With harvest at a slow pace, Brazilian exports continue to fall

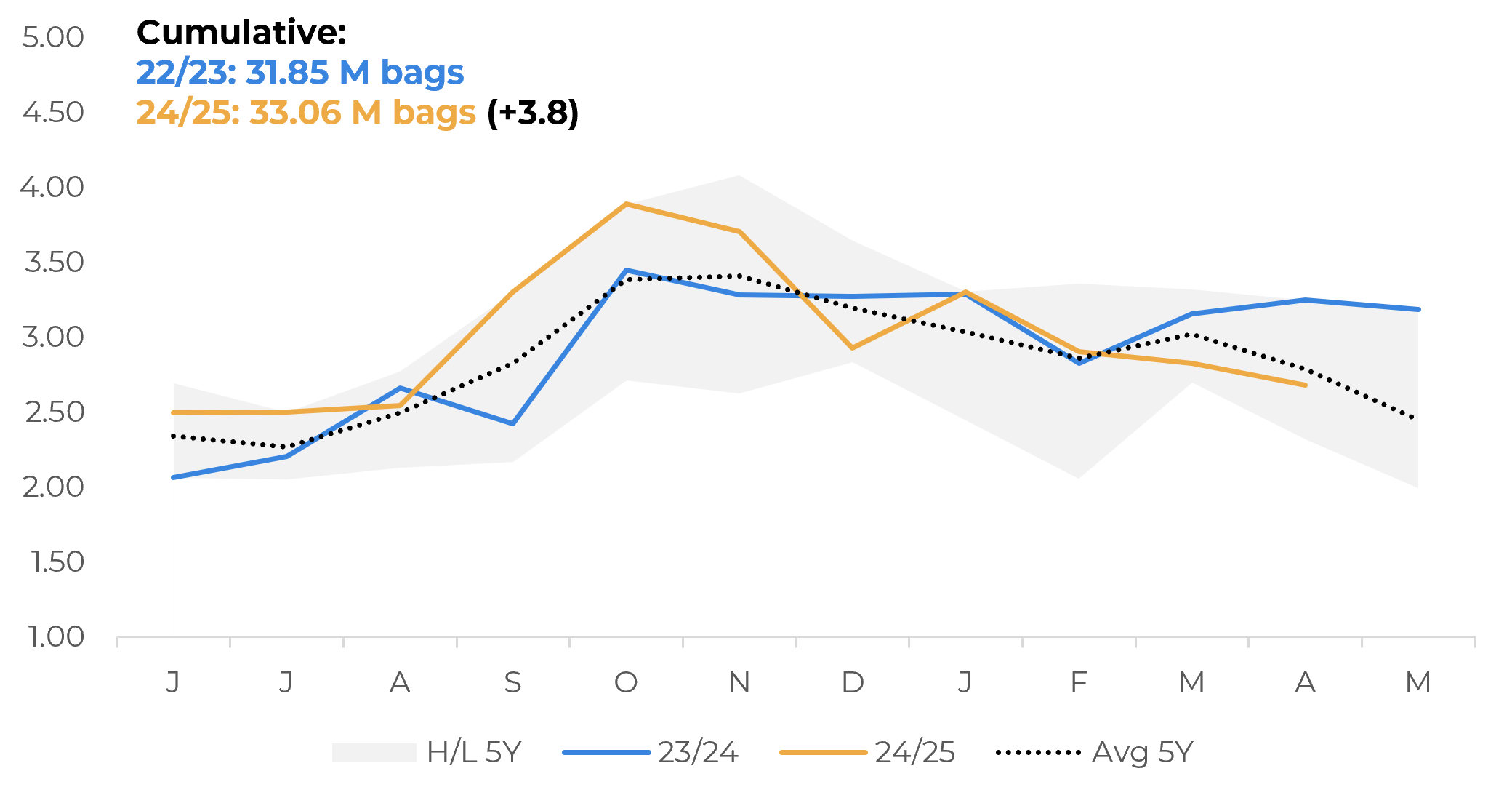

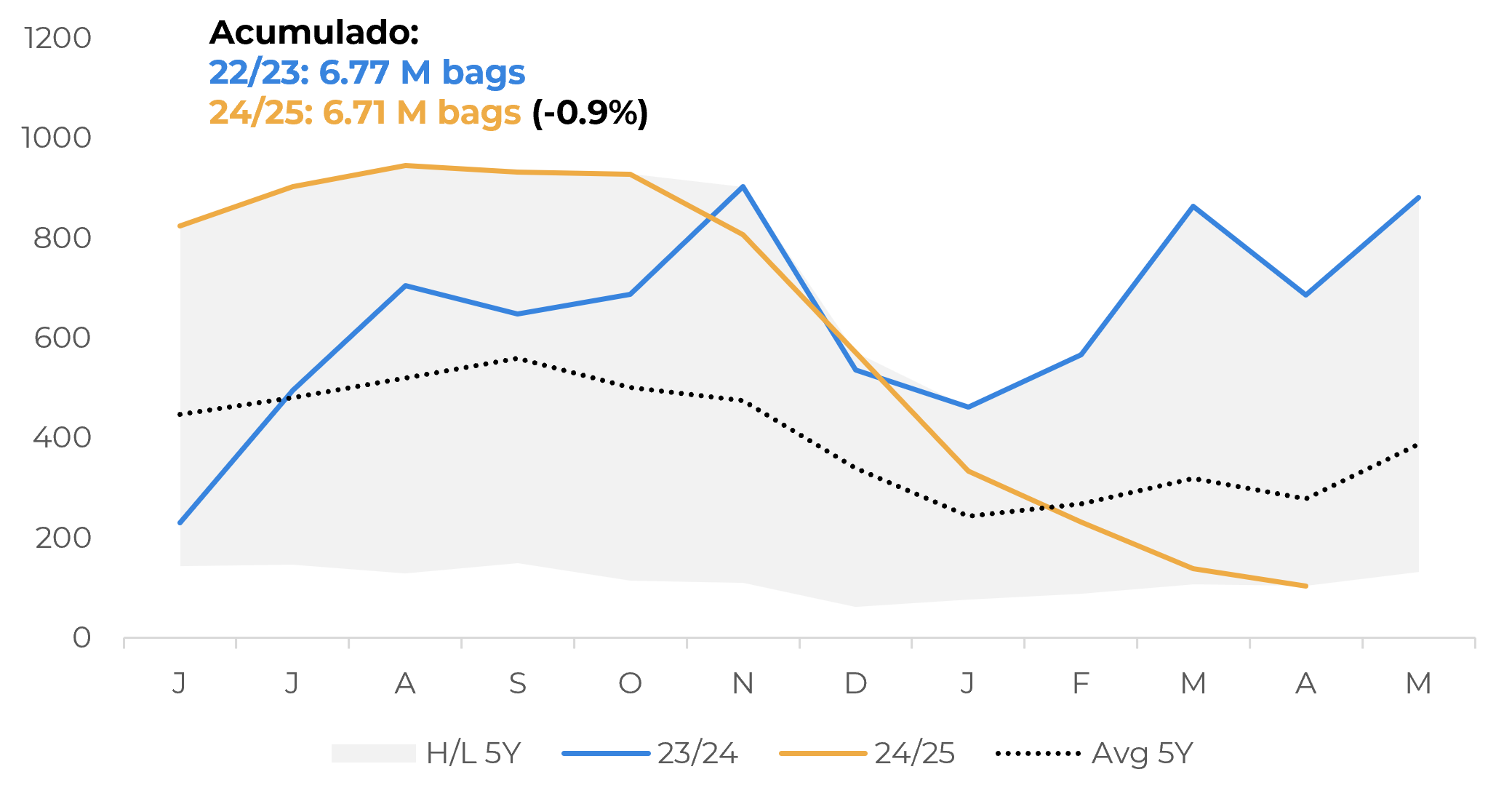

- Brazil's coffee exports fell in April, totaling 3.09 million bags. Of this total, 2.68 million bags were Arabica coffee, while only 103,580 bags were Conilon/Robusta, reflecting drops of 17.4% and 84.9%, respectively.

- This volume was below average for both varieties and reflects Brazil's low inventories and the lack of sellers in the market in recent months, as the 25/26 harvest is still in its early stages.

- However, in the 24/25 cumulative (June 2024 to May 2025), total exports are higher than in the same period of 23/24, driven by record shipments last year. While the accumulated Arabica exports remain above the previous cycle, Conilon exports have slightly declined, reflecting the significant decrease in shipments in 2025.

- With low Conilon stocks in Brazil and an accelerating Indonesian harvest, it is expected that Conilon shipments will remain below average in the coming months, possibly redirecting the variety to the domestic market.

