Dec 20

/

Laleska Moda

As prices soar, can demand keep up?

Back to main blog page

- Prices of coffee have been particularly strong this end of year, as a lot of uncertainty surrounds the 25/26 Brazilian crop. Arabica futures hit new record levels in NY in December, as the March contract traded closer to 350 c/lb on the 10th of December. Robusta futures have also been above 5,000 USD/Mt in December.

- Besides the 25/26 season in Brazil, there are other supports in the market, such as the lower Vietnamese c24/25 crop and the general farmer retraction in many origins, as most farmers are in no rush to sell their beans. In Brazil, around 80% of the 24/25 season has already been sold which could translate into a more restricted off season in 2025.

- However, there is a crescent fear that current high prices may hamper global coffee consumption. In European Union, for example, the apparent consumption for the 23/24 season (Oct/23 – Sep/24) was below 22/23 levels, albeit still higher than average levels, while Japan’s apparent consumption is still lower than historical average levels, but higher than in 22/23.

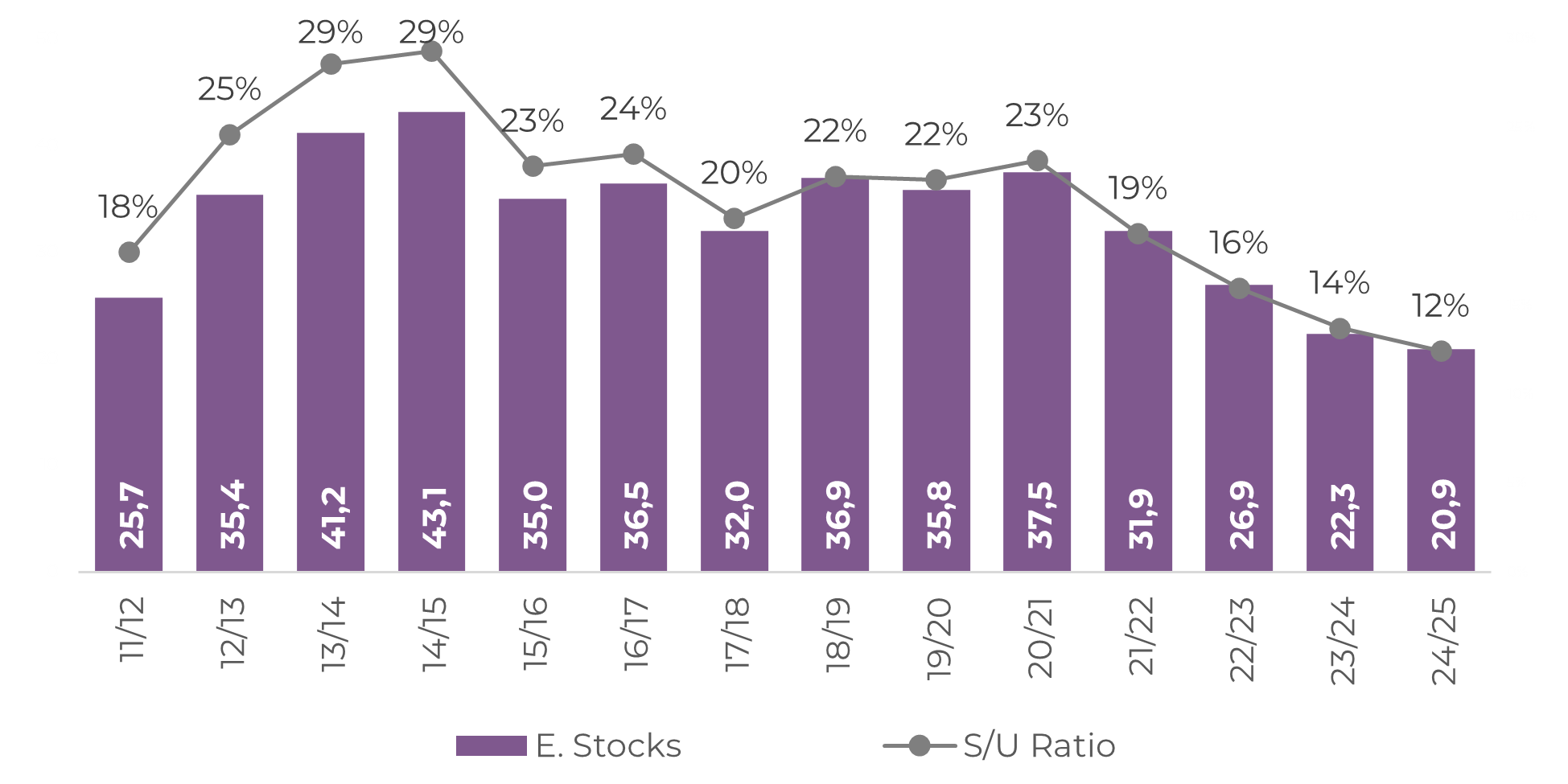

- On the other side, while stocks seem to be in a recovery trend, they remain below average levels, highlighting the concerns over supply.

