Feb 16

/

Natália Gandolphi

Coffee Weekly Report - 2024 02 16

Back to main blog page

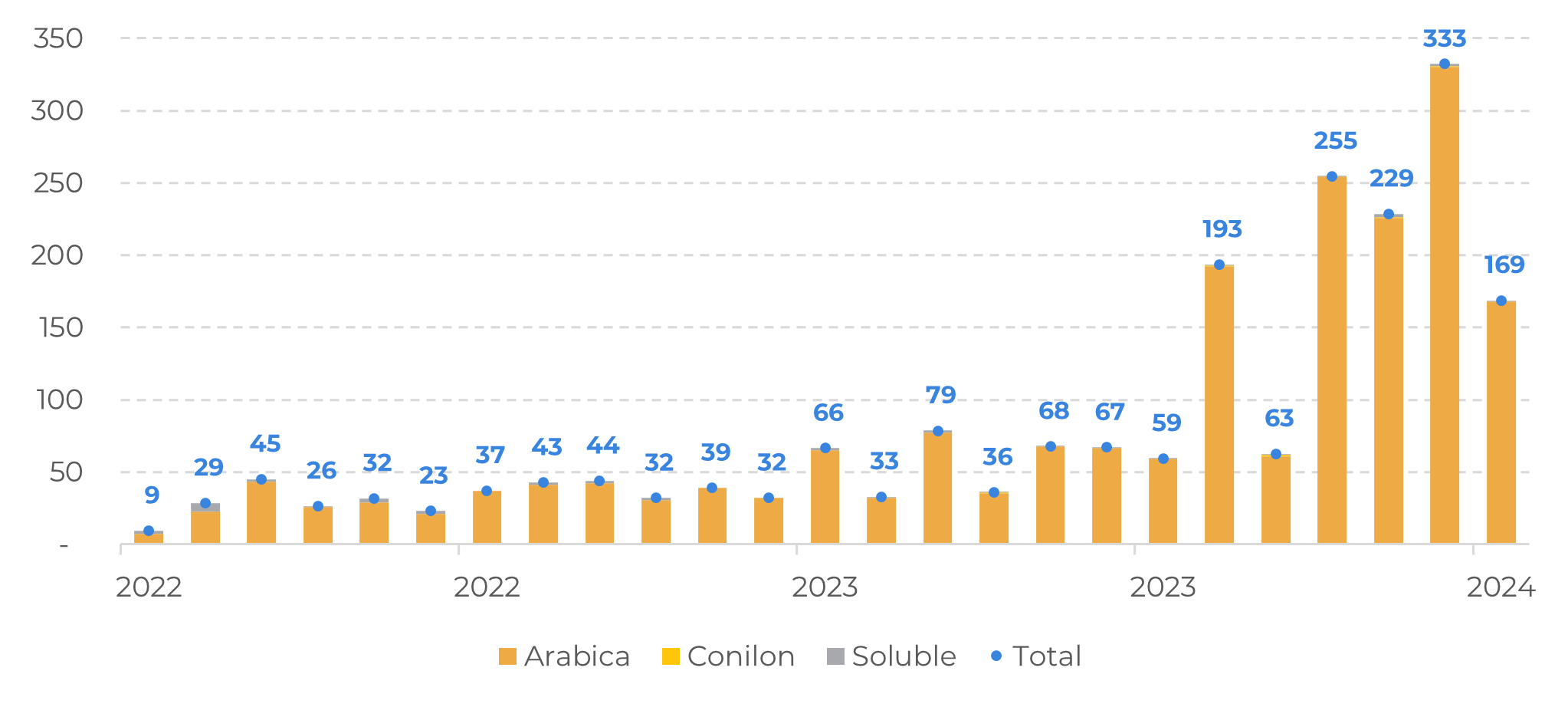

- Recent export data reveals China as a key importer of Brazilian coffee, maintaining its 6th position in January.

