Oct 1

/

Laleska Moda

The market remains concerned about the short term

Back to main blog page

- In general, the Arabica and Robusta coffee futures markets remain bullish. Despite a correction on Friday and a lower start this week, prices remain on high levels.

- Looking at the behavior of spreads in both London and New York, the closest to expiration contracts remain higher than the rest, indicating concerns about near-term supply.

- Similarly, despite last Friday's sell-off, speculative funds are still long in both types, with the market still pricing in a rise.

- The main support for prices continues to be the current weather outlook, with the Brazilian producing regions still experiencing predominantly dry and hot weather, increasing the chances of a negative impact on the Brazilian 25/26 crop.

- With stocks at both origins and destinations still low and showing no sign of significant improvement, the market remains sensitive to any change in supply. Any impact on 25/26 therefore adds risk, supporting prices and increasing uncertainty for producers and buyers.

The market remains concerned about the short term

Despite some negative fluctuations in recent weeks, the coffee market remains bullish, with both Arabica and Robusta futures trading at historic levels. It is interesting to note that if we look at the behavior of the spreads between the futures contracts for each variety, it is clear that the first expiry dates are the most highly valued, indicating a greater interest in short-term hedging.

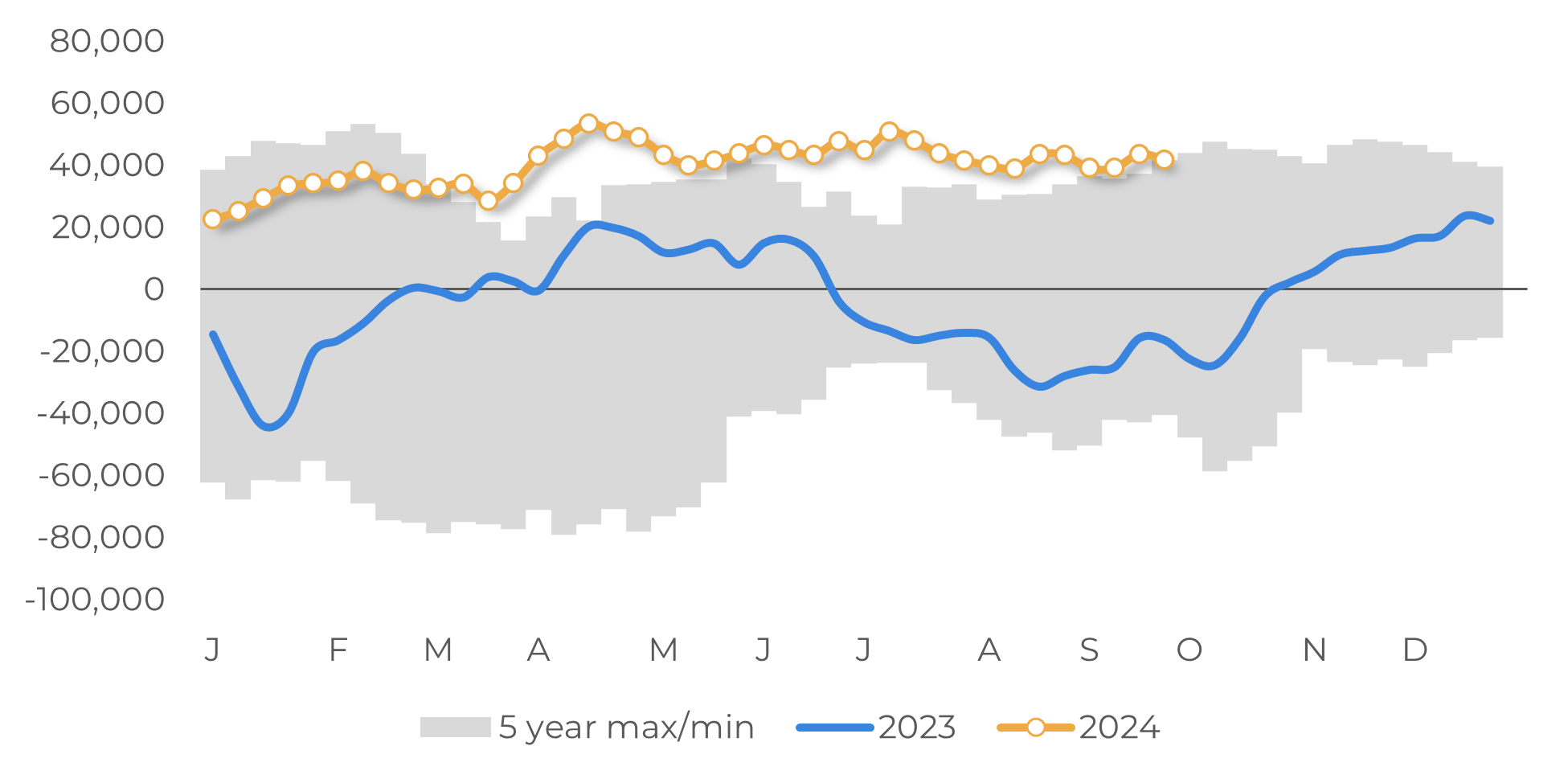

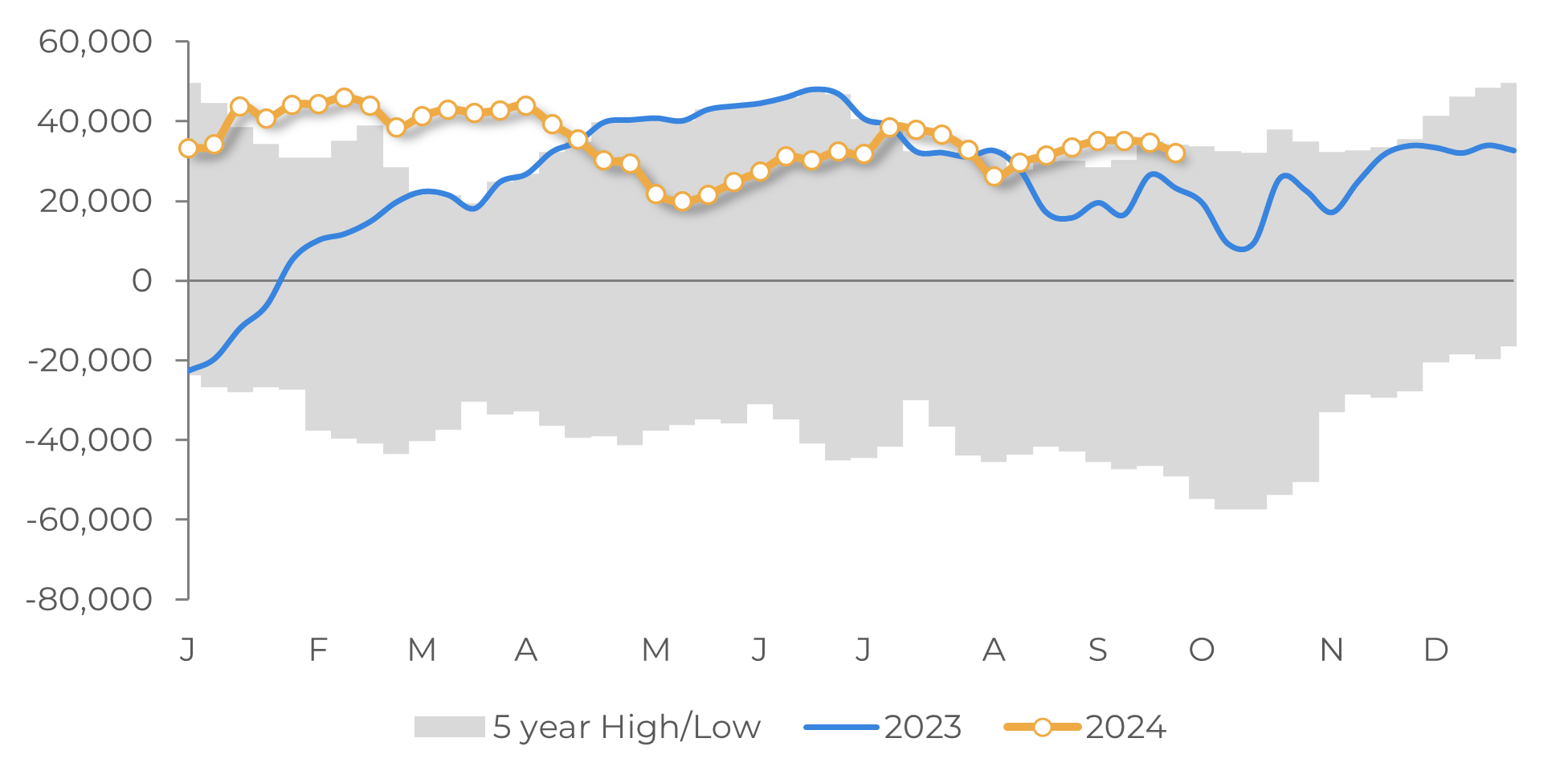

Indeed, other technical factors in the market also point to this trend. On Friday, the speculative funds of Arabica and Robusta liquidated some of their long positions, but they are still on historic long, suggesting that these players are also pricing in a rise in the market. Both the funds and the spreads.

The market continues to be supported by the Brazilian climate. Despite occasional rains in September, concerns remained with below historical averages for the month, while soil moisture levels remain below historical lows. In addition, the amount of rain over the last few days has been sufficient to trigger a new flowering in several regions, while forecasts still point to firm and warm weather in the coming days, increasing the risk of a negative impact on 25/26 September. Rainfall is expected to increase towards the end of the first half of October, which should bring some relief but may not be enough to harm some of the flowering that has already started.

