With tighter supply in Brazil, exports fall

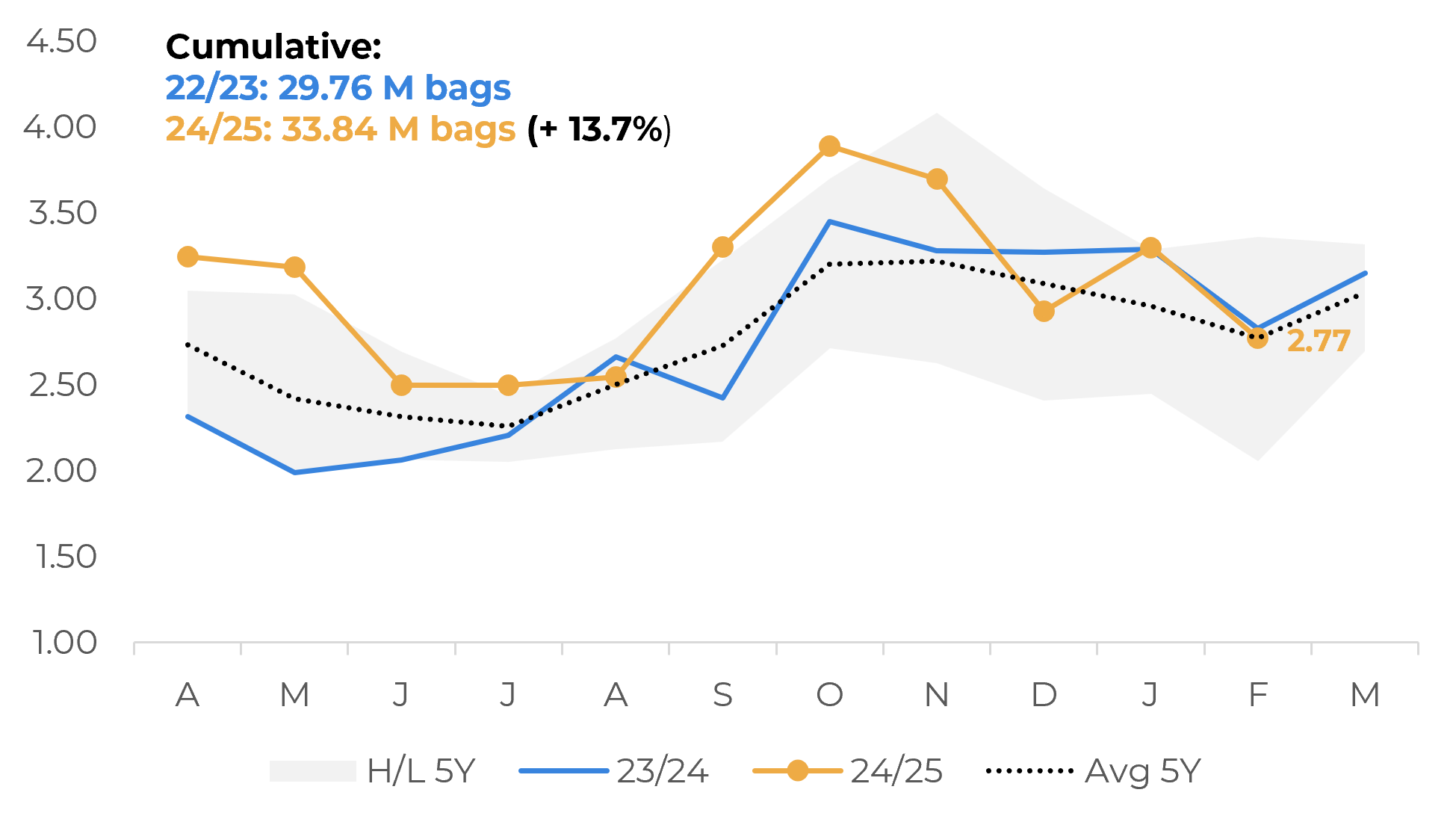

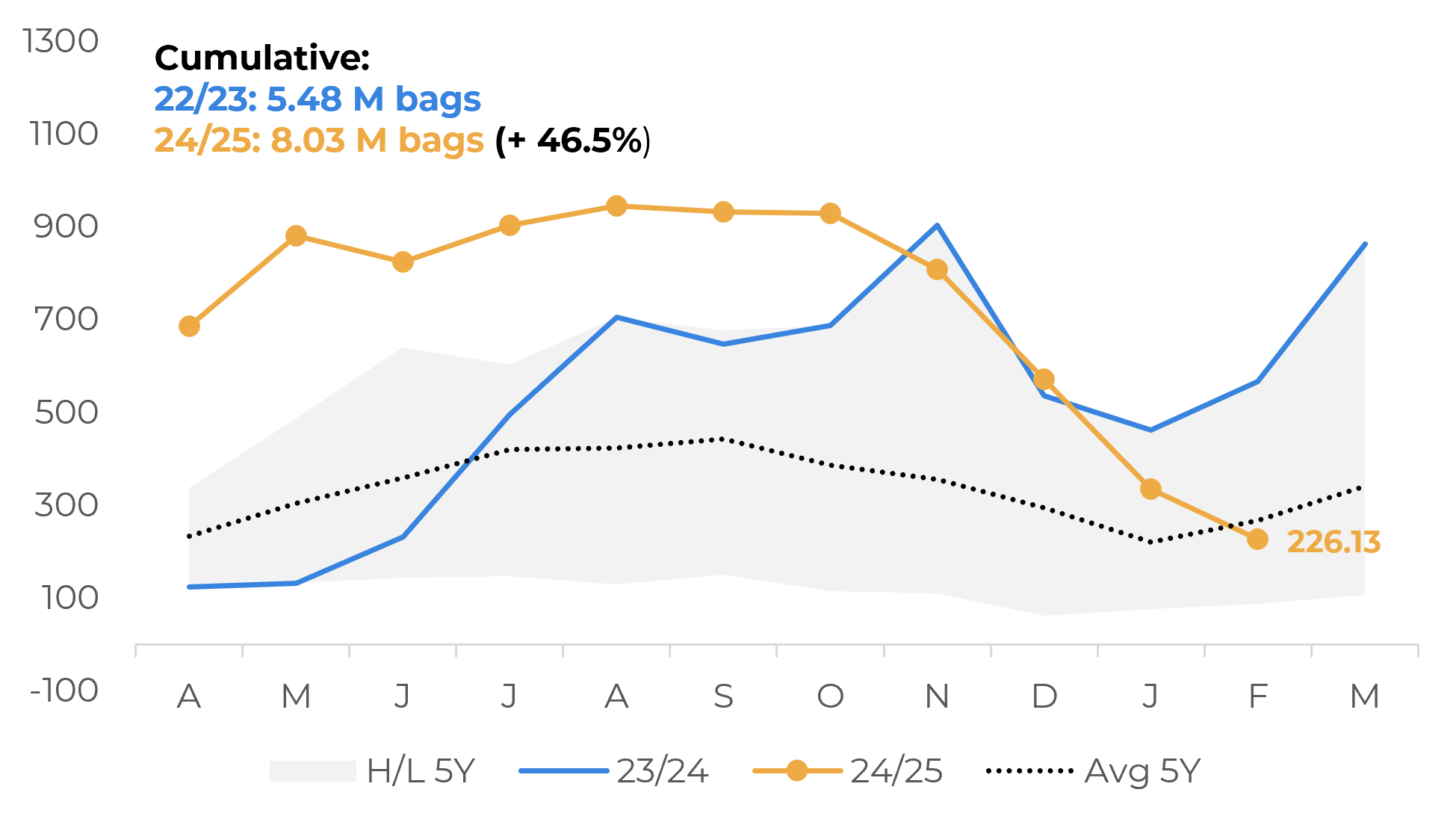

- Brazilian coffee exports totaled 3.27 M bags in February, down 10.4% year-on-year. While Arabica shipments fell by 2% over the year, Conilon shipments declined 60.1% during the month.

- Cumulatively (Apr/24 - Feb/25), both varieties remain at record levels and are expected to end 24/25 on a high note. However, lower shipments are expected in the coming months due to lower availability of coffee in the country.