- Despite constituting 4% of Brazil's coffee exports, China's import surge, initiated in the second half of 2023 by diverting imports from Ethiopia, poses a challenge to traditional destinations. This shift is driven by differentials and positions China as a potential major coffee destination over the next years.

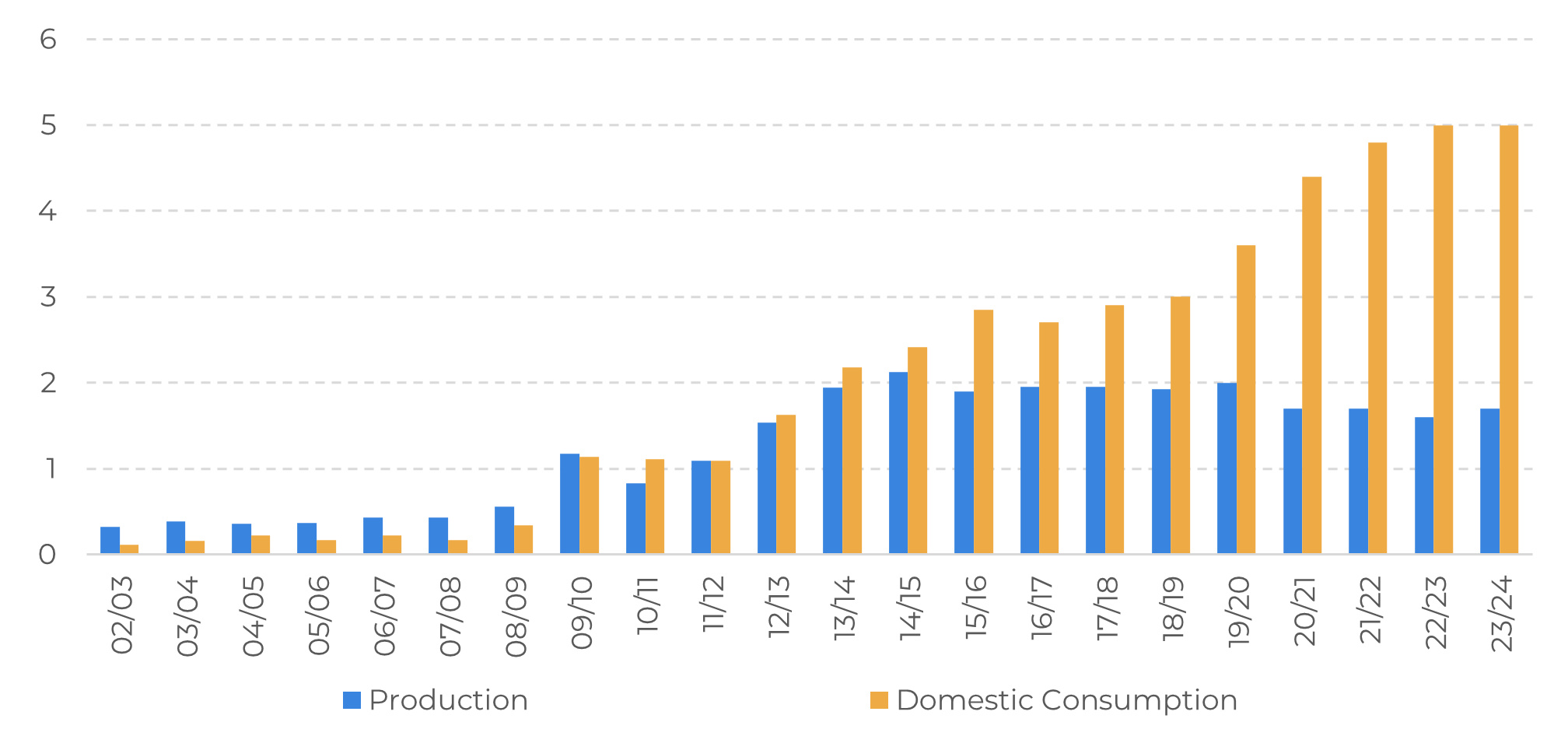

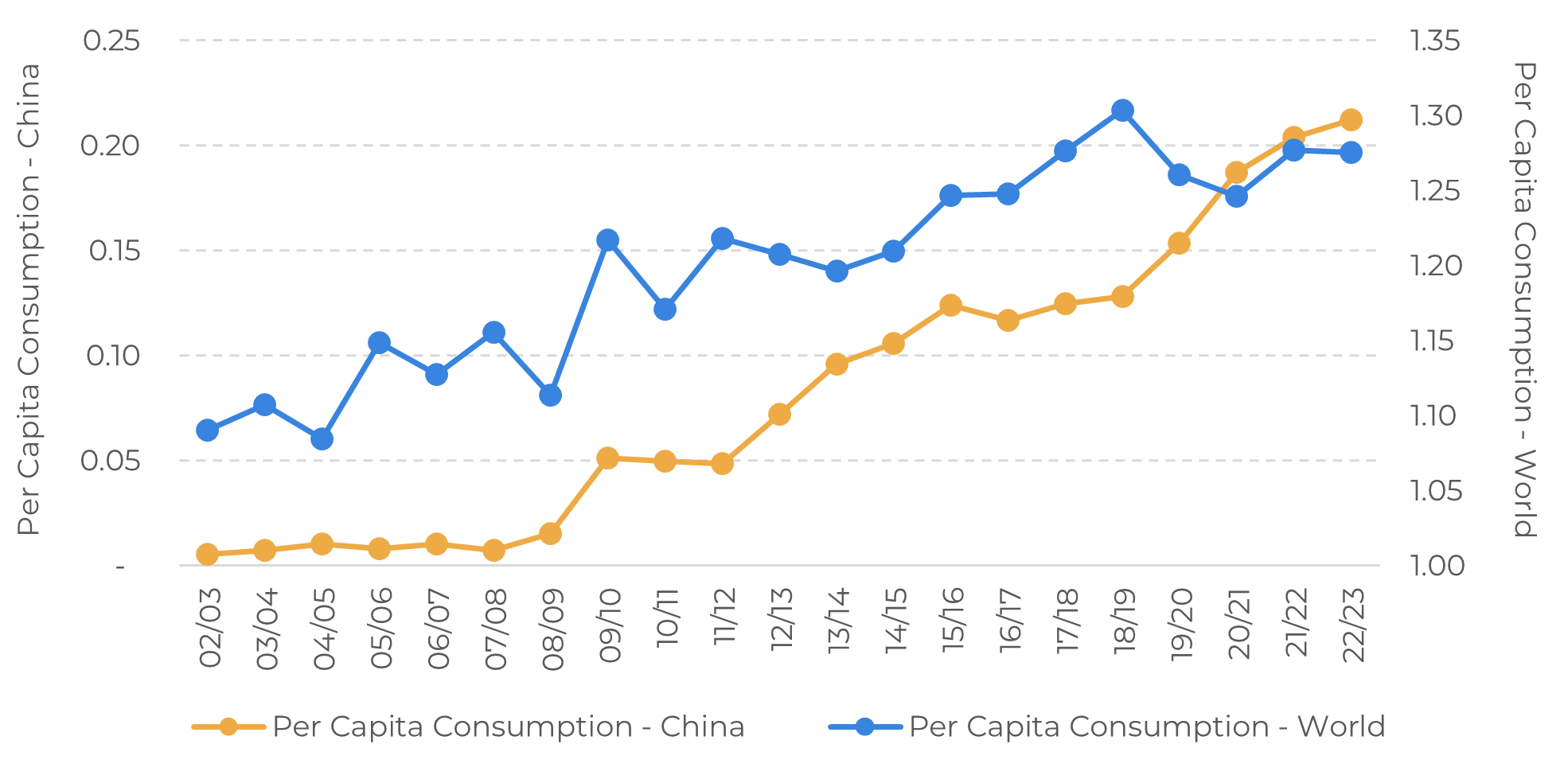

- Factors influencing China's coffee market include a production shift to net importing since the 10/11 cycle and low per capita consumption (0.21kg annually) compared to the global average (1.3kg).

