Coffee Live with Experts Highlights

This analysis summarizes the main points discussed during the Coffee Live with Experts on November 19. It is important to note that the session took place before the announcement of tariff relief by Trump, so some figures and text have since been updated with the latest data and may differ from those presented last week.

Macroeconomic Outlook

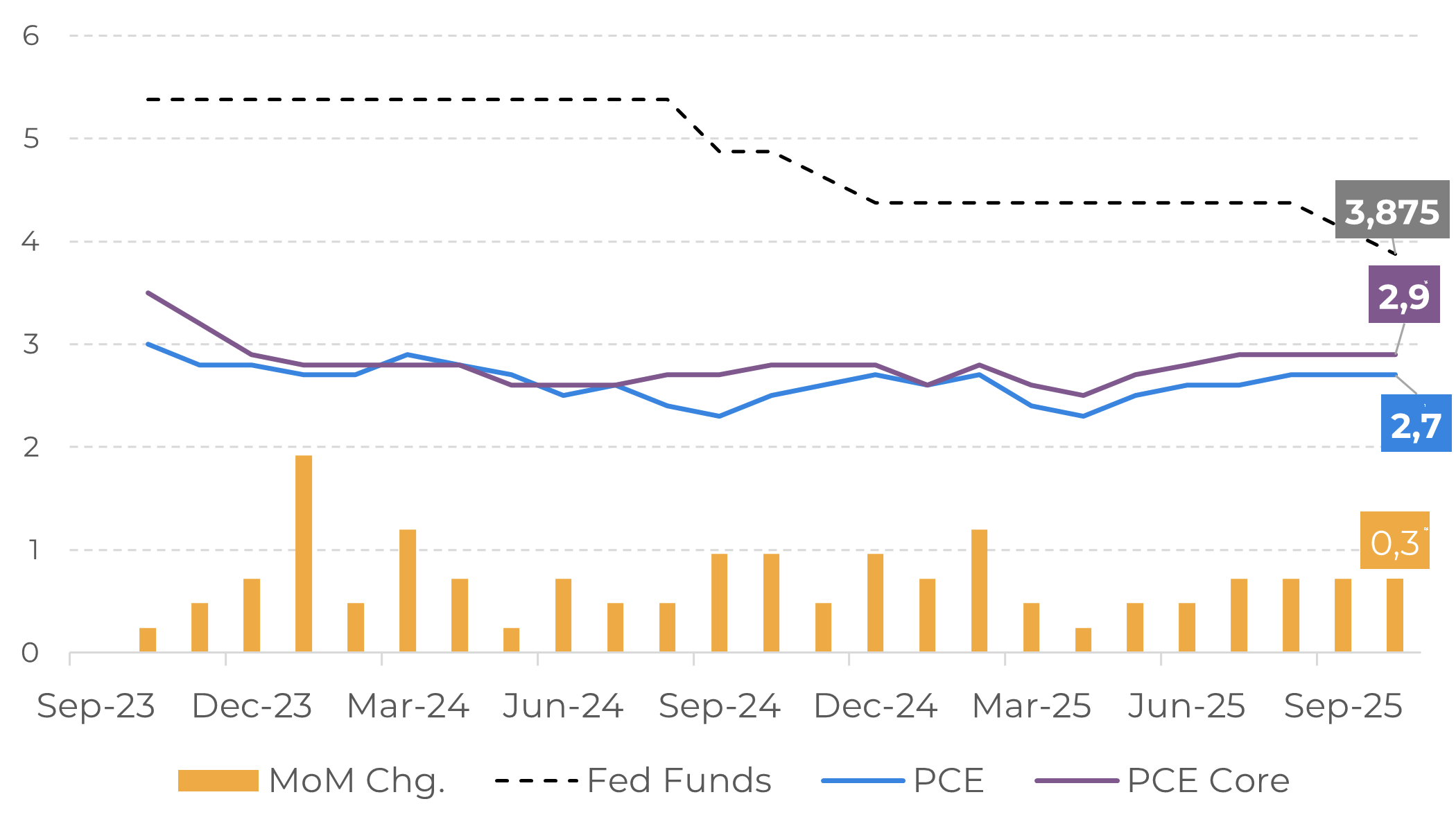

PCE and Fed Funds Target Rate (%)

