Futures remain below 400 c/lb, as concerns over demand extend

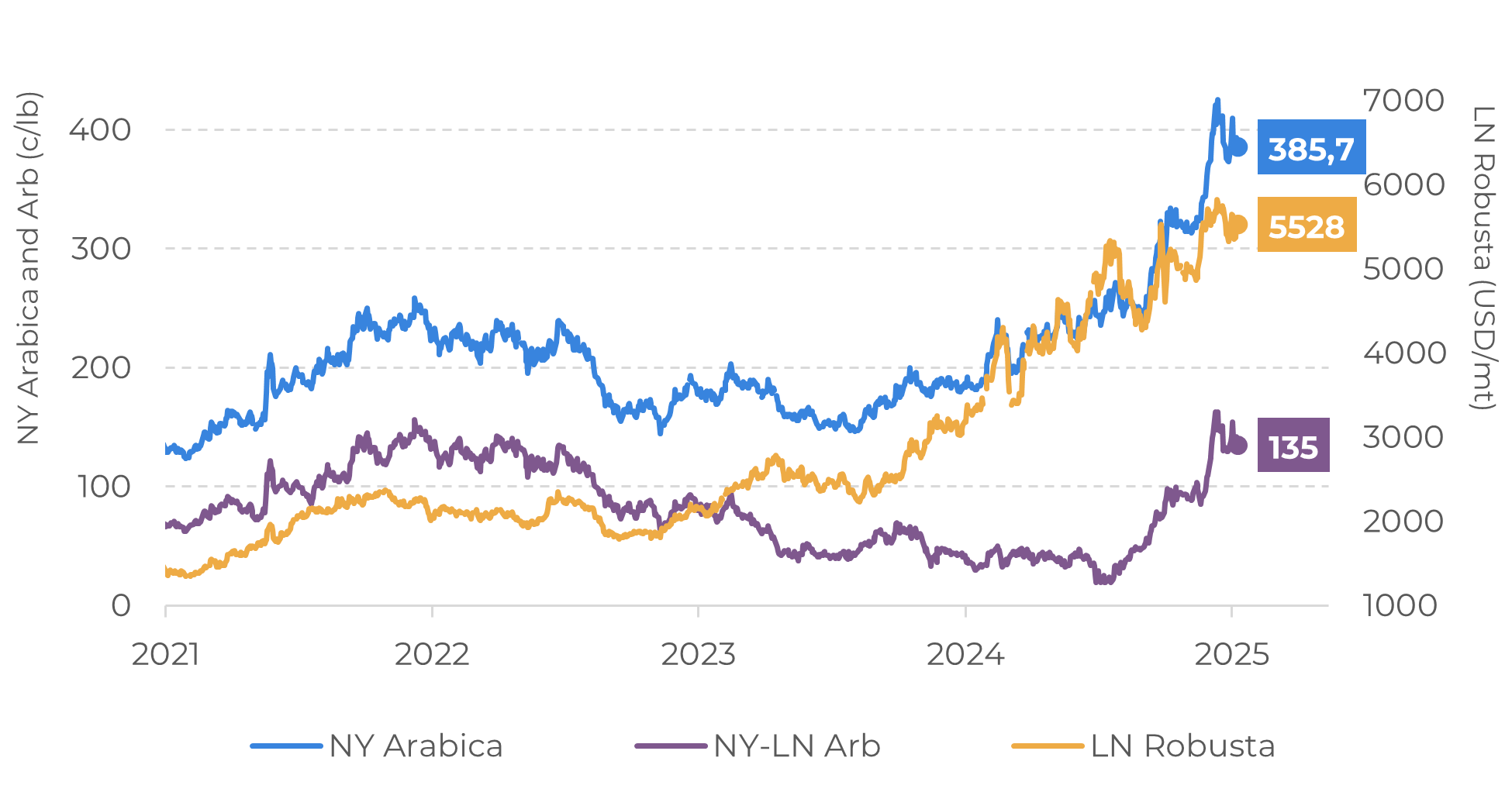

- After reaching 410 c/lb in the first week of March, Arabica coffee futures have retreated to 370 and 390 c/lb levels in recent days.

