Aug 8

/

Lívea Coda

Crop Forecast: Sugar Center-South - 2025 08 08

Back to main blog page

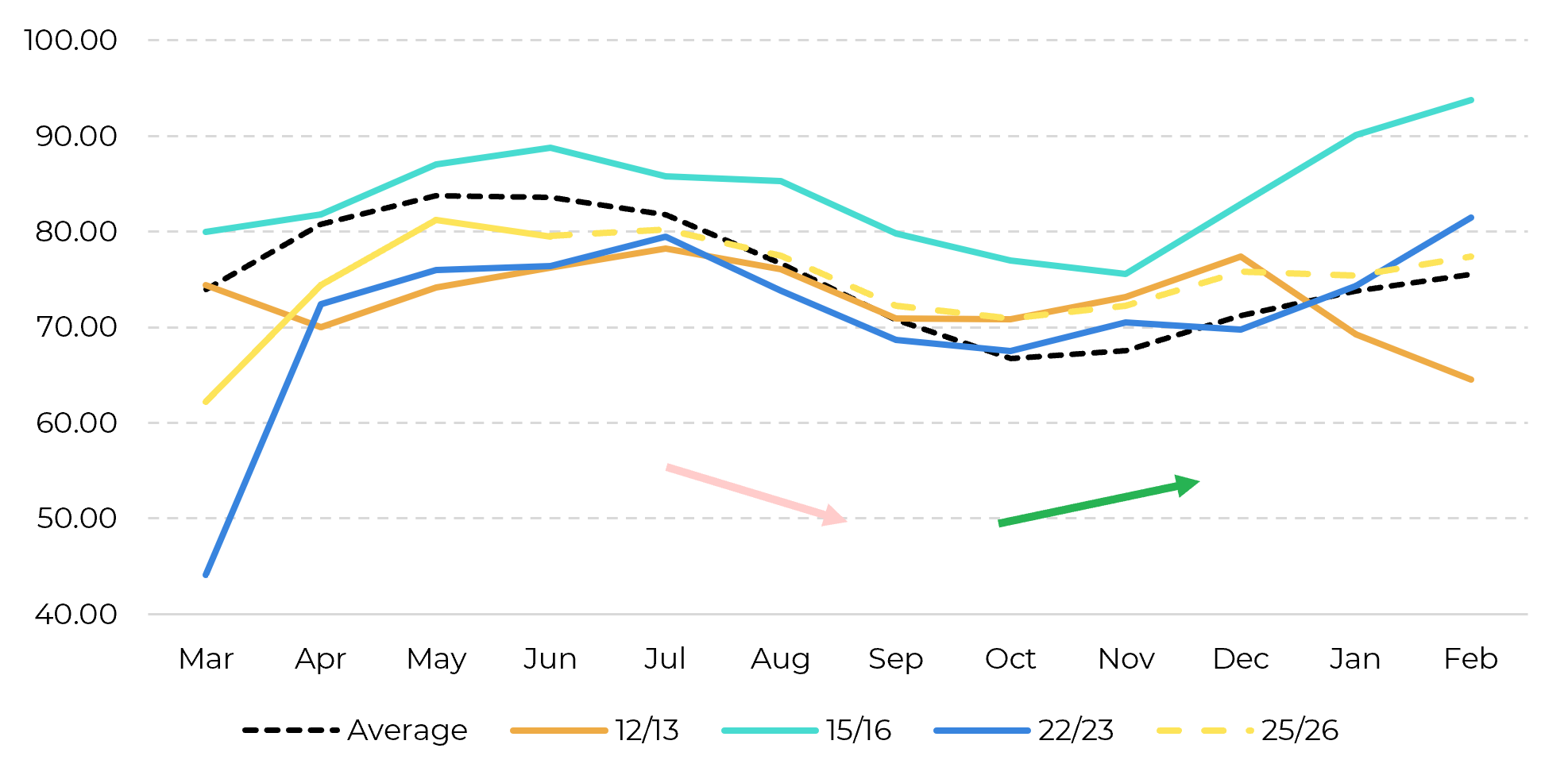

"The 25/26 season is underperforming relative to expectations, largely due to the lingering effects of 2024’s fires and early-2025 dryness, despite the beneficial rains received late last year. These conditions have pressured both TCH and TRS results so far. However, the Vegetation Health Index has shown improvement as crushing progressed, hinting at possible yield resilience ahead. Historical seasons such as 12/13, 15/16, and 22/23 displayed similar VHI trends and experienced TCH recovery in later stages."

Center-South crop update: lower TRS but higher mix

- The 25/26 season is falling short of expectations due to lingering effects from 2024’s fires and early 2025 dryness, despite favorable rains late last year, pressuring TCH and TRS results so far.