As prices soar, can demand keep up?

Coffee futures prices soared at the end of the year. In the first half of December, Arabica contracts broke through the 330 c/lb mark, setting multi-year records, with the first contract even reaching almost 350 c/lb on Tuesday, 10th of December. The rally was mainly driven by uncertainties over production for the 25/26 season in Brazil, as some trading houses in the market released their initial estimates, with some indicating production of less than 40 million bags of arabica, once again threatening supply for the next crop. In addition, farmers have shown little appetite for new sales, particularly in Brazil where around 80% of the 24/25 season is already sold out.

While Arabica contracts have remained close to the 330 c/lb level in recent days, there is no doubt that Arabica prices are at their highest levels in history and some of this rally will be reflected in higher prices for consumers, especially as Robusta prices remain high. Although down from September's record prices, Robusta contracts also remain above the 5000 USD/Mt mark.

In fact, some companies have already announced that coffee will be more expensive for consumers next year. In Brazil, for example, the top three roasters - JDE Peet's, 3 Corações and Melitta - have announced increases of between 11% and 30% in domestic coffee prices between this year and early 2025. At current coffee prices, this trend is likely to be repeated by other roasters and in other countries. This scenario has also increased concerns that demand for coffee could be affected in the coming months.

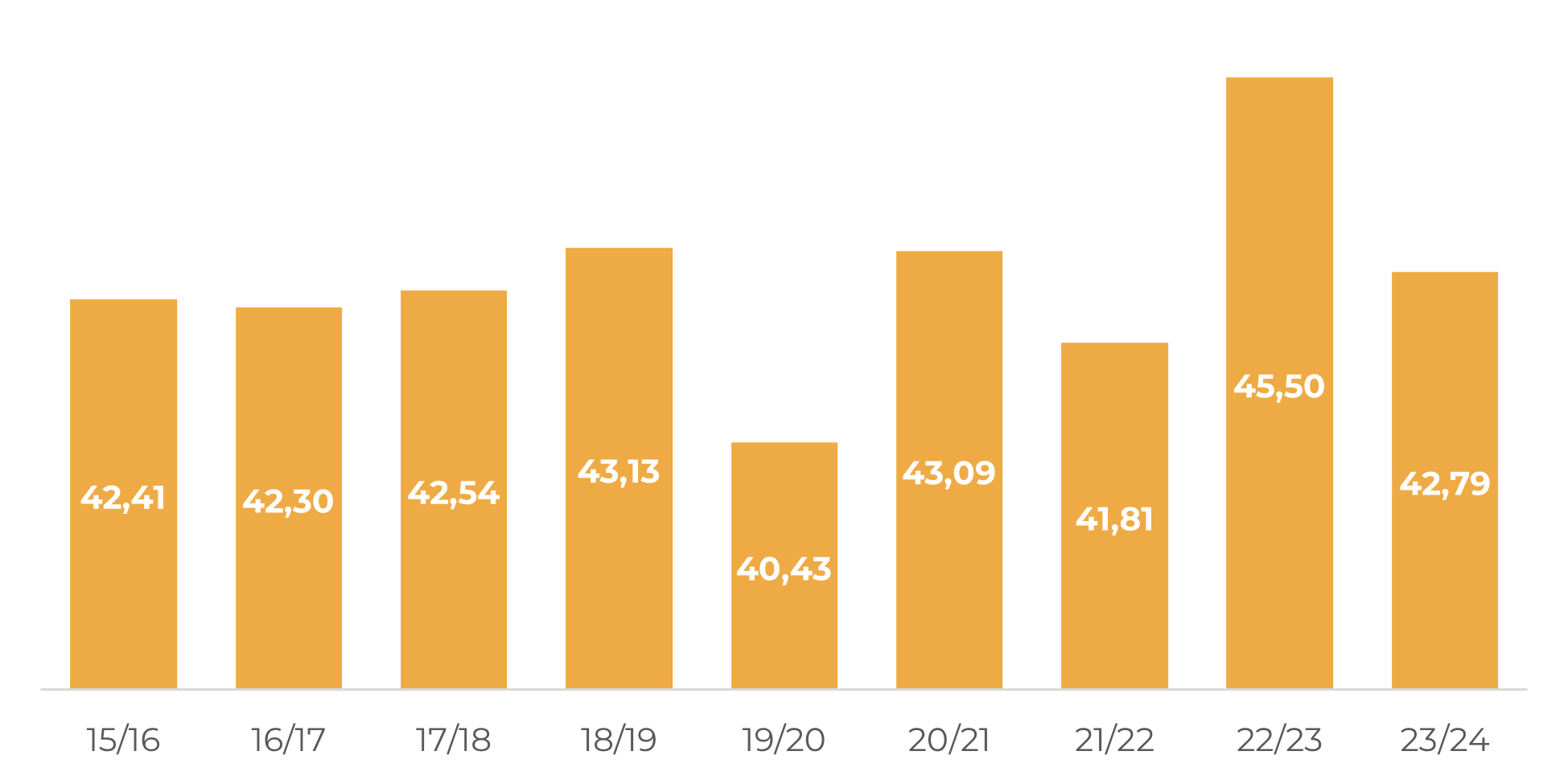

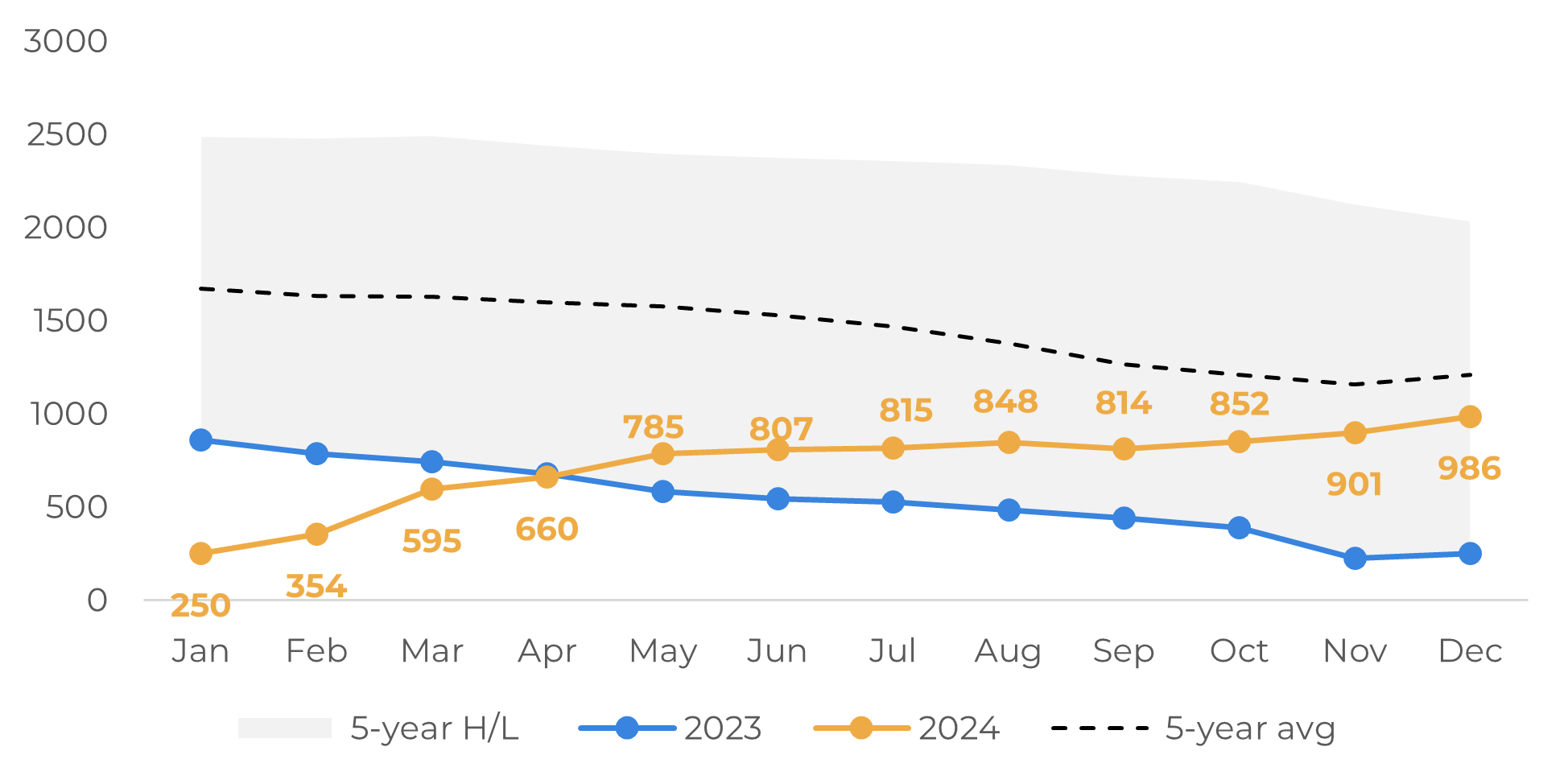

EU: Apparent Consumption (M bags)

