Feb 29

/

Lívea Coda

Crop Forecast: Sugar Center-South - 2024 02 29

Back to main blog page

"While there is optimism that the Center-South region may surpass the 650-million-ton mark by the end of the 23/24 season, concerns are mounting regarding the outlook for 24/25."

Center-South Cane, Sugar, and Ethanol Production Update

Before discussing our latest figures, it is important to talk about our forecast methodology. To best estimate cane volume, we update our expectations for area growth, yields and cane quality, considering key market sources such as Unica, MAPA, and Conab as well as realized weather, NDVI measurements and historical trends.

From cane availability, we draw sugar production. First, will mills be able to crush? Precipitation might induce lost days and slow crushing down. The second step is understanding mills optimization problem: sugar or ethanol? Sugar mix is set depending on which subproduct pays more.

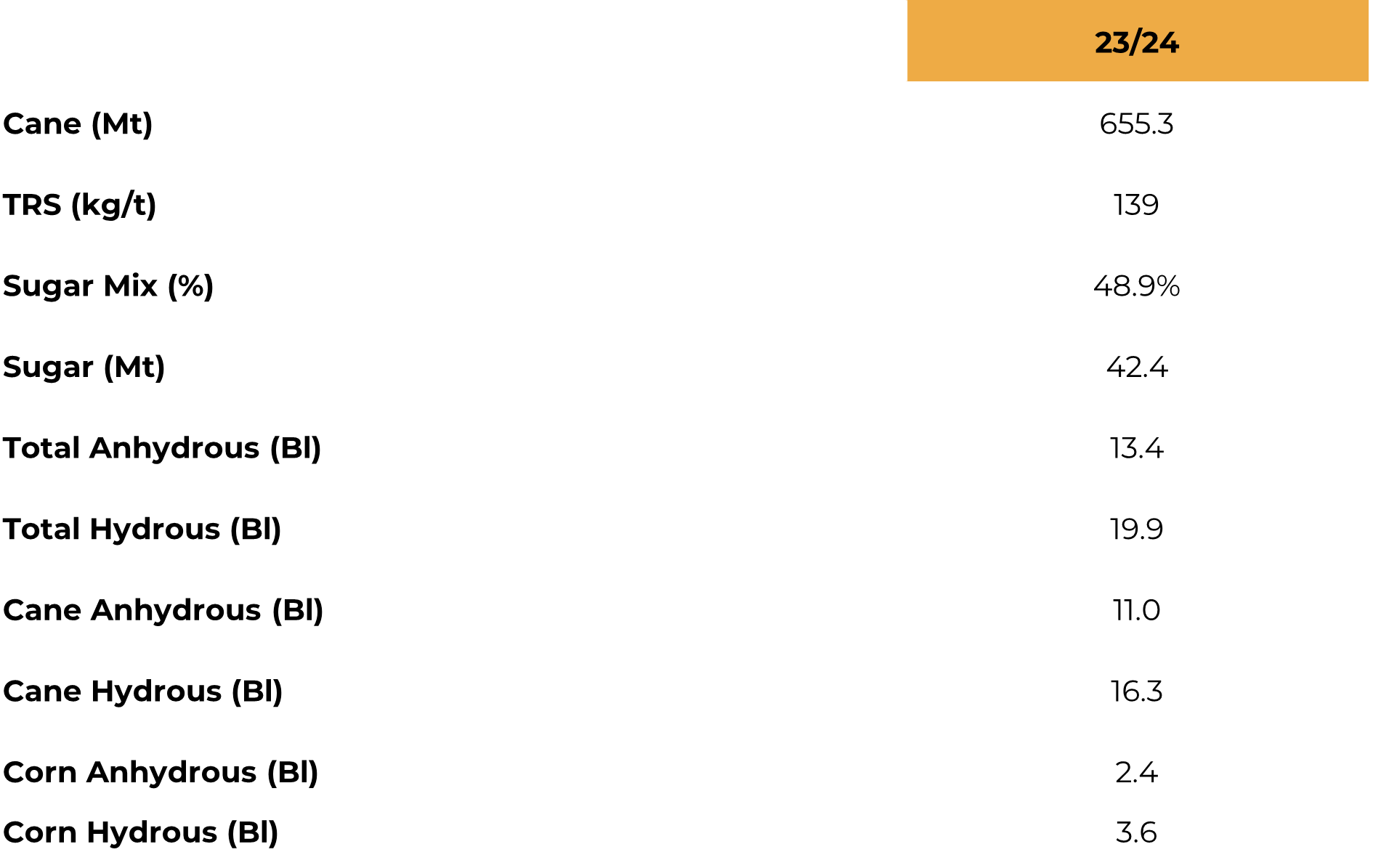

23/24 Crop year

Regarding 23/24, last cumulative yield results reported by Centro de Tecnologia Canavieria (CTC) suggests that the region can achieve over 655Mt of cane and produce 42.4Mt of sugar. The index reached 87.5 t/ha, an impressive growth compared to last season’s 77.2 t/ha. Crushing all of its availability, 655Mt, leads to an increase in both sugar and ethanol volume.

Image 1: Crop Summary

Source: hEDGEpoint

The lower precipitation levels have played a pivotal role in driving the record-breaking sugar output to 42.15 million tons, marking a substantial increase of 25.6% over the previous year and 10.3% compared to the 20/21 season.

While there is optimism that the Center-South region may surpass the 650-million-ton mark by the end of the 23/24 season, concerns are mounting regarding the outlook for 24/25. Diminished precipitation in key cane-producing regions suggests that TCH could experience a more pronounced correction than initially anticipated.

