Crop Forecast: Soybean Brazil - Crop 2025/26

Hedgepoint projects Brazilian soybean crop of 178 million tons in 2025/26

If the weather cooperates, Brazilian soybean production is expected to reach a new record in 2025/26

Hedgepoint's first estimate for the new Brazilian soybean crop for the 2025/26 season points to a production potential of 178 million tons, which, if confirmed, will result in yet another record production for the world's largest soybean producing country.

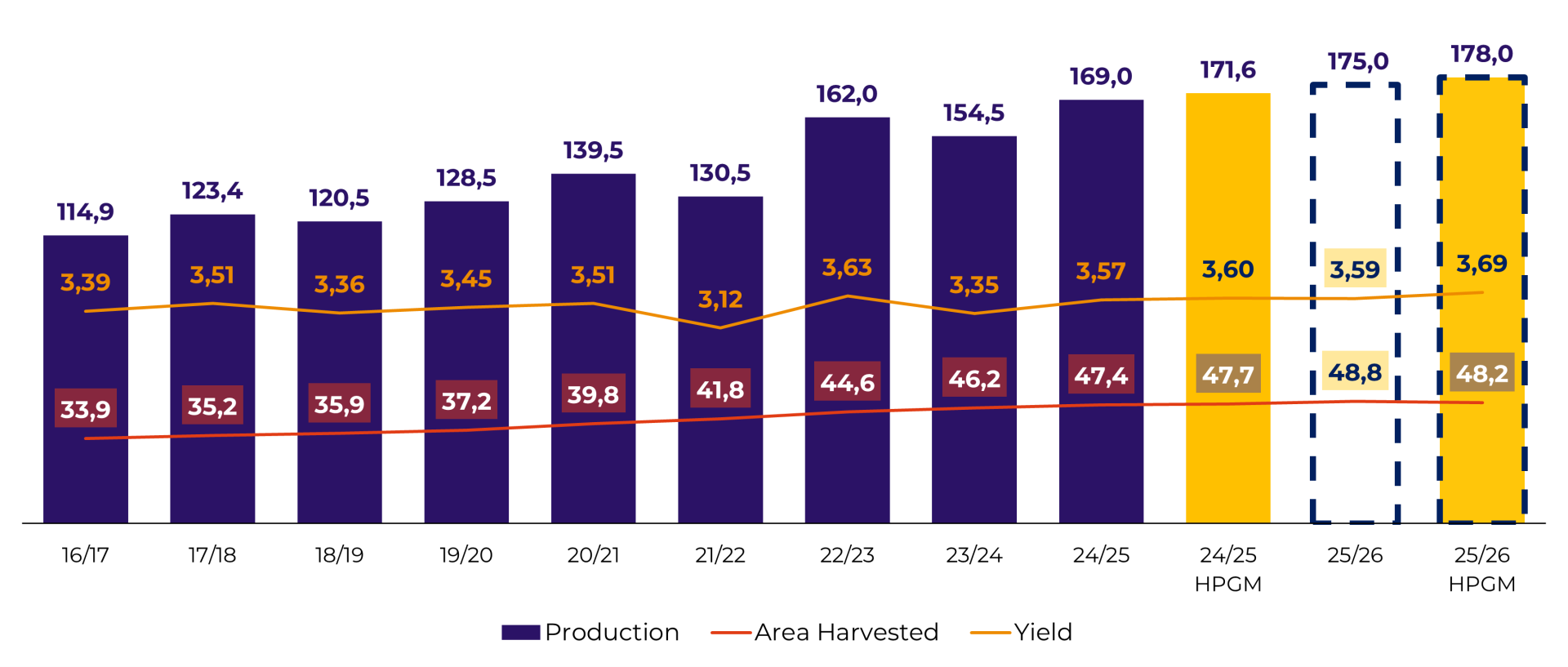

The estimate points to a possible 3.7% increase in production compared to the 2024/25 season (171.6 million tons), or 6.4 million tons. In terms of area, the expectation is for an area of 48.240 million hectares, with an expected increase of 1.2% compared to 2024/25 (47.678 million hectares), or approximately 562 thousand hectares. The average yield of Brazilian crops is expected to be 3,690 kg/ha, an increase of 2.5% on last season (3,600 kg/ha).

Brazil Soybean - Area, Yield and Production (M ha, ton/ha, M ton)

Source: Hedgepoint, USDA

Despite a new advance in the Brazilian area, we would point out that the expected growth points to the smallest advance in the area in many years. This is likely to be due to the decrease in Brazilian producers' profit margins since last season, resulting from lower average prices and an increase in production costs. This increase in costs is also likely to lead to a reduction in investments in crops, with less use of fertilizers and pesticides, which increases the risk of lower yields if the weather is not favorable for most of the crop's development.

