With favorable weather, Vietnam 25/26 may see further recovery

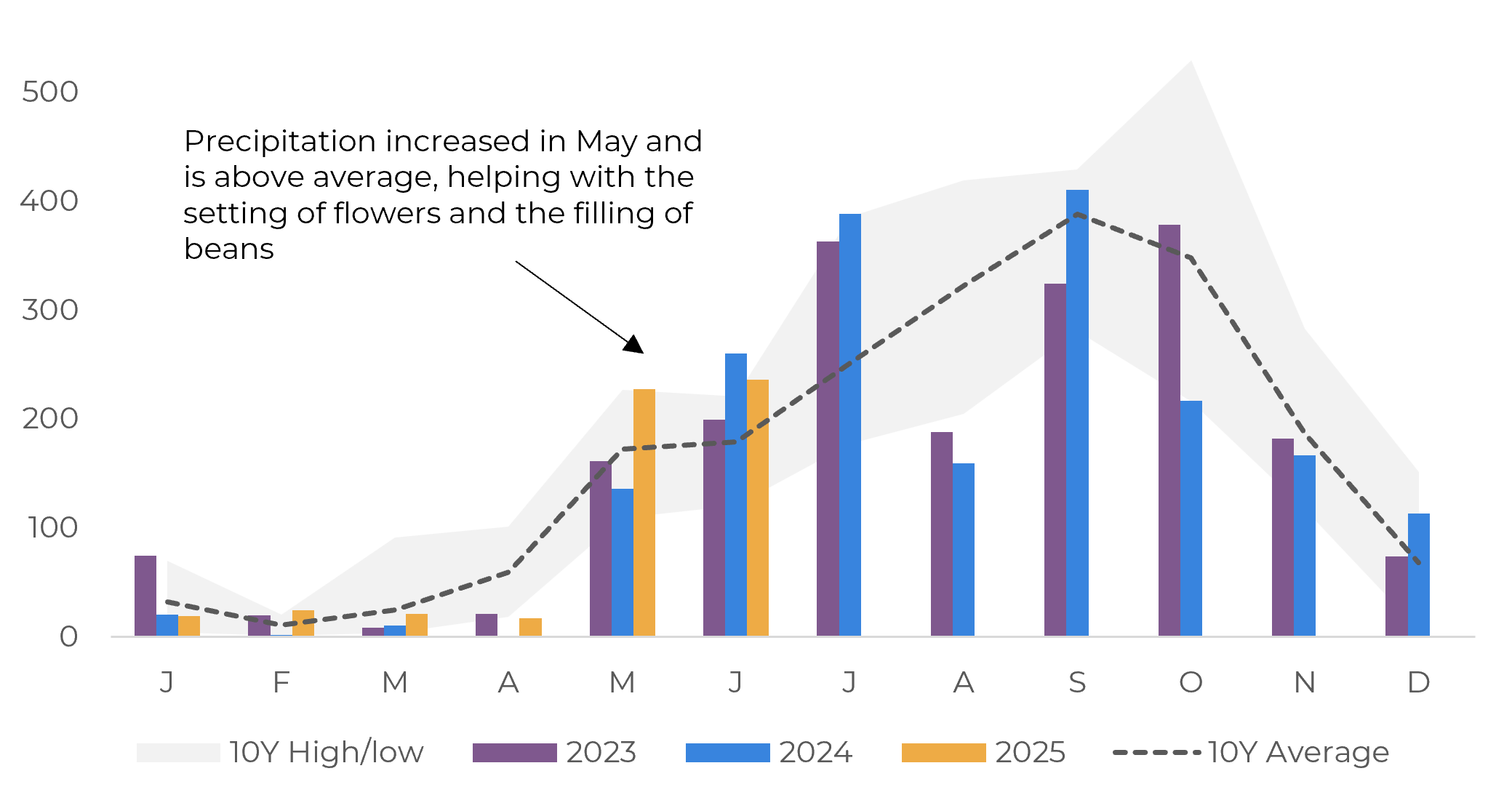

- Precipitations in Vietnam, the world’s largest Robusta producer, are coming at the right time this year, helping to set flowers and fill beans for the 25/26 season. The forecast currently remains for more intense rainfall in major producing regions, like the Central Highlands.

