American tariffs: New challenges for the coffee market

- While agents await new developments on the supply side, with the 25/26 Brazilian coffee harvest approaching, the commodity market has been shaken by the new tariffs imposed by the US government this week.

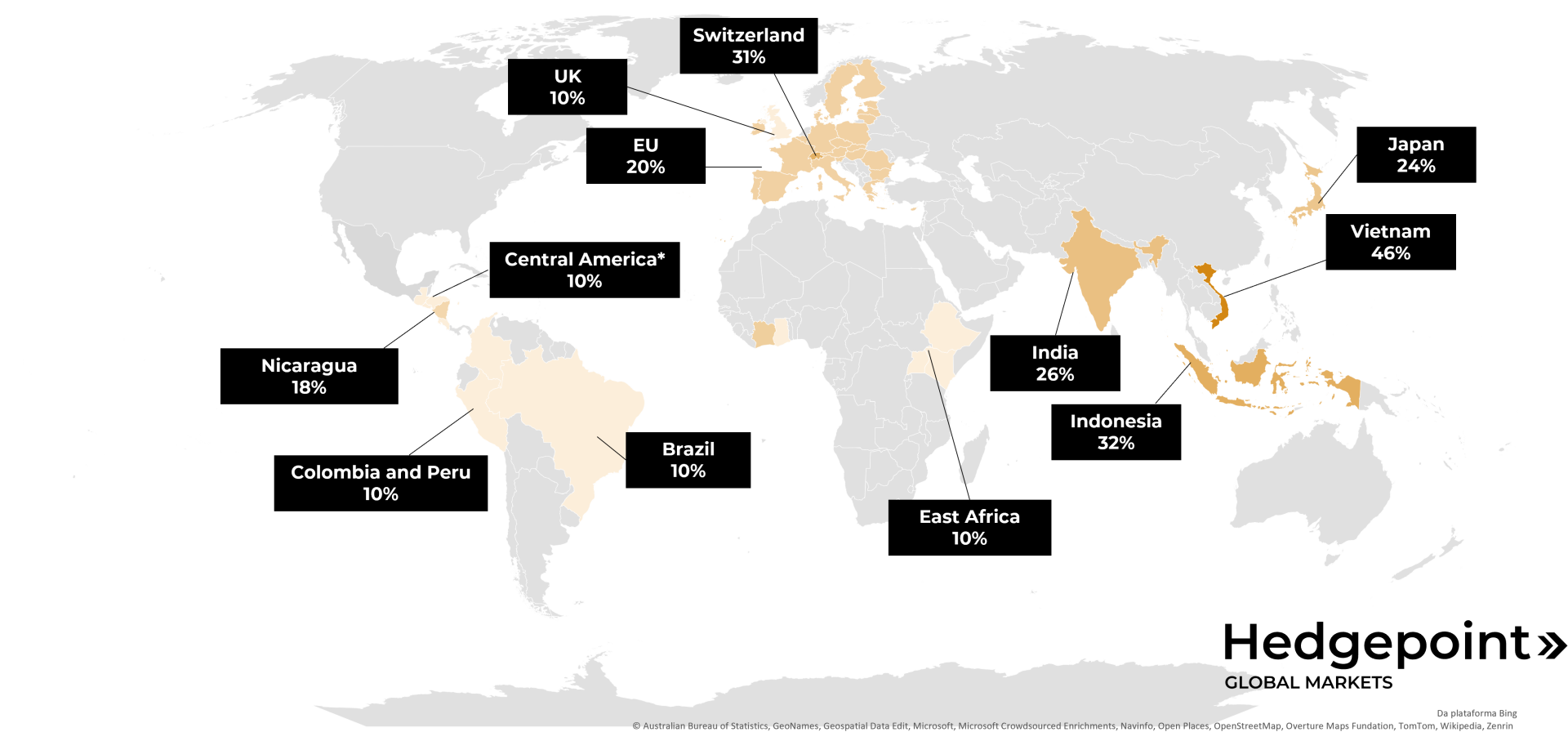

- On the coffee side, the list of affected countries includes major producers of the commodity, some of which will be subject to the basic 10% tariffs, such as Brazil and Colombia, while others are on the list of "worst offenders", such as Vietnam, which could face tariffs of up to 46% on its products.

- In addition to producing countries, some countries or regions that export processed coffee, such as the European Union, could also be affected by Trump's tariffs, which could lead to changes in the commodity's trade flows.

