Crop Forecast: Soybean Brazil - 2025 02 21

Brazil's 2024/25 soybean crop raised to 171.5 million tons

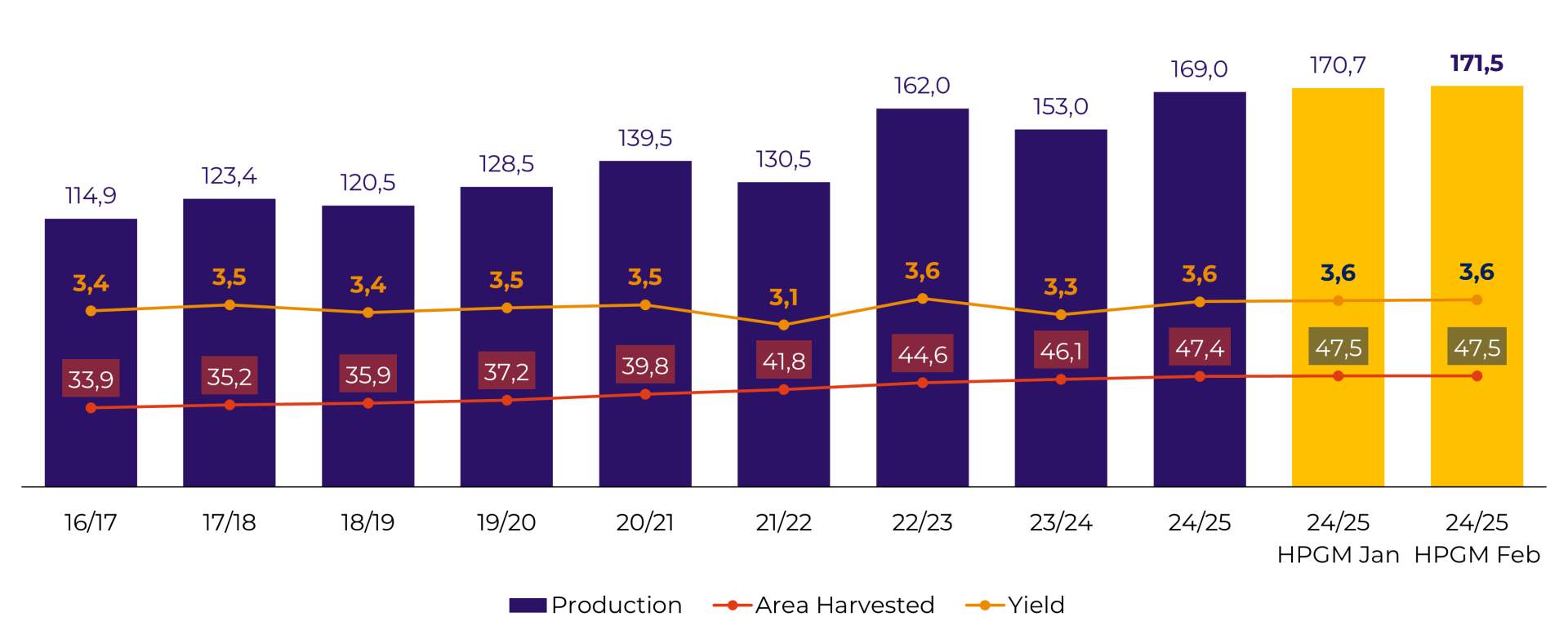

New projection points to even higher Brazilian soybean production: 171.5 million tons

Our new estimate points to a Brazilian soybean production of 171.5 million tons in the 2024/25 season, an increase of approximately 700 thousand tons regarding the January estimate.

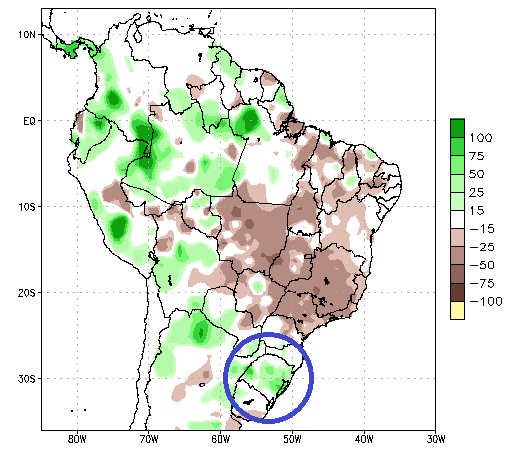

The positive adjustment comes from the high yields that are expected and are already being recorded in the crops of states such as Mato Grosso, Goiás, Minas Gerais and Bahia, where harvesting work has begun to advance at a strong pace in recent days. Despite the initial delays in sowing in these states, after the arrival of the rains in mid-October 2024, the weather proved to be very favorable to the development of the crops, guaranteeing high yields. It is also possible that the end of the harvest will reveal that average yields in these states have reached a new record, also guaranteeing record yields due to the increase in areas sown. These high yields provide some compensation for the losses that are expected in the states of Rio Grande do Sul and Mato Grosso do Sul, where the slightly wet weather, especially in January, caused problems for the development of the crops, which will not reach their productive potential this season.

