Coffee Crop Forecast: Brazilian 26/27 Season

26/27 Brazilian Coffee Crop Estimate

In this report, we present our first estimate for the Brazilian 26/27 season. The development did not come without challenges, and the weather in the next months will still be essential to the projection of the final numbers of the crop, especially with the bean-filling phase starting at the end of this year.

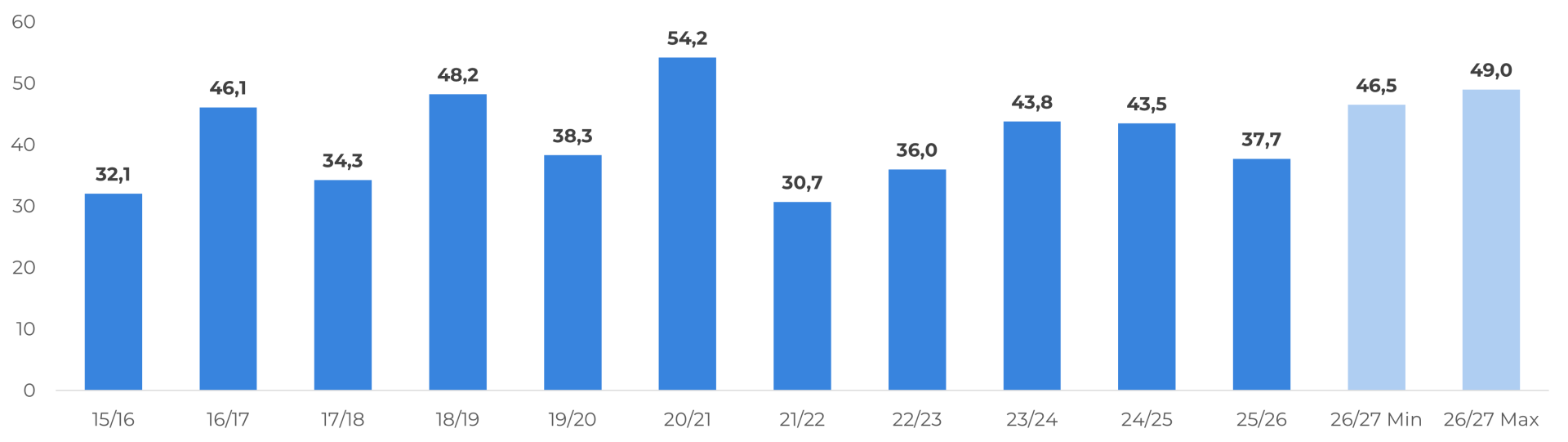

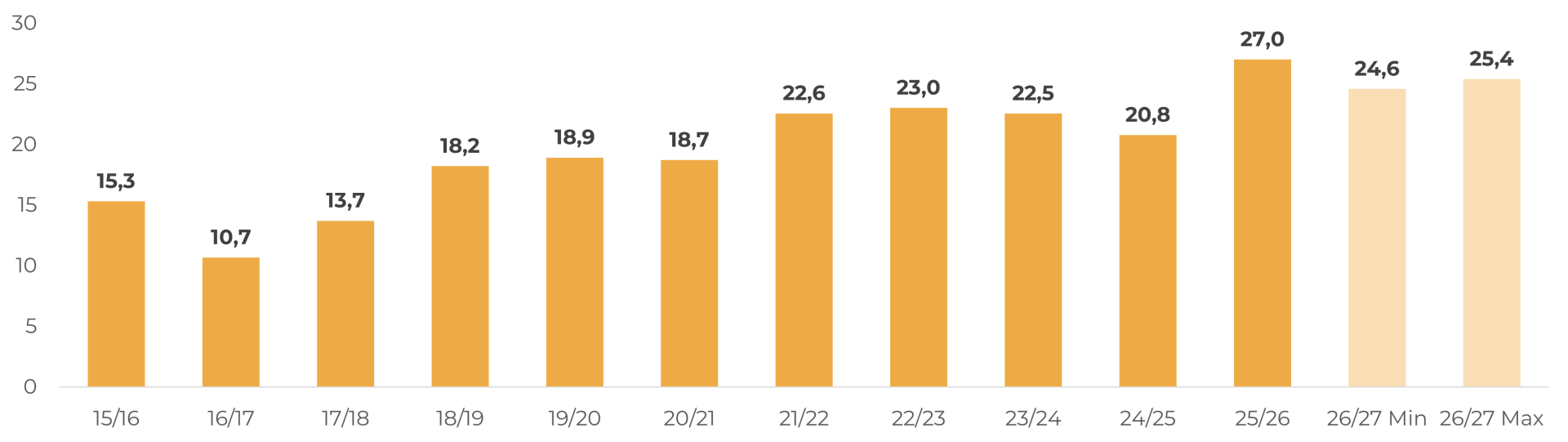

For now, Arabica figures are expected to be in the range of 46.5 to 49 M bags, while Conilon production could vary from 24.6 to 25.4 M bags, leading to a potential 71 M to 74.4 M bags in 26/27. Explore the detailed analysis below.

