Jan 19

/

Natália Gandolphi

Coffee Weekly Report - 2024 01 19

Back to main blog page

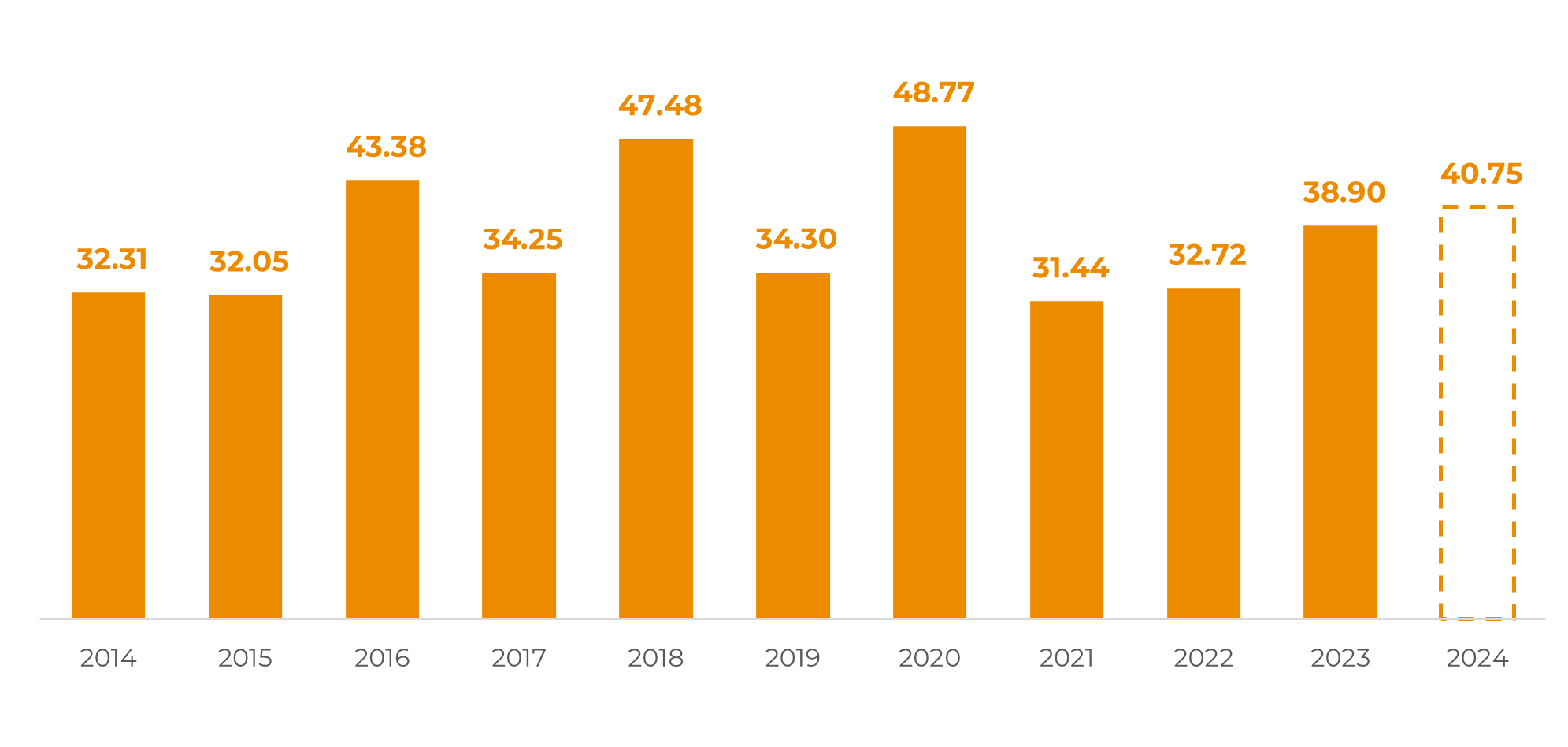

- Conab's 2024 first coffee crop assessment is out: arabica production shows a 4.74% YoY increase, reaching 40.75 million bags, and yields see a 2% improvement. Despite these positive indicators, the volume falls short, 6% below the projected 2024 trend.

