Feb 9

/

Natália Gandolphi

Coffee Weekly Report - 2024 02 09

Back to main blog page

- El Niño impacted Brazil's coffee-producing regions in Q4/2023, causing unprecedented temperatures and irregular rainfall, raising uncertainty regarding the 24/25 crop output.

- In South Minas Gerais, record-high temperatures persisted despite the El Niño subsiding in early 2024, posing ongoing challenges for coffee cultivation. Still, water reserves helped maintain average year-end levels.

- Cerrado faced low rainfall and 10-year high temperatures throughout 2023. As 2024 began, optimism waned with cumulative rainfall levels reported 30% below normal, setting a less optimistic tone for the upcoming crop cycle.

- Espírito Santo, heavily impacted by El Niño, faced high temperatures and record-low cumulative rainfall by the end of 2023. Concerns for 2024 center on low rainfall levels, potentially hindering the 24/25 conilon crop despite a slight improvement in early 2024.

Recent El Niño Impacts in Brazil

The coffee industry faced weather anomalies in the last quarter of 2023, largely influenced by the El Niño pattern that dominated the main coffee producing regions in Brazil. Unprecedented temperatures and irregular rainfall characterized this period, impacting production and creating a ripple effect on the coffee market.

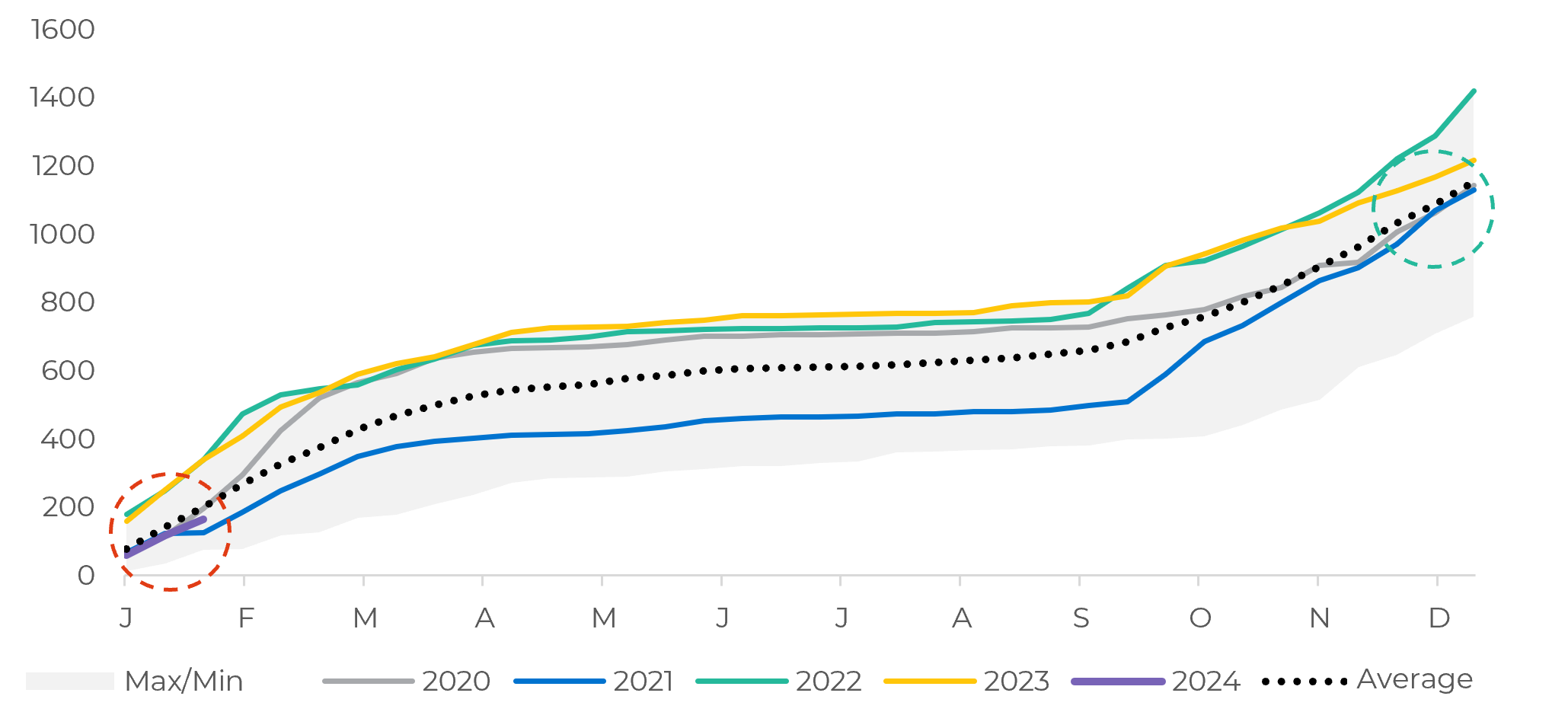

In South Minas Gerais, temperatures soared to record levels, disrupting the usual climate patterns. Despite the El Niño pattern subsiding by the beginning of 2024, temperatures remained above average, posing a continued challenge for coffee cultivation. The water reserves built in 2023 helped alleviate the impact of lower rainfall in November and December, maintaining average year-end levels. However, the outlook for 2024 is concerning, with rainfall levels currently reported to be below average, adding pressure to an already precarious situation.