Rains in October and November allowed the Arabica flowers to set

From August until early October, a dry spell in Brazil created uncertainty for the 26/27 crop development, delaying the flowering phase and causing losses in part of the first blooms in September. However, after mid-October, abundant rainfall returned to the Arabica coffee regions, enabling a second flowering (or the first, in some areas). Although below average levels, good rainfall volumes continued until mid-November, allowing flowers to set and restoring positive expectations for the 26/27 season.

Nevertheless, Arabica production in this cycle is unlikely to reach the levels of the 20/21 season. Although production has increased – supported by new planted areas and improved tree husbandry – some farms are still reporting lower-than-expected yields. Many had anticipated that 26/27 would bring a synchronization of the biennial cycle and an upturn across most Arabica-producing regions, but productivity remains uneven.

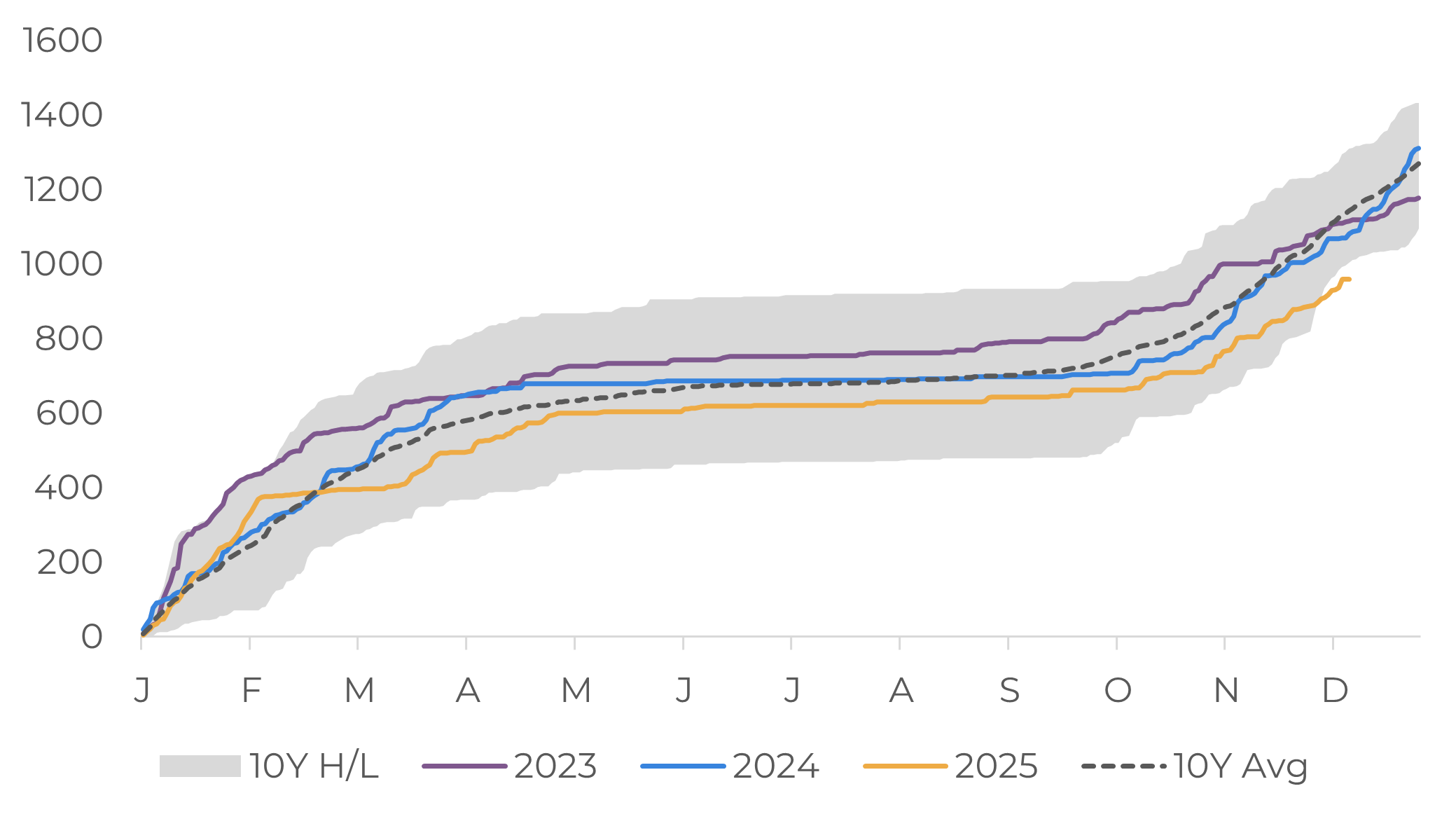

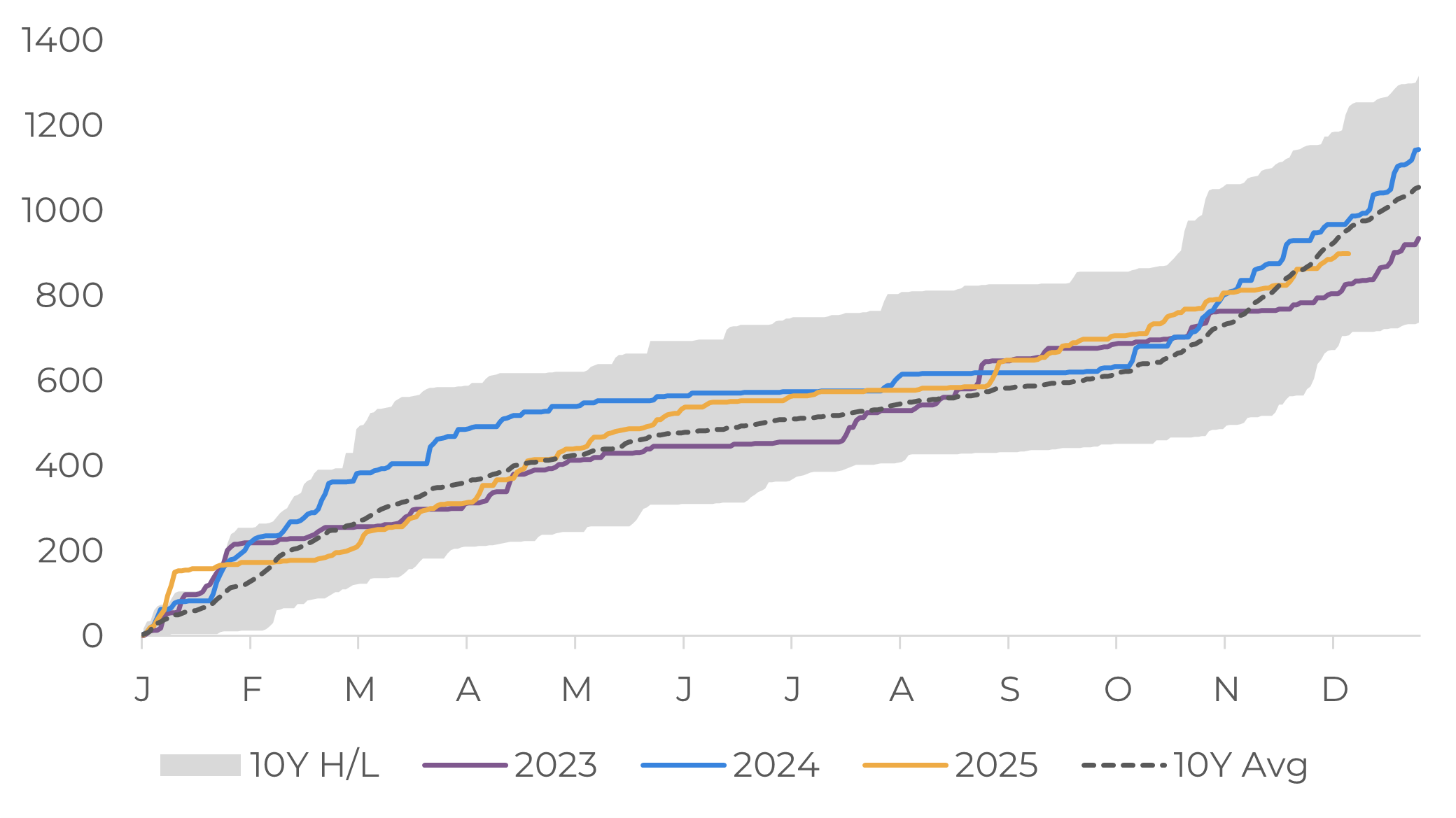

Minas Gerais: Weighted Cumulative Precipitation in Coffee Areas (mm)