Source: LSEG

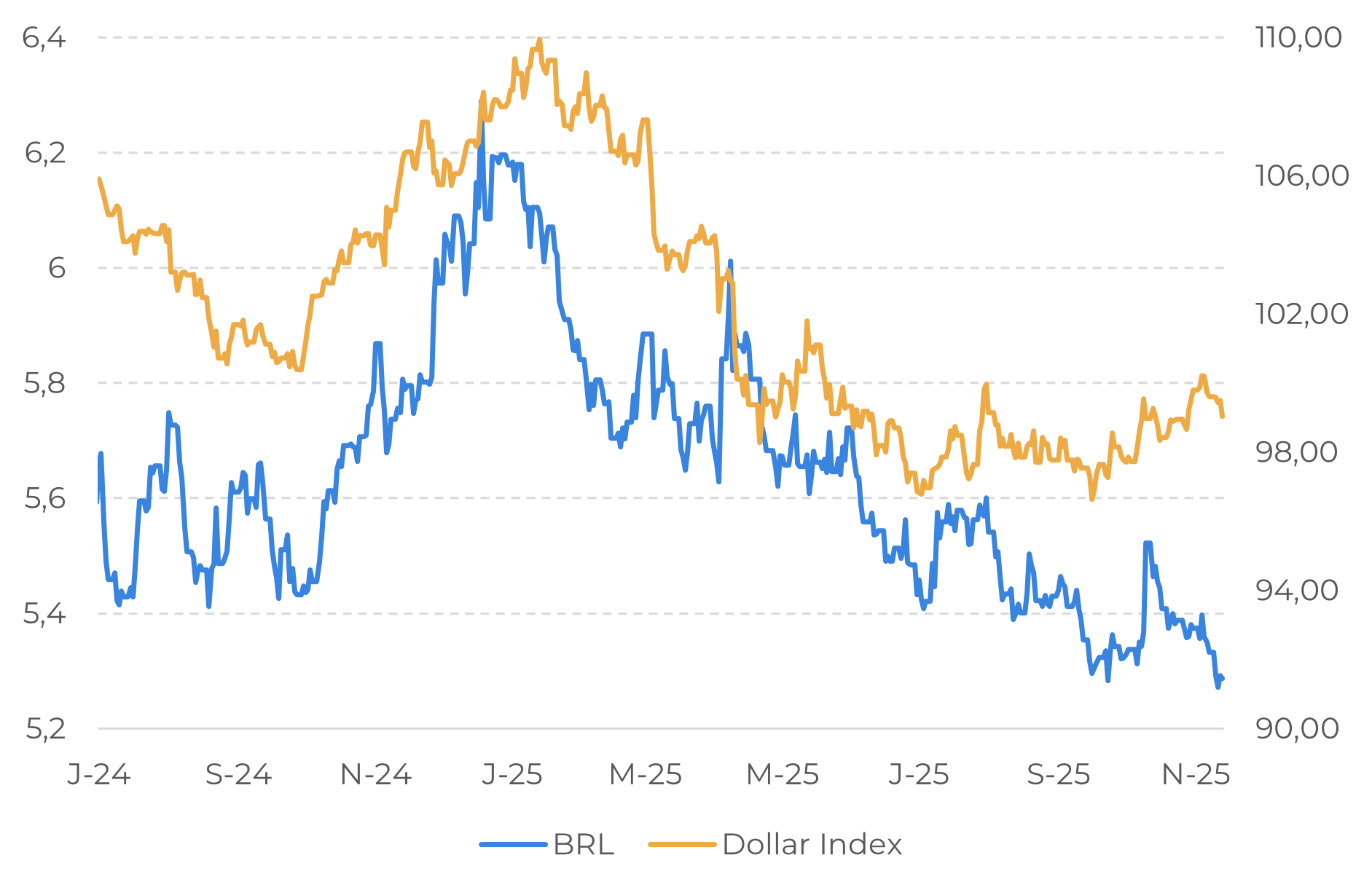

Dollar fluctuations are particularly relevant since coffee is traded in dollars. In Brazil, the currency has been influenced both by U.S. uncertainties and interest rate differentials. While Brazil’s Central Bank kept the Selic rate at 15% annually, Fed cuts could strengthen the real and affect Brazilian coffee trade.

