Jun 21

/

Laleska Moda

Coffee Weekly Report - 2024 06 21

Back to main blog page

- Arabica and robusta contracts have remained volatile in recent days as they await further definition of global production for the 24/25 crop.

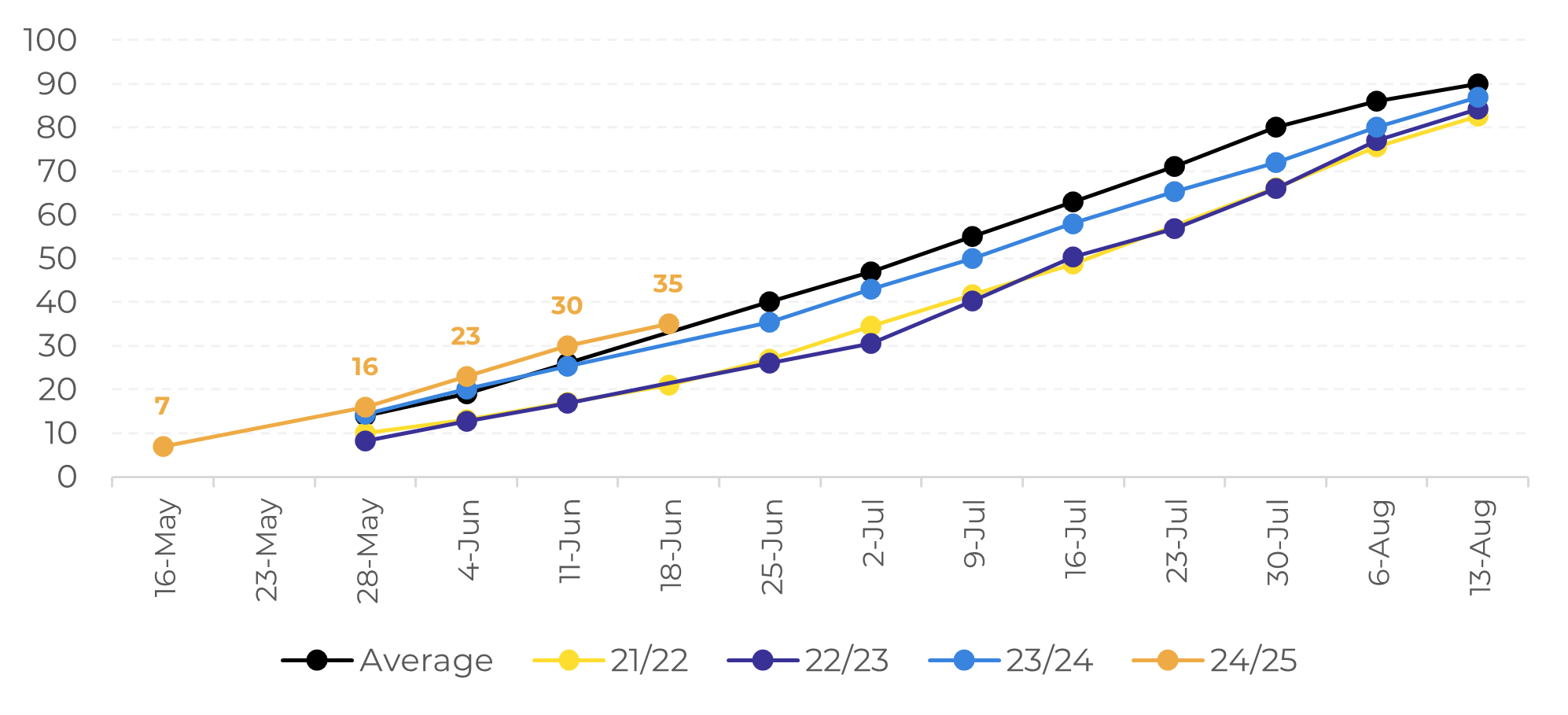

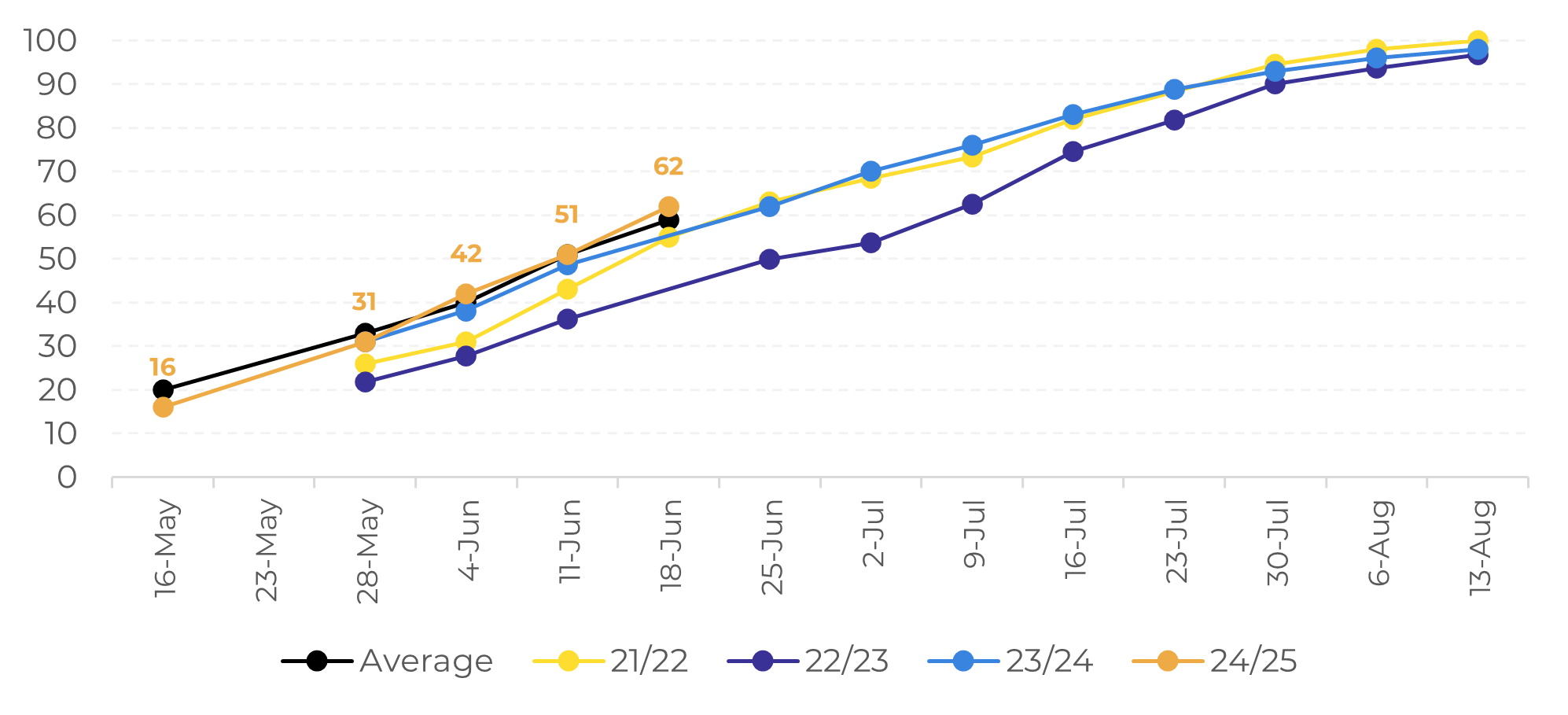

- In Brazil, the harvest has gathered pace in recent weeks and is already 44% complete, according to Safras & Mercado. However, expectations for production remain mixed as screens and yield problems continue to be reported.

- On the robusta side, although the rains have returned to Vietnam, there are still concerns about the impact of the drier weather until May on 24/25 production.

