Future prices drop, but weather concerns could cap the correction

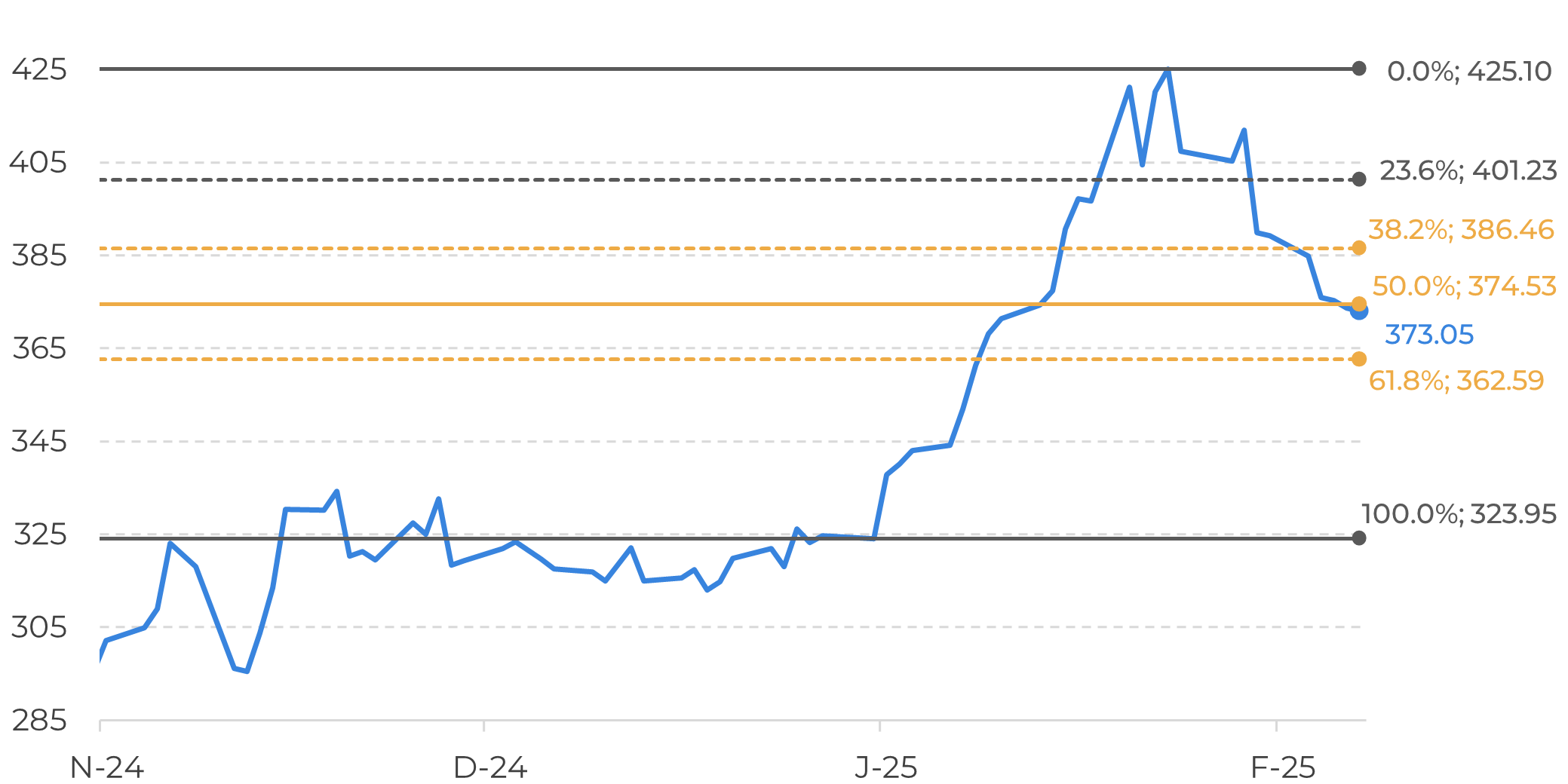

- After setting a record this month, arabica futures prices sharply fell in the last two weeks of February, coming back to the 370 c/lb levels. Robusta futures also followed the trend.

