Prices soar with weather risk in Brazil, but Robusta could still see corrections in the medium term

- The current forecast of a new cold front in Brazil led to soaring future prices for Arabica and Robusta on the Thursday and early Friday. Temperatures are expected to drop sharply next week, raising concerns about frost in coffee-growing regions. The drop in ICE certified stocks and the market's technically oversold condition also triggered covering, contributing to the rise.

- Price volatility is likely to increase in Brazil during the winter, but in the medium term, Robusta futures prices could fall due to the ongoing 25/26 harvest in Brazil and Indonesia. Both countries are reporting better-than-expected results, with Indonesia offering more beans on the international market since early May.

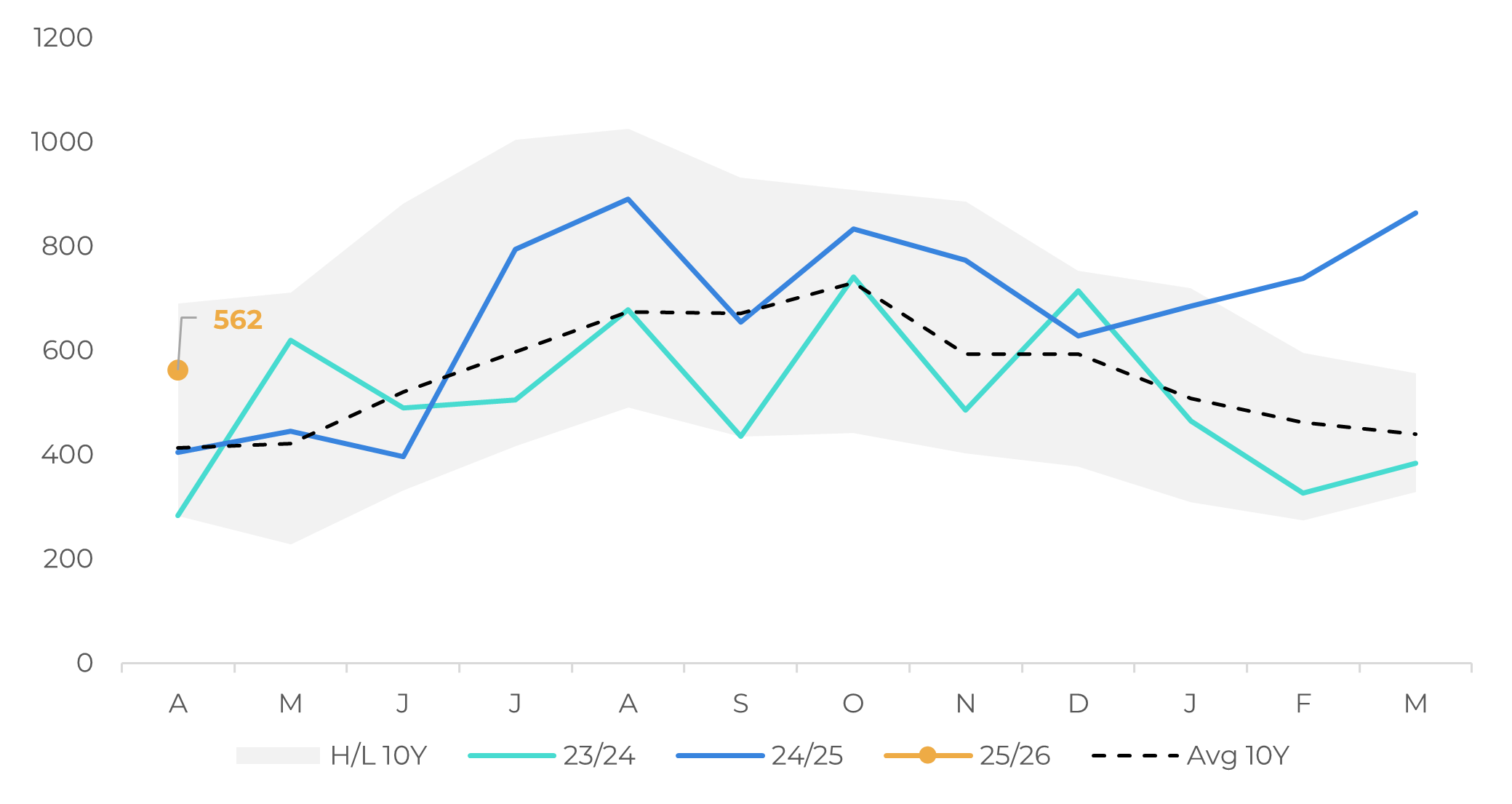

- Favorable weather has already led to a recovery in output and exports for the 24/25 season in the Asian country. Now, with good rainfall between late 2024 and early 2025, together with farmers who have invested more in their farms, the 25/26 cycle is expected to increase to 11.8 million bags, which should support higher exports this season.

- Uganda has also begun its main harvest for the 25/26 cycle in the Masaka, West, and Southwest regions, as well as its secondary harvest in the Central and East regions. The country has seen increased exports in recent months due to favorable results and high coffee prices.

Prices soar with weather risk in Brazil, but Robusta could still see corrections in the medium term

Indonesia: Cumulative Precipitation on Coffee Regions (mm)