- Nevertheless, the figures published by the USDA this week point to an increase in world production in 24/25 to 176.23 M bags, which would help to rebuild stocks after a tighter supply picture in 23/24 (169.18 M bags).

- On the demand side, the division lowered its estimates for 23/24 to 167.54 M bags, mainly due to revisions in the EU and US data, but expects a recovery in 24/25, with world consumption reaching 170.63 M bags.

Market remains volatile in anticipation of the 24/25 season

The coffee market has been volatile in recent days as it awaits news on global production. In Brazil, the June harvest has been progressing rapidly, and until this week, data from Safras & Mercado indicated that 44% of the country's crop had been harvested. Despite the progress, concerns have been reported about lower sceens and yield for both Arabica and conilon, with growing doubts about the impact of these problems on Brazilian production.

In Vietnam, the market is also cautious about the potential impact of the weather on the country's 24/25 production. Although rainfall returned in May, levels are still below historical averages, and it is too early to rule out a possible drop in productivity compared to 23/24. In Central America, the hot and dry weather of recent weeks could also affect the development of the 24/25 season.

This scenario of a possible limited supply in a new cycle has also caused LN and NY futures to return to April levels.

Figure 1: Arabica Harvest – Brazil – Historical (% of total)

Source: Safras & Mercado

Figure 2: Conilon Harvest – Brazil – Historical (% of total)

