Robusta’s prices reach new lows as harvest in Brazil and Indonesia gains pace

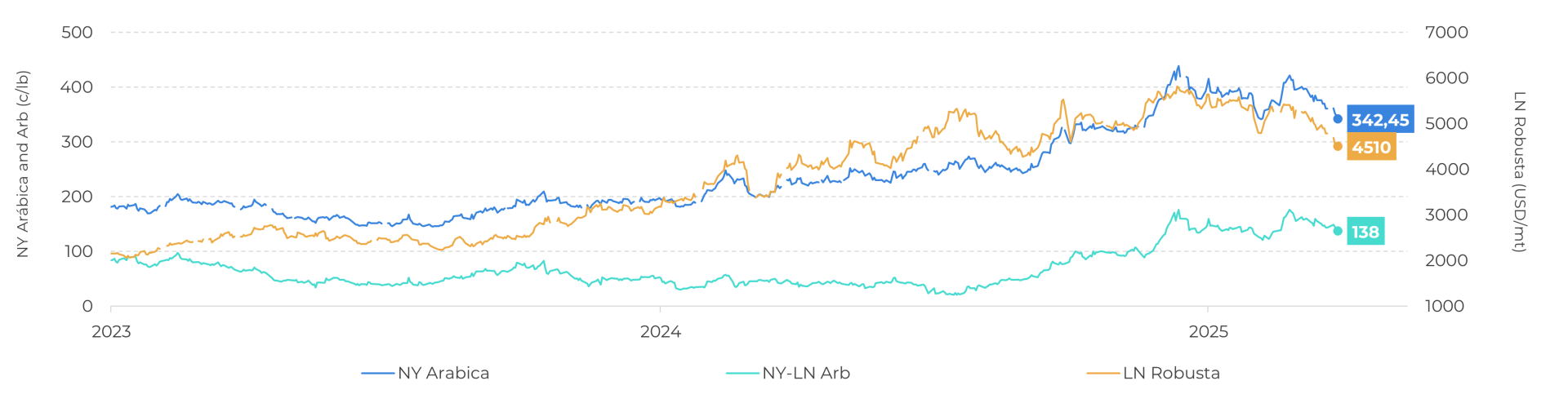

- Robusta futures prices have dropped sharply in recent days. The July contract hit a six-and-a-half-month low on Thursday, with cumulative losses of 4.8% for the week. For Arabica, while macroeconomic data from the U.S. on Thursday seems to have capped some of the decline, July’s contract still dropped 5.1% over the week, though.

