Dec 4

/

Lívea Coda

Crop Forecast: Sugar Center-South - 2023 12 04

Back to main blog page

"With cumulative cane yields remaining above 89t/ha in October 2023, the total raw material can be estimated as high as 655Mt for the 23/24 crop season – or even more! "

Center-South Cane, Sugar, and Ethanol Production Update

Before discussing our latest figures, it is important to talk about our forecast methodology. To best estimate cane volume, we update our expectations for area growth, yields and cane quality, considering key market sources such as Unica, MAPA, and Conab as well as realized weather, NDVI measurements and historical trends.

From cane availability, we draw sugar production. First, will mills be able to crush? Precipitation might induce lost days and slow crushing down. The second step is understanding mills optimization problem: sugar or ethanol? Sugar mix is set depending on which subproduct pays more.

23/24 crop year

Lorem ipsum dolor sit amet. Sit officia minus eos exercitationem quia sed mollitia sunt. Et galisum accusantium nam quam distinctio ut maiores eligendi et accusantium facilis est perferendis quia non voluptas laboriosam eos natus nemo? Et officiis expedita nam magni neque eum excepturi dolorem ut dolores quaerat ex quis fugit ut reprehenderit rerum sit repellat recusandae.

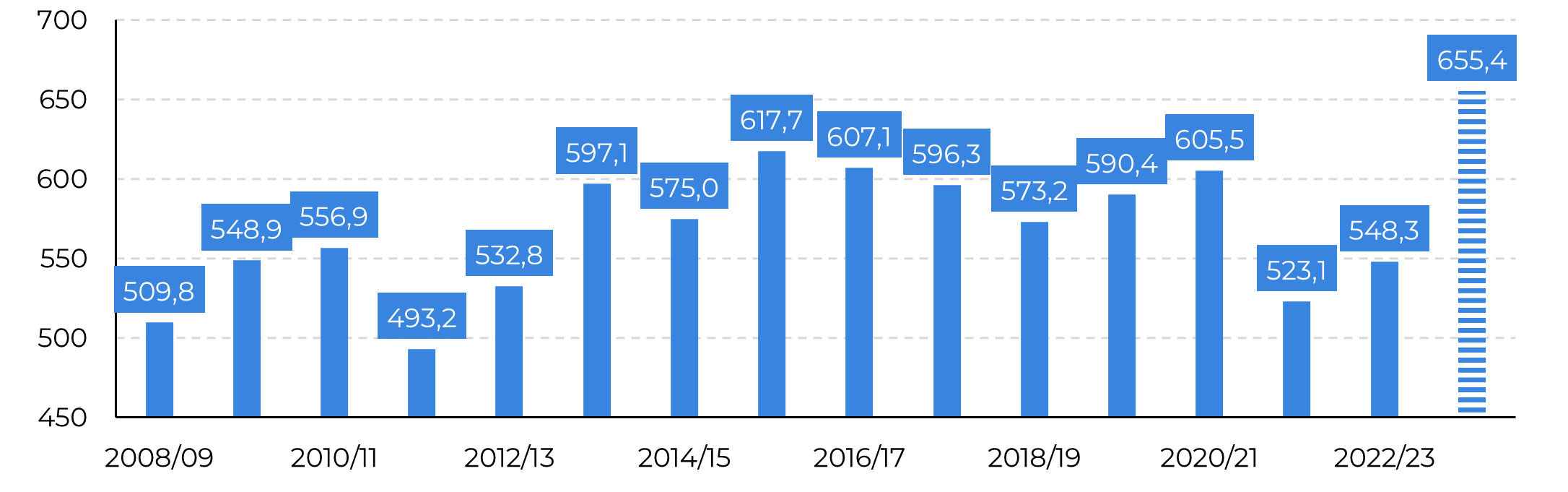

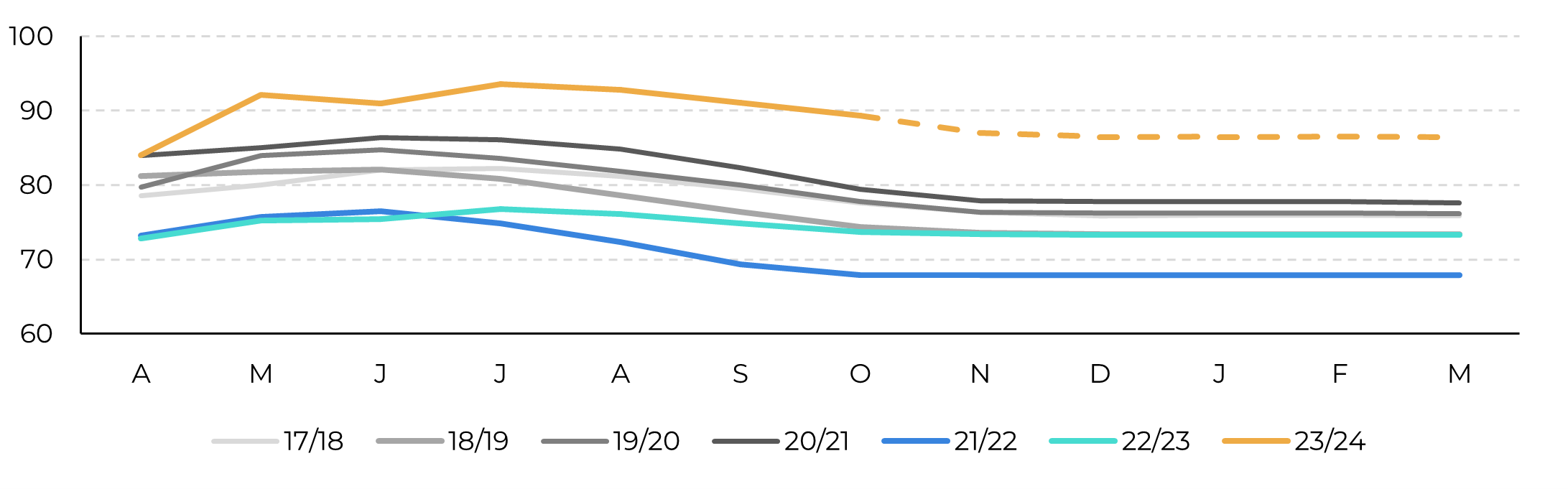

For Instance, with cumulative cane yields remaining above 89t/ha in October 2023, the total raw material can be estimated as high as 655Mt for the 23/24 crop season – or even more! The only thing on the millers’ way is the weather: as the region approaches summer, precipitation becomes abundant. Accounting for another two or three good-paced fortnights, the region is set to crush around 645Mt by March’s end. This also implies good prospects for 24/25 – if summer rains are close to average, Center-South could be heading to a second year of higher availability.

