As harvest gains pace in Brazil, prices drop

- Future coffee prices have been extremely volatile, with frequent ups and downs. Last week, the arrival of a cold front in Brazil, brought the temperatures down and increased the chances of frosts, especially on the South of Minas, the largest producing regions of Arabica. However, no frost were recorded and the easing fears over supply brought the market down.

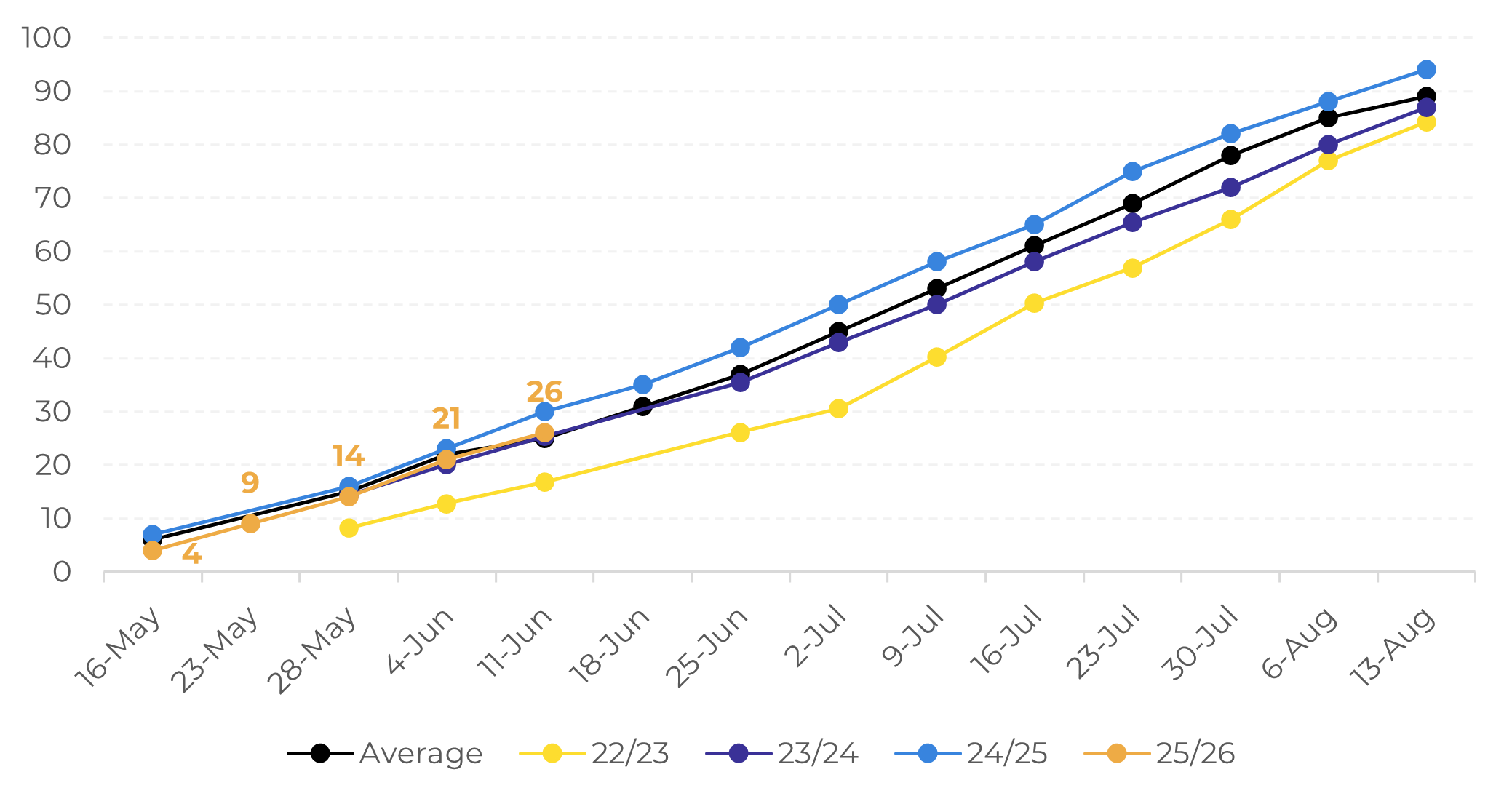

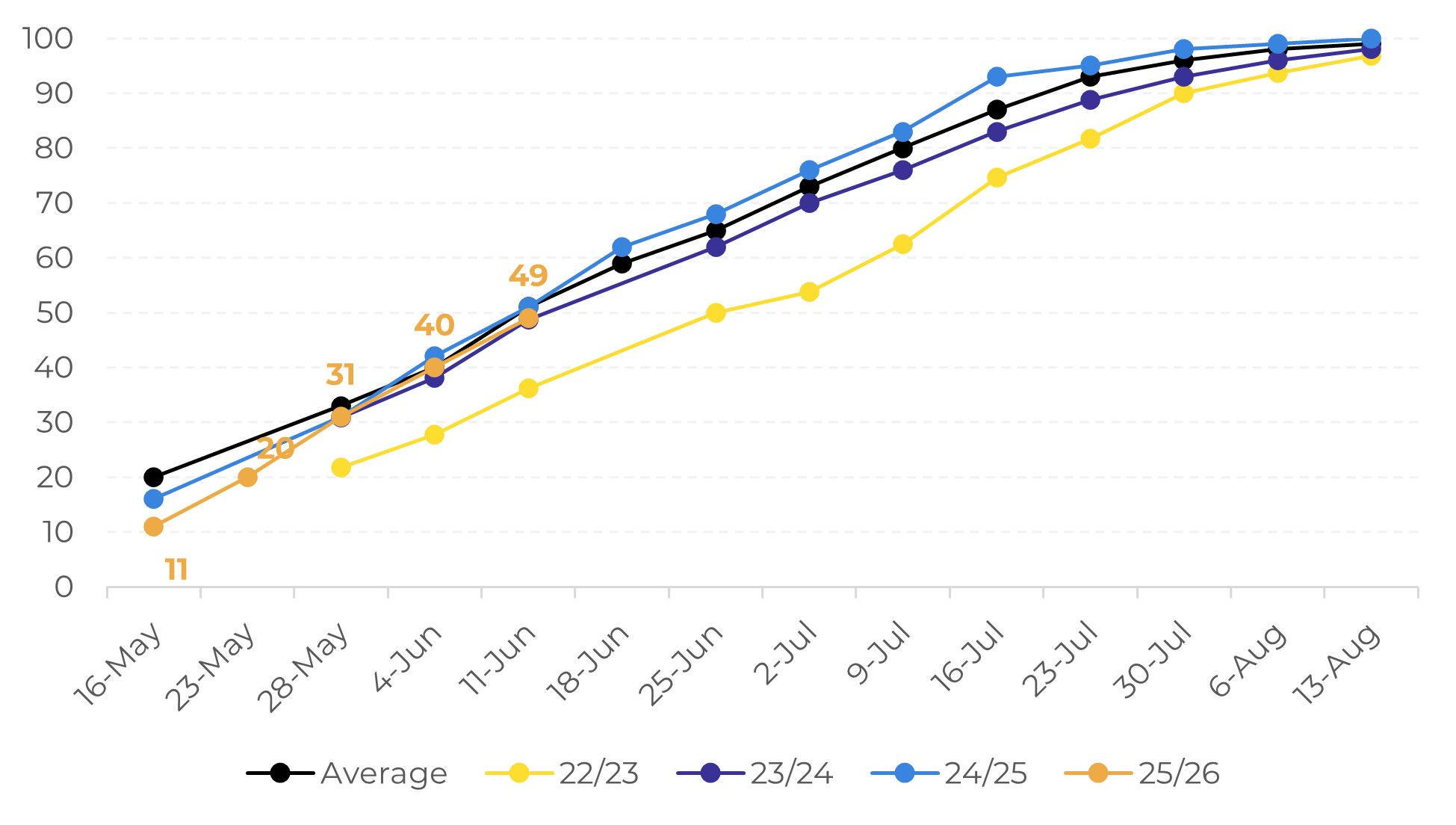

- The harvest of the 25/26 season in Brazil is now at full speed, with 35% harvested until the 13th. Arabica harvested volume is at 26% and Conilon, already at 49%, in line with 5-year average levels.

- While Brazil’s export figures for May were below those of 2024, the faster pace of the Conilon harvest suggests that farmers are increasingly focused on making new sales to cover harvest expenses and free up storage capacity for the incoming crop.

- The influx of Brazilian Conilon, together with the incoming Robusta from Indonesia and Uganda, is putting downward pressure on the market and could also reflect in Arabica prices in the coming weeks.

- On the other hand, in the medium-term, prices could still be volatile as winter has just begun in the Southern Hemisphere. The possibility of new cold fronts and a frosts risk, will likely keep agents on alert.

