Feb 7

/

Lívea Coda

Crop Forecast: Sugar Center-South - 2025 02 10

Back to main blog page

"In January, we updated our models and expectations for the 25/26 crop based on NDVI, rainfall, temperature, and soil moisture data. We expect 82 t/ha, translating to about 630Mt, compared to 617.7Mt in 24/25. The Center-South region is expected to have more sugar availability next season, with a higher sugar mix and comfortable biofuel stocks."

The Sugar Saga of 25/26: What to Expect

- Hedgepoint updated its models and expectations for the Brazilian Center-South 25/26 crop based on data for NDVI, rainfall, temperature, and soil moisture.

- Soil moisture improved in late 2024, remaining below average but better than 2023 levels; rainfall positively impacted cane development in key regions.

- The intercrop period had temperatures 1.5ºC lower than the previous year, indicating a recovery in TCH, but poor cane condition in 2024 could limit the upside, as a marginal reduction to area.

- Center-South region is expected to have more sugar availability next season with a higher sugar mix and comfortable biofuel stocks.

- Indian domestic prices rose 4% in January, while raw sugar prices corrected, increasing export parity. If we exclude India's 1 Mt exports, trade flow in Q2-25 would show tighter availability, meaning its export parity is a good level for sugar in the near term.

With the data realized in January for NDVI (Normalized Difference Vegetation Index), rainfall, temperature, and soil moisture, we were able to update our models and thus, our expectations for the upcoming 25/26 Center-South crop.

Soil moisture recovered some ground during the last months of 2024, remaining below average but surpassing 2023 levels. Rainfall has been positive for cane’s development, reaching above average in key producing regions such as Ribeirão Preto, Triângulo Mineiro, Araçatuba, and others, pushing the CS average closer to the norm. This also positively affected NDVI, which showed healthier results than in January 2024 and 2023.

Combining all these with the fact that the intercrop period (between November and January) had temperatures estimated to be 1.5ºC lower compared to the previous year, our model indicated a potential recovery in TCH.