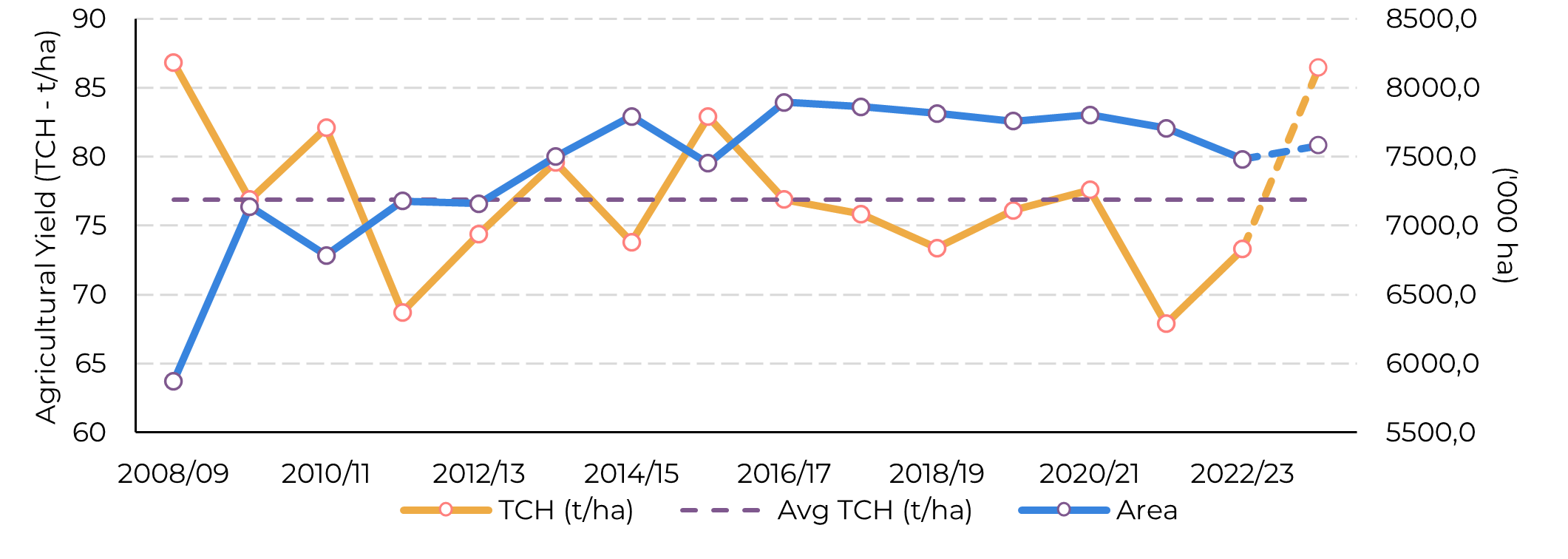

Image 1: Center-South – Area and Yield

Source: Unica, Conab, Mapa, hEDGEpoint

Image 2: Center-South – Cane Availability (Mt)

Source: Unica, Conab, Mapa, hEDGEpoint

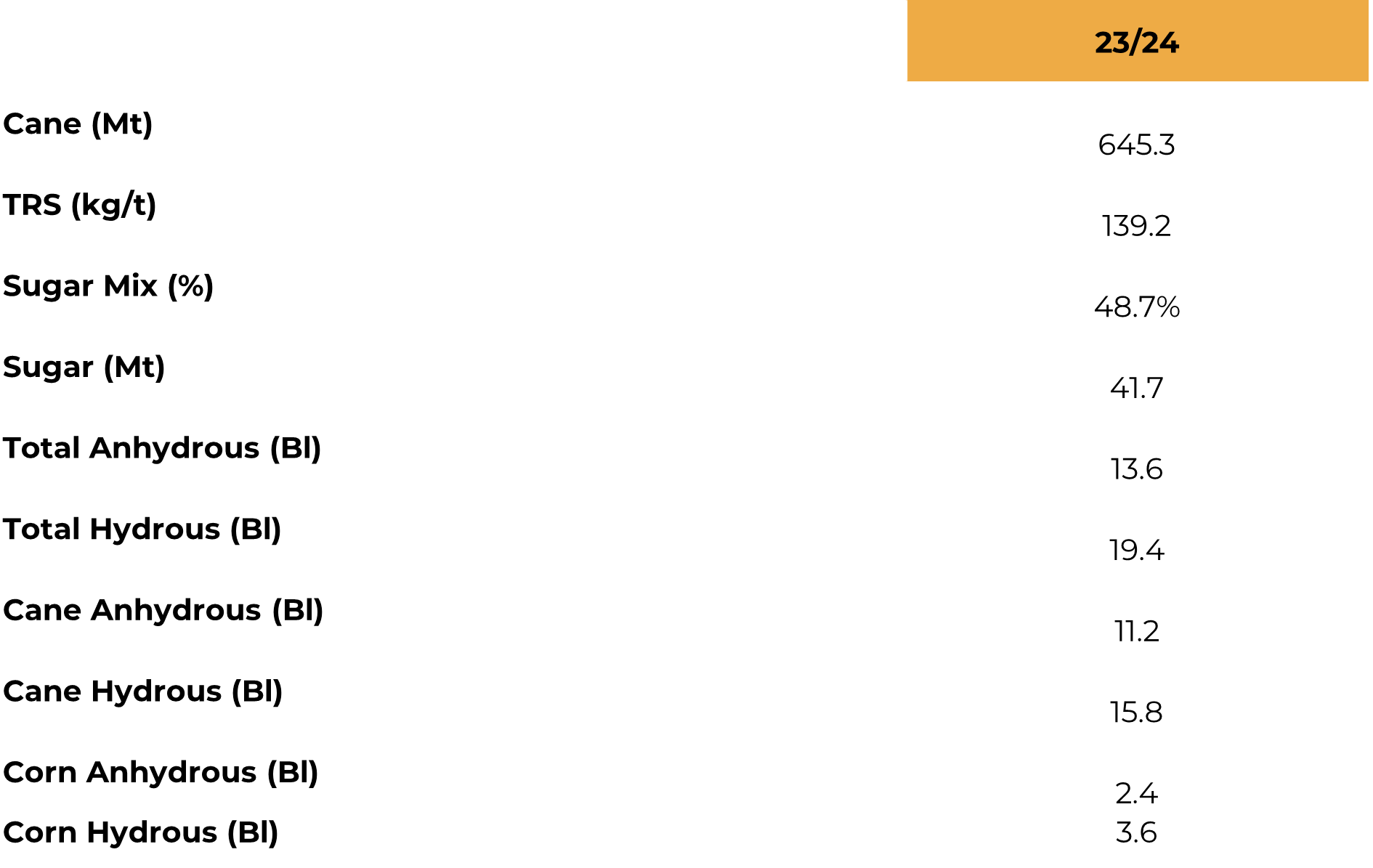

Of course, mix will start to melt with all the predicted rains and lower cane quality during intercrop. However, final figures can still reach a quite sugary result. With around 139.2kg/t and 48.7% being redirected to sugar, the region can produce 41.6Mt of the sweetener, 1.1Mt more than our previous estimate for the current season.

