Conilon exports fall in January, but 24/25 is on track for record

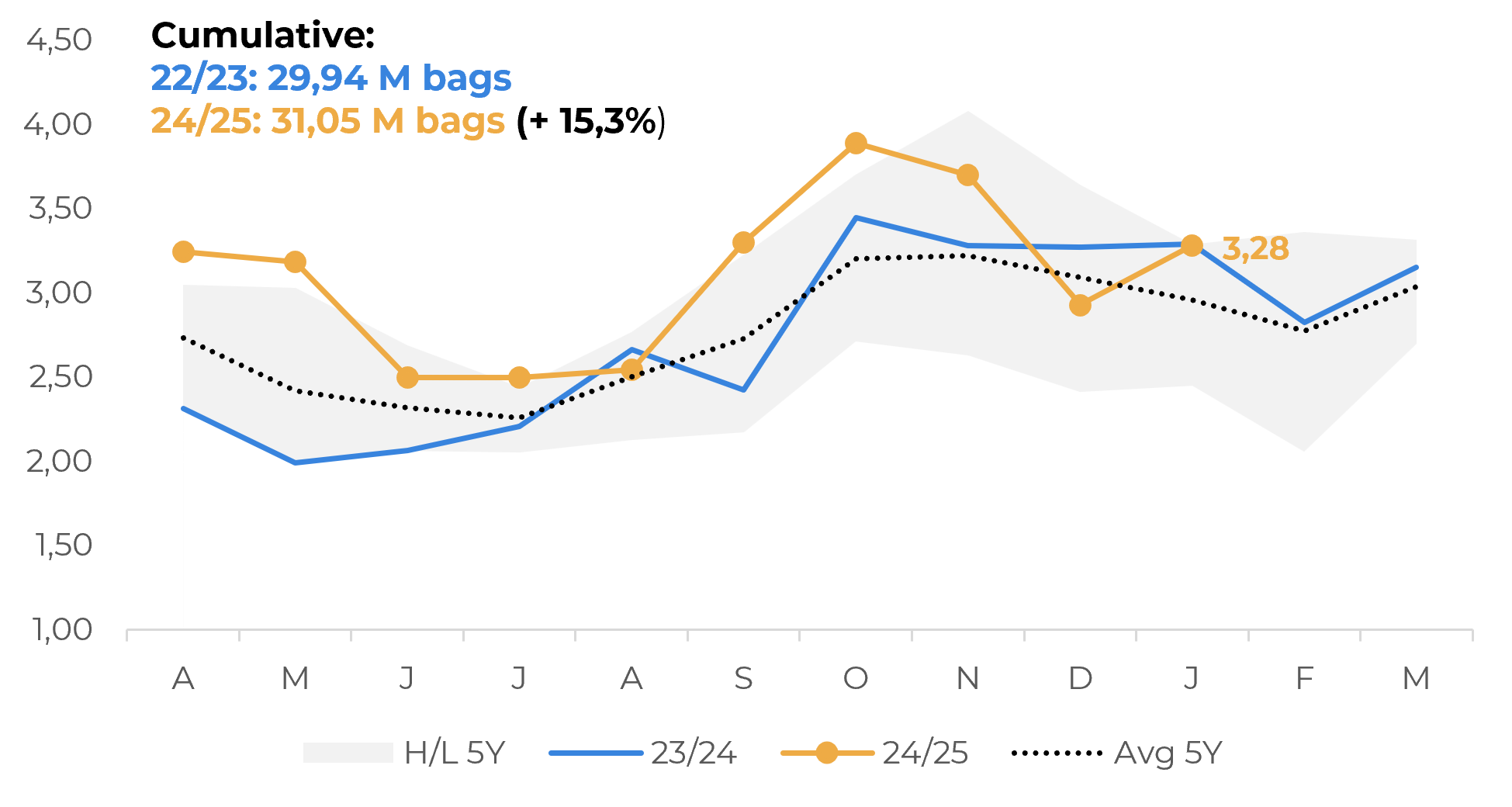

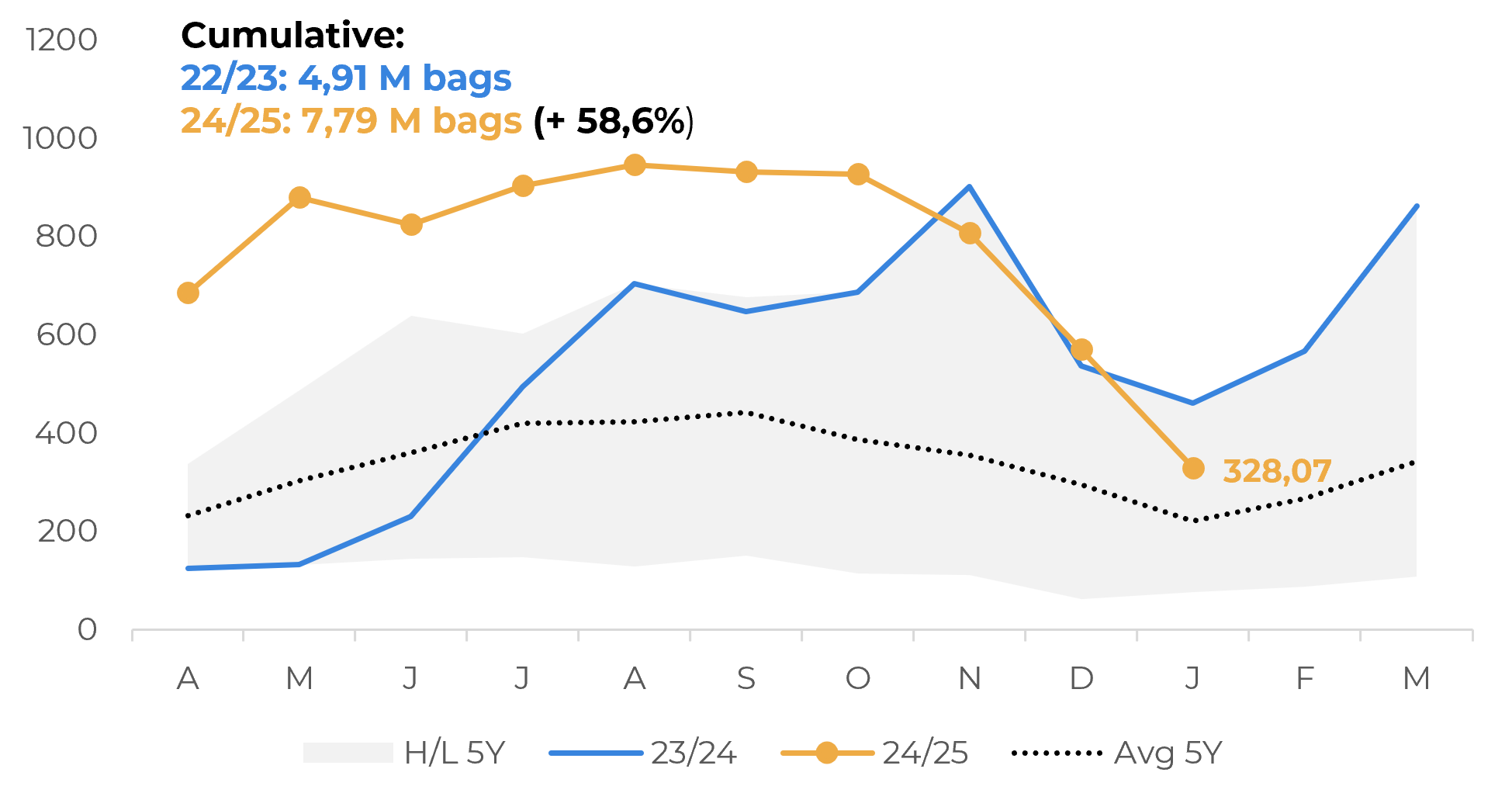

- Brazil's coffee exports fell slightly in January. While Arabica shipments remained firm, Conilon registered a significant drop last month, possibly reflecting the bean's lower availability and demand, as buyers may wait for the 25/26 harvest before making new purchases.

- However, the total accumulated shipments in 24/25 (Apr-Jan) already exceeds 42 million bags and should lead to a year of record exports.

