Dec 15

Coffee Weekly Report - 2023 12 15

Back to main blog page

- Brazilian coffee exports witnessed a significant surge, hitting 4.3M bags in November, surpassing the average by 1.3M bags (a remarkable 42% increase).

- The upswing is attributed to heightened availability in the 23/24 Brazilian crop and competitive pricing, reshaping destination patterns.

- Despite a decline in imports, the United States continues to be the primary destination, receiving 5.47M bags in 2023 (constituting 15.63% of the total).

- Notably, Japan experienced a 22% rise in Brazilian coffee imports, associated with stock withdrawal, while China's imports skyrocketed by an impressive 221%.

- Brazil has successfully displaced Ethiopia as China's primary natural arabica supplier, with a 194% surge in exports driven by favorable price differentials. This shift underscores evolving dynamics in the global coffee trade landscape.

Brazil’s coffee exports and shifting global trends

In previous reports, we’ve looked at the performance of demand in destinations, with data from the European Union suggesting a stronger growth than initially expected – since the decrease in imports did not fully explain the trend in stocks.

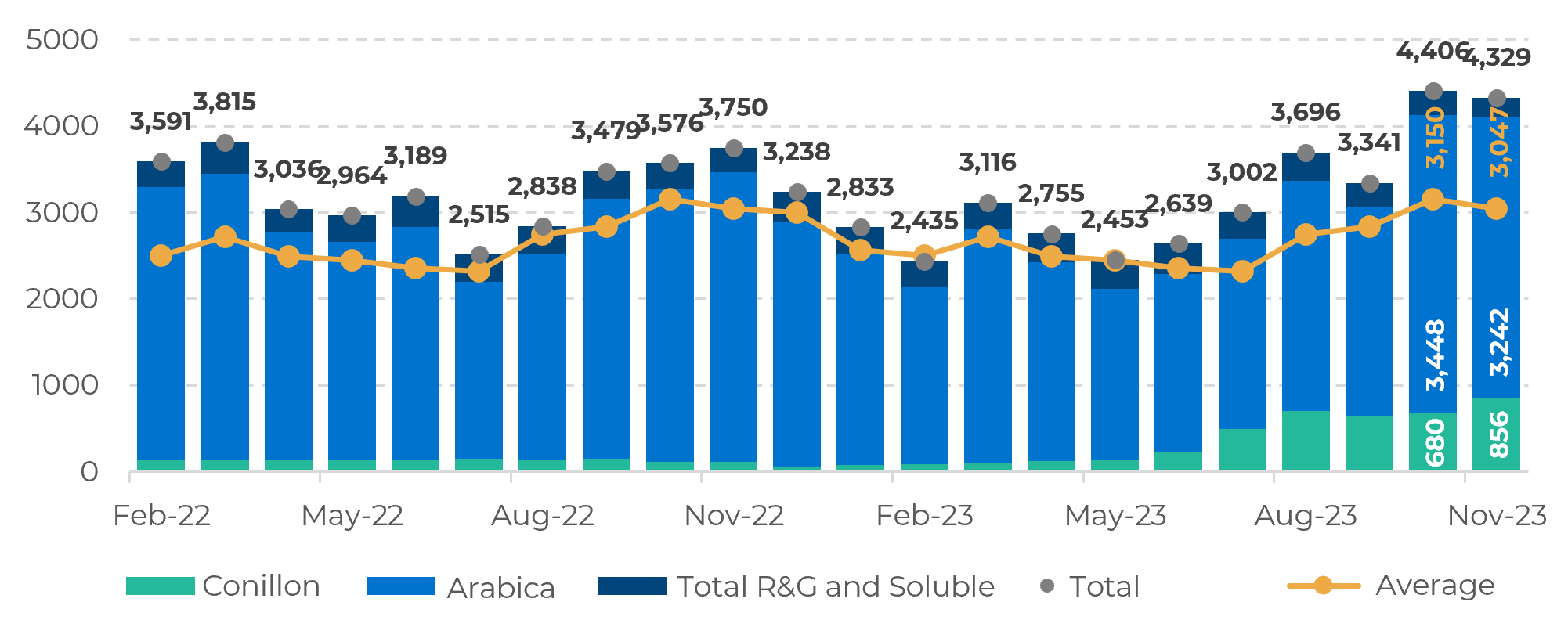

Still, that was a picture taken in the 22/23 cycle, and since then, Brazilian exports have increased, changing the landscape in destinations. Shipments reached 4.3M bags in November, with 3.2M bags of arabica and 856K bags of conilon (Figure 1).

The total has surpassed the average by 1.3M bags, nearly 42%. The move is explained by higher availability in the 23/24 Brazilian crop when compared to 22/23, as well as competitive prices from Brazil when compared to other origins.