- Vegetation Health Index improved as crushing progressed, suggesting the possibility of yield resilience moving forward. Seasons like 12/13, 15/16, and 22/23 showed similar VHI trends and later-stage TCH recovery.

- These years also presented higher than average crushing volume after July’s end.

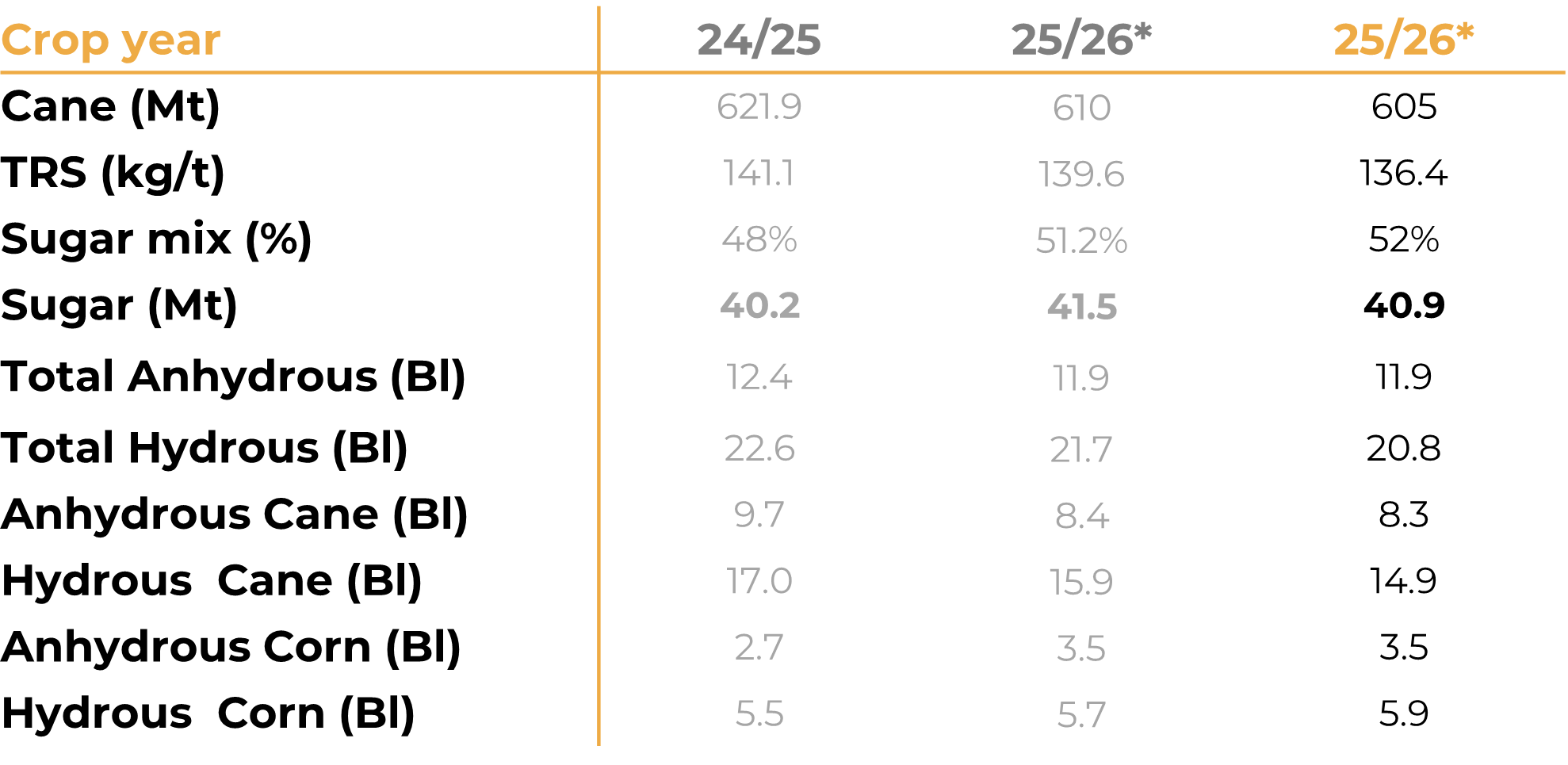

- Despite June’s ethanol diversion discussions, mills are pushing a record-breaking sugar mix, now expected to reach 52%.

- Sugar output is now forecast at 40.9 Mt (down 650 kt), with exports at 31.9 Mt - close to 24/25 levels. This reduction was a result of lower TRS expectations, marginally lower TCH, but higher sugar mix.

