Jun 7

/

Natália Gandolphi

Coffee Weekly Report - 2024 06 07

Back to main blog page

- Currently, there are three key developments on the radar: Vietnam's 24/25 crop, Brazil's 24/25 harvest, and USDA's initial 24/25 crop figures.

- In Vietnam, rainfall remains below average, with soil moisture recovering slightly in May, leading to a projected -1.05% change in yields, suggesting 27.45M bags for 24/25, close to 23/24's 27.7M bags.

- Brazil's arabica harvest is 23% complete, matching the five-year average, and conilon is currently at 42% (vs. 41% average). USDA revised Vietnam’s 23/24 output to 29.1M bags and expects 29.0M for 24/25, while Brazil's 24/25 forecast is 69.9M bags.

- Overall, USDA revised down production for 23/24 in selected countries, but expects a recovery in 24/25. The situation in Vietnam and Brazil remains uncertain, with indicators not especially optimistic in terms of fundamentals, although macroeconomic factors have weighed on prices at the end of the week.

Prices dynamic amid mixed crop forecasts

Currently, the market is following three major points in terms of fundamentals: 24/25 Vietnam crop development, 24/25 Brazil crop harvest, and the initial look at USDA’s 24/25 crop figures.

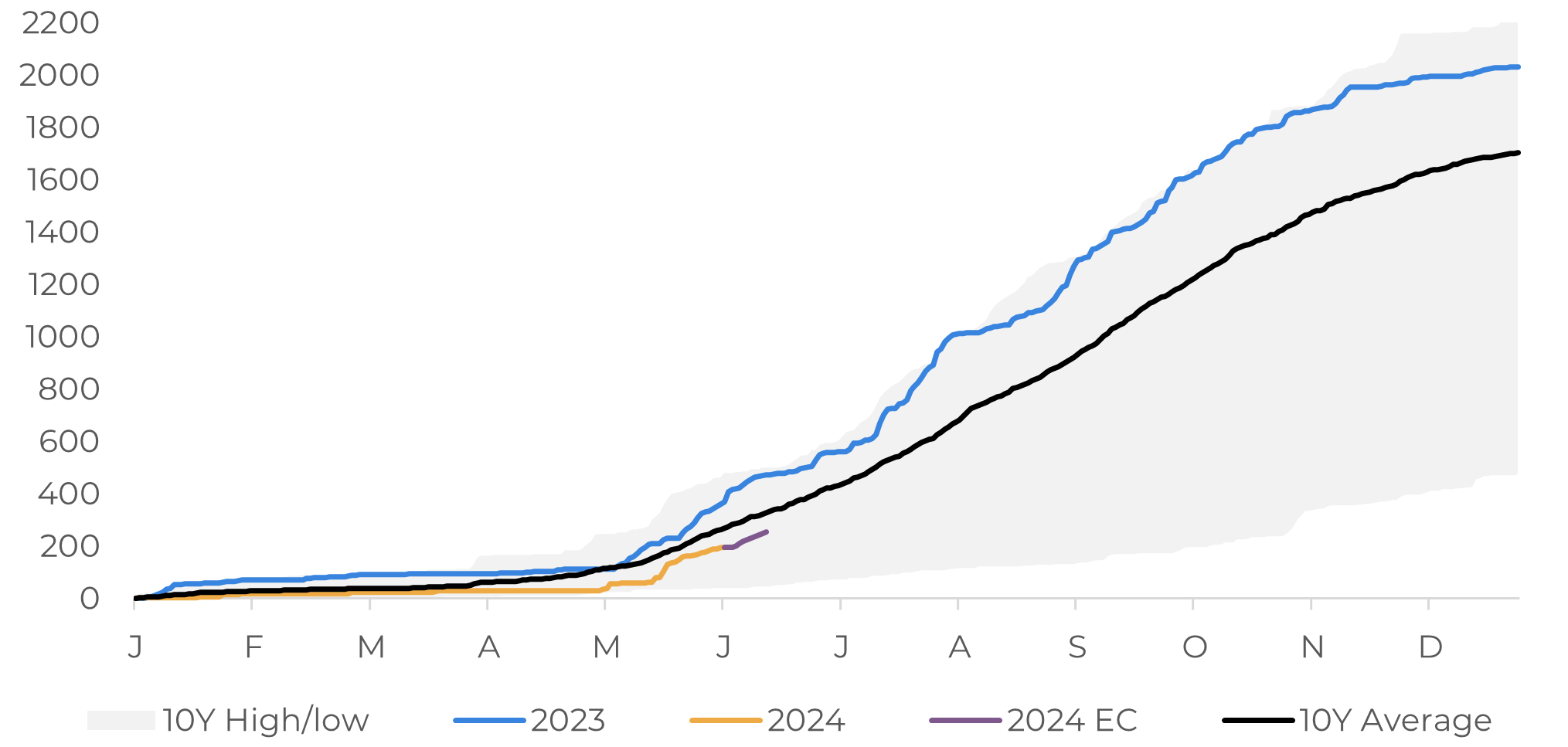

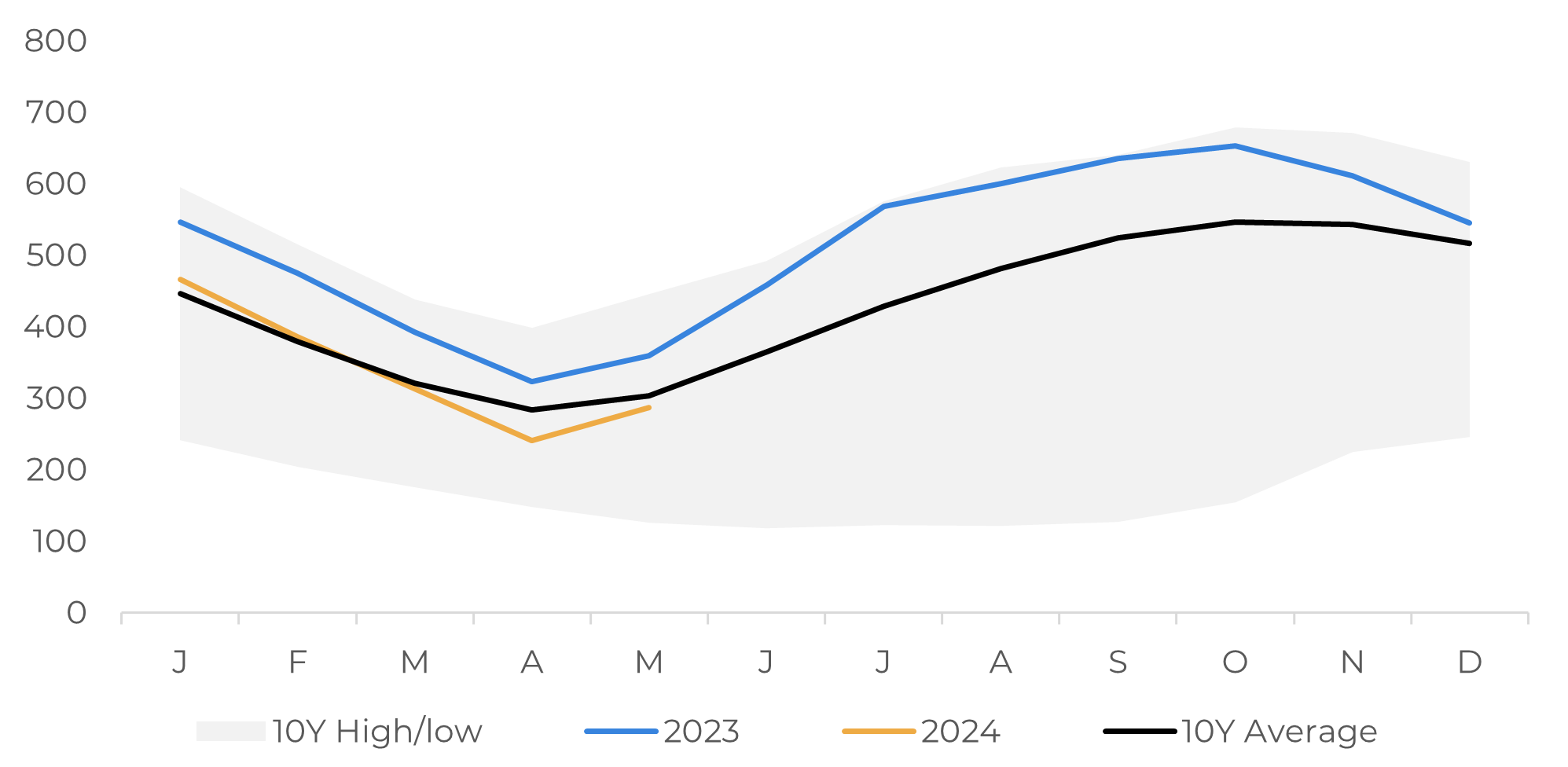

Starting with the first point, rainfall levels in the Central Highlands remain below average, despite the increase seen in May. Currently, cumulative precipitation is at 72% of average levels expected for the first week of June. Over the course of May, soil moisture in the region also recovered, but stayed below average.