- While uncertainty remains over the true impact of the drier weather in February and early March in 25/26 crop, the forecast for rain in Brazil in the second fortnight of March, coupled with growing fears over the impact on demand this year, has pressured down prices.

- The price hike of recent months is already being felt by consumers around the world and could still have a negative impact on coffee consumption. According to this week's FAO report, it may take months or even years for the price increases to be fully passed on to consumers.

- The main consumer price index in countries such as the US, Brazil, and members of the European Union point to a rise in coffee prices, particularly between the end of 2024 and 2025.

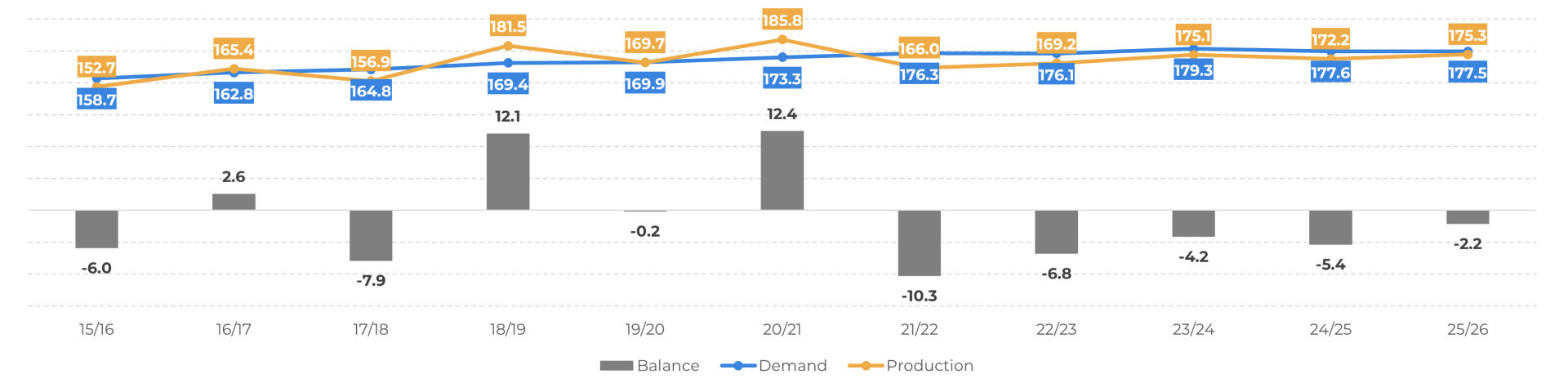

- Many traders and roasters have decided to make minimal purchases, only buying what they need to meet their commitments. However, the global balance still shows a deficit for the next crop, which could provide some support for prices in the long term.

Futures remain below 400 c/lb, as concerns over demand extend

NY Arabica, Arbitrage (c/lb), and LN Robusta (USD/mt)

