Prices continue to drop with easing supply concerns

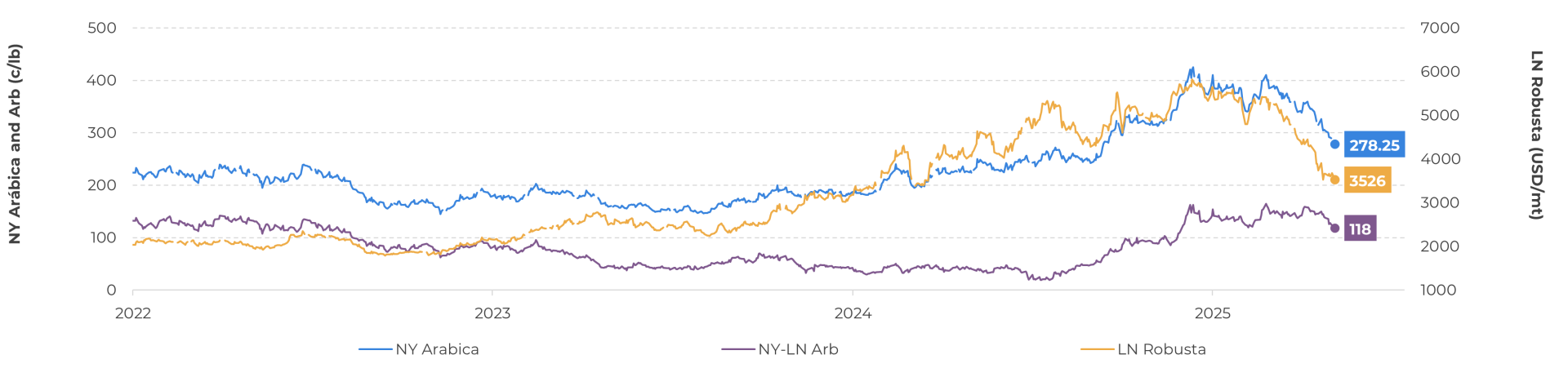

- Coffee prices are currently in a bearish trend, as Robusta contracts reached their lower levels in one-year last week, and Arabica futures dropped below the 290 c/lb levels, as concerns over supply eased.

- As mentioned in previous reports, the sharp drop in prices was expected, as the Brazilian 25/26 harvest reached its peak amid higher supply in origins such as Indonesia and Uganda. Vietnam exports are also expected to be higher in 2025, with the perspective of a recovery in 25/26 production, increasing the perception of sufficient supply in the next cycle.

