As Brazilian supply remains short, prices rise

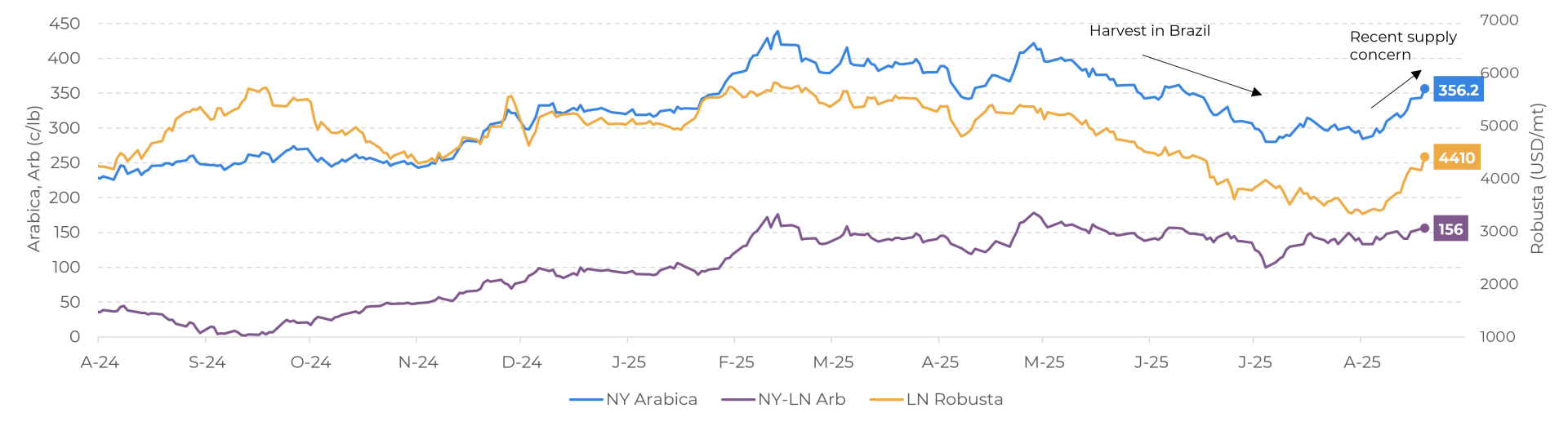

- Over the past few days, the prices of Arabica and Robusta futures have risen considerably as Brazilian farmers continue to offer little coffee, and the market awaits news on U.S.-Brazil tariff negotiations. Minor frosts in the Cerrado Mineiro region and a decline in ICE-certified Arabica stocks also contributed to this trend.

- While US buyers started to ask to postpone Brazilian coffee shipments, Brazil remains with the highest availability of the bean for this period, at least until the end of 2025. As mentioned before, most of the other origins are now in their off-season, with little coffee available. Differentials in most of Asia, Central America, Colombia and East Africa have increased in the past weeks, reflecting this scene.