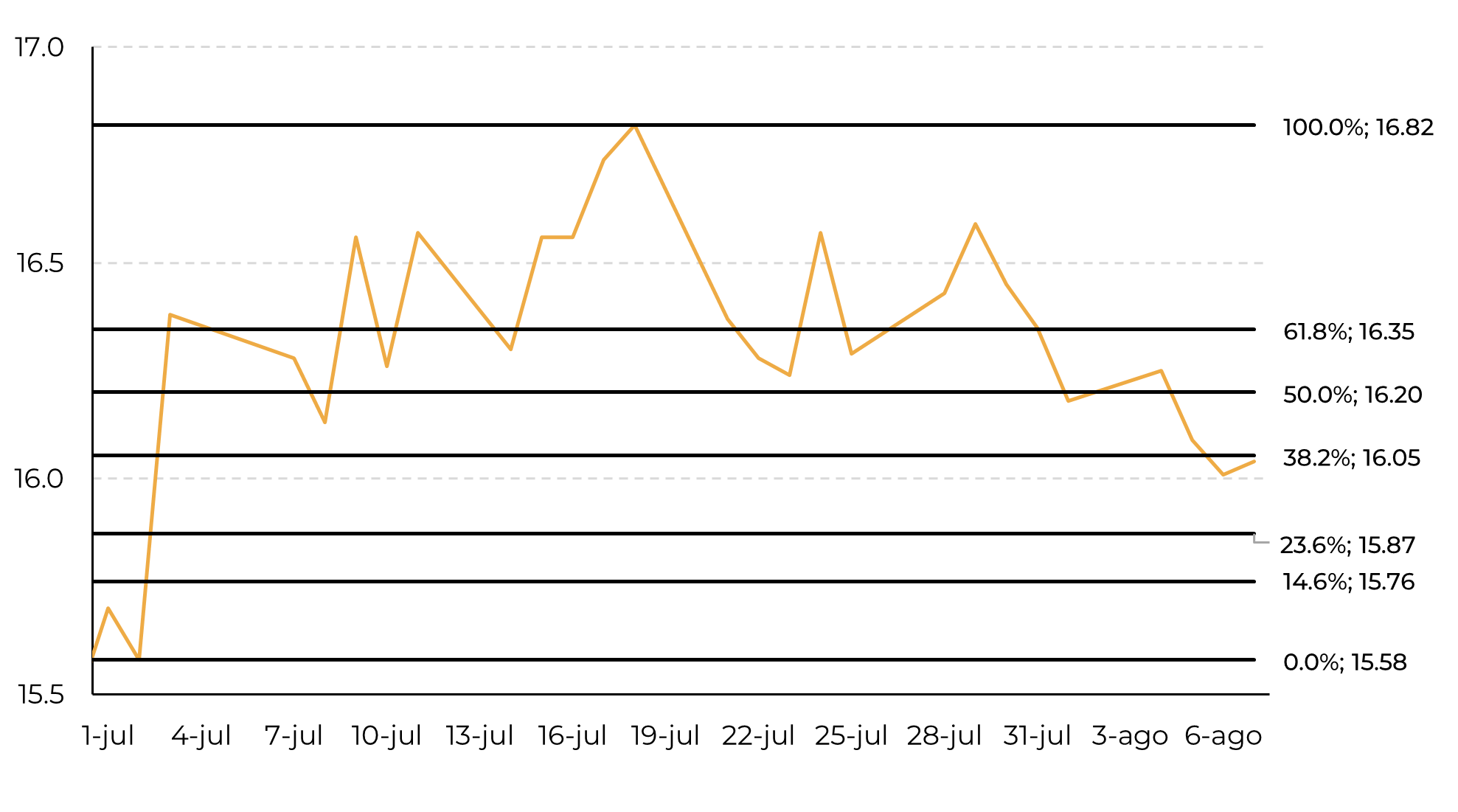

Image 1: Raw Sugar Fibonacci Retracement Levels

During July, raw sugar prices recovered by 65 points, driven largely by developments such as tariff discussions, the possible use of sugar in Coca-Cola production in the US (replacing high fructose corn syrup), tender activity in Pakistan, and a revision upwards of Chinese import figures by China’s Agriculture Ministry. Meanwhile, reports from Unica presented a somewhat mixed picture. While the end-of-June data continued to reflect weak performance, the first fortnight of July showed strong crushing volumes. The ambiguity stems mainly from the fact that TRS remains below previous seasons, while the sugar mix continues to break records, despite earlier discussions about potential diversion to ethanol.