- Chinese supply and demand dynamics strengthen with predominant arabica production, a close 50/50 split in internal consumption between roast & ground and soluble coffee, and potential global ranking growth if +12% per capita consumption growth is sustained. Still, cultural barriers, such as the competition with tea tradition, add complexity to comparisons.

China Brews Change: Coffee Import Surge

With the recent release of export data from Brazil, China is emerging as a significant importer of Brazilian coffee, maintaining its 6th position in January, consistent with its ranking at the end of 2023. This report delves into the essential aspects of China's coffee market, shedding light on anticipated long-term shifts based on the country's past trends over the last 5 years.

At present, China constitutes 4% of Brazil's coffee exports, in contrast to the U.S. at 15% and Japan at 6%. The surge in China's coffee imports began in the latter half of 2023, initially driven by a diversion of imports from Ethiopia due to differentials, as discussed in previous reports. Still, the country is almost evenly matched with Japan, one of the main traditional coffee destinations, and is yet to be considered as a main destination itself – why is that?

First, it is crucial to consider China's production trend. Until approximately the 12/13 cycle, the country maintained a relatively balanced output and consumption, even though its coffee imports were smaller. China initially became a net importer in the 10/11 cycle. Second, and perhaps most importantly, per capita coffee consumption in China is comparatively low. On average, an individual in China consumes 0.21kg of coffee annually. In contrast, the global average is 1.3kg per person per year, marking a six-fold difference between China and the global average.

Figure 1: Brazil Coffee Exports to China (‘000 bags)

Source: USDA

Figure 2: Production and Consumption in China (M bags)

Source: USDA

.