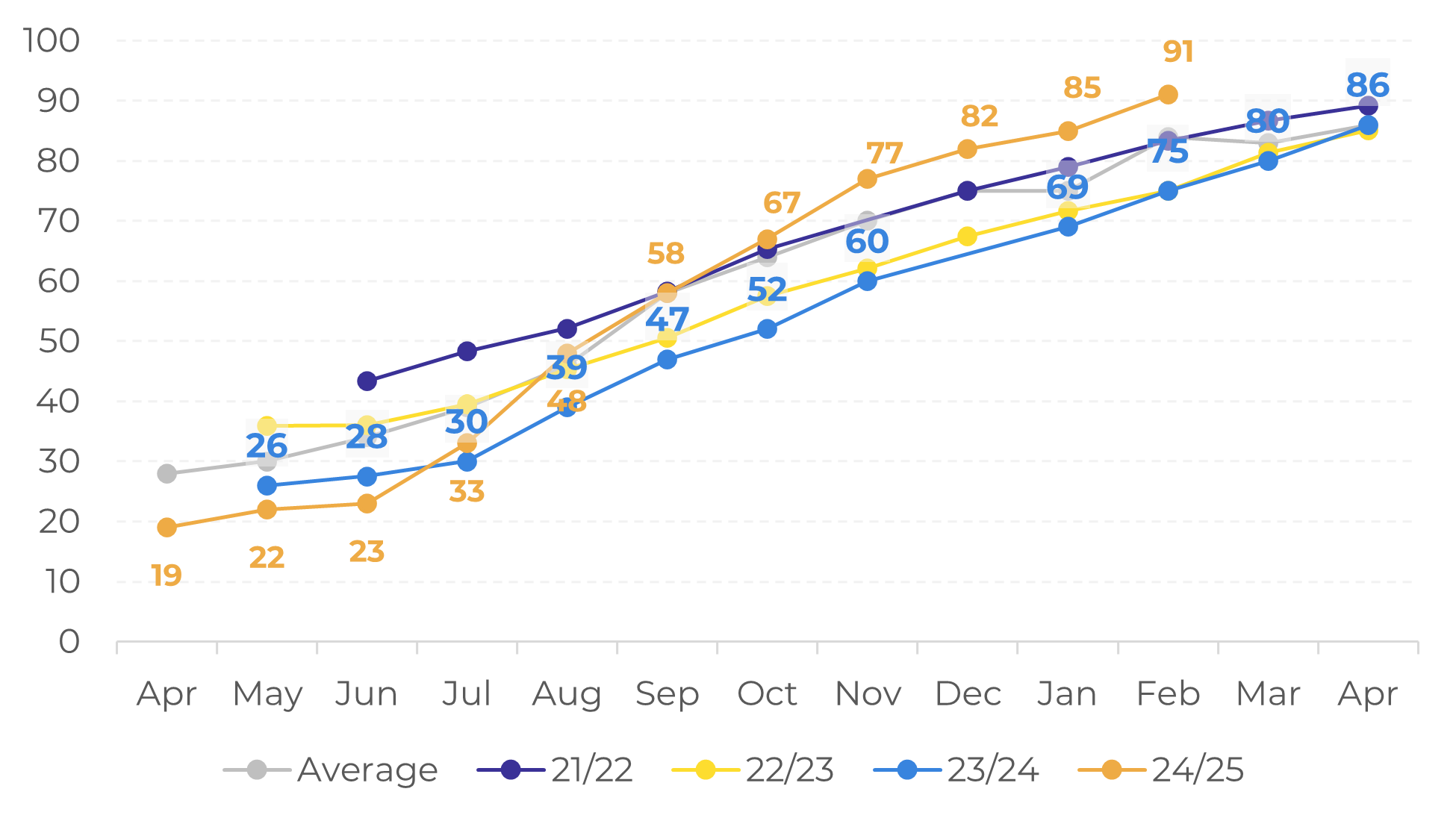

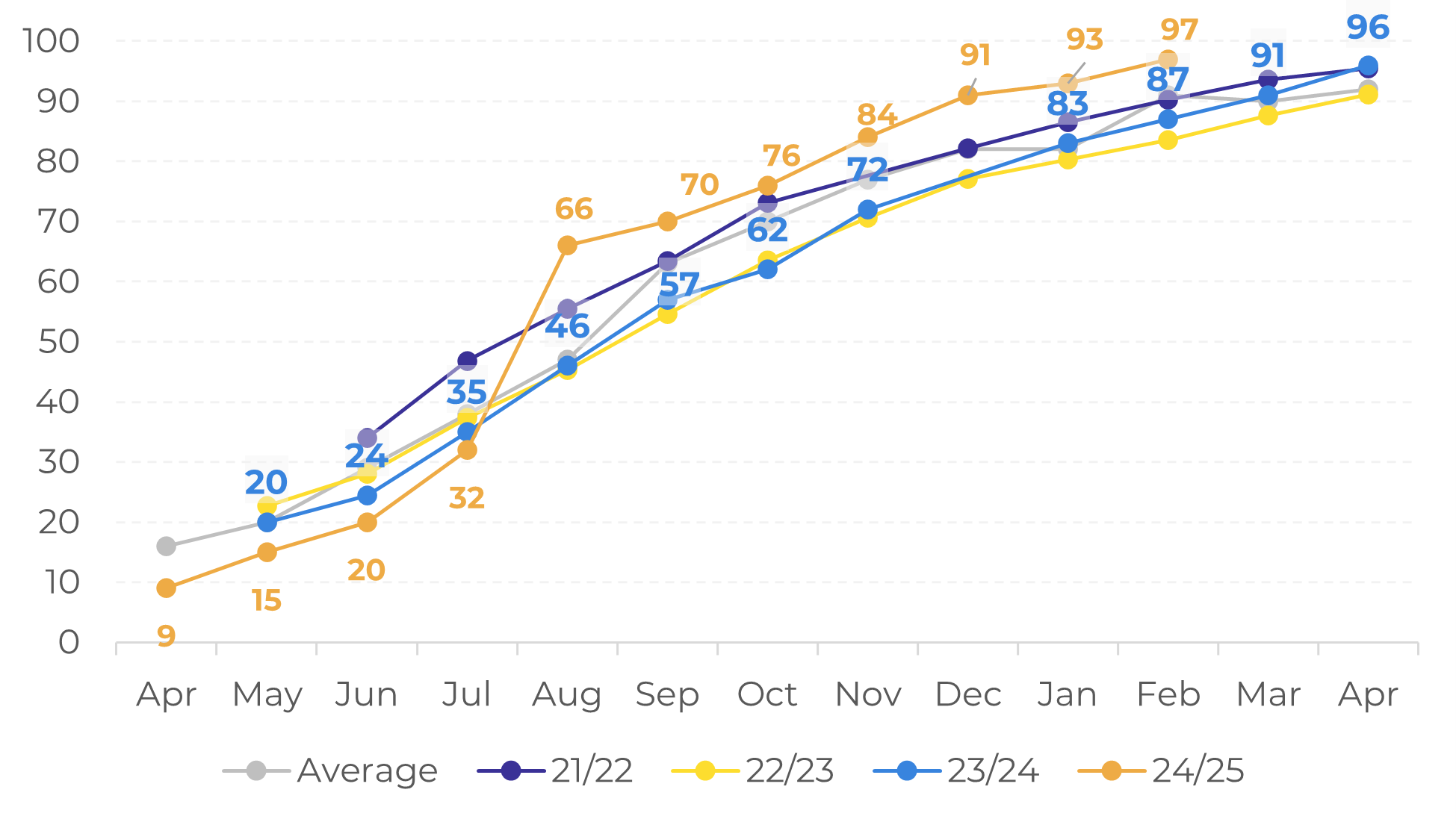

- While some of the stocks from previous harvests have been used in this cycle, the sales of the current crop (24/25) are higher than in recent years, pointing to a tight supply scenario in Brazil.

- A greater volume of Brazilian coffee is not expected to enter the market until the harvest in the country gains pace, after mid-June. For other origins, particularly Robusta, supply is also more limited, which should support prices, even amid fears of a fall in demand.

