ICE low stock level continues to support Arabica prices. But can the tides change?

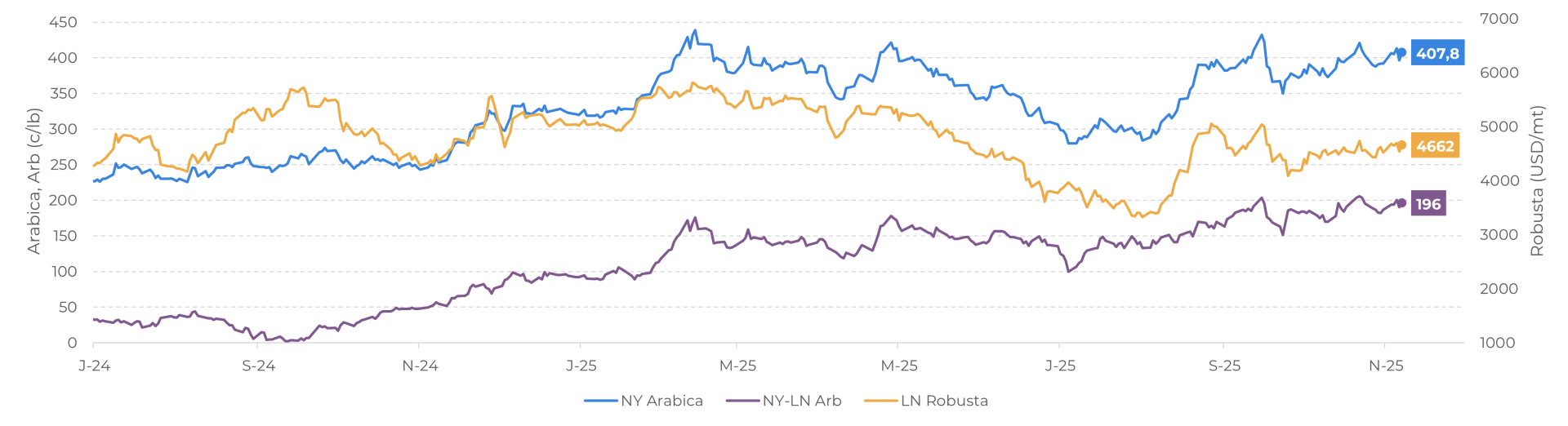

- Arabica futures prices continued to be highly volatile in October and early November. Although hopes for a deal between Brazil and the US ang good rains after mid-October weighed on on the bears side in part of the last month, prices are back to trade above the 400 c/lb levels in the past days.

