Nov 11

/

Laleska Moda

Fundamentals and macro environment could add downward pressure

Back to main blog page

- Arabica and robusta coffee futures prices have seen some correction in recent days, reflecting both fundamentals and the macroeconomic scenario.

- Last week in particular, Trump's election strengthened the dollar, increasing risk aversion and potentially putting pressure on global demand for commodities in the long term if an inflationary agenda is indeed adopted.

- On the other hand, the Fed's cutting rates by 0.25 percent while the Central Bank of Brazil raised them by 0.50 percent could strengthen the BRL, possibly bringing some support to commodities.

- However, the fundamentals have also become more bearish in the coffee market, especially with the rains in Brazil and the expectation that Vietnamese beans will enter the market in the coming weeks.

- A possible recovery - albeit limited - in destinations such as the European Union in 2024 could also contribute to the perception of a more comfortable trade flow, adding to a downward pressure.

Fundamentals and macro environment could add downward pressure

Coffee market sentiment has somewhat shifted towards a more bearish picture in recent weeks. On the one hand, the fundamentals have pointed to some relief in supply until the beginning of 2025, while on the other, the macroeconomic scenario has also brought some pressure to the commodities market.

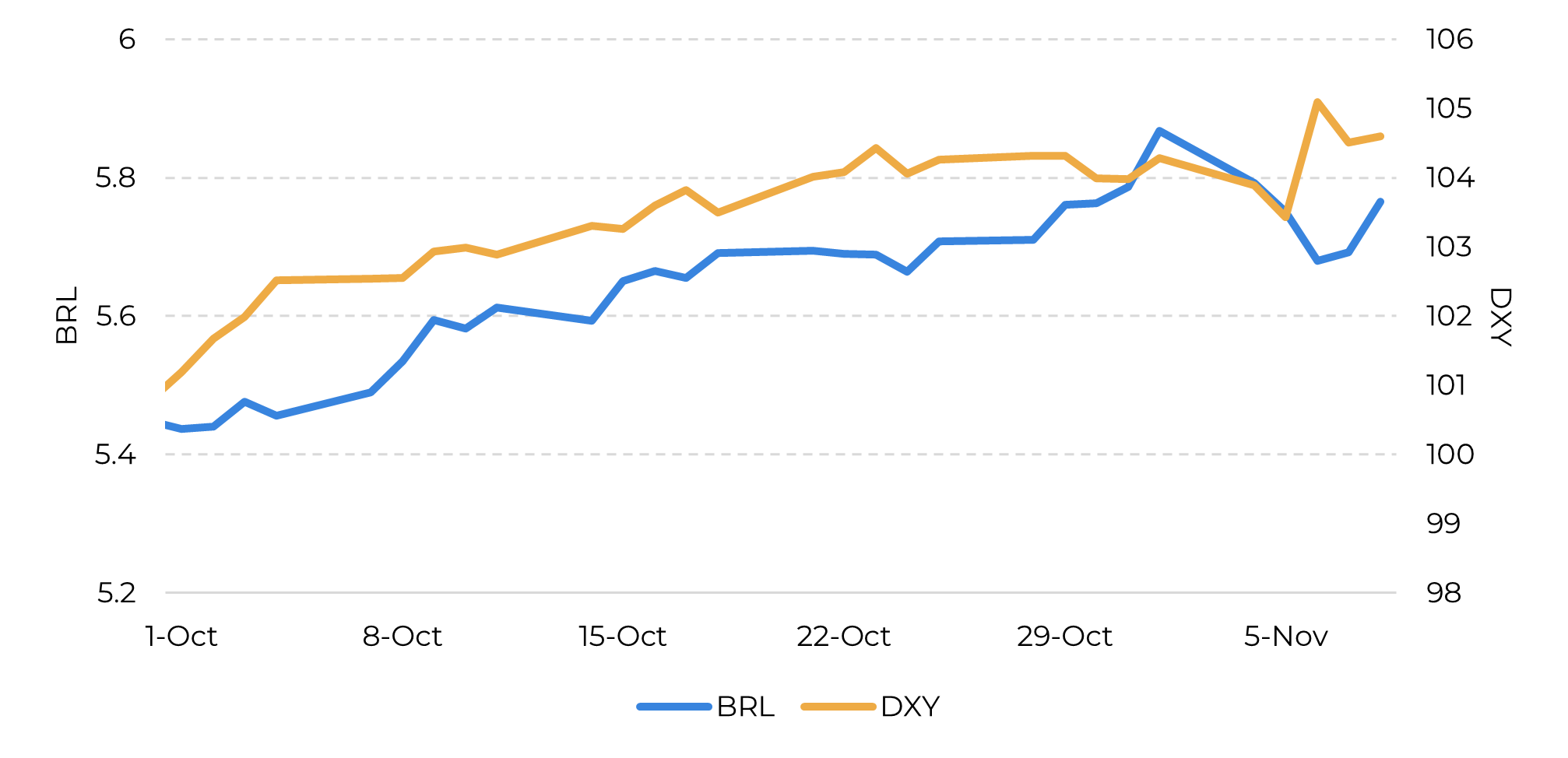

Last week, in particular, was marked by various factors in the global economy. In the US, Trump's election has boosted US Treasury yields, driven by expectations of a more protectionist and inflationary agenda from the new government, which tends to boost the US currency. A stronger US dollar, in turn, can induce a scenario of risk aversion, attracting more capital to the US and thus weakening other currencies - a factor that tends to put pressure on commodities in general. On the day the election was confirmed, 6 November, for example, the dollar index surpassed the 105 level, not seen since July, also influencing coffee prices.

