Rains in Colombia affect the 25/26 season, but prices drop this week

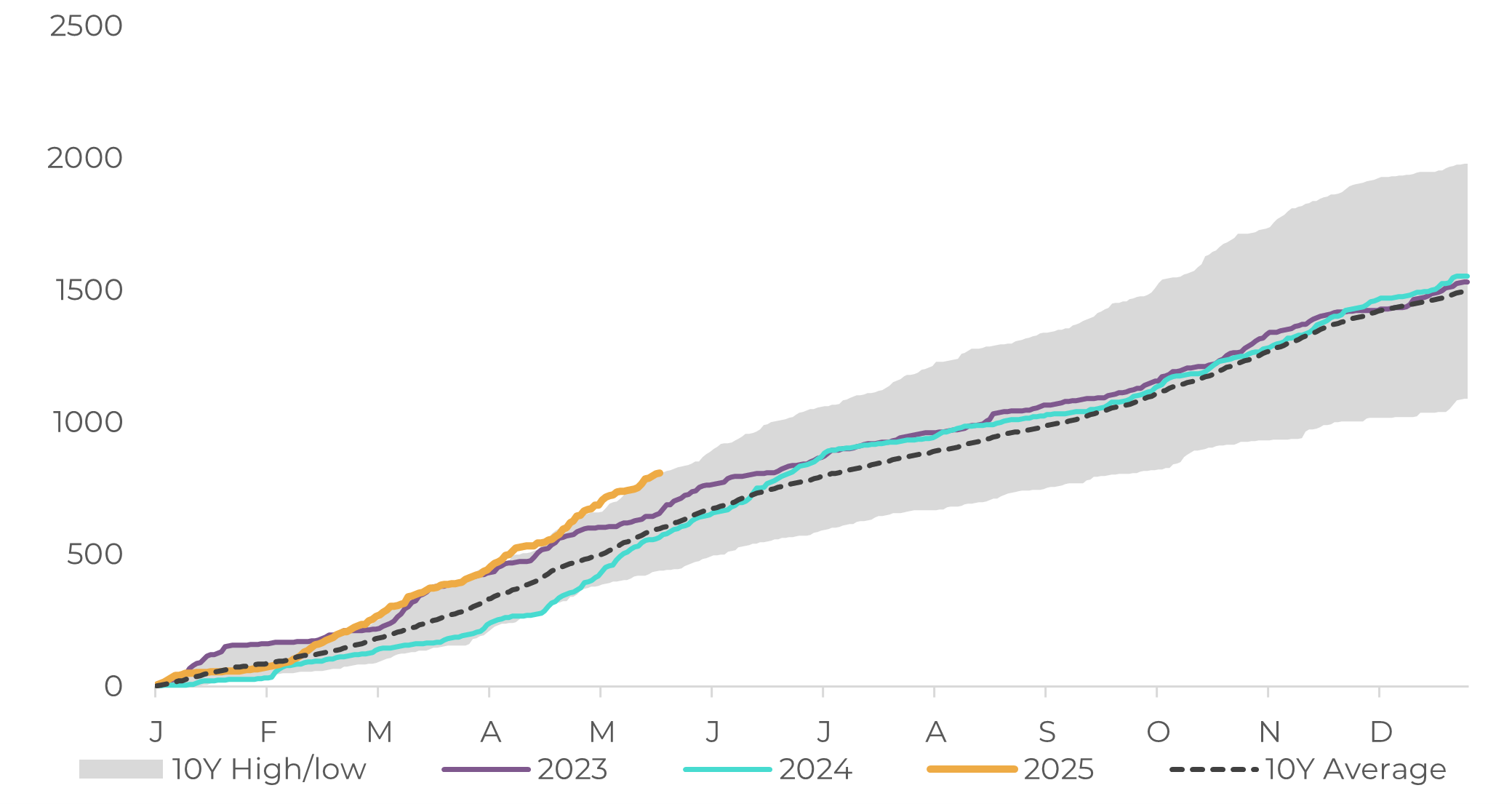

- Colombia recorded higher-than-average rainfall in 2025. While the higher humidity initially benefited the trees, the excessive rainfall in the second quarter is already affecting the 25/26 Mitaca harvest. The adverse weather is also expected to impact the country's main cycle later this year.