Source: Refinitiv

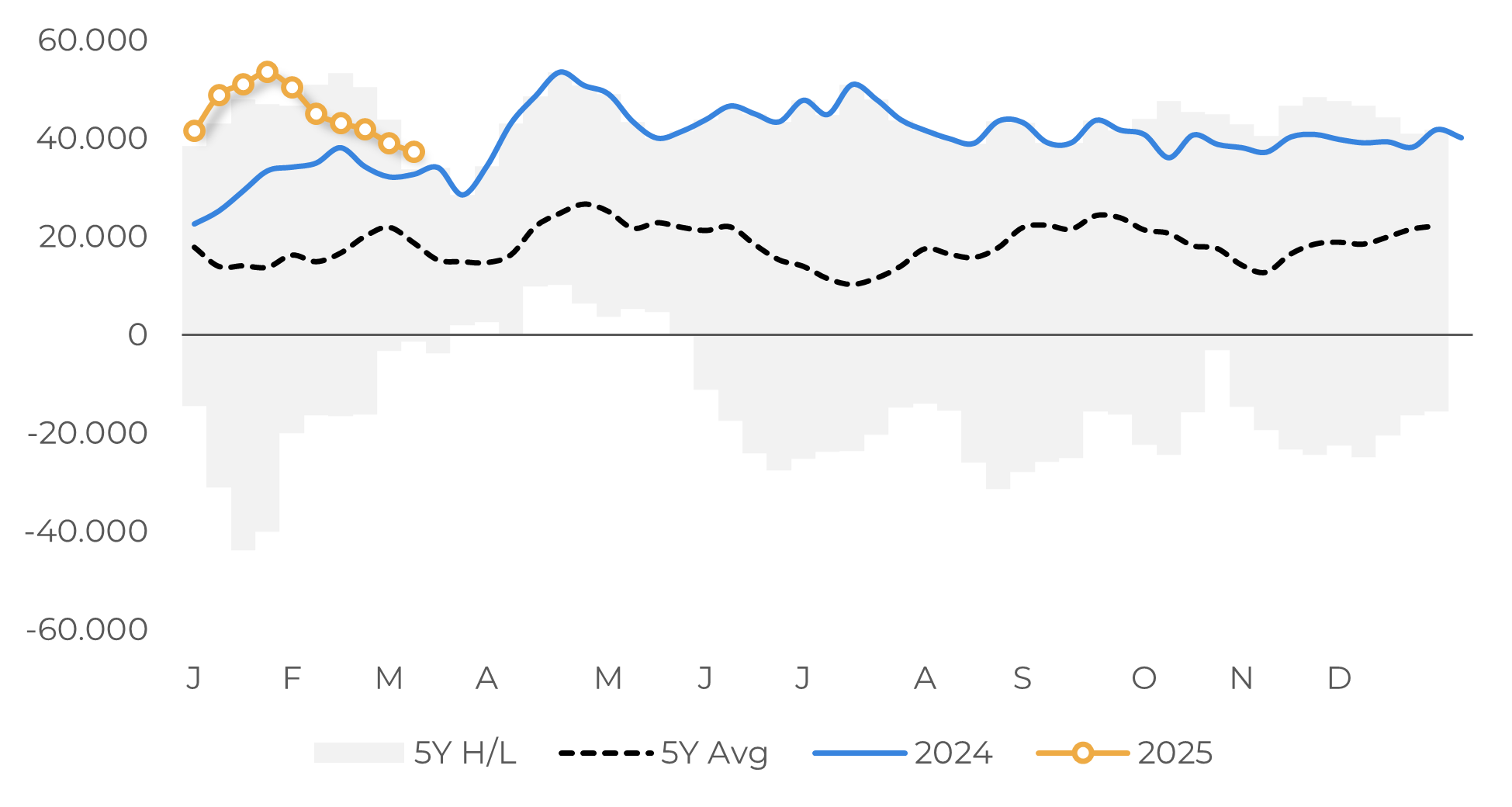

CFTC: Speculative Funds’ Position (lots)