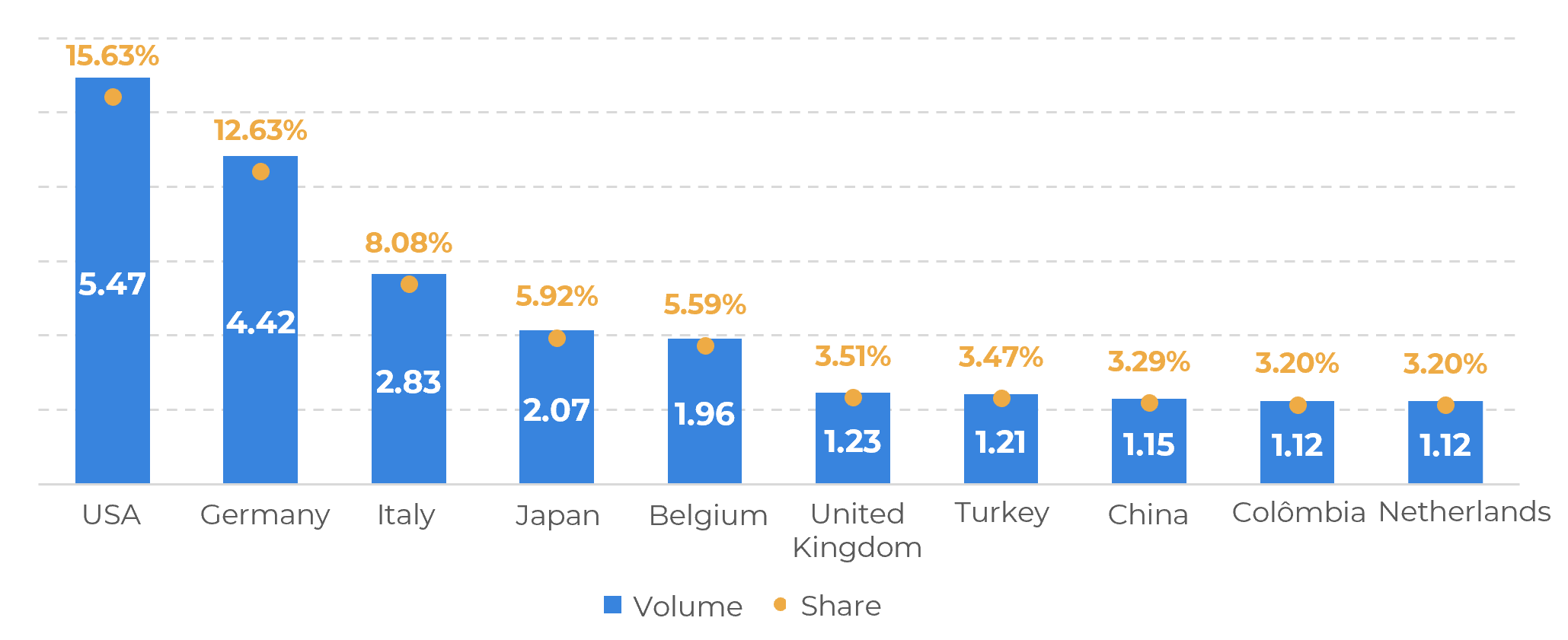

Considering the cumulative figure for 2023 (Jan-Nov), the USA has been the main destination for Brazilian coffee, at 5.47M bags, or 15.63% of the total (Figure 2). Germany and Italy follow in second and third places – although the EU as a whole has imported 14.73M bags from Brazil this year (down 14% YoY).

Figure 1: Brazilian Coffee Exports, by Type (‘000 bags)

Source: Cecafé

Figure 2: Brazilian Coffee Exports, by Destination (M bags)

Source: Cecafé

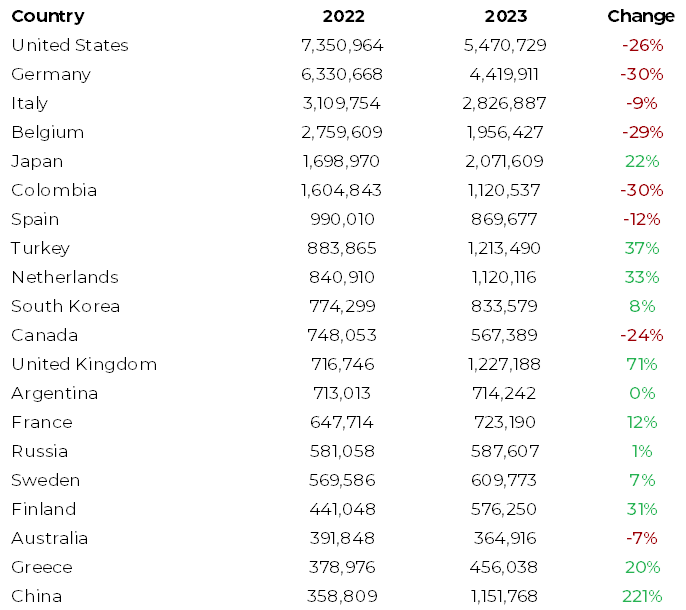

Looking at each country separately, the figures are surprising – the United States has imported 26% less when compared to 2022, Germany 30% less, and Italy, 9%. So, the question arises: given that Brazil is exporting more, and the main destinations are importing less, where is the coffee moving to?