However, the most significant market impact so far has come from U.S. tariffs. In mid-November, Trump lifted reciprocal tariffs on most origins, and on November 20 removed the 40% levy on Brazilian beans, easing market pressure. Still, volatility may persist as Arabica certified stocks have been heavily drawn down since August due to tariff effects.

BRL and Dolar Index Performance

Source: LSEG

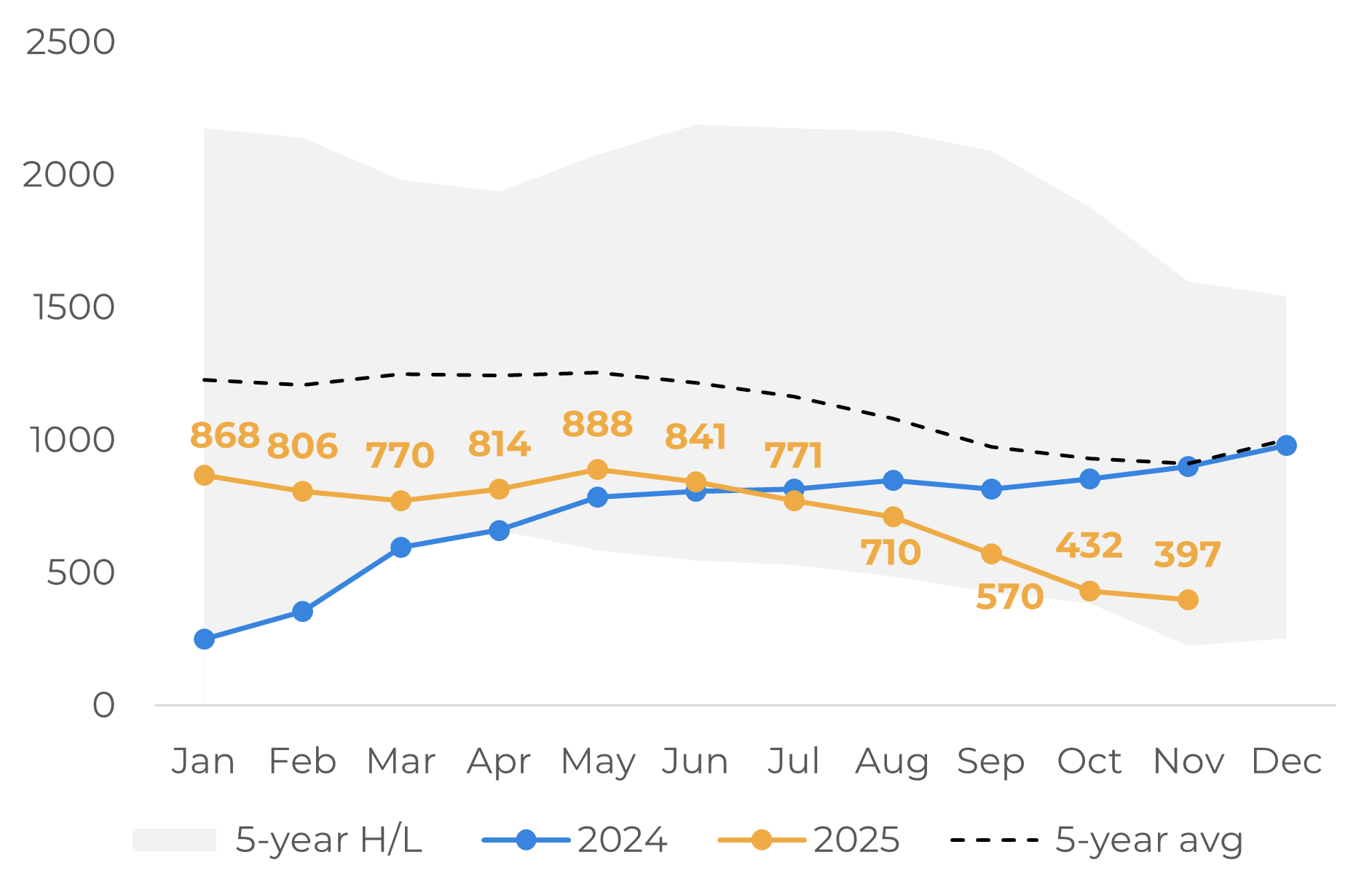

Low stocks continue to support prices

Arabica Certified Stocks (‘000 bags)