Source: Safras & Mercado

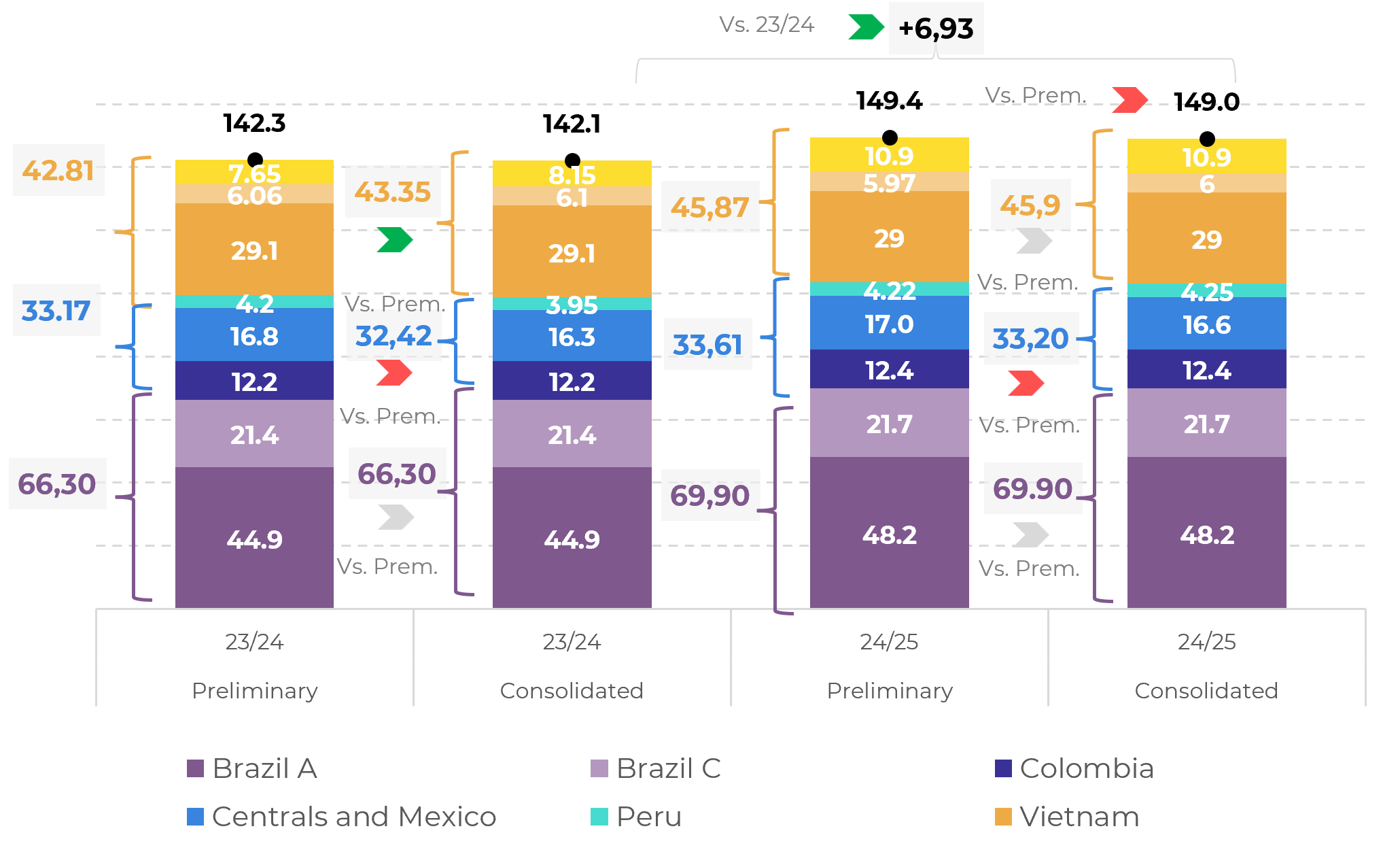

This week, the USDA also updated its global crop figures: in June, the figures for 23/24 and 24/25 were revised downwards from the preliminary report, due to adjustments made in Central America following the effects of El Niño in the region. However, the department still points to a strong increase in world production in 24/25, to 176.23 M bags, compared with 169.18 M bags in 23/24.