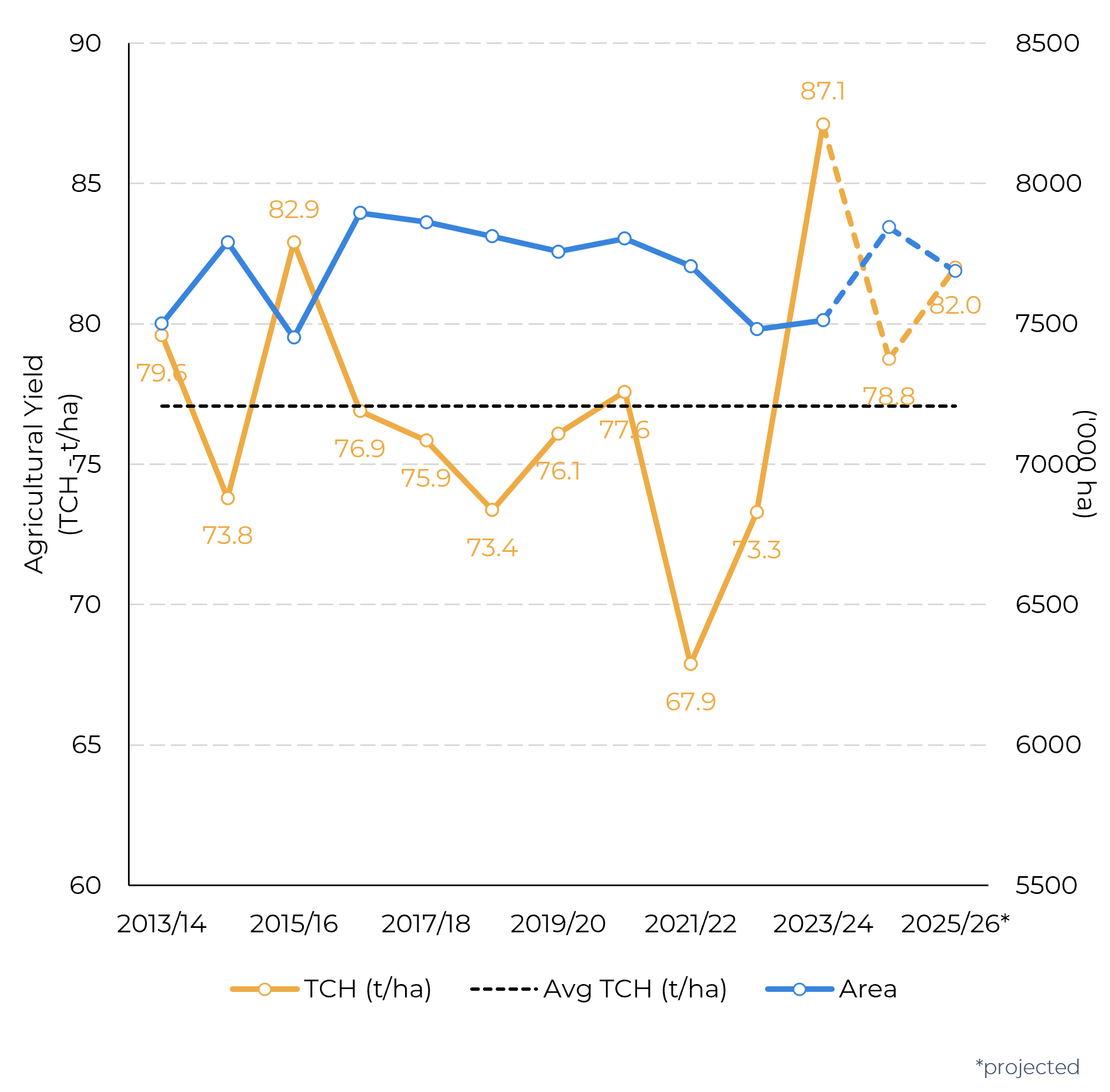

Image 1: Projected Area and TCH for Brazilian CS

Source: Conab, UNICA, CTC, Hedgepoint

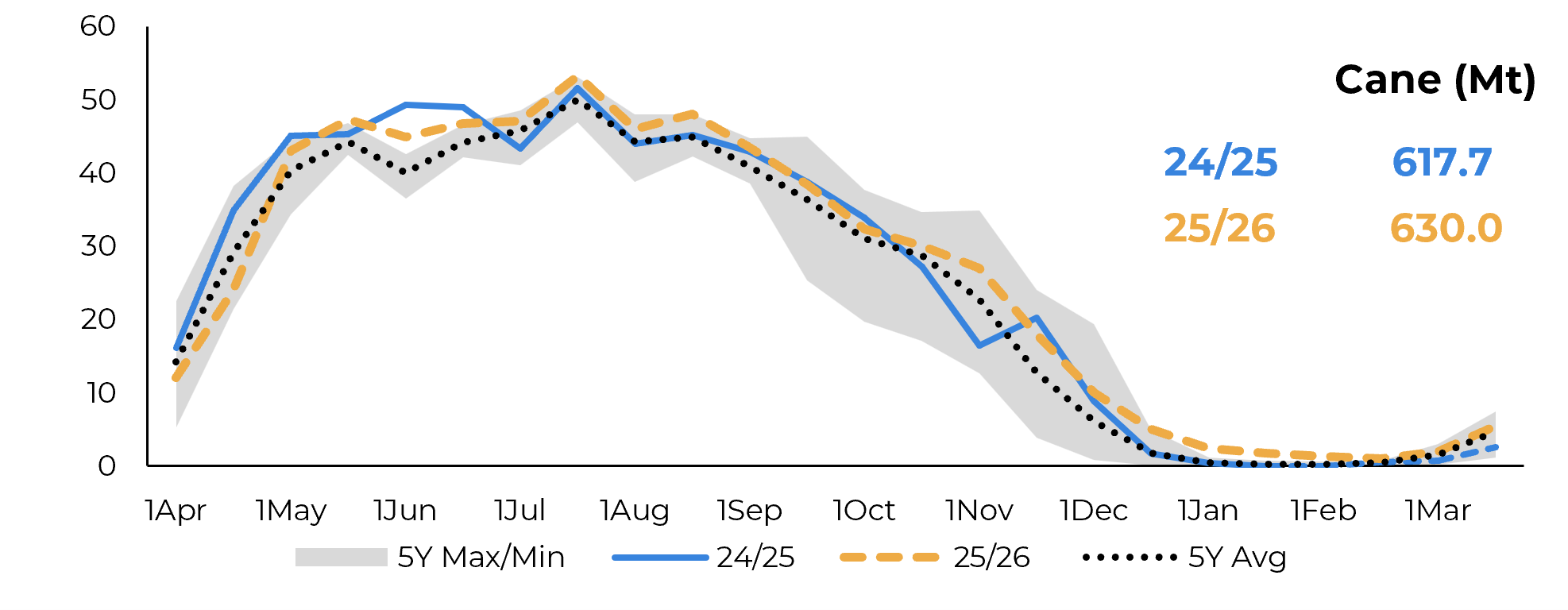

However, the poor condition of the cane during 2024 could limit the upside, making it challenging to return to 23/24 levels. Nevertheless, reaching 82 t/ha is expected, which translates to a production of 630Mt of cane, compared to the expected 617.7Mt during 24/25 – a number that could still surprise upwards.

The limitation to cane figures could also come from a slightly smaller area. While Conab had projected a 4.4% increase in 24/25, fires and poor planting conditions might lead to a reduction from this level in 25/26. We are currently working with a 2% drop in area for the upcoming season. However, this is a critical point to monitor, as there has been some late planting in November, which could still surprise us.