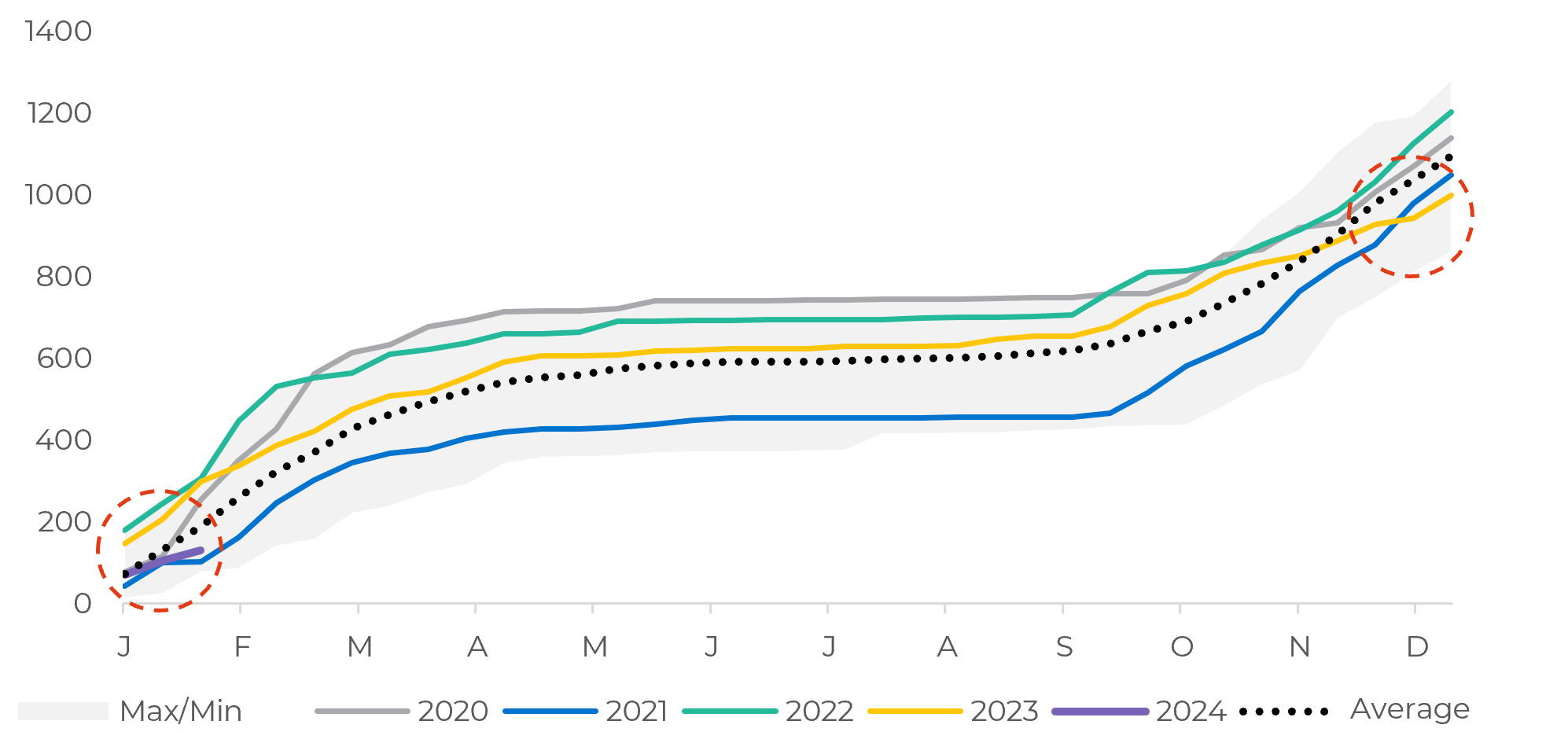

Cerrado faced a different set of challenges, experiencing consistently lower rainfall throughout the year. By the last quarter, cumulative rainfall volumes were already below those recorded in 2021. Coupled with temperatures at a 10-year high, the region faced increased pressure on coffee production. As the new year began, optimism was scarce, with cumulative rainfall levels reported to be 30% below normal, setting a less optimistic tone for the upcoming crop cycle when compared to the post-flowering period.