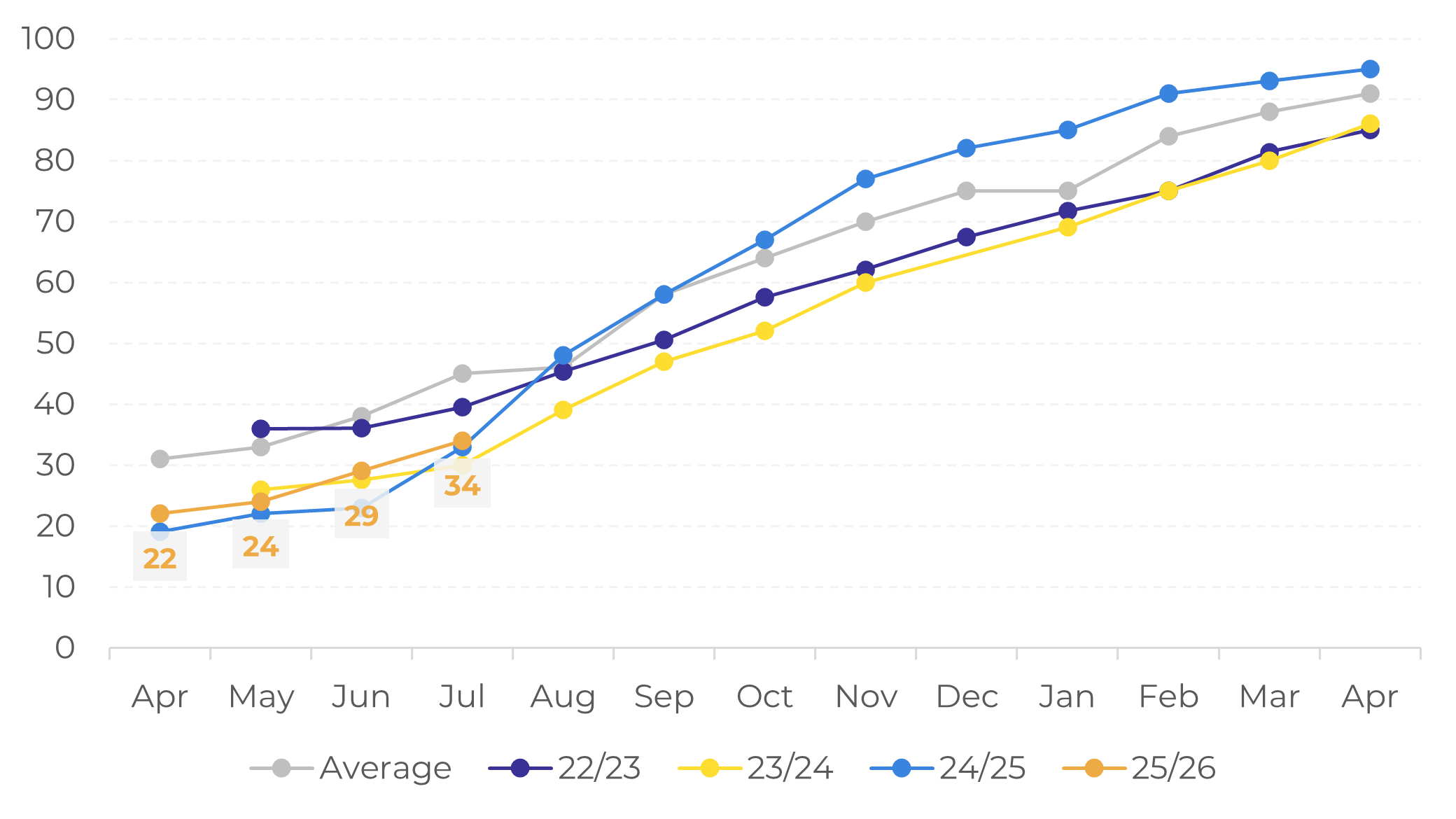

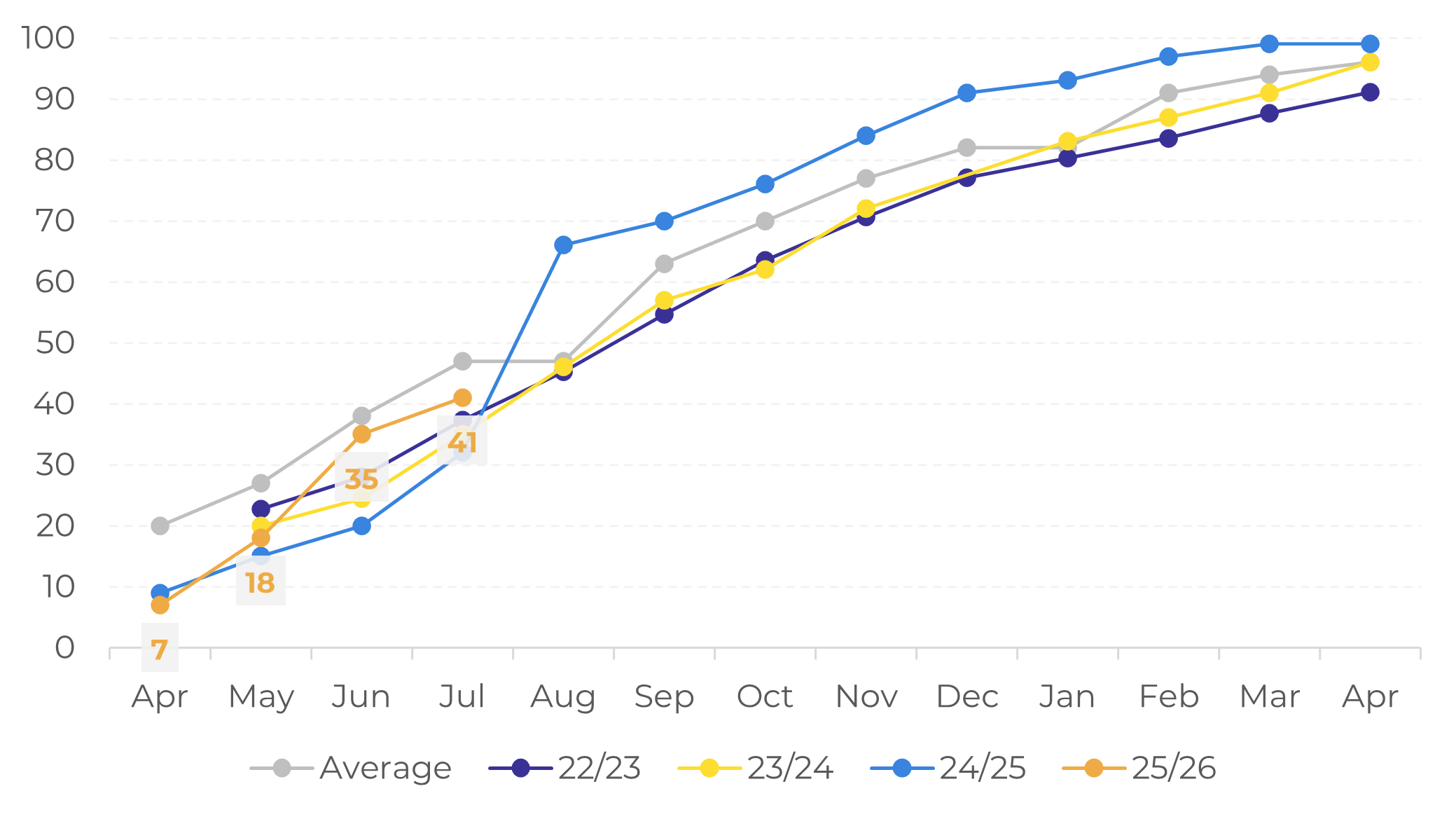

- Brazilian farmers, however, show little interest in selling large volumes of coffee. Latest farmer selling data show figures below average levels, indicating that growers continue to hold their beans. Many coffee producers wait for the flowering of the 26/27 season to return to the market.

- As a reflection, Arabica and Conilon/Robusta exports in July decreased significantly from past years levels. The trend could be for lower exports figures in the next months, as not only trade uncertainty remains, but weather could bring further volatility in the market.

As Brazilian supply remains short, prices rise

LN-Robusta (USD/mt), NY-Arabica and Arbitrage (c/lb)