- Even with advancements from 2022, yields still lag behind on-year expectations by 10%, prompting a shift in focus towards the 26/27 cycle for a potential record match. This adjustment aligns with a 3% YoY increase in productive coffee-growing areas.

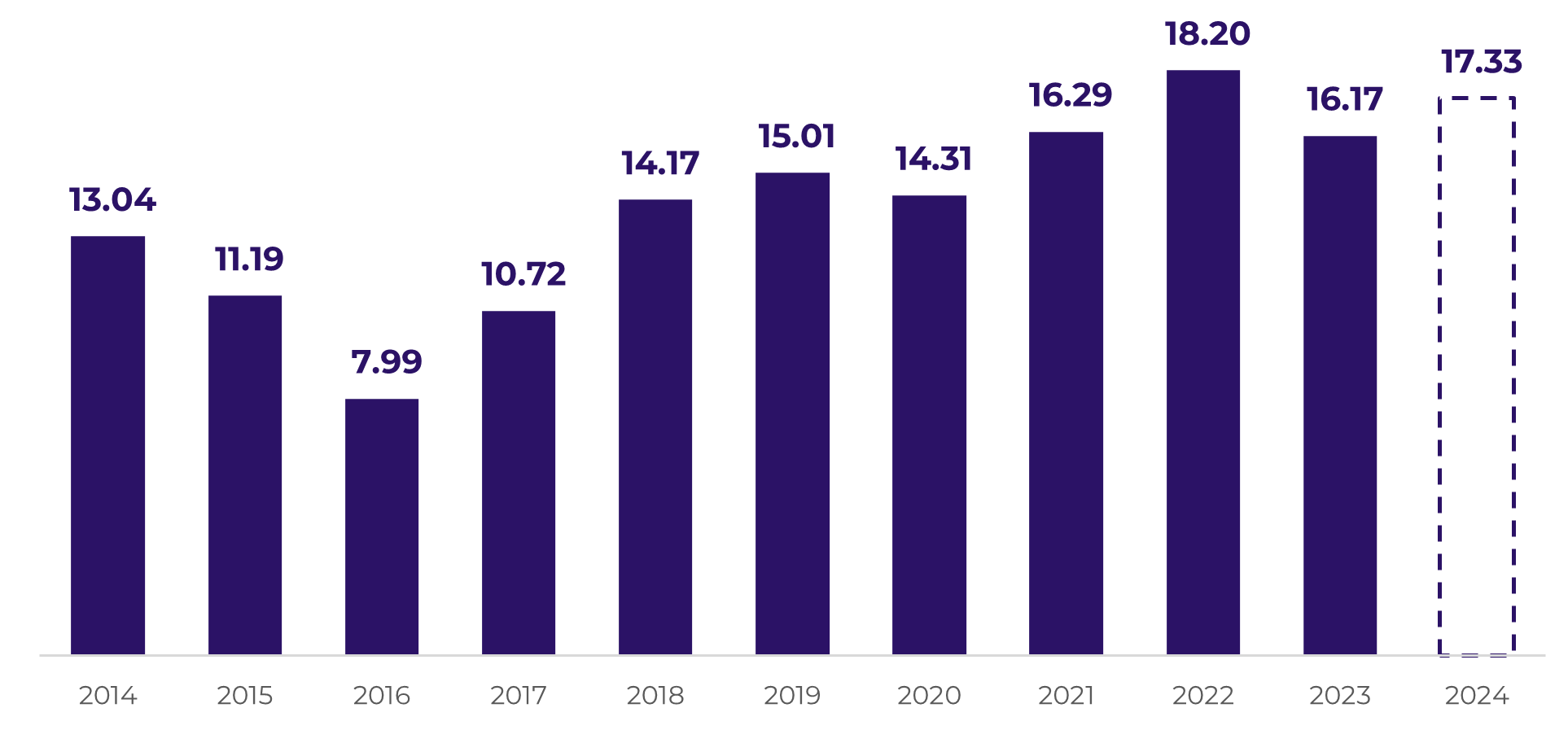

- In the conilon category, an estimated 17.3 million bags signal a 7% YoY rise. Variable rainfall, influenced by El Niño, affected fruiting, yet a slight expansion in cultivated area and overall positive crop development counteract challenges, with isolated cases of diseases being the only – yet not substantial – concern.

Conab’s 2024 Crop Update

Conab recently released its initial assessment of the 2024 coffee crop (24/25 cycle), revealing notable figures for both arabica and conilon varieties.

Arabica production recorded a positive trend with 40.75 million bags, marking a 4.74% increase and 1.84 million bags year-over-year (YoY).

However, when considering on-years for arabica production, the volume falls 6% below the expected trend for 2024 based on Conab's historical series (43.36 million bags). Despite this, it represents an improvement from the 23% decline below the trend observed in 2022.

However, when considering on-years for arabica production, the volume falls 6% below the expected trend for 2024 based on Conab's historical series (43.36 million bags). Despite this, it represents an improvement from the 23% decline below the trend observed in 2022.

