Market remains highly volatile as trade war intensifies

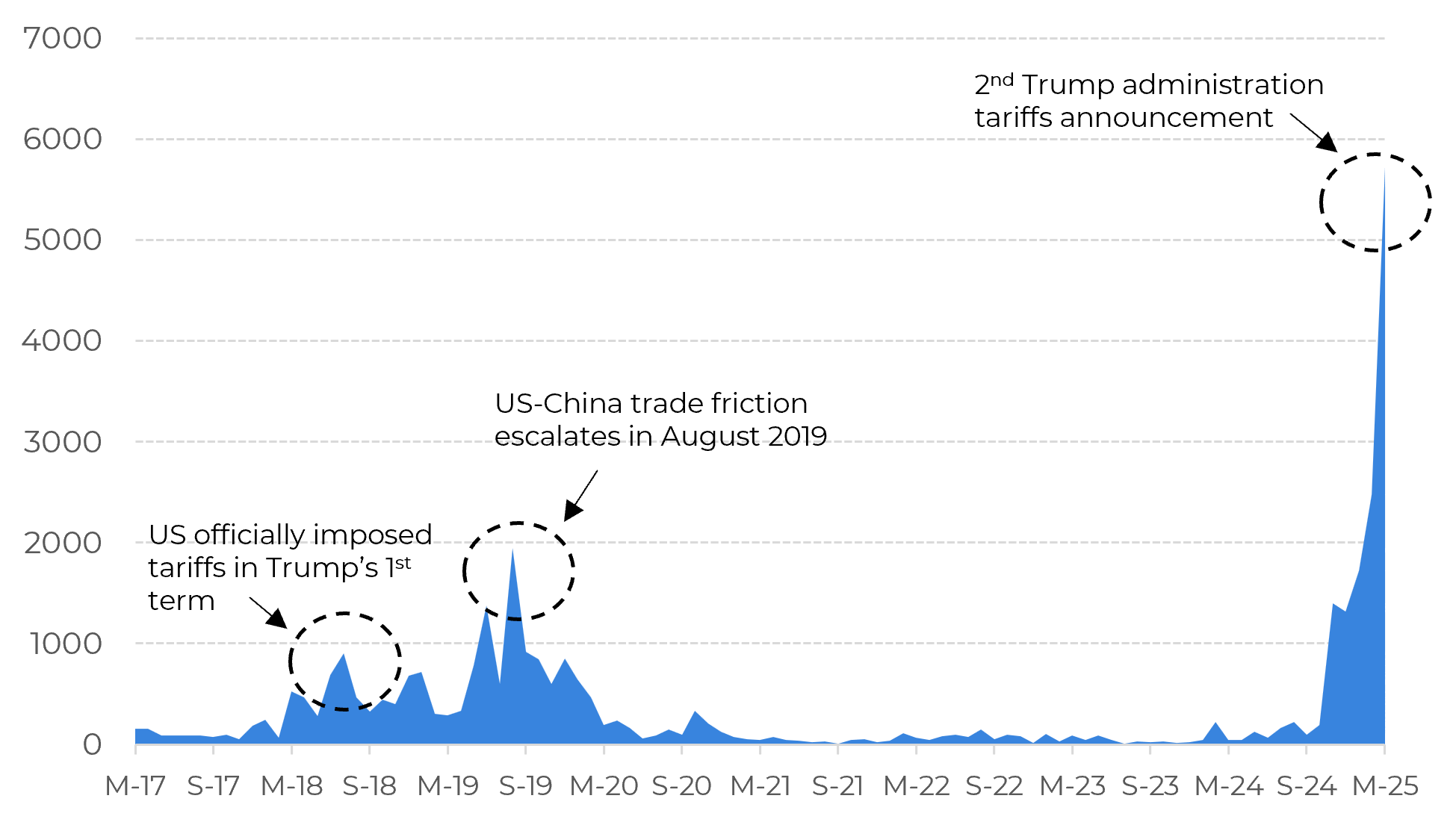

- This week, the world saw an escalating on trade war as US has now a massive 145% tariff on all Chinese goods, while China imposed a 125% levy on American goods (by time this report was released), increasing the tensions and the fears of a global recession and plunging markets until Wednesday morning.