Image 3: Cumulative Cane Yields Estimate (t/ha)

Source: UNICA, Conab, hEDGEpoint

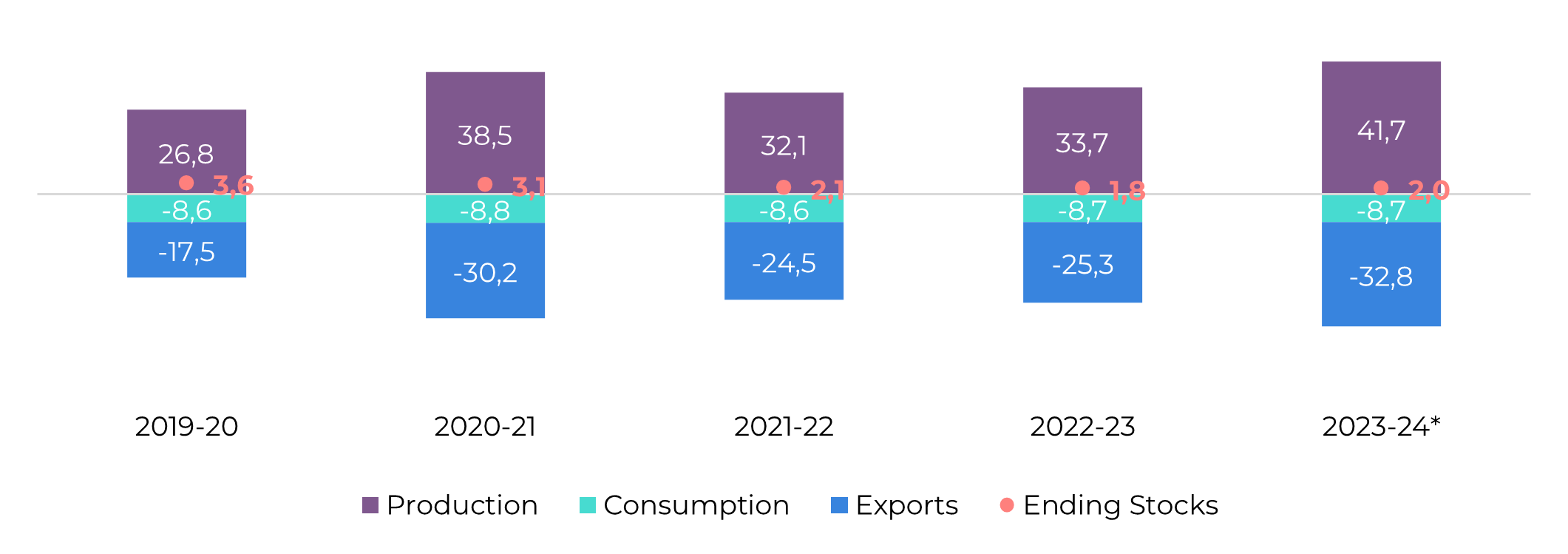

Image 4: Crop Summary

Source: hEDGEpoint

Although sugar mix is expected to be extremely high, cane availability also guarantees an abundance of ethanol. We expect that anhydrous production will reach 13.6B liters, while hydrous nearly 19.5B liters – pushing ending stocks to a higher level while preventing price reaction.

With a high mix, induced by ethanol competitiveness loss against sugar, Center-South will be able to reach a new production record at 41.7Mt. This trend eases short-term tightness and contributes to possibly lower international prices.

With a high mix, induced by ethanol competitiveness loss against sugar, Center-South will be able to reach a new production record at 41.7Mt. This trend eases short-term tightness and contributes to possibly lower international prices.

Image 5: Center South Sugar Balance (Apr-Mar Mt tq)

Source: Unica, MAPA, SECEX, Williams, hEDGEpoint

Crop Forecast - Sugar and Ethanol

Written by Lívea Coda

livea.coda@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Reviewed by Natália Gandolphi

natalia.gandolphi@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.