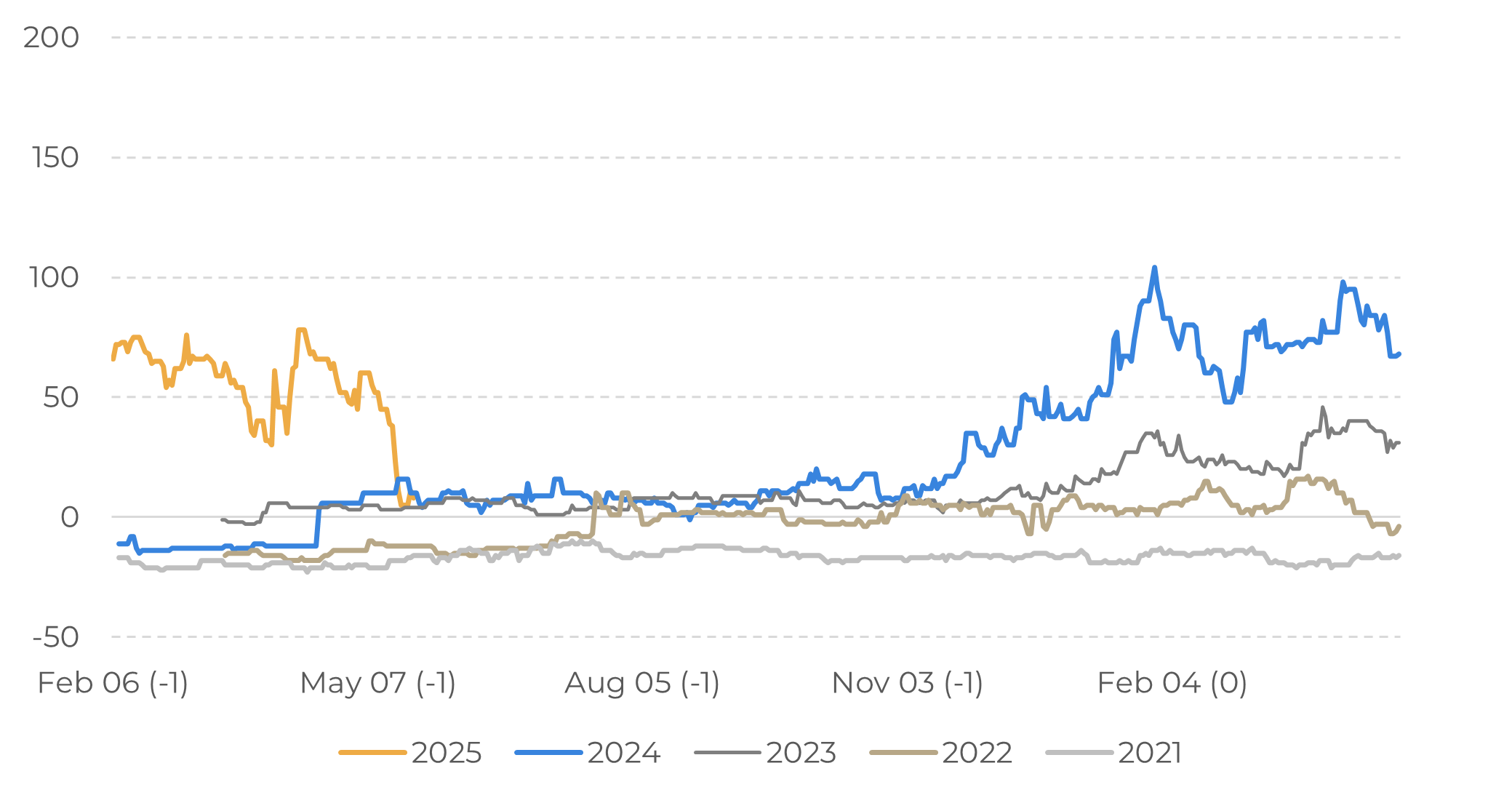

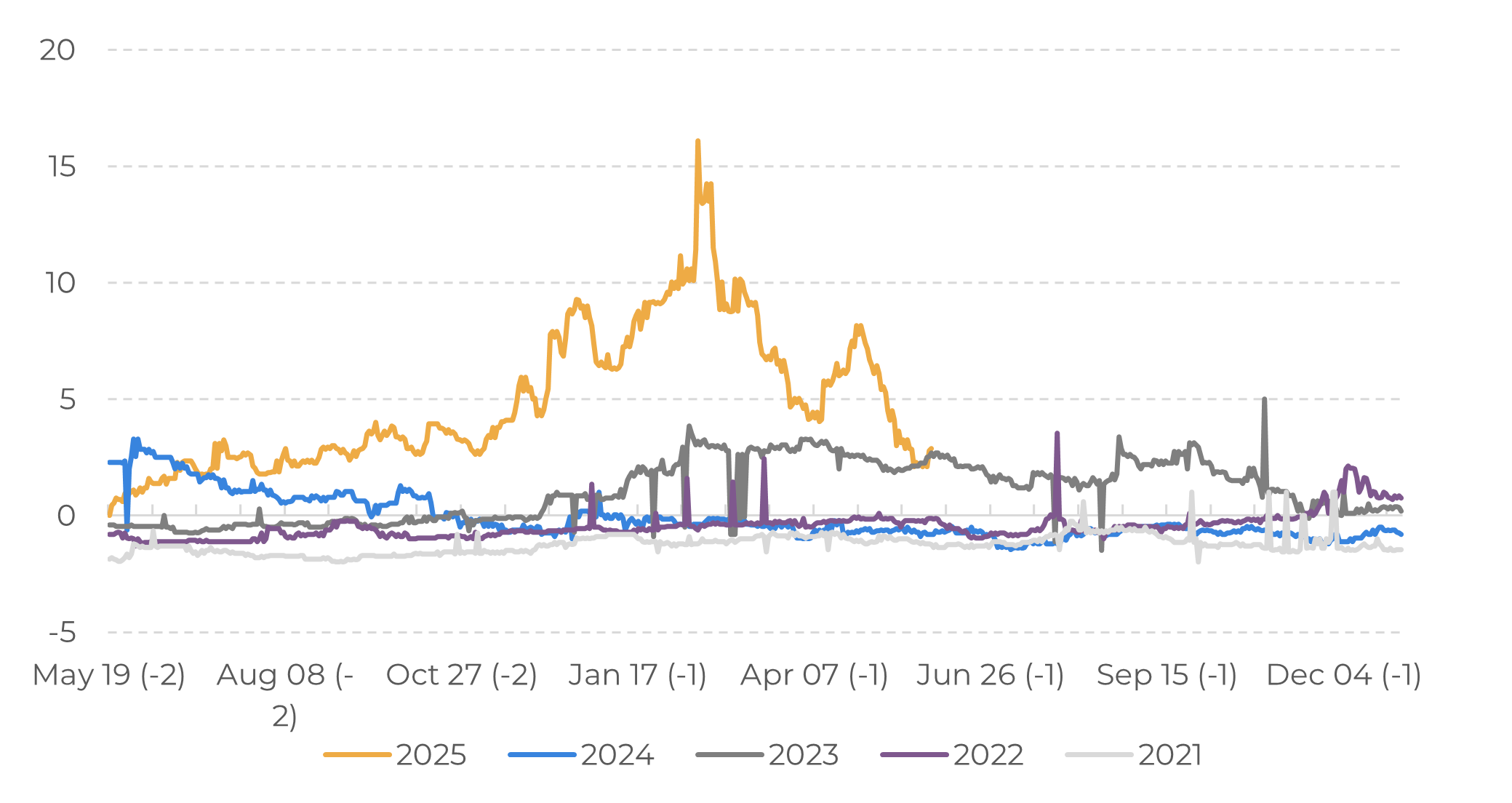

- The spreads for short-term contracts on both varieties have also fallen, highlighting the recent easing of supply concerns, particularly for Robusta. This is due to the growing pace of the 25/26 harvest in Brazil and Indonesia.