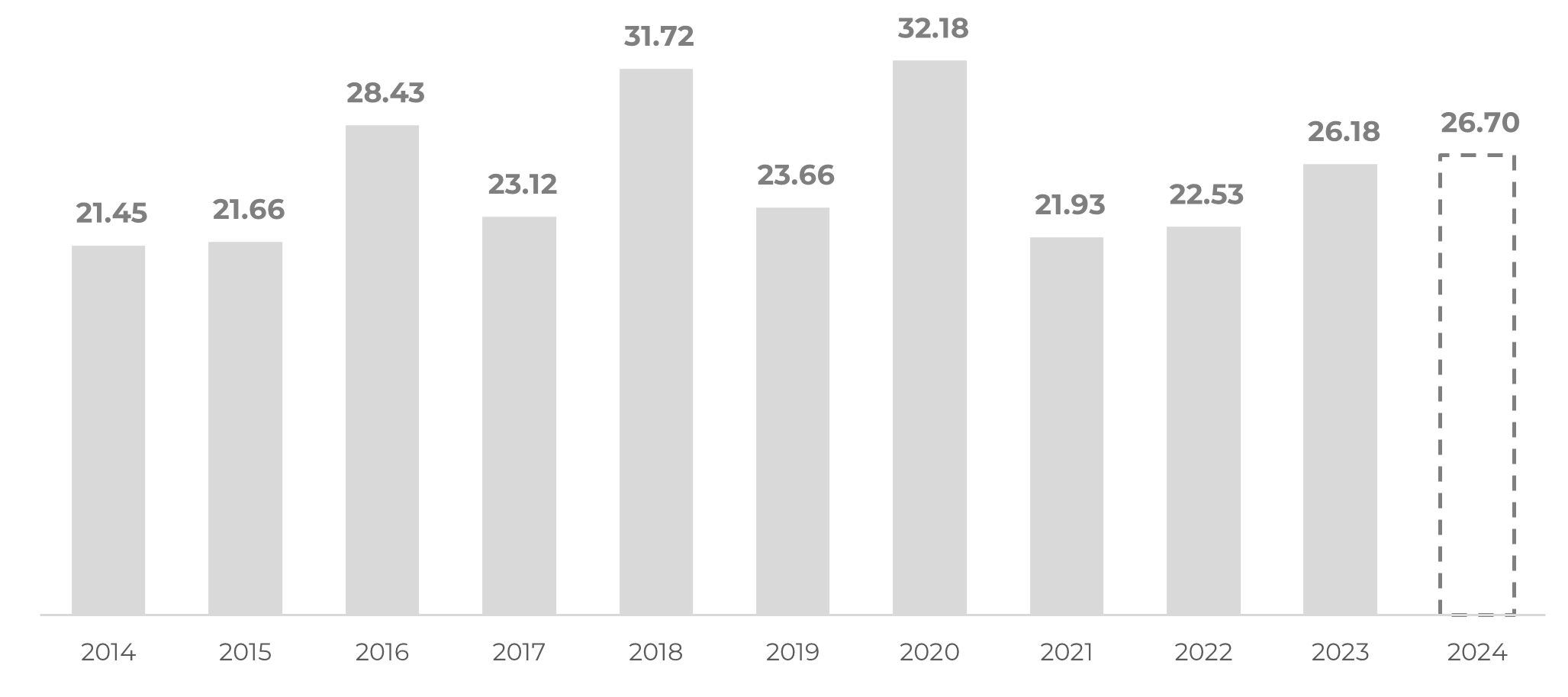

Yields for arabica also experienced a 2% increase, reaching 26.7 bags/ha. Yet, this figure is 10% below the trend for on-years, signaling a gap between actual results and expectations. Additionally, it only slightly exceeds the average expected for an on-year based on data since 2010 (26.3 bags/ha) and is 17% below the historical record reported in 2020 by Conab (32.2 bags/ha).

This suggests that while performance is better than in 2023, it has not fully reached the potential expected for an on-year. Consequently, attention is shifting to the 26/27 cycle to achieve a crop comparable in yield and size to the record set in 2020.

This suggests that while performance is better than in 2023, it has not fully reached the potential expected for an on-year. Consequently, attention is shifting to the 26/27 cycle to achieve a crop comparable in yield and size to the record set in 2020.

Figure 1: Brazilian Arabica Crop – Conab (M bags)