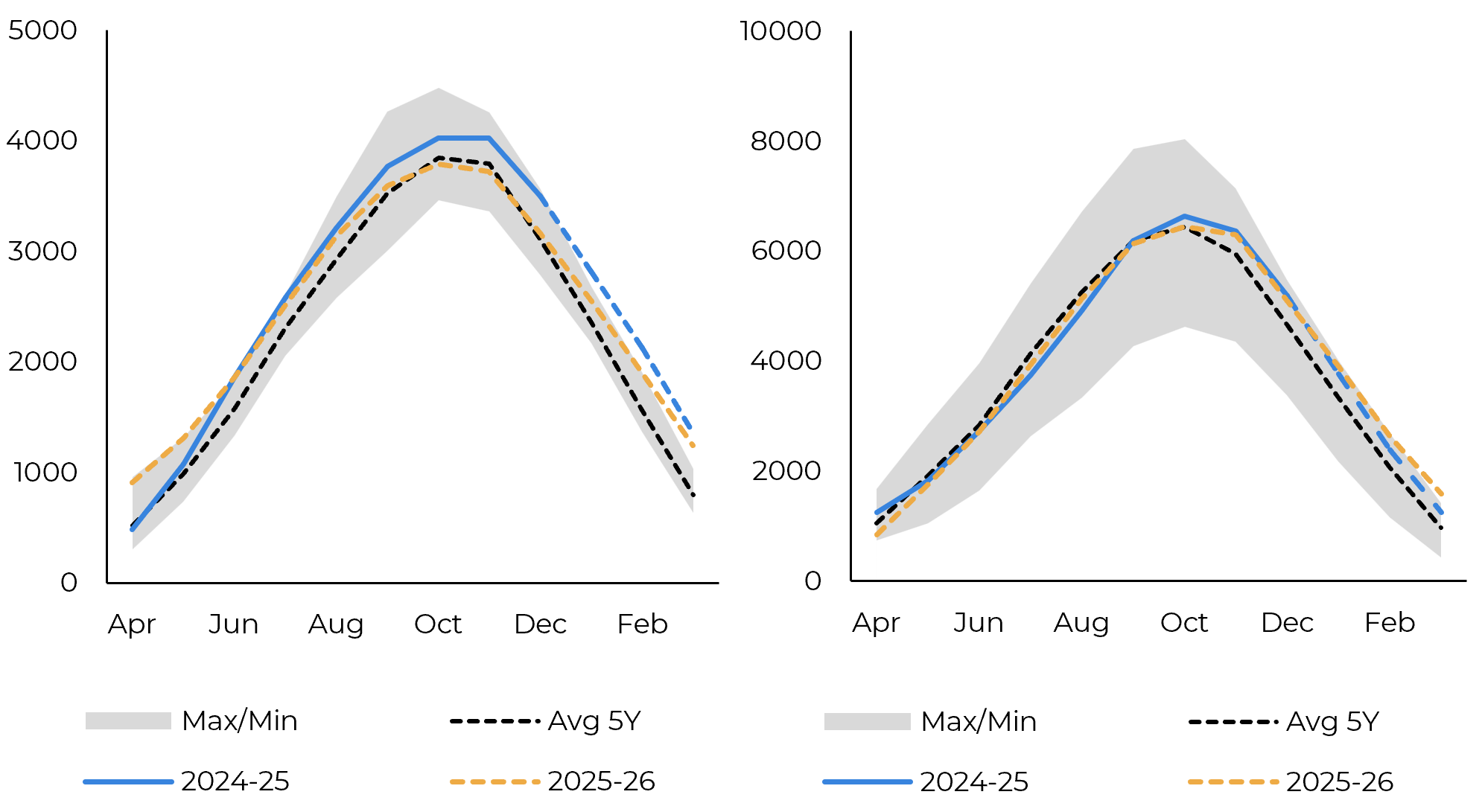

As a result, the Center-South region is expected to have more sugar availability in the next season. This is not only due to an increase in raw material but also because the sugar mix is expected to be higher. While sugar still pays quite a premium over ethanol, the increase in corn-ethanol production and the availability of more raw material make the biofuel stocks quite comfortable.

The limitation to cane figures could also come from a slightly smaller area. While Conab had projected a 4.4% increase in 24/25, fires and poor planting conditions might lead to a reduction from this level in 25/26. We are currently working with a 2% drop in area for the upcoming season. However, this is a critical point to monitor, as there has been some late planting in November, which could still surprise us.

As a result, the Center-South region is expected to have more sugar availability in the next season. This is not only due to an increase in raw material but also because the sugar mix is expected to be higher. While sugar still pays quite a premium over ethanol, the increase in corn-ethanol production and the availability of more raw material make the biofuel stocks quite comfortable.

This is true even when considering a 2% growth in demand and the implementation of a 30% blending of anhydrous on gasoline starting in June. Therefore, there is no indication that mills could change their revenue maximization solution: they should still prioritize the sweetener.

Image 2: Cane Crushing per Fortnight in Brazilian CS (Mt)