Source: ICE

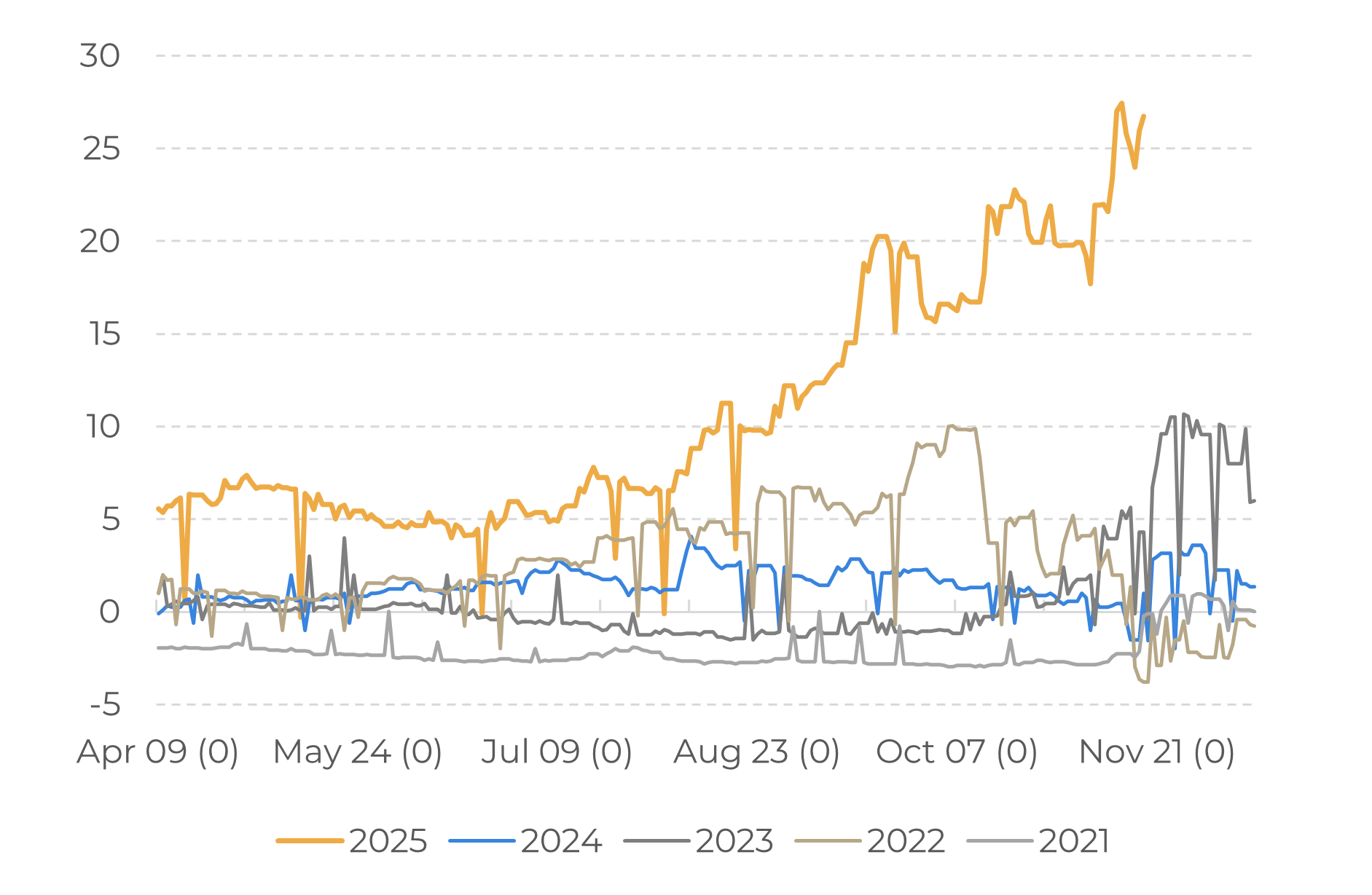

However, certified stocks must rise significantly to reach more comfortable levels, which could limit sharp price corrections in the coming months. In this sense, near-term Arabica contracts remain at historically high levels, reflecting persistent short-term concerns and raising hedging costs for market participants. In contrast, Robusta spreads are narrower than in 2024, suggesting less supply risk, supported by Brazil’s large Conilon crop and expectations of a recovery in Vietnam.