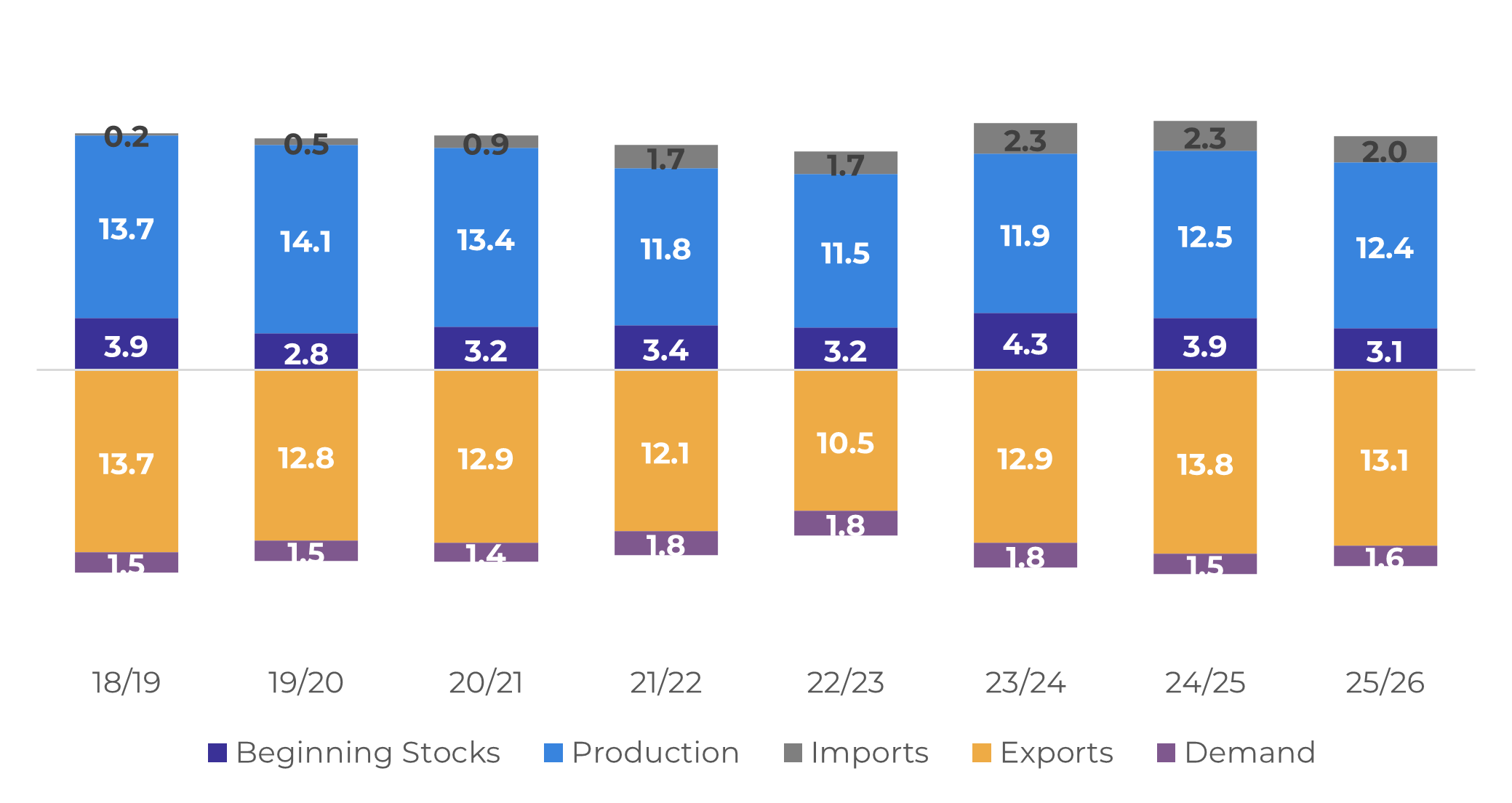

- With this in mind, we lowered our estimate to 12.4 million bags, a slight decrease from the 2024/25 season. This could affect Colombia's exports in the 2025-2026 cycle and impact the global balance.