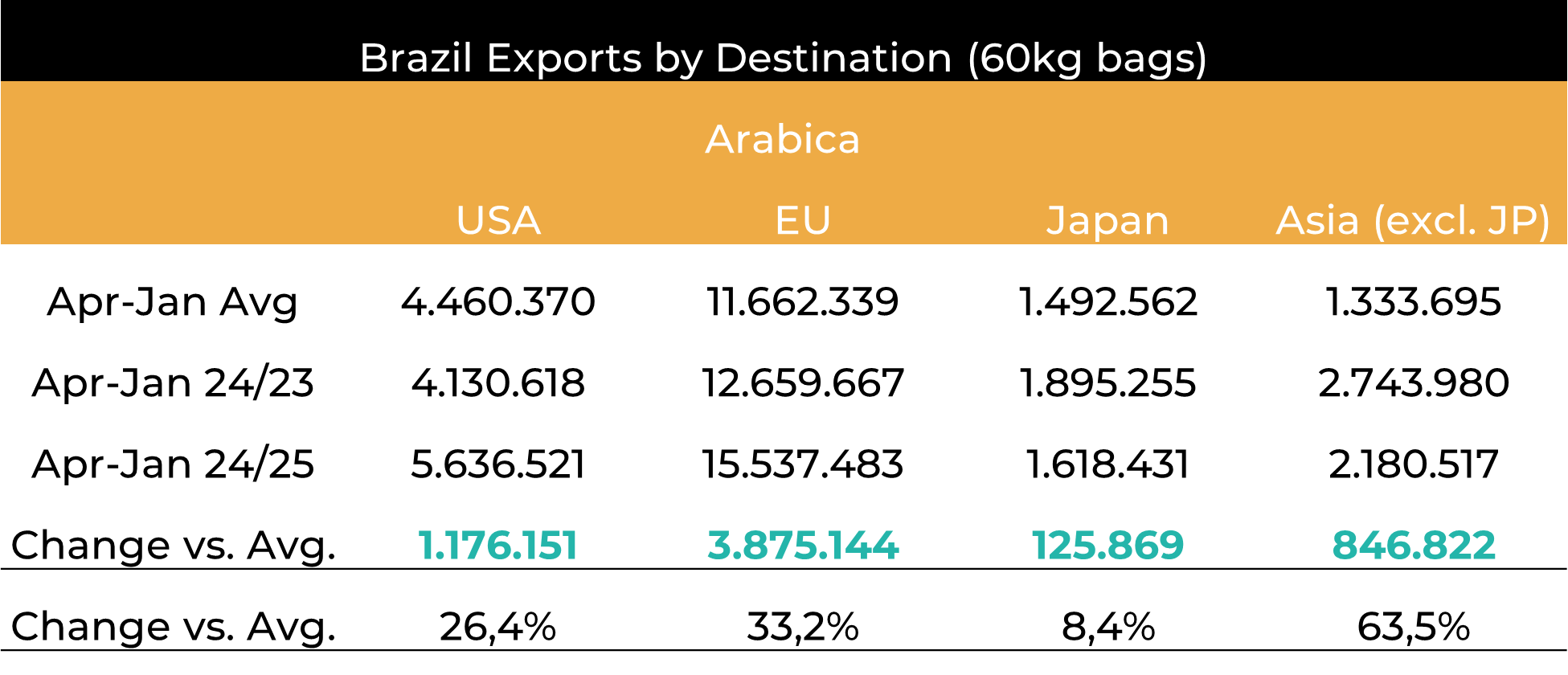

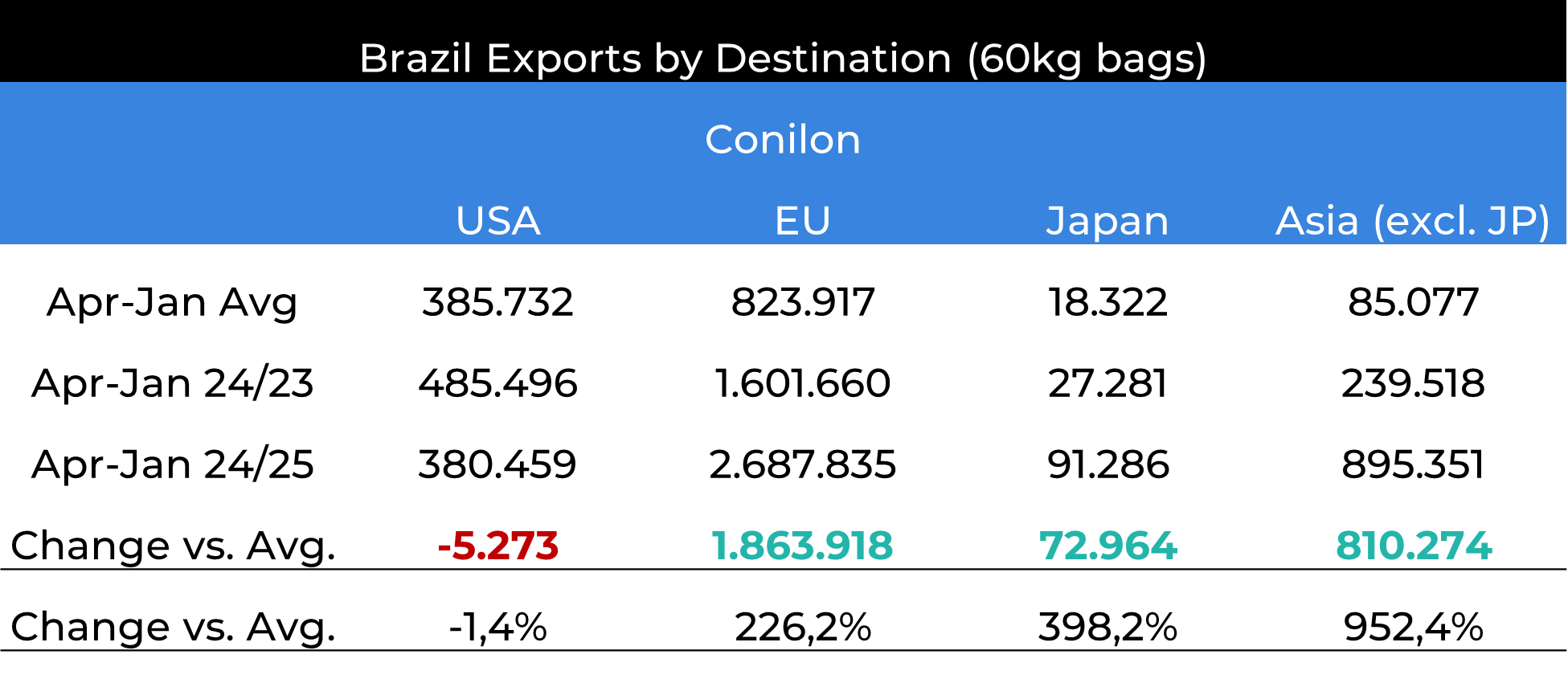

- Regarding the destination of Brazilian beans, the demand for Arabica increased in all destinations, especially in the US and the EU. For Conilon, there was a slight drop in shipments to the US, but a significant increase to the EU and Asia, including Japan.