Source: LSEG

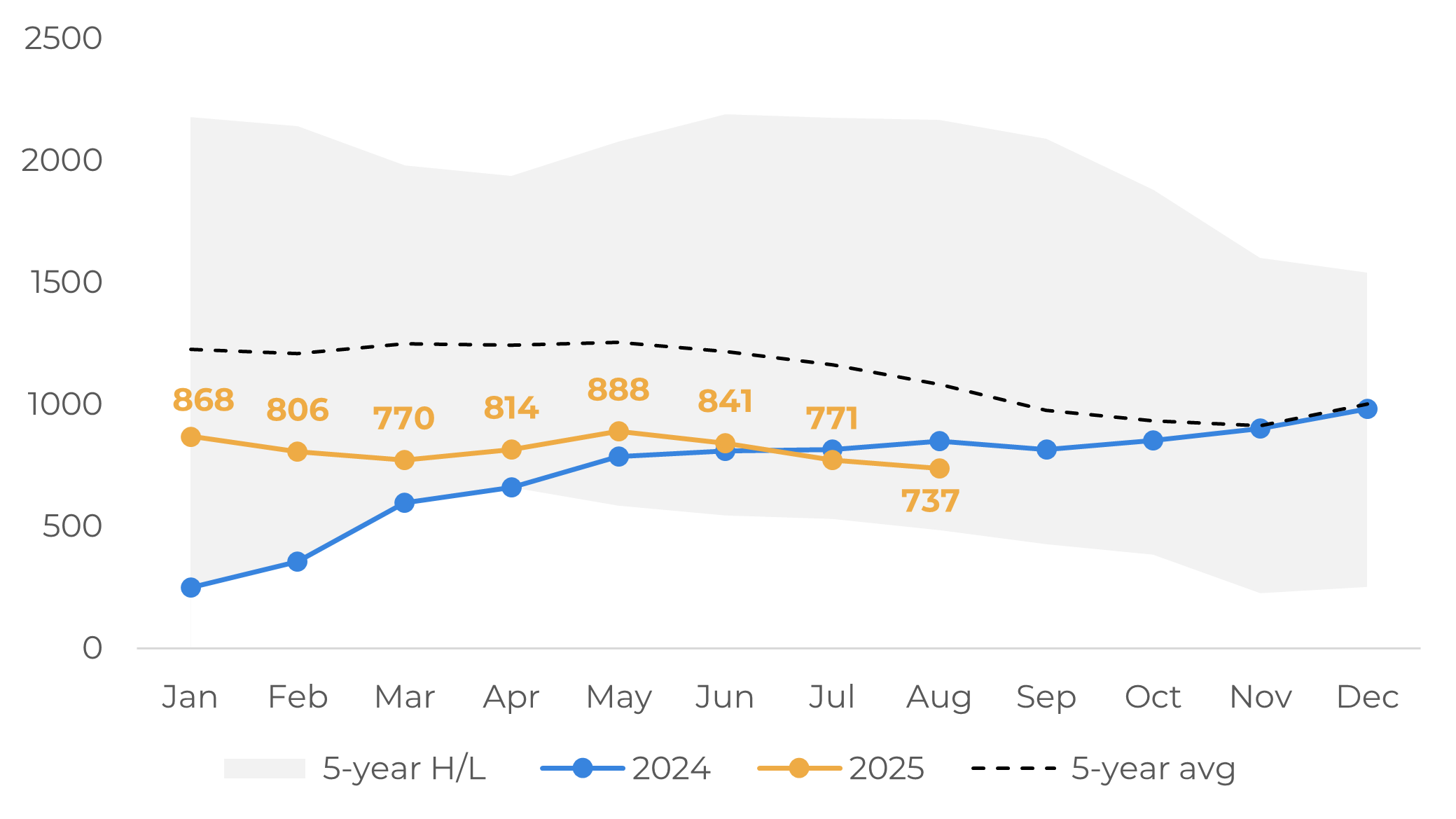

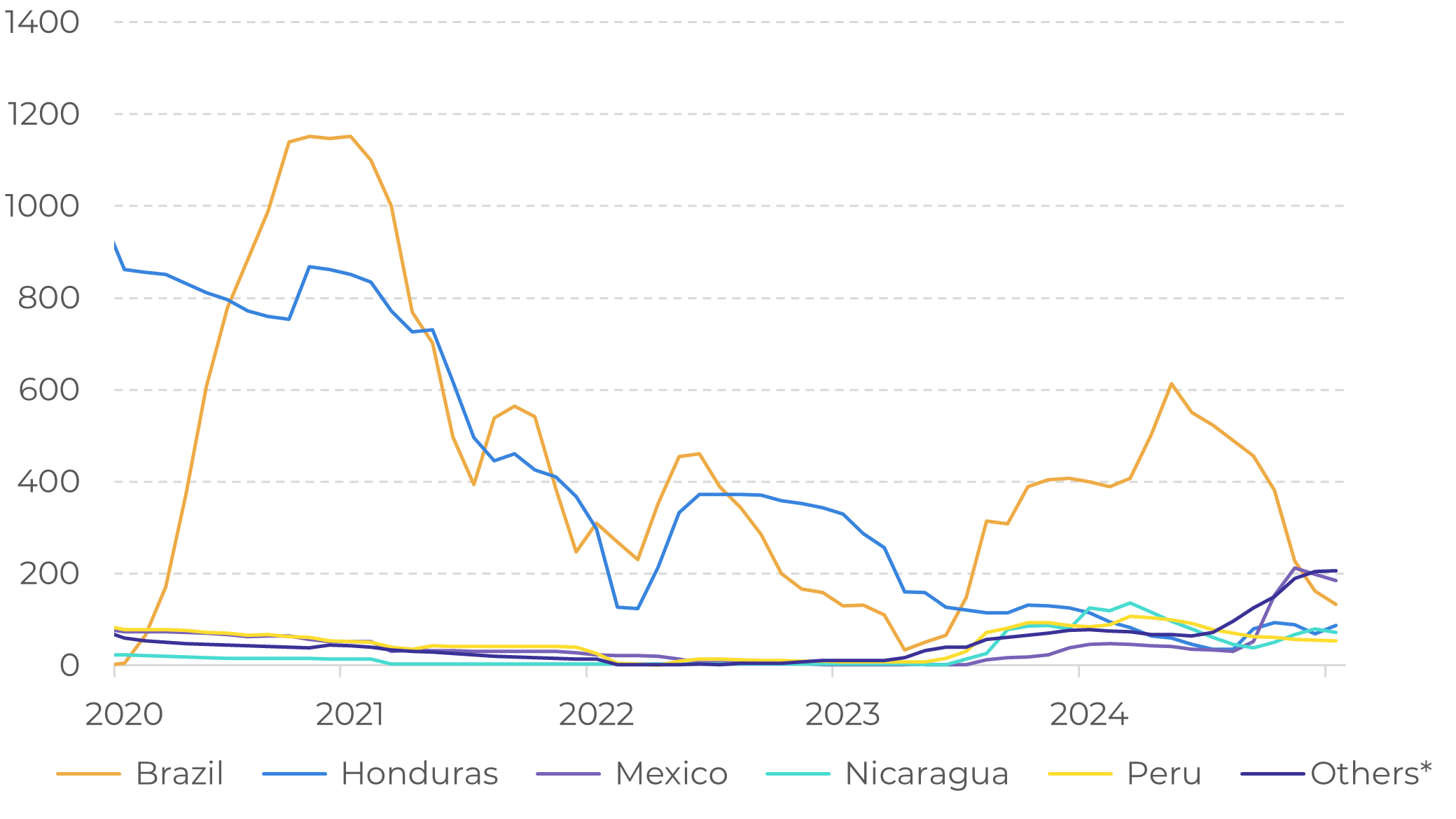

Beyond the frosts, the market has also been keeping track of the consecutive drops in the ICE certified stocks for Arabica last week (see the report here). The stocks are below both the average and the 2024 levels, with a significant decrease in Brazilian beans in the share, and low volume of coffee to pending grading, which could potentially highlight a challenge in futures recovery. Not only do the current Brazilian differentials not favor sending coffee to certified stocks, but farmers continue to show little interest in trading large volumes.

According to the latest farmer selling data, a total of 37% of Brazil's 25/26 crop has already been sold, which is below the five-year average of 46%. For Arabica, the figure stands at 34%, versus the 45% average. Meanwhile, Robusta farmer selling stands at 46%, slightly below the 48% average.