Source: ECF, Agridata, Hedgepoint

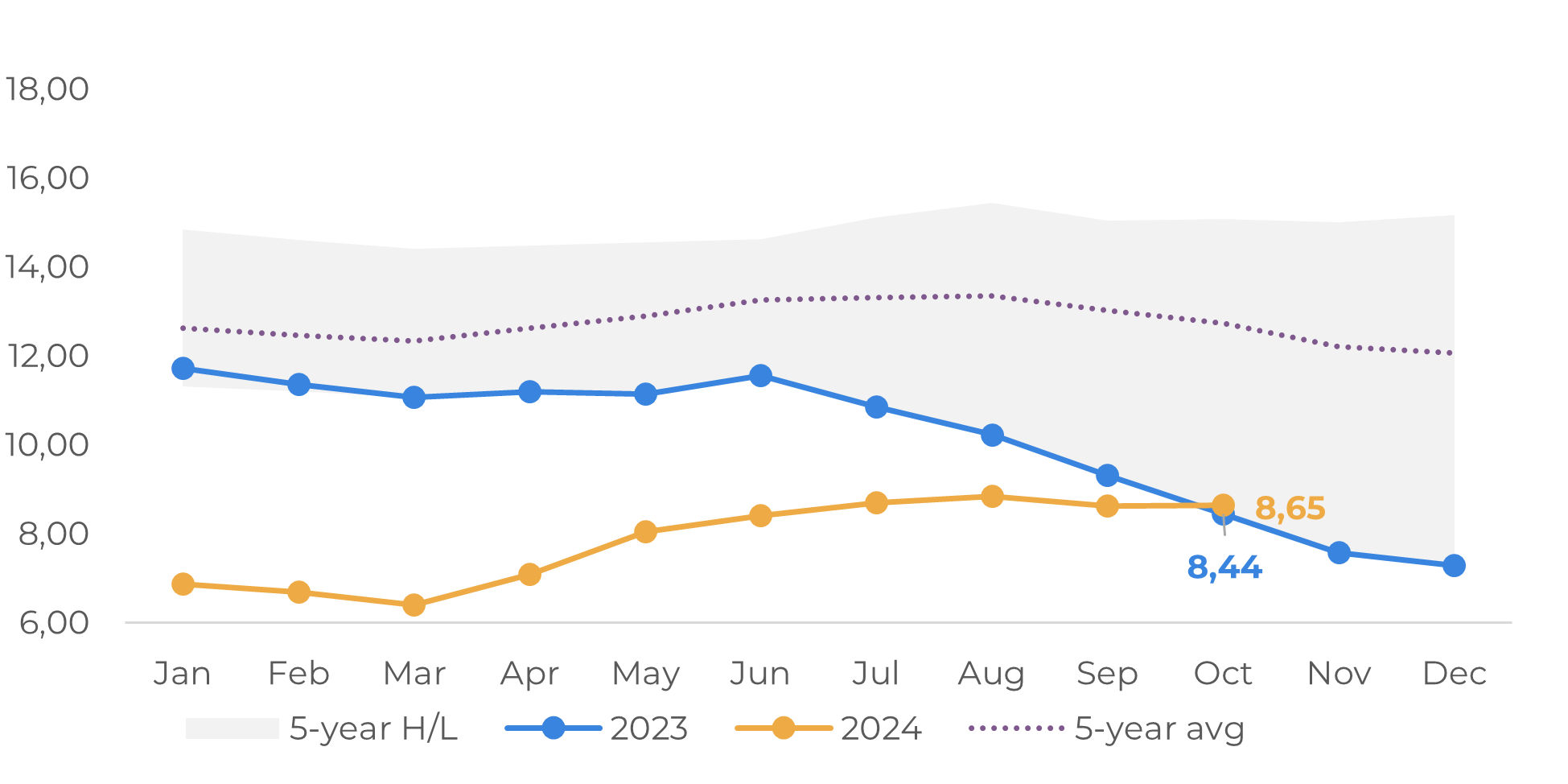

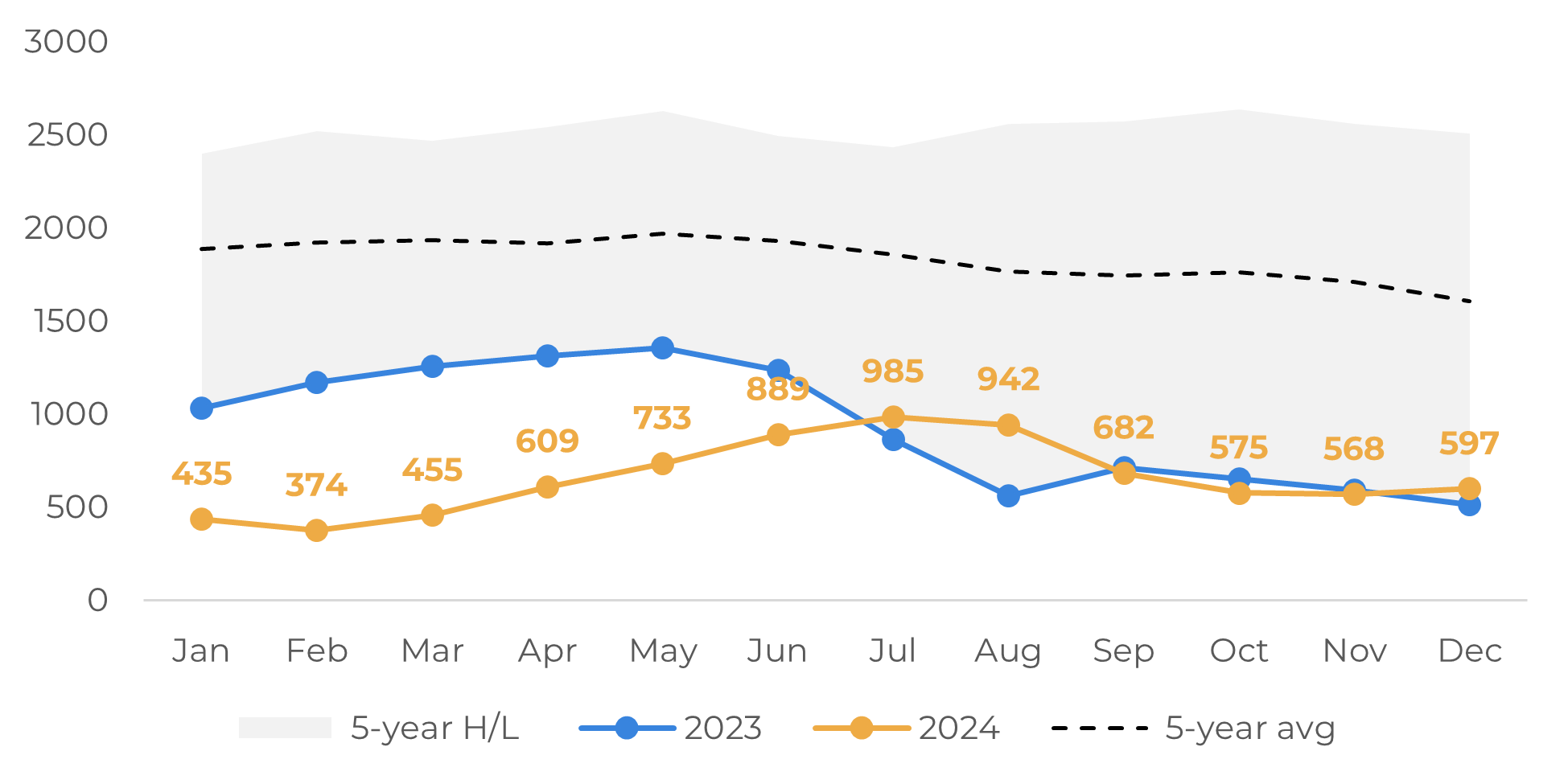

EU: ECF Stocks (M bags)

Source: ECF

In the European Union, the largest coffee consuming market, apparent consumption data for the 23/24 season (Oct/23-Sep/24) indeed showed a slight slowdown compared to the 22/23 cycle. However, the estimated 42.79 million bags is still above the 5-year average of 42.6 million bags, which could indicate that consumption is still resilient. Interestingly, the latest USDA report on global coffee supply and demand also points to a decline in European domestic consumption in 23/24 to 39.6 million bags (from 44.5 million in 22/23) yet predicts a recovery to 42 million bags in 24/25.

Another point of interest is the stock figures for the EU. Since reaching their lowest level in March, inventories have shown a slight recovery. However, the current figures are still below the average levels of 12 million bags seen in recent years, which could still provide support for prices in 2025, even if demand is indeed hampered.