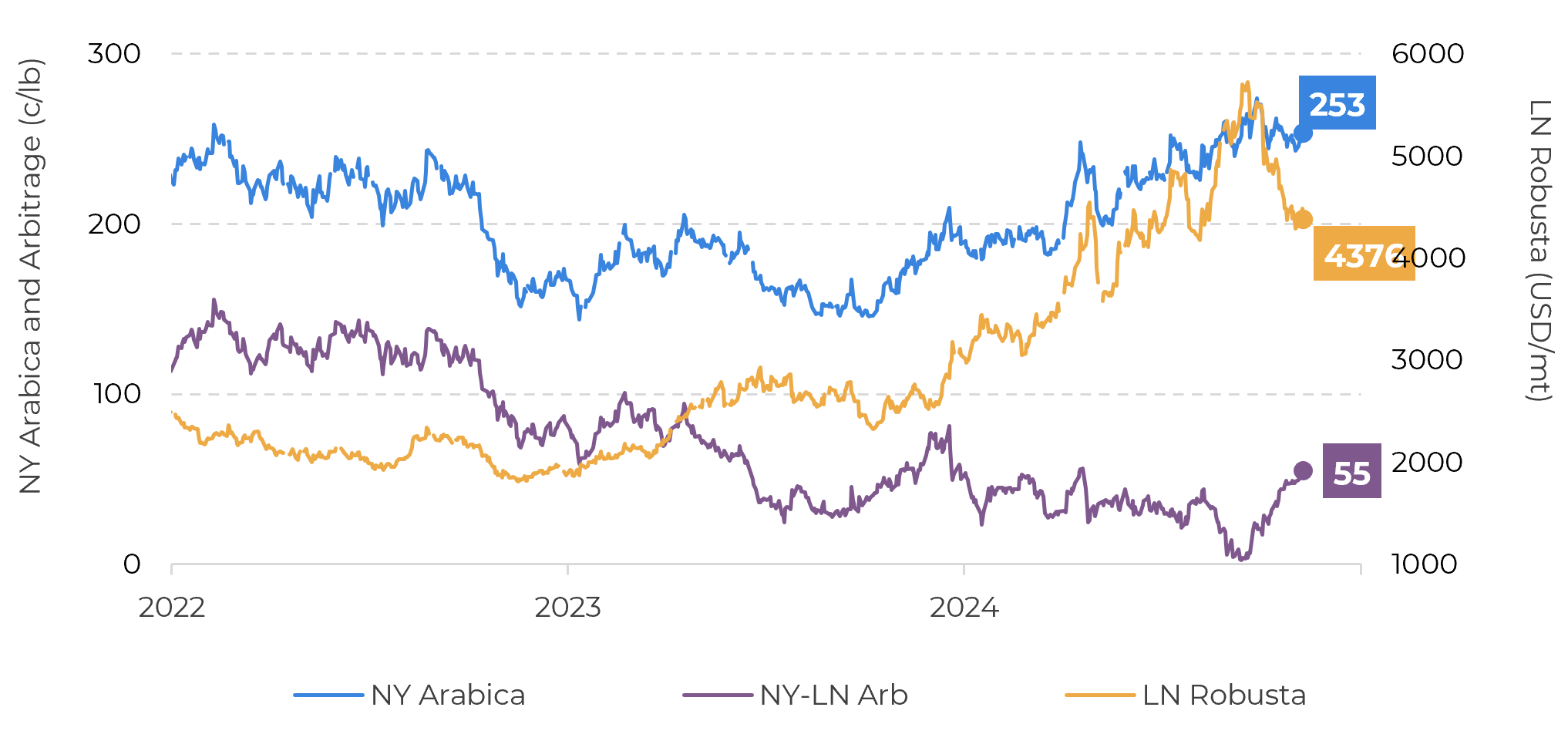

NY Arabica (c/lb) x LN Robusta (USD/mt) - Arbitrage (c/lb)

Source: Refinitv

Macroeconomic front: BRL x DXY

Source: Refinitv

Despite the uncertainty surrounding the new government, the Federal Reserve still implemented a 0.25 percentage point cut in the US interest rate on Thursday, due to indicators of increased economic activity and progress towards the 2 percent inflation target. Fed Chairman Powell also emphasized during the week that the central bank will continue to work to loosen monetary policy, leading to a correction in US treasury yields and the dollar index, which returned to 104.5. Even so, many analysts still point to the possibility that the new Trump administration's agenda will prevent further cuts in US interest rates, which could follow a low point for commodities in 2025.

In Brazil, the Central Bank raised interest rates by 50 basis points, from 10.75% to 11.25% this week, due to concerns about a strong labor market and risks related to fiscal debt and compliance with fiscal targets, as well as uncertainties about the effect of the US election on the Brazilian currency. The interest rate differential could benefit the strengthening of the BRL.

In Brazil, the Central Bank raised interest rates by 50 basis points, from 10.75% to 11.25% this week, due to concerns about a strong labor market and risks related to fiscal debt and compliance with fiscal targets, as well as uncertainties about the effect of the US election on the Brazilian currency. The interest rate differential could benefit the strengthening of the BRL.