Source: LSEG, Hedgepoint

As a result, August began with some marginal price corrections. Notably, the gap in cumulative sugar production compared to the 24/25 season narrowed from 14.2% to 9.2%, based on the latest fortnightly data from Brazil’s Center-South. Additionally, India released its first estimate for sugar production for the upcoming season. Gross sugar output (before diversion) is projected to rise by 18%, reaching approximately 34.9Mt, up from 29.5 Mt in the current cycle.

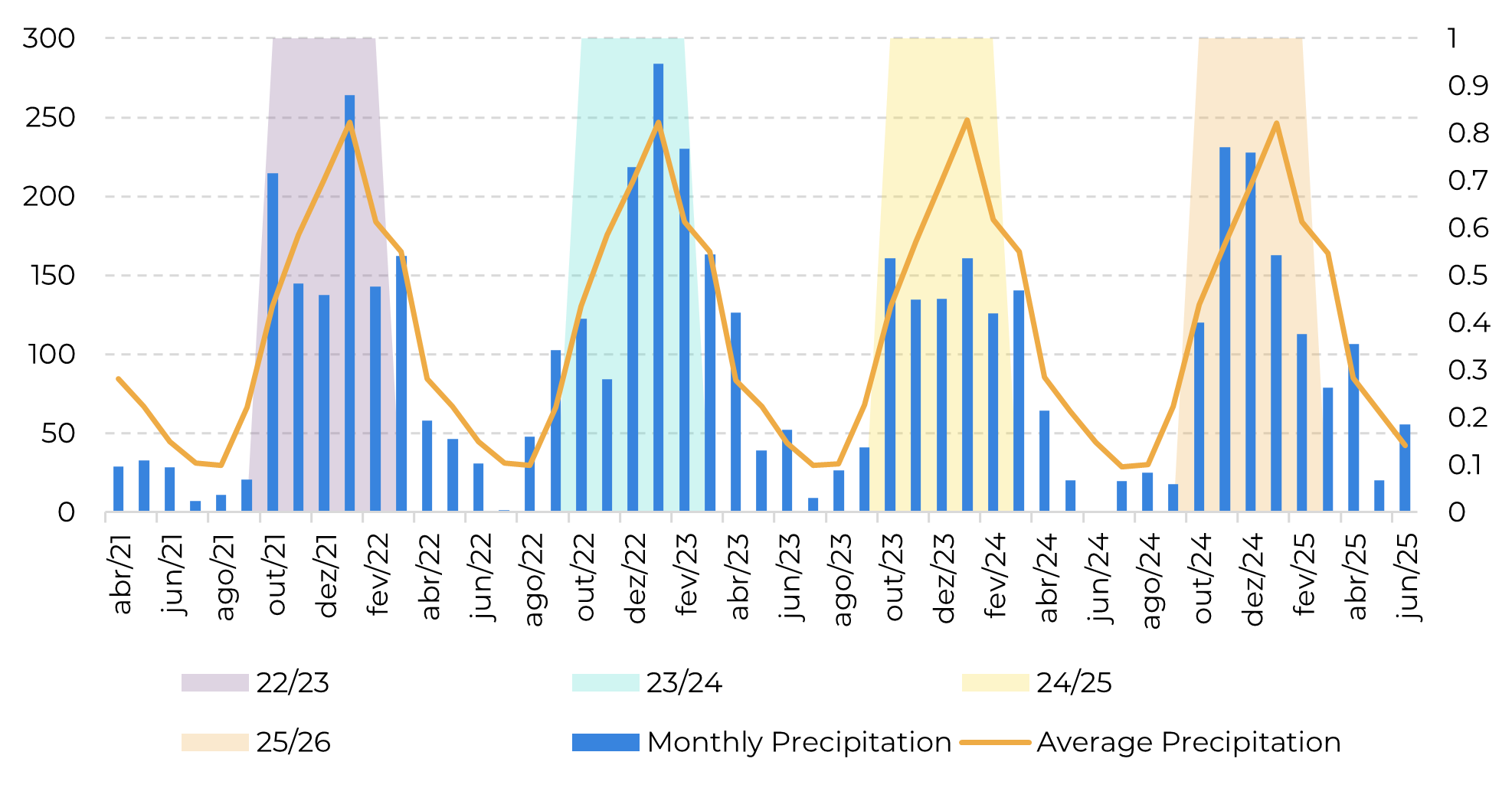

Image 2: Center-South Precipitation vs Average vs Key Development Windows

Source: Unica, Hedgepoint

While the market appears to be lacking momentum and we await further developments, our goal in this report is to assess how the latest Center-South results have impacted our figures.