Source: UNICA, Hedgepoint

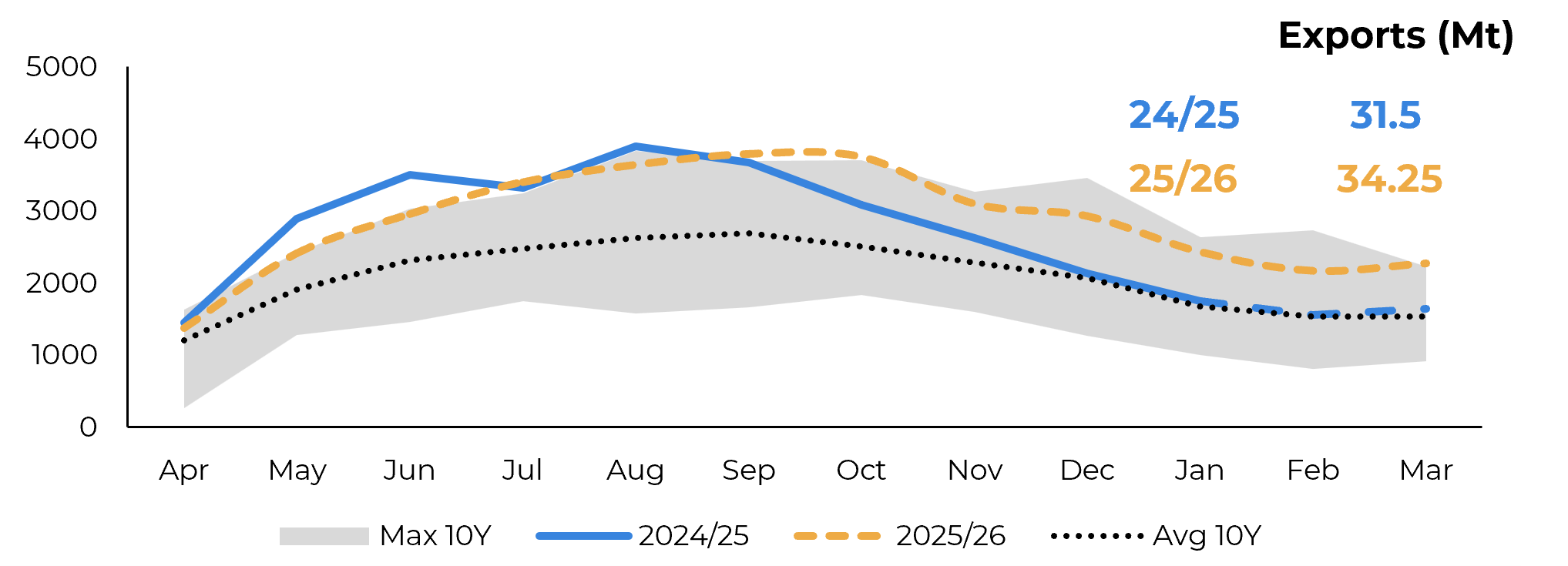

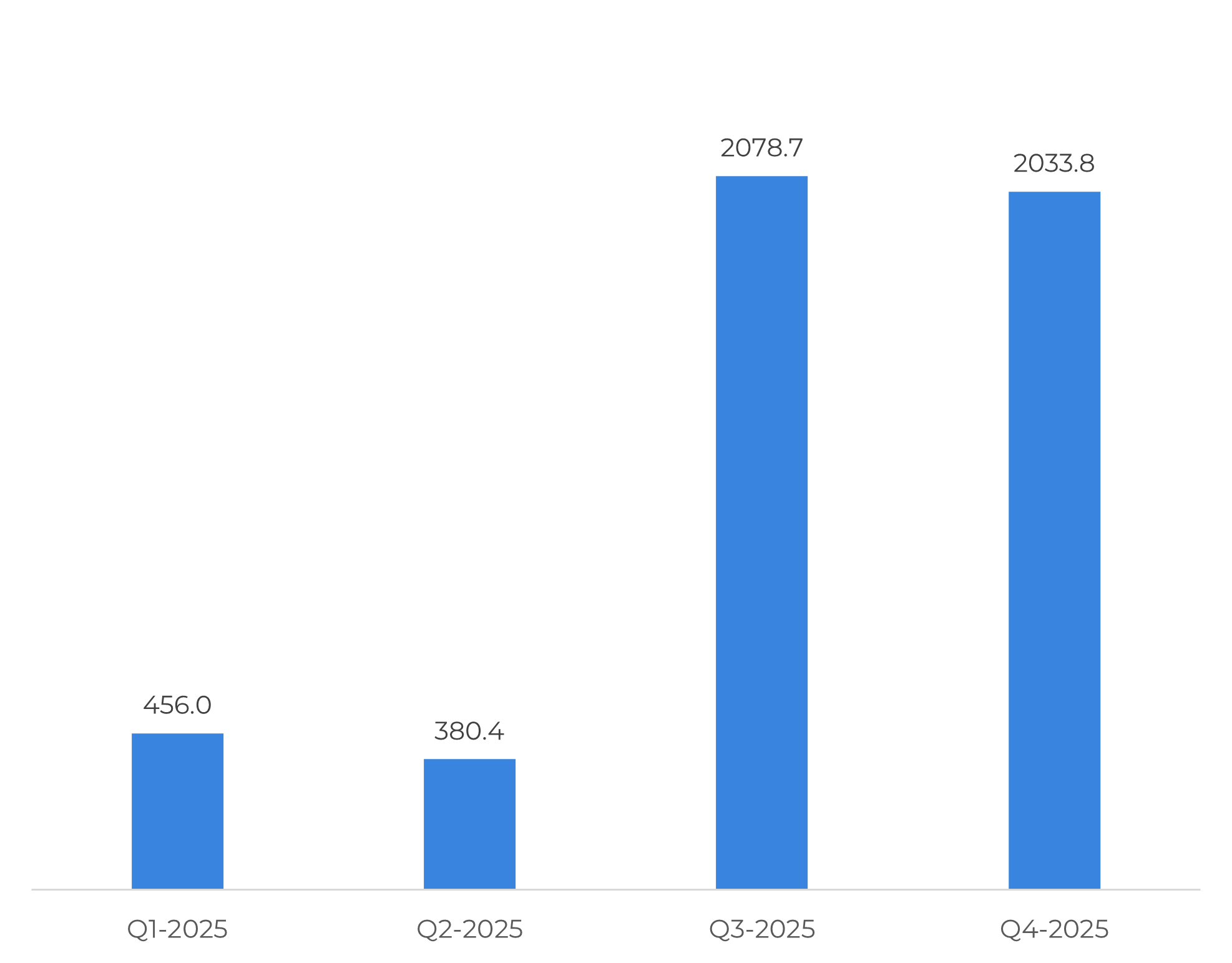

Image 3: CS Total Sugar Exports (‘000 t)

