Jun 30

/

Lívea Coda

Crop Forecast: Sugar Center-South - 2025 06 30

Back to main blog page

"Commodity markets faced a turbulent week, with geopolitical tensions and a failed ceasefire attempt. While sugar prices held steady near 16 c/lb, concerns over light frosts in Brazil’s Center-South and lower-than-expected yields, prompted a downward revision in cane estimates. Despite a marginally tighter supply outlook that could support prices, strong Northern Hemisphere crop prospects, weak energy signals, and cautious fund behavior continue to challenge any near-term price recovery."

Center-South crop update: marginally tighter

- Geopolitical tensions eased, even with a failed ceasefire attempt, triggering a wave of losses across commodities, with energy markets correcting and grains under pressure.

- Sugar held steady near 16 c/lb, but light frosts in Brazil’s Center-South and lower-than-expected May yields raised fresh concerns.

- The E30 ethanol mandate, now set for August, came later than expected, easing pressure on biofuel stocks.

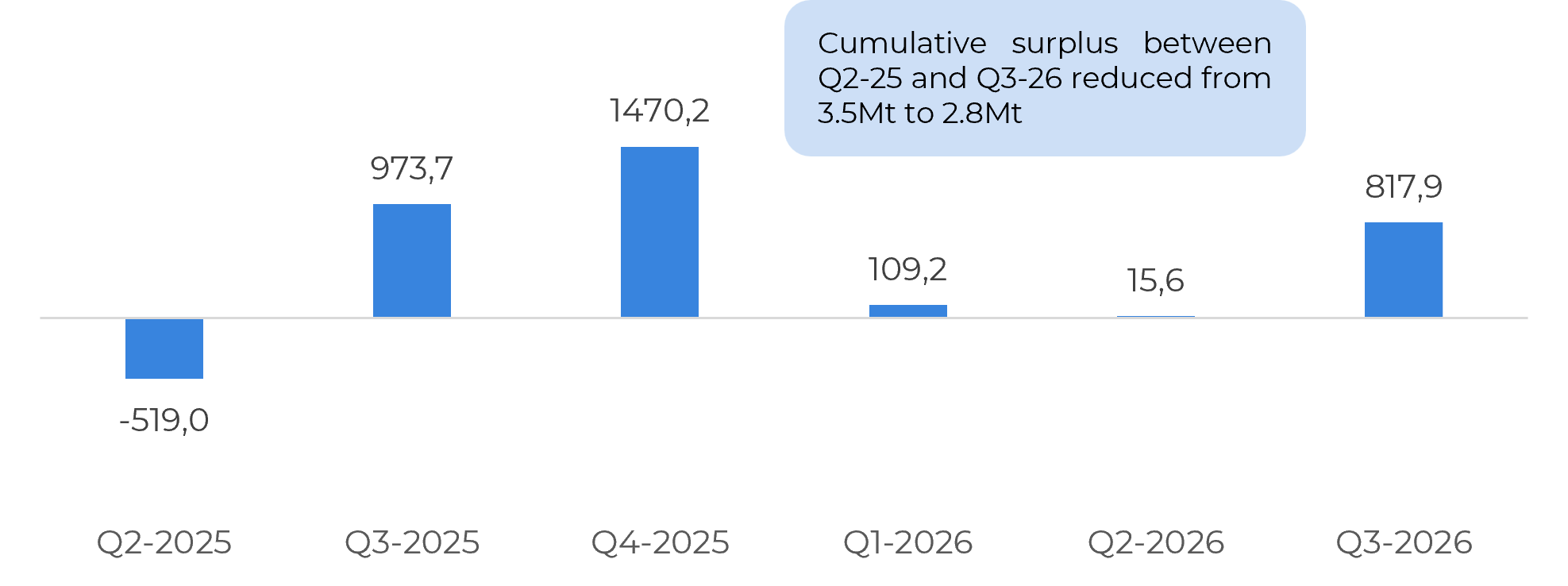

- Cane and TRS estimates were revised down, trimming sugar availability and exports, marginally tightening the global surplus to 2.8Mt.