With tighter supply in Brazil, exports fall in February

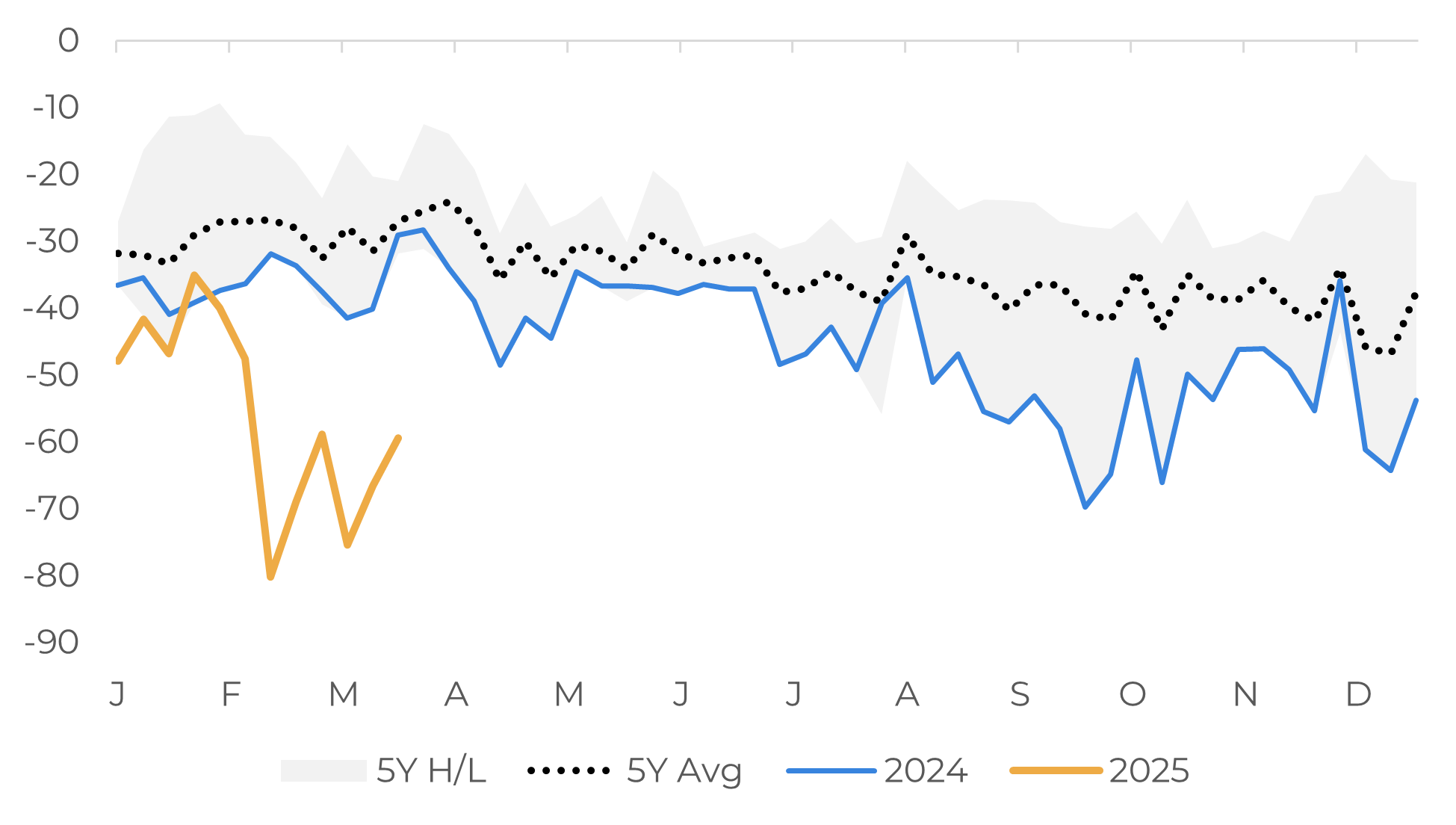

Brazil: Exports of Arabica (M bags)