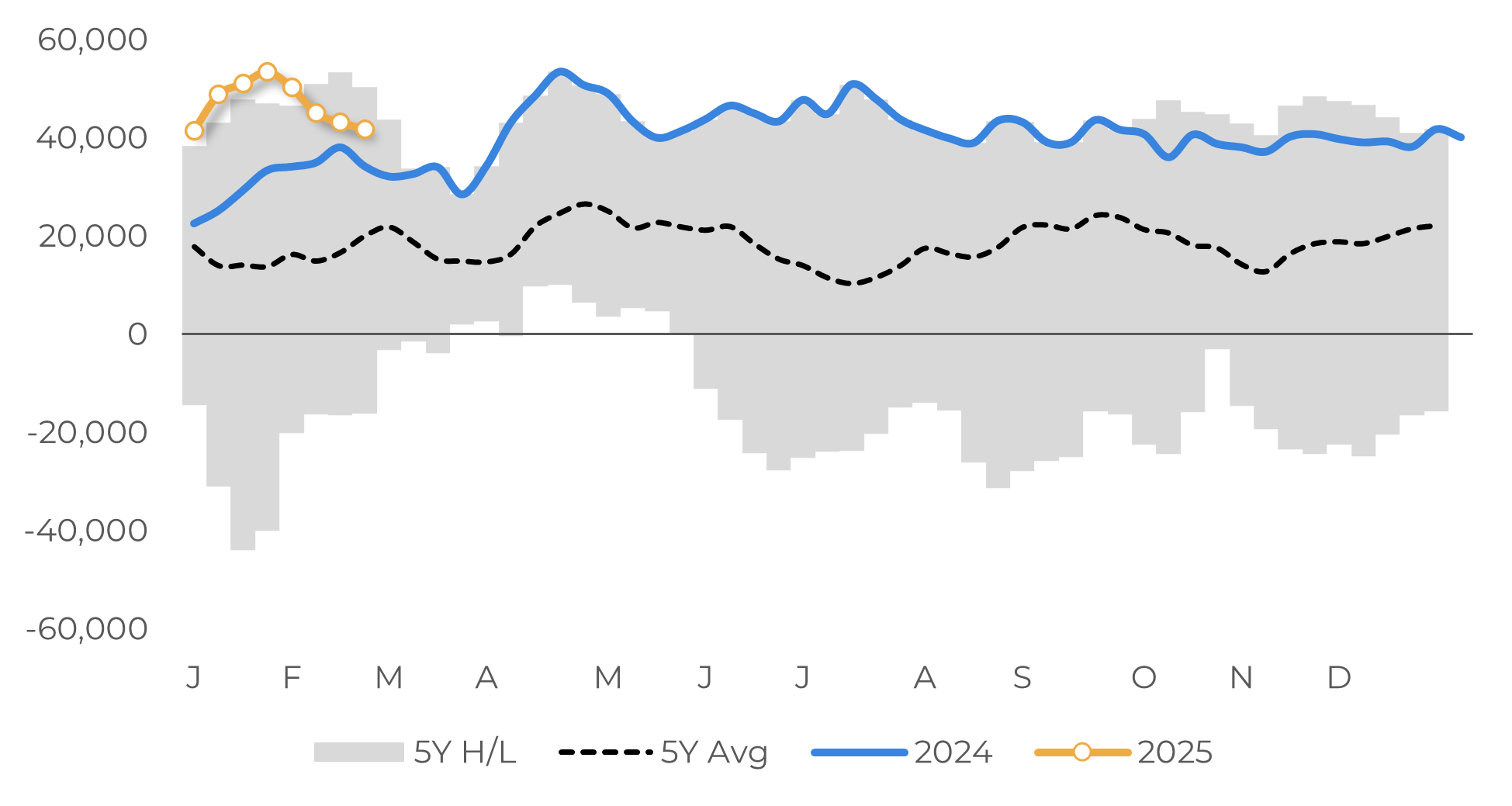

- A correction was expected after the expressive rally in early February, especially with the pause in roasters buying, the decrease in the Open Interest for call option and, the recent liquidation of long positions by speculative funds.

