Tariff Effect: Brazilian Coffee Exports down from 2024

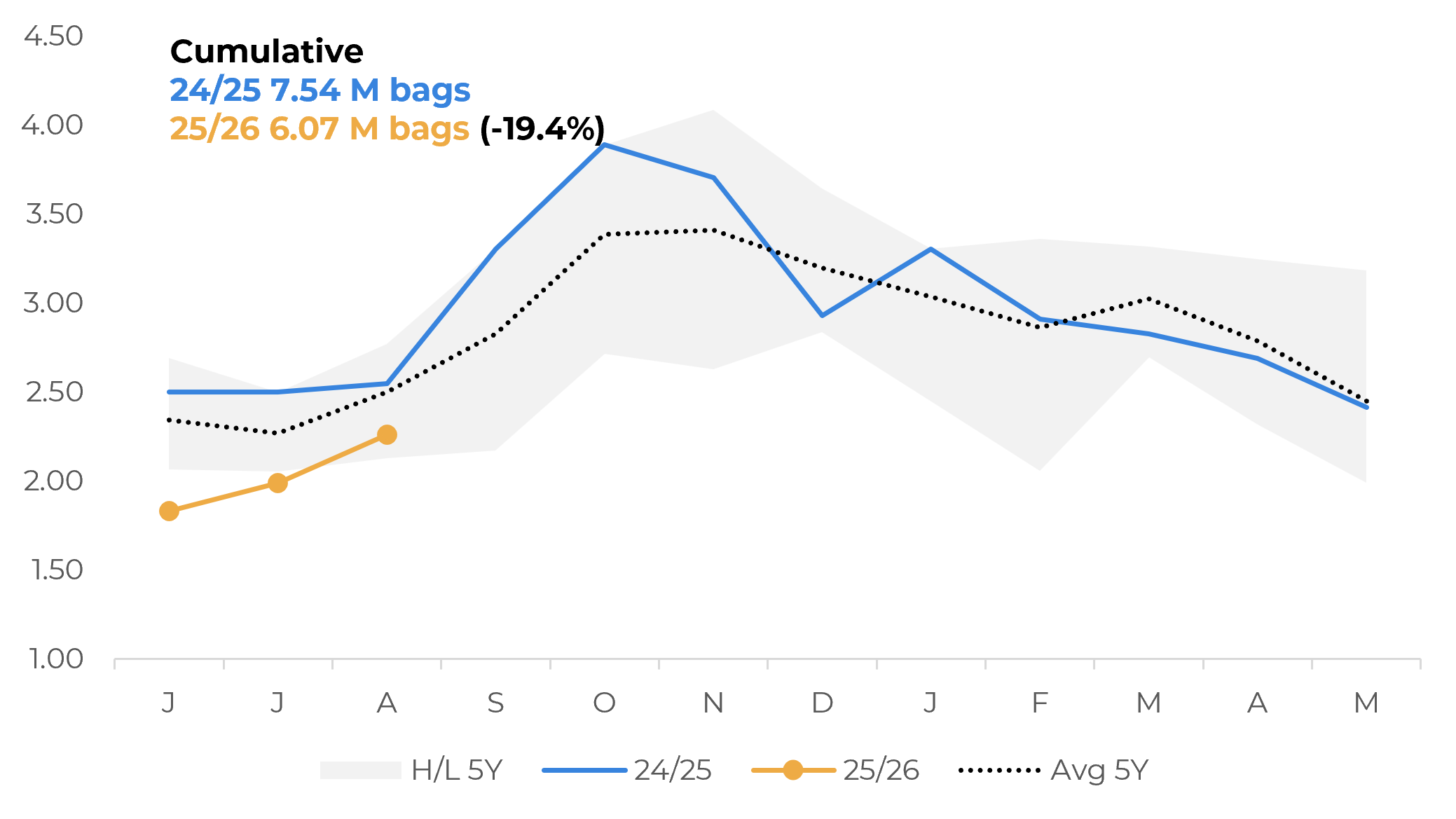

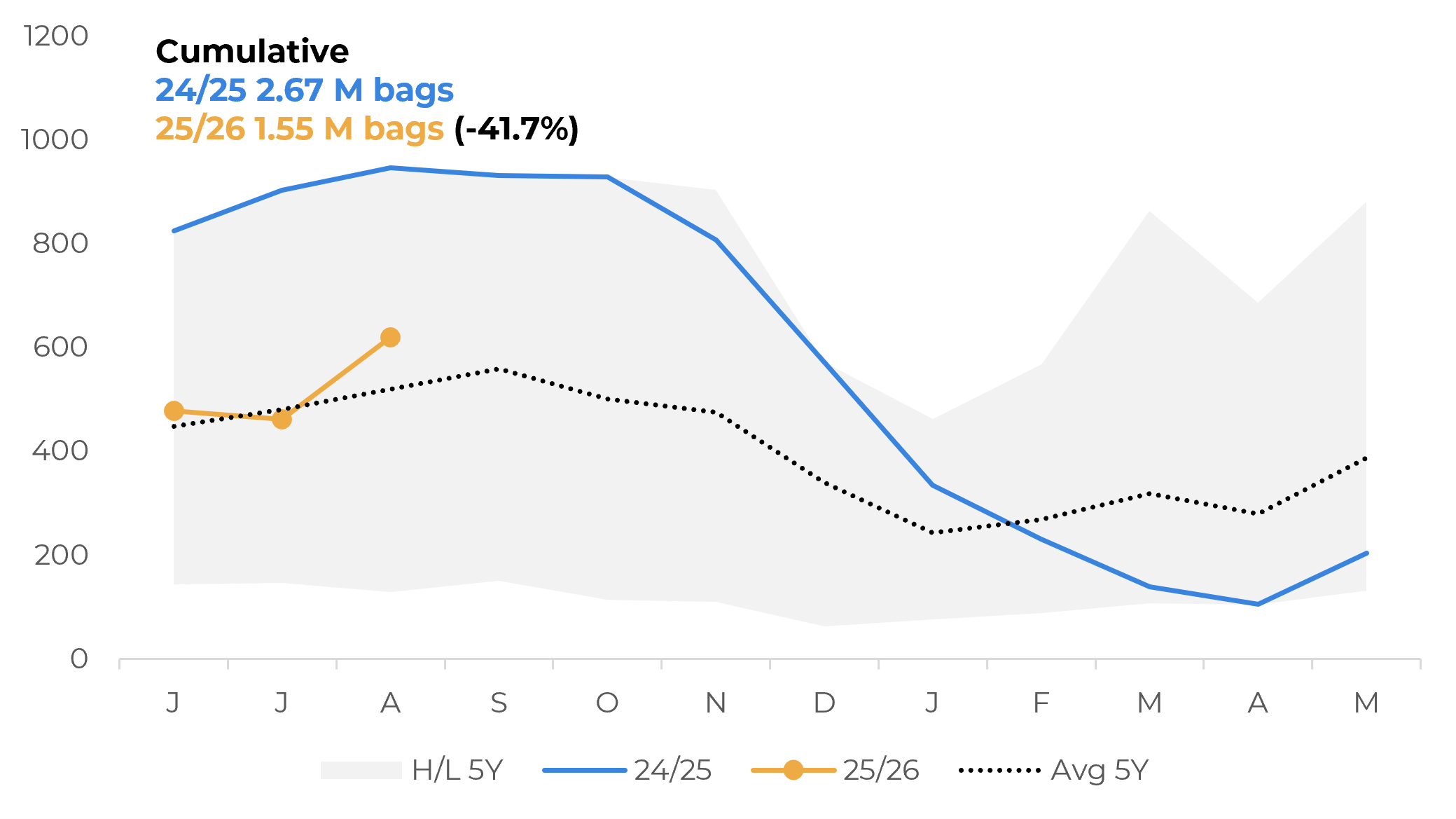

- Brazilian coffee exports totaled 3.1 M bags in August. Although this figure was higher than in July, it was still below levels seen in August 2024 and the average. The drop was expected due to record exports last year, a smaller Brazilian crop in 25/26, and a lack of Brazilian sellers. This has led to a drop in exports to main destination in this cycle.