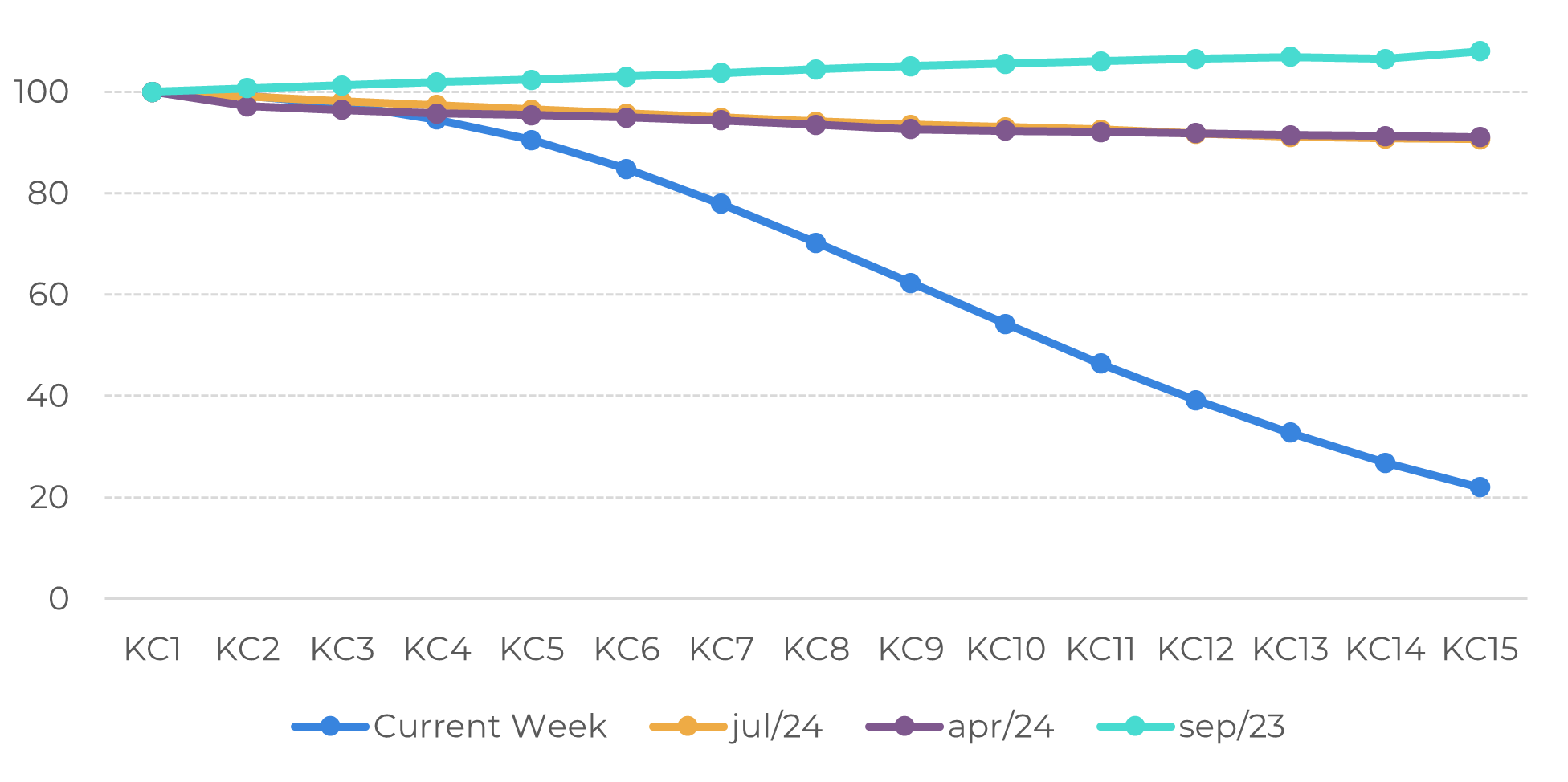

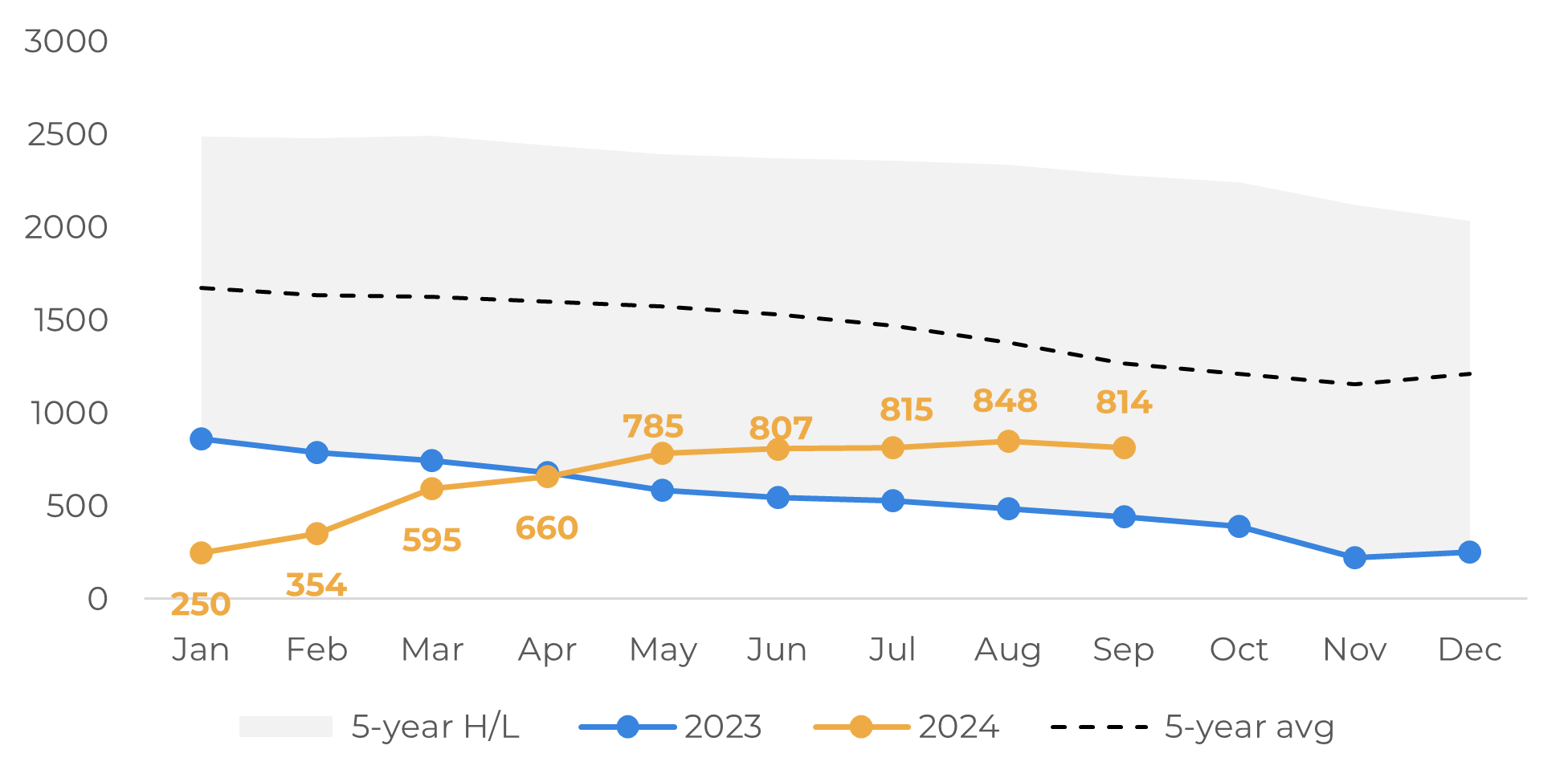

Cumulative Precipitation – Minas Gerais (mm)