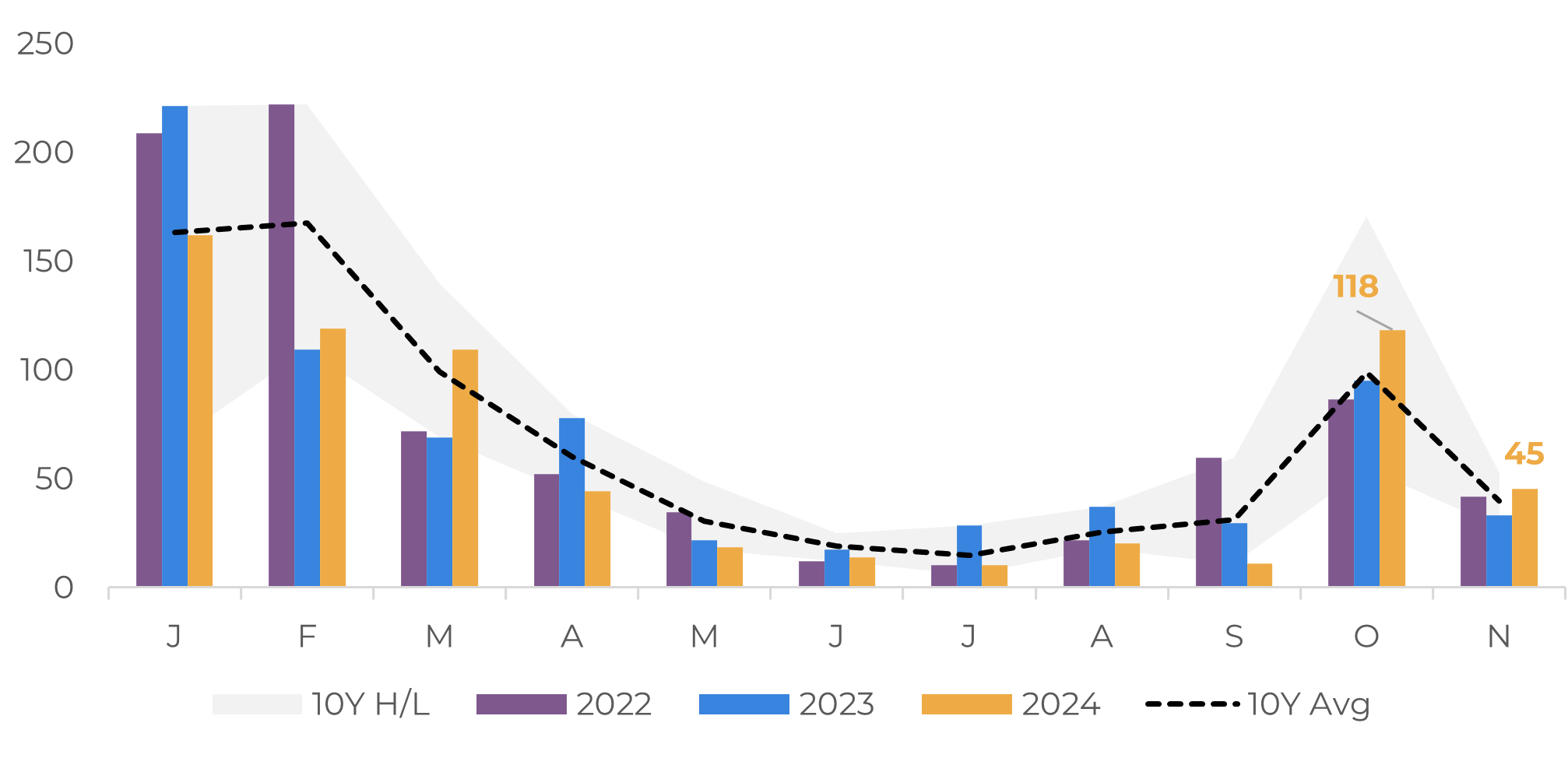

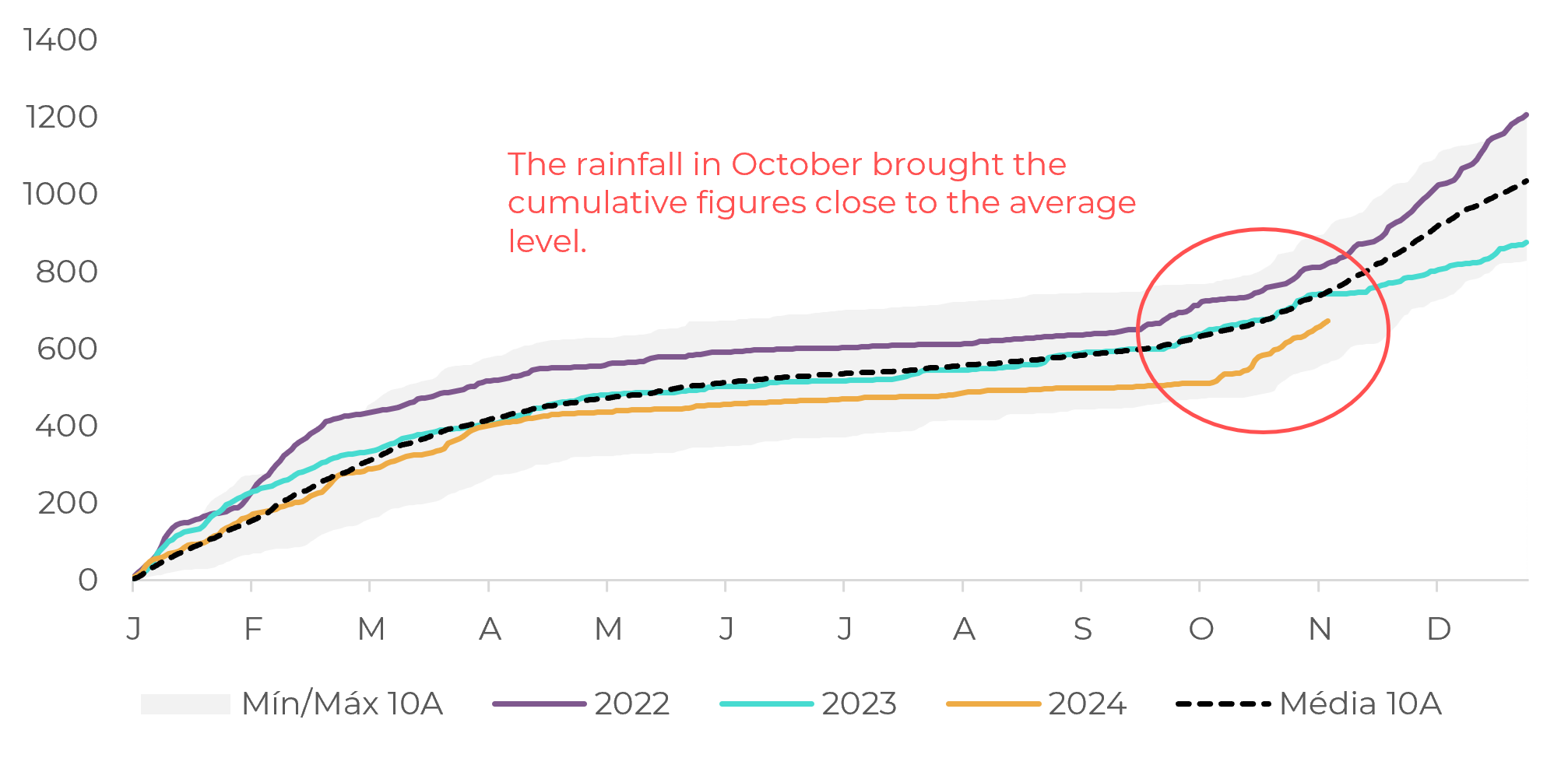

Still, on the fundamentals side, some possible relief on the supply could lead to further corrections. The rains in Brazil in recent weeks are already above historical averages and have helped the coffee plantations recover and to set the flowers of October. Although it's difficult to say whether the more favorable weather at the end of the year will be enough to compensate for all the damage brought by the drought until September, a more constant rainfall regime in the coming months will certainly help the 25/26 harvest, bringing a more positive outlook to market agents and putting pressure on coffee prices.

The entry of the Vietnamese 24/25 crop onto the market between late 2024 and early 2025 should also contribute to global trade flows. Although various storms and typhoons in the Asian country have brought volatility to prices in recent weeks due to their impact on the harvest and crops – like the recent Yinxing storm-, the entry of a larger volume of robusta into the market is expected.

Brasil: Cumulative Monthly Precipitation (mm)

Source: Refinitv

Brasil: Cumulative Precipitation (mm)

Source: Refinitv

In addition, as already mentioned in the last analysis (link), European stocks are recovering, due to the strong pace of imports from the bloc in 2024, also bringing the perception of more abundant supply and possibly reducing European demand between Q4/24 and Q1/25. This scenario has also already been reflected in the spreads of the arabica Z-H contracts and especially in the robusta X-F spread, as mentioned in the last analysis.