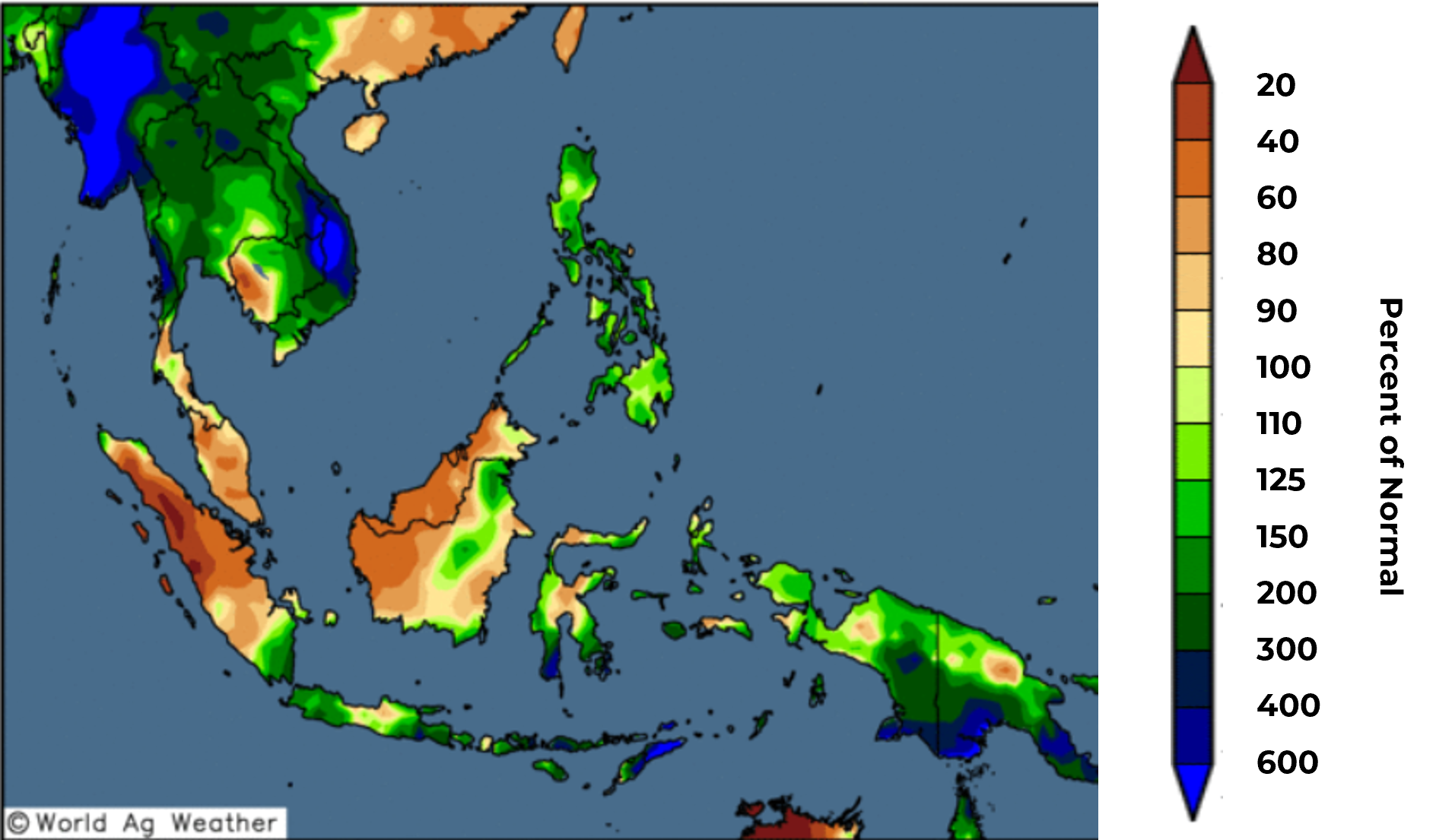

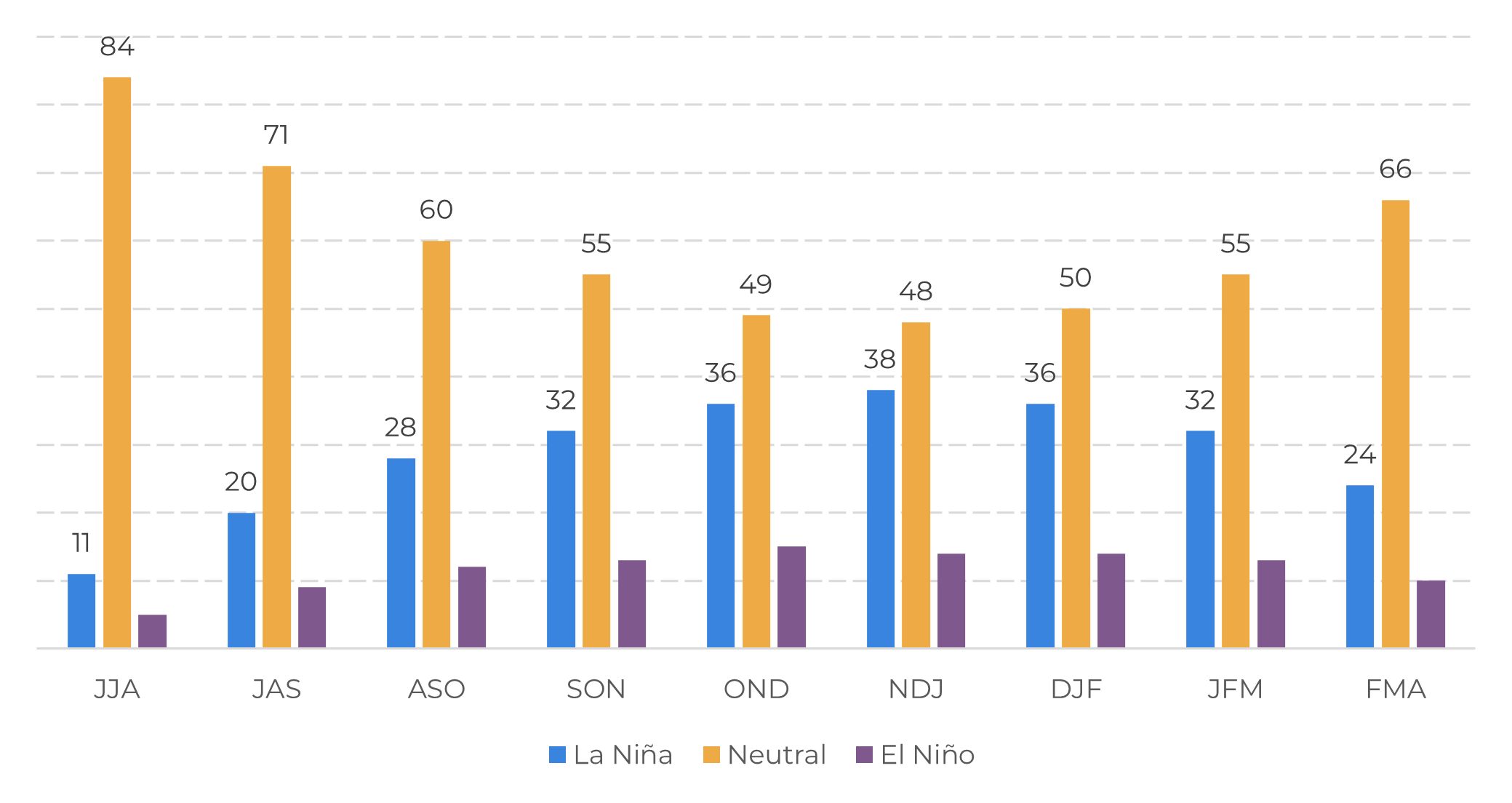

- While too much rain could also negatively affect the crops, for now, no harm has been recorded with a likely positive effect on yields. According to NOAA the probability is also for an ENSO-neutral state in the rest of 2025. A neutral ENSO has a positive correlation with higher rainfall in Vietnam, which could be an indicator of a more favorable development for the 25/26 season in the country.