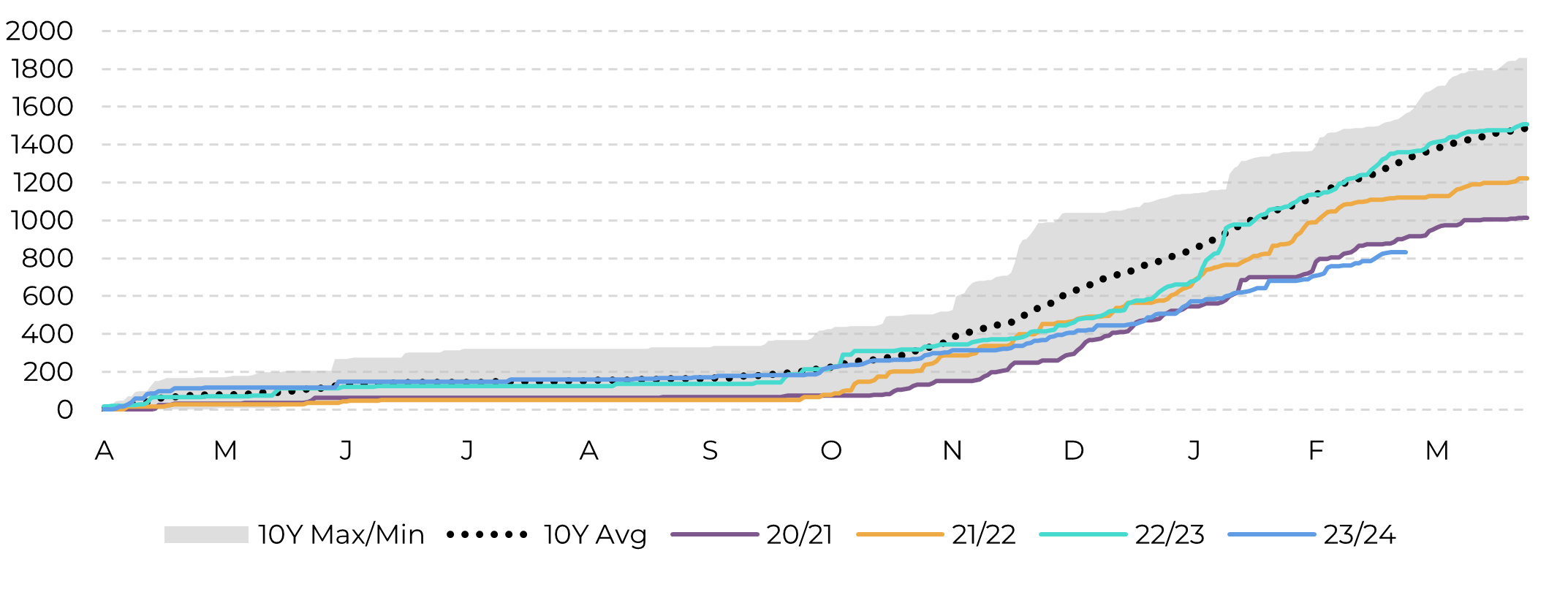

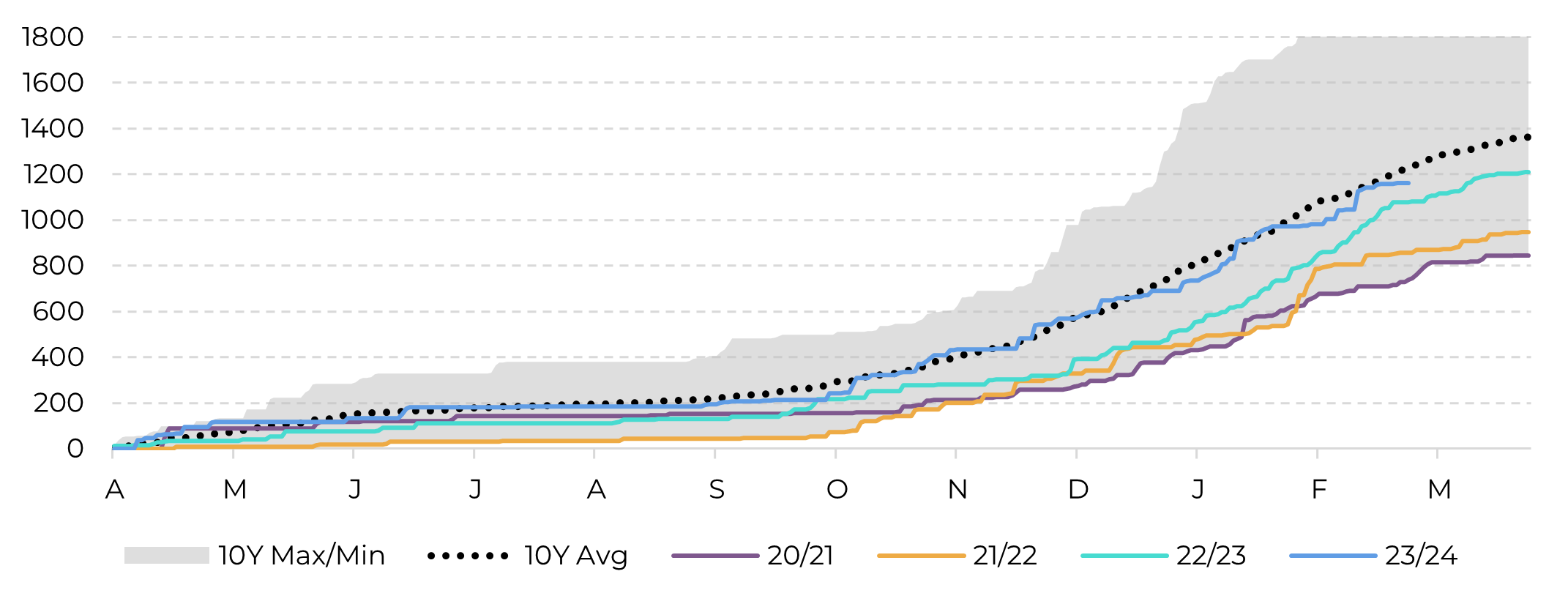

The difficulty in estimating Center-South’s output relies on the fact that rains were quite uneven and scattered throughout the entire region. While Ribeirão Preto, responsible for about 14% of Brazil’s total cane production, received well-below-average precipitation and remains at the lower end of historical values, São José do Rio Preto is close to average – as are many other microregions.