Source: Bloomberg, Hedgepoint

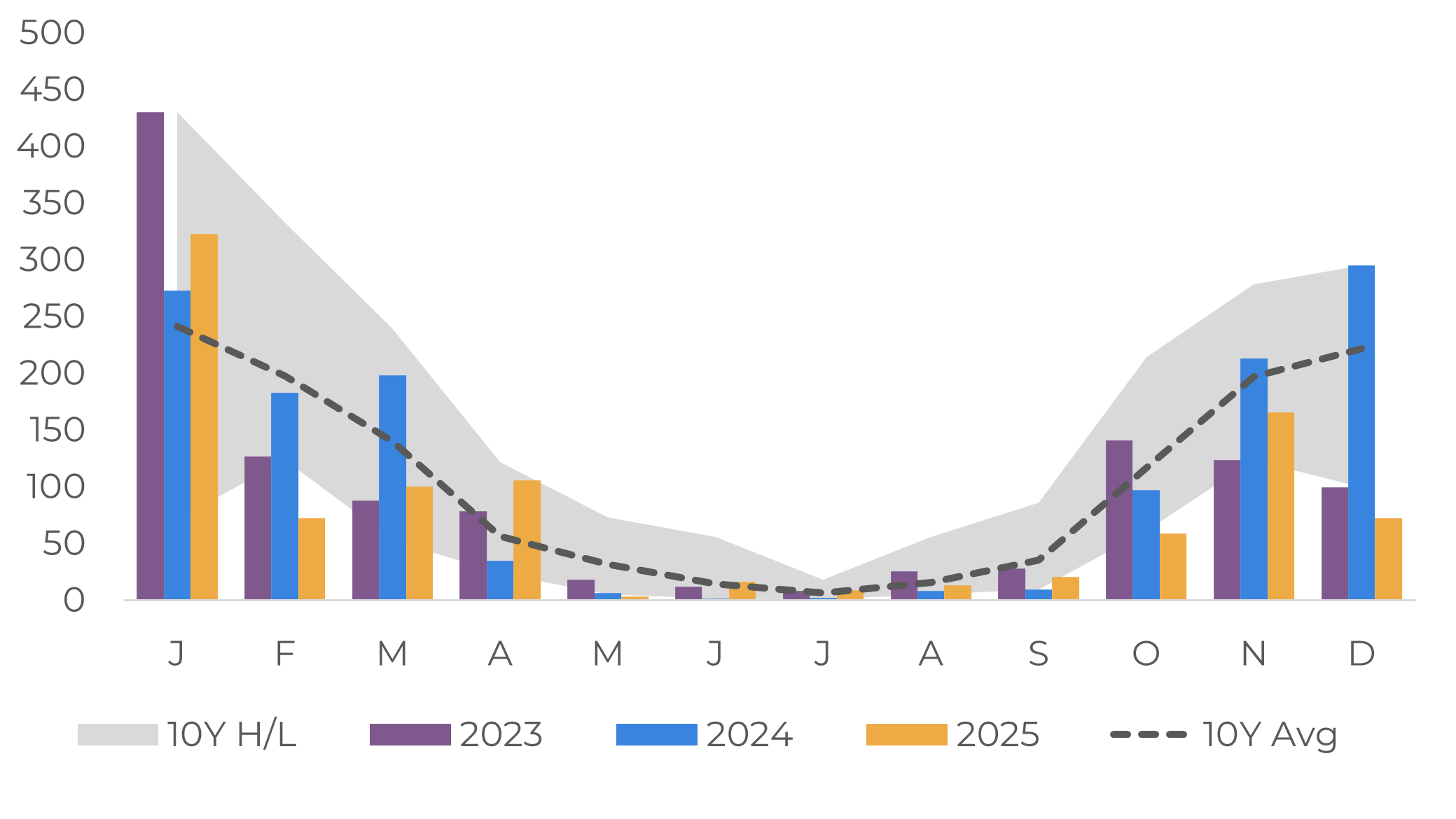

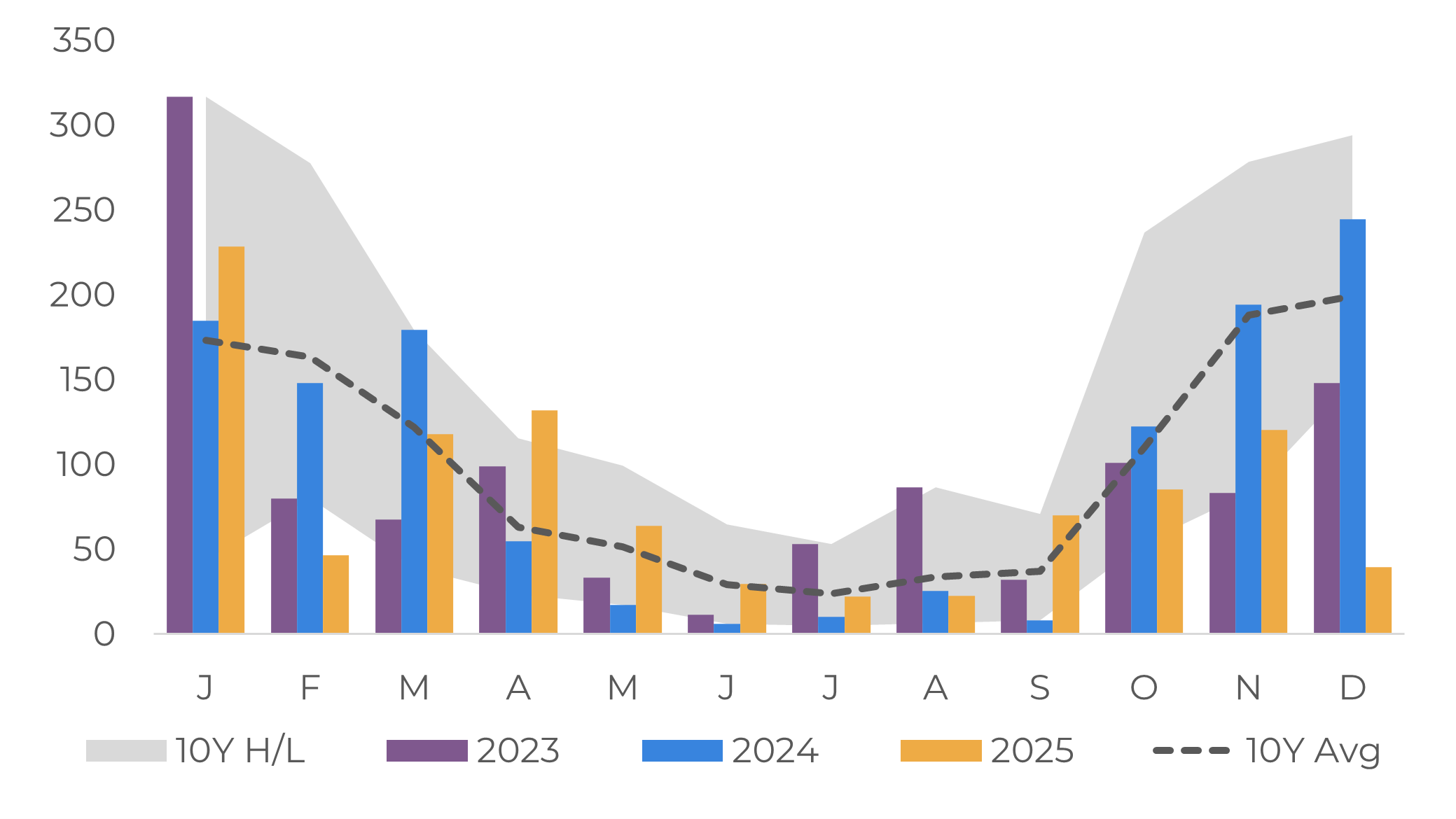

Minas Gerais: Weighted Monthly Precipitation in Coffee Areas (mm)

Source: Bloomberg, Hedgepoint

In certain regions, there has also been an increase in tree pruning, particularly in areas with more damaged plants that were not pruned last season due to higher prices. On the other hand, coffee growers continue to invest in new areas, though the results of these investments will only become evident in the coming years.

Despite these challenges, production is set to increase in the 26/27 season. For now, Arabica output is projected at 46.5 to 49 M, well above the 37.7 M bags harvested in the 25/26 cycle (+23,3 to 29,9%). More precise figures will be released between March and April, as the coffee fields are currently in the bean-filling phase, with precipitation levels in the coming months having a direct impact on processing yields.