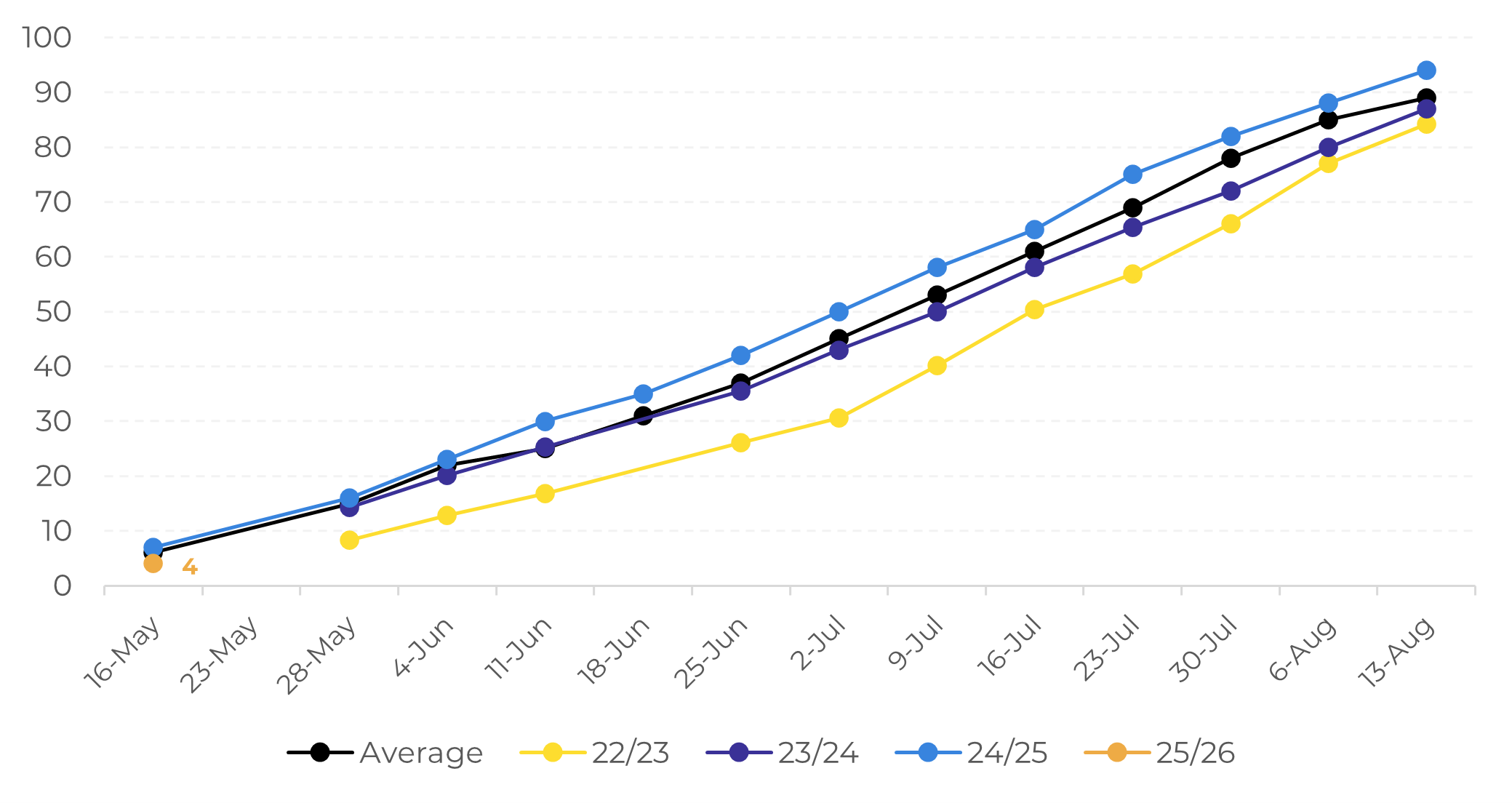

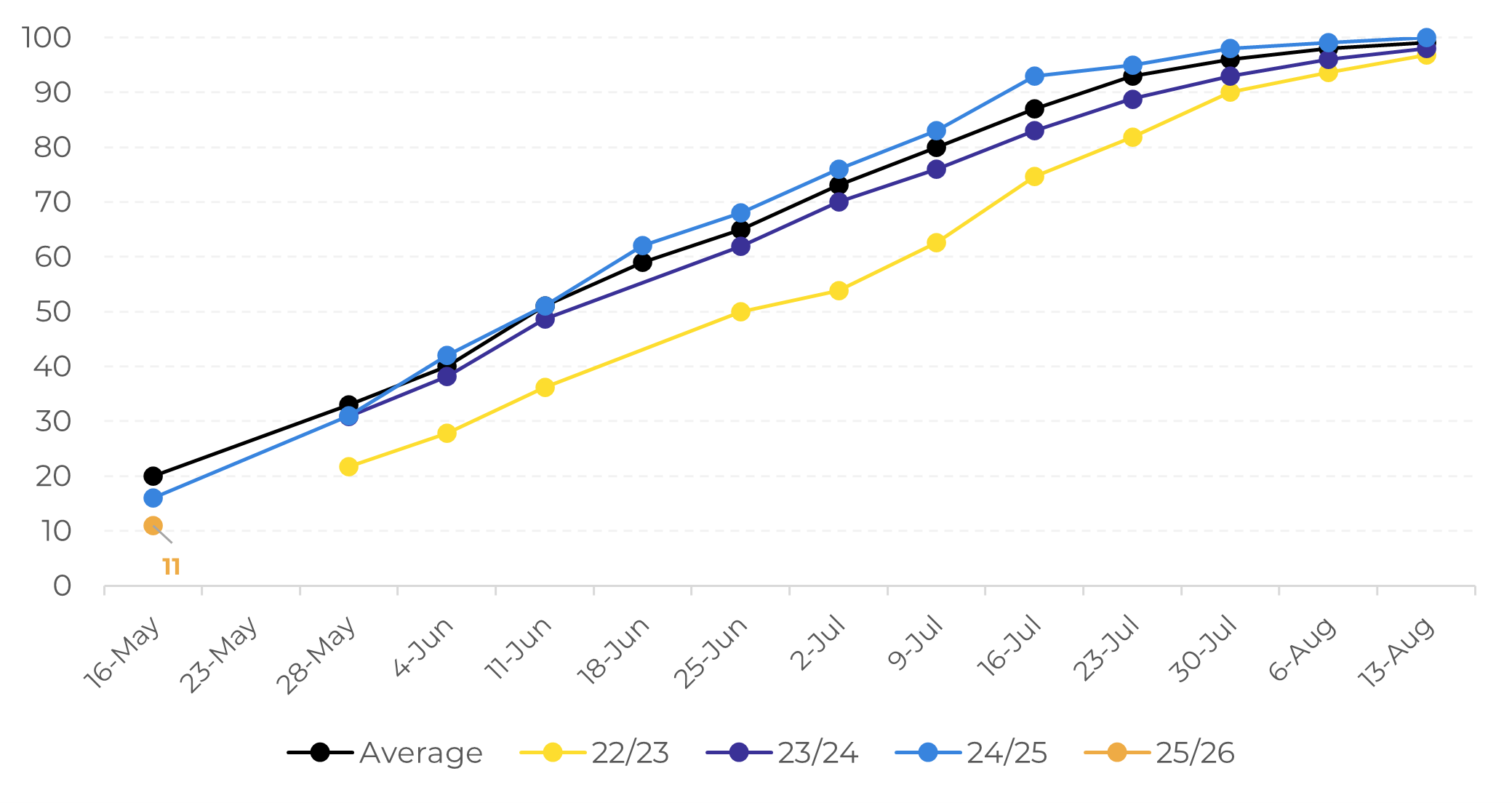

- Regarding the 25/26 harvest, it is progressing more slowly than in recent years due to the rainfall in several coffee-producing regions.

With harvest at a slow pace, Brazilian exports continue to fall

Brazil: Green Arabica Coffee Exports (M bags)

Source: Cecafé

Brazil: Green Conilon Coffee/Robusta Exports ('000 bags)

Source: Cecafé

Due to low Conilon stocks in Brazil and an accelerating Robusta harvest in Indonesia, Conilon shipments are expected to remain below average in the coming months. The prospect of a larger harvest in Indonesia has caused Asian differentials to retreat strongly, making these coffees more competitive than Brazilian beans. In Brazil, lower Arabica availability has widened the price spread between Arabica and Conilon, making the latter more attractive to domestic industries.

As the Conilon harvest usually progresses faster than the Arabica harvest, there is a tendency for more Conilon to be redirected to the Brazilian domestic market in the coming months. Currently, Brazil's Conilon harvest is at 11%, while the Arabica harvest is only at 4%. This brings the national total to 7%, which is below the average of 10% for the last few harvests. The slower harvest pace reflects the recent rains in several producing regions, including Espírito Santo, Bahia, Rondônia, and Matas de Minas. Some producers may prefer to wait for the beans to mature further and have a lower moisture content before harvesting their coffee, as most of them are already capitalized.

Brazil: Arabica Coffee Harvest (% of total)

Source: Safras & Mercado

Brazil: Conilon/Robusta Coffee Harvest (% of total)

Source: Safras & Mercado

In Summary

Weekly Report — Coffee

laleska.moda@hedgepointglobal.com

carolina.franca@hedgepointglobal.com

Disclaimer

To access this report, you need to be a subscriber.

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.