- Despite a bearish tone, weather risks and tighter supply could lift sugar prices above 17 c/lb, if the market is able to fight other unencouraging news, such as a healthier Northern Hemisphere.

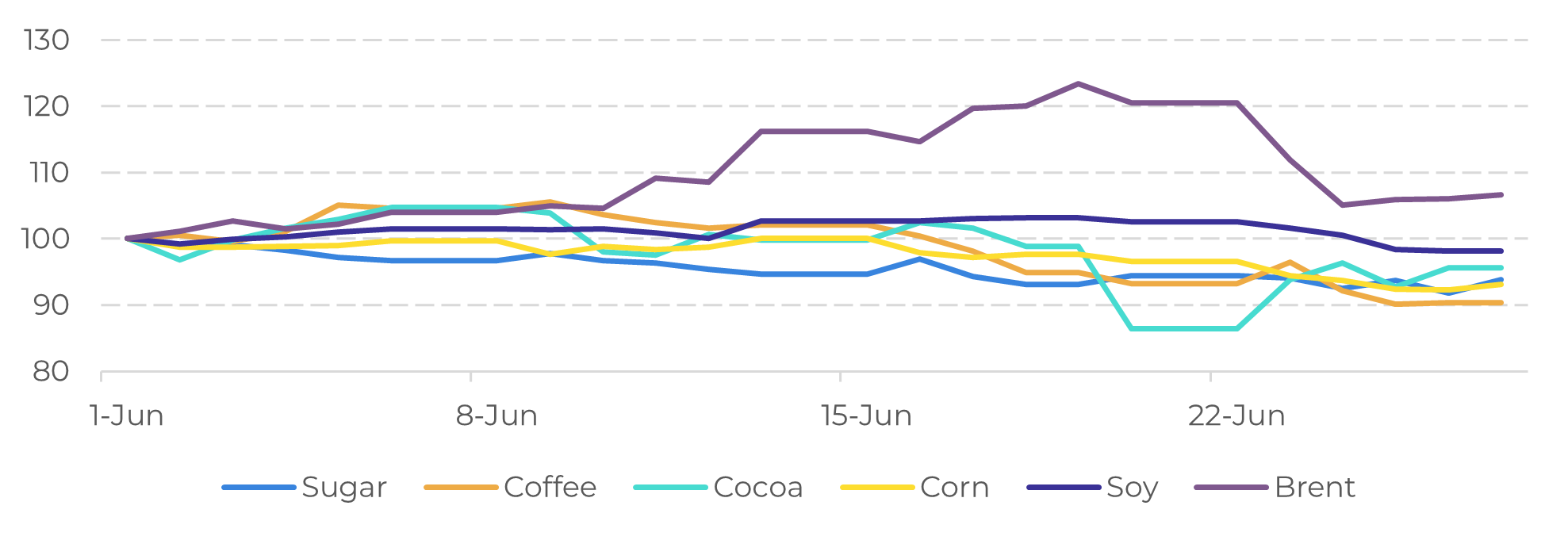

Image 1: Commodity Price Variation Index (June 1 = 100)

The commodity market experienced notable challenges over the past week, primarily influenced by new developments to current geopolitical tensions. Between June 23 and 24, a ceasefire initiative announced by U.S. President Donald Trump proved unsuccessful. Nonetheless, the announcement temporarily eased market sentiment, prompting a technical correction within the energy complex as negotiations toward a potential agreement continued.

Source: LSEG, Hedgepoint

On Monday 23, for instance, crude oil and other energy-related assets declined between 2 to 4% diminishing the support they had been providing to broader commodity markets. This downturn contributed to widespread losses across various sectors, including soybeans and corn. Sugar prices, meanwhile, remained relatively stable around 16 c/lb, although the prevailing sentiment continues to reflect a more bearish than bullish outlook.

