Cold front in Brazil and trade uncertainties bring support to prices

- Arabica’s September contract traded above the 300 c/lb this Monday, reflecting weather risks and trade uncertainties.

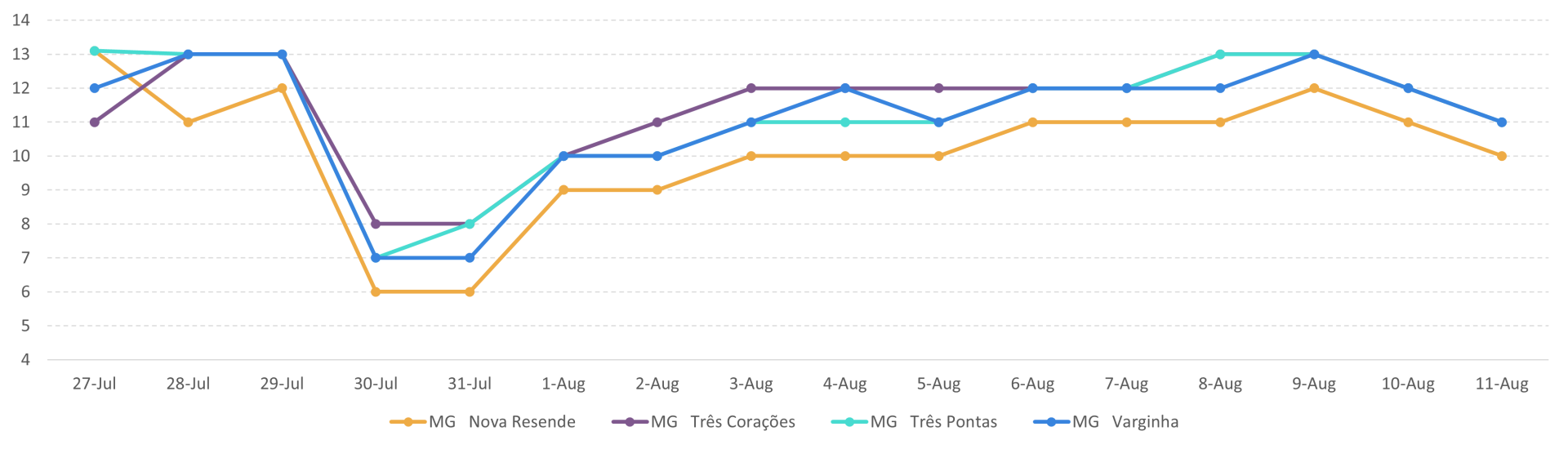

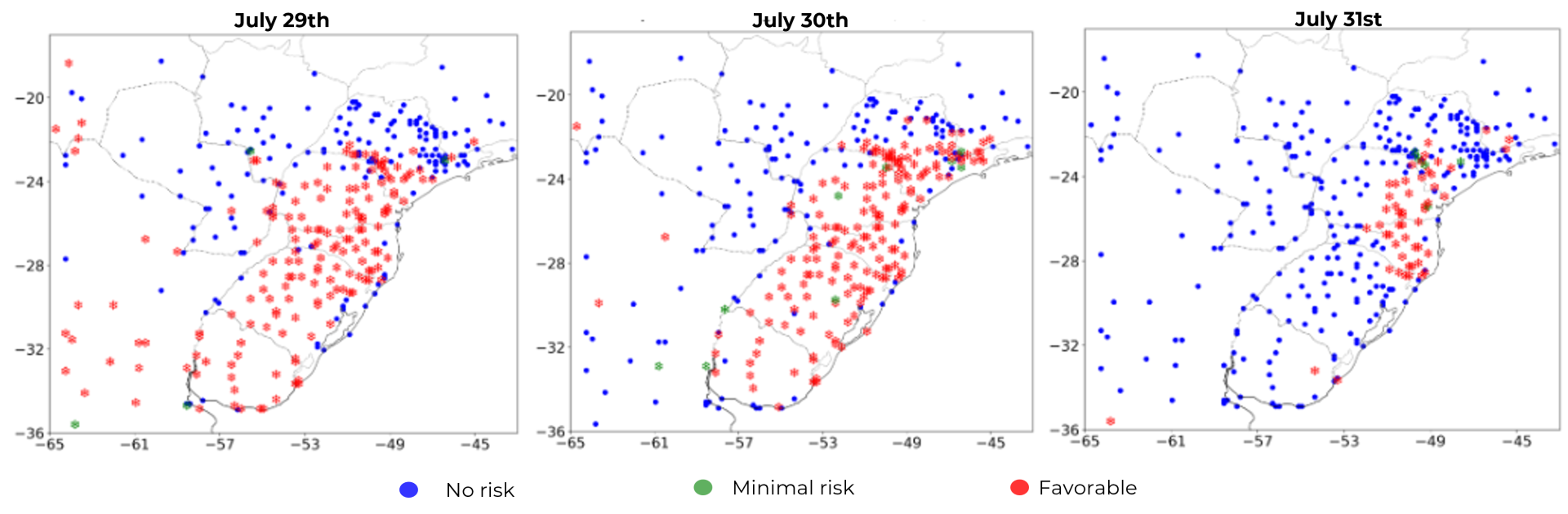

- A new cold front will arrive in Brazil this week, bringing lower temperatures. Weather forecast models indicate a sharp drop in temperatures in South of Minas, with some models showing minimum temperatures below 5°C and frost risks. Last weekend, hailstorms also hit some areas in South of Minas, although they were isolated events.

- In the Conilon regions, where the harvest is almost complete, some areas have reported the start of the flowering phase. Trade, however, continues to be slow.