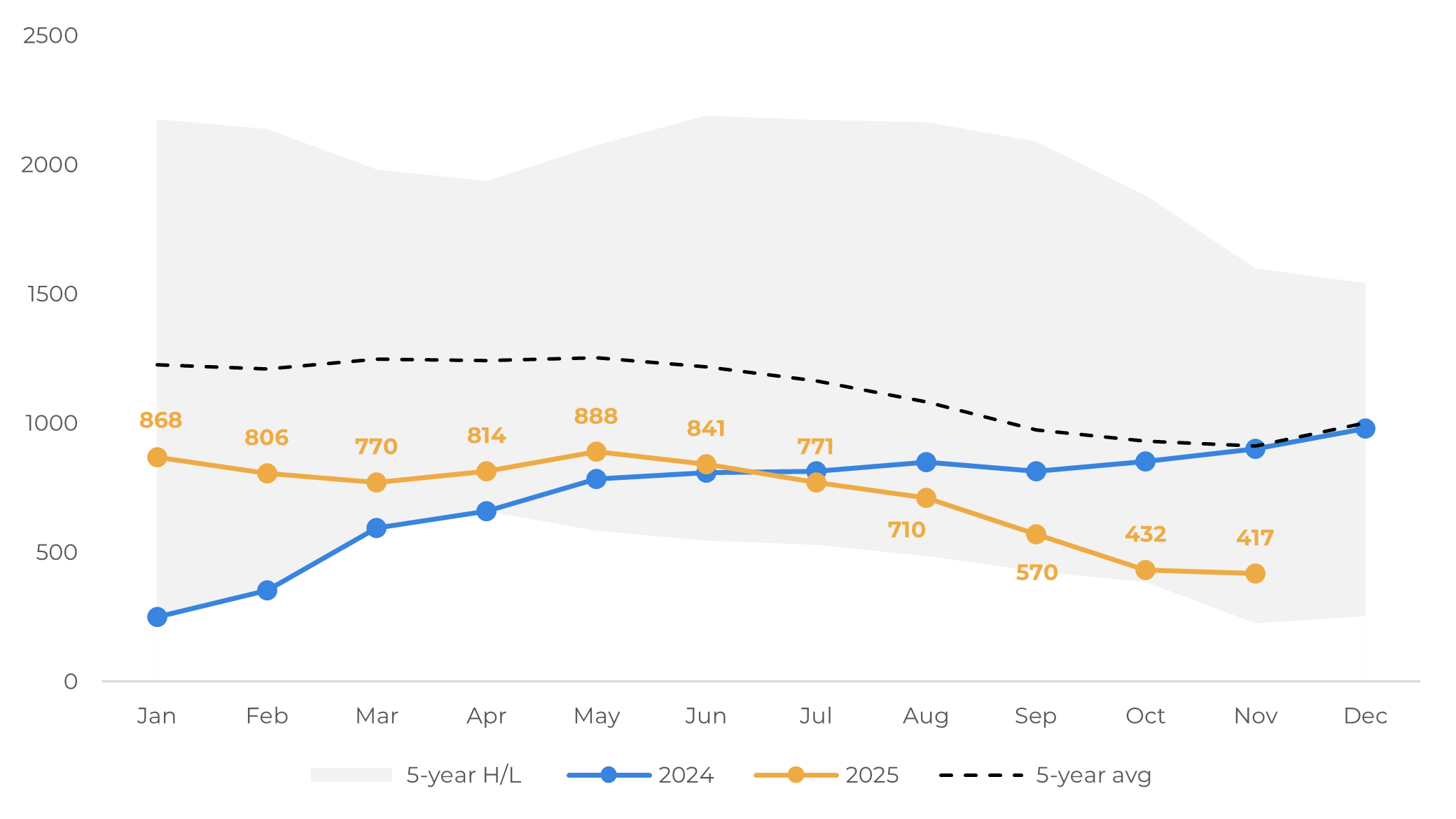

- On the fundamentals side, while no deal regarding coffee tariffs has been announced, the drop in Arabica certified stocks in the ICE warehouses continues to be the main driver behind the current bull market. Currently, Arabica stocks are around the 417 k bags, a 1-1/2 year low and close to late 2023 levels, when stocks fell to their lowest in more than 20 years.

- On the other hand, the past weeks Brazilian differentials could prompt more deliveries to ICE inventories, albeit a significant volume is needed for stocks to reach a comfortable level.

- Weather has also been monitored closely, as Brazil is currently in its development stage for the 26/27 cycle and the first estimates regarding the size of the crop are being made.

- In Asia, there has been an increase in fears of impact of heavy rains in Vietnam, due typhoon Kalmaegi.

ICE low stock level continues to support Arabica prices. But can the tides change?