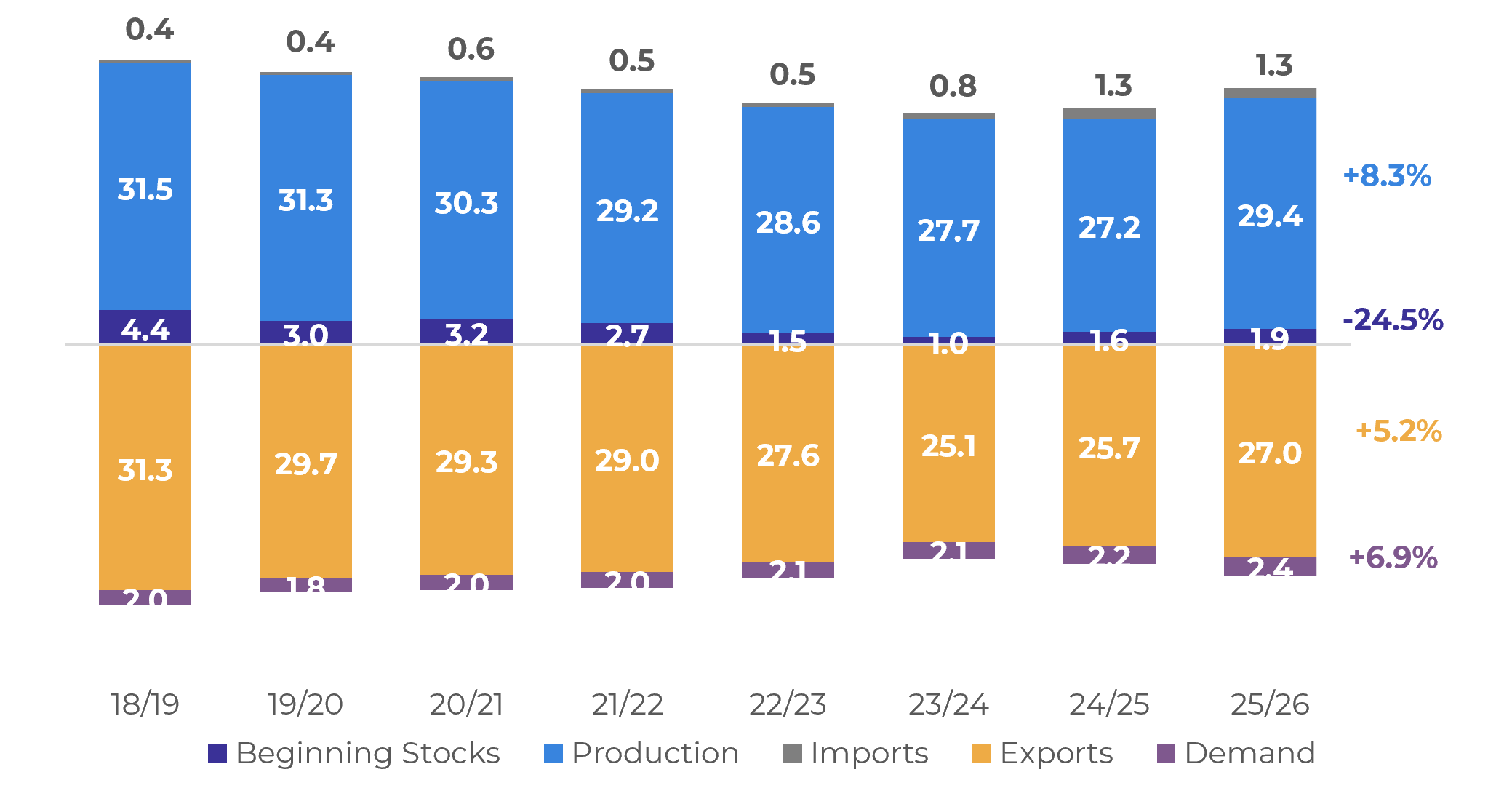

- With this in mind, we have also revised our numbers for the season. The expectation is of an increase of 8.3% in production in 25/26 over the 24/25 cycle, to 29.4 M bags. This could also allow an increase in exports and a higher availability of Robusta in 25/26.

- This positive scenario, alongside the good harvest rate of the 25/26 season of Conilon in Brazil – also a higher crop – continues to put downward pressure on future prices, with the July contract in London near a one-year low on Friday.

