Apr 26

/

Natália Gandolphi

Coffee Weekly Report - 2024 04 26

Back to main blog page

- This report analyzes the current weather situation in Vietnam and its impact on the 24/25 crop. It highlights the relationship between rainfall and yields, with correlation peaking in July. April is crucial for observing changes in rainfall as it marks the start of the rainy season, which influences the flowering stage.

- Current rainfall levels in the Central Highlands are only a third of expected volumes, which is not the lowest in the past decade. In 2014, the region experienced just 13% of normal levels, indicating potential for more severe deficits.

- If the current trend continues, the 24/25 crop could be threatened by inconsistent rainfall. Historical data suggests a potential 2% decrease in yields for the 24/25 cycle compared to the 23/24 cycle, if the situation persists.

- However, rainfall forecast models suggest improvement over the next two weeks, offering potential for recovery, emphasizing the importance of monitoring precipitation levels and their effect on crop development.

Weather in Vietnam: What are the potential damages?

In this report, we will analyze the current weather situation in Vietnam, observing the possible impacts for the development of the 24/25 crop in the country.

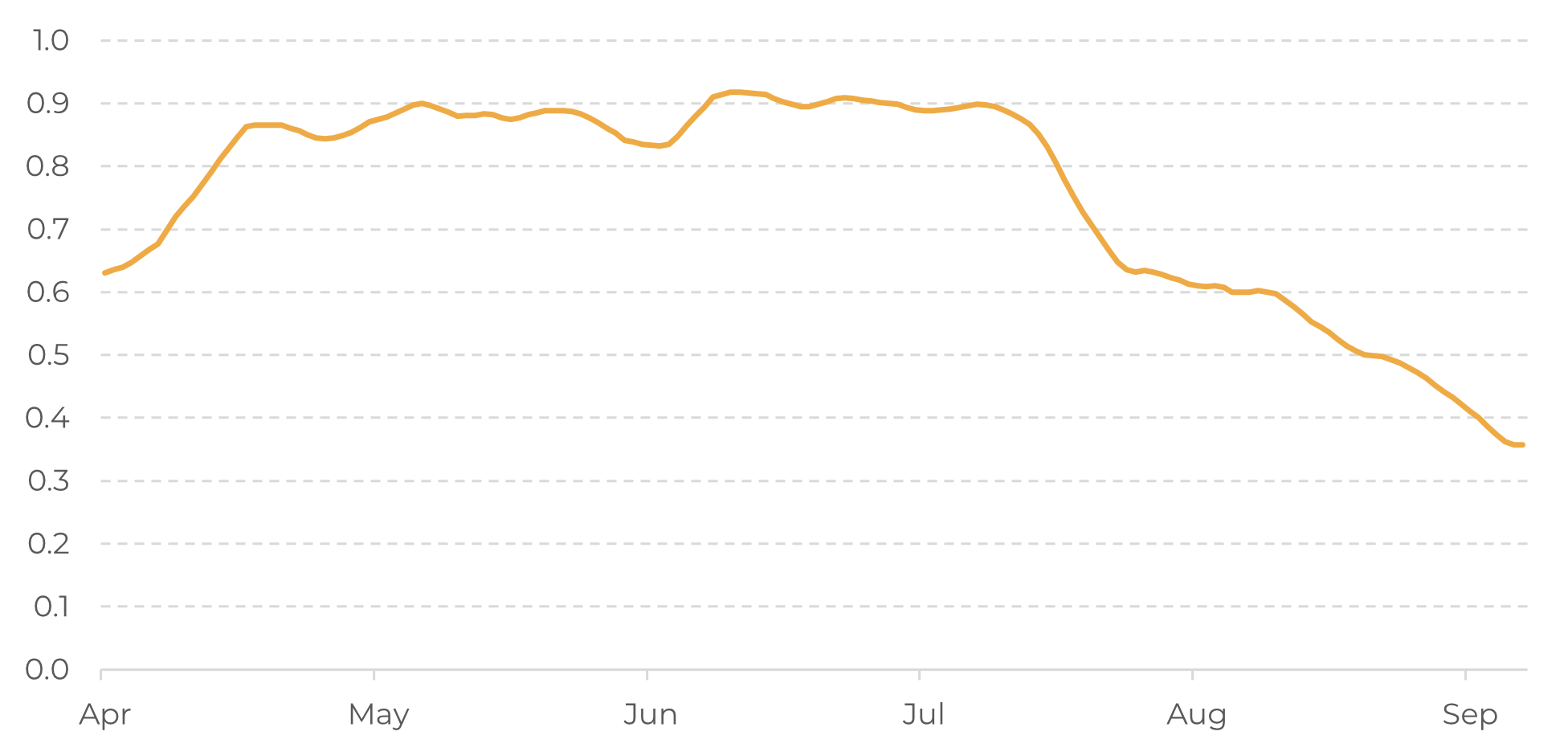

First, it’s important to establish the relationship between weather and changes in yields: Figure 1 shows the correlation between cumulative rainfall and yields, considering data from the past 7 years, shown in a 10-day moving average.