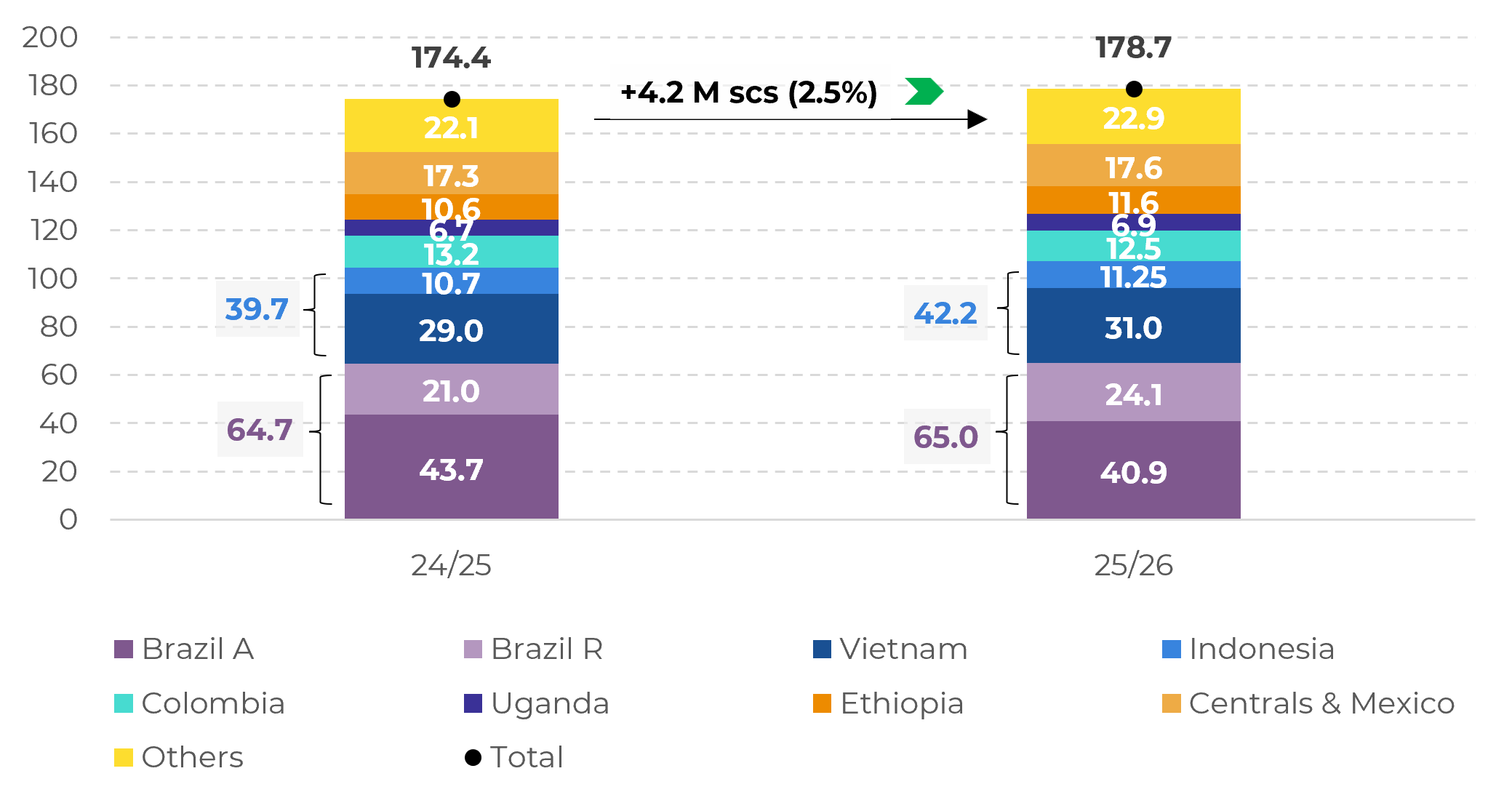

- USDA has also indicated an increase in 25/26 total production to 178.7 M bags of coffee, with an expected surplus in global balance, driven by good weather in most producing countries.