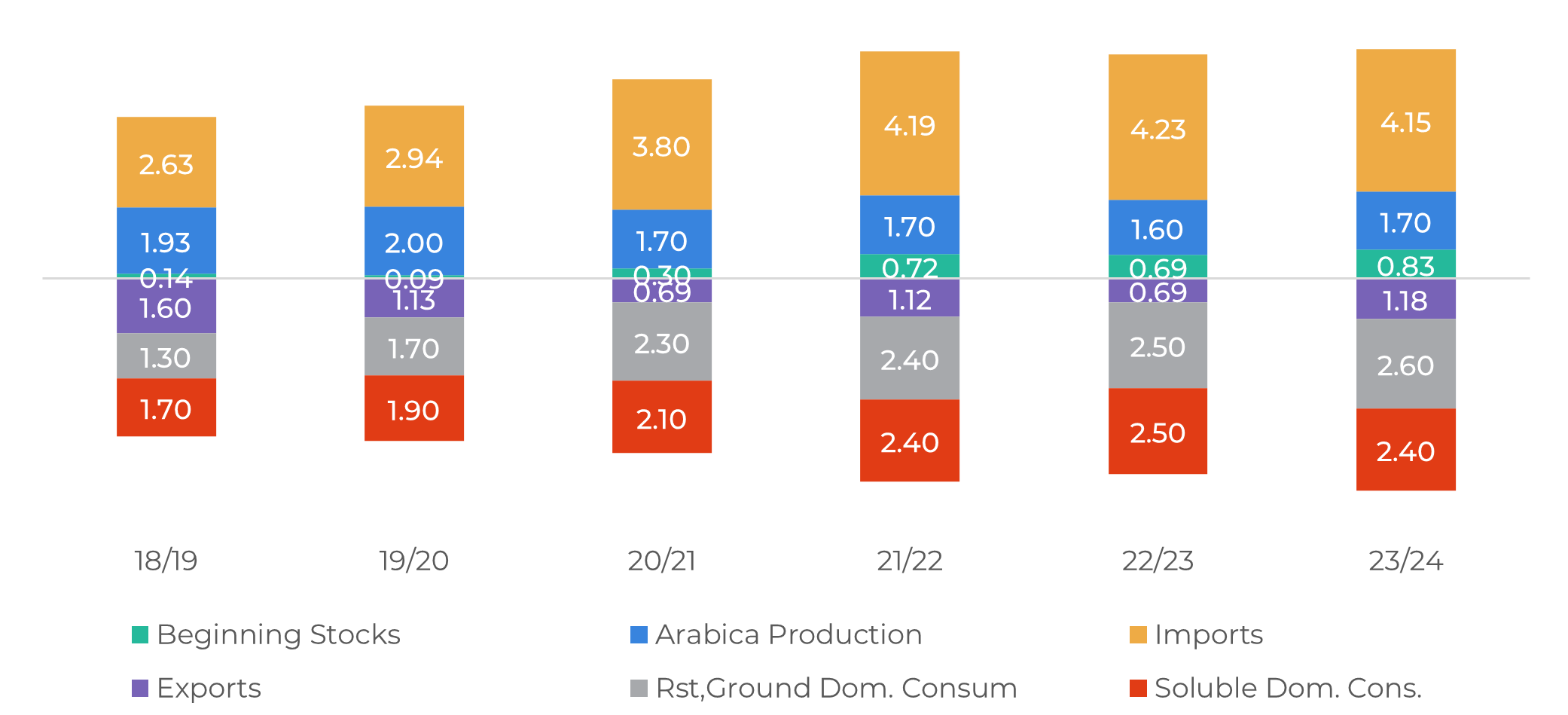

In recent years, the Chinese supply and demand (S&D) dynamics have strengthened considerably, despite a production growth rate that lags behind the escalating demand. China predominantly produces arabica coffee, amounting to just under 2 million bags. While there is a small portion designated for re-exports, the majority of the supply is domestically consumed.

This internal consumption is evenly split between roast and ground (R&G) and soluble coffee, maintaining a close 50/50 division in recent years. Interestingly, non-traditional coffee destinations typically favor soluble or instant coffees over R&G. For instance, according to USDA data, soluble coffee represents 5% of consumption in the European Union and 3% in the United States.

This internal consumption is evenly split between roast and ground (R&G) and soluble coffee, maintaining a close 50/50 division in recent years. Interestingly, non-traditional coffee destinations typically favor soluble or instant coffees over R&G. For instance, according to USDA data, soluble coffee represents 5% of consumption in the European Union and 3% in the United States.

If China maintains its average growth in per capita consumption (+12% YoY, in contrast to the global average of +0.5%), the country could potentially secure the 5th rank in global coffee consumption. This would place China behind the European Union as a bloc, the United States, Brazil, and Japan (at between 6.5M and 7.5M bags).

However, if China were to reach per capita consumption levels equivalent to the global average, it might only trail the European Union as a bloc in coffee demand, projected to exceed 33 million bags. Still, it is essential to acknowledge a cultural barrier for coffee consumption in China, where the well-established tradition of tea consumption competes. Therefore, any comparison relies on subjective factors beyond the quantitative measures explored in this analysis.

Figure 3: Coffee S&D – China (M bags)

Source: USDA

Figure 4: Per Capita Consumption – China and World (kg/person/year)

Source: USDA

In Summary

The recent export data from Brazil reveals China's emergence as a notable importer of Brazilian coffee, maintaining its 6th position in January. Despite constituting 4% of Brazil's coffee exports, a surge in imports started in late 2023.

China's production trend, shifting to a net importer since the 10/11 cycle, and low per capita consumption of 0.21kg annually, compared to the global average of 1.3kg, also influence the dynamic.

The Chinese supply and demand dynamics strengthen, primarily producing arabica, with internal consumption split between roast & ground and soluble coffee. If China sustains its +12% per capita consumption growth, it may rank 5th globally, but cultural barriers, competing with tea tradition, add complexity to comparisons.

Weekly Report — Coffee

Written by Natália Gandolphi

natalia.gandolphi@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

Reviewed by Pedro Schicchi

pedro.schicchi@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.