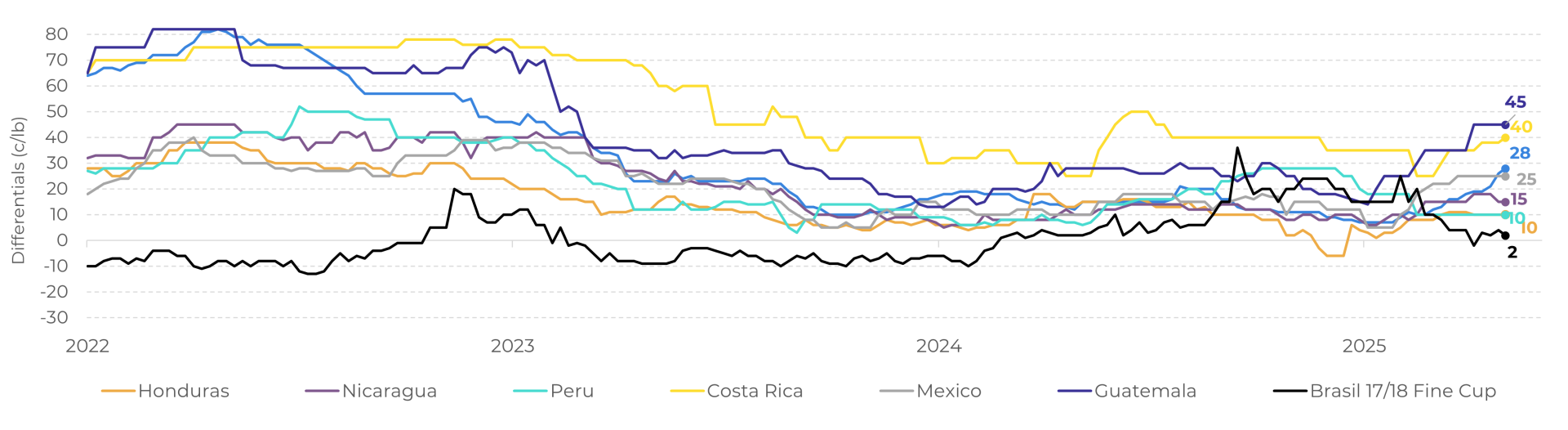

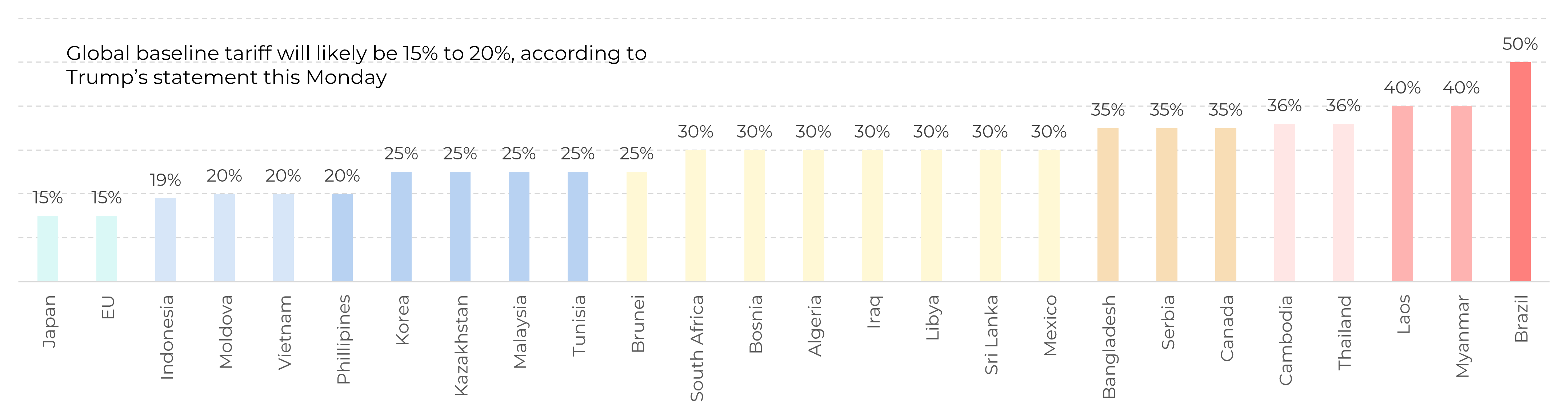

- The market also continues to wait for developments regarding US tariffs on Brazilian goods. If the levies are approved, it could halt the flow of Brazilian coffee to the US, and American roasters and exporters would then have to rely on other origins, such as Colombia, Central America, and East Africa, where differentials are higher.

Cold front in Brazil and trade uncertainties bring support to prices

Brazil: Minimal temperature forecast in Minas Gerais (ºC)

Source: Somar, Bloomberg

In addition to the risks posed by frost, hailstorms hit some coffee farms in the region over the weekend. Although the event was localized, affecting only a small area, those areas have reported damage from the hailstorms, including loss of leaves and possible impact on the 26/27 production. However, as mentioned, it was a localized event, and it is still too early to assess the extent of the damage.

In the Brazilian Conilon regions, where the 25/26 harvest is basically complete, the weather has been more favorable, with some farms in Espirito Santo and Bahia reportedly entered the flowering period of the 26/27 cycle. In this context, increased rainfall is vital for proper flower development and setting.

Brazil: Frost Risk for the next 3-days

Source: CPTEC

The current weather risks in Brazil, coupled with the uncertainties regarding the future of Brazilian coffee trade with the US, have also kept trade in the country sluggish, as farmers waits for further definitions. Although the Brazilian government and other supply chain agents, such as Cecafé and the US National Coffee Association (NCA), have engaged in trade talks with the US government, no agreement has yet been reached to exempt coffee from tariffs. In case the 50% levy is approved, it could halt the flow of Brazilian coffee to the US momently, and American roasters and exporters would then have to rely on other origins, such as Colombia, Central America, and East Africa.

Arabica Differentials (c/lb)

Source: LSEG, Safras & Mercado

However not only are most of this origins in its off-season, with limited supply to offer in the second half of 2025, but differentials are also higher than the Brazilian ones. Although in the last months the Brazilian differentials were higher, Brazilian beans are normally cheaper than other origins and, with the current harvest, prices were pressured down recently. In this sense, not only the US could face a shortage of coffee if they do not import from Brazil, but prices are also expected to increase in the country, as mentioned in previous analysis (link).

On a broader view, although some countries, such as Japan and the EU, have reached agreements to decrease the current proposed tariffs, the tariffs could still impact the American economy, especially by raising inflation. Therefore, in the medium to long term, coffee demand could be affected.

Update: New Tariffs to take place on August 1st

Source: LSEG, Hedgepoint

In Summary

Weekly Report — Coffee

laleska.moda@hedgepointglobal.com

luiz.silverio@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.