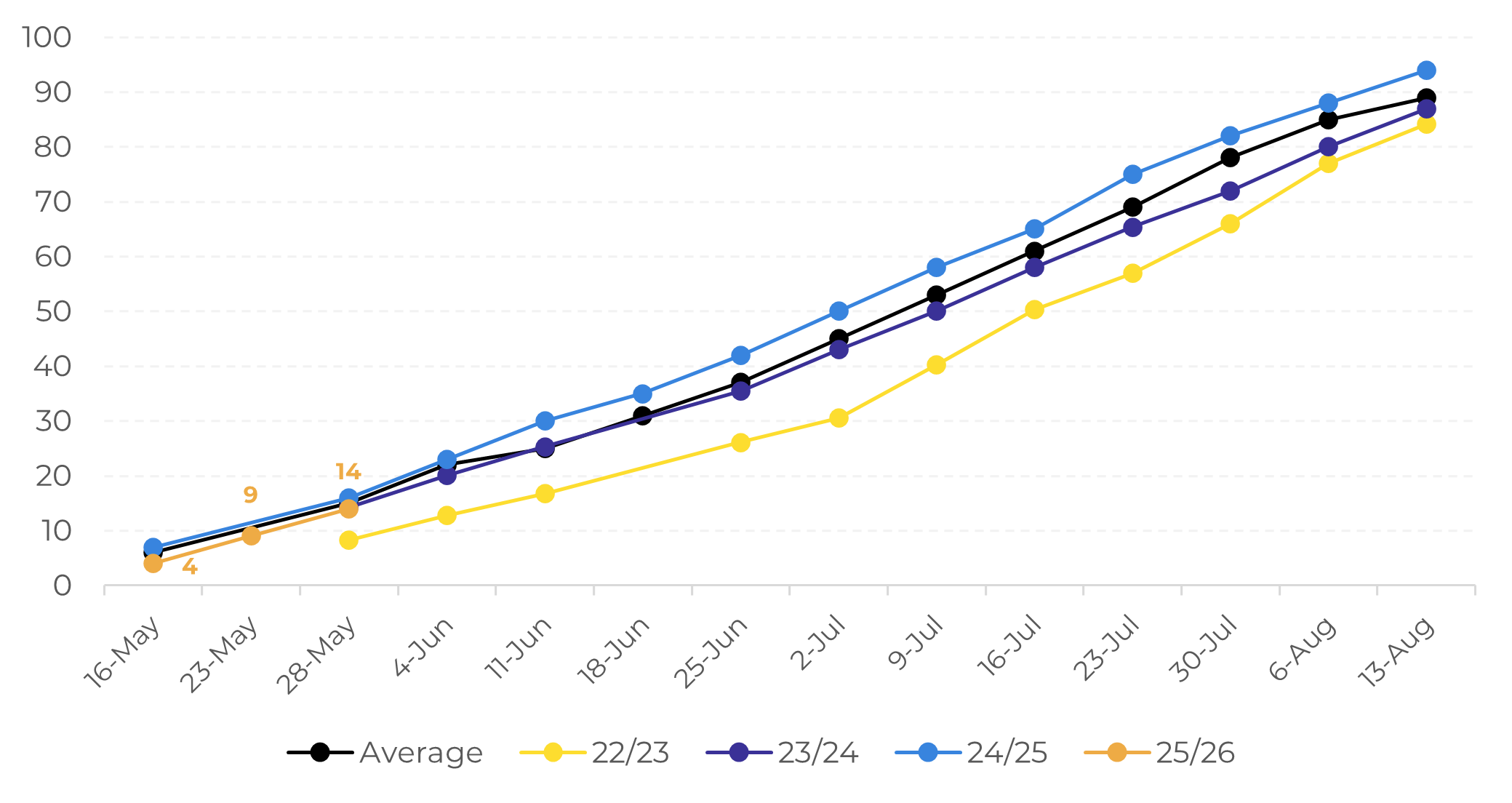

- In Brazil, 20% of the total expected crop has already been harvested. With the current dry weather, the pace is expected to increase in the coming weeks, and more coffee will be available on the market by the end of June. However, sales are still low on the physical market due to current tight stocks and price drops.

- In Asia, the Indonesian harvest is picking up pace, and more coffee is currently available on the market. This has led to a further drop in differentials. Although there is still no data on April's exports, an increase in Indonesian volume is expected, following the trend of the past few months.

Robusta’s prices reach new lows as harvest in Brazil and Indonesia gains pace

LN – Robusta (USD/mt), NY – Arabica and Arbitrage (c/lb)

Source: LSEG

Despite the turmoil in the macro environment, the coffee market is likely to respond more strongly to supply news in the short term. In this regard, the current spread between the July and September contracts for Robusta and Arabica dropped in May due to the expectation of increased supplies in the coming months.

In Brazil, 20% of the 25/26 harvest has been completed, with 31% of the Conilon crop and 14% of the Arabica crop harvested, more in line with average levels. The harvest is also showing promising results in terms of quality and bean size. Processing yields are more in line with average levels compared to the disappointing 24/25 season. Although a drop in total Arabica production is expected, the harvest is showing good results, with an expected recovery in Conilon production. Drier weather and low chances of frost, at least for now, could bring more coffee to market by the end of June and early July.

Robusta Spreads: July – Spetember (USD/mt)

Source: LSEG

Arabica Spreads: July – September (c/lb)

Source: LSEG

Meanwhile, the volume of Indonesia’s 25/26 Robusta beans is increasing in the market. The harvest, which occurs at the same time as Brazil’s Conilon harvest, is reaching its peak. The increased supply has already lowered Asian differentials and could lead to further corrections on London prices. According to recent news reports, many farmers and exporters are taking advantage of the 90-day tariff pause to ship coffee to the U.S. Although news regarding tariffs changes from time to time, uncertainties continue in the market, and buyers may prefer to secure coffee now. This could lead to an increase in Indonesian export figures between April and July.

Regarding sales, however, both the physical and futures markets are quiet in Brazil, with low volumes traded. Farmers may increase sales in the coming weeks as coffee supplies improves, but they are likely to sell older beans first and store the new ones since the harvest period is usually marked by lower prices. Overall, it is expected that most farmers will hold onto more of the 25/26 season until the first flowering and a clearer definition of the 26/27 cycle emerges, which could cap some of the expected price corrections in the coming months, at least for Arabica.