Arabica Certified Stocks (‘000 bags)

Source: ICE

Arabica Certified Stocks by Origin (‘000 bags)

Source: ICE

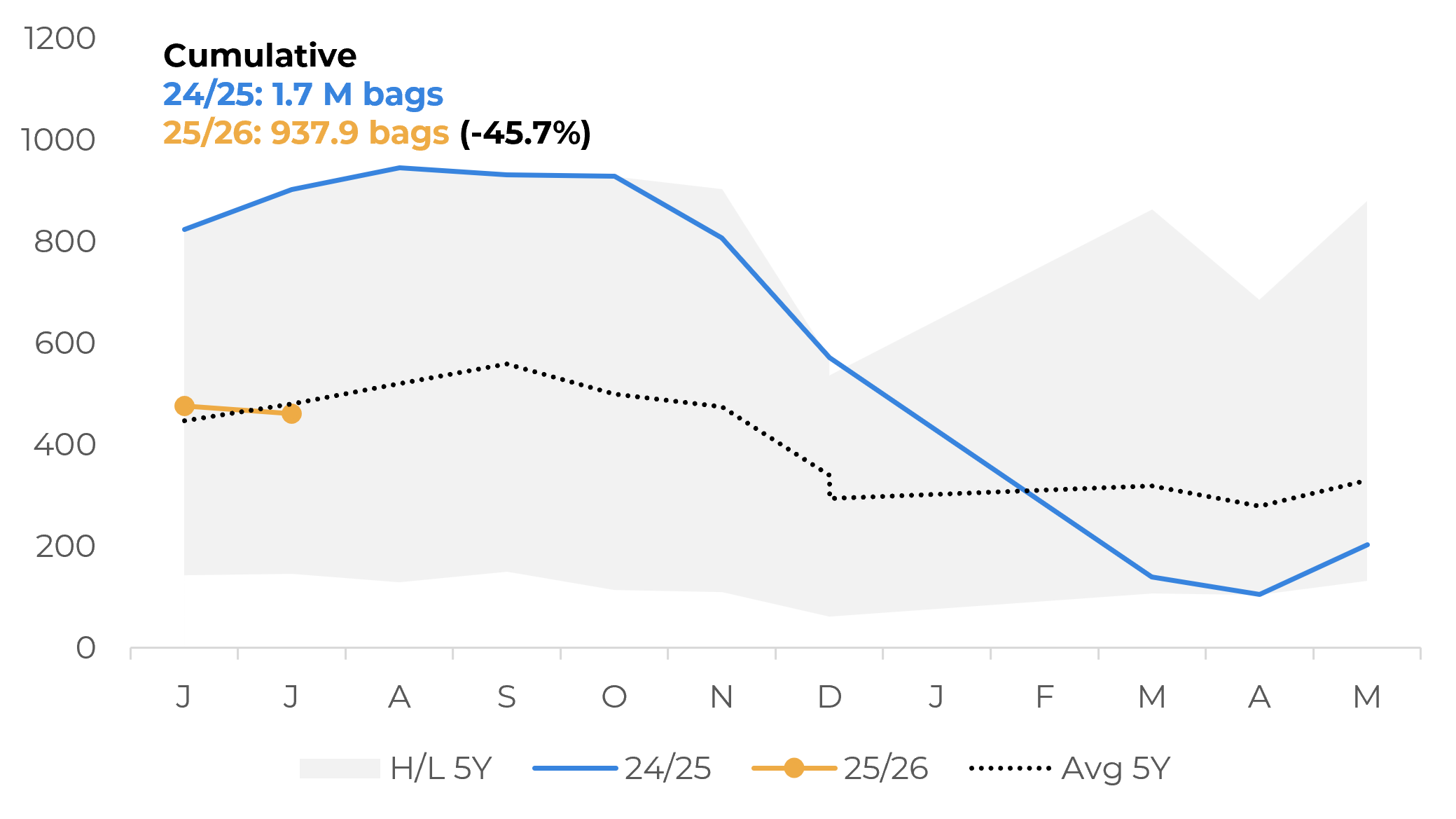

In the case of Robusta/Conilon, it's interesting to note that much of the already-sold volume is expected to be redirected to the domestic market due to its lower prices compared to Arabica. This trend is also reflected in the country's exports, with Conilon shipments in the 25/26 period already 45.7% lower than in the same period of 24/25.