Figure 1: Cumulative Precipitation (mm) – SMG

Source: USDA

Figure 2: Cumulative Precipitation (mm) – Cerrado

Source: USDA

.

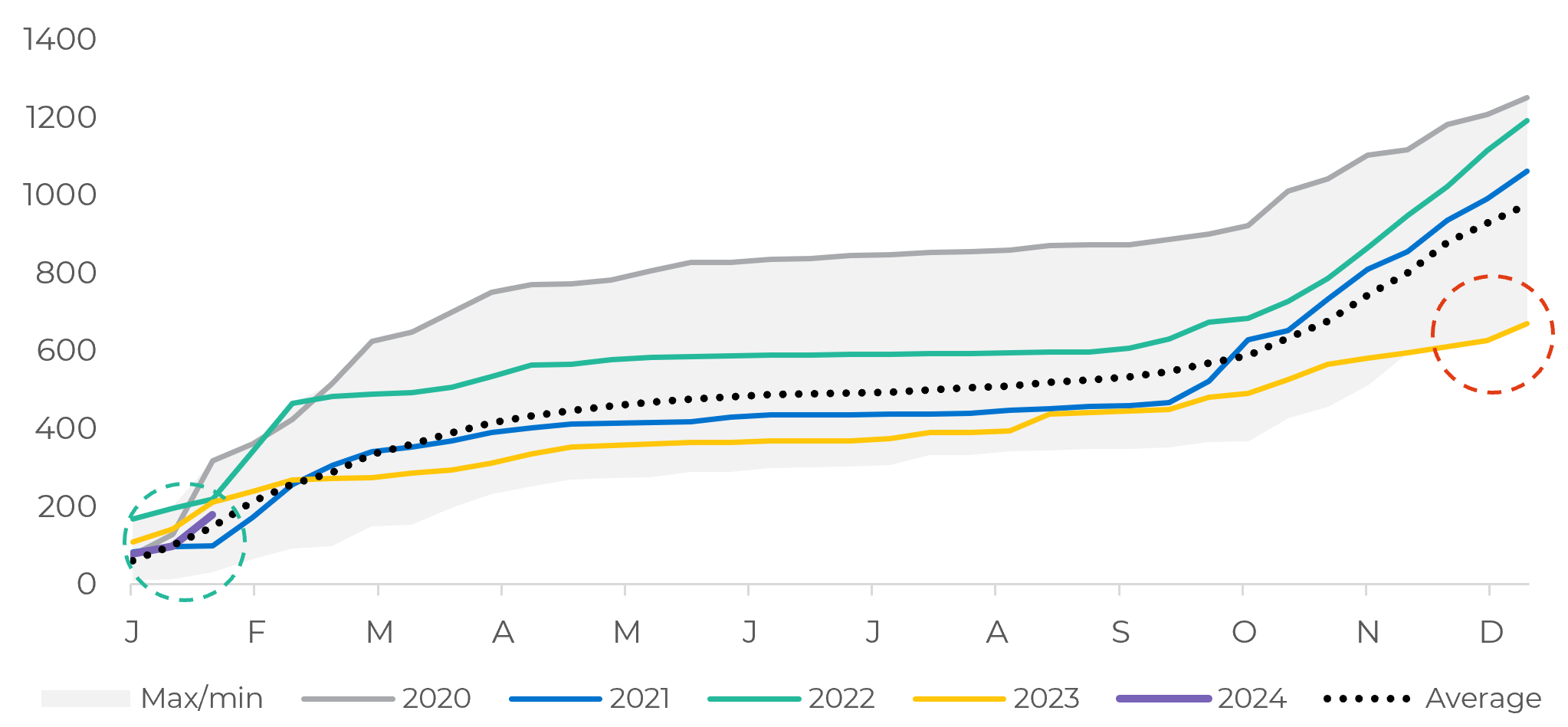

The proximity to Espírito Santo exposed ZMT to the impact of El Niño, with consistently below-average rainfall in the last quarter of 2023. Although the region experienced a shorter period of extreme temperatures, concerns for 2024 primarily revolve around low rainfall levels, despite a subsiding of temperatures. These conditions may hinder the 24/25 crop from surpassing the record set in previous crops.

