Mar 8

/

Natália Gandolphi

Coffee Weekly Report - 2024 03 08

Back to main blog page

- This week's macroeconomic events, particularly the release of U.S. non-farm payrolls and unemployment data, impacted commodity prices, notably affecting coffee.

- Although hiring in the U.S. labor market remained steady, the unemployment rate rose to a 2-year high. Despite positive non-farm payroll results for February, revisions from December and January, along with concerns about inflation, contributed to the trend.

- The upcoming release of Consumer Price Index (CPI) figures will be crucial, with a 78% probability of a Fed rate cut by June. Coffee prices, especially arabica, experienced a decline due to caution regarding labor market figures, technical markers, and the impact of a weakened Brazilian currency.

- The tight coffee market, coupled with contrasting origin and destination conditions, leaves it vulnerable to further corrections based on economic trends.

Macroeconomic impacts on coffee prices

This week’s macroeconomic events wreaked havoc over commodity prices, and coffee was one of the main commodities affected. This Friday (08), U.S. non-farm payrolls and unemployment data were released, showing that while hiring remained at a steady pace – suggesting that there is still resilience in the U.S. labor market – the unemployment rate has spiked to a 2-year high. In this report, we will look at the data for the American economy, and its possible impacts on coffee prices.

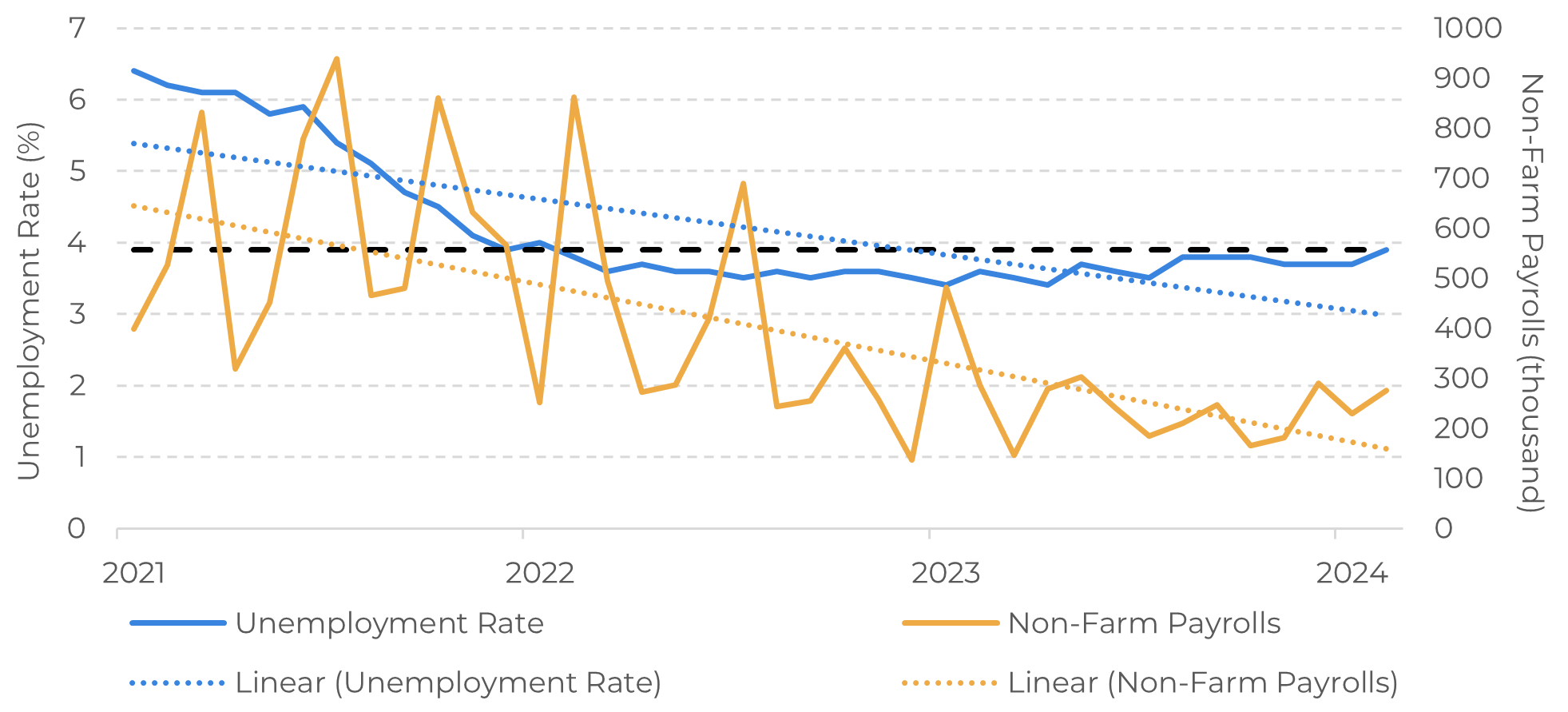

First, the results themselves. Figure 1 shows the unemployment rate and the non-farm payrolls since 2021. Even though both series are trending lower when compared to 3 years ago, markets agree that the U.S. labor market has been the central piece in the sticky inflation puzzle. Ultimately, while non-farm payrolls for February surpassed expectations (275K vs. the expected 200K), December and January results were revised lower (a combined 167K reduction), and the higher unemployment rate does corroborate the sentiment from the payrolls adjustment.