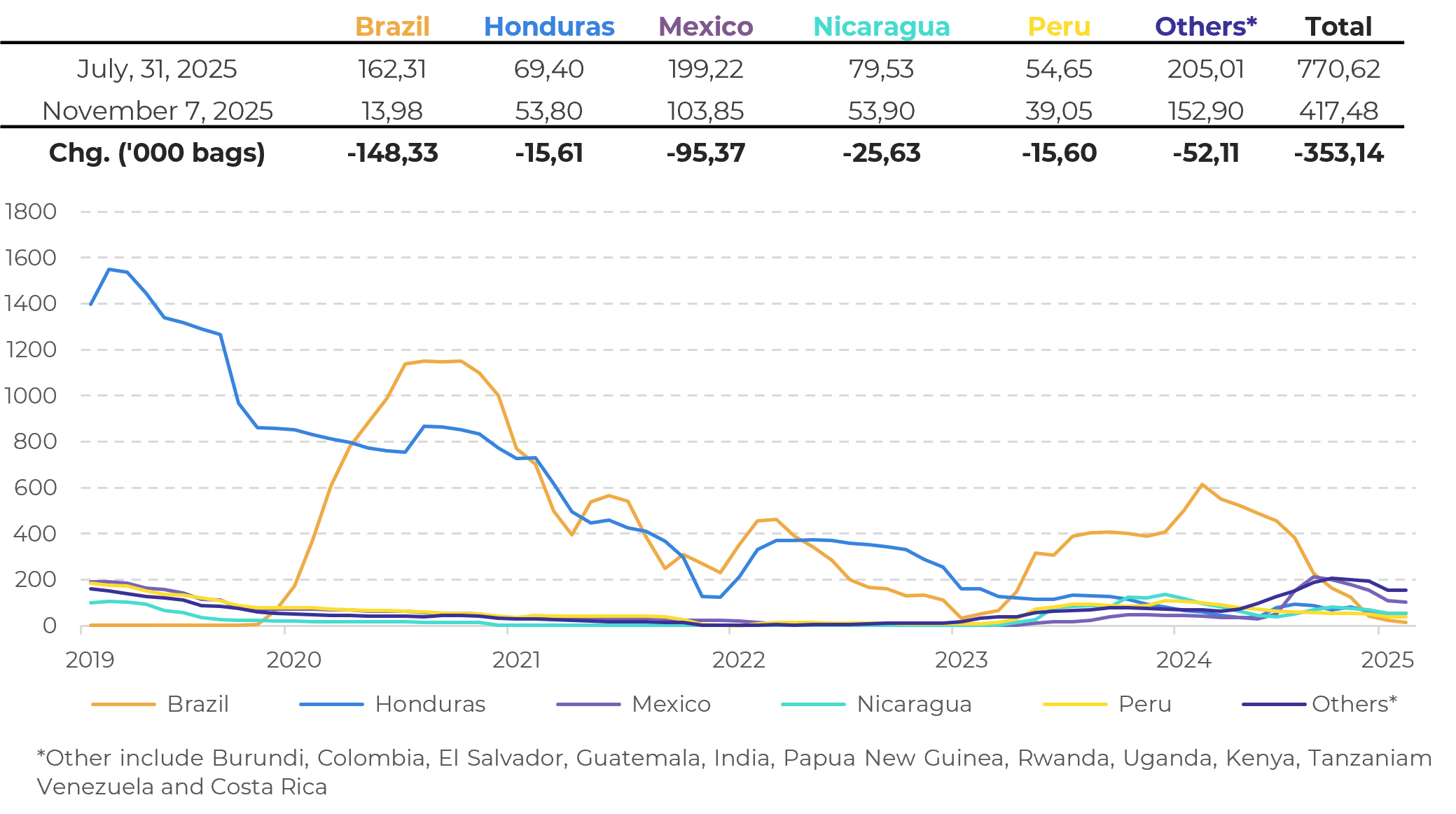

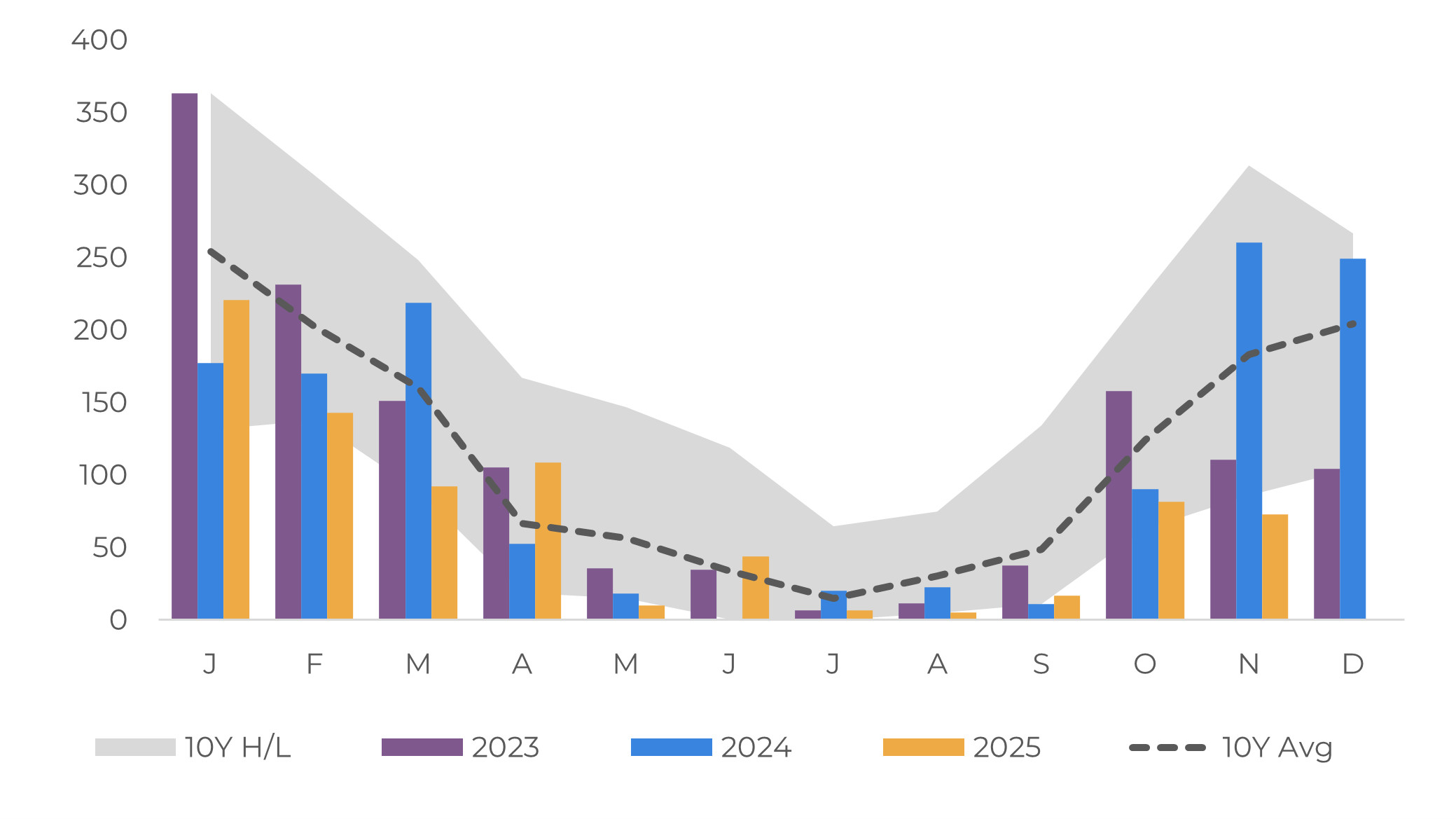

Since early August, certified stocks have been falling, with a decrease in the volume of most origins, including Mexico, Honduras, Nicaragua, Peru, Uganda and Brazil – the largest supplier of certified stocks in recent years. From 29 July to 7 November, total stocks plunged by 353.1 k bags (-43.8%), while the volume of Brazilian beans for the same period fell by148.3 k bags (-90.6%) . This reduction is the result of farmers' (especially Brazilian farmers') lack of interest in certified coffee, as they are well capitalized, and the price differentials previously did not compensate for the process. It is also the result of traders and roasters consuming the existing certified stocks, as coffee prices continue to increase. In the case of American companies, tariffs have also increased their costs, prompting them to consume the existing stocks.