Regarding this point, we would like to point out that despite the positive adjustment at a national level, there were significant negative adjustments to the average yields expected for crops in Rio Grande do Sul and Mato Grosso do Sul, as well as a one-off adjustment for the state of Paraná. In other words, these production losses are already "in the account", which nevertheless points to record Brazilian production. In any case, the weather is still an important factor for the final development of the crops and the progress of the harvest, especially in the state of Rio Grande do Sul, which is traditionally one of the last states to plant and harvest in the country. As such, whatever happens with the weather over the next 30 to 60 days could still alter the final production figures, even if only occasionally.

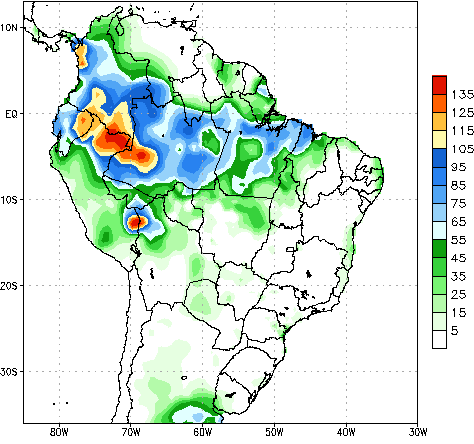

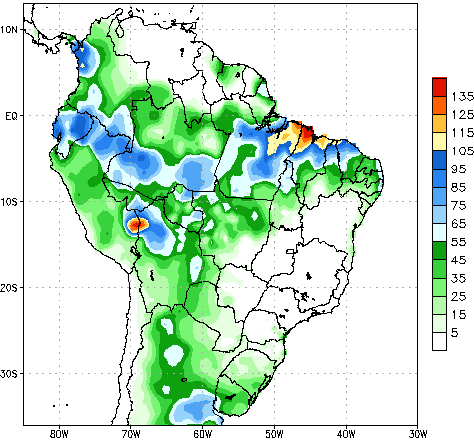

Regarding the last two weeks, slightly more favorable weather has been recorded in the southern region with the arrival of significant moisture and milder temperatures than in January, especially in Rio Grande do Sul. This may have prevented an increase in production losses in much of Rio Grande do Sul, improving soil humidity and temperatures for plants to recover. Even so, we know that there are already irreversible losses in some areas, but the size of these will only be consolidated as the harvest progresses, which should begin in mid-March. Until then, we're keeping the alert on for the South, but we're expecting a big harvest nationwide.

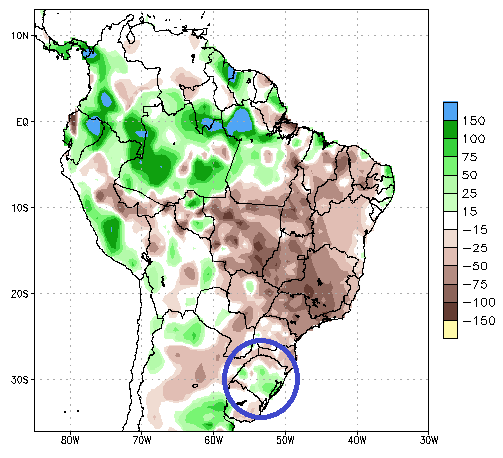

Speaking of the harvest, as of last Friday (14) approximately 27% of the Brazilian soybean area had been harvested. The percentage is a little lower than that recorded in the same period last year (29%) but is now above the average for the last five harvests for the period (25%), indicating a good recovery from the initial delays.

Brazil Soybean - Area, Yield and Production (M ha, ton/ha, M ton)

Source: Hedgepoint, Conab

Brazil - Precipitation anomaly - last 7 days (mm)

Source: NOAA

Brazil - Precipitation anomaly - last 14 days (mm)

Source: NOAA

Soybean Brazil - Harvest Progress (until 14-feb)

Source: Safras

NDVI: Vegetation Index (Key States)