Source: Conab

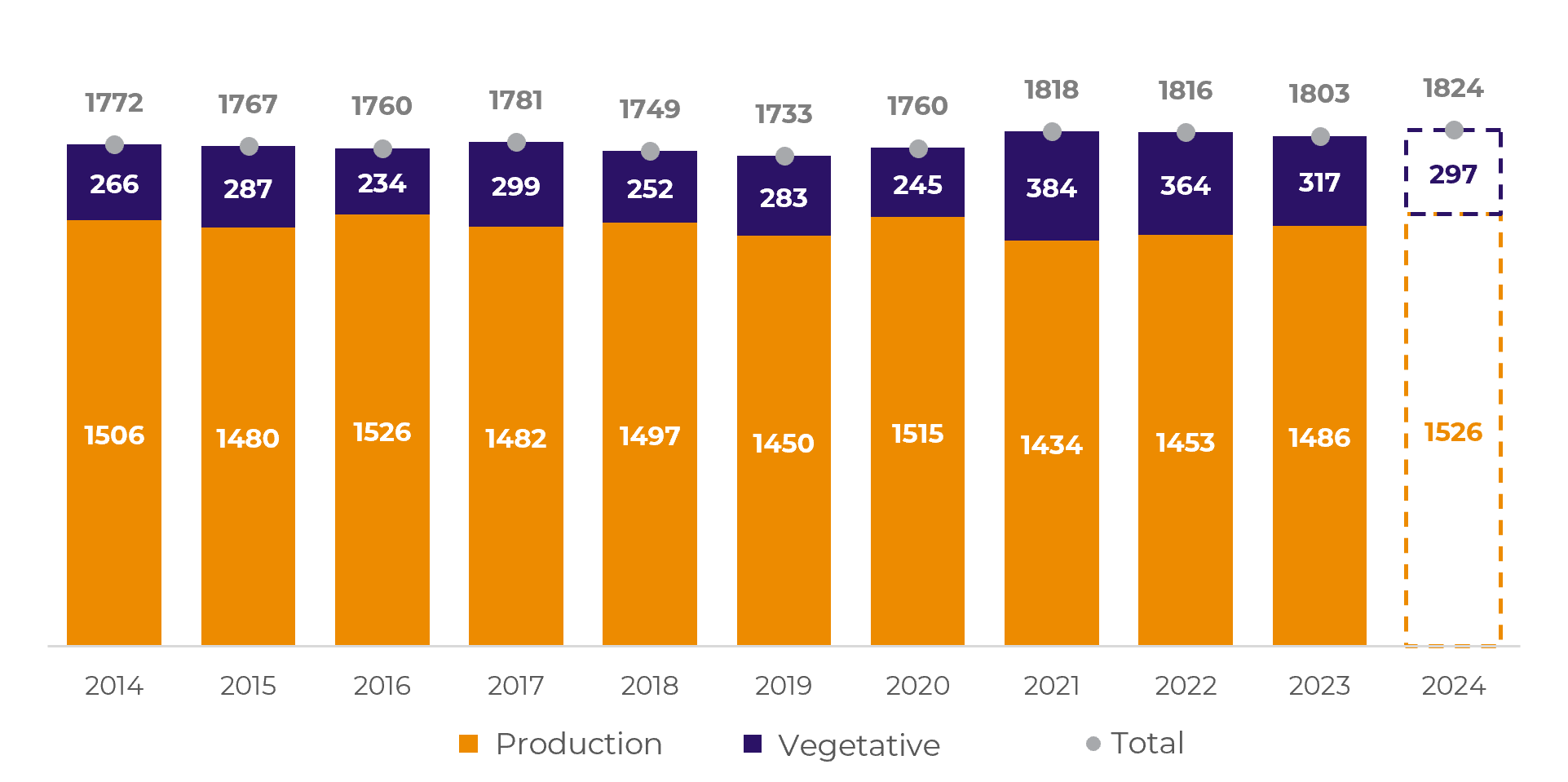

Figure 2: Brazilian Arabica Area – Conab (‘000 ha)

Source: Conab

.

This adjustment is a consequence of the trend in active coffee-growing areas, which saw a 3% YoY increase, reaching 1526 thousand hectares, despite ongoing challenges from irregular weather conditions.

Turning to conilon, despite its controversial market perception, Conab estimates the 2024 crop at 17.3 million bags, a 7% increase from 2023. The report highlights the crop's exposure to fluctuating rainfall influenced by El Niño, with beneficial rains between May and August 2023 aiding post-harvest recovery.

However, a shortage of rainfall from September led to water stress, impacting fruiting. While this cycle didn't incur losses from strong winds, high temperatures caused damage to leaves and roots, affecting photosynthetic potential. Despite these challenges, the initial outlook suggests a slight increase in cultivated area, and overall, the crops are developing well, except for isolated cases of cancro.

Figure 3: Brazilian Arabica Yields – Conab (bags/ha)

Source: Conab

Figure 4: Brazilian Conilon Crop – Conab (M bags)

Source: Conab

In Summary

Conab's 2024 coffee crop assessment reports positive trends: Arabica production rose 4.74% YoY to 40.75 million bags, with a 2% increase in yields. However, it falls 6% below the expected trend for 2024. Despite improvements from 2022, yields remain 10% below on-year expectations, prompting attention towards the 26/27 cycle for a record match.

This adjustment is attributed to a 3% YoY increase in productive coffee-growing areas. For conilon, estimated at 17.3 million bags, a 7% YoY increase, the crop faced variable rainfall due to El Niño, impacting fruiting. Despite challenges like high temperatures causing damage, there is a slight increase in cultivated area, with positive overall crop development, except for isolated cases of diseases.

Weekly Report — Coffee

Written by Natália Gandolphi

natalia.gandolphi@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

Reviewed by Lívea Coda

livea.coda@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.