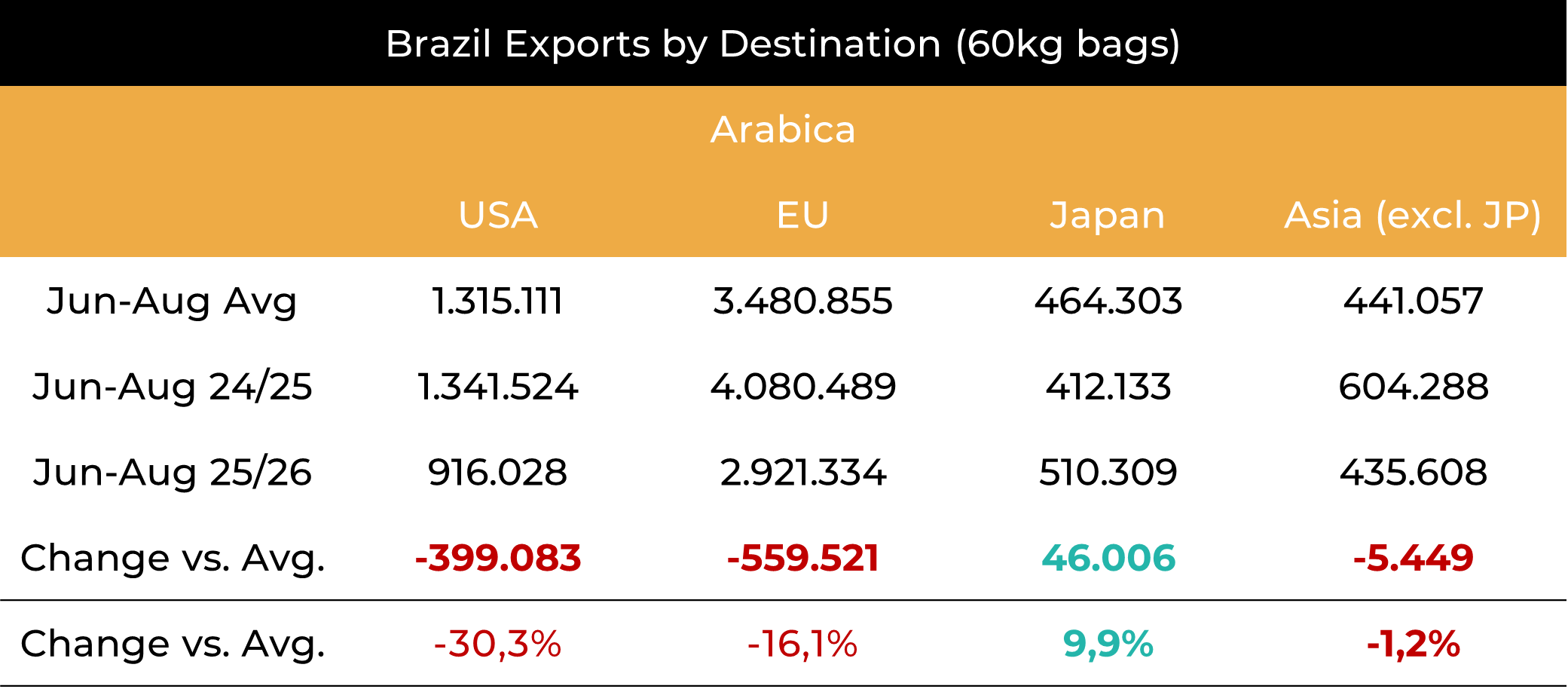

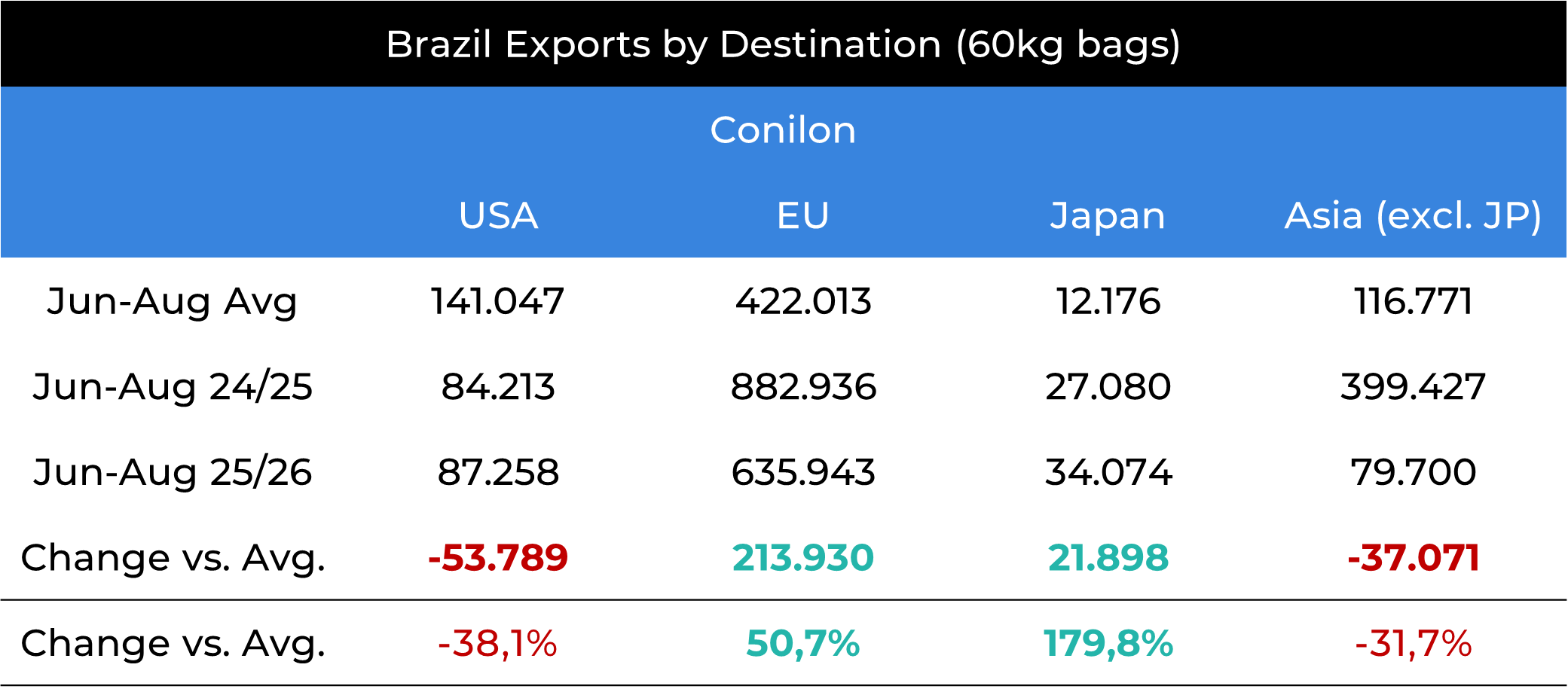

- However, the results also reflected the current 50% tariff on Brazilian coffee imposed by the US. Total exports to the country in August dropped 46.4% compared to 2024 and 48.6% compared to the five-year average for the month. Both Arabica and Conilon exports reduced significantly from last year.

- The reduced volume of Brazilian exports to the US continues to support prices due to the expectation of a drop in American stocks. The decline in certified stocks persists, further reinforcing the short-term tight supply.

Tariff Effect: Brazilian Coffee Exports down from 2024

Brazilian Exports: Arabica (M bags)

Source: Cecafé

Brazilian Exports: Conilon/Robusta (‘000 bags)

Source: Cecafé

In the case of the US, the current 50% tariff on Brazilian beans also intensified the movement, as stated by Cecafé last week. Brazilian exports to the US in August totaled only 301.09 K bags of coffee, a drop of 46.4% from last year and way below average shipments to the US.

