European Imports decline in 2025

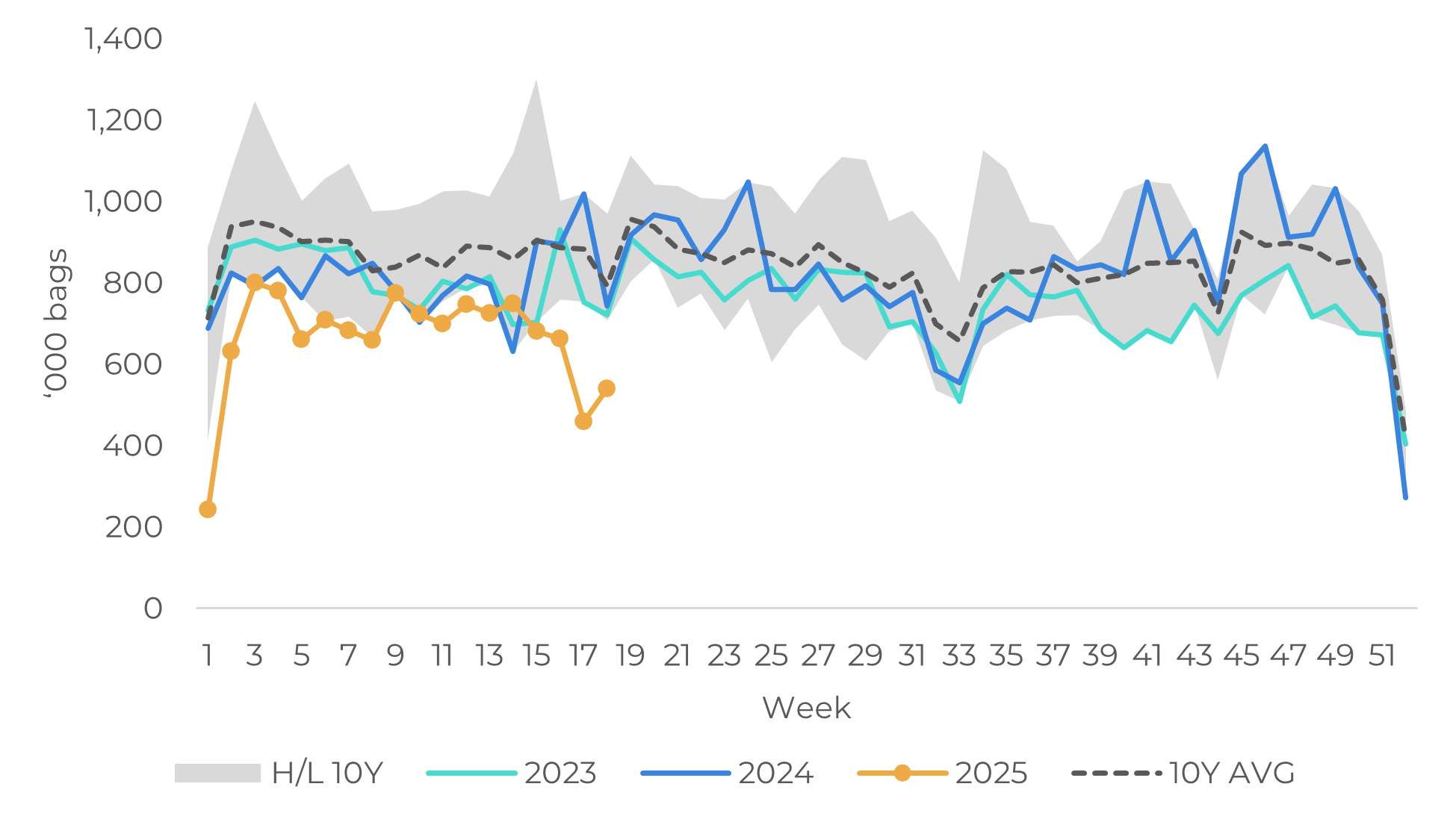

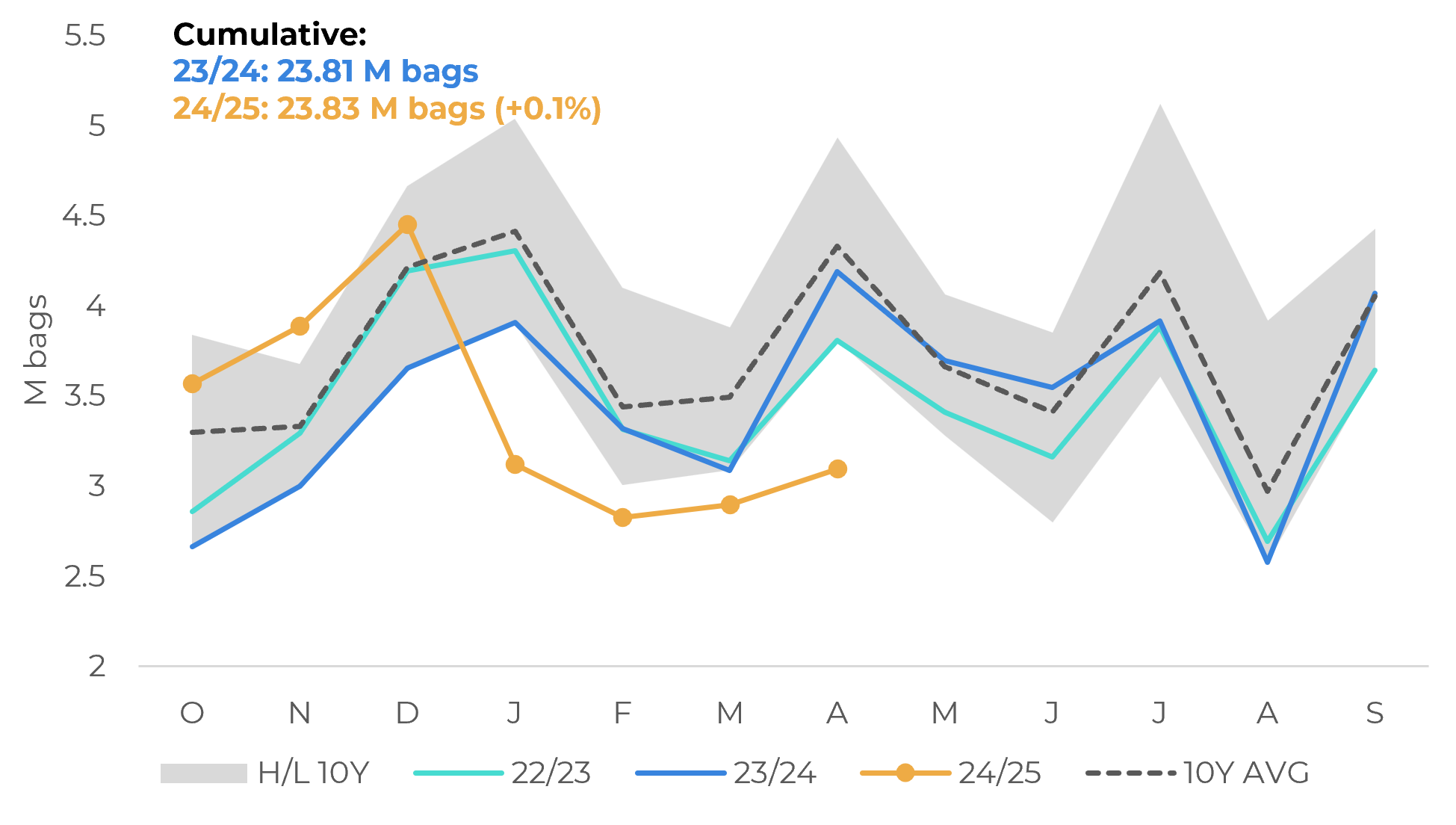

- Coffee imports from the European Union are at a slow pace in 2025, with the lowest weekly shipments for years recorded in April. This brought cumulative shipments for the 24/25 season to levels similar to the same period in 23/24, despite a stronger start of imports in the cycle.

- While this reduction raises an alert regarding demand in one of the world's largest coffee markets, the movement may also reflect limited supply in the period and high price volatility in recent months, with a possible demand dislocation.

- The EU's two largest coffee suppliers, Brazil and Vietnam, continue to face supply constraints, which may have been reflected in the bloc's movement. Many traders and roasters may also be anticipating the intensification of the 25/26 Brazilian harvest and waiting for possible price corrections.