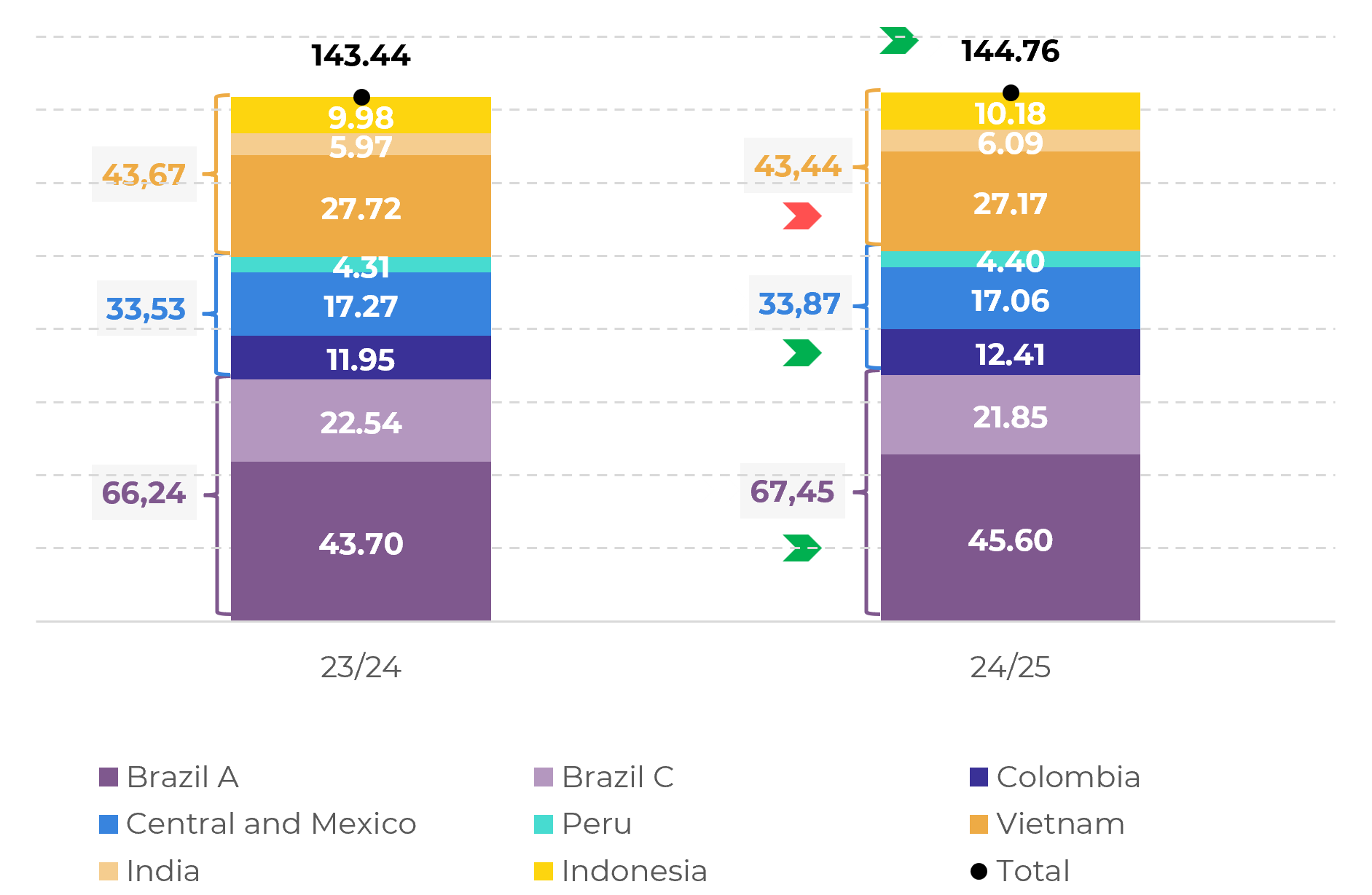

Although production is generally expected to recover in 24/25, most market participants believe that the increase will be small. For example, our estimates for the main producing countries are for an increase of just over 1 M bags in this next cycle, with room for adjustment depending on the weather in the coming months.

On the demand side, the USDA figures point to a negative revision between the preliminary figures for 23/24, with world demand for the season coming in at 167.54 M bags (compared to 170.22 M bags in the dec/23 report), weighed down by the correction in the figures for Europe and the US in particular. For 24/25, the department indicated a recovery to 170.63 million bags. However, with the higher production forecast for 24/25, estimates point to a recovery in ending stocks (25.78 M bags compared to 23.93 M bags in 23/24).

Figure 3: Production by Country - USDA – Preliminary vs. Consolidated (M bags)

Source: USDA, Hedgepoint

Figure 4: Production by Country - Hedgepoint (M bags)

Source: Hedgepoint

In Summary

The coffee market is awaiting further news on production for 24/25. This week's USDA figures point to a tighter scenario in 23/24, but a recovery in 24/25, which would lead to a more bearish scenario.

However, initial perceptions still point to a tight market in the coming months. In Brazil, production should pick up in 24/25, but we could still see slight corrections due to yield problems. In Asia, there are still doubts about the impact of the weather in 2023 and early 2024 on 24/25 production, especially in Vietnam.

Weather in Central America is also likely to be in focus in the coming weeks, with low rainfall and high temperatures until early June. As a result, the market is likely to remain volatile in the short term, pending further definition of supply.

Weekly Report — Coffee

Written by Laleska Moda

laleska.moda@hedgepointglobal.com

Reviewed by Natália Gandolphi

natalia.gandolphi@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Global Markets LLC and its affiliates (“HPGM”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint Commodities LLC (“HPC”), a wholly owned entity of HPGM, is an Introducing Broker and a registered member of the National Futures Association. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and outside advisors before entering in any transaction that are introduced by the firm. HPGM and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. In case of questions not resolved by the first instance of customer contact (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ombudsman@hedgepointglobal.com) or 0800-878- 8408/ouvidoria@hedgepointglobal.com (only for customers in Brazil)

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.