Arabica Certified Stocks (‘000 bags)

Source: ICE

Arabica Certified Stocks by Origin (‘000 bags)

Source: ICE, Hedgepoint

On the other hand, there is an expectation of new shipments to the certified stocks in the coming months. Although Brazilian differentials have increased in the past week, in parts of August and September they traded lower, which prompt some traders to certified lots of coffee beans. According to recent news , there is an expectation of at least 150 K bags arriving in the ICE certified stocks in the next months. However, for stocks to return to comfortable levels, a larger volume of coffee is needed, which could still provide support for prices in the short term.

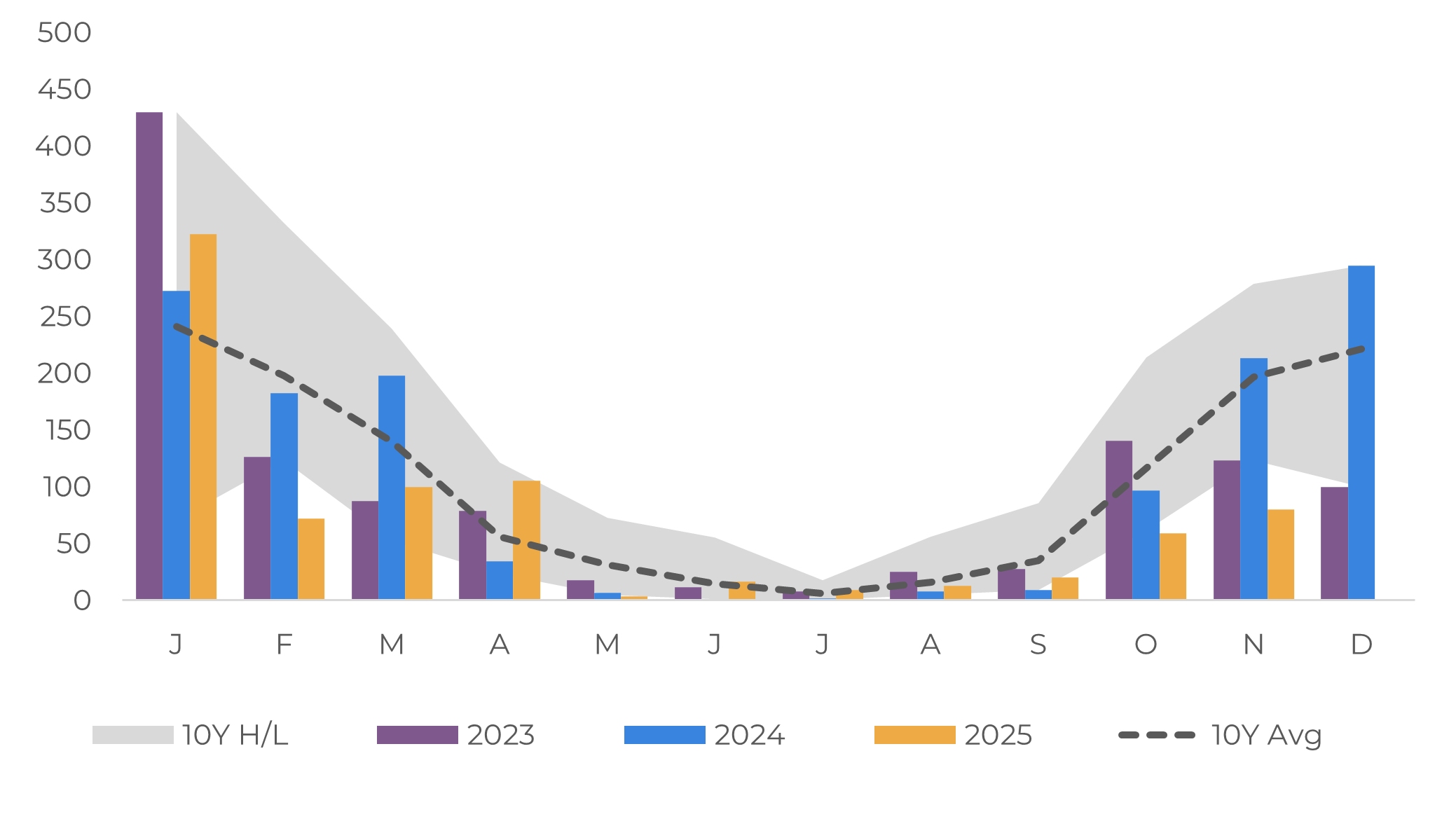

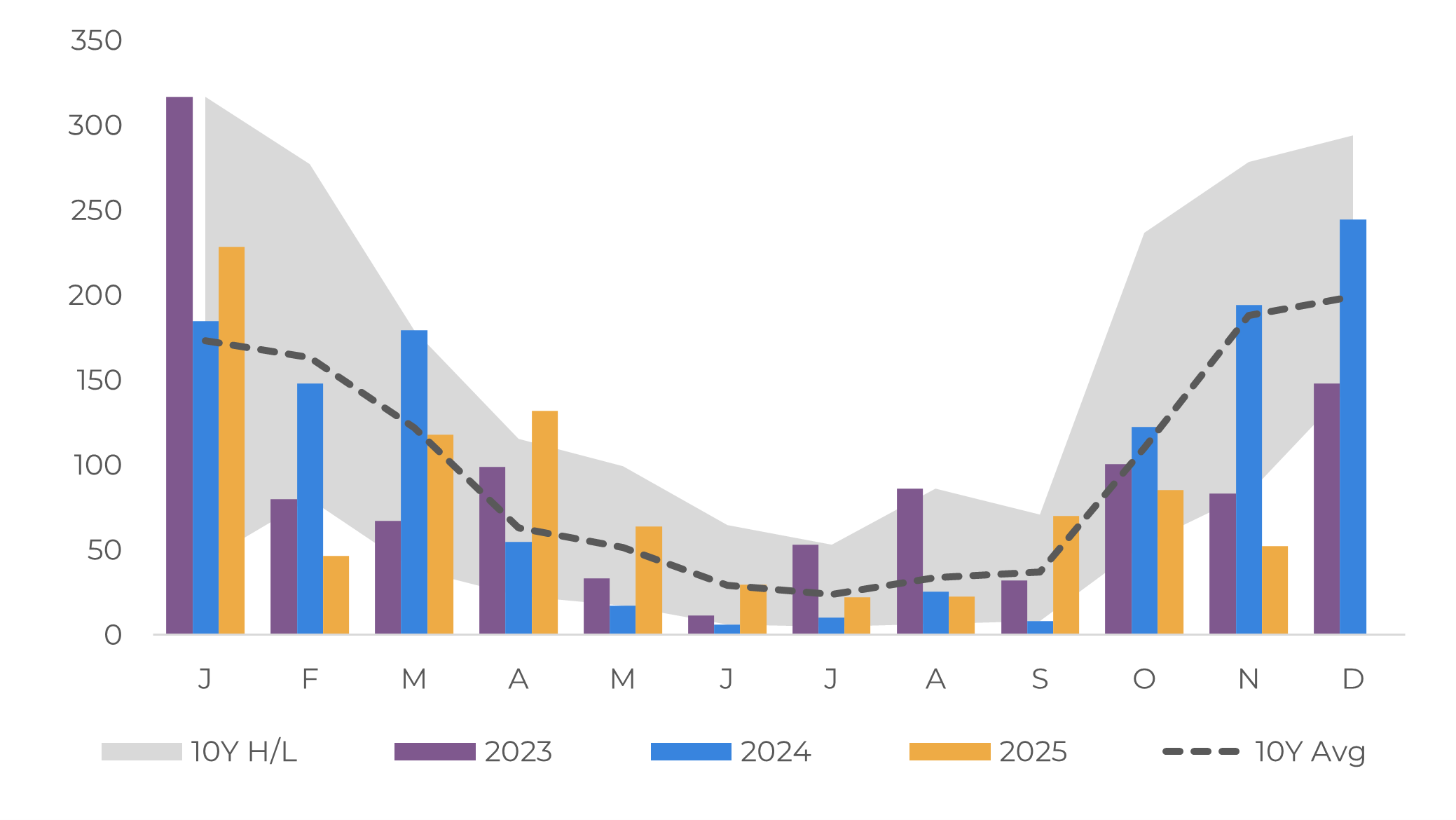

Weather has also been monitored closely in the past weeks and will also play a role in prices movements, as Brazil is currently in its development stage for the 26/27 cycle. Until mid-October, the weather remained dry in most producing regions, bringing some fears over the next season, as many coffee trees had early bloom in September. However, although it is still early to discard negative effect of the previous weather in coffee yields, the rain levels in the second half of October and early November brought hopes for 26/27.

LN-Robusta (USD/mt), NY-Arabica and Arbitrage (c/lb) (1st contract)

Source: LSEG

Most Arabica regions have received significant rainfall in past weeks, leading to a new flowering in late-October and helping the development of the trees, wich are now entering in the bean developing phase. At first look, it is very likely that Arabica production will have a recovery in this cycle, it’s still too early to access the size of the crop.

Brasil: Minas Gerais Monthly Cumulative Precipitation in Coffee Regions (mm)

Source: Bloomblerg, Somar, Hedgepoint

Brasil: São Paulo Monthly Cumulative Precipitation in Coffee Regions (mm)