Source: Source: SECEX, Williams, Hedgepoint

Image 4: Ahydrous (left) and Hydrous (right) Stocks (‘000 m³)

Source: UNICA, Hedgepoint

Adding to that, some investments that were made between 2023 and 2024 to crystallization capacity are expected to be fully operational, making it possible to reach 51% during 25/26. Of course, the main risk to this view would be another year of poor cane quality with higher reducing sugar concentration.

Nevertheless, as discussed earlier, weather conditions have improved. Typically, such quality issues are linked to short-term events. For instance, 2024 dryness affected the quality of that year's crop, and the higher concentration of reducing sugars wasn’t a result of any condition recorded in 2023. Therefore, we need to wait and monitor if we will have any anomalies that could bring the sugar mix down.

Image 5: Total Trade Flows (‘000t)

Looking at the current weather forecasts, especially regarding climate events, 2025 is expected to be a neutral year, neither a strong El Niño nor a La Niña is predicted. This trend usually brings weather closer to the norm and guarantees a healthier result.

However, there might be some incentive to start the crushing season a little later. Since there isn't expected to be any leftover cane, some mills might be willing to wait a bit longer for the cane to develop before beginning the crushing season. As a result, we could see exports picking up pace later, perhaps by the end of May. This is especially true when compared to 24/25, when the region had leftovers to start quite quickly and early. Therefore, trade flows can still be somewhat supportive until the next Brazilian season is up and running. Once Brazil starts crushing, prices might find themselves in a quite bearish stance.

However, there might be some incentive to start the crushing season a little later. Since there isn't expected to be any leftover cane, some mills might be willing to wait a bit longer for the cane to develop before beginning the crushing season. As a result, we could see exports picking up pace later, perhaps by the end of May. This is especially true when compared to 24/25, when the region had leftovers to start quite quickly and early. Therefore, trade flows can still be somewhat supportive until the next Brazilian season is up and running. Once Brazil starts crushing, prices might find themselves in a quite bearish stance.

Source: Green Pool, Hedgepoint

Until then, Brazilian availability is becoming scarce, nearing average levels during the offseason. This trend, combined with India's pursuit of higher prices to export the 1Mt allowed by the government, makes the domestic price from the Asian country the most supportive factor behind the recent uptrend.