Source: Refinitv

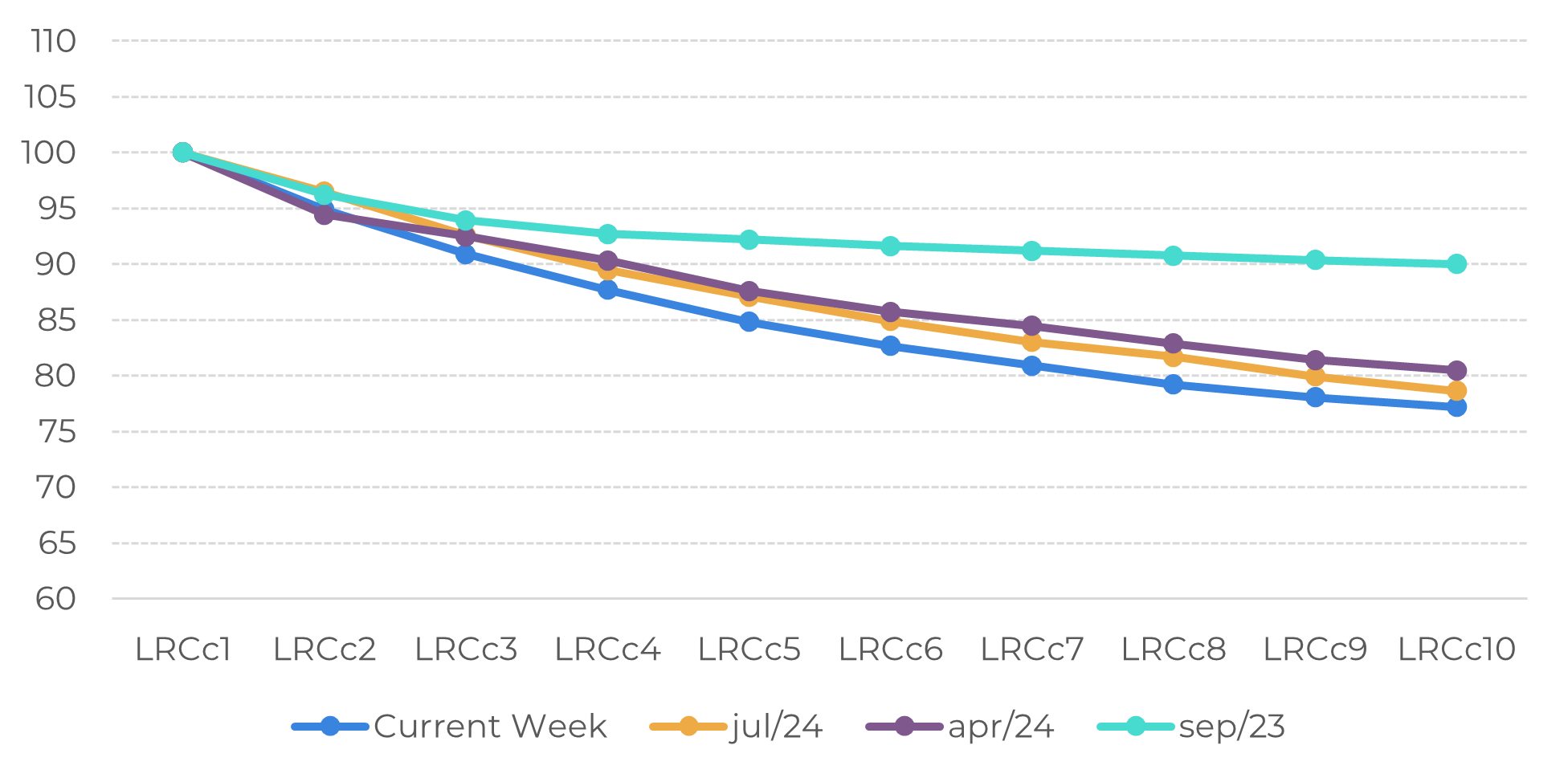

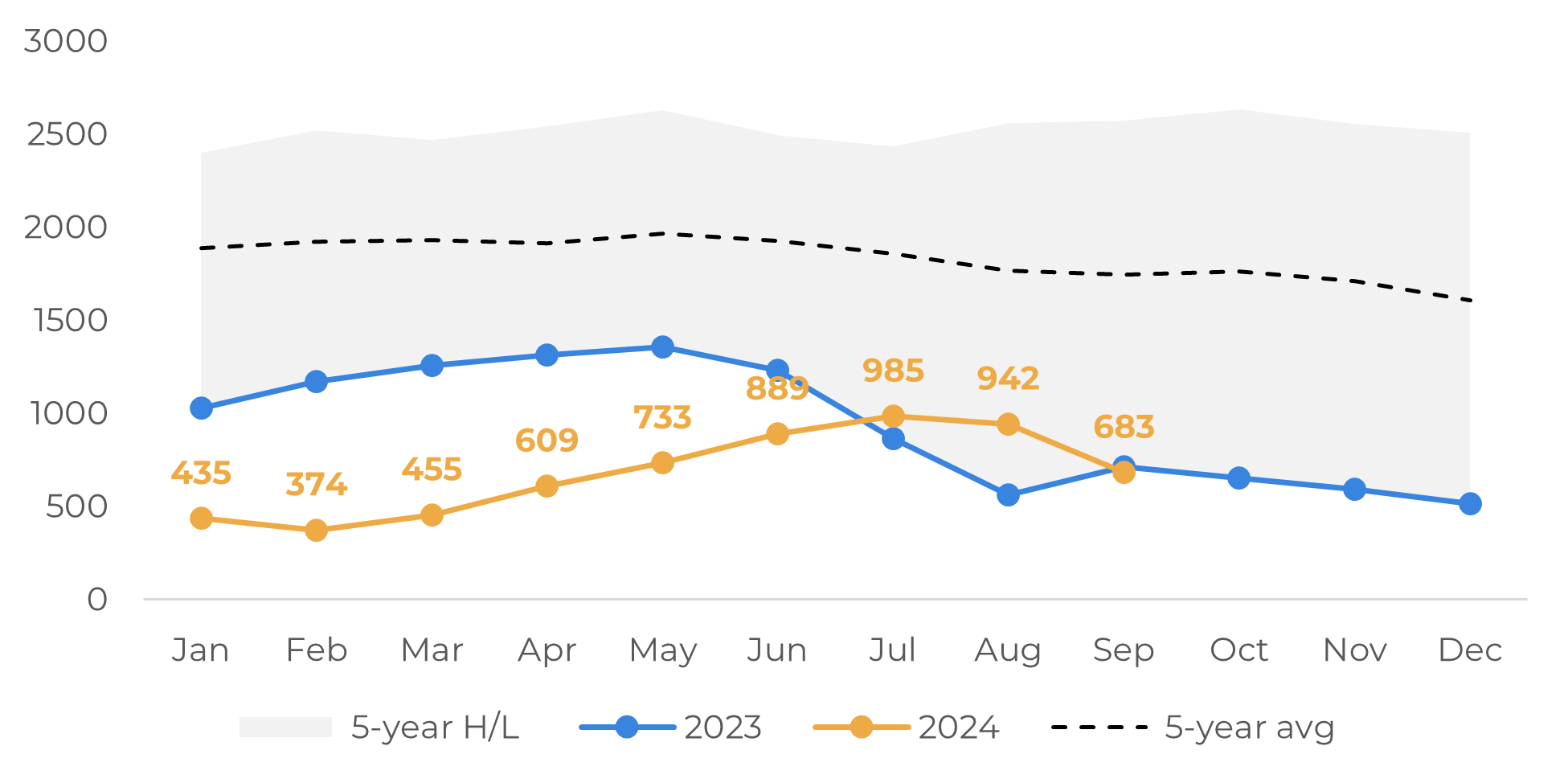

Soil Moisture – Minas Gerais (mm/0-1.6 m soil)

Source: Refinitv

Indeed, other technical factors in the market also point to this trend. On Friday, the speculative funds of Arabica and Robusta liquidated some of their long positions, but they are still on historic long, suggesting that these players are also pricing in a rise in the market. Both the funds and the spreads.

The market continues to be supported by the Brazilian climate. Despite occasional rains in September, concerns remained with below historical averages for the month, while soil moisture levels remain below historical lows. In addition, the amount of rain over the last few days has been sufficient to trigger a new flowering in several regions, while forecasts still point to firm and warm weather in the coming days, increasing the risk of a negative impact on 25/26 September. Rainfall is expected to increase towards the end of the first half of October, which should bring some relief but may not be enough to harm some of the flowering that has already started.

Arabica - CFTC Position of speculative funds (lots)

Source: CFTC

Robusta - ICE Position of speculative funds (lots)

Source: ICE