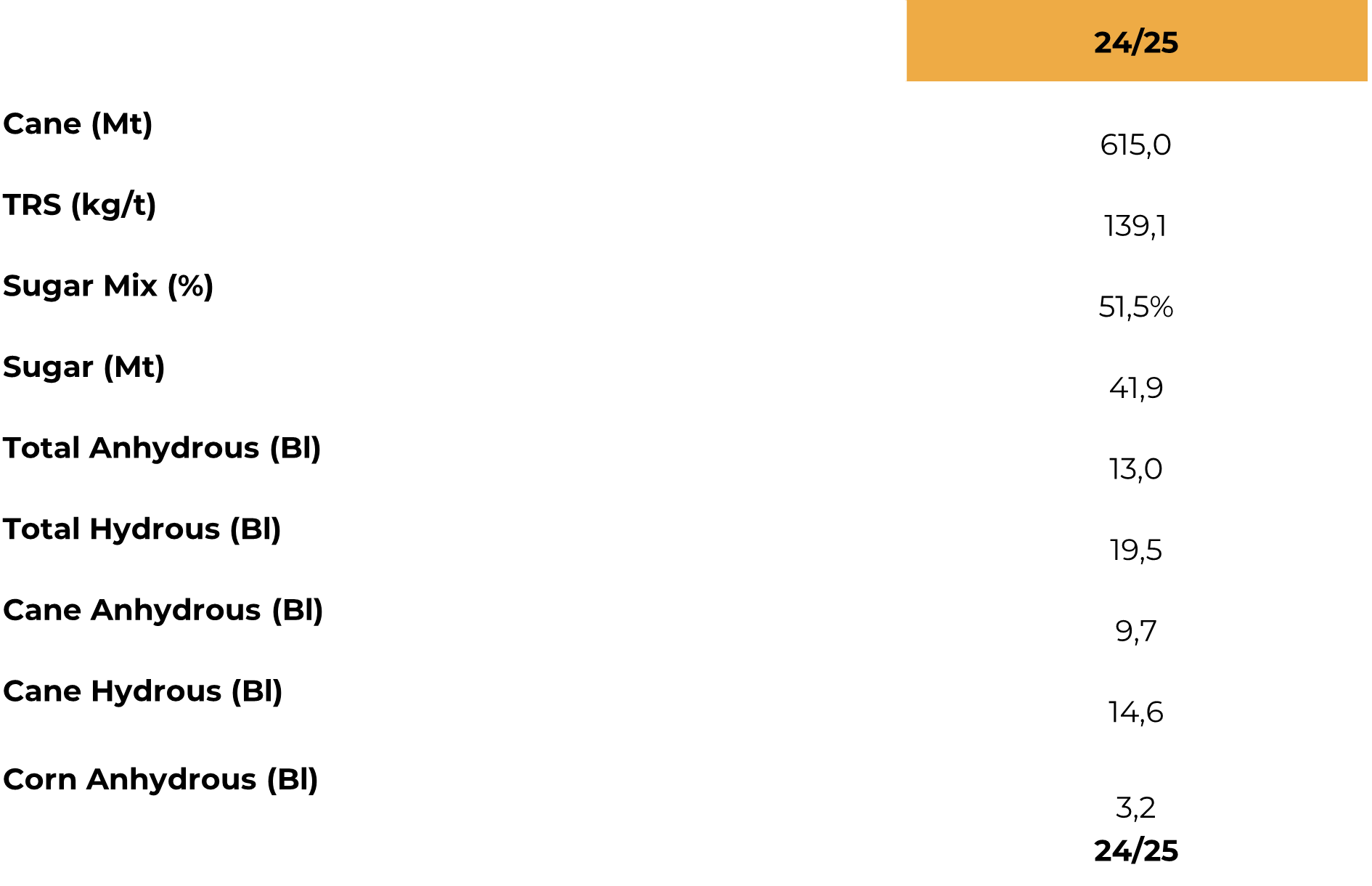

24/25 Crop Year

Image 2: Cumulative Precipitation (mm) | Ribeirão Preto

Source: Bloomberg, hEDGEpoint

Image 3: Cumulative Precipitation (mm) | São José do Rio Preto

Source: Bloomberg, hEDGEpoint

We believe that it is still premature to peg a major crop reduction, but December and January’s dryness cannot be unaccounted for. As a result, we've adjusted our cane expectations downward from 620 million tons to 615 million tons. It's worth noting that there's still time for cane to mature, and mills have leftovers from the 23/24 season to start with. Additionally, the average age of the cane is lower than in previous years. There's potential for an upside if weather conditions improve in the coming days, but there's also a possibility of downside if the weather doesn't cooperate. Ultimately, the market is heavily influenced by weather conditions.

Image 2:

Despite revising our cane expectations down, a consistent market trend, reinforced by daily observations, has led to a slight increase in our sugar production estimates from 41.8 million tons to 41.9 million tons: a rise attributed to a higher sugar mix. It's noteworthy that the Center-South region has consistently maintained elevated sugar mix levels, surpassing record highs during 23/24. Given the reported investments in crystallization , it wouldn't be surprising if the region exceeds the 51% mark and reaches 51.5%. Therefore, despite a modest reduction in cane estimates, Center-South continues to contribute to bearish sentiment while offsetting much of the absence seen in the Northern Hemisphere.

Source:

Crop Update - Sugar and Ethanol

Written by Lívea Coda

livea.coda@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Reviewed by Natália Gandolphi

natalia.gandolphi@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.