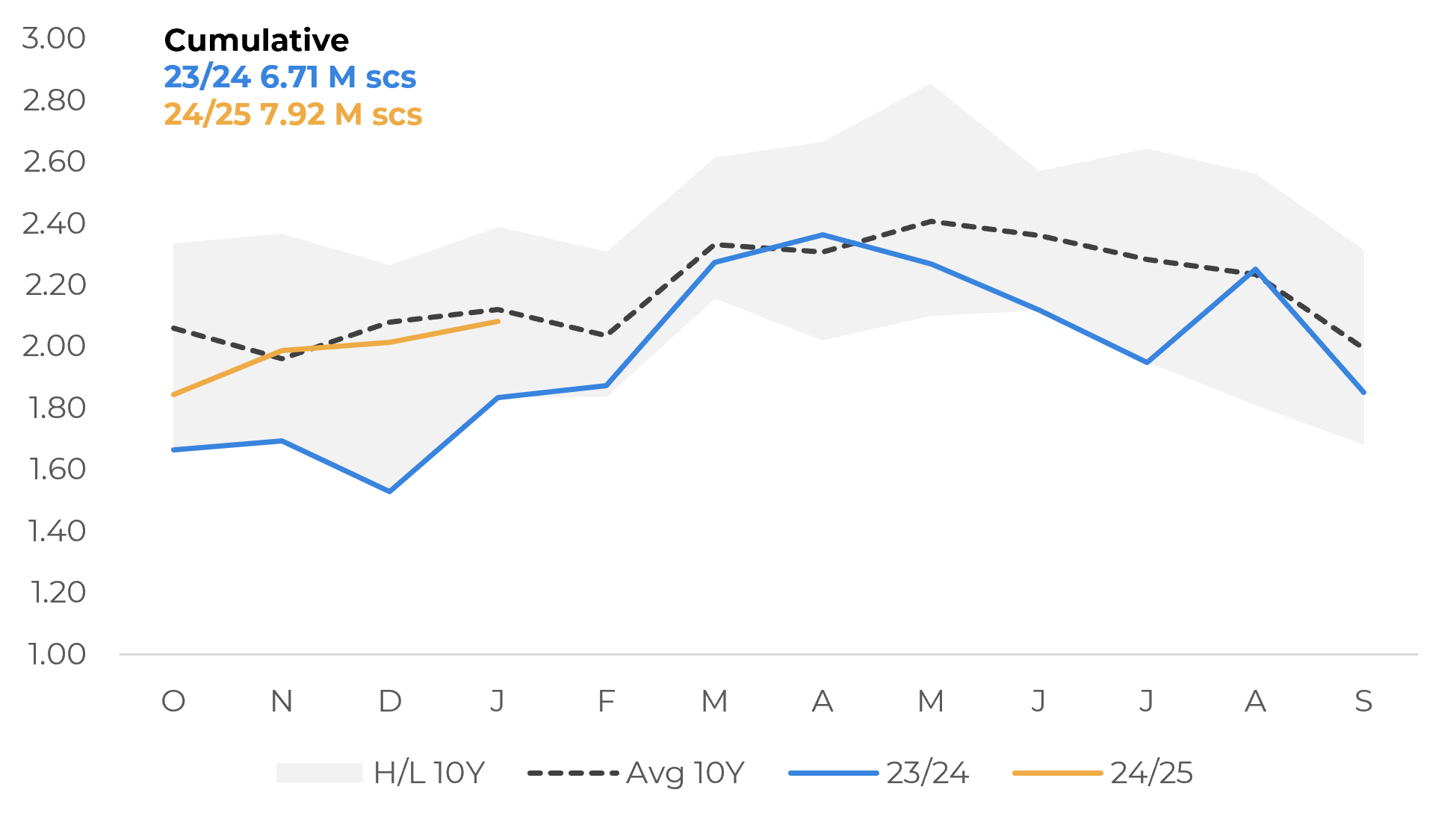

- The news comes at a time when US coffee imports are recovering. Given that the tariffs could lead to a further increase in coffee prices for Americans, the country's imports (and demand) could be at risk throughout 2025.

- At the same time, the difference in tariffs between regions could lead to changes in coffee trade flows around the world, as the US is the largest consumer of the bean.