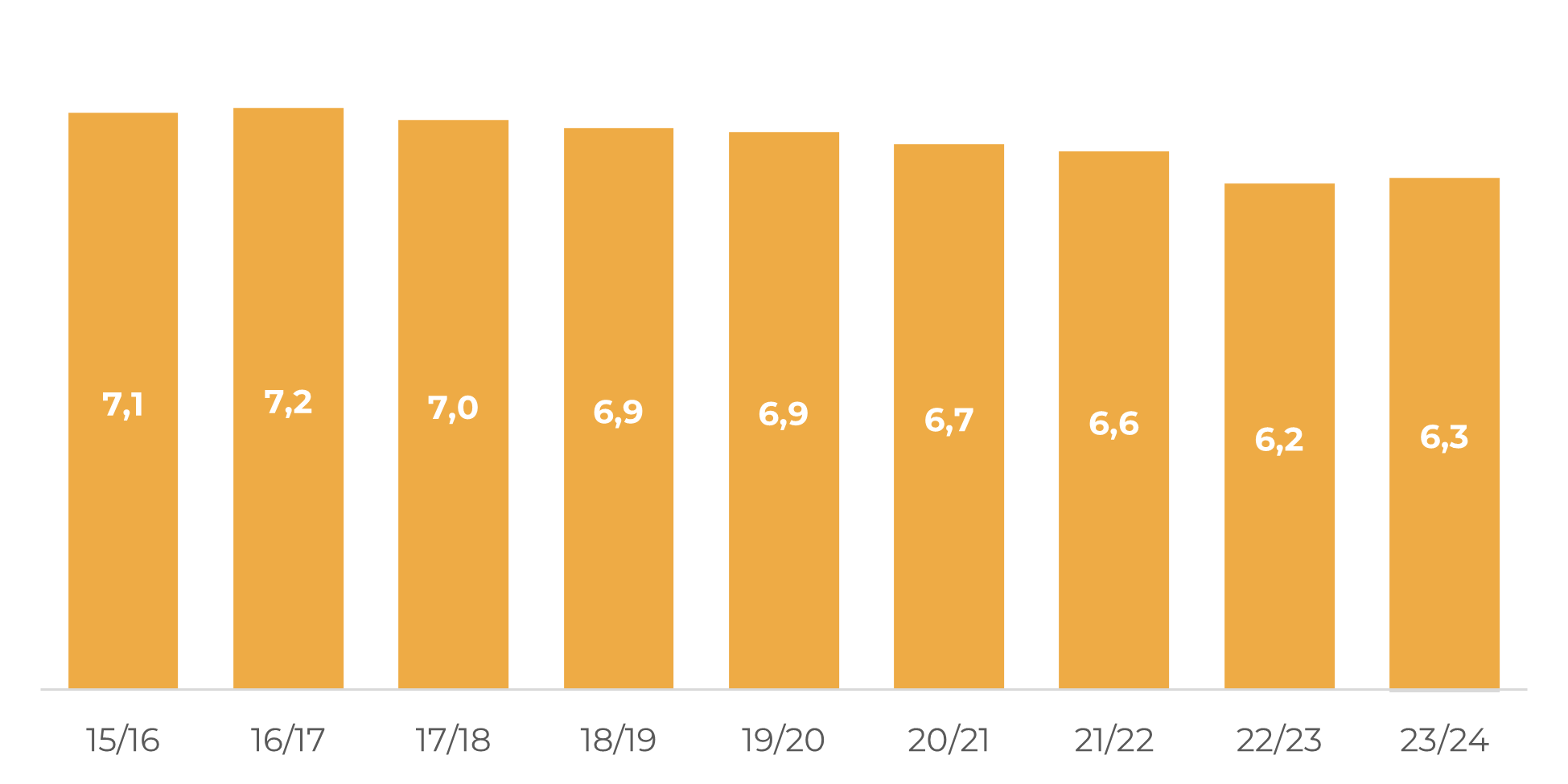

Japan: Apparent Consumption (M bags)