Still, the story develops next week, with the release of CPI figures on Tuesday (12). It will be the first of the three releases expected until Fed’s June meeting, with a combined probability of 78% of a cut in the Fed’s target rate (vs. the 25.7% combined probability of a cut in May, and a solid bet on unchanged rates for the upcoming meeting on March 20).

Figure 1: U.S. Unemployment Rate and Non-Farm Payrolls

Source: Refinitiv

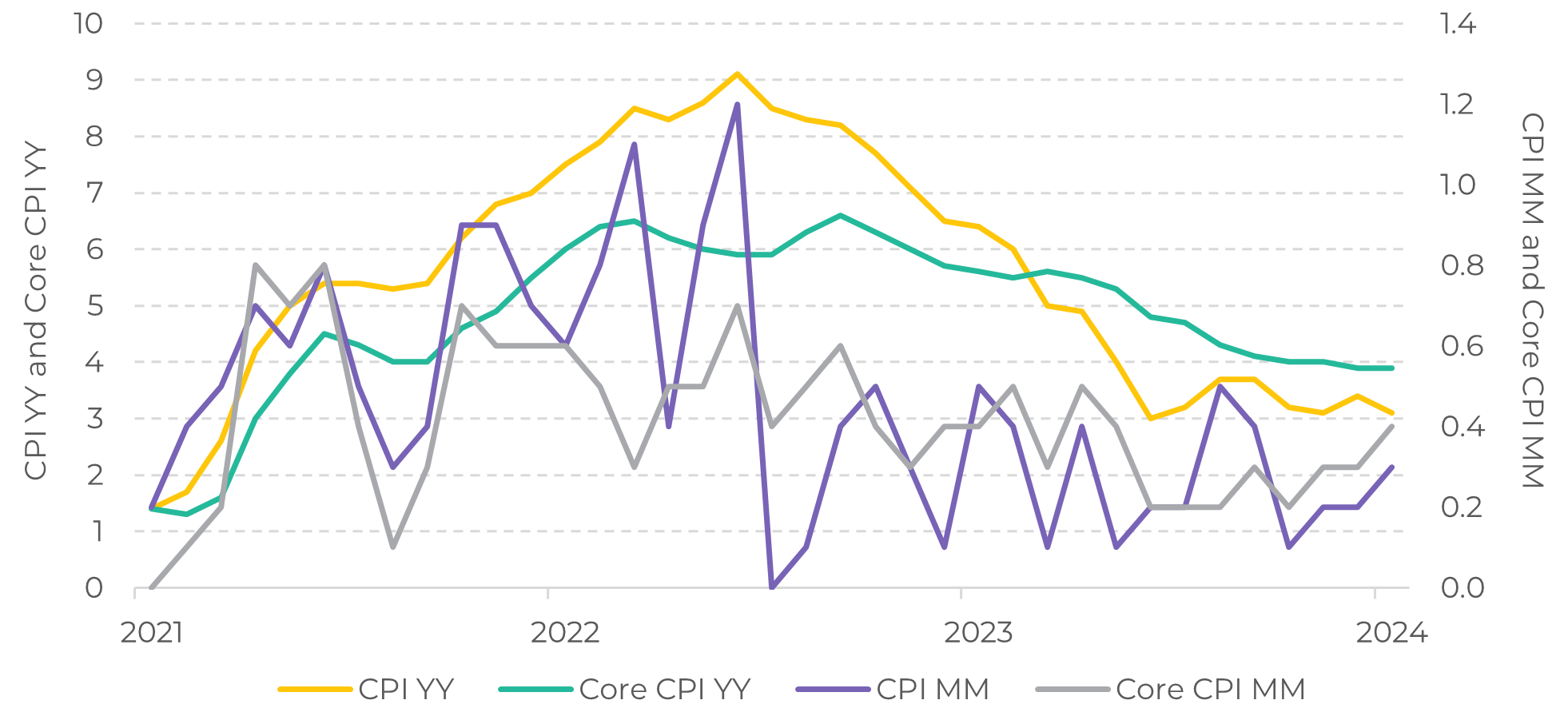

Figure 2: U.S. Consumer Price Index

Source: Refinitiv

For reference, the month-over-month CPI is expected at 0.4%, already a small increase when compared to the last result (0.3%), and the yearly figure is currently expected at 3.1%, unchanged from the previous result. It’s important to note that the monthly figures are showing more resilience, since in the yearly comparison some components have applied less pressure (such as energy and food items).