American tariffs: New challenges for the coffee market

US: New Tarrifs – Coffee Markets

Source: Refinitiv, Hedgepoint

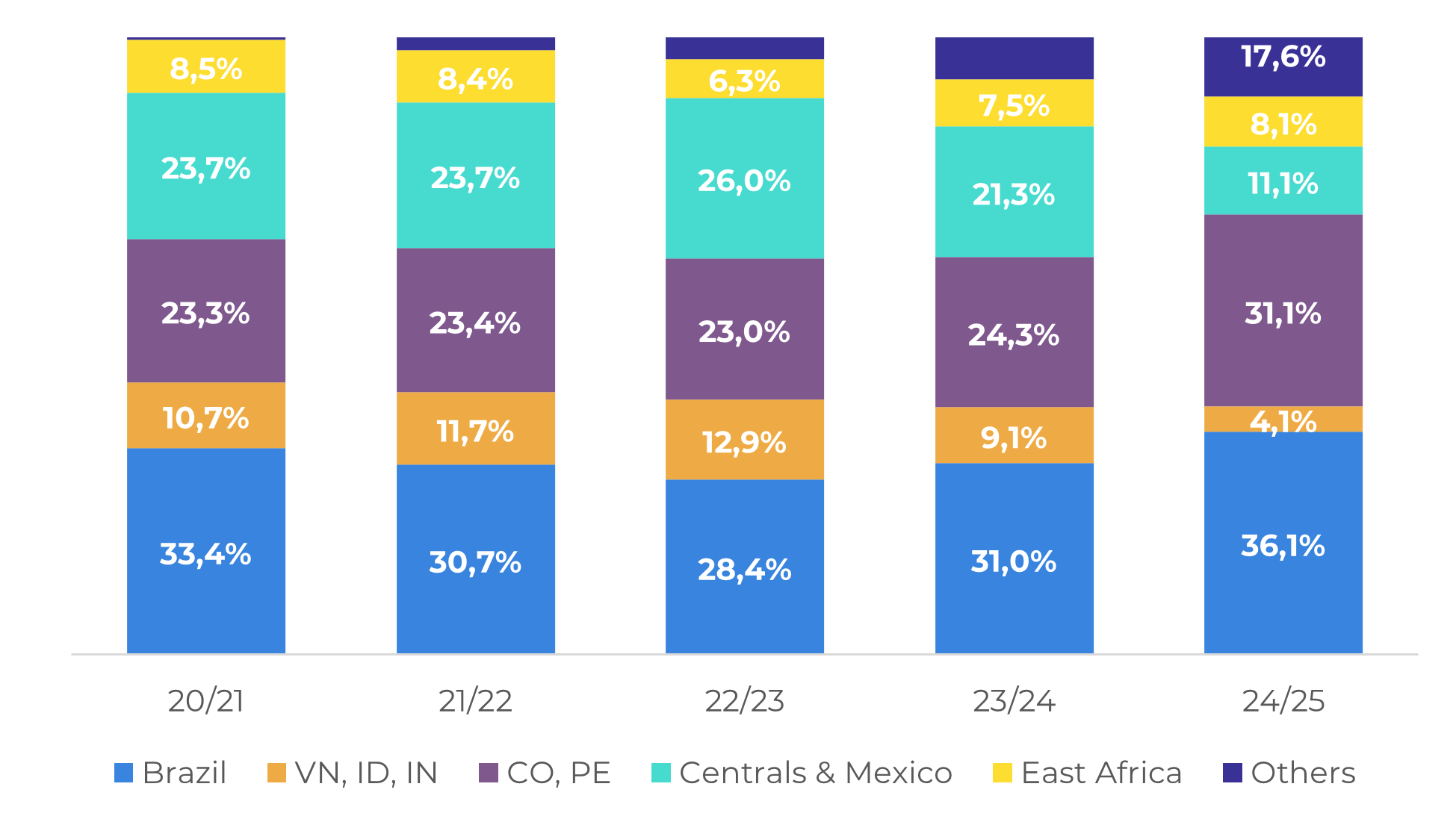

On the producer side, it is interesting to note that base duties of 10% could be imposed on most Arabica coffee producers, as in the case of Brazil, Colombia, Peru, most Central American countries and East Africa. While this should lead to higher prices for coffee in general, a uniform tax across countries could mean little change in the competitiveness of these origins due to this specific factor.