As harvest gains pace in Brazil, prices drop

Brazil: Arabica Harvest Pace (% of total)

Source: Safras & Mercado

Brazil: Conilon Harvest Pace (% of total)

Source: Safras & Mercado

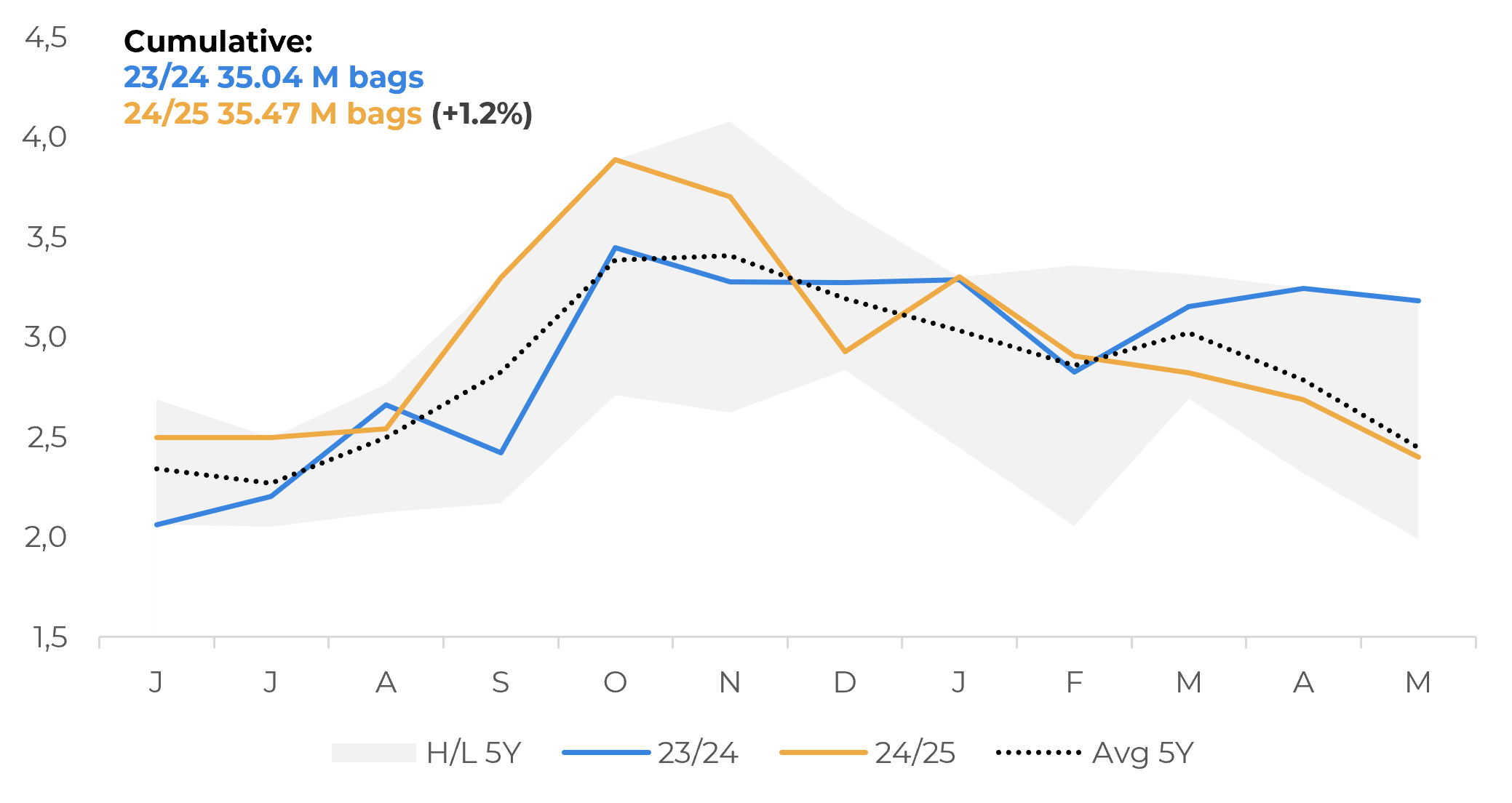

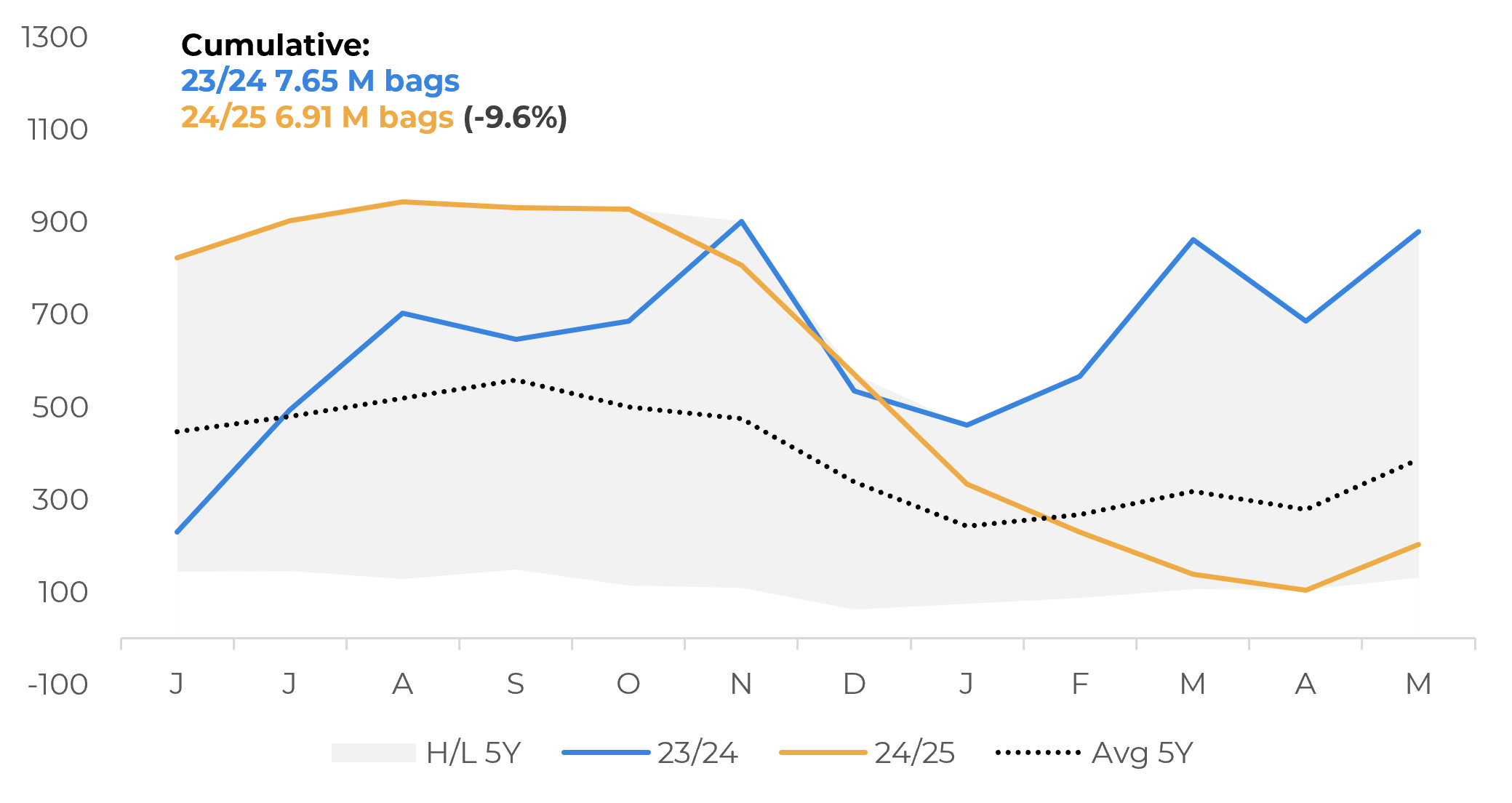

The influx of Brazilian Conilon, together with the incoming Robusta from Indonesia and Uganda, is putting downward pressure on the market and is also starting to impact Arabica prices. For nor, Brazilian exports for both Arabica and Robusta are low: the cumulative figures for the 24/25 season (June/24-May/25) showed a 9.6% decrease compared to the 23/24 season (record). But Arabica exports still totaled almost 35.5 M bags in the season, up 1.2% from 23/24. While June’s figures could still be low compared to previous years, given that farmers showed little interest in sales up until now, we do expect an increase in the coming months, as more coffee hits the market.

Additionally, favorable weather conditions in Vietnam and Central America are likely supporting the development of the 25/26 season, which may sustain the current bearish sentiment in the market. However, this does not mean that prices won't react in the coming months. With winter just beginning in the Southern Hemisphere, new cold fronts and the risk of frost could keep market participants on alert and potentially trigger price hikes as temperatures drop in Brazil. That said, any such reaction would largely depend on whether frost actually occurs. If no damage is reported and forecasts turn less favorable for frost, the market could face renewed pressure amid the backdrop of easing supply.

Brazil: Arabica Exports (M bags)

Source: Cecafé

Brazil: Conilon/Robusta Exports (‘000 bags)

Source: Cecafé

In Summary

Weekly Report — Coffee

laleska.moda@hedgepointglobal.com

ignacio.espinola@hedgepointglobal.com