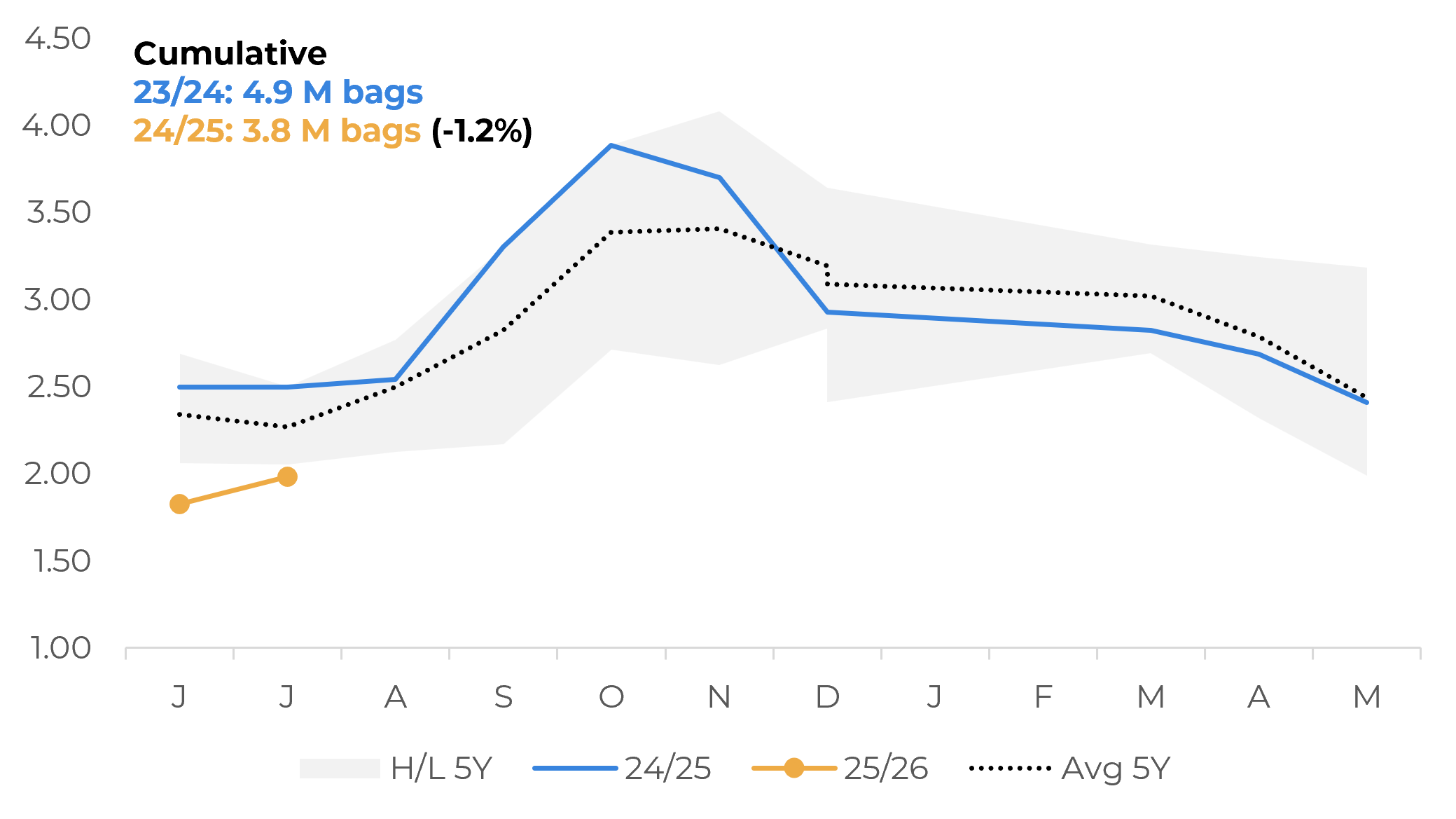

However, the current low farmer selling has also led to a drop in Arabica exports, with cumulative figures in 25/26 down 1.2% from 24/25. Shipments are below average and at minimal levels, which could continue given farmers' lack of interest in new sales and ongoing uncertainties around trade. Many farmers in Brazil are waiting for the 26/27 season to begin, as it will be essential for estimating production in the next cycle.

There is also some market concern about the current "veranico," which is expected in major coffee-producing regions of Brazil and is likely to make farmers more reluctant to sell. This weather phenomenon is expected to bring higher temperatures and reduced precipitation, which is necessary for flowering in Brazil. This brings some risks to the development of the 26/27 crop. On another note, since there has been no major flowering yet in Arabica regions, the impact on coffee production could be low, but the weather should be monitored closely in the coming weeks.

Brazil: Arabica Farmers Selling (% of total)

Source: Safras & Mercado

Brazil: Conilon/Robusta Farmers Selling (% of total)

Source: Safras & Mercado

Regarding global trade, US-Brazil trade remains subdued as no agreement has been reached yet. According to Cecafé, US buyers have started asking Brazil-based firms to delay coffee shipments to the country to avoid the 50% tariff. Last week, Cecafé President Marcio Ferreira commented that US coffee industries have inventory for 30 to 60 days, which gives them some leeway to wait a little longer for ongoing negotiations and a possible exemption from tariffs on coffee.

However, most of the other origins are in their off-season with limited stock, and higher availability is not expected until mid-November, after the main harvest of the 25/26 crop begins. Differentials in most of Asia, Central America, Colombia and East Africa have increased in the past weeks, reflecting this scene.