Correlation naturally increases starting in April, reaching a peak in the first week of July. The largest gain in correlation happens throughout April, which demands attention as we reach the end of the month, since we have diminishing returns from correlation from that moment on.

After July, the metric starts to decrease toward the end of development, since further rainfall levels closer to the harvest aren’t as relevant as during flowering of the cherry filling stage.

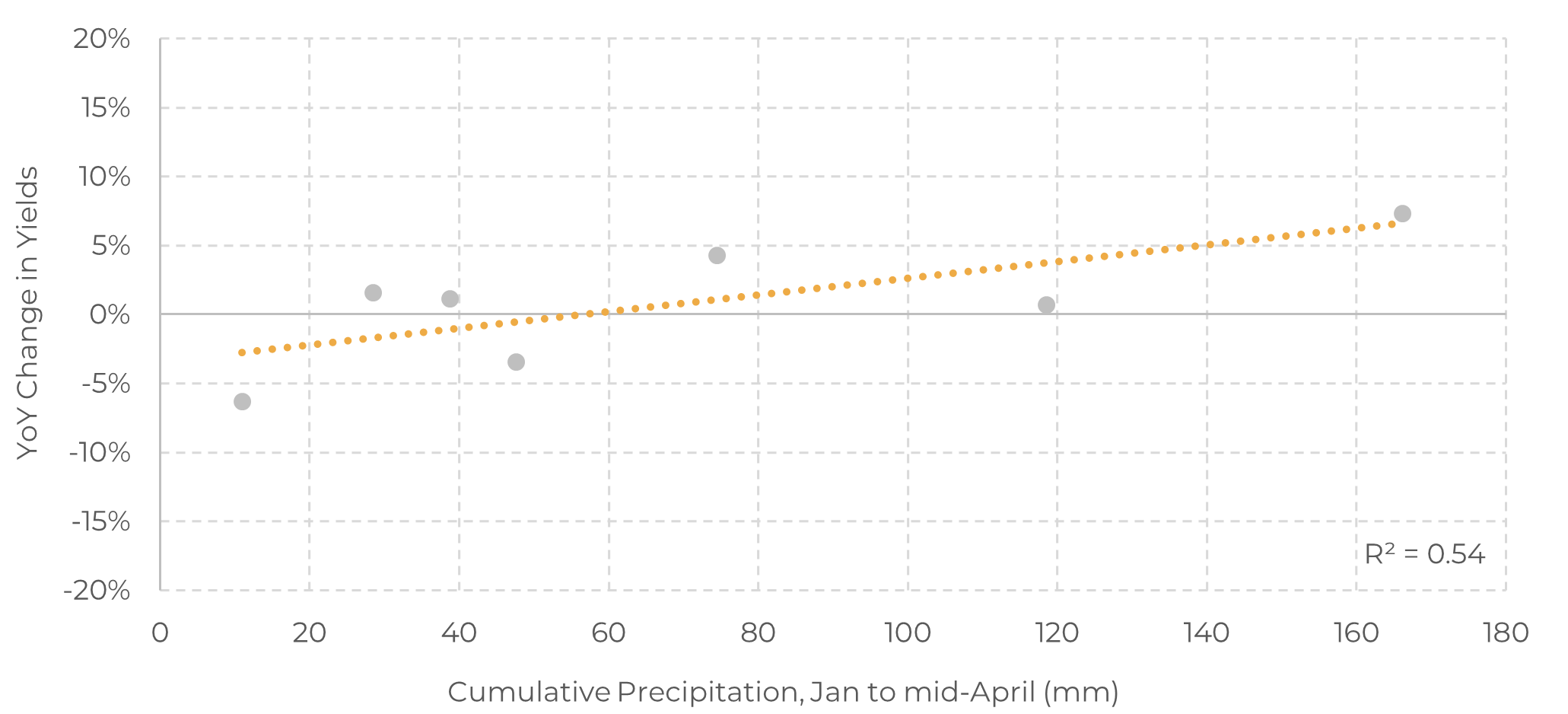

Therefore, there are still a few months ahead of the current period to reach peak correlation between precipitation and yields. And that is the relationship being observed in Figure 2: higher precipitation levels historically correlate to year-over-year growth in total yields. Of course, other factors will also kick in, but the consistency in rainfall levels presents itself as one of the key major factors to be analyzed in this period.

Figure 1: Cumulative Rainfall vs. YoY Yield Change Correlation – Vietnam (10-day moving average)

Source: Refinitiv, USDA

Figure 2: Distribution – Precipitation vs. Yield Change – Vietnam

Source: Refinitiv, USDA

April marks the beginning of the rainy season that will shape up crop production within that same year, with volumes increasing for the next 5 months, comprising of the flowering and cherry filling stages.