- Besides that, there is an ongoing expectation of negative impact on the demand given current prices, with some of the largest companies in the world pointing to weakens in sales.

- Despite this bearish look in the short-term, prices could show some reaction again in March, as weather in Brazil starts to raise concerns and overall availability of the bean remain low.

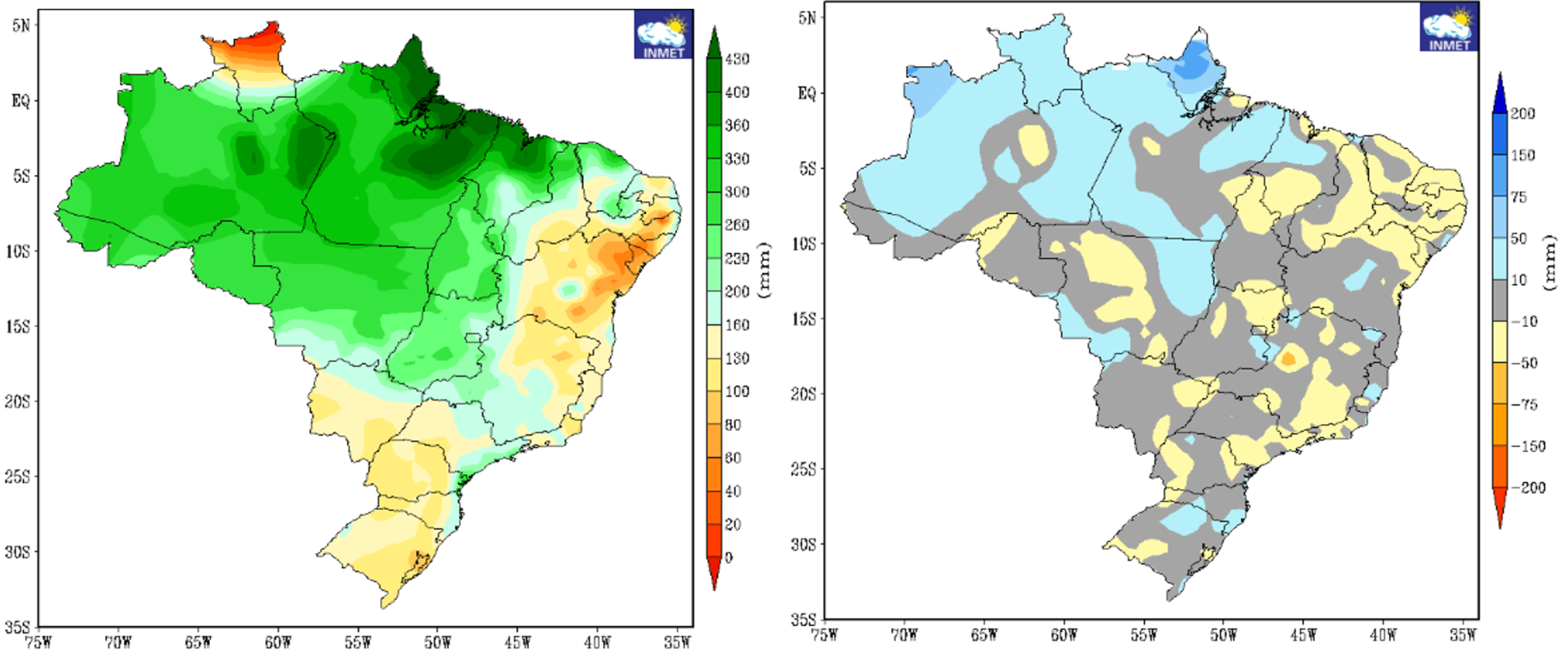

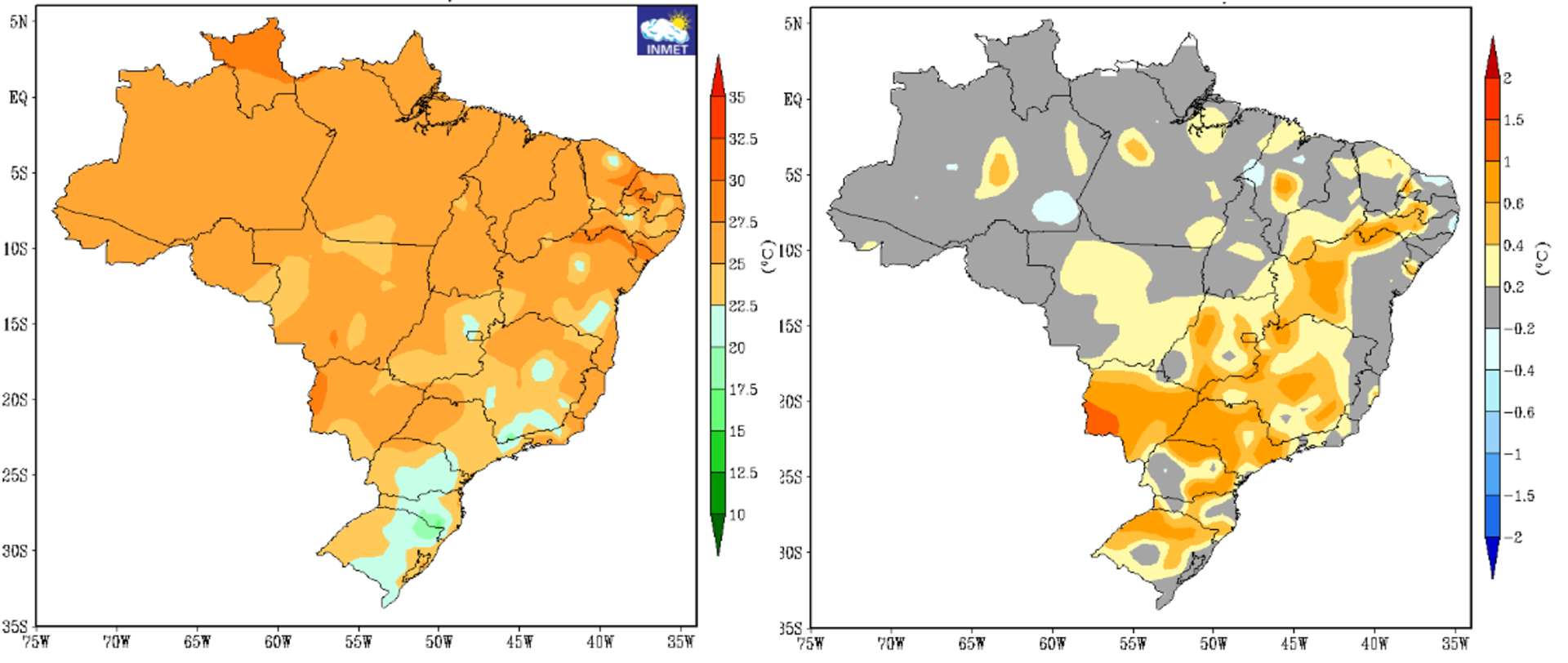

- A new heatwave is expected to hit key producing regions in early March, while cumulative precipitation in 2025 remains below average levels.

Future prices drop, but weather concerns could cap the correction

Fibonacci Retracements: NY Arabica 2ºContract (c/lb)

Source: Refinitiv; Hedgepoint

CFTC: Speculative Funds (lots)