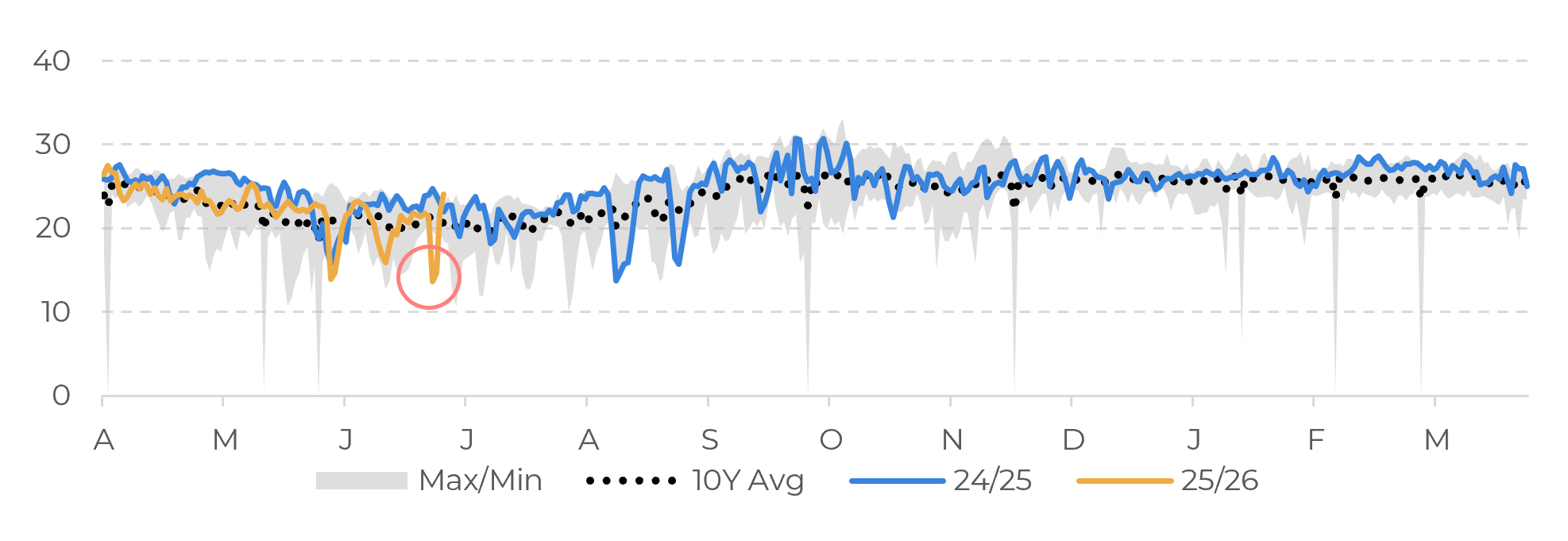

Image 2: Center-South Average Temperature (°C)

Source: Bloomberg, Hedgepoint

In more specific developments within the sweetener market, reports of light frost occurrences in Brazil’s Center-South region have raised concerns. Although there has been no confirmation of severe events or measurable impacts on sugarcane yields, the recent onset of winter heightens uncertainty moving forward. Despite these potential risks, market prices remained largely unresponsive, even when coupled with the announcement on Wednesday, June 25, regarding the implementation of the E30 ethanol blend mandate, scheduled to take effect on August 1, 2025.

Although the latter development may be interpreted by some as bullish, given that it increases the demand for anhydrous ethanol to meet the new blending mandate, most market participants had anticipated its implementation earlier in the season, potentially as early as June, as noted in our previous report (link). Consequently, the perceived delay in enforcement has, in fact, contributed to a more comfortable outlook for biofuel inventories.

The recent frost reports have caught our attention. May’s yields were already lower than expected, and now, even though winter has just started, there have already been some light frosts in the Center-South region. Because of this, we decided to review our models, thus, our cane expectations.

The recent frost reports have caught our attention. May’s yields were already lower than expected, and now, even though winter has just started, there have already been some light frosts in the Center-South region. Because of this, we decided to review our models, thus, our cane expectations.