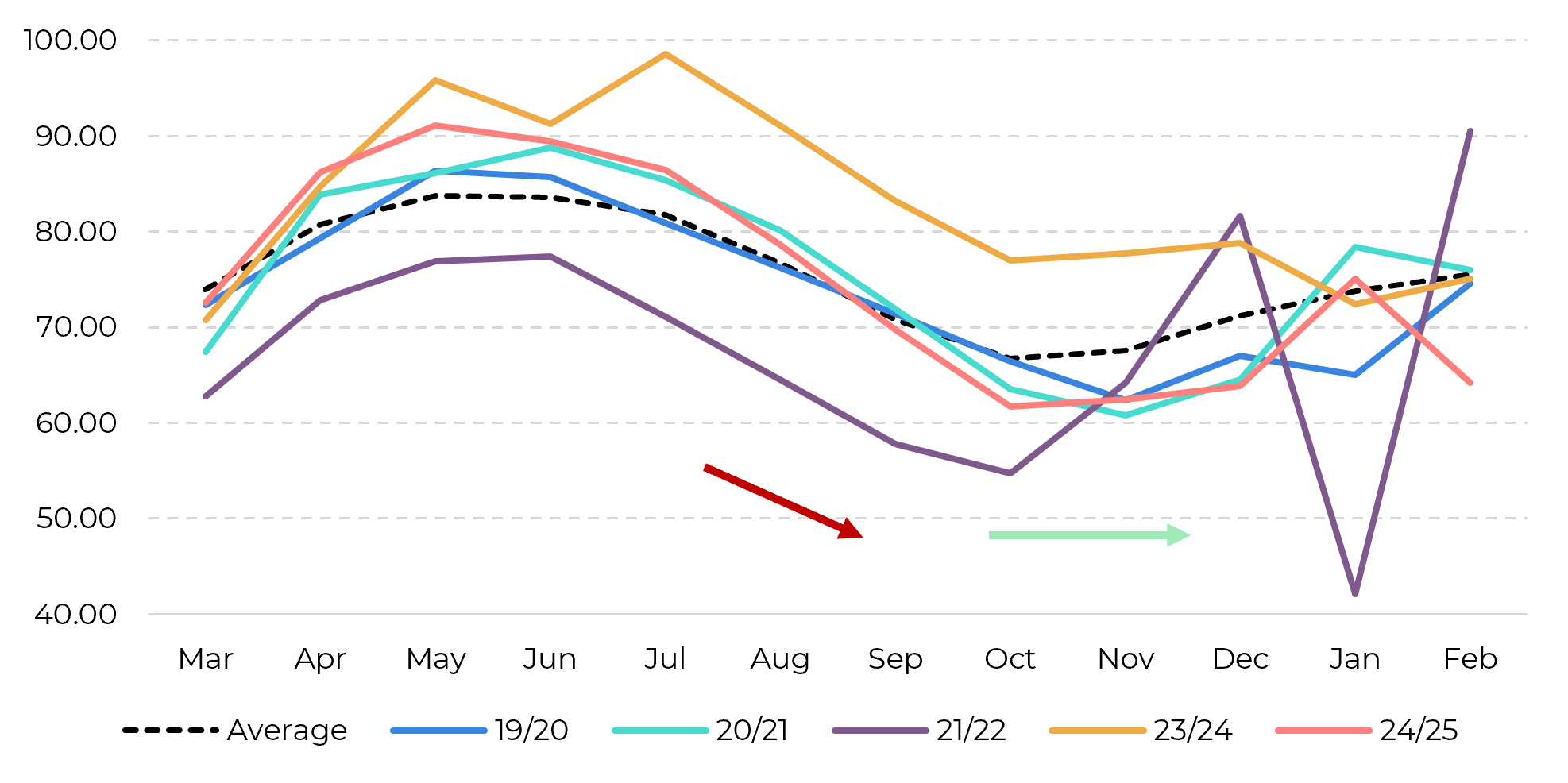

The past few Unica reports have made it clear that both TRS and TCH are underperforming in the 25/26 season compared to initial market expectations. At the end of 2024, many market analysts, including us, anticipated that the new season would surpass the previous one, or would be just as good, especially given the favorable rainfall between October and January, a critical development window for cane in Brazil’s Center-South region.

However, it now appears that the lingering effects of last year’s fires and the dry start to 2025 have negatively impacted the cane that was crushed during the first part of the season.