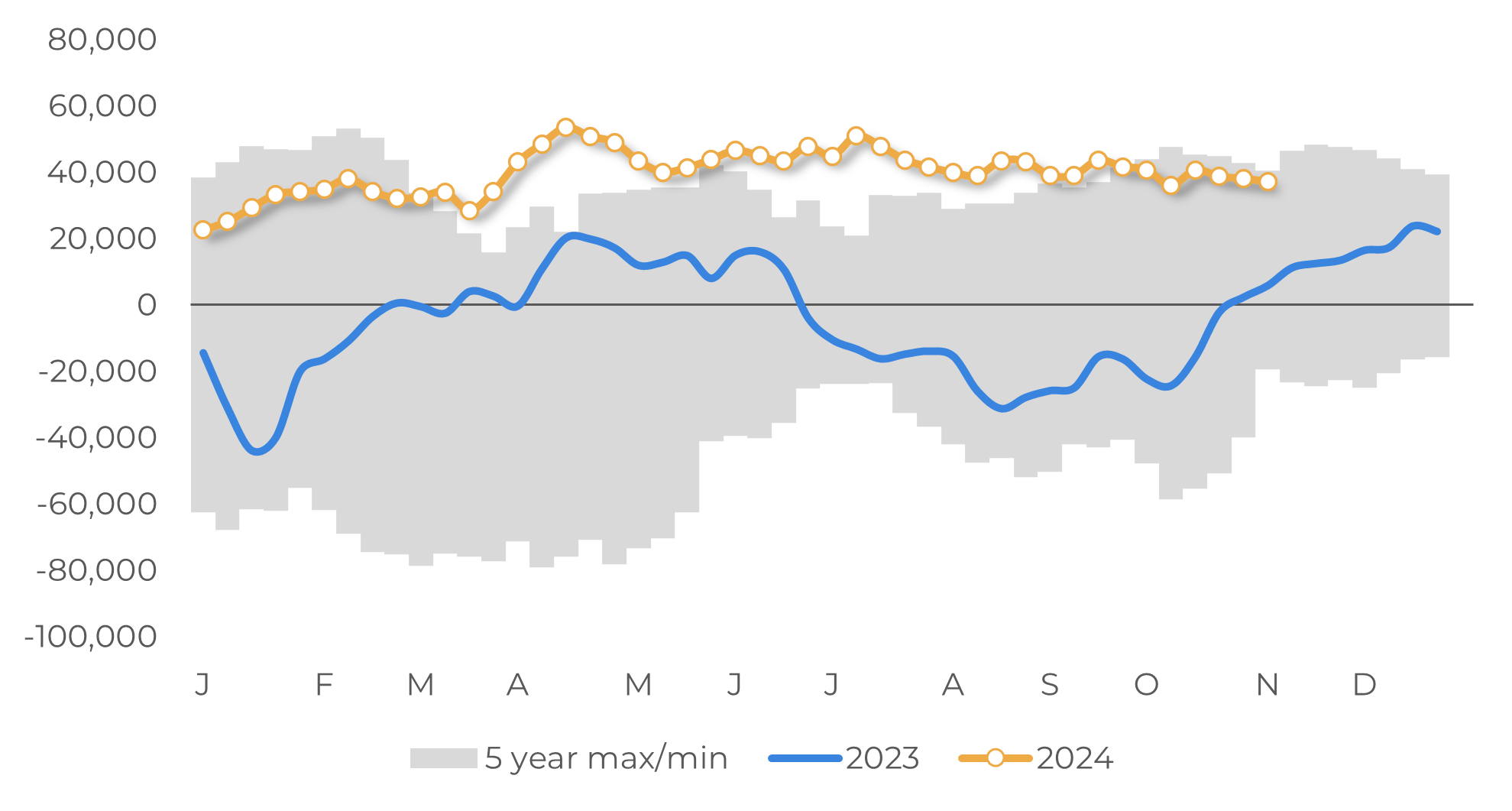

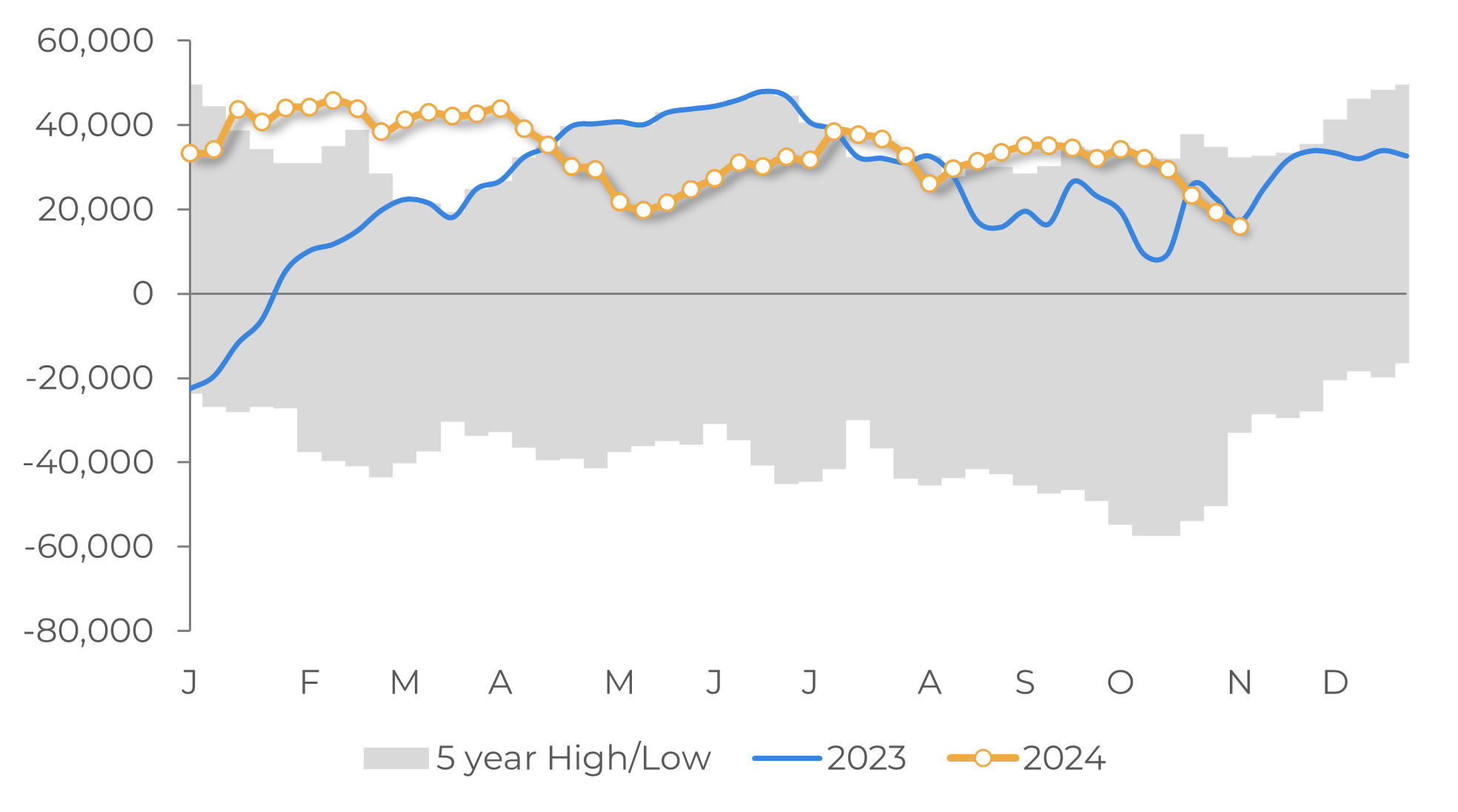

In this regard, it is also interesting to note that hedge funds, albeit at a low level, have been liquidating their long positions, as indicated by the CFTC (link) and ICE fund position report (link). As with the behavior of spreads, robusta coffee hedge funds have seen more realizations in recent weeks, possibly reflecting expectations of Vietnamese coffee entering the market and the more positive weather in Brazil. Although the funds remain relatively long, future liquidations of positions could lead to further corrections in coffee prices.

NY Arabica – Speculative Funds (lots)

Source: CFTC

LN Robusta – Speculative Funds (lots)

Source: ICE

In Summary

In general, market sentiment has become more bearish, at least in the short term. In the macroeconomic scenario, although the increase in interest rates in Brazil and the reduction in the US may provide some support for coffee prices, the newly elected US government still poses risks in terms of the appreciation of the US dollar and a possible negative effect on commodity prices in general.

Apart from the macro scenario, the fundamentals could still lead to a more bearish scenario. While the rains in Brazil could help production on 25/26, the entry of the Vietnamese harvest could ease robusta trade flows in the coming months. In addition, some destinations, such as the EU, are moving towards a recovery in stocks. Although these stocks remain below historical levels, this scenario tends to reduce European demand, at least until the beginning of 2025, which could also contribute to future corrections in coffee prices.

Weekly Report — Coffee

Written by Laleska Moda

laleska.moda@hedgepointglobal.com

Reviewed by Livea Coda

livea.coda@hedgepointglobal.com

livea.coda@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Global Markets LLC and its affiliates (“HPGM”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint Commodities LLC (“HPC”), a wholly owned entity of HPGM, is an Introducing Broker and a registered member of the National Futures Association. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and outside advisors before entering in any transaction that are introduced by the firm. HPGM and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. In case of questions not resolved by the first instance of customer contact (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ombudsman@hedgepointglobal.com) or 0800-878- 8408/ouvidoria@hedgepointglobal.com (only for customers in Brazil)

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.