Source: CFTC

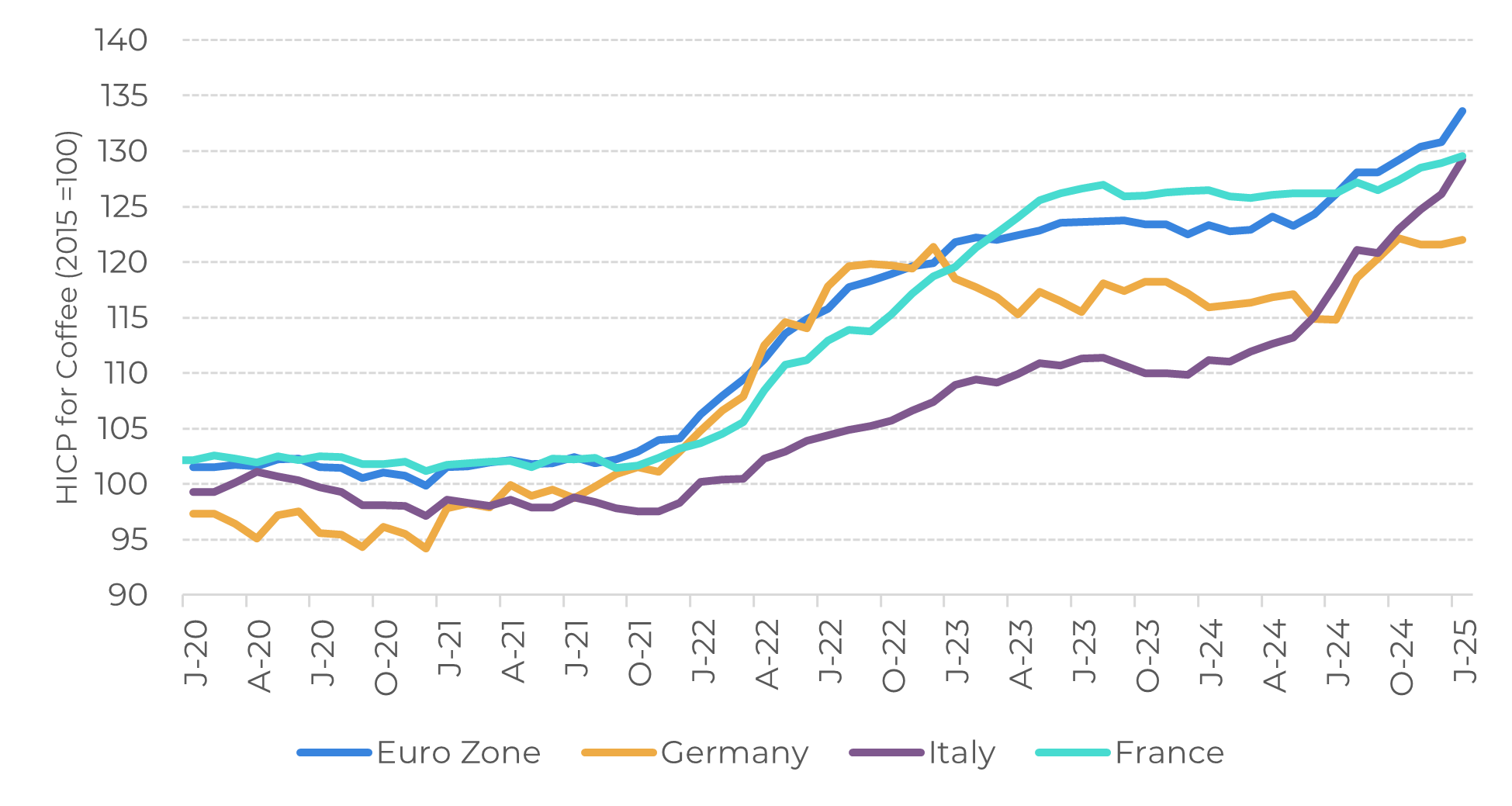

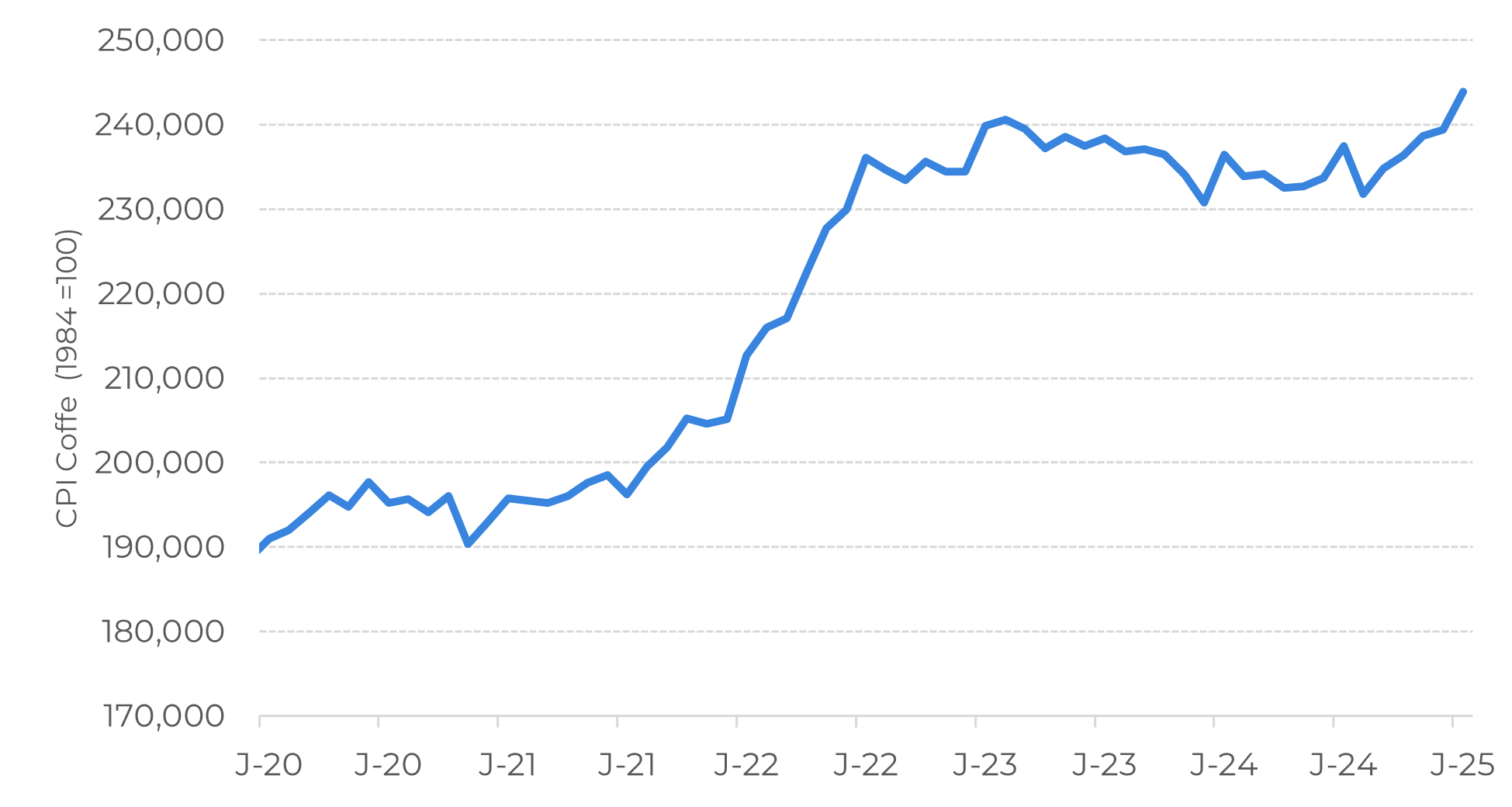

The spike in futures prices since December, particularly for Arabica, and the increase in hedging costs have been passed on to consumers more strongly since the end of 2024, with many of the largest companies in the sector signaling a further increase in selling prices in 2025. According to a report published this week by the FAO (Food and Agriculture Organization of the United Nations), the current price shock could take months to years to be passed on to consumers. In Europe, for example, the organization expects prices to be passed on to consumers over 11 months, while in the US it will take around 8 months.

An analysis of consumer price indexes in major coffee markets confirms this trend. In Europe, for example, the Harmonized Index of Consumer Prices (HICP) for coffee - also used as an indicator of inflation and price stability - has reached its highest level in years in the eurozone and major economies such as Germany, France and, Italy. Meanwhile, in the United States, after a sharp increase between 2021 and 2022, the Consumer Price Index (CPI) for coffee also rose at the end of 2024, reflecting the sharp rise in prices.