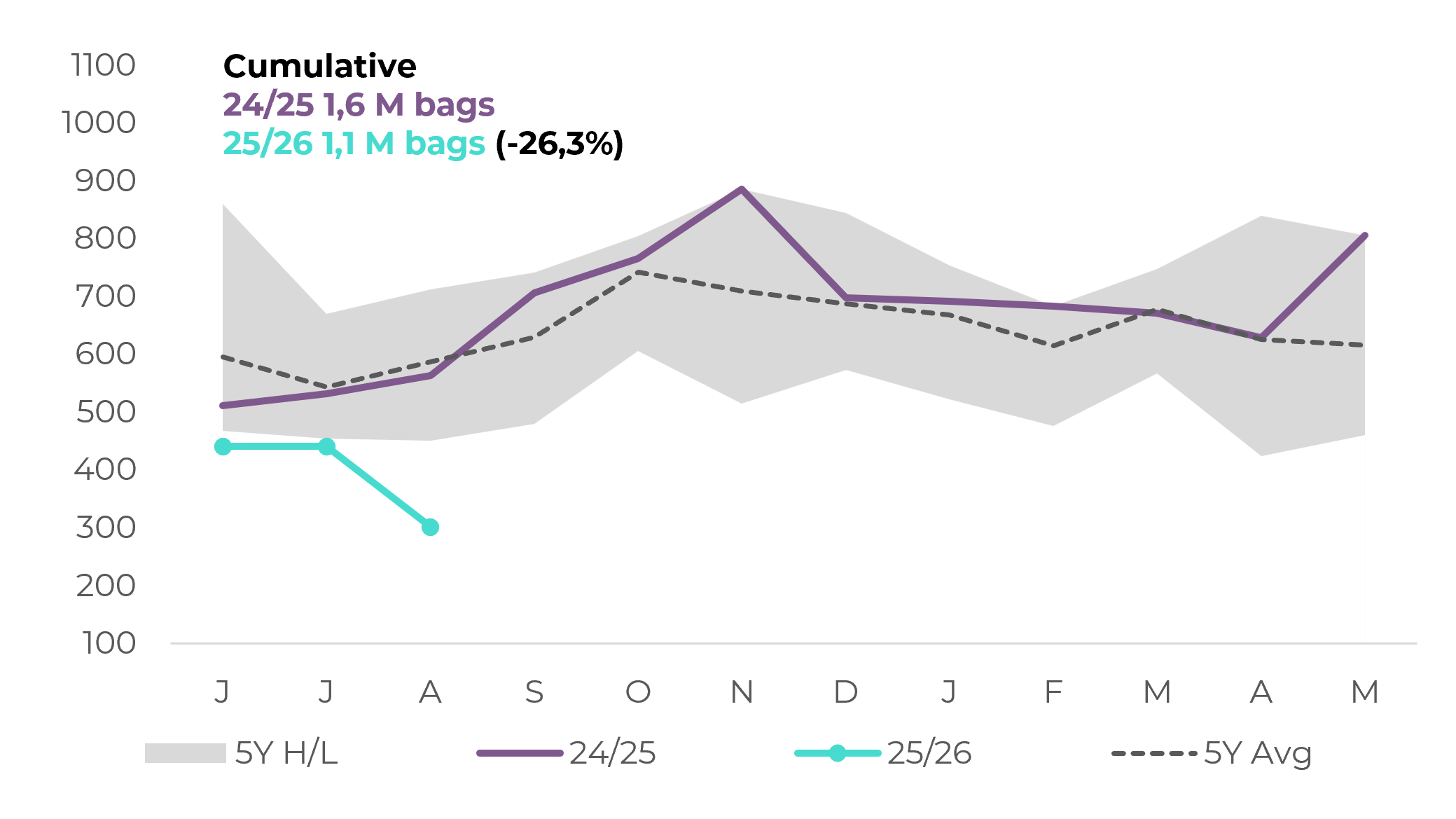

Arabica exports to the US totaled 244.7 thousands bags in the past month, a decrease of 49.5% from 2024, while Conilon shipments, were down 75.1% in the same period, with only 9.5 thousands bags. The performance is also way below average export figures for the country. Cumulatively, Brazil’s shipments to the US are also below 2024 and average figures, with total volume at 1.1 million bags in 25/26 (Jun-Aug), down 26.3% from the 1.6 M bags of 24/25.

Brazilian Coffee Exports by Destination: Arabica (M bags)

Source: Cecafé

Brazilian Coffee Exports by Destination: Conilon/Robusta (‘000 bags)

Source: Cecafé

The recent reduction in Brazilian coffee exports to the US is expected to result in a decline in domestic stocks. Although rising prices may dampen American demand, lower stocks in the country amid the off-season of other Arabica-producing origins increase the risk of a supply shortage, which is supporting prices. Additionally, certified stocks continue to decline (see report), further reinforcing the tight short-term supply.

Meanwhile, persistent dry conditions in Brazil are delaying the flowering of the 2026/27 Arabica crop. Forecasts suggest rainfall may not return until late September, and concerns over a potential La Niña event between October and December are adding uncertainty to the next production cycle.

These factors are contributing to elevated price volatility, with funds increasing their long positions. This has also led to the December Arabica contract coming back to the 417 c/lb this Monday, 15.

Brazilian Total Exports to the US (‘000 bags)

