Dec 22

Coffee Weekly Report - 2023 12 22

Back to main blog page

- The market's path to full carry is intertwined with historical trends, inflation dynamics, public debt, and real rates, shaping its evolving landscape.

- The emergence of the Brazilian 24/25 scenario introduces complexity, with recent weather issues providing a contrast to the medium run potential pressure derived from debt issuance impacts on yields.

- Still, while yields signal a bearish outlook in the medium term, an immediate downward impact on the Dollar Index provides crucial short-term support.

- Navigating this intricate terrain demands a nuanced understanding, emphasizing adaptability to regional dynamics and global indicators. Market participants must remain vigilant to capitalize on emerging opportunities and mitigate risks in this multifaceted environment.

Front-month inversion: macroeconomic factors

The prospect of the market returning to full carry hinges on a multifaceted analysis that considers historical trends and the current macroeconomic context.

Delving into the data from 2002 to 2023, the market last experienced average carry in early 2020, marked by a 9% figure derived by subtracting the first contract from the sixth contract.Understanding this historical perspective is crucial for gauging the potential trajectory of the market.

A pivotal aspect of this analysis is the impact of inflation dynamics on market behavior. Notably, U.S. inflation, which soared to a 20-year high of 9.1% in 2022, has since exhibited a downward trend.

This deceleration in inflation rates prompts a recalibration of expectations regarding the Fed Funds Rate. Projections now point to lower rates persisting throughout 2024.

The inverse relationship between inflation and market dynamics becomes evident as the specter of inflation recedes.

Delving into the data from 2002 to 2023, the market last experienced average carry in early 2020, marked by a 9% figure derived by subtracting the first contract from the sixth contract.Understanding this historical perspective is crucial for gauging the potential trajectory of the market.

A pivotal aspect of this analysis is the impact of inflation dynamics on market behavior. Notably, U.S. inflation, which soared to a 20-year high of 9.1% in 2022, has since exhibited a downward trend.

This deceleration in inflation rates prompts a recalibration of expectations regarding the Fed Funds Rate. Projections now point to lower rates persisting throughout 2024.

The inverse relationship between inflation and market dynamics becomes evident as the specter of inflation recedes.

Figure 1: United States Inflation Rate (%)