With lower availability, US importers and roasters could be forced to seek Brazilian coffee. Meanwhile, Brazil's government has unveiled an aid package for companies affected by steep U.S. tariffs. The package centers on credit lines for exporters and government purchases of products facing difficulty in finding alternative markets. If Brazil's government starts competing with the private sector for coffee, this could impact physical price differentials. However, no further measures have been taken at this time.

Brazil: Green Arabica Exports (M bags)

Source: Safras & Mercado

Brazil: Green Conilon/Robusta Exports (‘000 bags)

Source: Safras & Mercado

In general, current market fundamentals and challenges are supporting coffee futures. Given all the changes that have occurred in the past few weeks, it's interesting to note that the spread between near-term and long-term Arabica and Robusta contracts has increased, indicating concern and support in the short term. Speculative funds have also increased their net long position on Arabica, according to the CFTC report (link). For Robusta, speculators have also decreased their net short position (link).

In the medium term, the development of the 26/27 crop in Brazil and farmers' willingness to sell will highly influence prices. It's also important to note that weather will play a key role in the development of the 2025/2026 season in origins such as Vietnam, Colombia, Central America, and East Africa, further influencing prices. On the demand side, it's worth mentioning that the EUDR is expected to take effect at the end of this year. This could lead to a short-term surge in European demand, as we saw in 2024. Additionally, current market movements suggest that roasters may be short-covered again. This could lead to an increase in demand in the short term, which would support prices, particularly for the September and December Arabica contracts and the November and January Robusta contracts.

In the long term, a larger crop in Brazil in the 26/27 season — if the weather improves after September — and the possible impact of tariffs on US demand could put downward pressure on the market in 2026. While the future remains highly uncertain, we are likely to see another volatile year for coffee.

In Summary

Weekly Report — Coffee

laleska.moda@hedgepointglobal.com

livea.coda@hedgepointglobal.com