Source: Cecafé

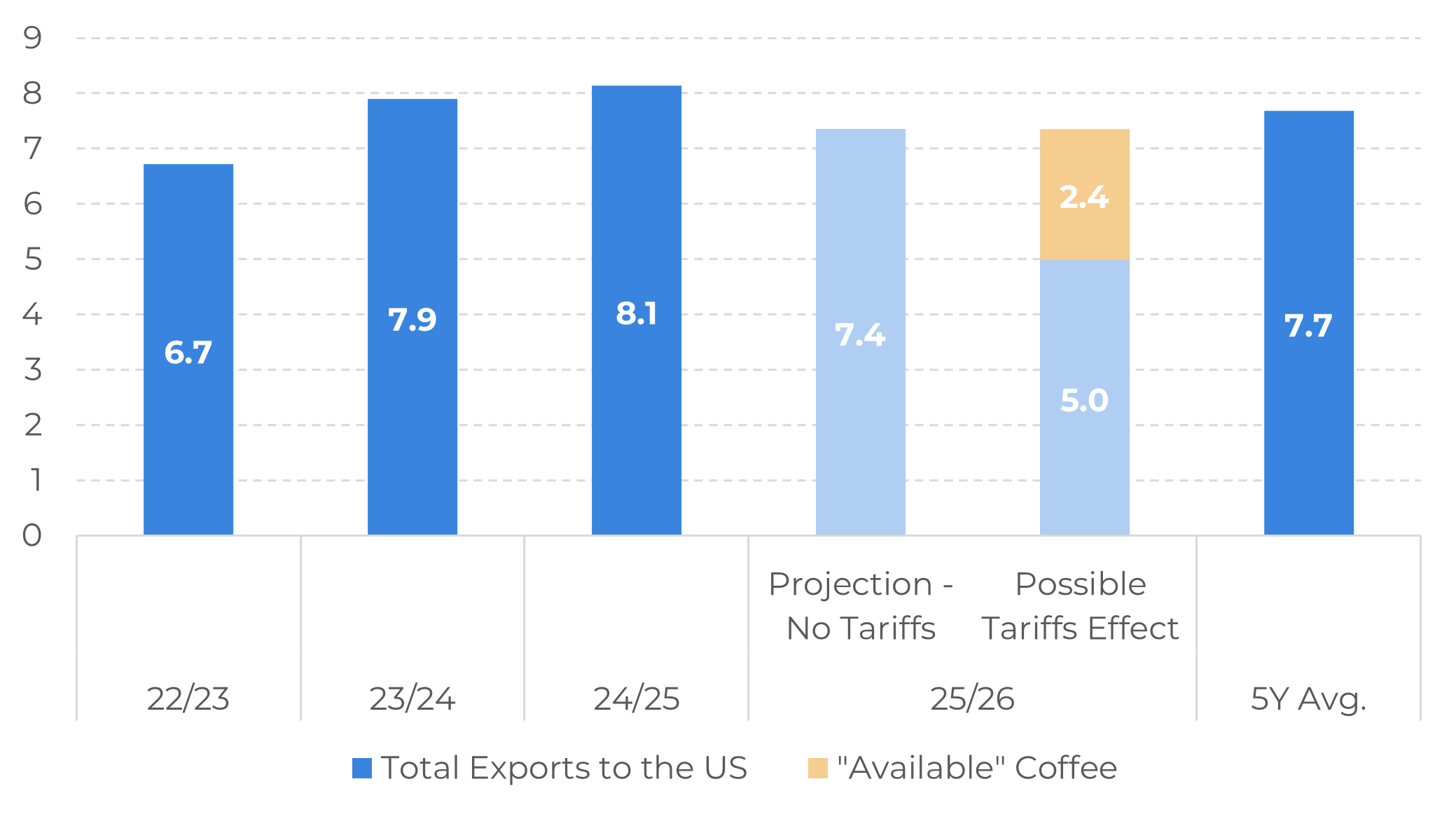

Tariff Effect: Projection of Total Brazilian Exports to the US (M bags)

Source: Hedgepoint

Despite the current challenges, a price correction in the medium-term remains possible, particularly for Brazilian domestic prices and differentials. First, flowerings in Arabica areas remain minimal, with little impact from the lack of rain for now. Therefore, if precipitation levels are closer to average from the end of September onward, there is still the possibility of a higher Arabica production in the next cycle, while Conilon outlook remain positive for the 26/27 cycle.

Additionally, although Brazil’s Arabica output for 25/26 is lower, the decline in exports - particularly to the US - suggests a short-term build-up in domestic inventories. If this trend continues, surplus coffee that would have otherwise been exported may remain in the local market, increasing availability over the coming months and potentially pressuring Brazilian differentials.

This scenario, however, remains dependent on the weather outlook in Brazil and changes in the current US tariffs on Brazilian coffee. In this context, any shifts in trade tariffs or weather conditions could lead to significant price fluctuations, for up or down, as the market continues sensitive to supply.

In Summary

Weekly Report — Coffee

laleska.moda@hedgepointglobal.com

thais.italiani@hedgepointglobal.com