With favorable weather, Vietnam 25/26 may see further recovery

Vietnam: Cumulative Precipitation in Central Highlands (mm)

Source: Gadas/CPC

Precipitation Anomaly Forecast – European Model – 14 Days (mm)

Source: World Ag Weather

According to NOAA data, there is a higher probability of 2025 remaining with an ENSO-neutral state (no La Niña or El Niño). A neutral ENSO has a positive correlation with higher rainfall in Vietnam, which could be an indicator of a more favorable development for the 25/26 season in the country, especially regarding yields.

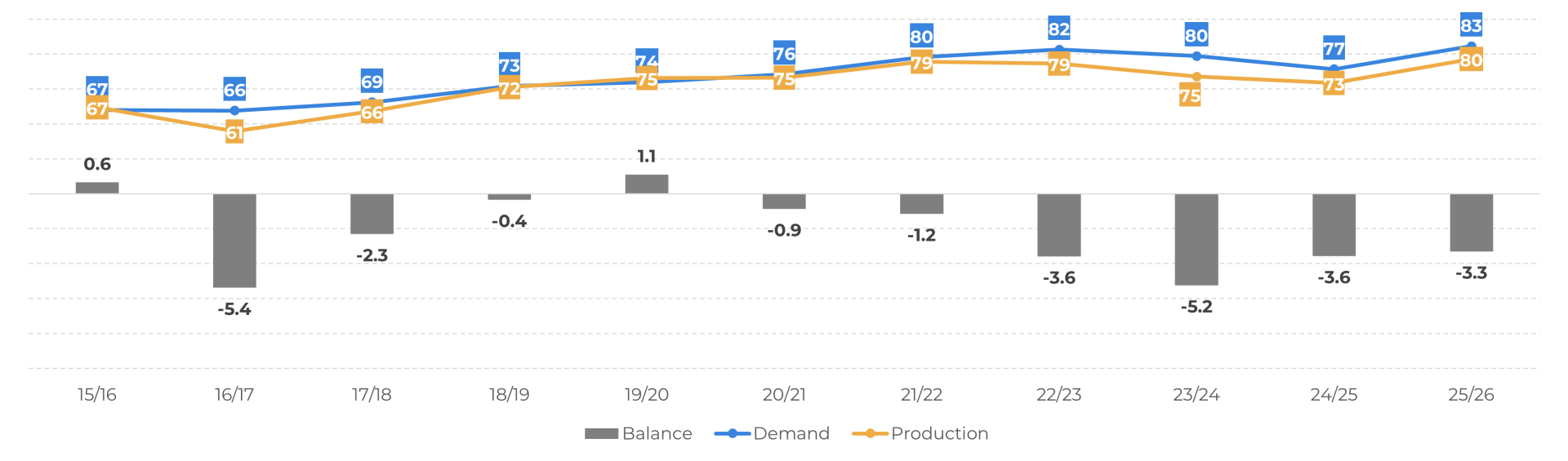

Keeping this in mind, we have increased our production estimates for Vietnam from 27.9 M bags to 29.4 M bags for the 25/26 season, which is an 8.3% increase compared to the 24/25 cycle. In this scenario, the country could increase its export figures and supply beans for its growing internal market, even with low carryover stocks.

In contrast, trade in the country has been rather dull lately, especially after differentials fell sharply with the harvest in Indonesia and Brazil, leading us to lower our expectation for total exports in 24/25. However, as the 25/26 season approaches in Vietnam, farmers may return to the market to sell remaining beans to finance the harvest and free up storage space for new coffee, which could still lead to higher figures than 23/24.

Current arbitrage levels also favor an increase in global Robusta consumption and a decrease in Arabica, which could also favor the trade in Vietnam in the coming months. In this regard, it is expected an increase in global consumption of Robusta in 25/26 – in 24/25 we projected a decrease mainly due to the reduction in Conilon consumption in Brazil. With this increase, Robusta global balance could still face a new deficit in 25/26, despite the larger production in the cycle. However, in the short-term prices are still expected to face downward pressure, especially the July contract, given the current harvest in Brazil and Indonesia and the positive perspectives regarding Vietnam 25/26 season.

IRI Model – ENSO Probability Forecast in 25/26

Source: NOAA, Columbia University

Vietnam: Supply and Demand (M bags)

Source: Hedgepoint

Robusta Supply and Demand (M bags)

Source: Hedgepoint

In Summary

Weekly Report — Coffee

laleska.moda@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.