Figure 3: Cumulative Brazilian Exports by Destination (bags)

Source: Cecafé

For traditional destinations, Japan reported a 22% increase in Brazilian coffee imports, but this move is related to the previous stock withdrawal in the country.

Considering data from the past two years, stocks from Brazilian origin in the country dropped by 46% - the highest figure among the reported origins.

Considering data from the past two years, stocks from Brazilian origin in the country dropped by 46% - the highest figure among the reported origins.

As for other destinations, the highlight goes to China: the country imported 1.15M bags from Brazil in 2023 – a 221% increase vs. the 359K bags reported last year!

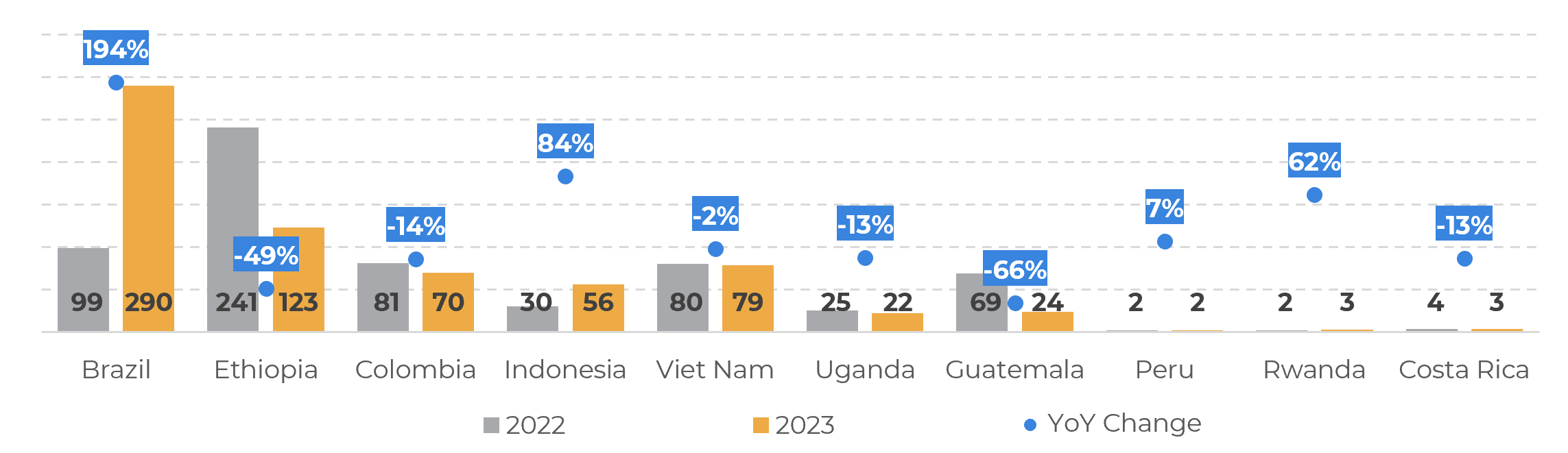

It’s important to note that Brazil has taken Ethiopia’s place as China’s main natural arabica supplier. From the third quarter of 2022 to the third quarter of 2023, Ethiopia’s exports to China dropped by 49%, whereas Brazilian exports to the country increased by 194%.

This move has been mostly due to the spread between the two (Ethiopia’s average natural arabica FOB differential was -3 c/lb in the period, whereas the Brazilian good cup ¾ MTGB 14/16 was averaging -17 c/lb).

This move has been mostly due to the spread between the two (Ethiopia’s average natural arabica FOB differential was -3 c/lb in the period, whereas the Brazilian good cup ¾ MTGB 14/16 was averaging -17 c/lb).

Figure 4: China Coffee Imports – Third Quarter, 2022 and 2023 (‘000 bags)

Source: Trade Map

In Summary

Brazil's coffee exports have surged, reaching 4.3M bags in November, exceeding the average by 1.3M bags (42%). This increase is attributed to higher availability in the 23/24 crop and competitive prices. Despite a decline, the USA remains the leading destination, with 5.47M bags in 2023 (15.63% of the total).

Notably, traditional destinations like Japan show a 22% increase, while China's imports skyrocketed by 221%, making Brazil its primary natural arabica supplier, replacing Ethiopia. This shift is largely due to price differentials, with Brazil offering a more attractive option.

Notably, traditional destinations like Japan show a 22% increase, while China's imports skyrocketed by 221%, making Brazil its primary natural arabica supplier, replacing Ethiopia. This shift is largely due to price differentials, with Brazil offering a more attractive option.

Weekly Report — Coffee

Written by Natália Gandolphi

natalia.gandolphi@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

Reviewed by Victor Arduin

victor.arduin@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.