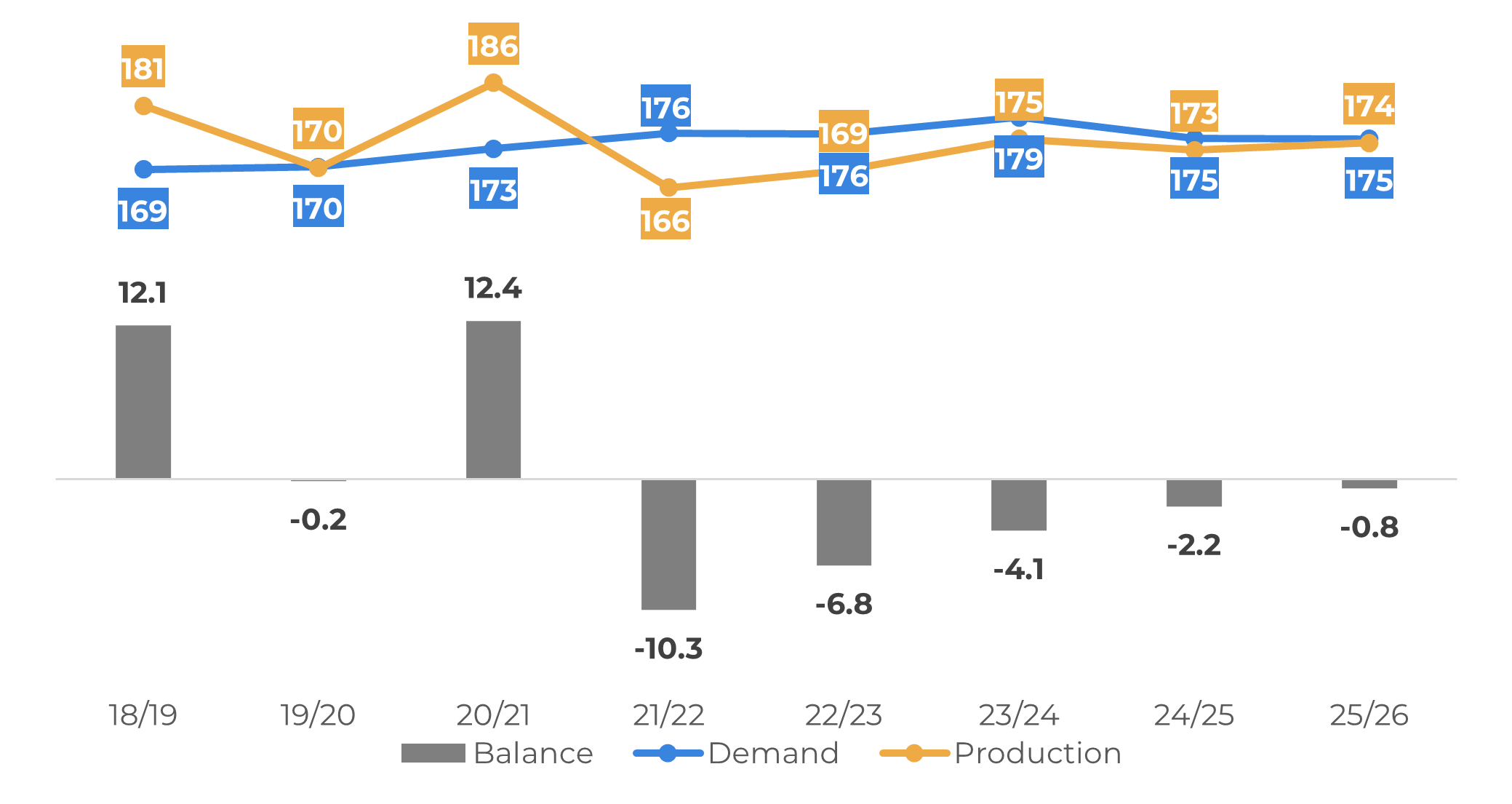

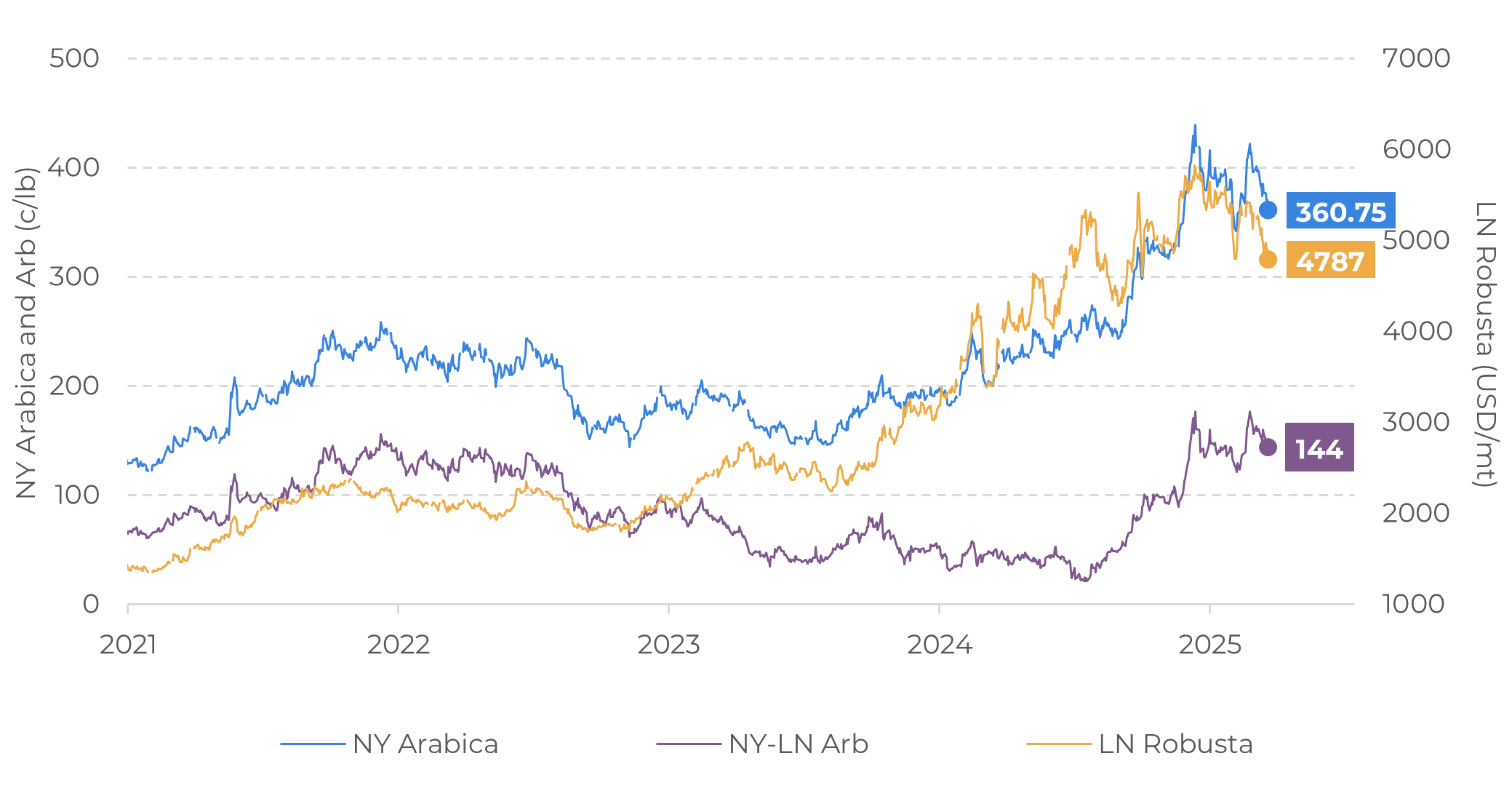

- Despite the more bullish view on the long-term, Arabica and Robusta’s contracts lost some ground this week, as pace of the harvests in Brazil and Indonesia increases. The USDA also released its first figures for the 25/26 season for both countries, indicating an increase in supply. For now, our estimates remain unchanged.

- Arabica and Robusta certified stocks also showed some significant recovery in May, especially the latter, with more Indonesian and Vietnamese beans sent to ICE.

- Besides the supply, this Thursday, the ABIC (Brazilian Coffee Industry Association) pointed to a decrease in coffee retail sales from January to April in Brazil – the second largest consuming county of coffee.

Rains in Colombia affect the 25/26 season, but prices drop this week

Colombia: Cumulative Precipitation in Coffee Areas (mm)

Source: Refinitiv

Colombia: Coffee Supply and Demand (M bags)

Source: Hedgepoint

Regarding our figures, with the drop in Colombia we also reviewed our global balance, which now points to a deficit of 800,000 bags in 25/26. Despite this bullish outlook in the medium to long-term, future prices have dropped in the past few days, reflecting the perspectives of improving supply in the coming months, as the harvests in Brazil and Indonesia gain pace.

In Indonesia, the 25/26 harvest is picking up speed, and more coffee is becoming available on the market. This is also reflected in the recent decrease in Asian differentials. Interestingly, the drop in Indonesian and Vietnamese differentials has led these countries to send more coffee to ICE-certified stocks, which are currently recovering. Arabica certified stocks also improved in May, with an increase in volume from Central American origins.