Source: GADAS

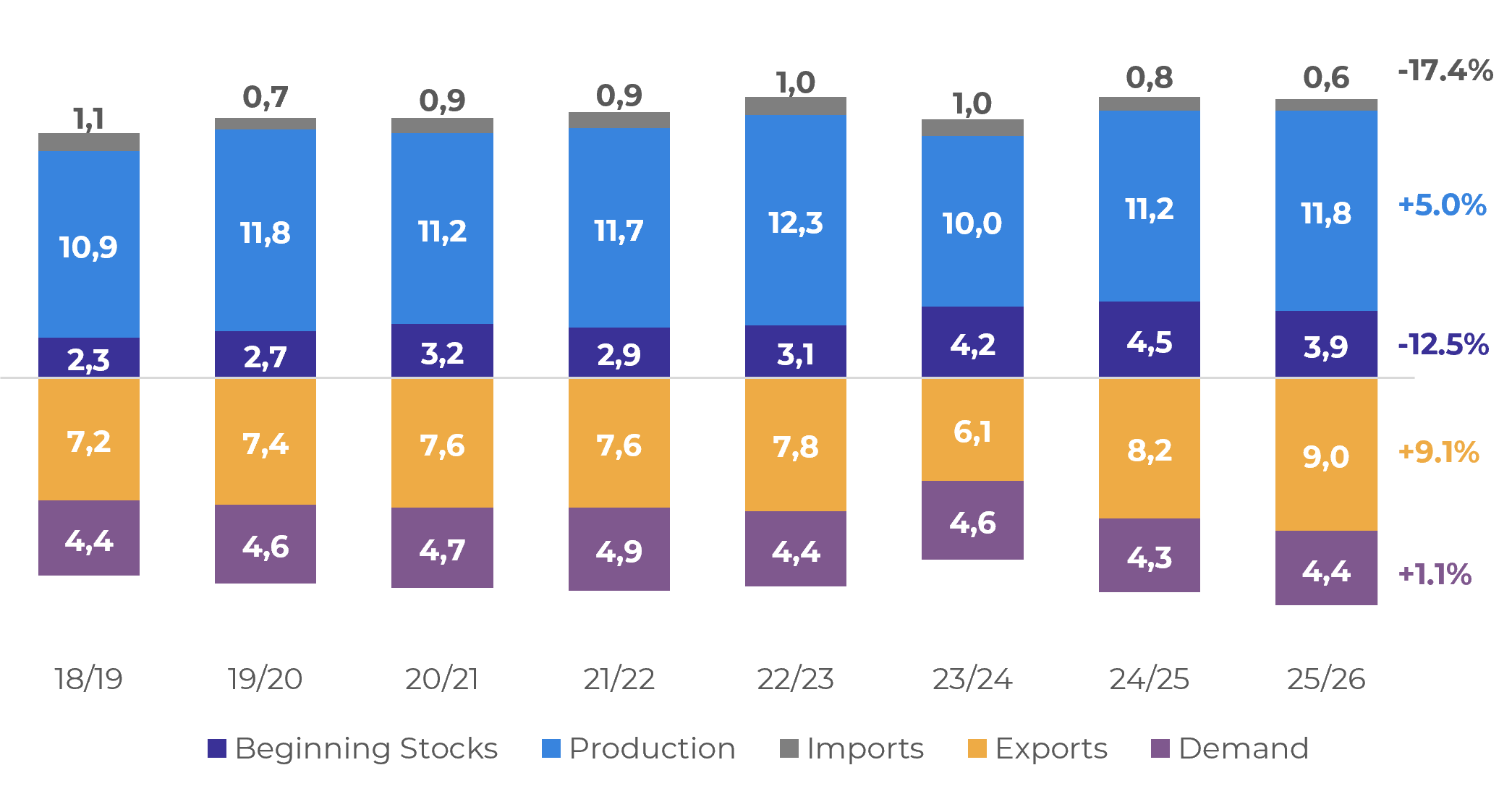

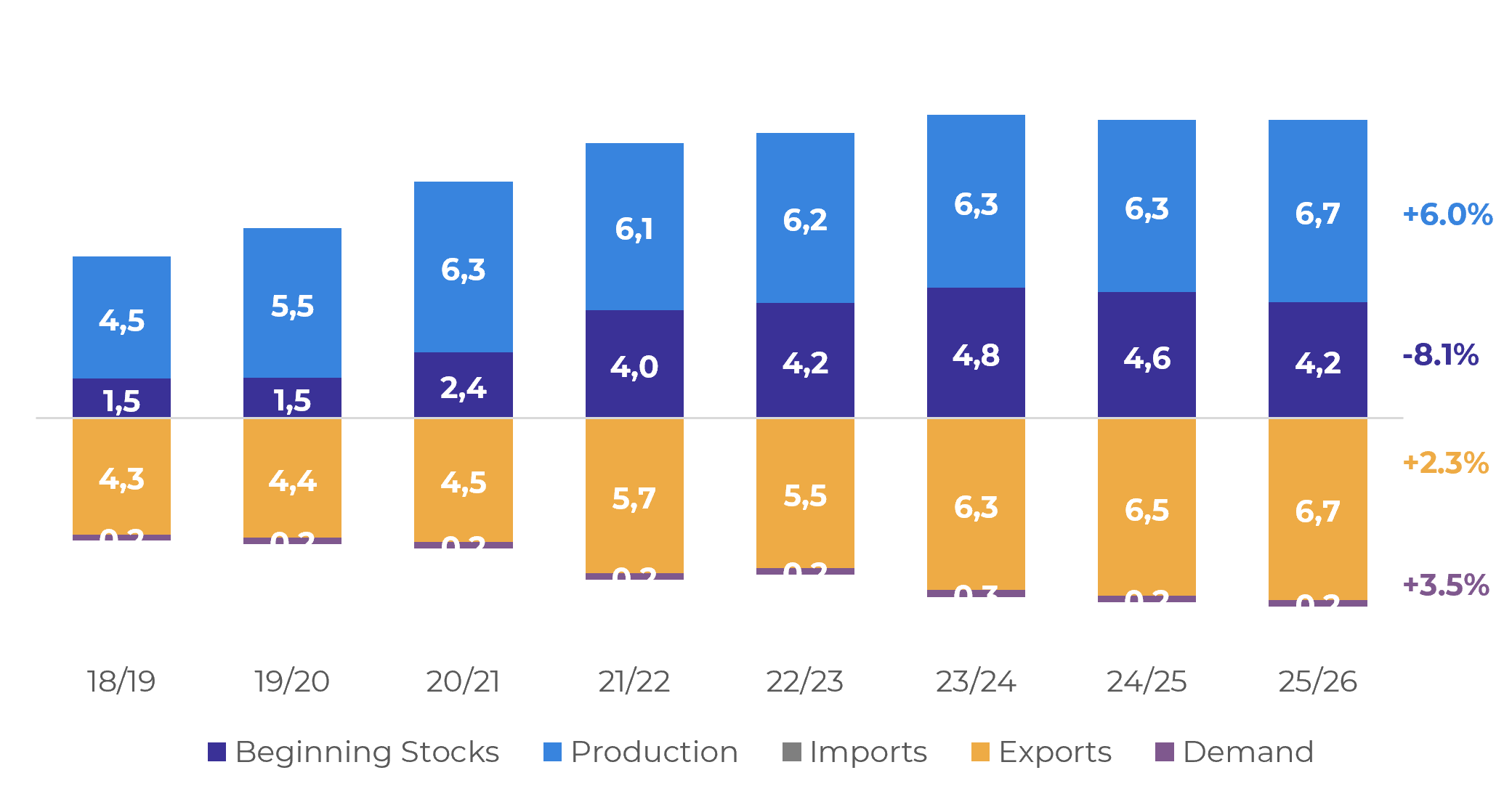

Indonesia: Supply and Demand (M bags)

Source: Hedgepoint

The weather has also been favorable in Indonesia since the end of 2023, helping to recover the 24/25 cycle and further increase the 25/26 cycle. Since last year, farmers have had more capital due to the rise in Robusta prices. They have invested in new areas and improved crop conditions (e.g., using more inputs). This has led us to increase our estimates for the 25/26 cycle to 11.8 million bags, a 5% increase from the 24/25 season