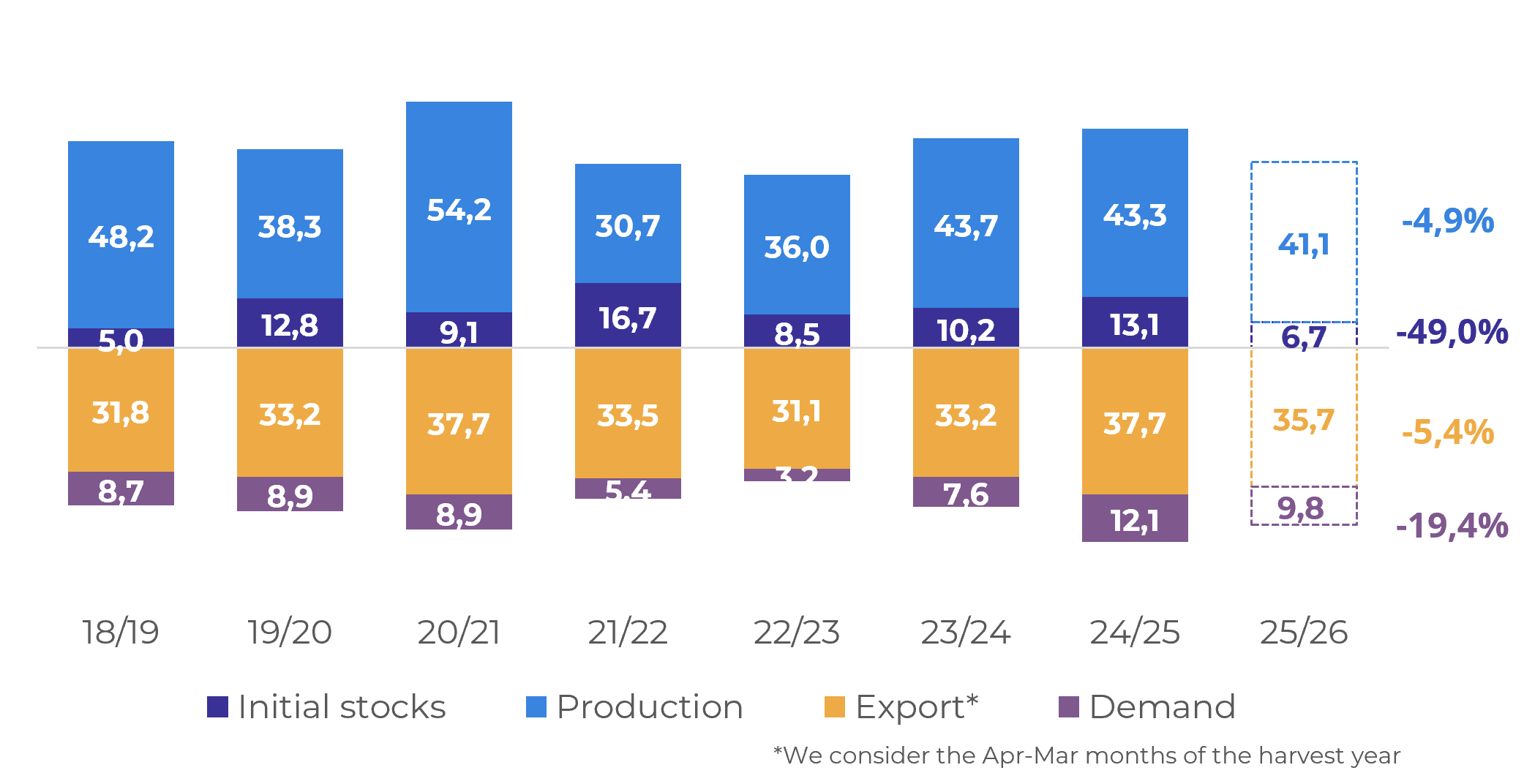

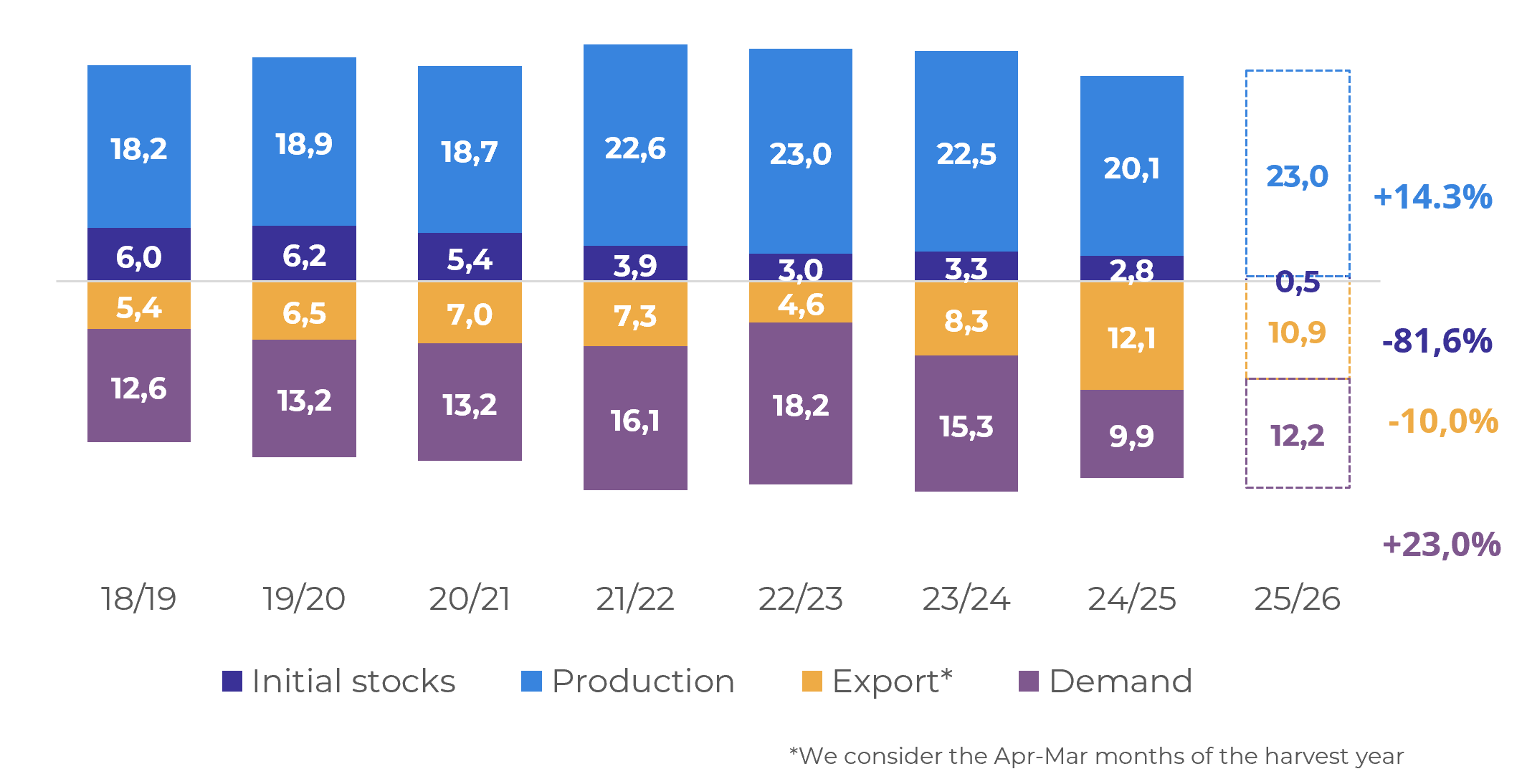

- For 25/26, however, we initially expect a slight drop in exports of both varieties, due to lower Arabica production, lower stocks of both varieties, and a possible increase in domestic consumption of Conilon.

Conilon exports fall in January, but 24/25 is on track for record

Brazil: Green Arabica Exports (M bags)

Source: Cecafé

Brazil: Green Conilon Exports ('000 bags)

Source: Cecafé

In terms of the main buyers of Brazilian coffee, Arabica increased its share in the 24/25 crop in all destinations compared to the recent years average, especially in the European Union and the United States. On the other hand, compared to the same period in the 23/24 season, there was a slight drop in the bean's presence in Asia. On the Conilon side, while there was a considerable increase in shipments to Asia and the EU, there was a slight decline in exports to the US. Comparing only 24/25 and 23/24 harvests, the movement was also similar.

Expectations for the next few months of the 24/25 season indicate lower shipments. This is primarily due to the reduced supply in Brazil and the upcoming 25/26 harvest season. Even so, as already mentioned, we expect this cycle to continue with record total shipments.

Brazil: Arabica Exports by Destination (bags)

Source: Cecafé

Brazil: Conilon Exports by Destination (bags)

Source: Cecafé

In Conilon’s case, while higher production would tend to favor exports, we must remember that 24/25 was marked by a substantial increase in the share of Brazilian beans in global exports, bringing stocks of the variety in Brazil to their lowest levels in history. In addition, with the current levels of spread between Arabica and Conilon prices in the country, we expect the use of the latter variety in the national blend to be favored, leading to an increase in consumption and a limitation on grain exports.

Hedgepoint: Brazil Arabica Supply and Demand (M bags)

Source: Hedgepoint

Hedgepoint: Brazil Conilon Supply and Demand (M bags)

Source: Hedgepoint

In Summary

Weekly Report — Coffee

laleska.moda@hedgepointglobal.com

livea.coda@hedgepointglobal.com