Arabica: December and March Contracts Spread (c/lb)

Source: LSEG

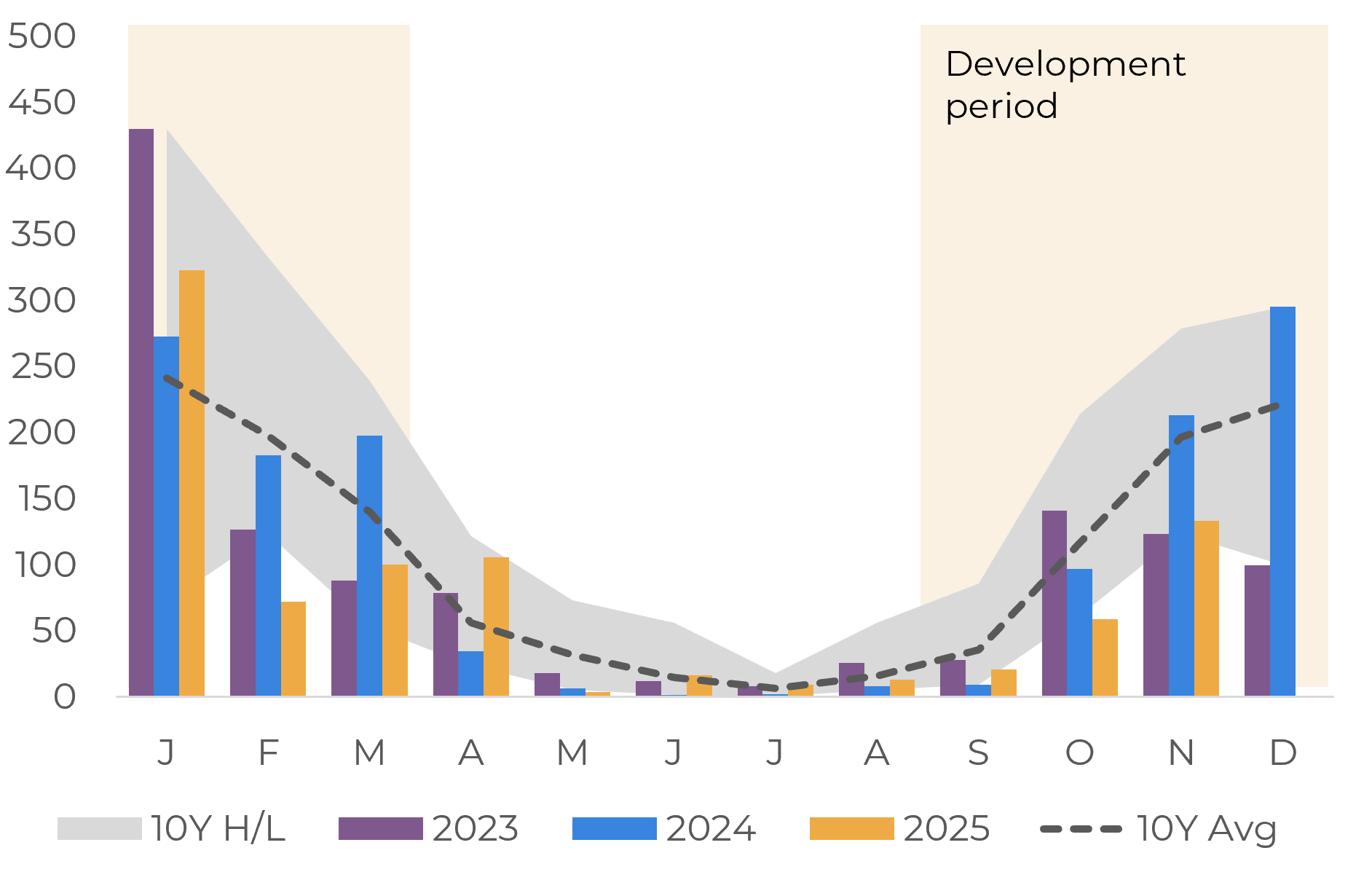

Weather in Brazil is more favorable

Brazil: Monthly Cumulative Precipitation in Minas Gerais Coffee Regions (mm)

