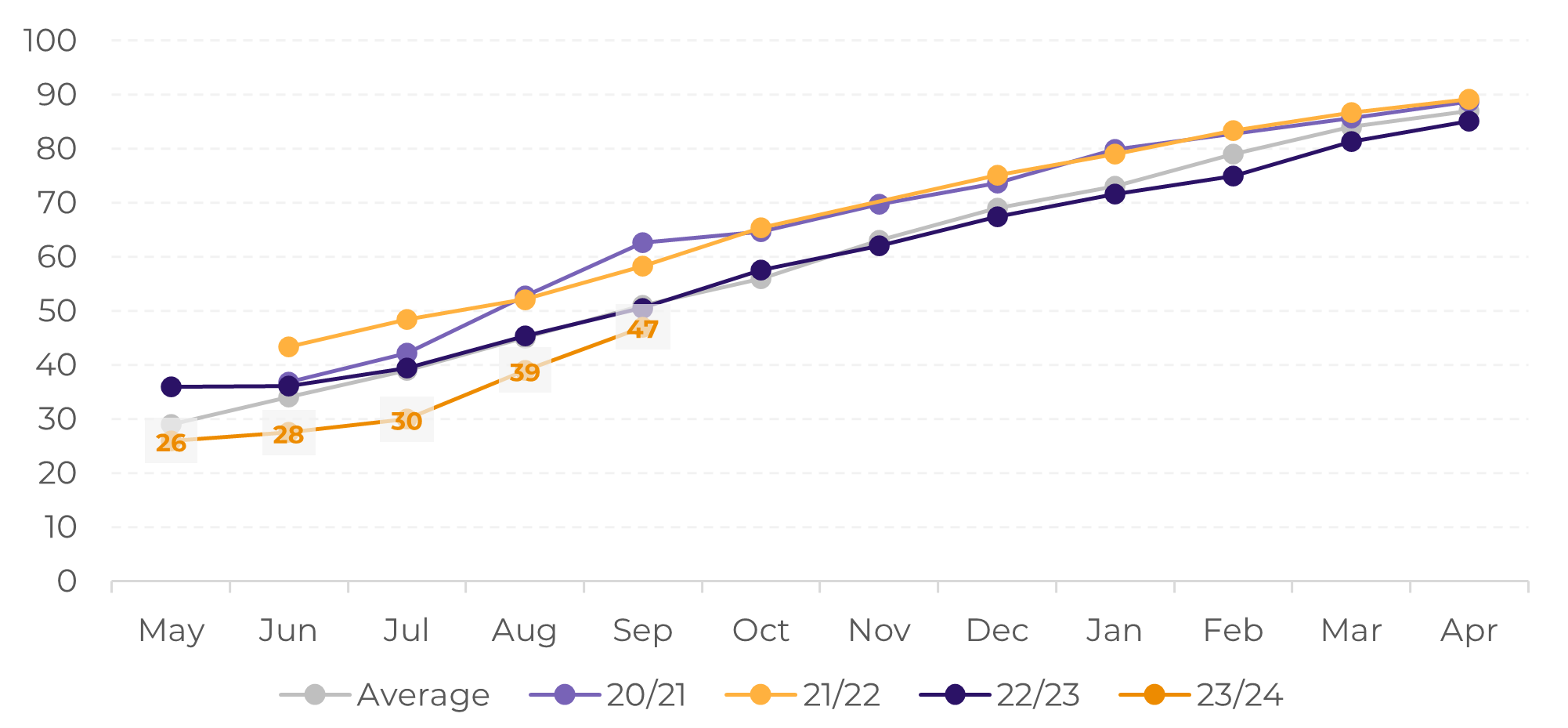

It’s also important to highlight the results from farmer selling data in Brazil, indicating that while liquidity has improved when compared to August, this crop’s sold volume is still below the average expected for the period.