Source: Refinitiv

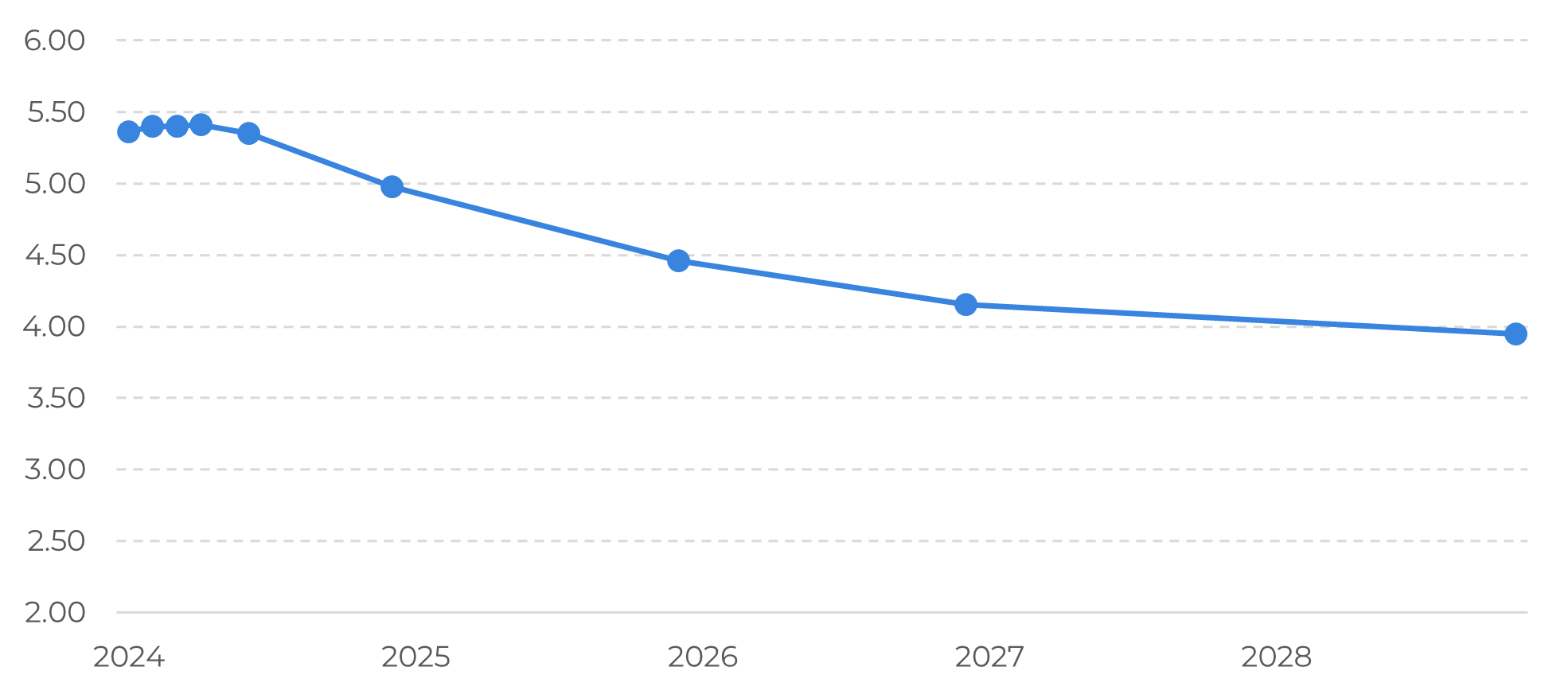

Figure 2: Fed Funds Rate Curve (%)