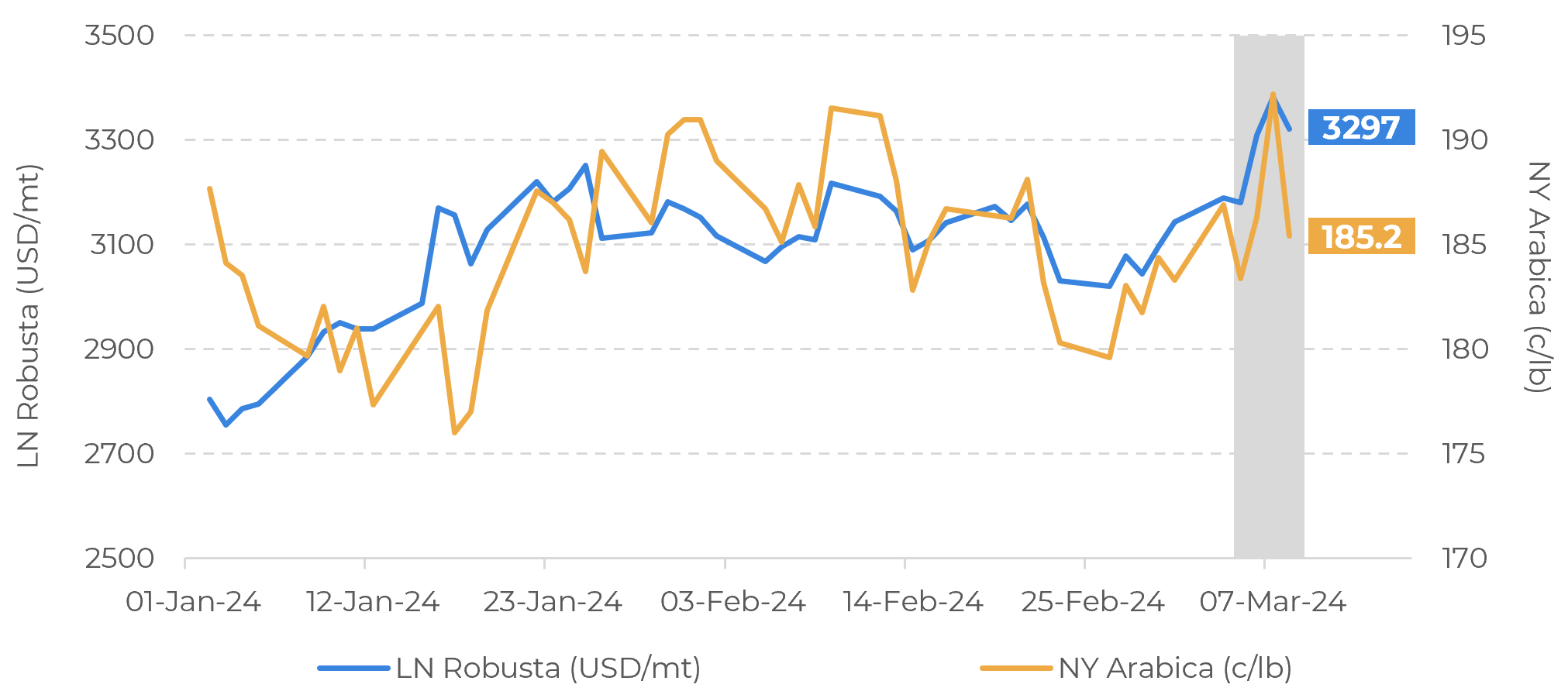

Still, alongside a correction from Thursday’s close, results knocked coffee over, especially arabica. The second contract had settled at 192.20 c/lb, the highest since December 2023, but there is also a technical component to it: a medium-term resistance at 192.10 c/lb. With the combined elements of caution regarding U.S. labor market figures and technical markers, coffee prices responded negatively.