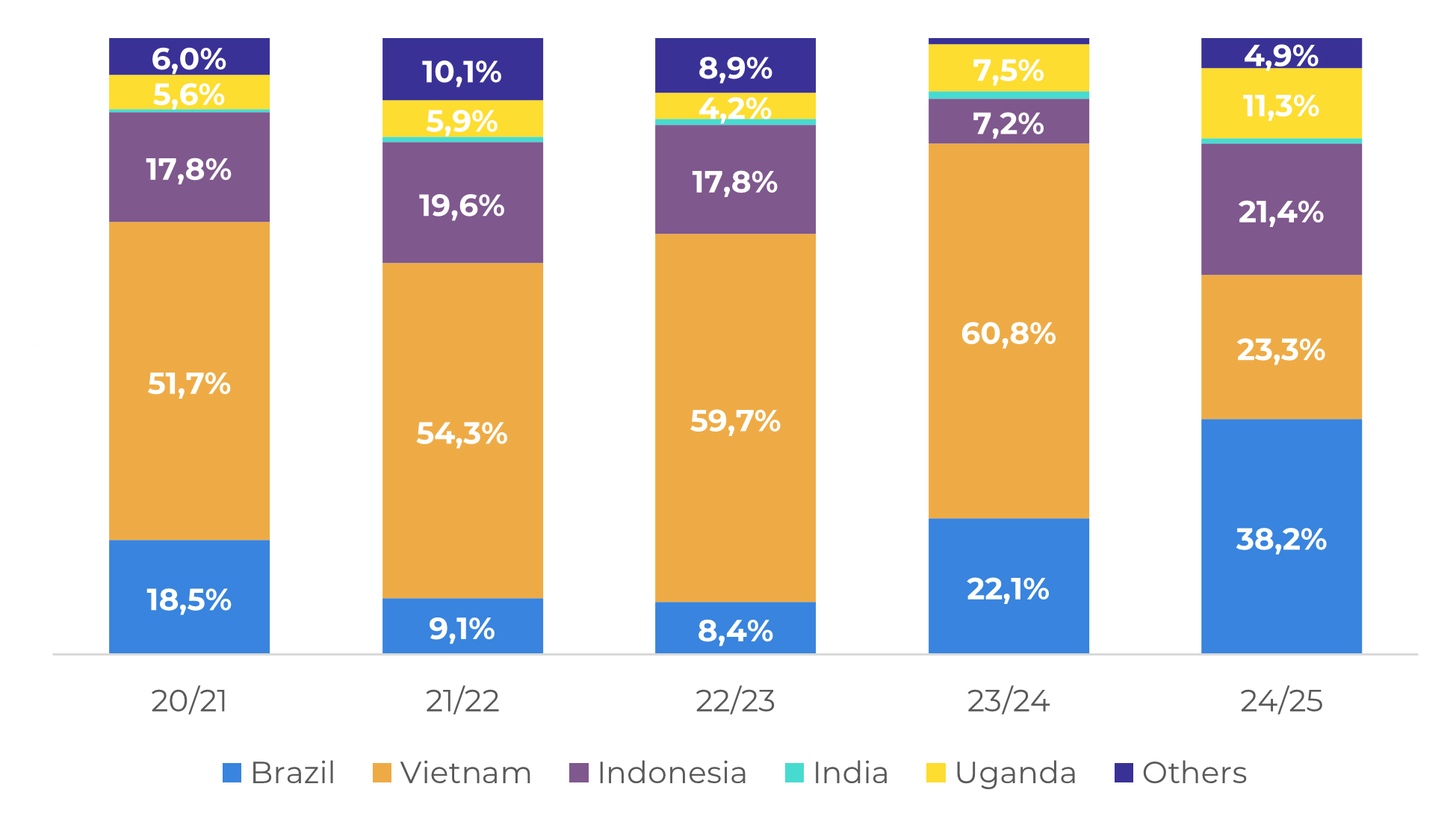

Robusta, on the other hand, is expected to face high taxes in both Indonesia and Vietnam. In the case of Vietnam, a tax of 46 per cent could be levied on the country's production, while in Brazil, Conilon could be taxed at just 10 per cent. This factor is important when looking at the share of these origins in US imports of Robusta/Conilon coffee: despite Brazil's growing share of imports on 24/25 - a reflection of lower supply in Vietnam - the Asian markets generally contribute with most of the Robusta coffee imported into the US.

With Asian coffees potentially more expensive due to taxes, US demand for coffees from origins such as Brazil and Uganda - which would also have lower taxes- could increase. On the other hand, a potential reduction in US demand for Asian coffees could lead to greater availability of these beans for other destinations.

In addition to producing countries, European Union countries that export processed coffee are also in the tax net. As many of these countries also export coffee to the US, we could see a change in dynamics in the coming months. Again, it's interesting to note the difference between the EU's tariff levels and those of, for instance, the United Kingdom, which is also an exporter of processed coffee.