Brazil: Arabica Harvest Pace (% of total)

Source: Safras & Mercado

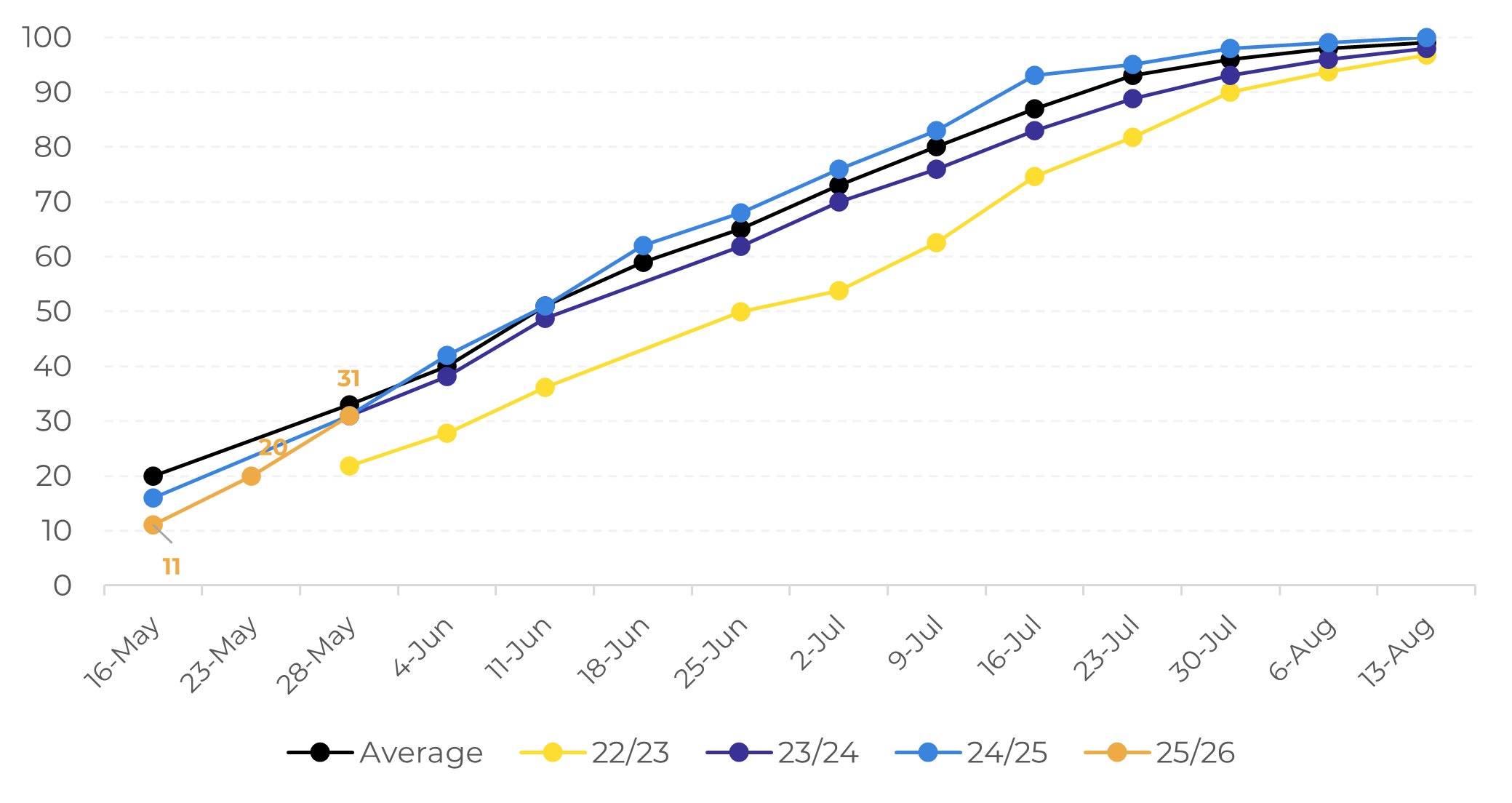

Brazil: Conilon Harvest Pace (% of total)

Source: Safras & Mercado

In Summary

Weekly Report — Coffee

laleska.moda@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Disclaimer

To access this report, you need to be a subscriber.

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.