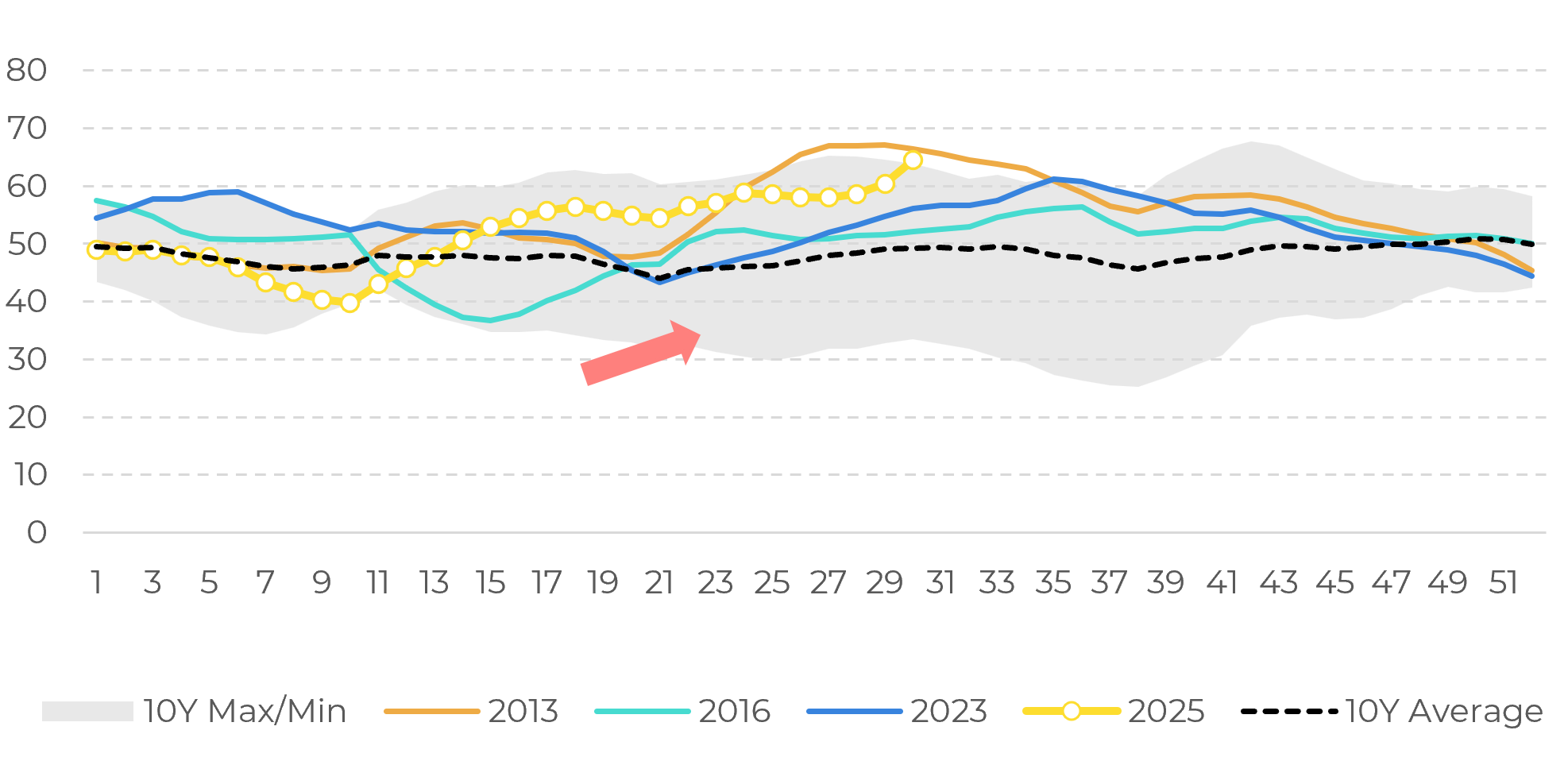

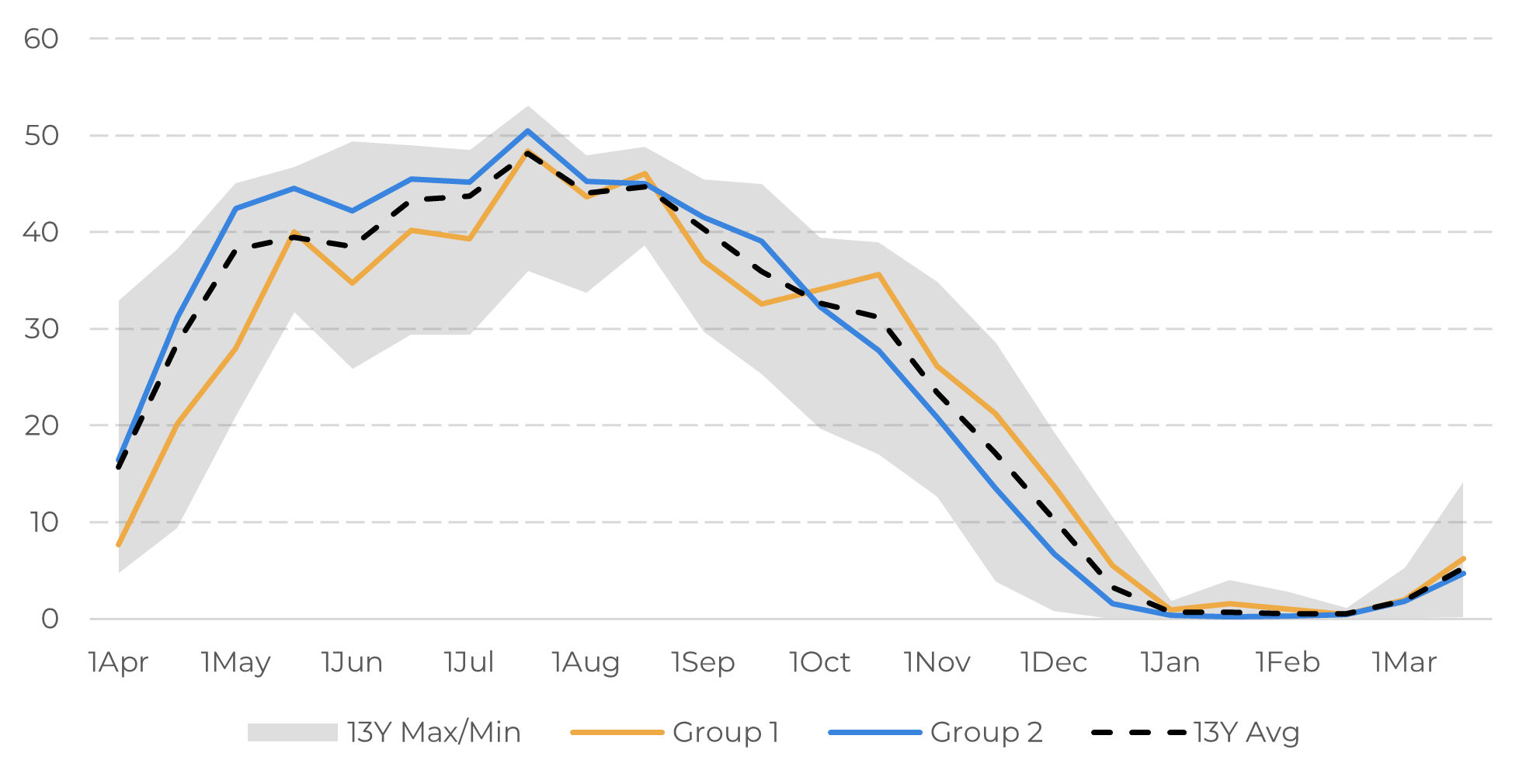

Still, there’s reason to believe the situation may not be as severe as it seems. Analyzing the Vegetation Health Index (VHI), we observe that as crushing activity gained momentum, the index began to show significantly better results. This may suggest that the cane yet to be crushed could yield stronger results moving forward. To explore the potential for TCH resilience, we looked at seasons where final cumulative yields exceeded April’s figures, namely 12/13, 15/16, and 22/23 (Group 1). In each of these years, VHI behavior resembled what we’re seeing in 25/26: a slow start followed by a sharp increase as the harvest advanced.

Still, there’s reason to believe the situation may not be as severe as it seems. Analyzing the Vegetation Health Index (VHI), we observe that as crushing activity gained momentum, the index began to show significantly better results. This may suggest that the cane yet to be crushed could yield stronger results moving forward. To explore the potential for TCH resilience, we looked at seasons where final cumulative yields exceeded April’s figures, namely 12/13, 15/16, and 22/23 (Group 1). In each of these years, VHI behavior resembled what we’re seeing in 25/26: a slow start followed by a sharp increase as the harvest advanced.