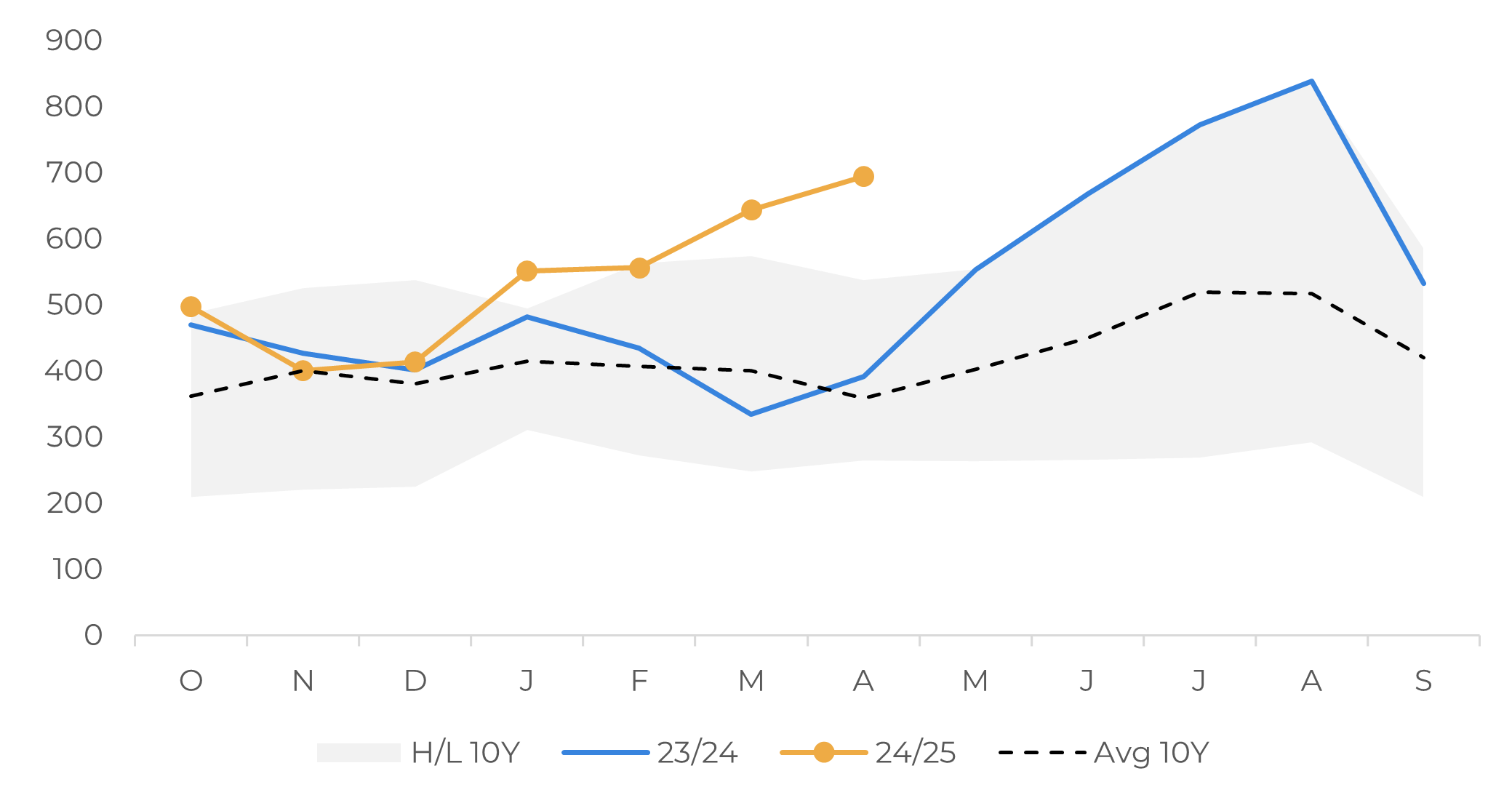

Higher coffee availability in the country during Brazil's off-season also led to increased exports in 2025. The previous cycle ended with a 12.4% increase, and the first month of the 2025/26 season also had higher-than-average shipments. Given these factors, we expect larger export figures from Indonesia in the 25/26 cycle, especially considering the more competitive differentials for Asian coffees.