Source: JCA, Hedgepoint

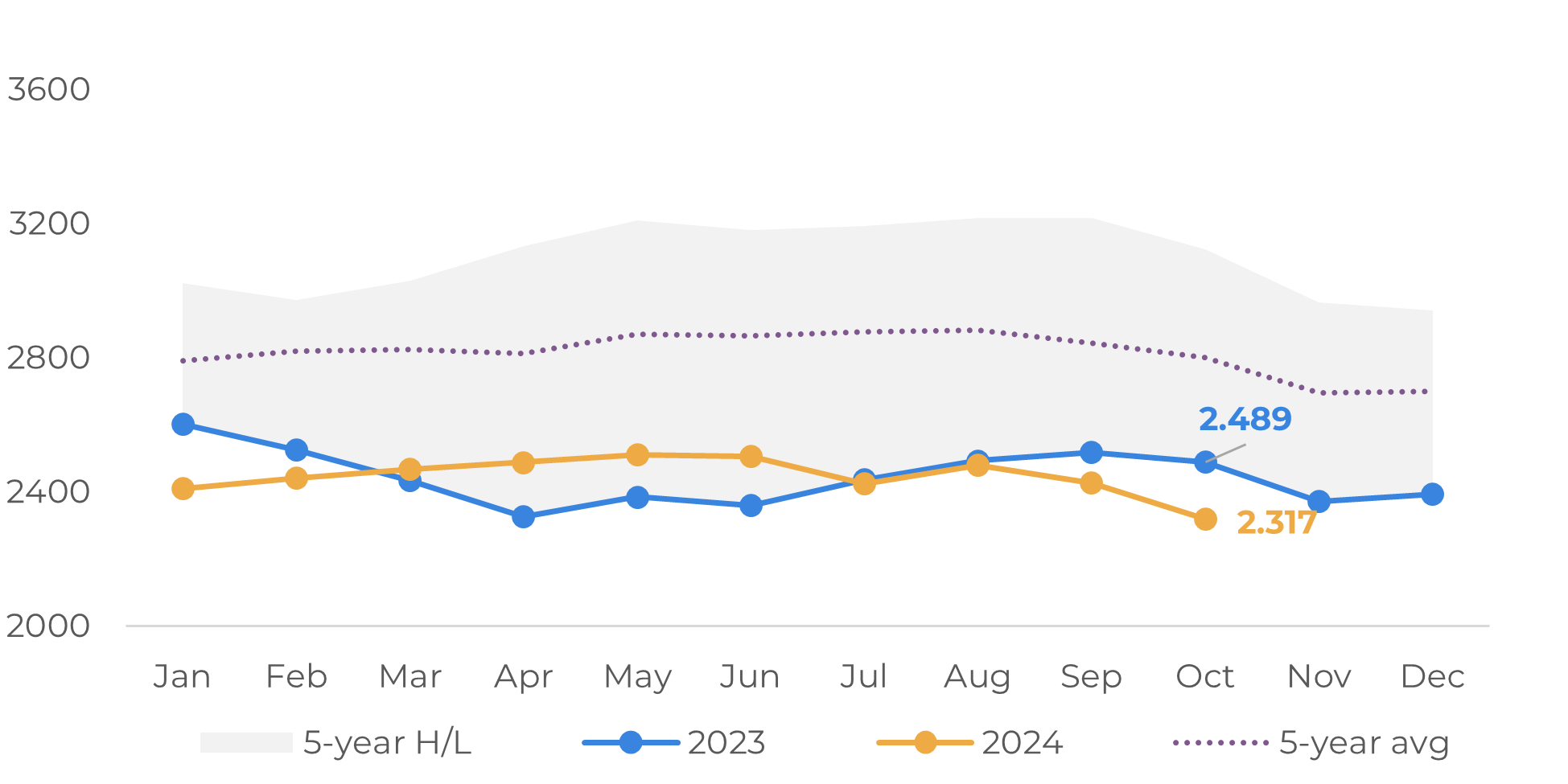

Japan Coffee Federation (JCA) Stocks (‘000 bags)

Source: JCA

In another traditional coffee market, Japan, apparent consumption data for the 23/24 season shows a slight recovery from 6.2 million bags in 22/23 to 6.3 million bags last season. Stocks, on the other hand, remain at their lowest levels for years, especially since August. Of course, rising prices may still have some impact on consumption in the 24/25 season, but current consumption and stock data also point to a delicate balance in the coming months.

Current certified ICE stocks are also likely to be a concern for the market. While there has been a recovery in certified Arabica stocks in recent months, they are still below average. However, in Brazil, the 24/25 crop is already 80% sold, with producers likely to hold on to their remaining beans. It is good to note that while we have the 24/25 harvest in Central America and Colombia in the next few weeks, the recovery in Arabica certified stocks has been relying heavily on the Brazilian beans. Robusta certified stocks, on the other hand, declined after August and remain well below average.

ICE Certified Arabica Stocks (‘000 bags)

Source: ICE, Hedgepoint

ICE Certified Robusta Stocks (‘000 bags)