Source: Bloomblerg, Somar, Hedgepoint

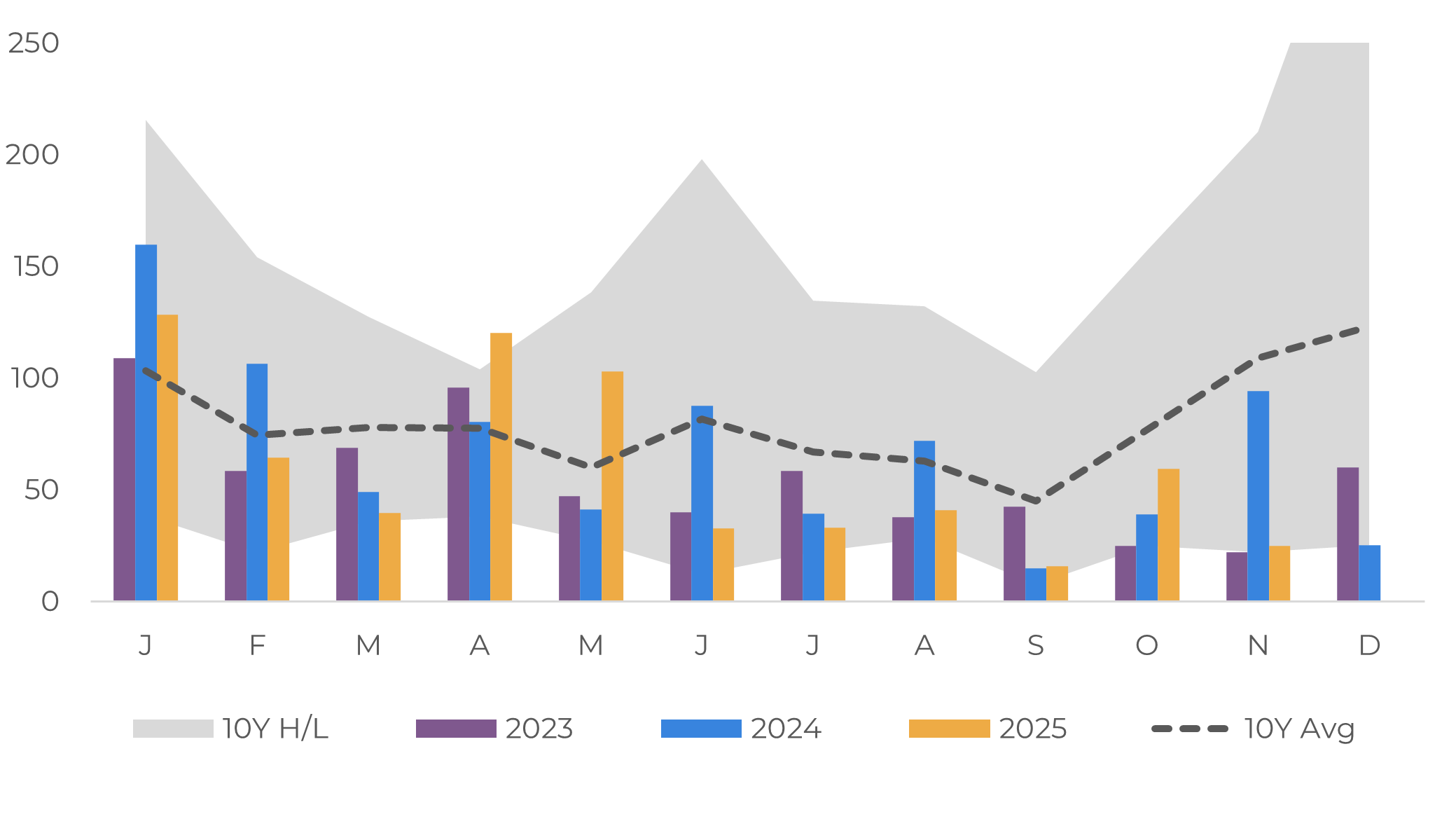

As for Conilon, the weather has been favorable throughout 2025, with a good amount of rainfall in these past weeks, which is helping the development of beans. There is, however, the possibility of a small drop in production in the next season, due to the record crop in 25/26. Usually, when trees produce a large amount, the next cycle is followed by a drop in production, as the reproductive effort tends to reduce plant vigor. Farmers usually prune these trees to increase their potential for the following season (27/28), which reduces the total crop output in the cycle. Meanwhile, there has also been an increase in Conilon areas in recent years, particularly in Espirito Santo and Bahia, which will help to offset some of the expected decline.

Nevertheless, we are not expected to provide our first estimate for the 26/27 cycle until the end of this month. It is also worth bearing in mind that concrete estimates usually emerge after the filling phase, between February and March. These crop forecasts will also have a significant impact on price movements, given that Brazil is the largest coffee producer. Increased production in Brazil will be essential for stock recovery around the world and could help to reduce current bullish price pressures.

Brazil: Espírito Santo Monthly Cumulative Precipitation in Coffee Regions (mm)

Source: Bloomblerg, Somar, Hedgepoint

Brazil: Bahia Monthly Cumulative Precipitation in Coffee Regions

(mm)

Source: Bloomblerg, Somar, Hedgepoint

Outside Brazil, these past days the market has also paid close attention to the arrival of typhoon Kalmaegi in Southeast Asia. Last week, Robusta prices received support as agents feared the impact of the typhoon in Vietnam. Although most of the impact was concentrated on the coastal areas, the event still brought heavy rain to the Central Highlands, which can affect the quality of beans and pace of harvest.

In Summary

Weekly Report — Coffee

laleska.moda@hedgepointglobal.com

carolina.franca@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.