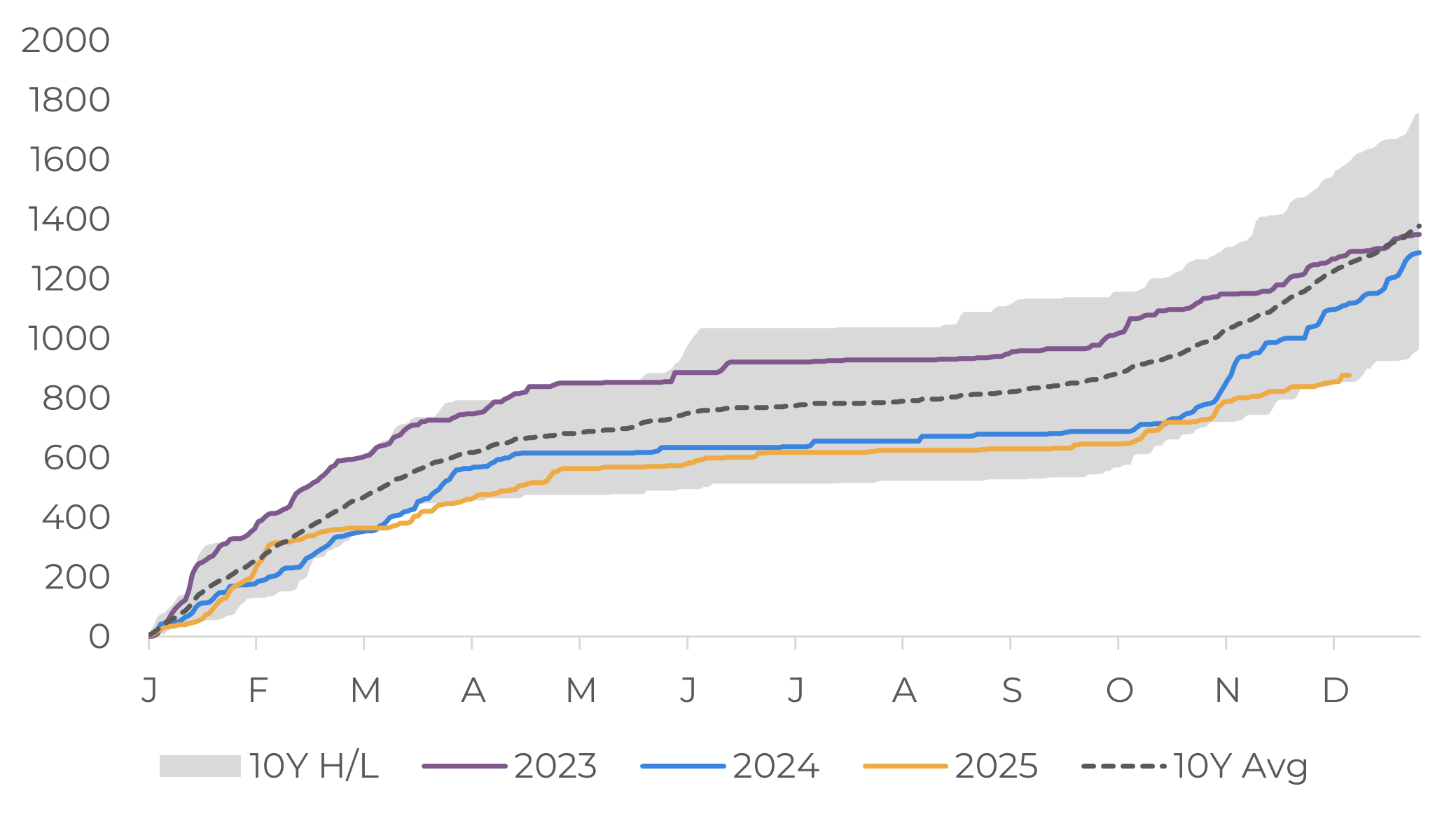

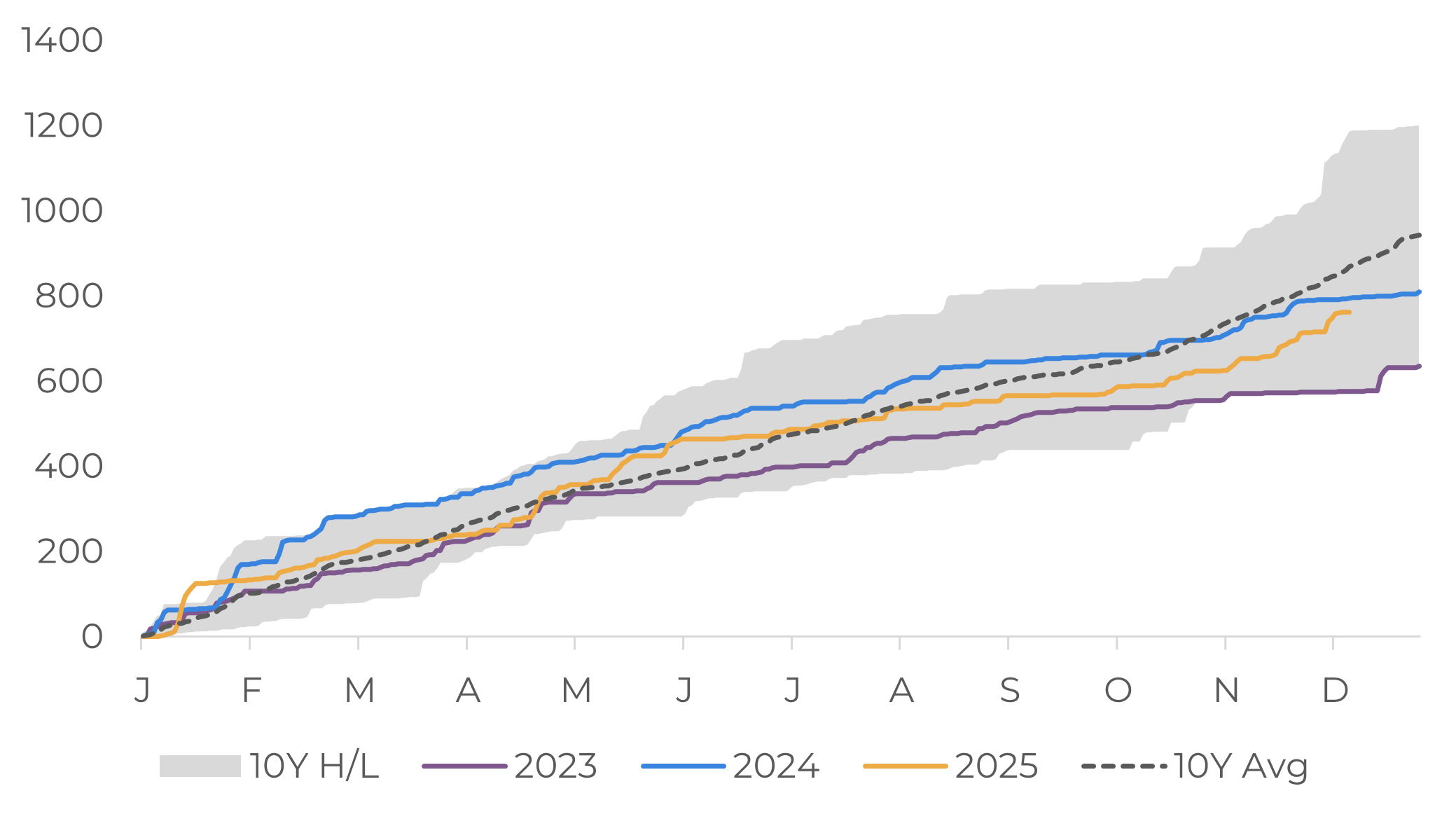

São Paulo: Weighted Cumulative Precipitation in Coffee Areas (mm)

