Crop Forecast: Soybean Brazil - 2025 03 21

Brazil's 2024/25 soybean crop reduced to 170.1 million tons

Brazilian crop reduced to 170.1 million tons, but remains at record level

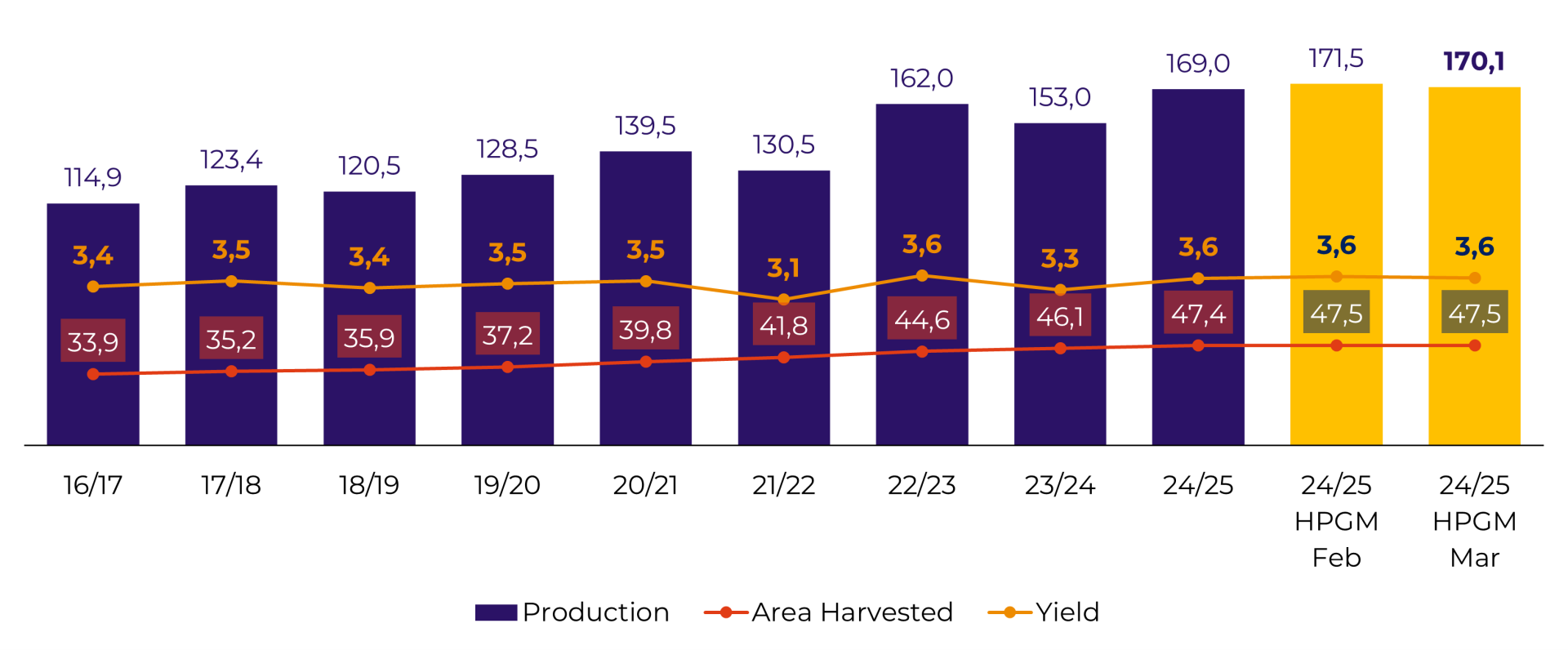

Our new estimate brings a reduction for the 2024/25 Brazilian soybean crop regarding the previous estimate (February), with production now projected at 170.1 million tons (171.5 in the February projection).

Even with the reduction, the current level still indicates record Brazilian production in the 2024/25 season, as well as a significant recovery regarding the production losses recorded in the 2023/24 crop, when production was around 153 million tons.