Source: CFTC

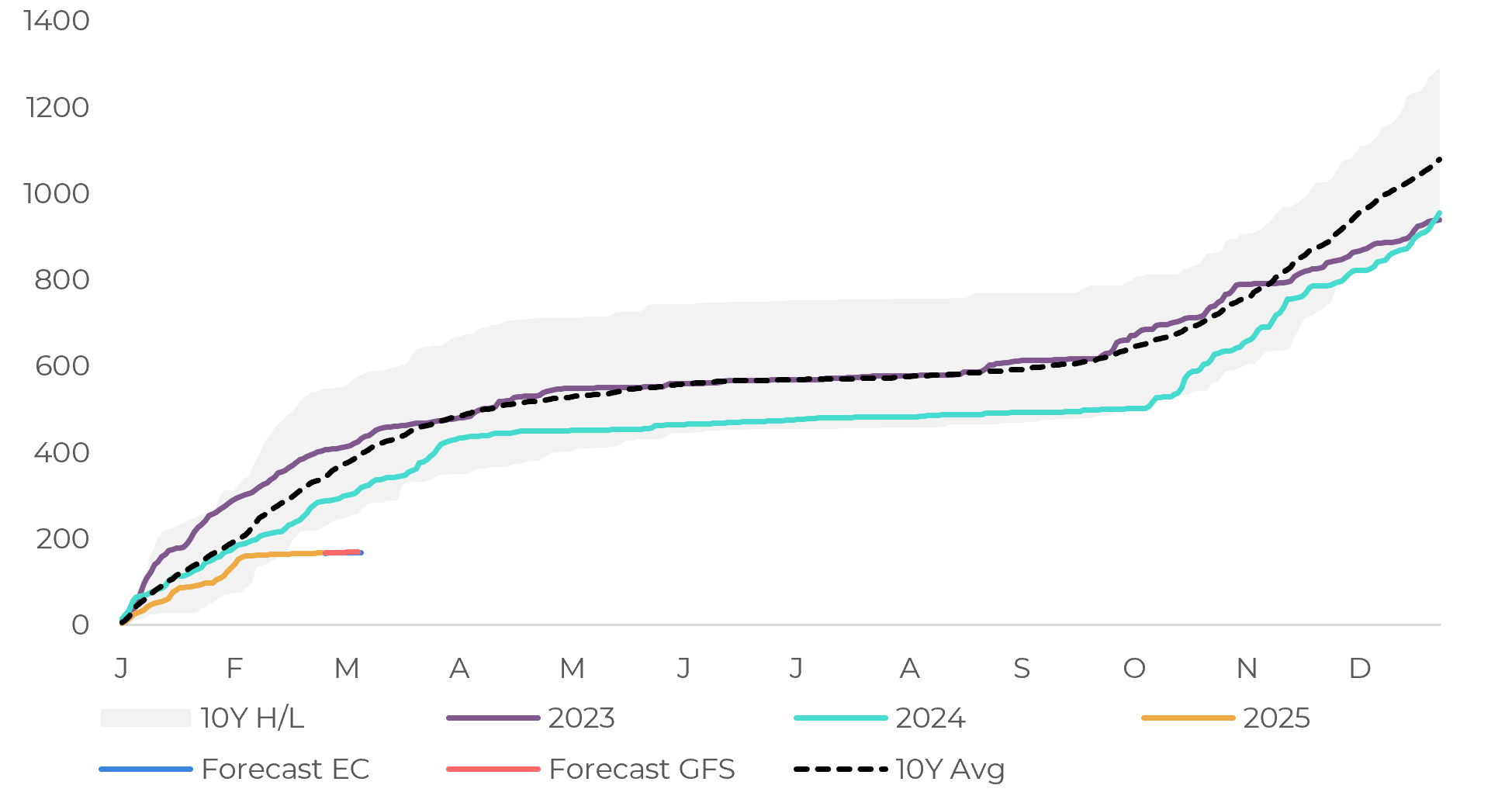

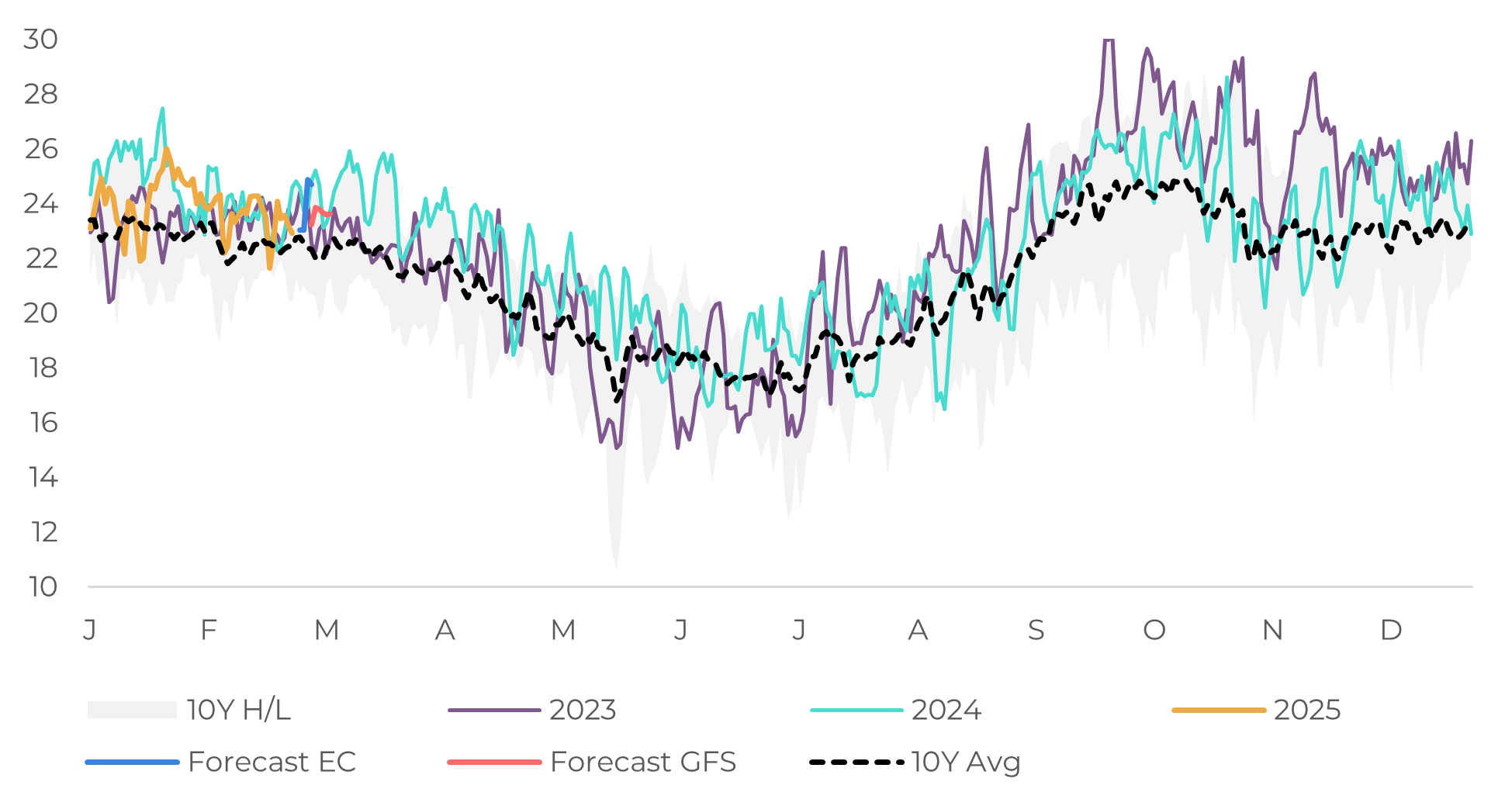

On the other hand, supply concerns are unlikely to dissipate any time soon and will continue to support prices, especially given the current weather conditions in Brazil. Despite good rainfall at the end of 2024 and in January, February was dominated by dry and hot weather in the Center-South of the country, where the main coffee-growing regions are located.

The regions most affected were once again the Arabica's. In Minas Gerais, the largest producing state, cumulative rainfall in 2025 is already at its lowest level for decades. While this trend has been felt throughout the state, the South of Minas and the Zona da Mata have been the most affected regions. Not only is rainfall low, but average temperatures are also above average, following a series of heat waves in the country.