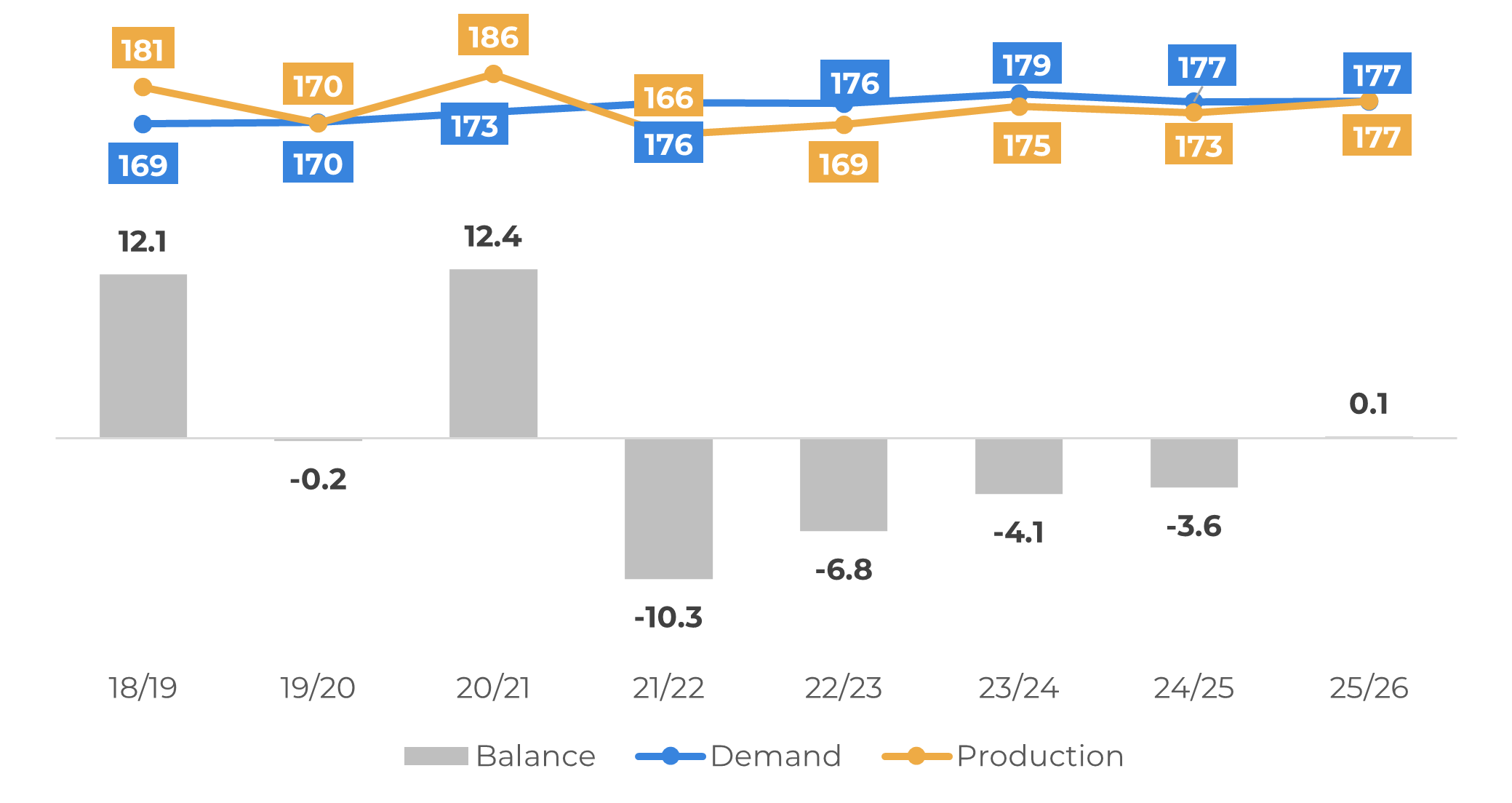

- Despite the drop in Arabica production in Brazil, we also expect an increase in total production figures in the next cycle, although we still anticipate a tighter balance. However, due to the projected higher Robusta supply in 25/26 and favorable weather in Brazil thus far for the 26/27 season, the bearish trend may persist unless new fundamentals emerge.

Prices continue to drop with easing supply concerns

LN Robusta (USD/mt), NY Arabica and Arbitrage (c/lb)