Source: Refinitiv

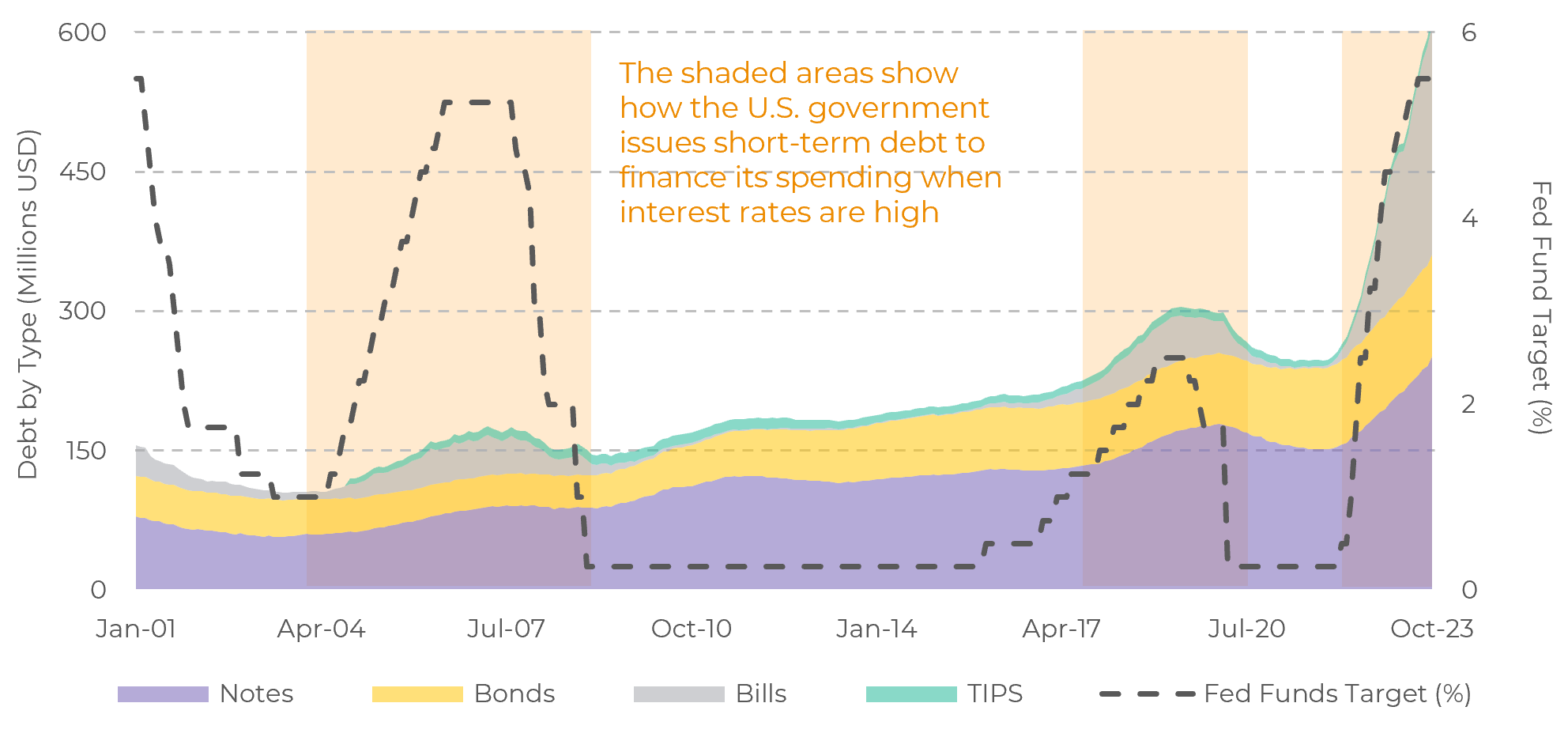

However, a significant short-term obstacle on the horizon relates to the burgeoning public debt and its repercussions on commodity markets. The U.S. Treasury Department, in its perennial quest to minimize the long-term cost of U.S. debt, resorts to issuing short-term debt instruments, such as T-bills, during periods of elevated interest rates.

Even if interest rates undergo a reduction in the upcoming year, the persistently high public deficit will likely demand continued debt issuance. This, in turn, amplifies the overall debt burden on the country, potentially requiring higher market premiums.

Even if interest rates undergo a reduction in the upcoming year, the persistently high public deficit will likely demand continued debt issuance. This, in turn, amplifies the overall debt burden on the country, potentially requiring higher market premiums.

