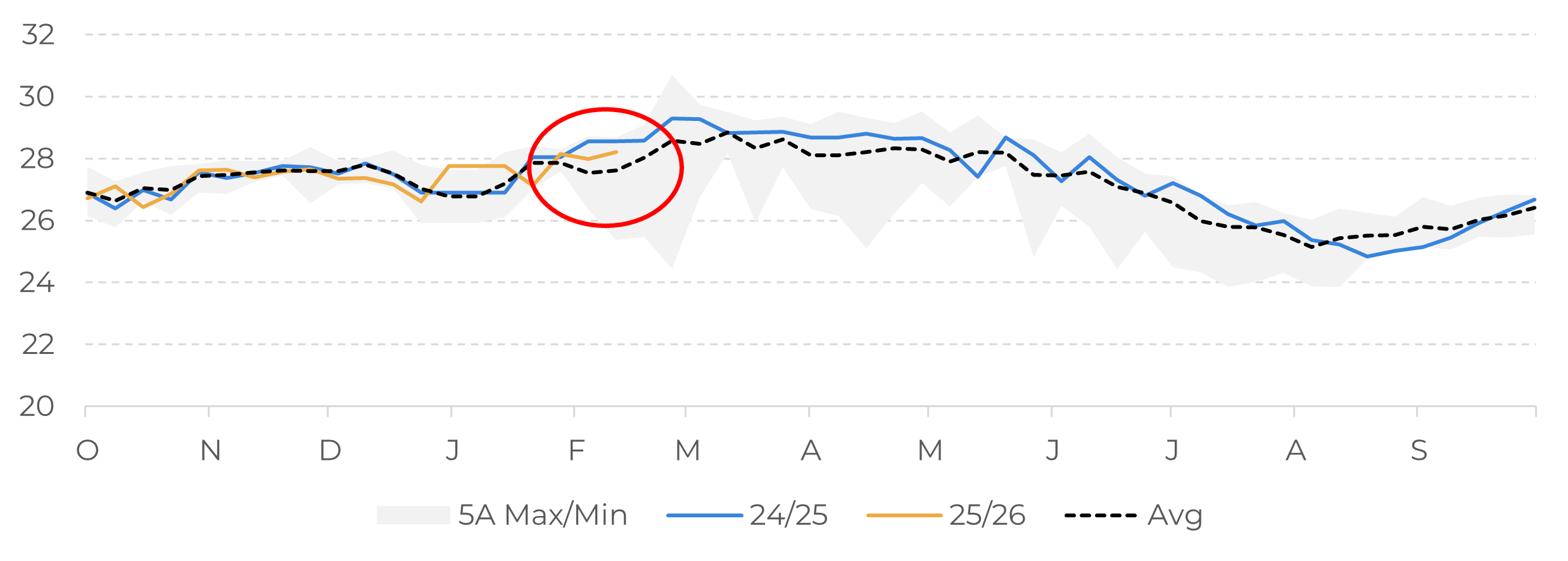

In Ghana, the world's second-largest producer, even though the cumulative rainfall between October 2025 and February 2026 was above average and higher than that recorded in the same period last season, the last two weeks have been marked by below-average precipitation. Although the average temperature remains within historical standards, the weather in the coming weeks will play a significant role in the development of the fruits and country's mid-crop, which will continue to be monitored by the market.

Estimated cumulative rainfall for Ghana's cocoa-producing regions (mm)

Souce: CPC Gadas, Hedgepoint

In this sense, although the market remains bearish, the weather continues to be one of the main factors to be monitored, with the potential to cause short-term volatility. Any news related to the main producing regions may cause adjustments in prices, particularly in a market that is close to oversold levels.

In Summary

In an environment still marked by volatility and technical adjustments, cocoa futures have continued to trade sideways in recent days, with no significant changes in fundamentals in the short term. Despite this, the weather remains one of the main factors of concern for the market, with recent conditions in Ivory Coast and Ghana requiring closer monitoring, especially in view of the approaching mid-crop. Although cumulative rainfall since the beginning of the crop remains generally favorable, recent episodes of below-average precipitation and high temperatures reinforce weather risks, and any updates may lead to price adjustments in a market already close to oversold levels.

Weekly Report — Cocoa

carolina.frança@hedgepointglobal.com

laleska.moda@hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without intending to create obligations or commitments to third parties. It is not intended to promote or solicit an offer for the sale or purchase of any securities, commodities interests, or investment products. Hedgepoint and its associates expressly disclaim any liability for the use of the information contained herein that directly or indirectly results in any kind of damages. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests, such as futures, options, and swaps, involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgment and/or consult advisors before entering into any transactions. Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately. Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only). Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets. “HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.