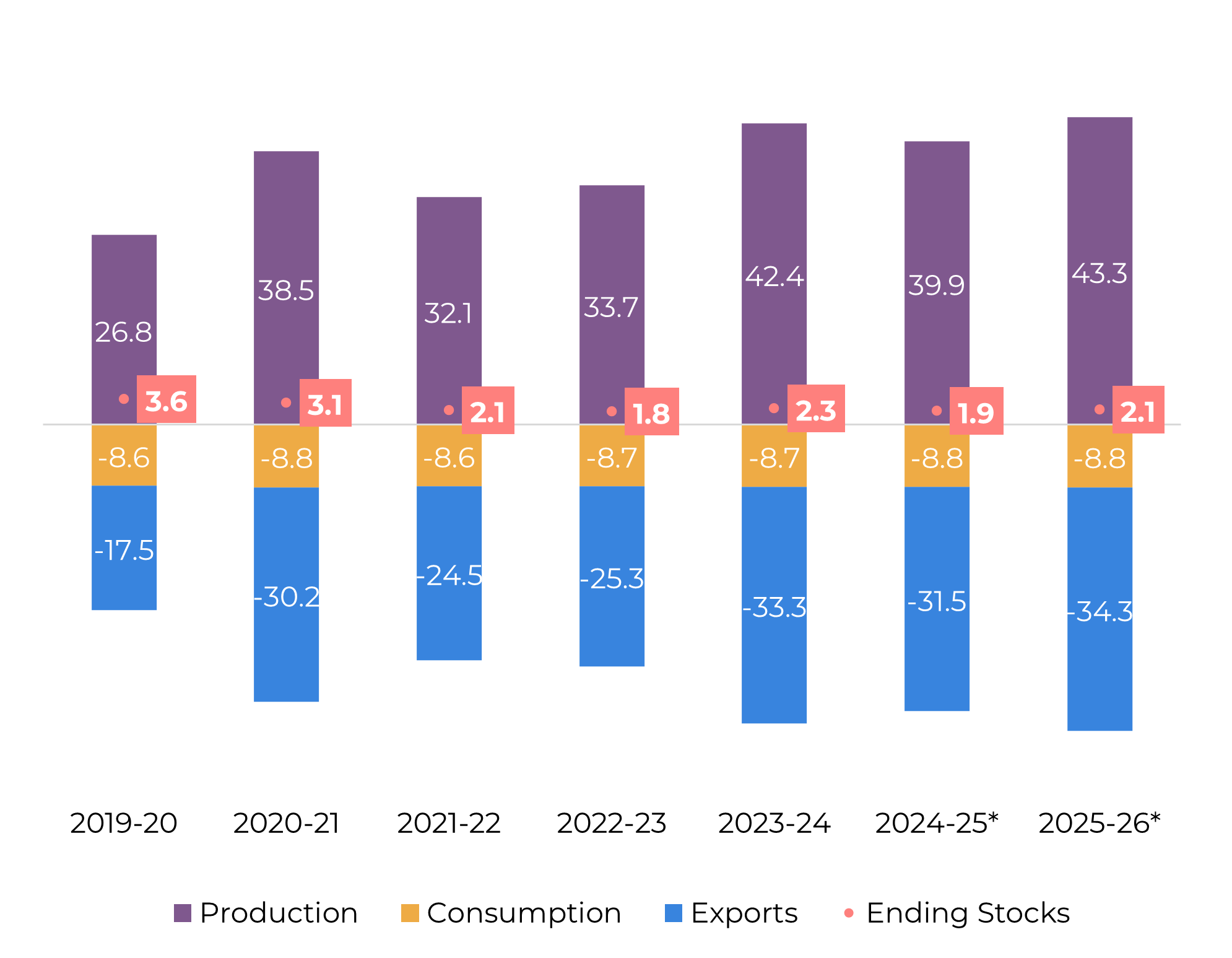

Image 6: Center-South Supply and Demand Balance (Mt)

Source: UNICA, SECEX, Williams, Hedgepoint

Indian domestic prices rose by an average of 4% during January, pushed by lower stocks. Meanwhile, raw sugar prices fluctuated, but the March contract actually managed to drop by 2% over the month. As a result, the export parity rose sharply. For Indian millers to be indifferent between selling in the domestic market and contributing to trade flows, raw prices should be close to 19.7 c/lb. In terms of white sugar, the parity is open, but they are also reportedly asking for higher premiums.

If we exclude the 1Mt exports from India, Q2-2025 would show tighter availability. Therefore, the 19+ level could serve as a short-term floor. However, if demand is comfortable enough to wait for Brazil, the price might orbit around that value until it starts correcting.

Summary

In January, we updated our models and expectations for the 25/26 crop based on NDVI, rainfall, temperature, and soil moisture data. We expect 82 t/ha, translating to about 630Mt, compared to 617.7Mt in 24/25. The Center-South region is expected to have more sugar availability next season, with a higher sugar mix and comfortable biofuel stocks. Weather conditions have improved, and 2025 is expected to be a neutral year, bringing weather closer to the norm. Some mills might start the crushing season later, leading to exports picking up pace by the end of May. Until then, Brazilian availability is becoming scarce, and India's pursuit of higher prices supports the recent uptrend. Indian domestic prices rose by 4% in January, while raw sugar prices corrected. If we exclude the 1Mt exports from India, Q2-2025 would show tighter availability, with the 19.5c/lb level serving as a short-term floor. If demand waits for Brazil, prices might hover around that value until correcting.

Crop Update - Sugar and Ethanol

Written by Lívea Coda

livea.coda@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Reviewed by Laleska Moda

laleska.moda@hedgepointglobal.com

laleska.moda@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without intending to create obligations or commitments to third parties. It is not intended to promote or solicit an offer for the sale or purchase of any securities, commodities interests, or investment products. Hedgepoint and its associates expressly disclaim any liability for the use of the information contained herein that directly or indirectly results in any kind of damages. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests, such as futures, options, and swaps, involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgment and/or consult advisors before entering into any transactions. Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately. Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only). Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets. “HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.