Source: Somar, Bloomberg

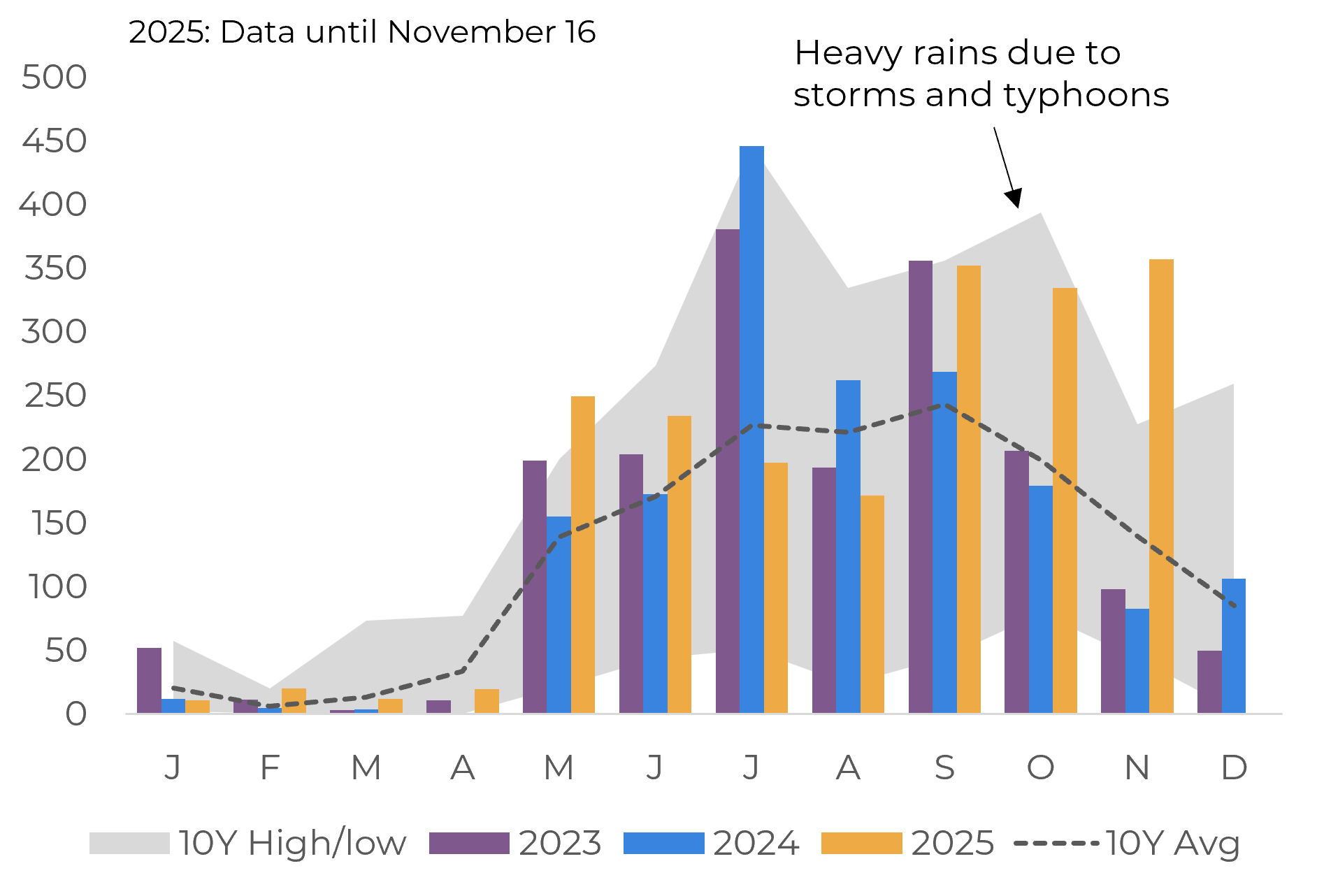

Other origins harvest the 25/26 season

Vietnam: Cumulative Precipitation in Central Highlands (mm)

Source: Gadas, CPC

In the Arabica side, higher precipitation in Central America in the past months are expected to lead to recovery in washed Arabica in the region, albeit continued rains are also delaying the harvest. However, in Colombia, heavy rainfall in the first half of the year lead to a decrease in production in 25/26, With this, the total output of washed Arabica in Latin America is expected to change little from the 24/25 cycle.