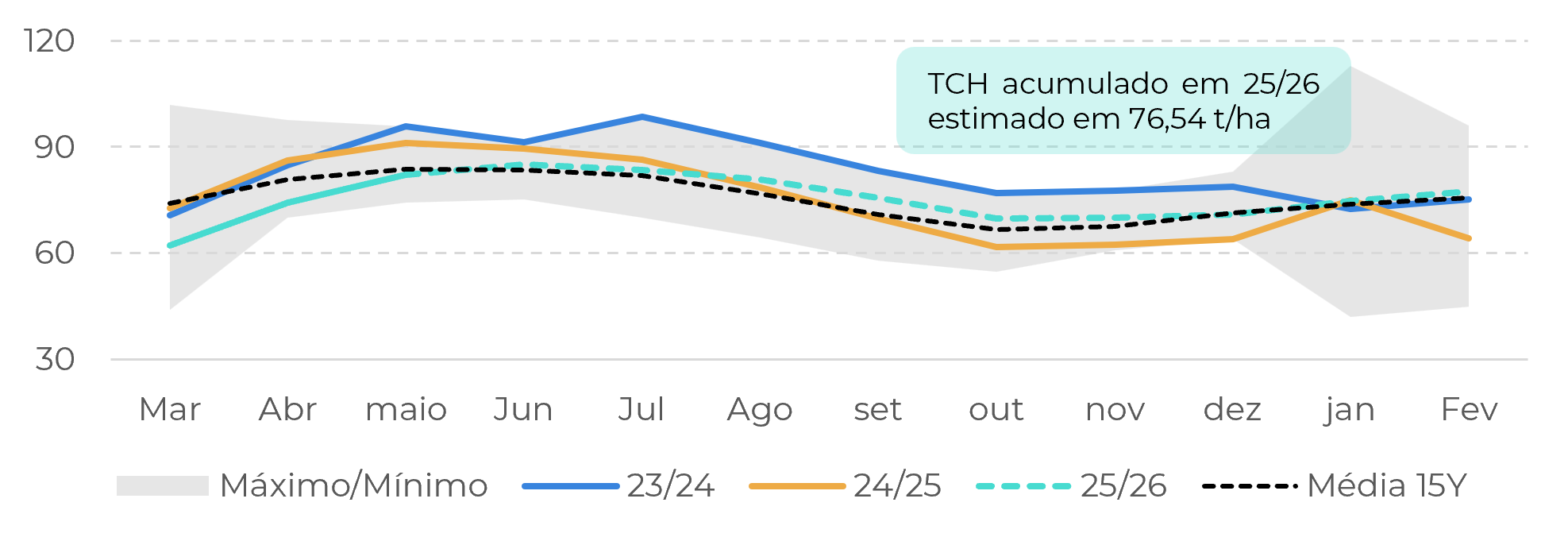

Image 3: Monthly TCH Estimates (t/ha)

Source: CTC, UNICA, Hedgepoint

Even though the Vegetation Health Index still points to generally good conditions in the region, with rainfall levels not much worse than in past seasons, TCH (tonnes of cane per hectare) continues to fall short of expectations. This may be a lingering effect of the stress experienced between August and September 2024, which summer rains were not able to fully reverse. On top of that, the risk of future frosts could further challenge TCH recovery.