Source: Bloomberg, Hedgepoint

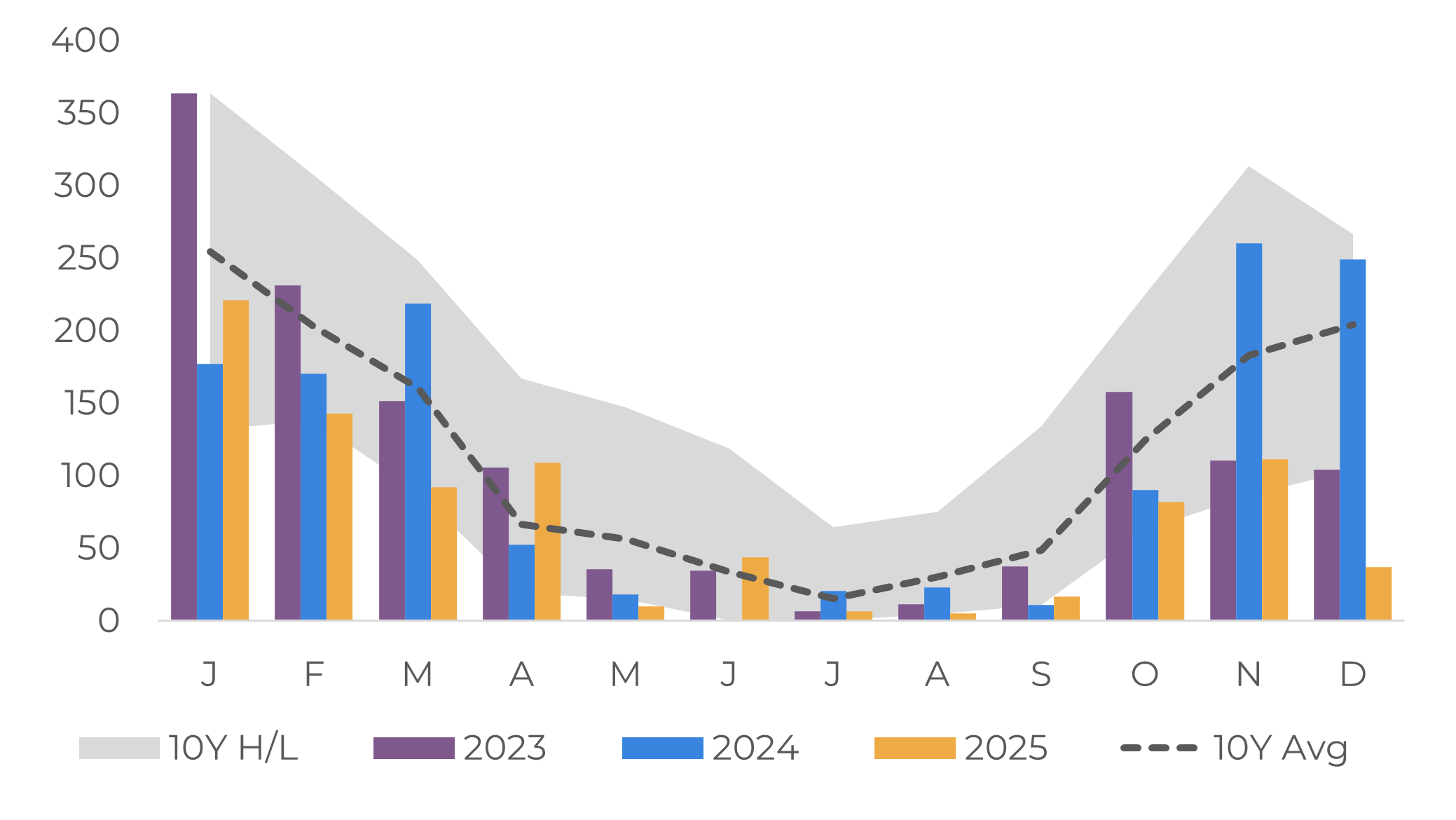

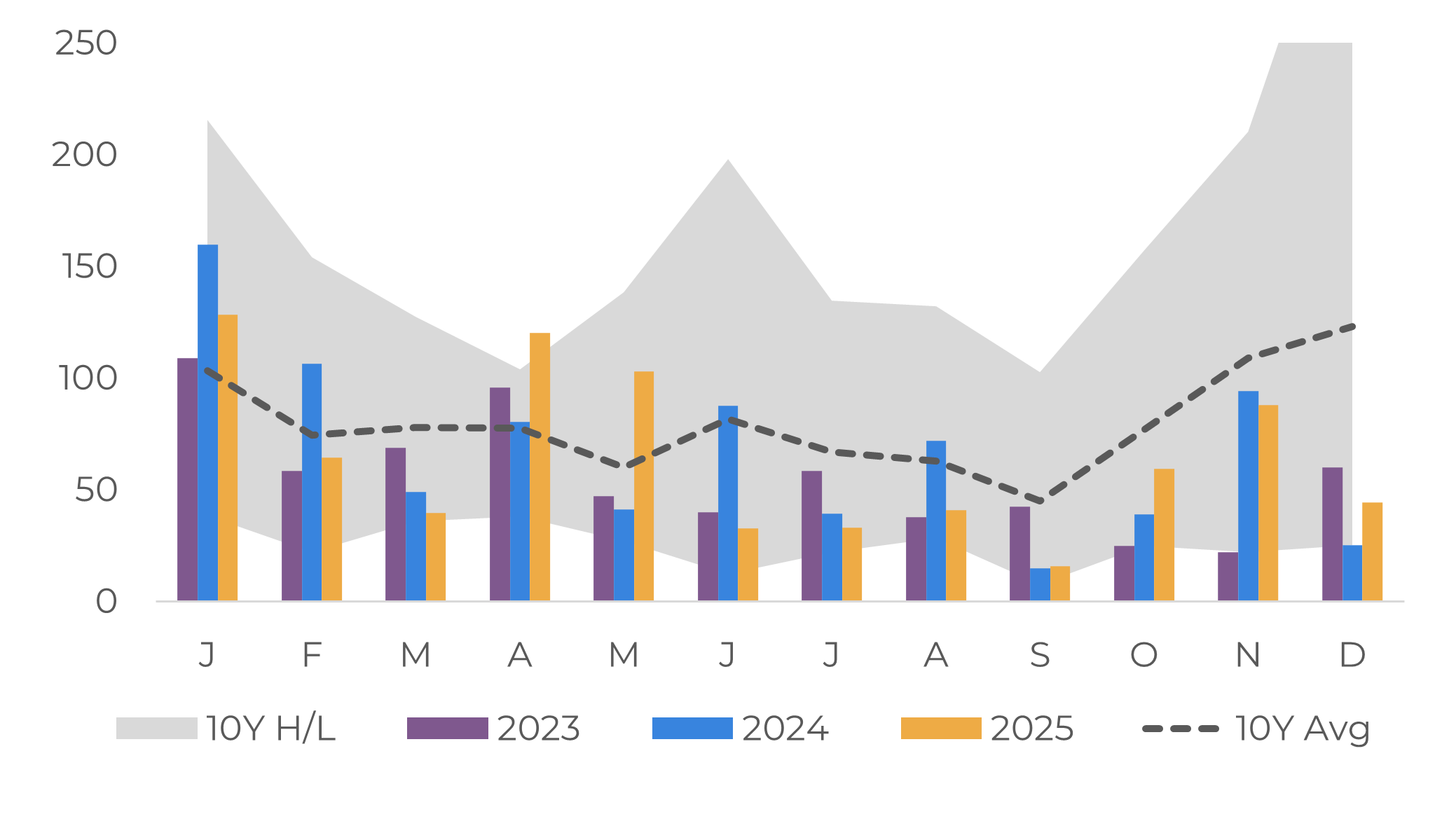

São Paulo: Weighted Monthly Precipitation in Coffee Areas (mm)

Source: Bloomberg, Hedgepoint

Conilon production will be good, but below 25/26

Weather conditions, particularly in Espírito Santo and Bahia, have been more favorable for the development of the 26/27 Conilon crop since August. Although precipitation has remained below average, its consistency, combined with good reservoir levels, supported flower setting and bean development across most regions, sustaining positive expectations for the upcoming cycle.

Espírito Santo: Weighted Cumulative Precipitation in Coffee Areas (mm)

Source: Bloomberg, Hedgepoint

Espírito Santo: Weighted Monthly Precipitation in Coffee Areas (mm)

Source: Bloomberg, Hedgepoint

It is important to note, however, that the 25/26 season delivered exceptional production. Typically, after such a strong cycle, yields decline as plants have expended much of their energy. In this context, a drop in production for 26/27 was anticipated, though the expansion of cultivated areas in recent years has partially offset the expected decline. Since 2023, higher Robusta prices have prompted farmers to invest in new areas and renovation of old areas, with part of these new areas entering in production this cycle.

Consequently, Conilon production is expected to reach around 24.6 to 25.4 M bags, a drop of 6 to 9% from the 27 M bags from 25/26 levels, but still at the high end of production. Such as for Arabica, the Conilon areas are also in the bean-filling phase, and further revisions in our number will be made after March.

Bahia: Weighted Cumulative Precipitation in Coffee Areas (mm)

Source: Bloomberg, Hedgepoint

Bahia: Weighted Monthly Precipitation in Coffee Areas (mm)

Source: Bloomberg, Hedgepoint

Brazil’s 26/27 season could contribute to global stock recovery

