Crop Forecast: Soy Brazil - 2025 01 23

Brazil's 2024/25 soybean crop estimated at record 170.7M tons

Straight to the point: record crop on the way

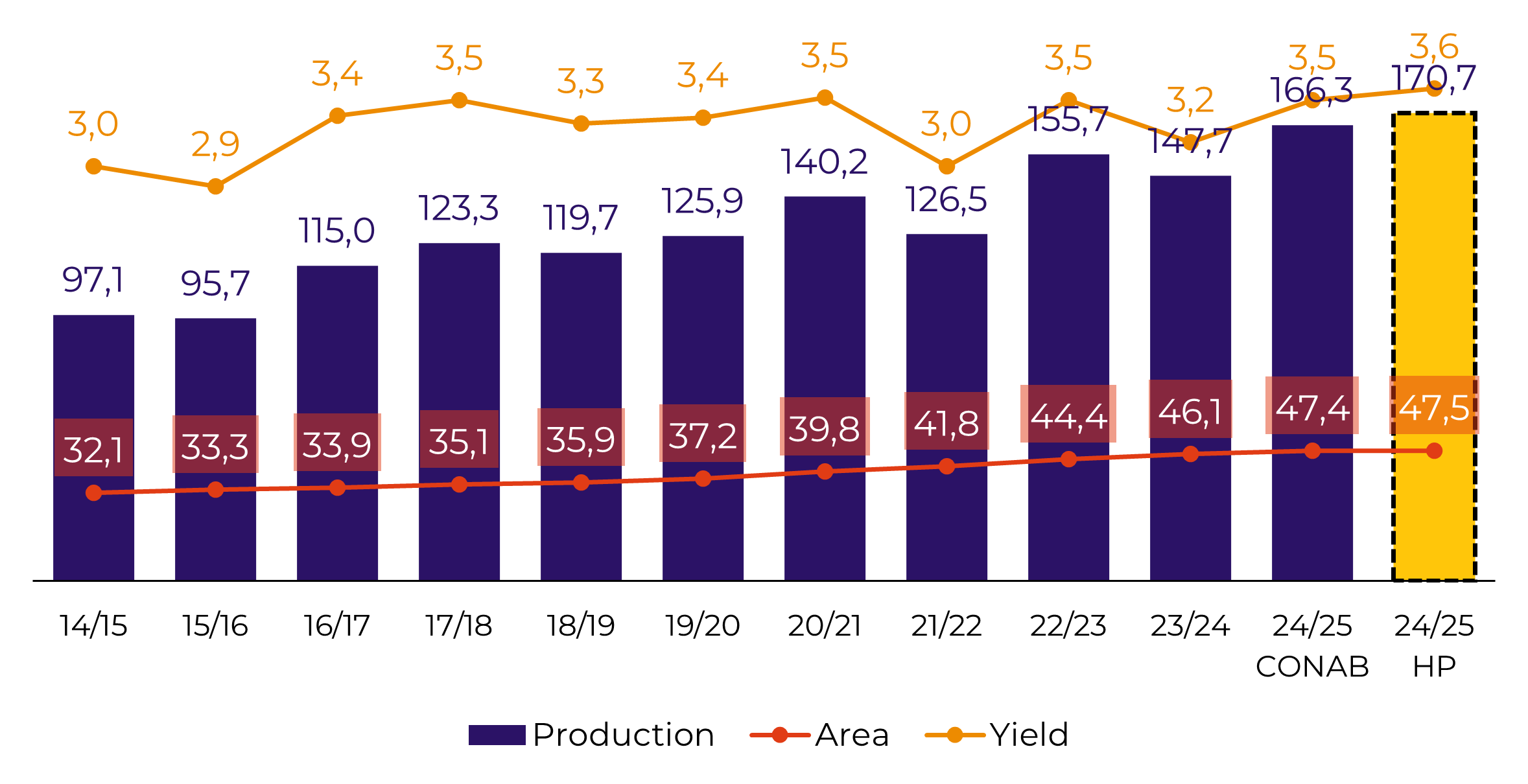

We estimate that Brazilian soybean production should reach a new record in the 2024/25 season, with a production of 170.72 million tons. The area planted this season is expected to reach 47.54 million hectares, also pointing to a new record. The average yield expected for the country is 3,591 kilos per hectare, or 59.85 bags per hectare.

Even with some production issues in Rio Grande do Sul and Mato Grosso do Sul, states that have been suffering from low humidity in recent weeks, the high yields expected for states such as Paraná, Mato Grosso, Goiás, Minas Gerais and Bahia should guarantee a new record production for the world's largest soybean producer.

It is important to note that our current forecast already includes some production losses in Rio Grande do Sul and Mato Grosso do Sul, states that are not expected to reach their initial production potentials. Despite this, the problems are far from being considered catastrophic. If the rains return in the coming weeks, especially in Rio Grande do Sul, we could see some recovery in the expected average yields, preventing losses from increasing. However, if the weather continues to be dry and temperatures remain high, the problems could increase, requiring further adjustments to state and, consequently, national production. Therefore, it is still important to monitor the weather conditions for the development of the Rio Grande do Sul crop, in particular. As for the states in the central region of the country, we must pay attention to the weather conditions to finalize the development and progress of the harvest, which is already starting in Paraná and Mato Grosso.