Source: Cecafé

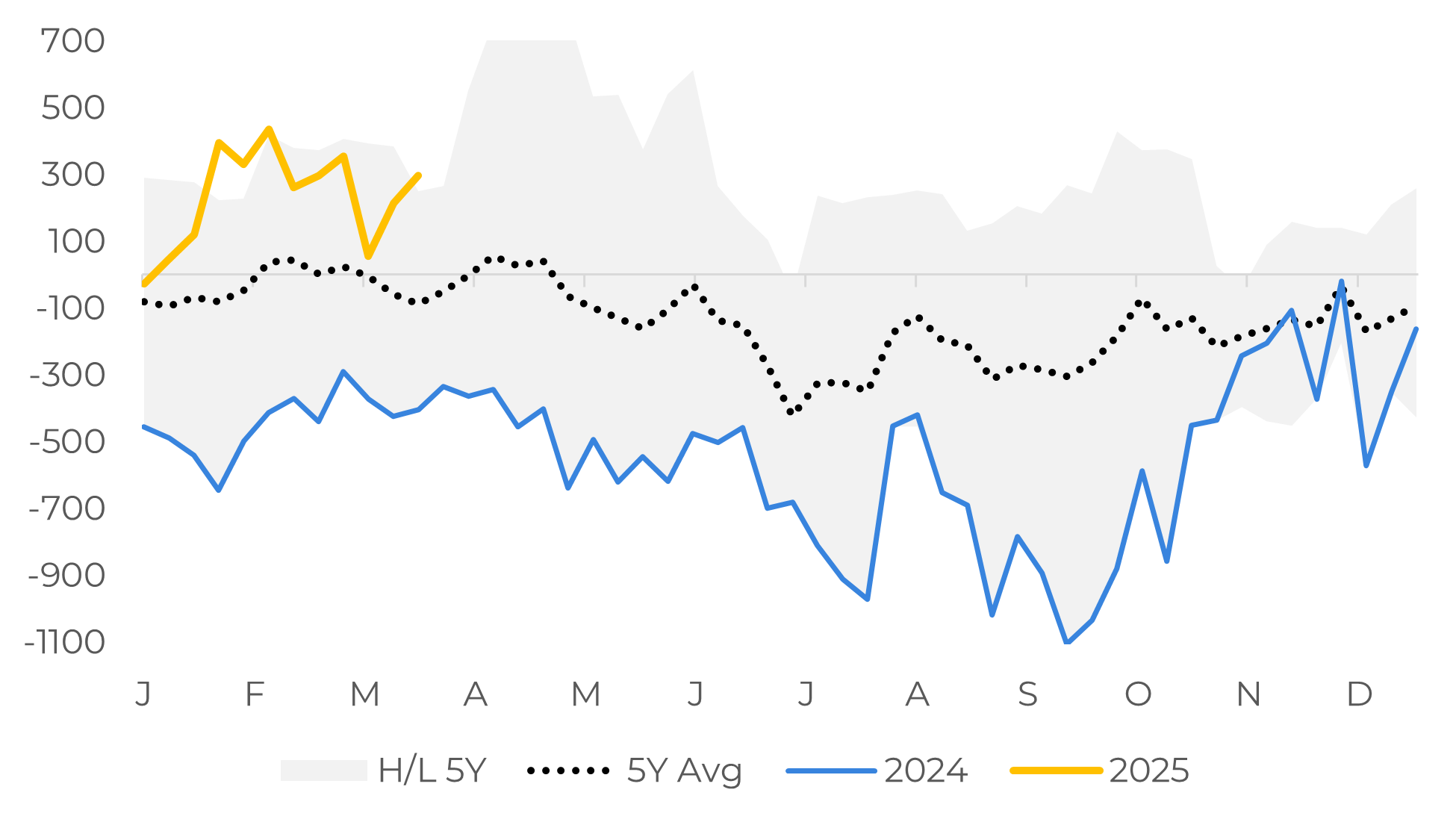

Brazil: Exports of Conilon (‘000 bags)

Source: Cecafé

While the 24/25 season was smaller than initially expected, the strong pace of exports has led to a reduction in domestic coffee stocks and above-average sales for the current season. By February this year, approximately 91% of the 24/25 Arabica crop had been commercialized, compared to 97% for Conilon. As a result, Brazilian sales and exports are expected to remain limited in the coming months, at least until the harvest of the 25/26 crop intensifies.

Field work for the 25/26 crop is expected to begin in April in some regions (notably Conilon), but should not intensify until the end of May, as usual, with a significant volume of new coffee entering the market after mid-June. As a result, the market will rely on other origins to meet demand in the coming months, particularly for Robusta.

Brazil: Farmer Selling – Arabica (% of total)

Source: Safras & Mercado

Brazil: Farmer Selling – Conilon/Robusta (% of total)

Source: Safras & Mercado

In this sense, while in 2024 Brazil supplied much of the demand for Robusta in the first half of the year, with reduced volumes in Vietnam, this year Brazilian availability is lower, which could support prices, at least until a larger volume of the 25/26 crop from Brazil and Indonesia enters the market. On the Arabica side, while supply of the washed type tends to increase in the first half of the year - given the Colombian and Central American counties harvest - lower availability in Brazil also tends to support prices in the short term, both in the futures market (especially the May/25 contracts for these varieties) and at local prices.

Brazil: Basis Arabica Good Cup type 6 (c/lb)

Source: Safras & Mercado, Hedgepoint

Brazil: Basis Conilon 7/8 (USD/mt)

Source: Safras & Mercado, Hedgepoint

In Summary

Weekly Report — Coffee

laleska.moda@hedgepointglobal.com

livea.coda@hedgepointglobal.com