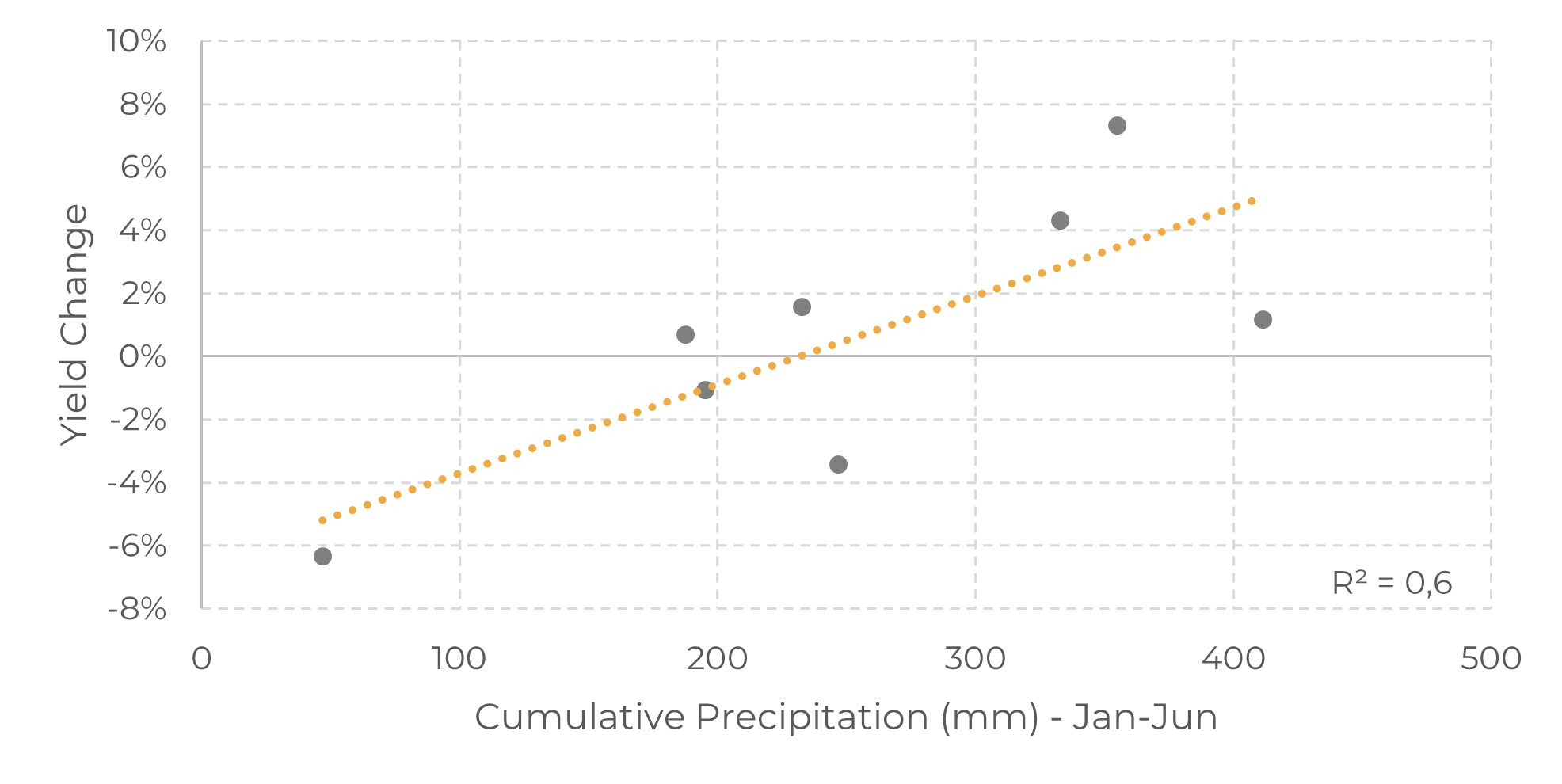

Running the model that correlates rainfall levels and the year-over-year change in yields, the picture has changed since April – previously, the model was suggesting a -2% change in yields. Currently, the model suggests a -1.05% change. In figures, it would suggest a total production of 27.45M bags, vs. the 27.18M bags seen in April.

Consequently, the recovery has helped to support production levels for the 24/25 crop in Vietnam – however, not enough to show an increase vs. the 23/24 figures, seen at 27.7M bags.

Second, the harvest in Brazil has advanced as well. Currently, Safras & Mercado reports that 23% of the arabica harvest is complete, in line with the 5-year average (20%). Conilon, shows a similar trend (42% vs. the 41% historical average).

Figure 1: Cumulative Precipitation – Central Highlands (mm)

Source: Refinitiv

Figure 2: Soil Moisture – Central Highlands (in top 1.6m of soil)

Source: Refinitiv

Despite the increase in harvest pace, screen size has reportedly not improved greatly when compared to the beginning of the harvest – which raises the possibility of a downward reduction in production figures. Still, with the total harvest at 21%, it’s early to pinpoint the size of the potential reduction.

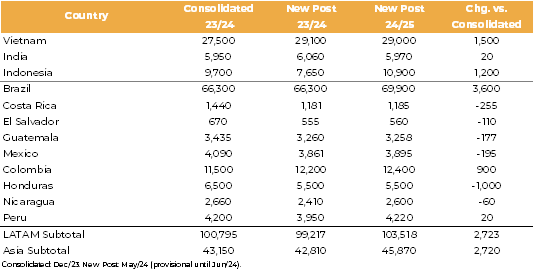

These two facts, both in terms of Vietnam and Brazil, have contrasted with USDA’s preliminary figures for the 24/25 crop in both countries. The agency revised Vietnam’s 23/24 output from 27.5M bags to 29.1M in its new post reports, and points to a negligible reduction for 24/25: 29.0M bags.