It's worth remembering that the adverse weather conditions of recent months have already had an impact on the Brazilian 24/25 season, leading us to revise our figures downwards to 63 million bags in August. In addition, the drought and high temperatures in Vietnam in the first half of the year maintain our expectation of a smaller 24/25 crop in that country, which should be harvested in the coming weeks. As a result, we forecast a new global coffee deficit for 24/25, the fourth consecutive year of negative balances.

This scenario should also be reflected in continued limited stocks of bean, both at origins and destinations - in a previous analysis we pointed to our expectation of limited stocks. It's worth noting that ICE certified stocks also fell again in September, after a brief recovery in August. In the case of Robusta, certified stocks actually fell from last year's historic lows, probably as a result of continued strong demand for the variety amid low stocks in Southeast Asia. Although Brazilian conilon exports are growing in this scenario, the country's shipments may not be sufficient to fill the gap left by Vietnam in particular, so the market remains sensitive to supply, and prices might continue to be supported.

Arabica Certified Stocks (‘000 bags)

Source: ICE

Robusta Certified Stocks (‘000 bags)

Source: ICE

In Summary

The coffee market continues to rise as the outlook continues to raise concerns about supply in the short to medium term, as reflected in the structure of the futures market.

Adverse weather conditions in 2023 and 2024 have not only led to a smaller Brazilian crop but could also affect the crop to be harvested in Vietnam this year, reflecting not only lower stocks but also the possibility of another global coffee deficit.

Now in the second half of 2024, the dry and hot weather could still have a negative impact on the 25/26 season in Brazil, maintaining the high volatility in the market, as any impact on the next season will add to the supply risk, supporting prices and increasing uncertainty for producers and buyers.

Weekly Report — Coffee

Written by Laleska Moda

laleska.moda@hedgepointglobal.com

Reviewed by Victor Arduin

victor.arduin@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Global Markets LLC and its affiliates (“HPGM”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint Commodities LLC (“HPC”), a wholly owned entity of HPGM, is an Introducing Broker and a registered member of the National Futures Association. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and outside advisors before entering in any transaction that are introduced by the firm. HPGM and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. In case of questions not resolved by the first instance of customer contact (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ombudsman@hedgepointglobal.com) or 0800-878- 8408/ouvidoria@hedgepointglobal.com (only for customers in Brazil)

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.