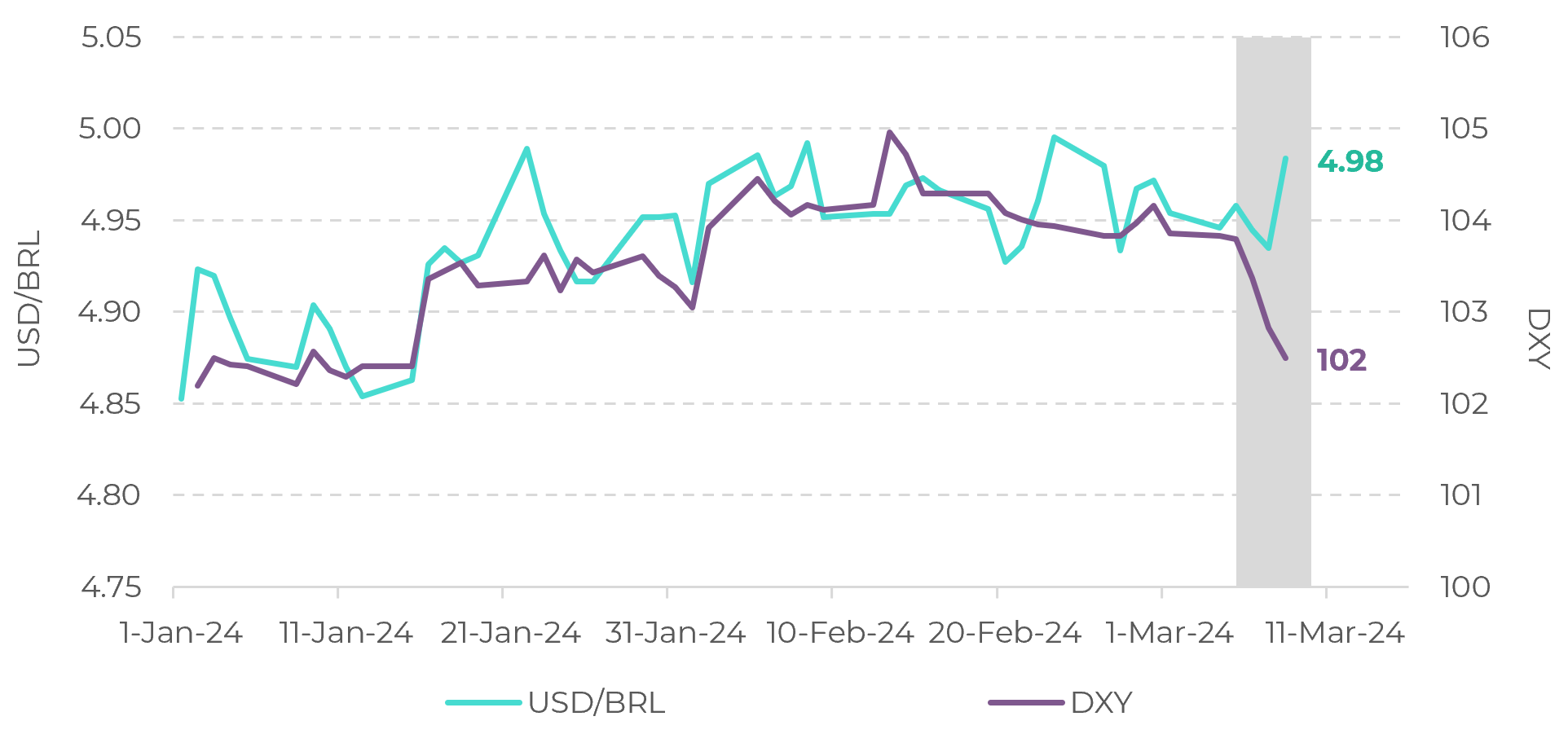

Arabica received the brunt of it, but not without reason. Figure 4 shows the daily settlements for the Dollar Index and the USD/BRL exchange rate. The Brazilian currency lost some ground, reflecting internal expectations – namely, public spending discussions impacting this year’s balance, as well as poorer results from Petrobras. Therefore, a higher pressure for arabica when compared to robusta.

Figure 3: LN Robusta and NY Arabica – 2nd Contract

Source: ICE, Refinitiv

Figure 4: Dollar Index and USD/BRL Exchange Rate

Source: Refinitiv

In Summary

This week has been all about macroeconomic results, with some spillover in commodities markets, especially coffee. Fundamentally, as highlighted in past reports, the market remains tight in destinations, while origins are either fresh with new 23/24 supplies, counting on ample stocks from the previous cycle, or a combination of both – creating a contrast that leaves the market vulnerable to the same trend of corrections as seen this week.

U.S. inflation data will be watched closely by the market, since it will dictate the probability of rate cuts in the next Fed meetings. It’s also important to note that while this week’s results were slightly bearish for coffee prices, the definition of further pressure over prices will depend on how much these labor results will translate into inflationary pressures.

Weekly Report — Coffee

Written by Natália Gandolphi

natalia.gandolphi@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

Reviewed by Victor Arduin

victor.arduin@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.