- The 90-days tariff pause for most countries, except for China, brought relief to the market and led to a partial recovery of financial assets and commodities, but the tensions between the two largest economies in the world will likely keep the market pressured.

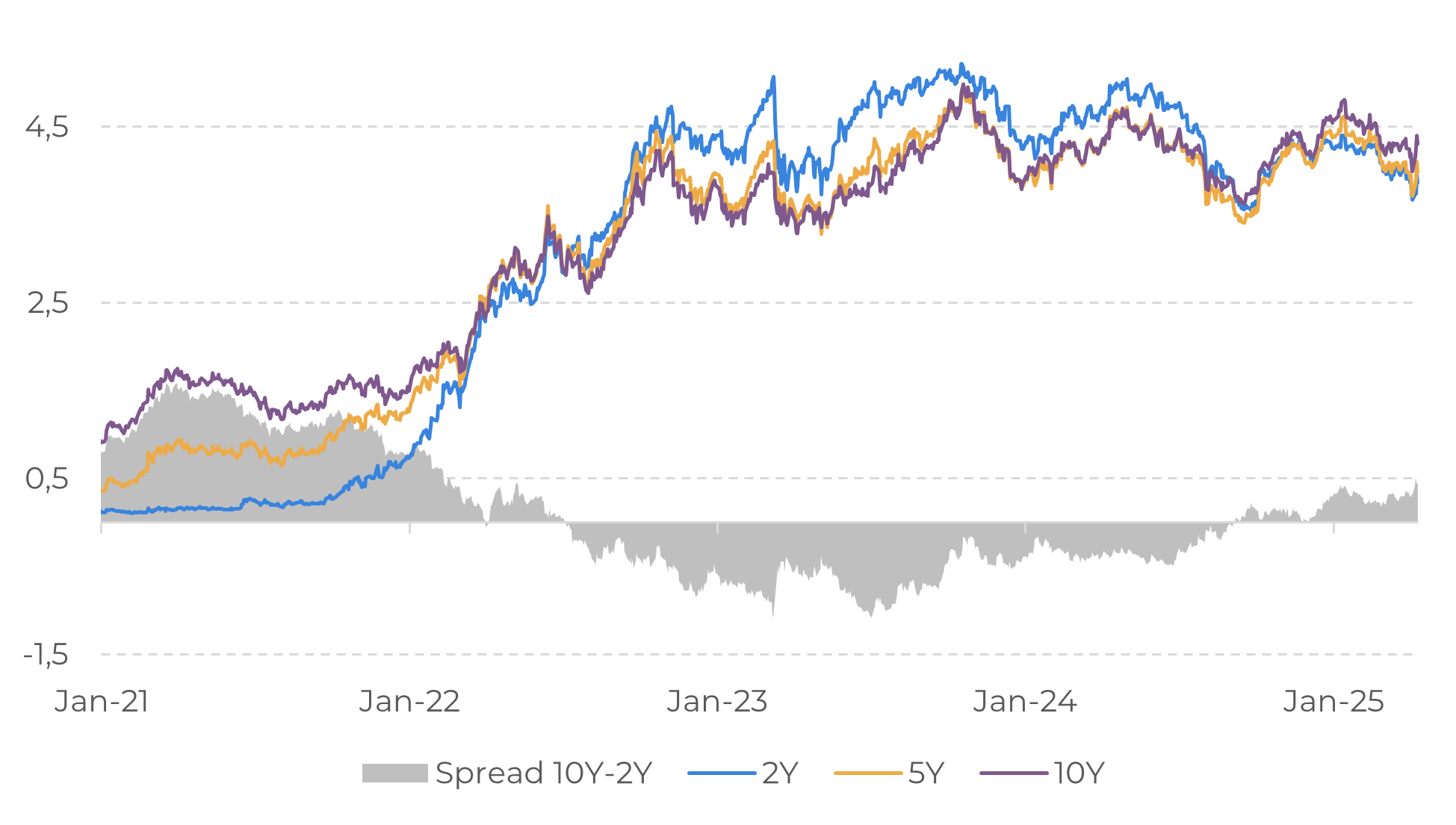

- US Treasury bonds also recovered after suffering a sell-off in recent days. However, this raised the alarm of a weakness in the confidence of US assets, deepening the concerns over uncertainties and turbulence in the market.