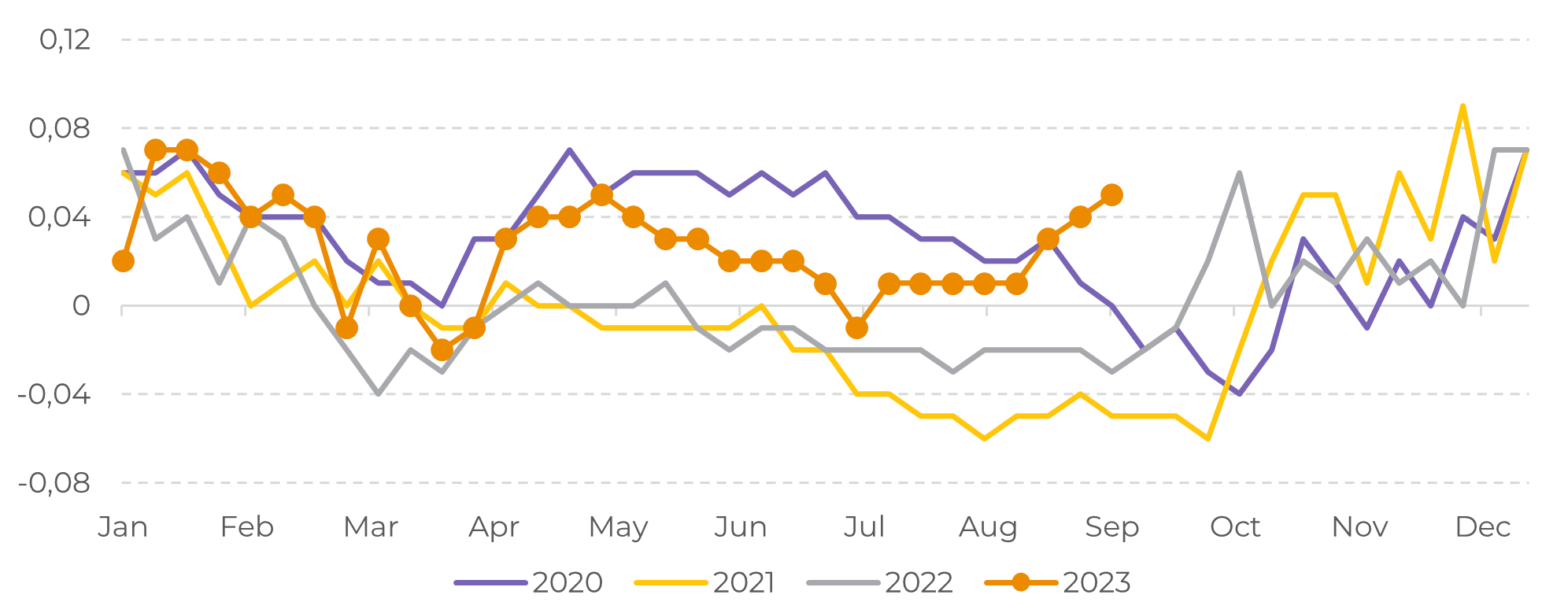

This perspective of higher stocks going into the last quarter of the year – when other arabica origins begin their harvest – also weighs down on prices.