Europe: Hamonised Index of Conumer Prices (HICP) for Coffee

Source: Eurostat

USA: Consumer Price Index (CPI) for Coffee

Source: Bureau of Labor Statistics

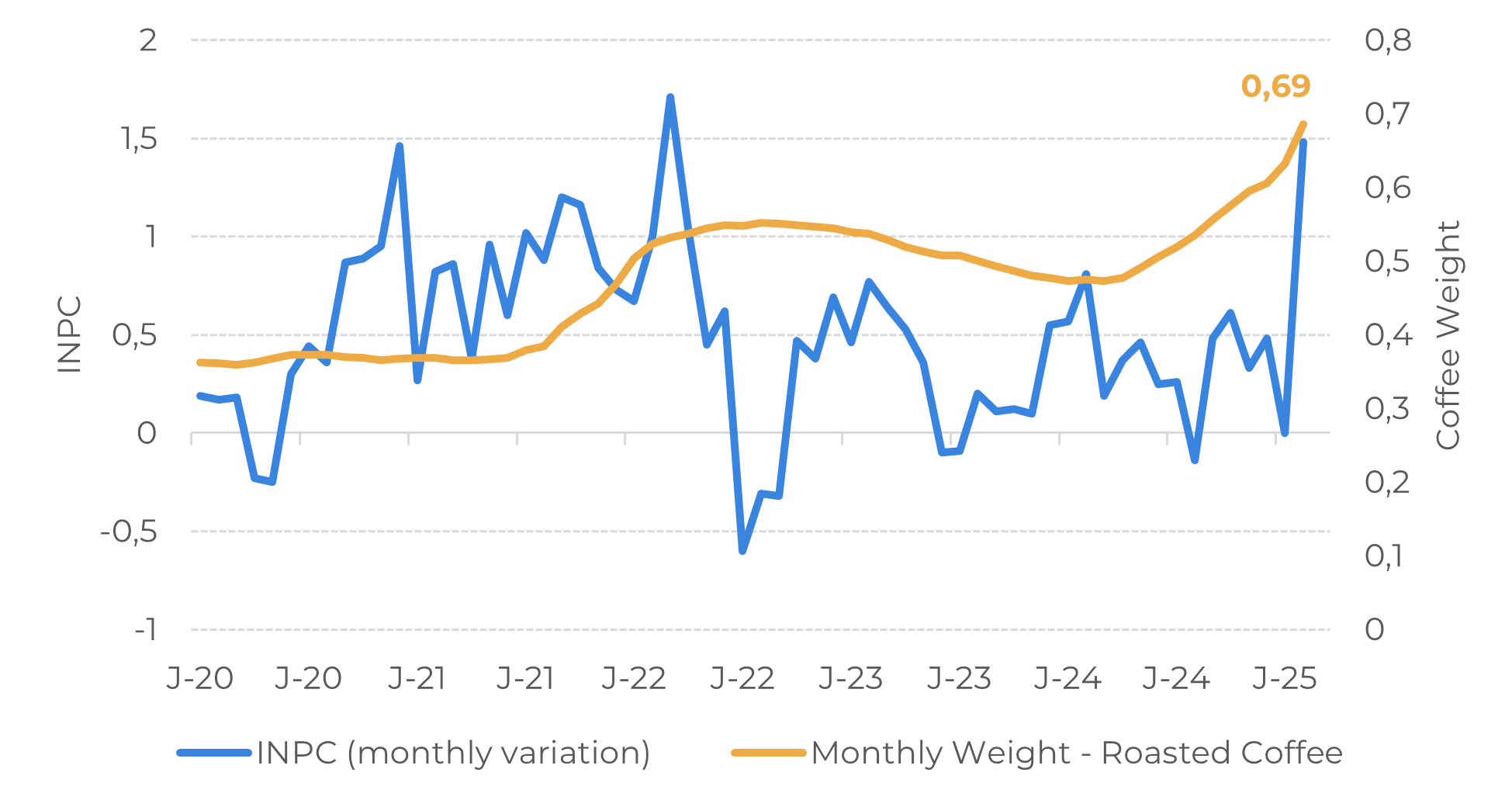

Brazil: INPC variation and Roasted Coffee Weight on the Index (%)