USA: Share of Imports by Origin (%)

Source: U.S. International Trade Commission, Hedgepoint

USA: Share of Imports by Origin of Robusta/Conilon (%)

Source: U.S. International Trade Commission, Hedgepoint

USA: Coffee Imports (M bags)

Source: U.S. International Trade Commission

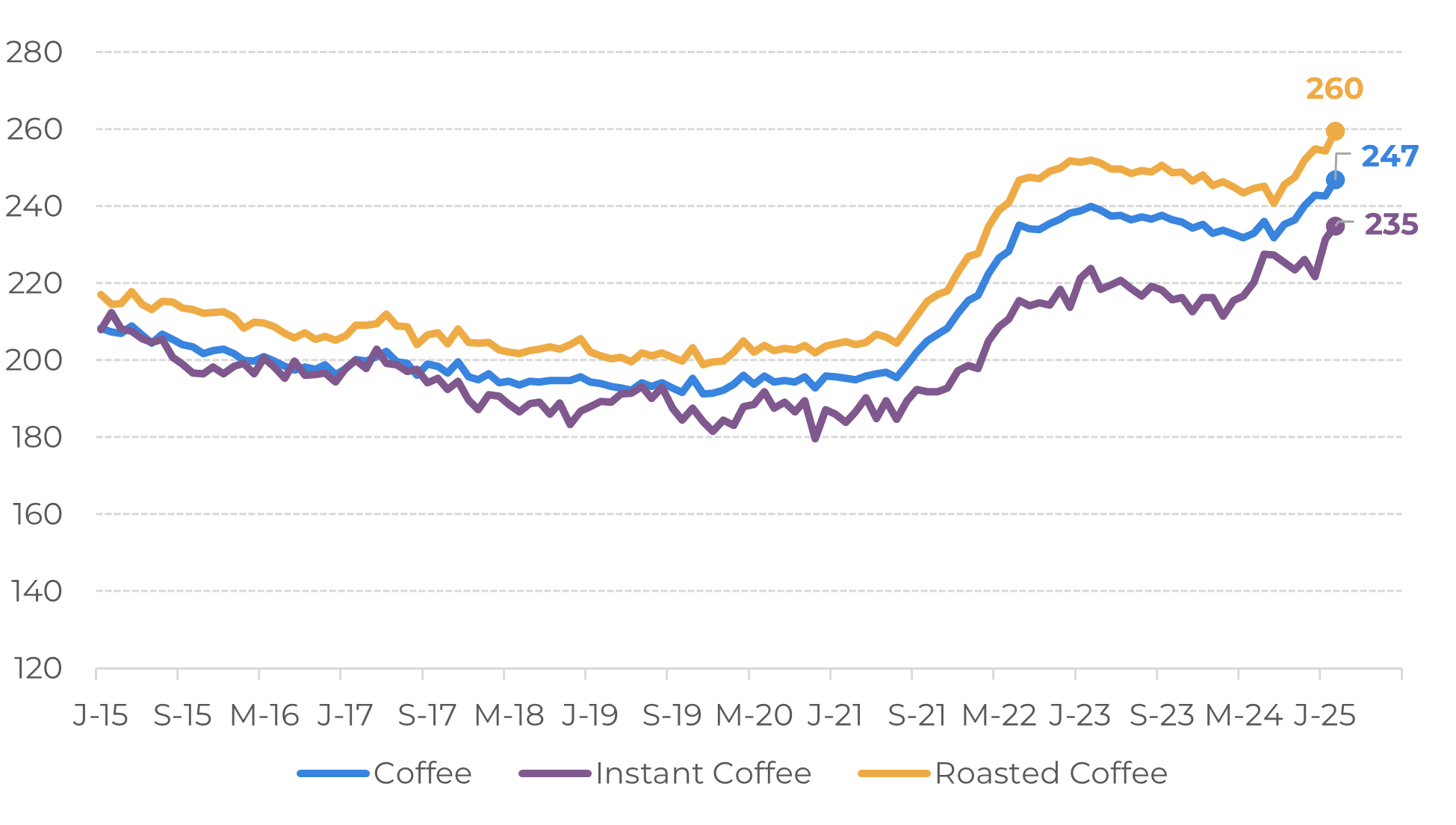

USA: Consumer Price Index (CPI) - Coffee

Source: US Bureau of Labor Statistics

In Summary

Weekly Report — Coffee

laleska.moda@hedgepointglobal.com

livea.coda@hedgepointglobal.com