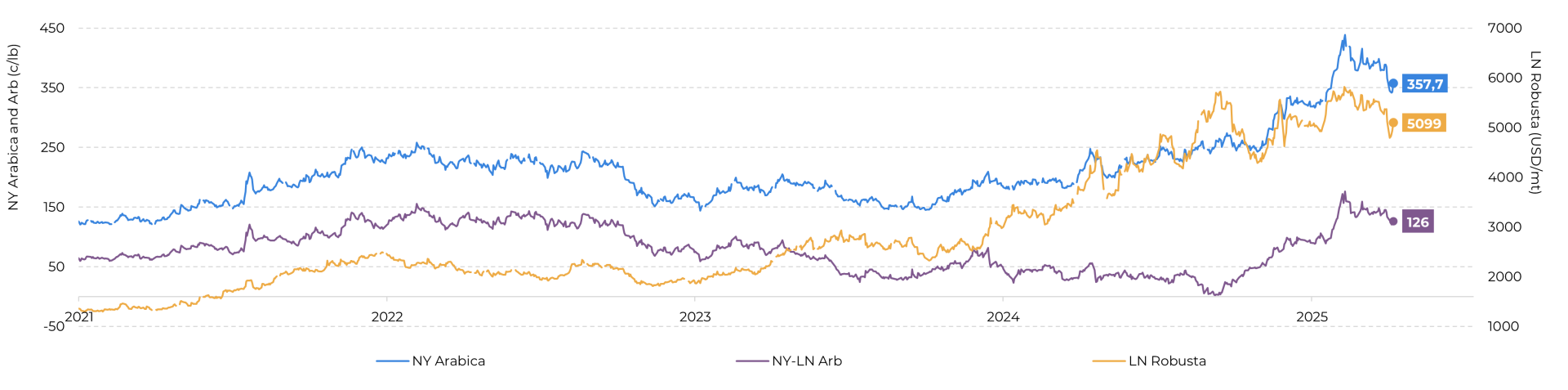

- Coffee futures followed the trend of the past few days, falling sharply on Wednesday morning, but recovering after the 90-day pause announcement. The recovery, however, could be capped by the uncertainties in the macro front.

- The new economic outlook and the likelihood of a drop in US demand are likely to keep the coffee market bearish, even with the prospect of a smaller Brazilian Arabica crop in 25/26. A change in price direction could only come from new supply fundamentals.

Market remains highly volatile as trade war intensifies

*The tariff data used in this analysis was last updated at 3 p.m (BRL time) of the 11th.

USA: Treasury Yields (%, YoY)

Source: Refinitiv

USA: Trade Policy Uncertainty Index

Source: Bloomberg

However, later in the day (09), Trump raised China's levies to a massive 125% and announced a 90-day pause on reciprocal tariffs, equalizing all tariffs from countries that did not retaliate to a universal rate of 10% on the same day, while negotiations between the world's nations and the US take place. Following this action, the EU also imposed a 90-day pause on its retaliatory measures pending negotiations.

The move completely turned the market on its head, with big gains in US financial markets and commodities, with the S&P 500 stock index rallying. US 10-year Treasuries and the dollar also rebounded after the announcement, with the former seeing strong demand.

Coffee futures also followed this trend. The Arabica and Robusta May/25 contracts hit multi-month lows on Wednesday morning – with the former trading below 340 c/lb and the latter below 4,780 c/lb – but regained ground in the following days. The May Arabica was back to 360 c/lb and Robusta to 5,100 USD/mt levels this Friday. However, a further recovery could be capped, as the trade war escalates.

LN Robusta (USD/mt), NY Arábica e Arbitragem (c/lb)

Source: Refinitiv

Even before the duties announcement, there were already fears of higher inflation and slower growth in the country. The shocking announcement of the tariffs and all the uncertainties regarding their application and rates, which seem to change from day to day, have shaken confidence in the US and could lead investors to choose safer strategies and diversify away from US assets, as pointed out by some banks around the world. In this sense, it is good to remember that one of the largest foreign holders of US Treasuries is China, whose government could divest part of its share as it clashes with the American government, triggering more turbulence in the market, worsening the economic situation and consumer confidence.

In Summary

Weekly Report — Coffee

laleska.moda@hedgepointglobal.com

carolina.franca@hedgepointglobal.com

Disclaimer

To access this report, you need to be a subscriber.

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.