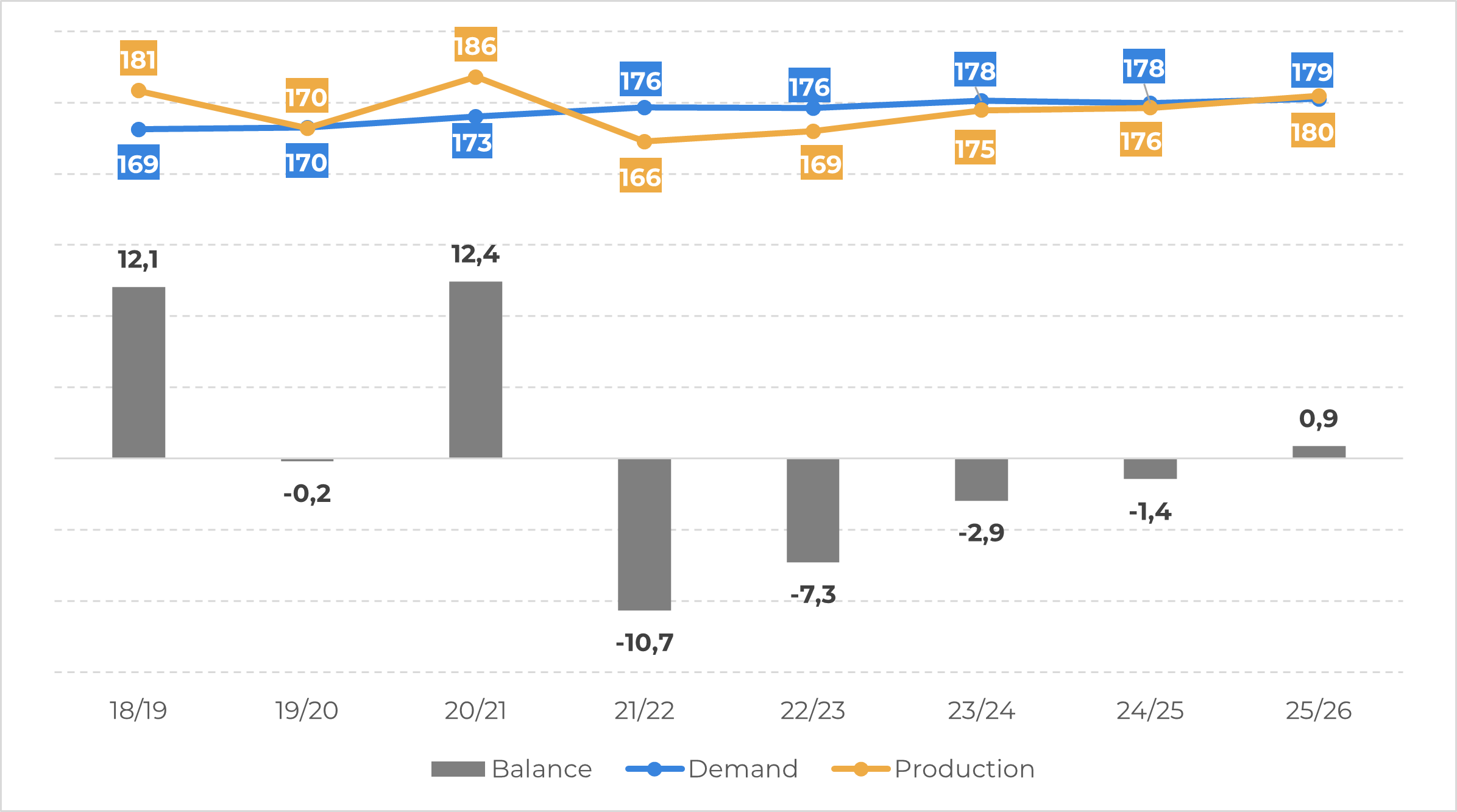

Global balance

Global Supply and Demand for Coffee (M bags)

Source: Hedgepoint

Weekly Report — Coffee

laleska.moda@hedgepointglobal.com

thais.italiani@hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without intending to create obligations or commitments to third parties. It is not intended to promote or solicit an offer for the sale or purchase of any securities, commodities interests, or investment products. Hedgepoint and its associates expressly disclaim any liability for the use of the information contained herein that directly or indirectly results in any kind of damages. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests, such as futures, options, and swaps, involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgment and/or consult advisors before entering into any transactions. Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately. Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only). Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets. “HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.