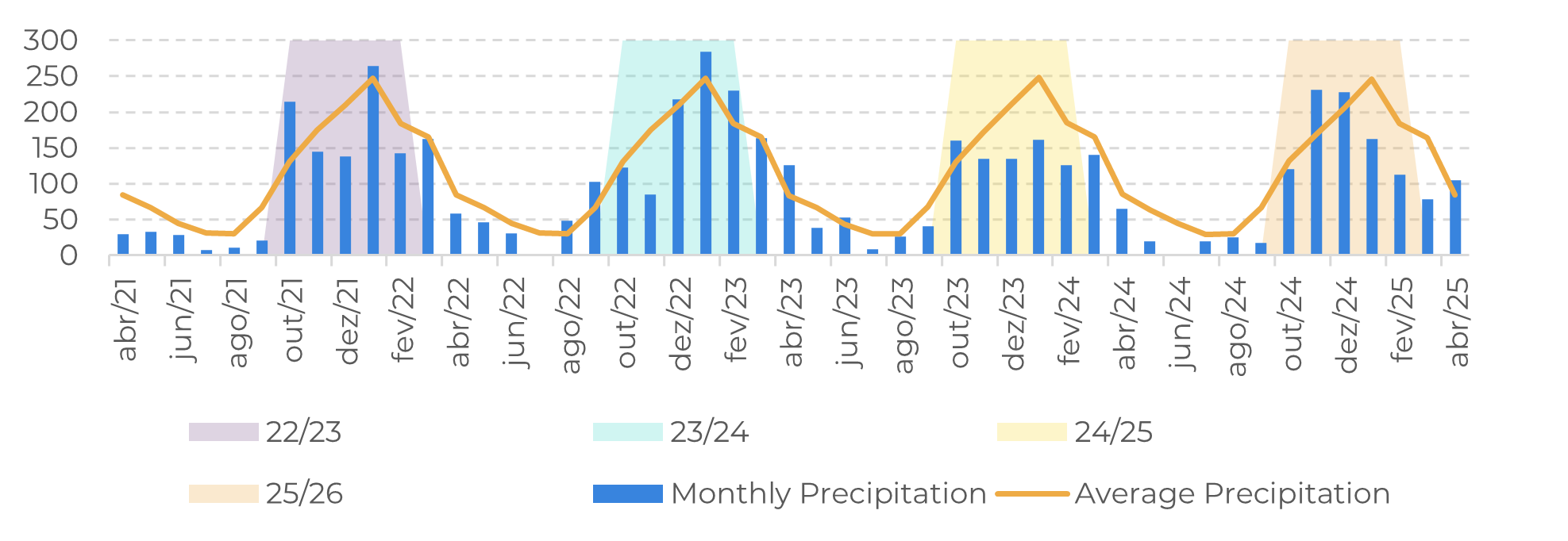

Image 4: Monthly Precipitation vs Average vs Main Crop Development Window (mm)

Taking this into account, and assuming the monthly TCH trend will align more closely with the 15-year average than recent observations, we’ve revised our cane production estimate from 620Mt down to 610Mt. This estimate is still slightly above the market average, reflecting favorable conditions at the start of the season that still allow for a more optimistic outlook, especially given a higher VHI.

Source: UNICA, Hedgepoint

The latest UNICA report made it clear that matching the TRS (Total Recoverable Sugar) levels of the past two seasons will be extremely difficult. As a result, we’ve revised our TRS estimate down to 139.8 kg/t. Regarding the sugar mix, if mills maintain their current pace, it’s still possible to reach around 51.3% for the season.