As for Brazil, the agency didn’t alter its 23/24 estimate, and suggests a 3.6M bags addition in 24/25, especially for arabica – reaching 69.9M bags. Altogether, with the releases from other countries, Latin American production was revised up by 1.58M bags, and would also show a 2.7M bags increase in 24/25 vs. the previously consolidated figure, and a 4.3M bags addition considering the new post figures.

Considering Asian countries, the subtotal for 23/24 has been revised down, by 340K bags, with a change in 24/25 vs. the previously consolidated 23/24 figures of 2.72M bags, and +3M bags considering the new post results.

Figure 3: Distribution – Cumulative Precipitation vs. Yield Change in Vietnam

Source: Refinitiv, Hedgepoint

Figure 4: USDA Crop Updates (‘000 bags)

Source: USDA

In Summary

Altogether, USDA’s new crop figures for 23/24 and 24/25 suggest that the balance will be tighter in 23/24, with a total reduction of 1.9M bags for the countries released so far. On the other hand, the agency expects a 7.3M bags addition for 24/25, when compared to the new post results, or, 5.44M bags compared to the previously consolidated 23/24 figures.

Despite this more bearish outlook from USDA, especially looking at Vietnam’s and Brazil’s figures, the spread curve has a steeper inclination for long-term contracts vs. short-term.

While it is early to pinpoint the actual impact in both crops, as development is still underway in Vietnam, and the harvest is ongoing in Brazil, indicators are not especially optimistic. On the other side, prices are subject to macroeconomic fluctuations: job market data from the U.S. cleared the weekly price increase in todays (07) settlement, showing higher payrolls results than expected.

Weekly Report — Coffee

Written by Natália Gandolphi

natalia.gandolphi@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

Reviewed by Lívea Coda

livea.coda@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.