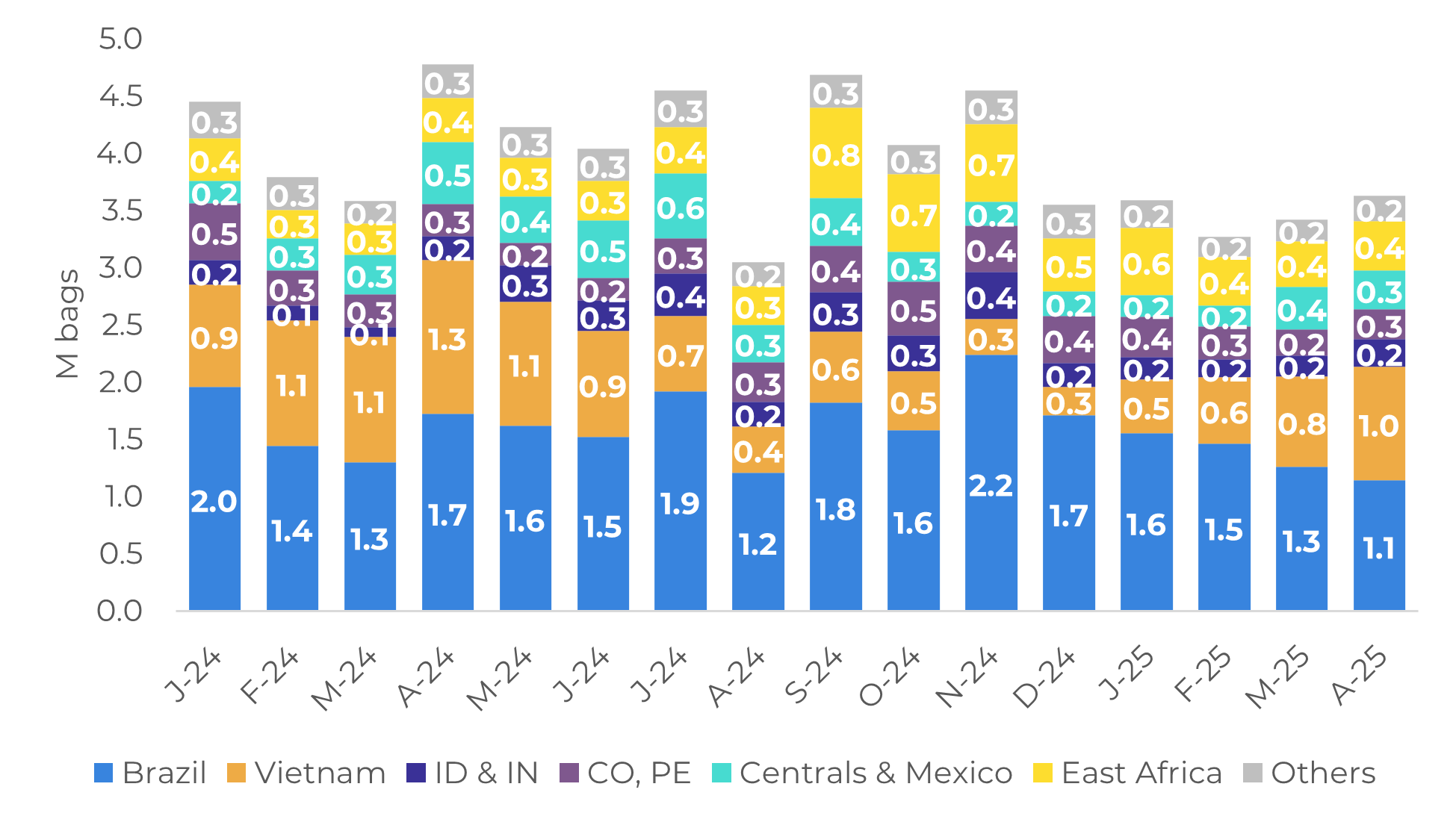

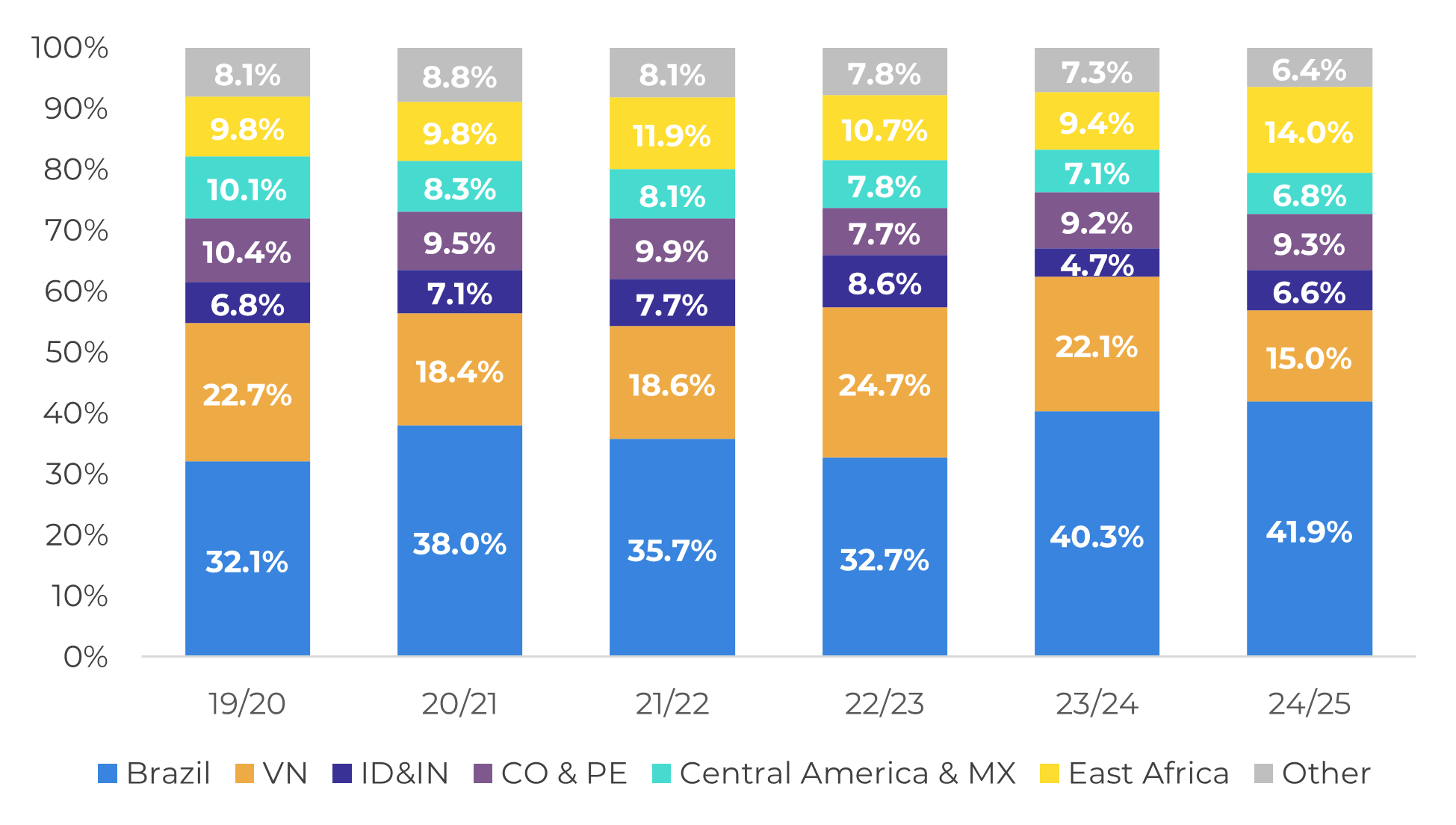

- In terms of bean suppliers, EU imports of Vietnamese coffee fell in the 24/25 crop year, reflecting lower stocks and the delay in the 24/25 crop year in Vietnam. On the other hand, although imports from Brazil have fallen in 2025, the cumulative volume for the season still shows an increase in the country's share of the bloc.

European Imports decline in 2025

EU: Weekly Net Coffee Imports ('000 scs)

Source: European Comission

EU: Net Coffee Imports (M scs)

Source: European Comission

In addition, after high shipments in 2024, Brazilian coffee stocks fell sharply at the end of last year, with most of the 24/25 crop already sold, limiting the country's supply on the global market. On the EU import side, it is also worth remembering that with the sharp rise in coffee prices from December 2024 and hedging costs, many traders and roasters have reduced their trading in anticipation of lower prices as the harvest of the Brazilian 25/26 crop gathers pace.

As a result, the share of Brazilian beans in European imports has been on a downward trend since January. Outside of Brazil, shipments from Vietnam have also seen lower volumes in recent months, reflecting lower stocks, the delay in the 24/25 harvest which began in December last year, and the reluctance of producers to sell the remainder of their stock, especially after prices for both Arabica and Robusta reached record levels at the beginning of the year. Despite the gradual recovery of the country's exports to the EU in 2025 as the harvest progressed, volumes were still low for the period.

This development was also reflected in the country's share of EU imports in the 24/25 harvest (Oct/24 - Apr/25). With lower Vietnamese availability, Vietnam's share of European imports fell from 22.1% in 23/24 to just 15.0%. This led to an increase in Brazil's share in the EU (despite the reduction in 2025), especially on the Conilon side, in addition to the increase in Indonesia. Another interesting movement was the increase in the volume of coffee from East Africa, especially from Uganda (producer of Robusta and Arabica) and Ethiopia (producer of Arabica side), possibly in a movement of the bloc in search of diversification.

EU: Monthly Imports by Origin (M scs)

Source: European Comission

EU: Share of Origins in Imports (% of total)

Source: European Comission

In Summary

Weekly Report — Coffee

laleska.moda@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Disclaimer

To access this report, you need to be a subscriber.

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.