Source: ICE, Hedgepoint

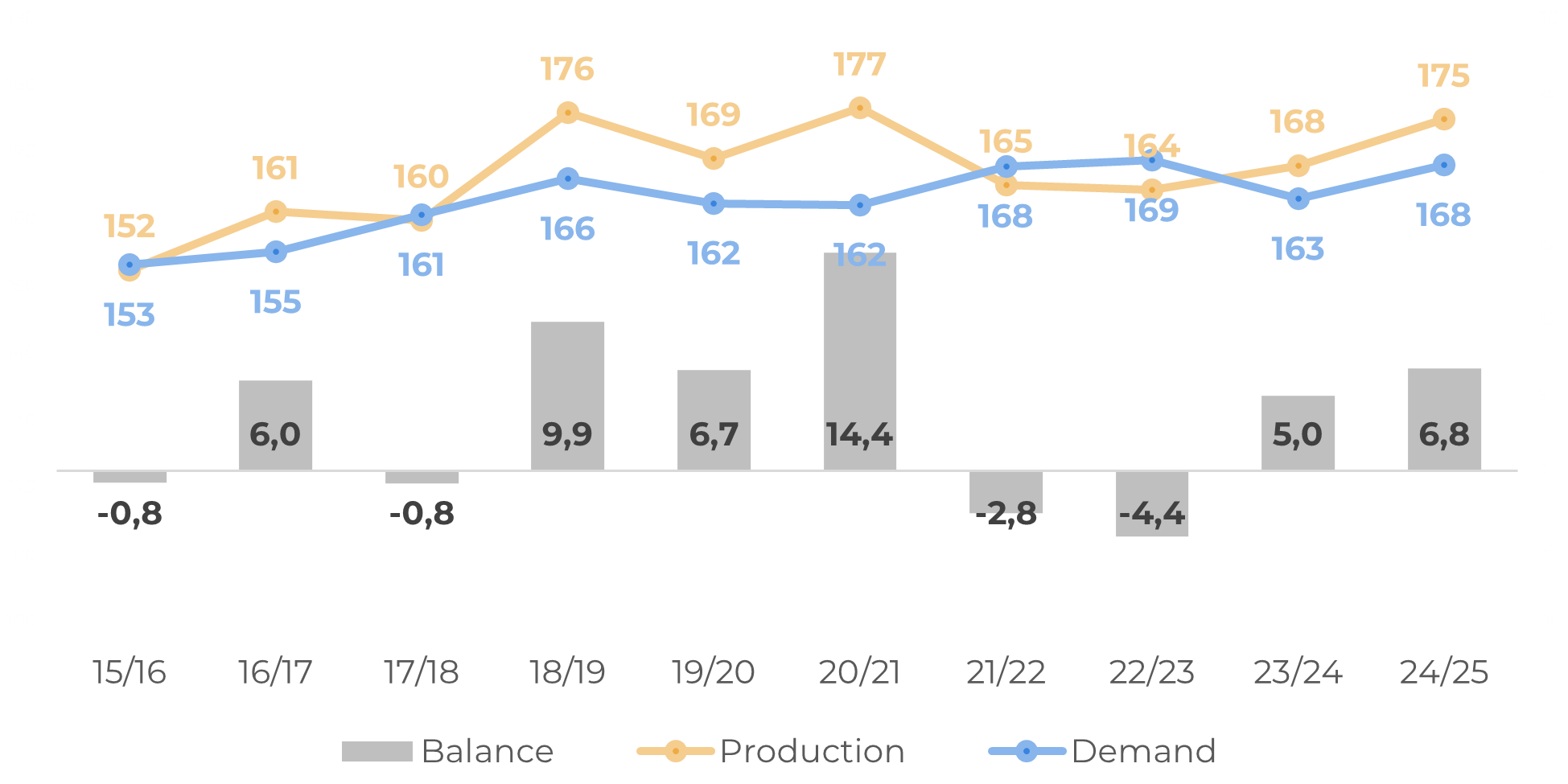

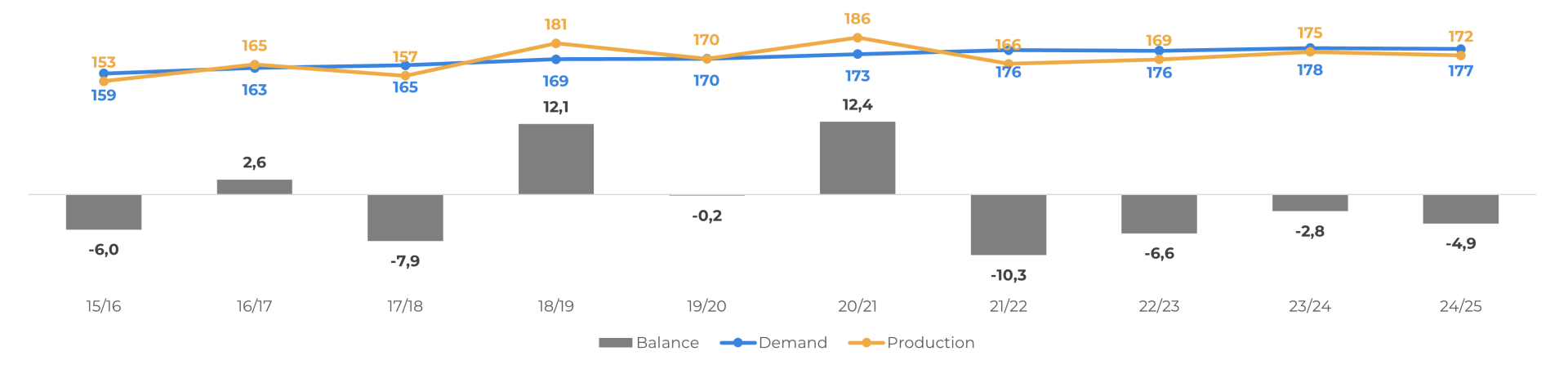

In global terms, the USDA expects a surplus in 24/25 resulting from higher production, but consumption is also expected to recover. As a result, stocks are expected to fall for the fourth year in a row.

Hedgepoint, on the other hand, has already factored in a slight decline in consumption in 24/25, given the rise in prices. In the coming months, we could see an even larger decline, but for now we are maintaining our estimates. However, world production has not been able to keep up with demand in recent years, leading to consecutive years of deficit and an expected reduction in stocks, especially in producer countries. As a result, supply will be even more constrained, despite a possible further negative impact on demand, with the market highly sensitive to the outcome of the Brazilian 25/26 season.

USDA: Global Coffee Balance (M bags)

Source: USDA

USDA: Global Coffee Stocks (M bags)

Source: USDA

Hedgepoint: Global Coffee Balance (M bags)

Source: Hedgepoint

In Summary

The coffee market was extremely volatile in 2024, with prices hitting new records on supply concerns, particularly as the first forecasts for the 25/26 Brazilian season hit the market. However, there are ongoing concerns that current price levels could affect demand.

In some consuming markets, such as the EU, apparent consumption has indeed fallen, but current 23/24 estimates are still above average, while in other markets demand continues to show resilience. Global coffee stocks, on the other hand, remain below average and are likely to remain so in the coming months.

With farmers around the world reluctant to sell large quantities of their beans, particularly in Brazil, coffee could still be supported even with a possible slowdown in demand in 2025.

Weekly Report — Coffee

Written by Laleska Moda

laleska.moda@hedgepointglobal.com

Reviewed by Lívea Coda

livea.coda@hedgepointglobal.com

livea.coda@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Global Markets LLC and its affiliates (“HPGM”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint Commodities LLC (“HPC”), a wholly owned entity of HPGM, is an Introducing Broker and a registered member of the National Futures Association. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and outside advisors before entering in any transaction that are introduced by the firm. HPGM and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. In case of questions not resolved by the first instance of customer contact (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ombudsman@hedgepointglobal.com) or 0800-878- 8408/ouvidoria@hedgepointglobal.com (only for customers in Brazil)

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.