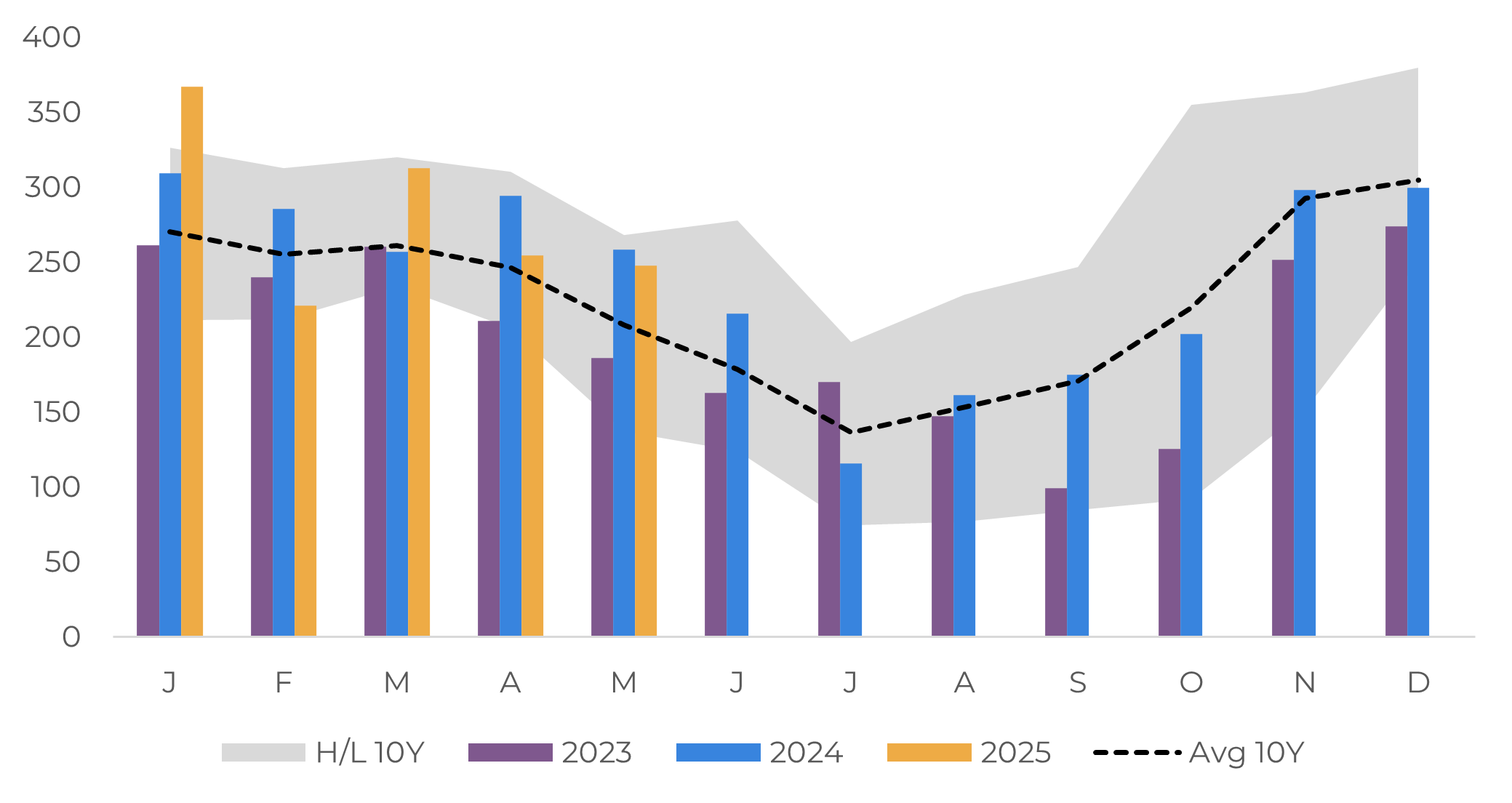

Indonesia: Coffee Exports (‘000 bags)