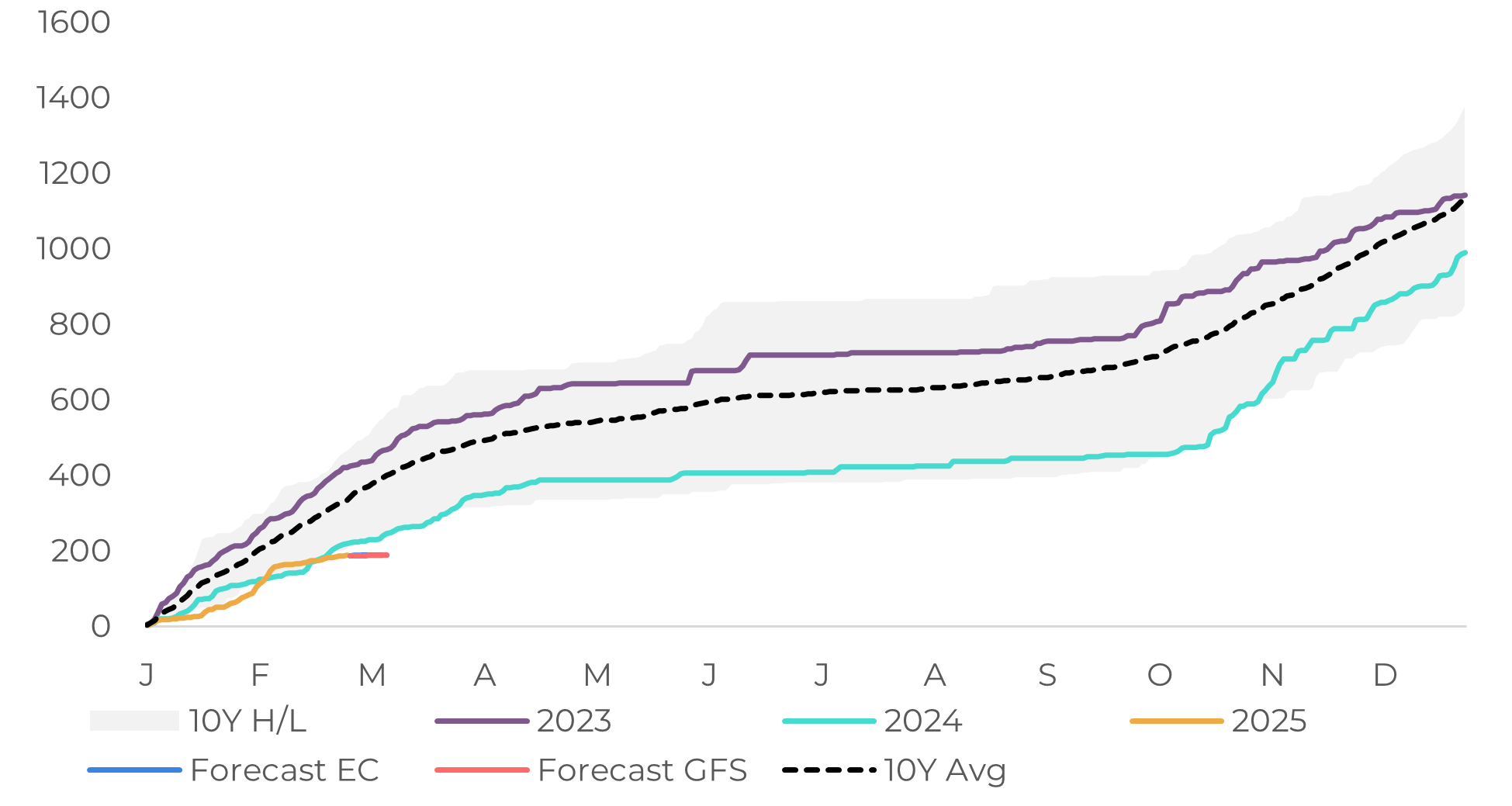

Minas Gerais (BR): Cumulative Precipitation (mm)