Global Coffee Balance (M bags)

Source: Hedgepoint

LN – Robusta (USD/mt), NY – Arabica and Arbitrage (c/lb)

Source: LSEG

Meanwhile, the current dry weather in Brazil is favorable for fieldwork, and the harvest rate is likely to increase until the end of this month. More coffee will hit the market in June. Additionally, despite the recent forecast of lower temperatures in some coffee-growing regions, there is still no risk of frost in the short term, which could contribute to a more bearish outlook.

Data on Brazil’s demand has also dragged the market down this week. On Thursday, 22, a new report published by the Brazilian Coffee Industry Association (ABIC) pointed to a decrease of 5.13% in retail sales of coffee in the country between January and April. While the year started with a rise in sales, March and April results were below 2024 levels, likely reflecting the rise in prices. According to ABIC, all categories of coffee showed an increase in prices, with traditional blend up 49.8% and soluble with a rise of 85.1%. On the other hand, 2024 was marked by an increase in domestic demand in Brazil.

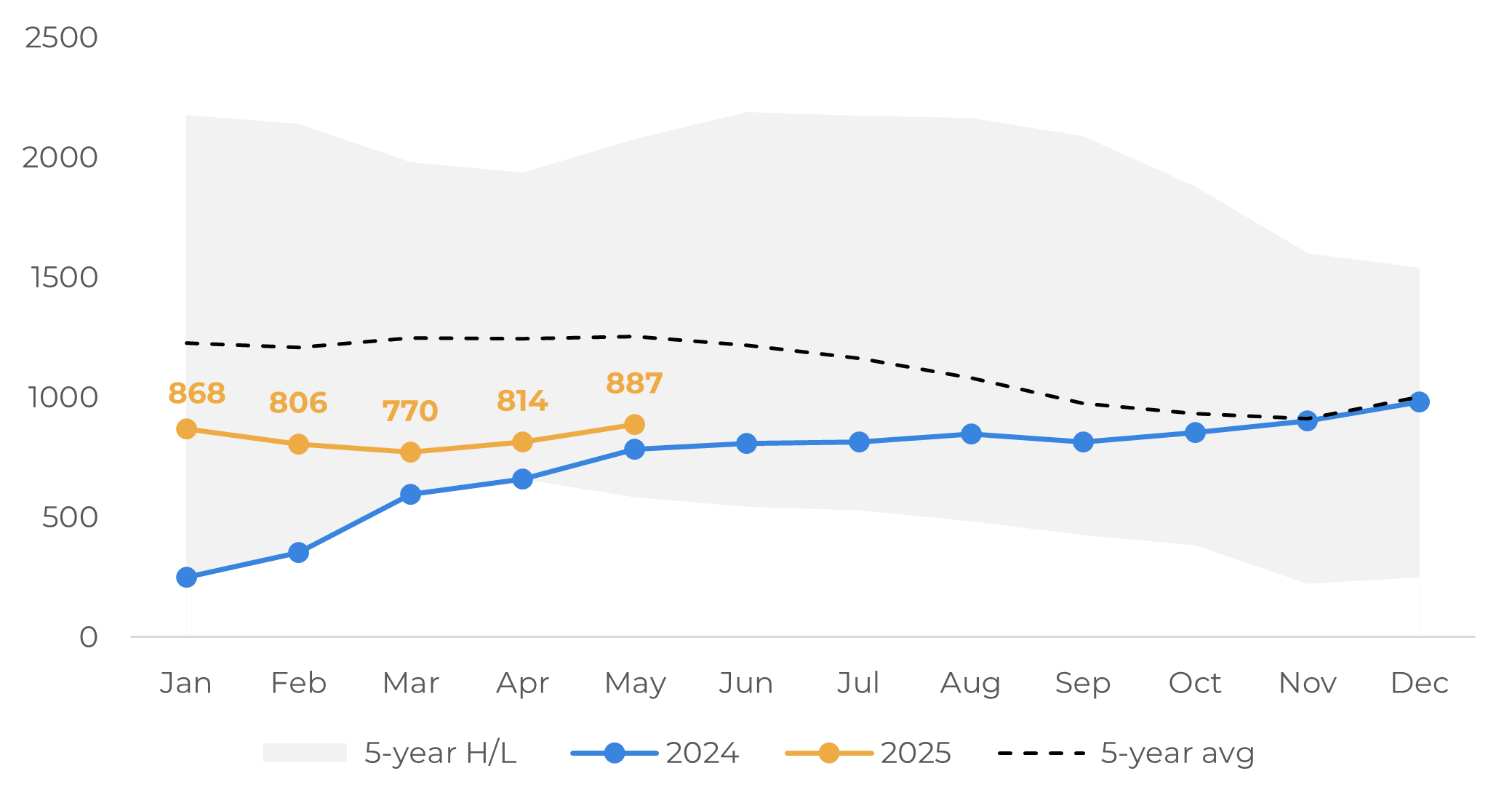

Arabica Certified Stocks (‘000 bags)