The negative adjustment was due to the decrease in the productive potential of crops in Rio Grande do Sul, a state that once again suffered from low humidity and high temperatures in the last days of February and the first days of March. This had an even greater impact on crops that had already been suffering from a water deficit since the end of December, increasing production losses in crops sown earlier and located mainly in the northwest of Rio Grande do Sul. Despite the production losses, we must also point out that there are crops in good condition in some regions of the state, which indicates that the poor distribution of rainfall was the main factor behind the state's lower production this season.

The cut in production in Rio Grande do Sul in this latest estimate contrasts with the increase in production potential in important producing states in the central belt of the country, especially the states of Mato Grosso, Goiás and Minas Gerais.

In Mato Grosso, the progress of the harvest has revealed the highest average yield in the state's history, which added to the increase in area results in a record crop in the country's largest producing state, with a crop of over 49 million tons.

Similarly, high and possibly record yields are also leading to historic productions in the states of Minas Gerais and Goiás.

In view of this, we can say that the large productions in the central states of the country provide some compensation for Rio Grande do Sul's losses at a national level, guaranteeing record Brazilian production.

Regarding the harvest of this "super crop", harvest works has continued at a good pace in recent weeks, ensuring a strong recovery from the delays accumulated in the first weeks of the year. As of March 14, approximately 70% of the Brazilian soybean area had been harvested, which indicates a pace above the average of the last five crops, which is around 64%, and higher than the same period last season (60%). If, on the one hand, the less humid weather recorded in most of the country in recent weeks has once again caused problems for the development of the crops in Rio Grande do Sul, on the other hand it has allowed machines to make strong progress in the crops in the central belt of Brazil.

Brazil Soybean - Area, Yield and Production (M ha, ton/ha, M ton)

Source: Hedgepoint, Conab

Brazil - Precipitation anomaly - last 15 days (mm)

Source: NOAA

Brazil - Precipitation anomaly - last 30 days (mm)

Source: NOAA

Soybean Brazil - Harvest Progress (until 14-mar)

Source: Safras, Hedgepoint

NDVI: Vegetation Index (Rio Grande do Sul)

NDVI - Rio Grande do Sul

Source: Reuters

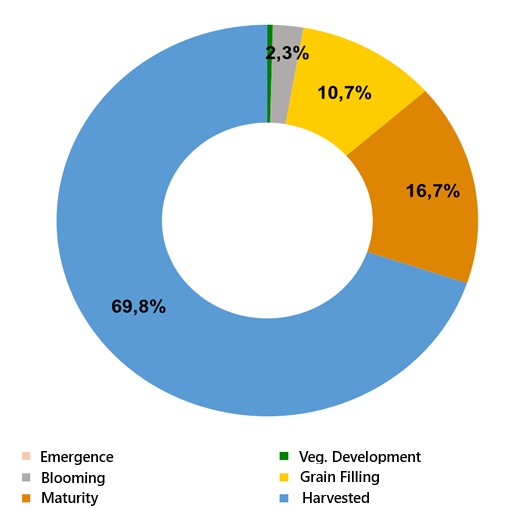

Crop phenology

Soybean Brazil - Phenology in Mar 16th

Source: Conab

Regarding the phenology of Brazilian crops, the latest data from Conab indicates that as of March 16, 10.7% of the country's crops were still in the grain filling stage. In addition, 2.3% of the crops were still in the flowering stage, while 16.7% were in the maturity stage. Most of these crops are in Rio Grande do Sul and in states in the North and Northeast regions.

For comparison, in the same period last year the national percentages were: 15.8% grain filling, 3.4% flowering and 18.2% ripening.

Weather forecasts for the coming weeks

Brazil - Precipitation Forecast - 1 to 7 days (mm)

Source: NOAA

Brazil - Precipitation Forecast - 8 to 14 days (mm)

Source: NOAA

Market Intelligence - Grains & Oilseeds

Luiz.Roque@hedgepointglobal.com

Ignacio.Espinola@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.