Source: Refinitiv, Hedgepoint

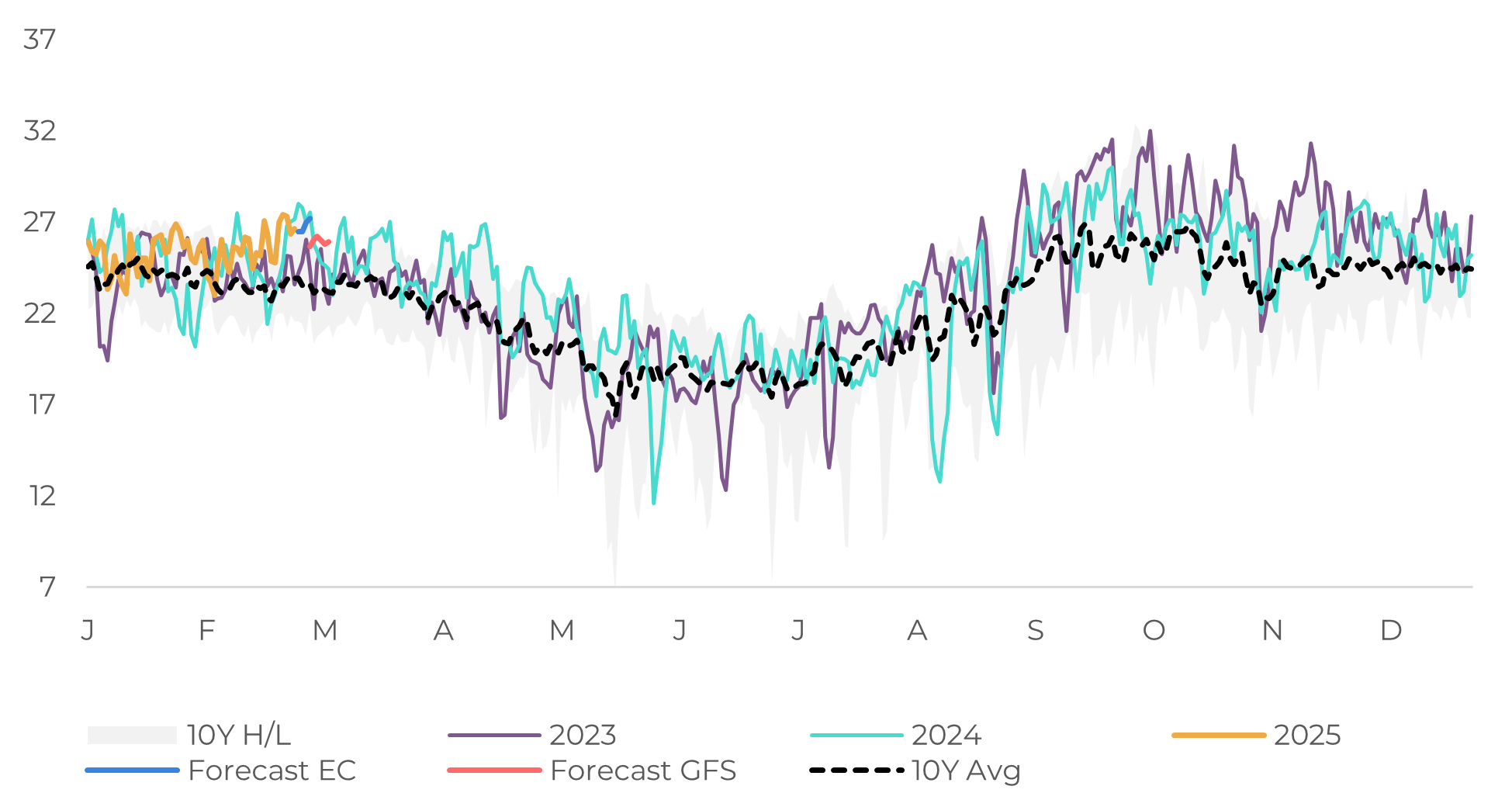

Minas Gerais (BR): Average Temperature (°C)

Source: Refinitiv, Hedgepoint

São Paulo (BR): Cumulative Precipitation (mm)

Source: Refinitiv, Hedgepoint

São Paulo (BR): Average Temperature (ºC)

Source: Refinitiv, Hedgepoint

Brazil: Forecast of Total Precipitation and Precipitation Anomaly in March (mm)

Source: Inmet

Brazil: Forecast of Average Temperature and Temperature Anomaly in March (ºC)

Source: Inmet

In Summary

Weekly Report — Coffee

laleska.moda@hedgepointglobal.com

carolina.franca@hedgepointglobal.com

Disclaimer

To access this report, you need to be a subscriber.

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.