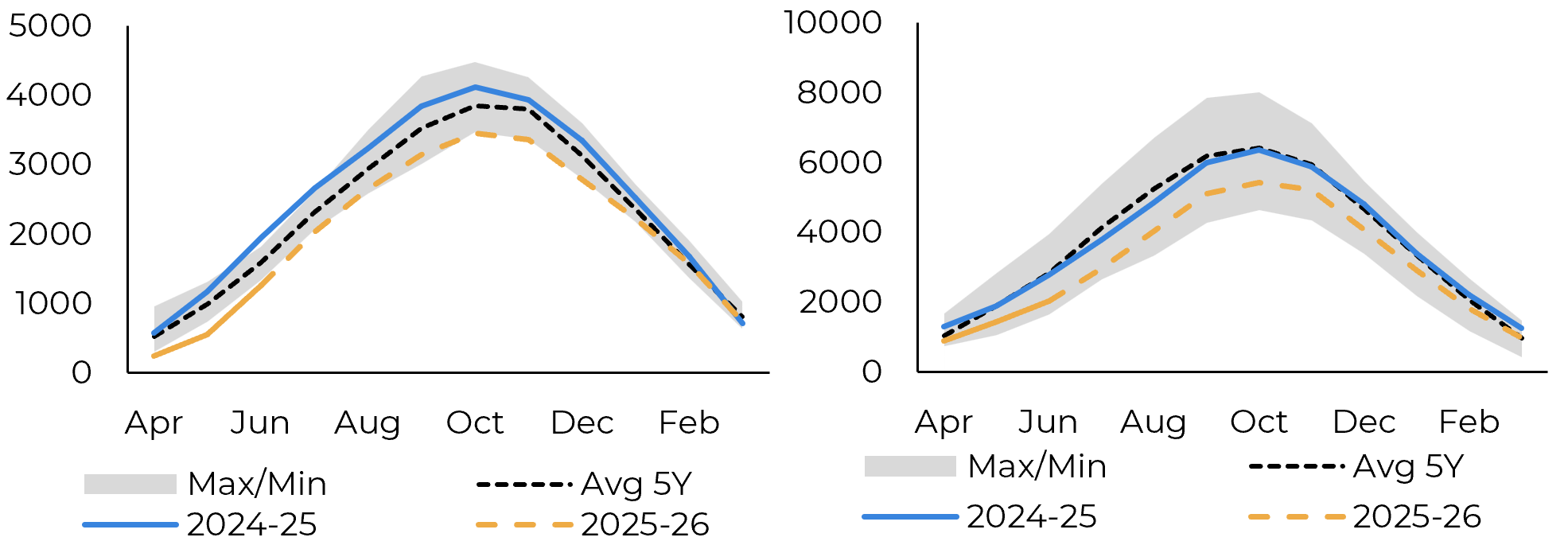

Image 5: Ahydrous (left) and Hydrous (right) Stocks (‘000 m³)

Source: UNICA, Hedgepoint

These adjustments had a limited impact on our ethanol stock projections. This is because our initial crop estimates assumed the E30 mandate would be in place by June, rather than the official start in August. Additionally, hydrous ethanol’s share in fuel demand (not in energy equivalence) has been underwhelming. According to ANP data, April’s volume accounted for just 38%, a 1 percentage point drop from last year, largely due to worsening pump parity. As a result, we’ve also revised our hydrous share in fuel demand expectations for the season downward, which adds some relief to stock levels.

Image 6: Total Trade Flows (‘000t)

On the sugar side, the lower cane volume and TRS reduced availability by 700kt, from nearly 42.4Mt to 41.6Mt. This directly impacted our export forecast, which we’ve adjusted from 33.4Mt to 32.7Mt for the Center-South. Consequently, the surplus available in our global trade flows between Q2-25 and Q3-26 dropped from about 3.5Mt to 2.8Mt. While the overall outlook remains bearish, this tighter balance suggests sugar prices could return to levels above 16 c/lb. With a 2.8Mt surplus and potential weather risks ahead, prices may even rebound to above 17 c/lb.

Source: Green Pool, Hedgepoint

In the short term, however, several factors continue to weigh on sugar’s potential recovery. First, crop prospects in the Northern Hemisphere remain favorable, with positive developments reported in India, China, and Thailand. Second, market activity remains subdued due to a broader risk-off sentiment. Third, support from the energy complex is limited, not only due to recent geopolitical developments, but also because its direct influence on the Center-South fuel market is uncertain under Petrobras’ new cost pass-through policy. Lastly, last-minute sales have consistently capped price rebounds since the end of May.

Investment funds currently lack strong incentives to shift their positions, and the overall outlook for the 2025/26 season remains bearish. However, there are key risks ahead that warrant close monitoring, most notably, weather conditions in Brazil and the potential for frost events during the winter months.

Crop Update - Sugar and Ethanol

Written by Lívea Coda

livea.coda@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Reviewed by Gustavo Costa

gustavo.costa@hedgepointglobal.com

gustavo.costa@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without intending to create obligations or commitments to third parties. It is not intended to promote or solicit an offer for the sale or purchase of any securities, commodities interests, or investment products. Hedgepoint and its associates expressly disclaim any liability for the use of the information contained herein that directly or indirectly results in any kind of damages. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests, such as futures, options, and swaps, involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgment and/or consult advisors before entering into any transactions. Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately. Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only). Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets. “HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.