Source: LSEG

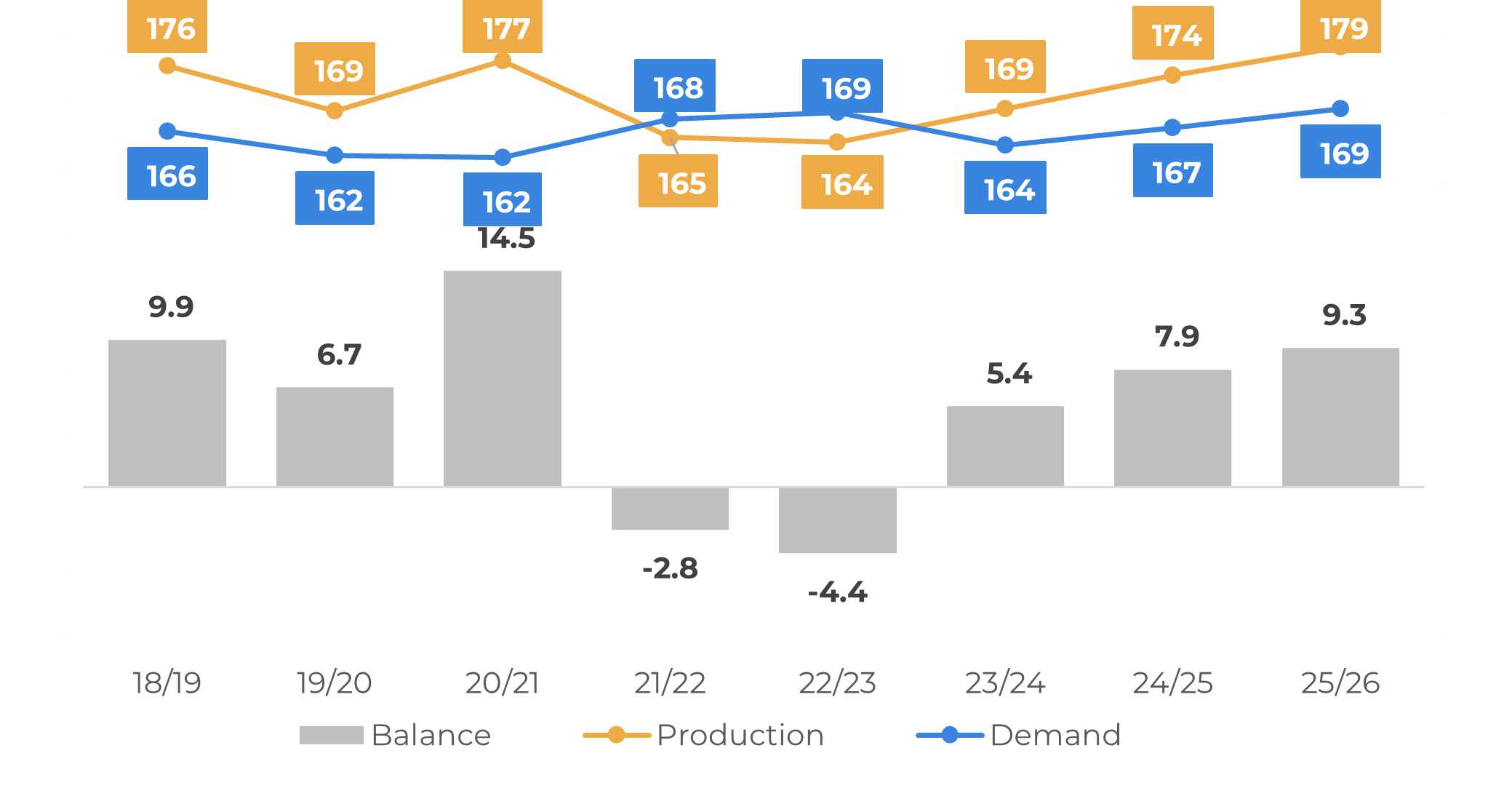

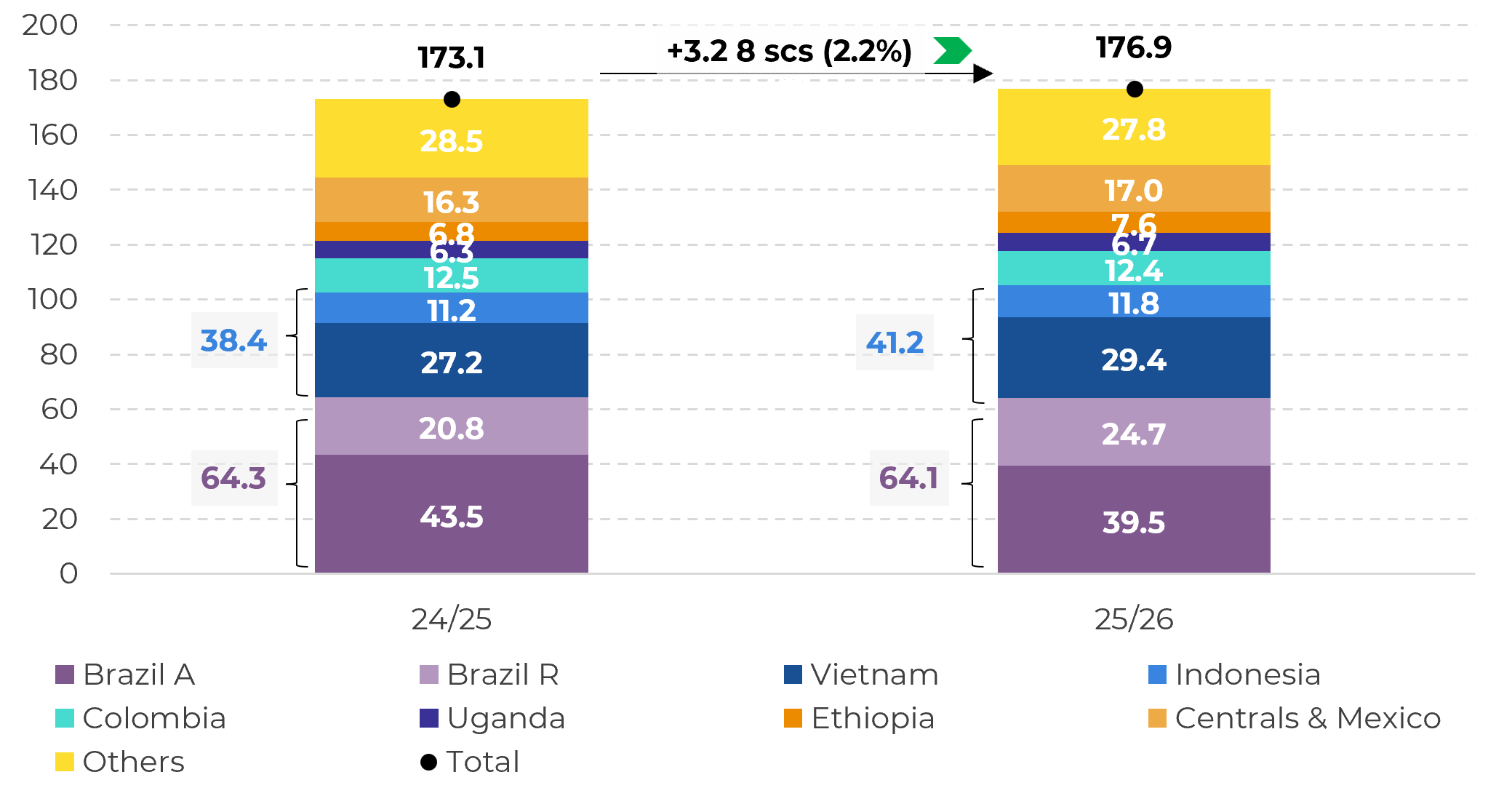

According to the USDA, the 25/26 season production is forecasted to increase 4.3 M bags over the previous season, leading to a positive balance in this cycle. Improved climate conditions compared to last year. In Asia, the increase is more significant: Vietnam, production is expected to reach 31 m bags, while Indonesia is forecasted to produce 11.3 M bags. Central Americans countries, Mexico and East African countries, such as Uganda and Ethiopia are also expected to have a similar trend.

In Brazil, USDA anticipates a crop of 65 M bags in the 25/26 season (similar to our expectations) and increase of increase by 300,000 bags from 24/25, with a higher Conilon output, compensating for the Arabica drop. Only in Colombia, the department expects a decline of 700,000 bags in 25/26 due to excessive rainfall during the flowering period hindered bean development.

USDA: Global Coffee Supply and Demand (M bags)

Source: USDA

USDA: Production by Country (M bags)

Source: USDA

We also expect an increase in supply in 2025/26, mostly due to the increase in Robusta production around the world. While Brazil and Indonesia are already showing good results during their harvests, we also expect increases in Vietnam and Uganda, given the current favorable weather conditions for coffee development. Weather has also been benign in Central America. However, we still expect a delicate balance in the 25/26 cycle.

Hedgepoint: Global Coffee Supply and Demand (M bags)

Source: Hedgepoint

Hedgepoint: Production by Country (M bags)

Source: Hedgepoint

However, for now, fundamentals are pointing to a more bearish look in the rest of 2025, especially if the weather forecast remains positive for the 26/27 Brazilian crop development.

While the market is likely to reflect short-term fundamentals – with an increase in supply given – a tighter balance could mean that any changes in current perspectives could trigger price recovery. In this sense, it's also interesting to note that, despite current corrections of Arabica and Robusta contracts, spreads between the September and December contracts remains positive, while both long and short CFTC commercial positions remain on low levels, which tend to bring more volatility to prices at any fundamental changes.