In this scenario, considering the data that is available so far for this cycle, and the already present relationship between precipitation levels and productivity, the rainfall deficit would point to a 2% decrease in yields, comparing the 23/24 cycle to the 24/25 cycle.

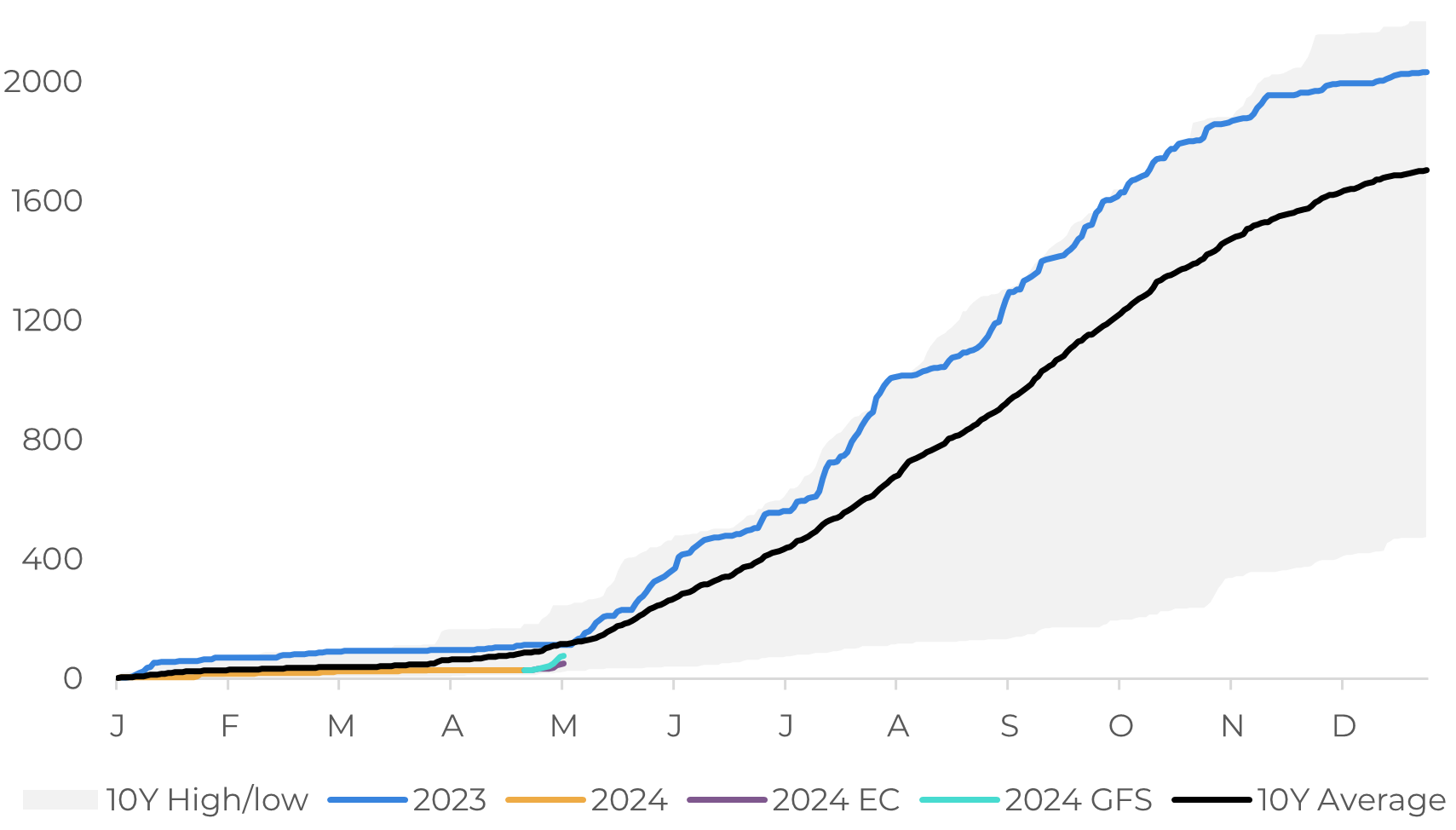

Currently, the Central Highlands region is reporting rains at only a third of the expected volume until April 23rd – still, that is not historically the lowest recorded in the past 10 years. In 2014, the cumulative volume was only 13% of normal levels for the period!

Consequently, there is still time for recovery – and precipitation forecast models suggest that rains will indeed pick up in the next two weeks. Still, if the current scenario persists, 24/25 crop development could indeed be threatened by inconsistent rainfall.