With Conilon production still elevated and a recovery on the Arabica side, the Brazilian 26/27 season could reach between 71 and 74.4 M bags of coffee. Although this is lower than some agents initially expected – with rumors suggesting production could exceed 80 million bags – output remains high and could contribute to a partial recovery in global stocks next year.

However, as stated before, more concrete figures for the 26/27 season will only be possible after the bean-filling phase (December to March), when processing yields can be properly assessed. This uncertainty could also lead to higher market volatility. While sentiment is currently shifting toward a more bearish outlook, driven by expectations of higher Brazilian production next year and the removal of most U.S. tariffs on Brazilian coffee, any weather disturbance could trigger short-term price spikes.

Stocks will remain a key driver of price movements, as inventories in most destinations – including ICE-certified stocks – continue at low levels. Until these inventories reach more favorable levels, prices may still find some support.

Hedgepoint: Brazil’s Arabica Production (M bags)

Source: Hedgepoint

Hedgepoint: Brazil’s Conilon Production (M bags)

Source: Hedgepoint

Coffee Report

Reviewed by Thais Italiani

thais.italiani@hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without intending to create obligations or commitments to third parties. It is not intended to promote or solicit an offer for the sale or purchase of any securities, commodities interests, or investment products. Hedgepoint and its associates expressly disclaim any liability for the use of the information contained herein that directly or indirectly results in any kind of damages. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests, such as futures, options, and swaps, involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgment and/or consult advisors before entering into any transactions. Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately. Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only). Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets. “HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.