Speaking of yields, we would like to point out that the expected increase in average national yields stems mainly from a potential recovery in the average yields of crops in Rio Grande do Sul, after another season of yield losses due to unfavorable weather in 2024/25. On the other hand, at this first moment we estimate a reduction in average yields in states such as Mato Grosso, Minas Gerais and Goiás, given that the average yields recorded in 2024/25 were well above expectations and the averages of recent crops, with almost perfect weather being recorded. In any case, we can't rule out repeating or even surpassing the high yields recorded in 2024/25, which, if it happens, could lead to the Brazilian harvest surpassing the 180 million ton mark. It all depends on the weather.

In this regard, we would point out that the weather for the development of the 2025/26 crop is likely to be marked by the return of the La Niña phenomenon. Current estimates by the National Oceanic and Atmospheric Administration (NOAA), a US government agency, point to a probability of approximately 71% that La Niña will be present between October and December 2025. In view of this, it is possible that we will see good yields in the states of the central belt and in the North and Northeast regions of the country, since La Niña usually brings normal or above-average rainfall to the Center-North of Brazil. However, the phenomenon also tends to bring below-average rainfall to the southern states, putting the yields of Paraná, Santa Catarina and Rio Grande do Sul in risk. At this point, we would highlight the importance of production in Paraná and Rio Grande do Sul, which, in "normal" years, are among the three largest producing states in the country, second only to Mato Grosso. Therefore, if La Niña is strong, a new record production in Brazil will be at risk. Despite this, it is important to note that current estimates point to a La Niña of low intensity, which tends not to cause major problems for Brazilian production. Even so, attention needs to be redoubled in the coming months, especially in the South.

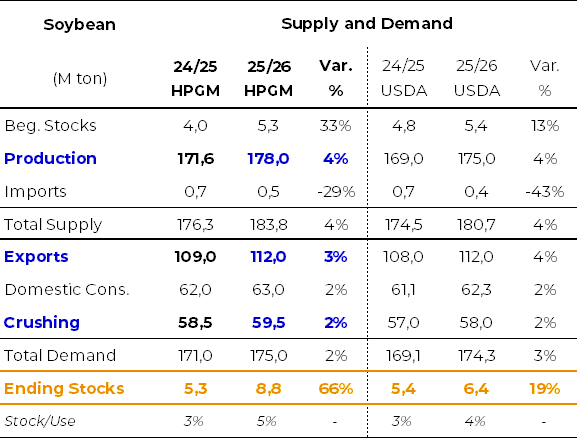

Turning to the demand side, Hedgepoint's estimate points to a new record for soybean exports in 2025/26. Exports are expected to reach 112 million tons between January and December 2026, with even greater Chinese demand for Brazilian soybeans. Despite this, it's important to keep a close eye on the next chapters of the negotiations between the US and China, because if a possible trade agreement directly involves soybeans, we could see impacts on Brazilian shipments, which may require estimates adjustments. In any case, the expectation is for firm Brazilian exports in 2026.

On the domestic consumption side, the highlights are the recent increase in the biodiesel blend (B15), in force since August 2025, and a probable increase in meat exports in 2026, which should lead to an increase in soybean crushing. Regarding biodiesel, we would point out that, as it is an election year, it is possible that the new increase planned for the blend (from B15 to B16) will not take place, with the government paying more attention to inflation data during the election race. In this matter, although less likely, we can't rule out a possible reduction in the blend either, should biodiesel prices lead to higher diesel prices at gas stations. It is therefore important to be attentive to the impacts of the electoral race on the Brazilian economy, with possible direct impacts on domestic demand for soybeans.

Finally, especially due to a possible new record production, Brazilian soybean stocks are expected to grow in the 2025/26 season, even with the expected increase in exports and crushing. The initial estimate points to ending stocks of 8.8 million tons, an increase of 3.5 million tons compared to the 2024/25 season (5.3 million tons), or 66%. Given this, we could see significant negative pressure on Brazilian prices, especially during the harvest, which deserves special attention.

Soybean Brazil - Supply and Demand - Hedgepoint x USDA (M ton)

Source: USDA, Hedgepoint

In Summary

The behavior of prices in the Brazilian market in 2026, in this context of increased supply, tends to be influenced even more closely by demand. With regard to soybean exports, the trade war between the US and China demands attention. As for domestic consumption for crushing, there is uncertainty at the soybean oil demand, since biodiesel mandates depend on government measures and it will be an election year. At the export side of soybean meal and oil, Argentina's growing presence and increasing competitiveness are noteworthy, which could limit Brazilian exports.

Market Intelligence - Grains & Oilseeds

Luiz.Roque@hedgepointglobal.com

Revised by Thaís Italiani

Thais.Italiani@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.