In any case, even if further cuts are necessary, we are unlikely to see enough reductions to prevent us from achieving record production this season. Several factors have been helping in this cycle, such as the increase in area, technological intensifications, the recovery in the pace of planting, and above all, the weather, which after October 2024 proved to be very favorable for the development of crops in most of the states in the central belt of the country.

Brazil Soybean - Area, Yield and Production (M ha, ton/ha, M ton)

Source: Hedgepoint, Conab

Crop phenology

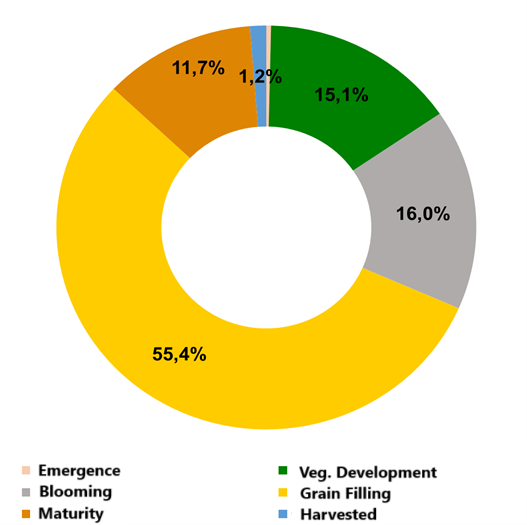

Soybean Brazil - Phenology in Jan 19

Source: Conab

Regarding to the phenology of Brazilian crops, the latest Conab figures indicate that 55.4% of the country's crops are still in the grain filling stage. This calls for special attention to be paid to the weather in the coming weeks in order to finalize the development of the new crop, especially in the South, Northeast and North regions, where most of this percentage is found.

Weather still a decisive factor

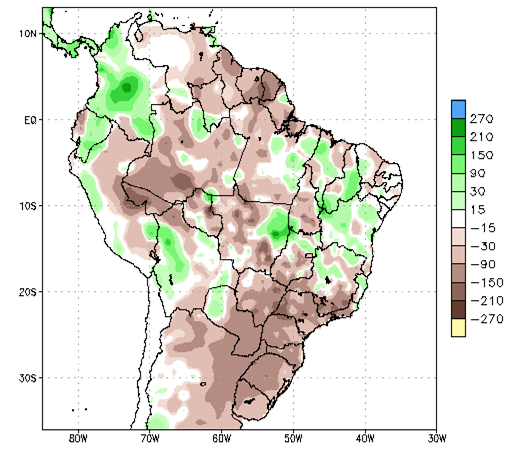

The last 30 days have seen below-average rainfall in the South and part of the Midwest, a fact that supports concerns regarding the production in Rio Grande do Sul and Mato Grosso do Sul. In Paraná, although the rainfall was also below average in the period, we should remember that the crops were already in the final stages of development due to the good pace of planting, with less potential damage to the plants.

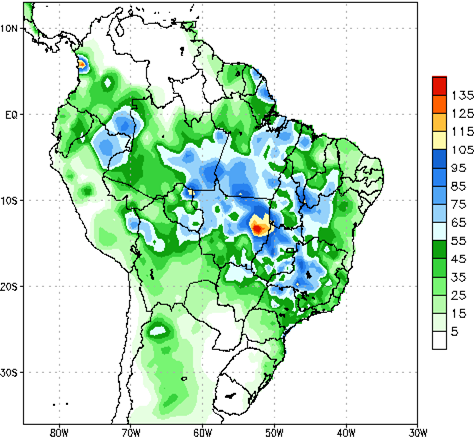

Brazil – Precipitation Anomaly – last 30 days (mm)

Source: NOAA

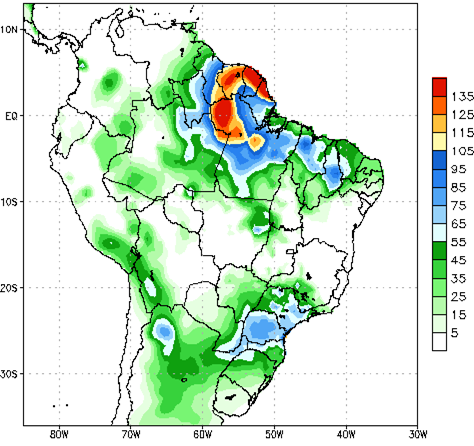

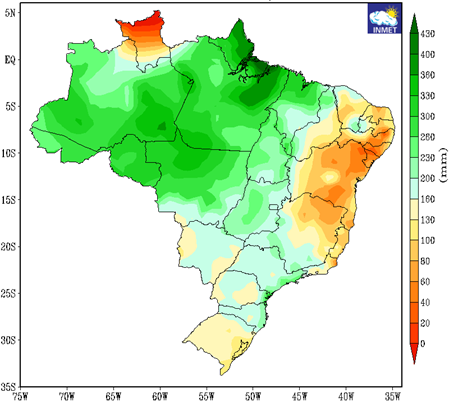

Brazil – Precipitation Forecast – 1 to 7 days (mm)