Source: IBGE

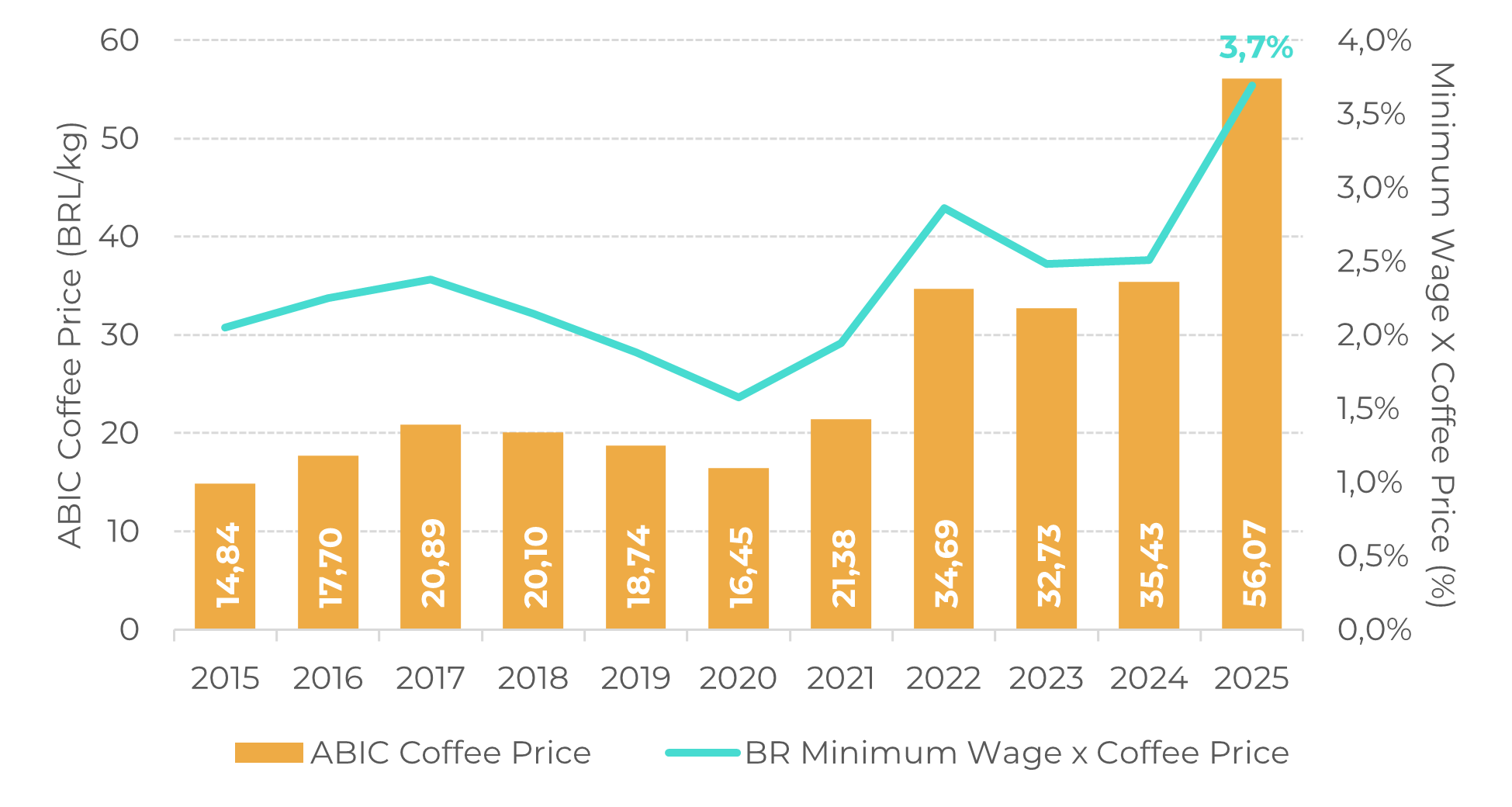

Brazil: ABIC Price (BRL/kg) and Reason with Minimum Wage (%)

Source: ABIC, IPEA

Global Coffee Balance (M bags)

In Summary

Weekly Report — Coffee

laleska.moda@hedgepointglobal.com

carolina.franca@hedgepointglobal.com

Disclaimer

To access this report, you need to be a subscriber.

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.