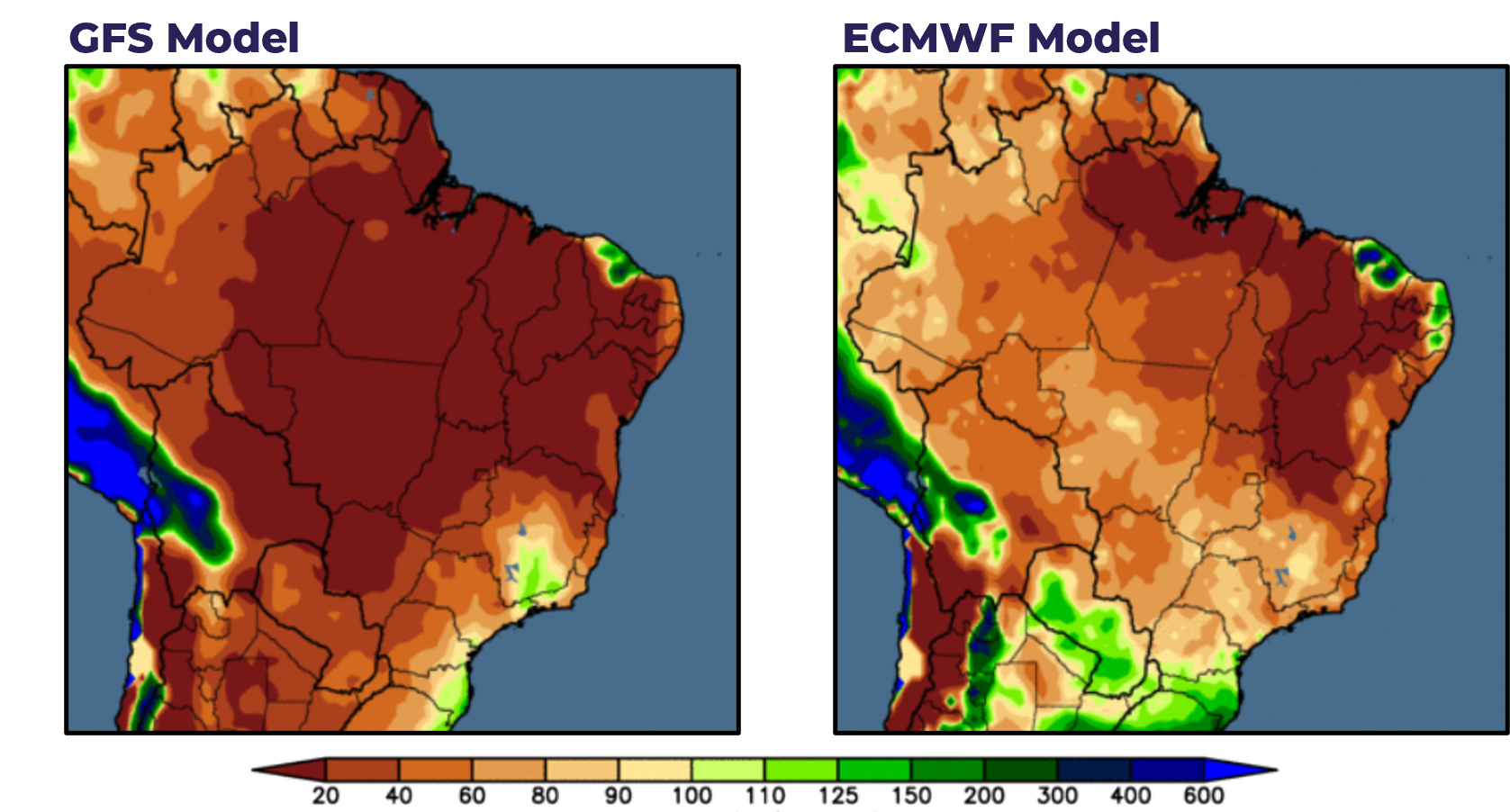

Differently from the past week, forecast models are now starting to deviate: the American model suggests near-zero rainfall levels over most coffee areas – except for regions in Sul de Minas and Zona da Mata – whereas the European model already shows a slightly more optimistic view.

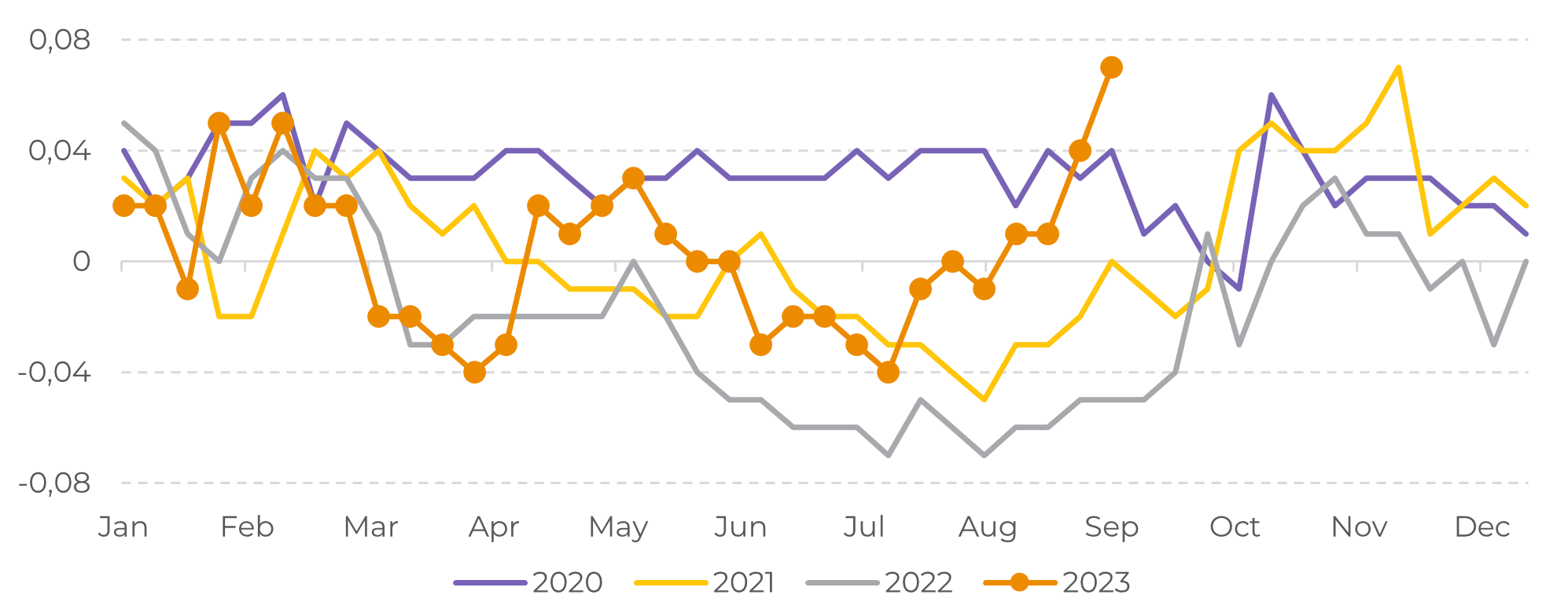

Still, rains must follow through to maintain the optimum NDVI levels seen so far, and also to lower the likelihood of pests. For instance, broca: Dry conditions may boost coffee borer beetle activity, with higher temperatures speeding their life cycles, particularly in densely planted lower-altitude areas.