Figure 3: Cumulative Precipitation – Central Highlands (mm)

Source: Refinitiv

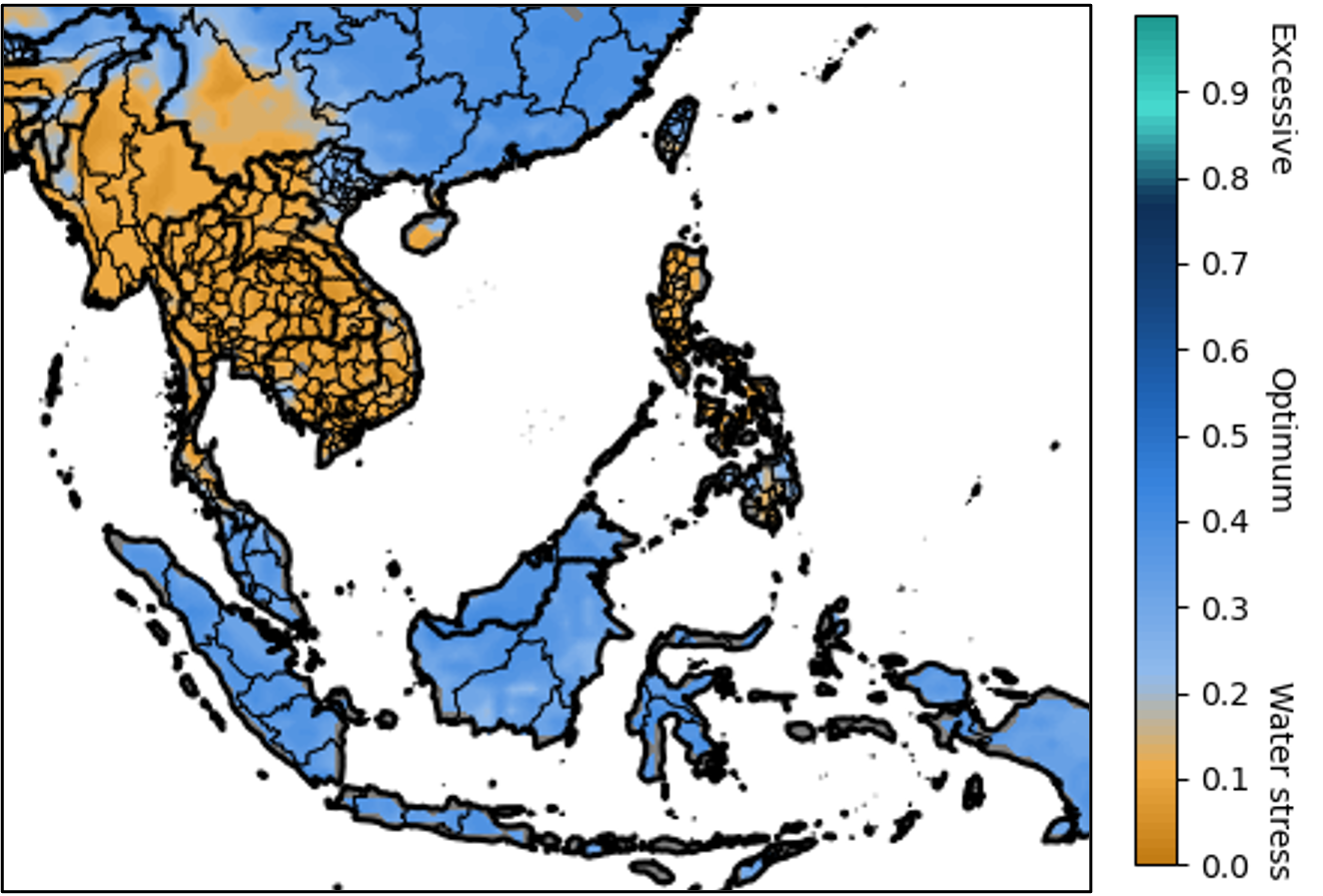

Figure 4: Soil Moisture – Vietnam and Indonesia (Volumetric Moisture Content)

Source: NOAA, Hedgepoint

In Summary

This report examines the current weather situation in Vietnam and its possible impact on the 24/25 crop. There is a strong correlation between rainfall and yields, peaking in July, and April is crucial for its increasing returns on correlation.

Rainfall is essential for flowering and cherry filling stages, and current rainfall is only a third of expected levels in the Central Highlands region. If the current situation persists, the 24/25 crop could be threatened by inconsistent rainfall. Historical data shows potential for a 2% decrease in yields compared to the 23/24 cycle. However, models suggest rain will improve in the next two weeks – which will be closely watched by the market, as a support indicator for London, and, to a lesser extent, NY.

Weekly Report — Coffee

Written by Natália Gandolphi

natalia.gandolphi@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

Reviewed by Laleska Moda

laleska.moda@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.