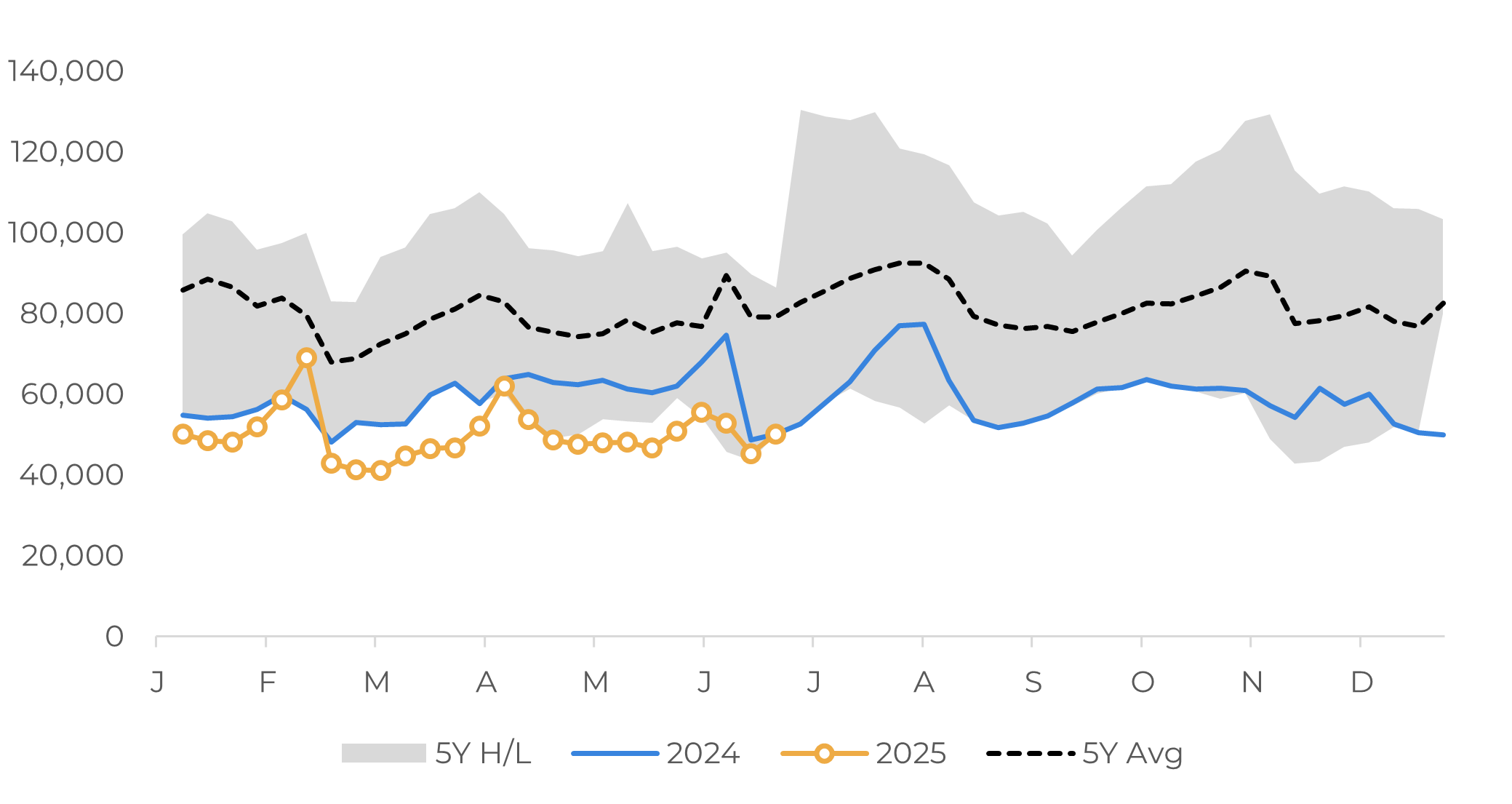

CFTC: Commercial Long Positions (lots)