Source: NOAA

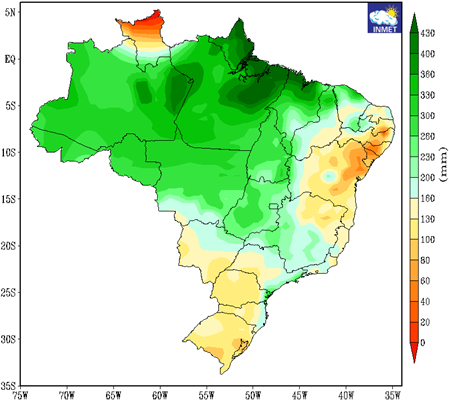

Brazil – Precipitation Forecast – 8 to 14 days (mm)

Source: NOAA

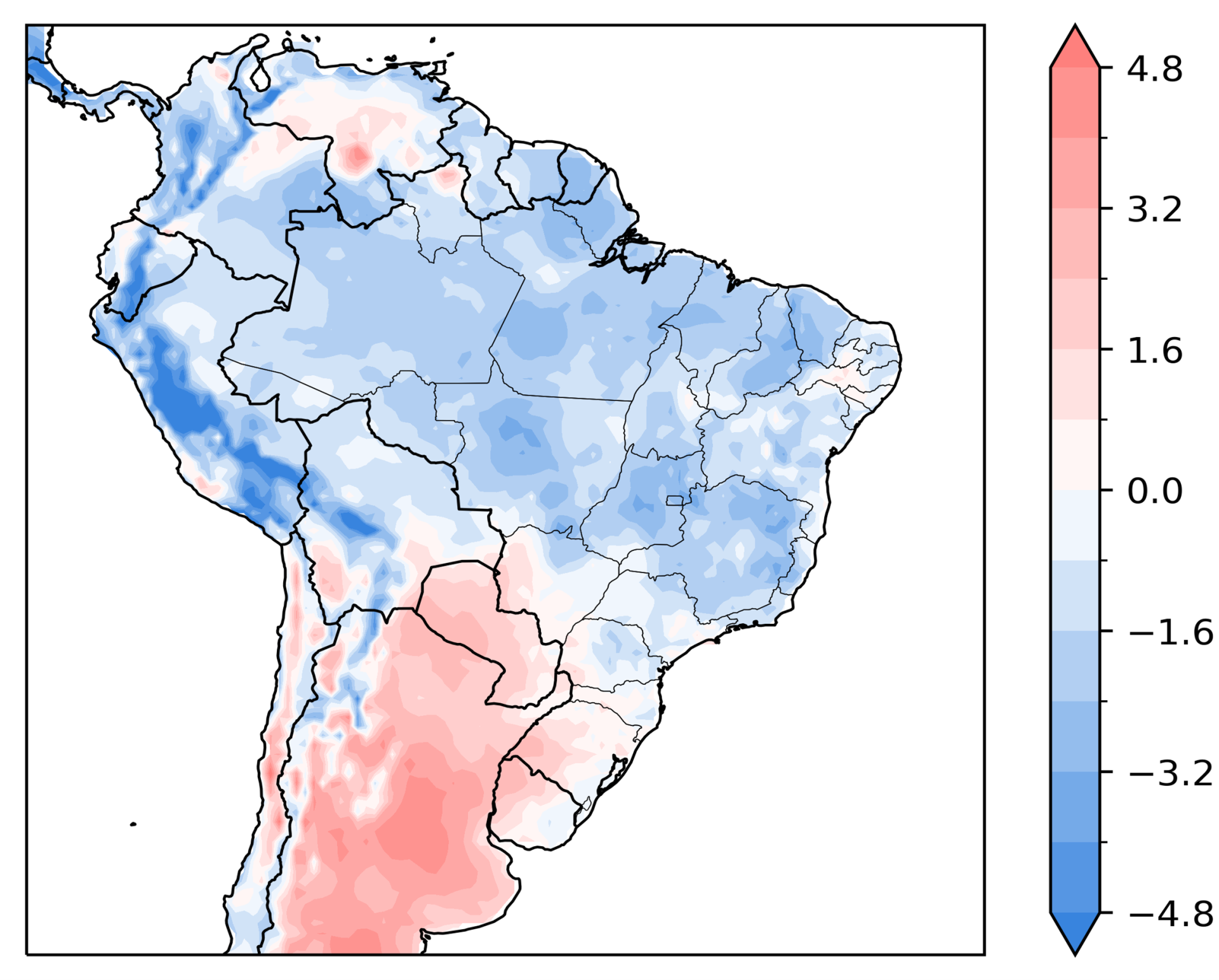

Brazil – Temperature Anomaly – 1 to 14 days (°C of normal)

Source: INMET

Brazil – Total Precipitation Forecast – February-25 (mm)

Source: INMET

Brazil – Total Precipitation Forecast – March-25 (mm)

Source: INMET

Market Intelligence - Grains & Oilseeds

Luiz.Roque@hedgepointglobal.com

Thais.Italiani@hedgepointglobal.com