Source: ICE

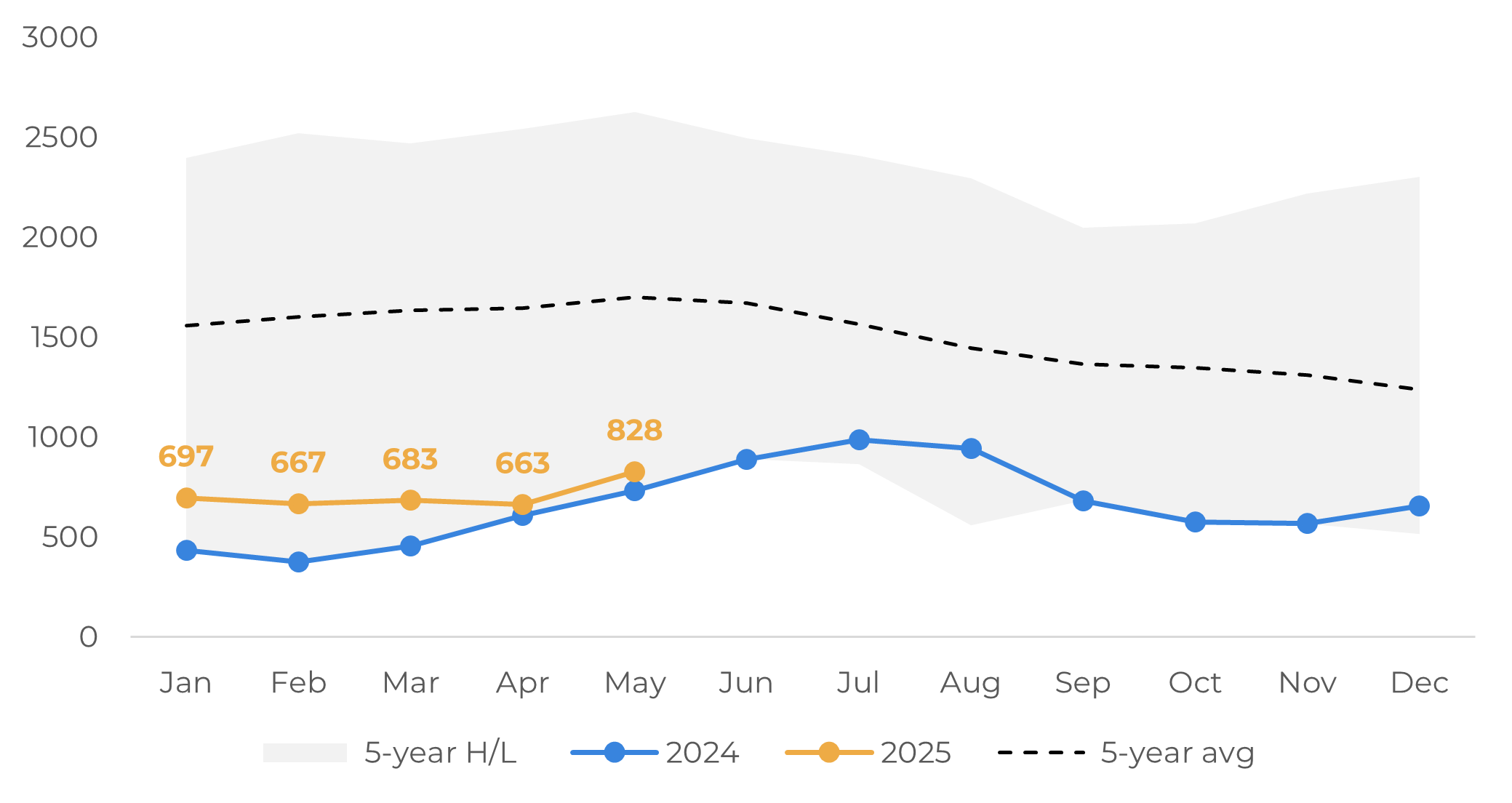

Robusta Certified Stocks (‘000 bags)

Source: ICE

In Summary

Weekly Report — Coffee

laleska.moda@hedgepointglobal.com

carolina.franca@hedgepointglobal.com