Source: Bank of Indonsia; ICO

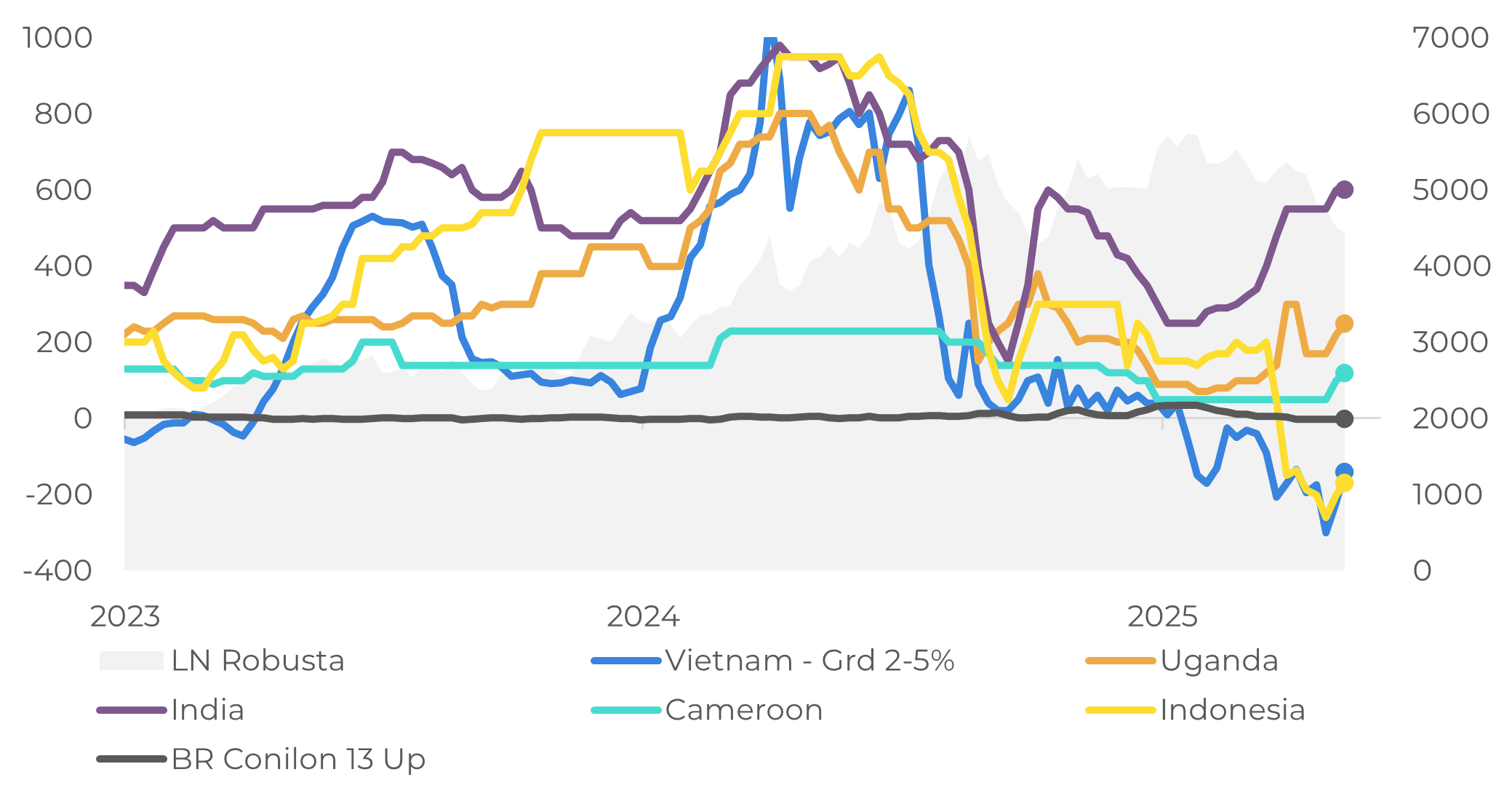

Robusta Differentials (USD/mt)

Source: LSEG; Safras & Mercado

As farmers in Brazil have been less active in the market in recent months, Indonesia is not the only country increasing its exports. Uganda, Africa’s largest Robusta coffee producer, has also shown an increase in export figures for the 24/25 cycle (October 2024–September 2025). Since mid-2024, the country's shipments have shown above-average results, with higher imports from destinations such as the US and the EU. Financial support from the government and favorable weather are also expected to lead to increased production and exports in the 25/26 season. The country has started its main 2025/26 harvest in the Masaka, West, and Southwest regions, as well as its secondary harvest in the Central and East regions, which will increase the country's supply.

Uganda: Supply and Demand (M bags)

Source: Hedgepoint

Uganda: Coffee Exports (‘000 bags)

Source: Uganda Coffee Development Authority

With this development, concerns about Robusta supply are expected to decrease, which could lead to a correction in the July contract once weather risks in Brazil ease. The September contract could also face pressure due to higher current output in Brazil, Indonesia, and Uganda, as well as favorable weather conditions in Vietnam that are aiding the development of the 25/26 season. In this scenario, support for Robusta prices is limited in the medium term.

The potential for prices to rebound in the medium term is primarily linked to weather conditions in Vietnam and Brazil for the remainder of 2025. In Vietnam, insufficient rainfall in the coming months could negatively affect the 2025/2026 crop. Meanwhile, in Brazil, winter frost poses a risk, and if September brings drier weather, market volatility could increase due to potential effects on the 2026/2027 season. However, current forecasts for both countries remain favorable, so despite this week’s price reaction, we expect lower values in the coming months for now.

In Summary

Weekly Report — Coffee

laleska.moda@hedgepointglobal.com

livea.coda@hedgepointglobal.com