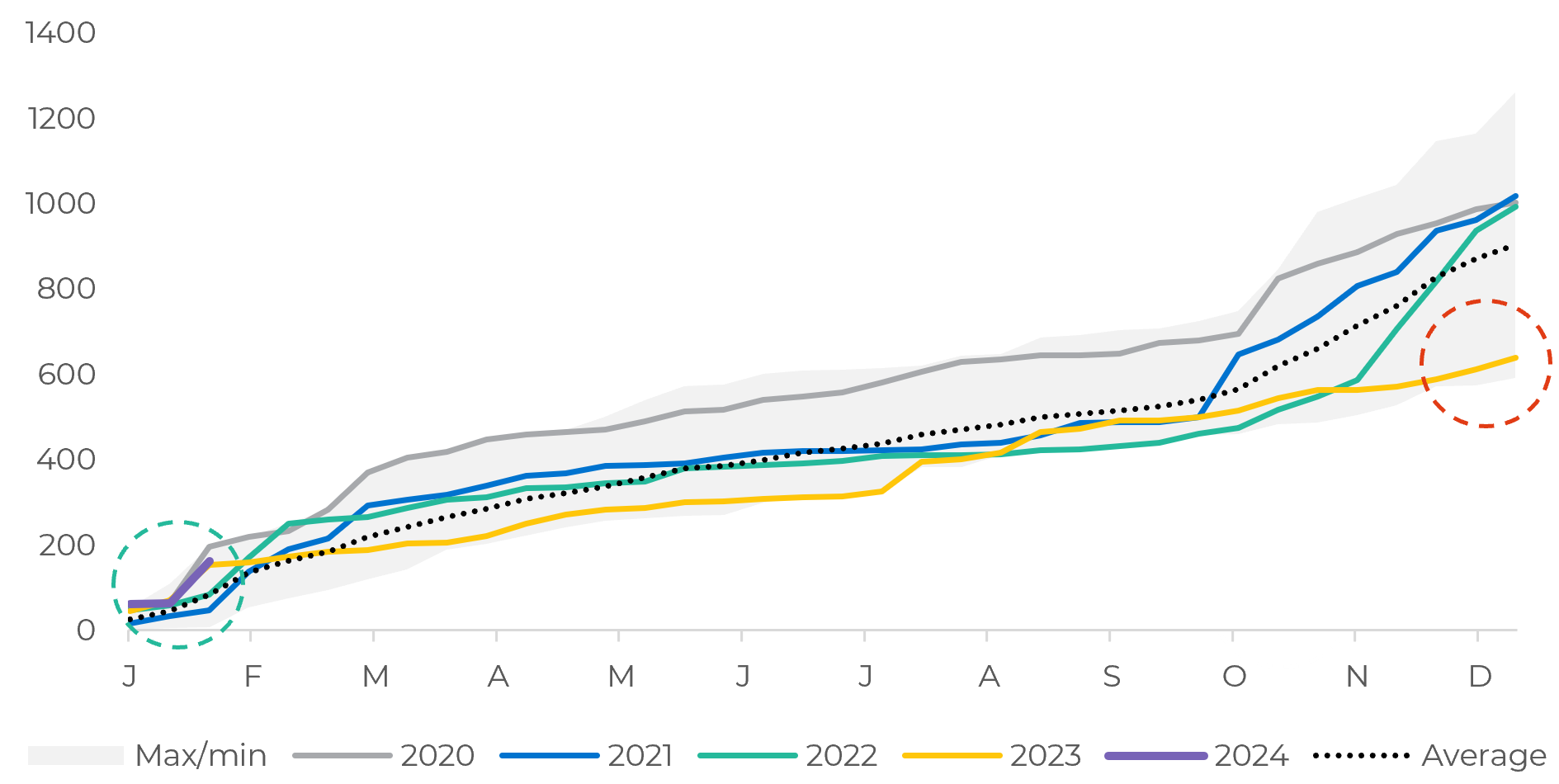

Espírito Santo bore the brunt of El Niño during the last quarter of 2023, with persistently high temperatures in January exacerbating the situation. Record-low cumulative rainfall figures by the end of 2023 cast a shadow over Brazil's 24/25 conilon crop, despite a slight improvement in the beginning of 2024.

Despite varying production profiles across regions, the cumulative rainfall levels in 2023 partially offset the impact of lower rains in Q4, leading to an overall average year-end scenario. However, the focus now shifts to 2024, where January rainfall levels remained below average, echoing the challenges faced in 2021.

Figure 3: Cumulative Precipitation (mm) – Zona da Mata

Source: USDA

Figure 4: Cumulative Precipitation (mm) – Espírito Santo

Source: USDA

In Summary

As the industry grapples with these weather-induced challenges, the market is marked by both bullish and bearish points. The warm and dry weather in Brazil during Q4/23, potential production reduction, as well as some demand markers analyzed in our previous reports contribute to a bullish sentiment. Still, the 24/25 crop in Brazil can surprise positively, according to each regions’ rainfall patterns throughout the year, and the recent recovery in the first weeks of January.

Weekly Report — Coffee

Written by Natália Gandolphi

natalia.gandolphi@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

Reviewed by Lívea Coda

livea.coda@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.