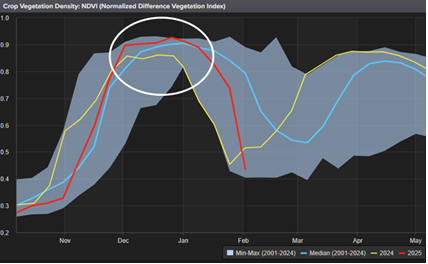

NDVI - Mato Grosso

Source: Reuters

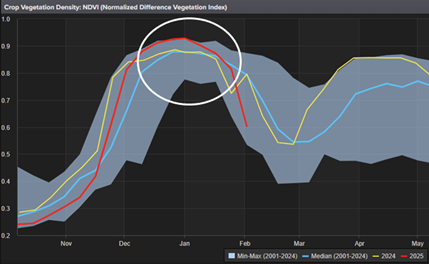

NDVI - Goiás

Source: Reuters

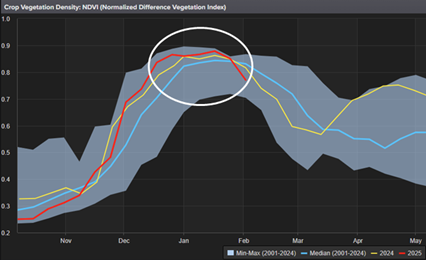

NDVI - Minas Gerais

Source: Reuters

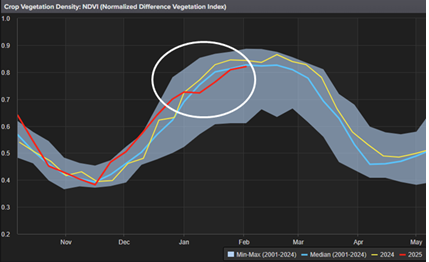

NDVI - Rio Grande do Sul

Source: Reuters

Crop phenology

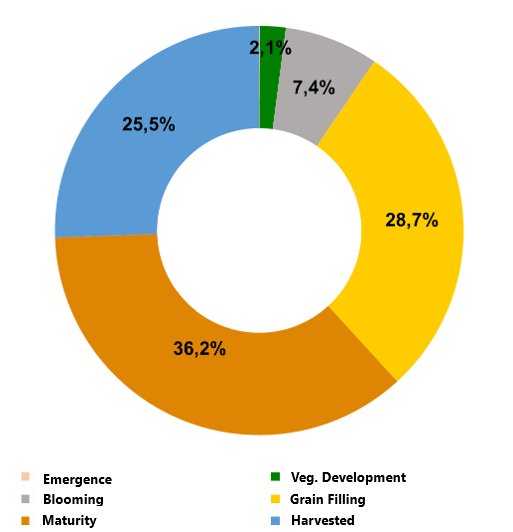

Soybean Brazil - Phenology in Feb 16th

Source: Conab

Regarding the phenology of Brazilian crops, the latest data from Conab indicates that as of February 16, 28.7% of the country's crops are still in the grain filling stage. Most of this percentage is in Rio Grande do Sul. In addition, 2.1% of the crops are still in the vegetative development stage and 7.4% are in the flowering stage, the vast majority of which are also in Rio Grande do Sul. In view of this, we would like to stress the need to monitor the weather in the coming weeks for the development of the Rio Grande do Sul crop.

For comparison, in the same period last year the national percentages were: 24.6% grain filling, 5.5% vegetative development and 13.4% flowering.

Weather forecasts for the coming weeks

Brazil - Precipitation Forecast - 1 to 7 days (mm)

Source: NOAA

Brazil - Precipitation Forecast - 8 to 14 days (mm)