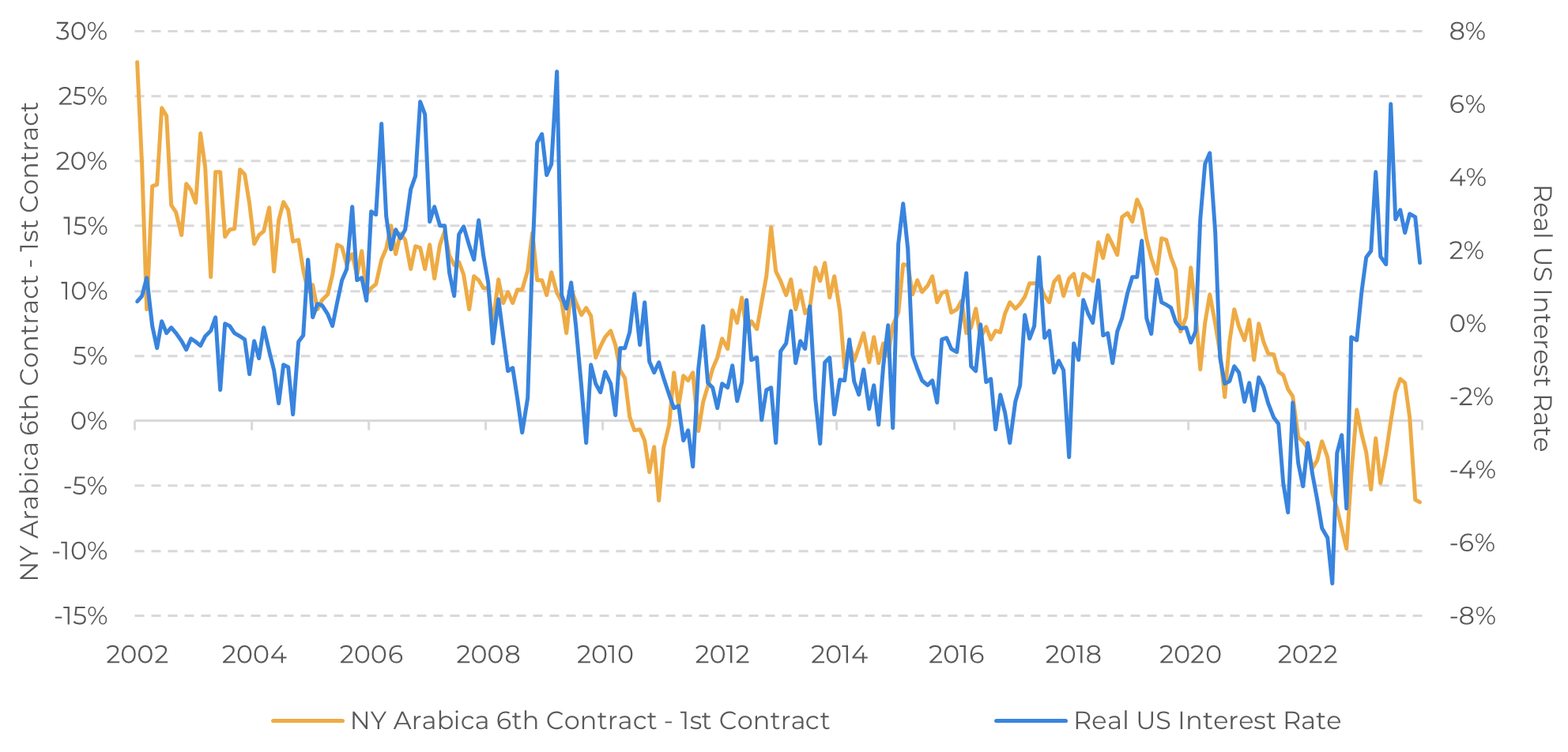

Shifting the focus to the realm of real rates, an examination of spreads reveals a nuanced perspective. Presently, the inversion of spreads is not likely. Drawing on historical correlations, the NY arabica coffee carry has shown a positive relationship with U.S. yields.

However, the delicate balance between debt financing and inflation control introduces complexities. Fundamentals emerge as a dominant factor, emphasizing the intricate interplay of economic forces.

However, the delicate balance between debt financing and inflation control introduces complexities. Fundamentals emerge as a dominant factor, emphasizing the intricate interplay of economic forces.

Figure 3: Federal Debt by Type Versus Federal Fund Target Rate

Source: U.S. Departament of Treasury

Figure 4: NY Arabica 6th Contract – 1st Contract vs. Real US Interest Rate

Source: ICE, Refinitiv, Fred Data

In Summary

In conclusion, the market's journey back to full carry is intricately tied to a confluence of factors. Historical trends, inflation dynamics, public debt considerations, and real rates all contribute to the evolving landscape.

Navigating this complex terrain requires a nuanced understanding of the intricate relationships shaping the market – which, while the Brazilian 24/25 takes shape, will hold a stronger influence over prices.

Yields themselves are a bearish point, especially in the medium run, but in the short run, the immediate downward impact on the Dollar Index provides support.

Yields themselves are a bearish point, especially in the medium run, but in the short run, the immediate downward impact on the Dollar Index provides support.

Weekly Report — Coffee

Written by Natália Gandolphi

natalia.gandolphi@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

Reviewed by Alef Dias

alef.dias@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.