Source: CFTC

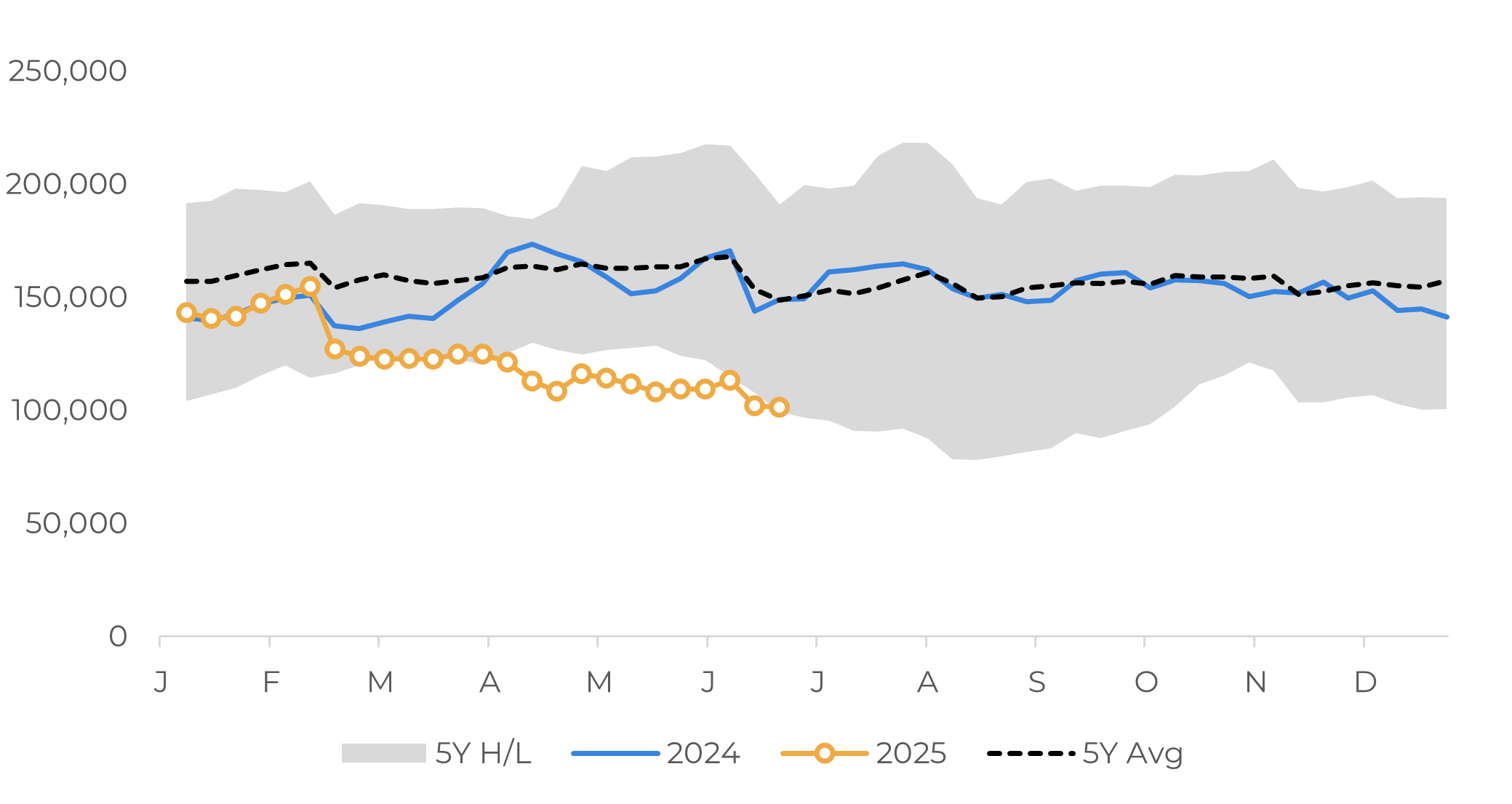

CFTC: Commercial Short Positions (lots)

Source: CFTC

In Summary

Weekly Report — Coffee

laleska.moda@hedgepointglobal.com

livea.coda@hedgepointglobal.com