Source: NOAA

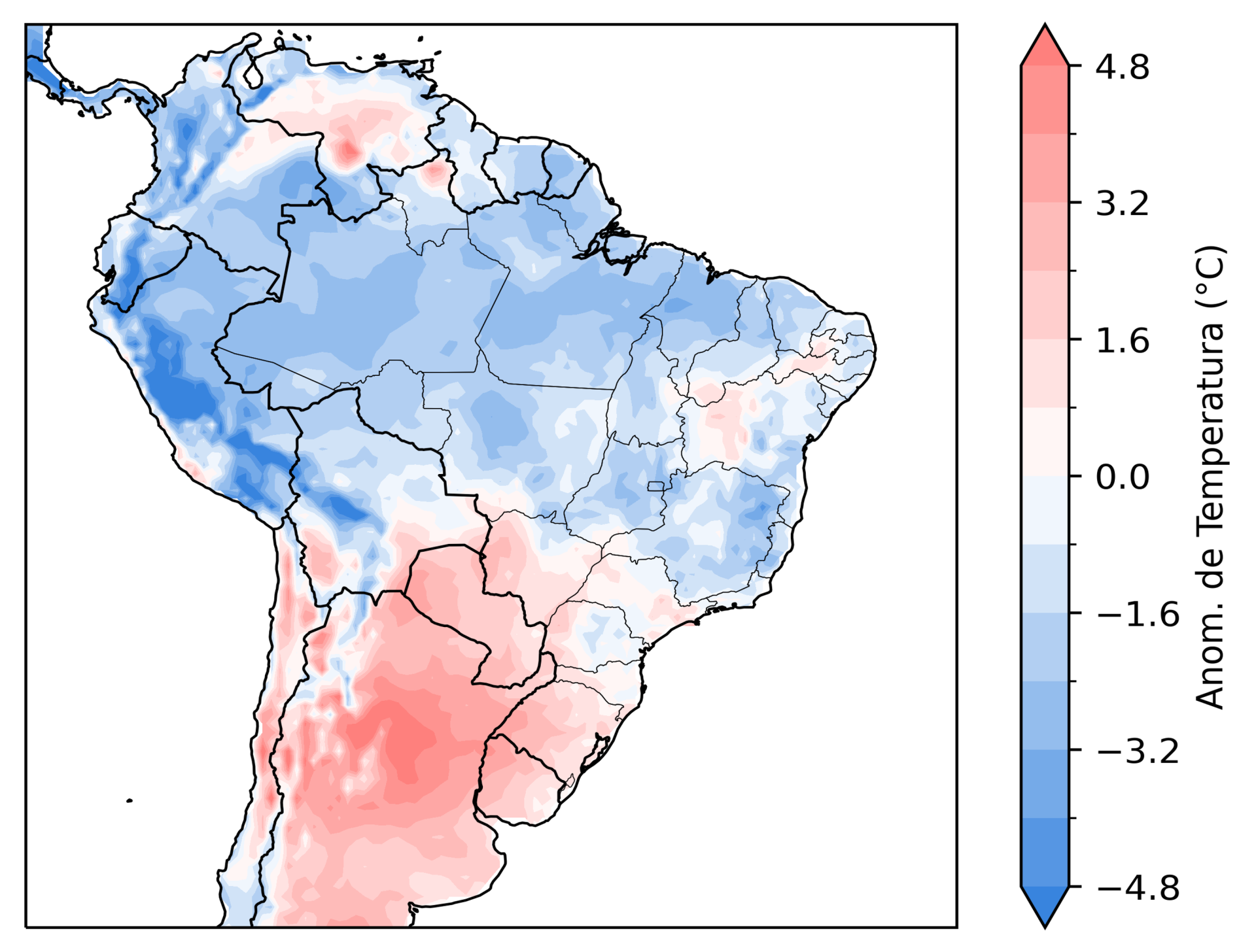

Regarding temperatures, the next 14 days should once again bring slightly higher temperatures to the state of Rio Grande do Sul, which added to the expected low humidity should be unfavorable for crop development.

Brazil - Temperature anomaly - 1 to 14 days (°C from normal)

Source: INMET

Looking further ahead, for the whole of March, the weather maps once again point to less humidity over southern Brazil, which keeps the alert on for the end of crop development in Rio Grande do Sul due to the possible increase in production losses.

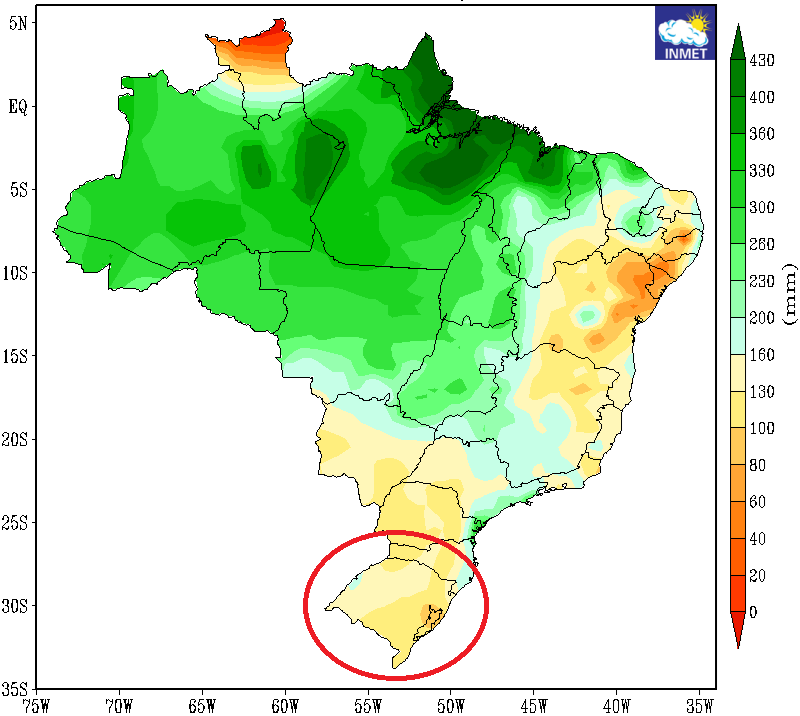

Brazil - Total Precipitation Forecast - March/25 (mm)

Source: INMET

Market Intelligence - Grains & Oilseeds

Luiz.Roque@hedgepointglobal.com

Thais.Italiani@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.