Image 3: Vegetation Health Index in Center South per Week - Group 1 (left), Group 2 (right)

Source: NOAA, Hedgepoint

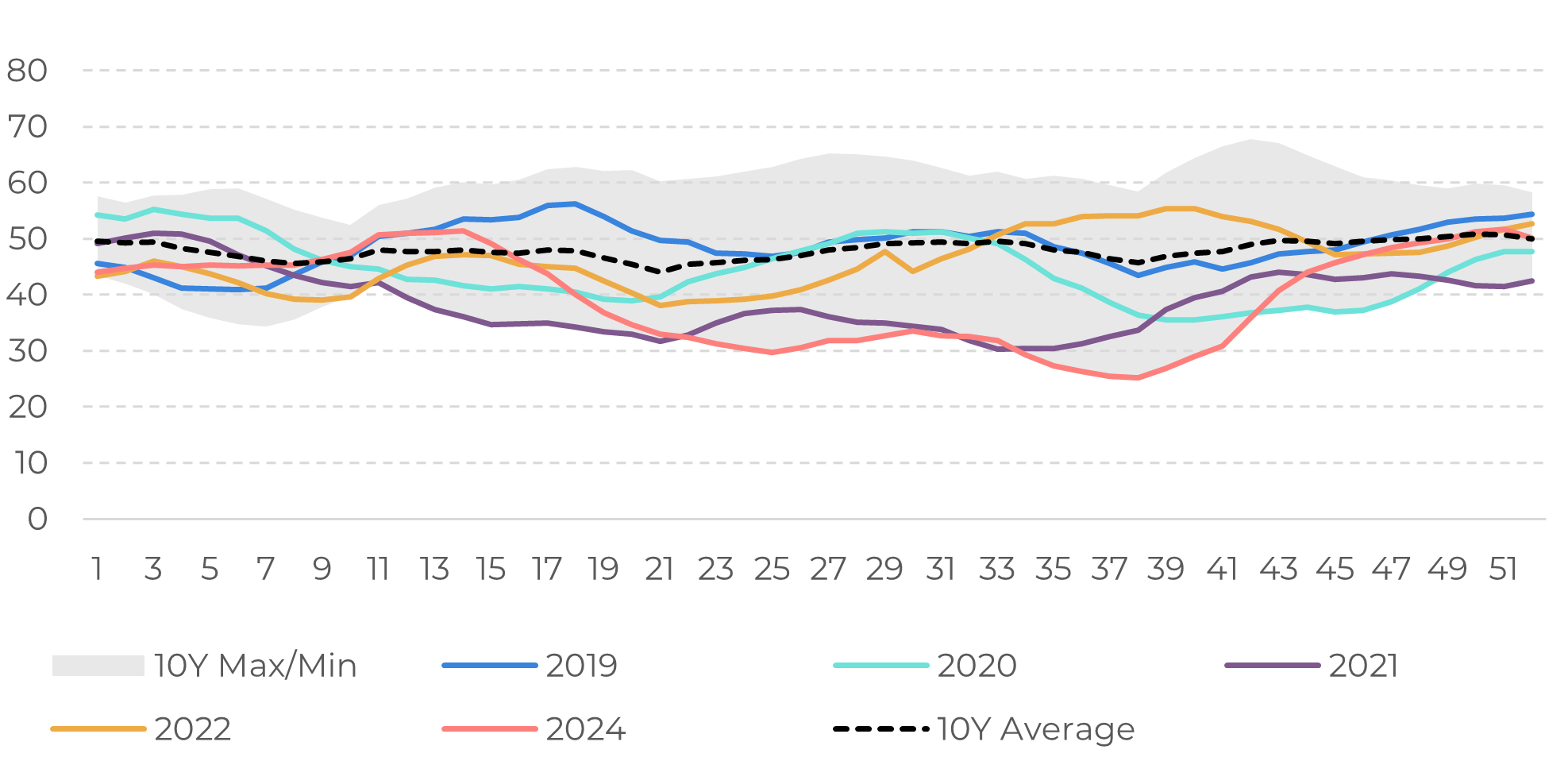

A notable pattern in these seasons was a gentler decline in monthly TCH during the mid-season, indicating some resilience, followed by a more pronounced recovery in the second half of the crop (after July), even when starting from a lower base.

In terms of crushing volume, these three seasons also had more cane being processed after the end of July. For example, while the 13-year average shows that about 50% of the season’s cane is crushed by the end of July’s second fortnight, the average for Group 1 was only 46%. In contrast, recent seasons that didn’t show mid-season VHI recovery nor TCH resilience (24/25, 23/24, 21/22, 20/21 and 19/20 – Group 2) averaged 53% crushed by the same time. Since 25/26 seems to align more closely with the former group, some improvement is likely. Based on our calculations, cumulative TCH could still reach 76 t/ha, resulting in approximately 605 Mt of cane.

Image 4: TCH in Center South - Group 1 (left), Group 2 (right)

Source: CTC, Unica, Hedgepoint

TRS, however, presents a more complex challenge. With weather not appearing to be a major limiting factor this year, the lower TRS values seem to be closely tied to yield issues. Therefore, while some improvement may occur alongside TCH recovery, historical comparisons with Group 1 suggest limited upside. Our analysis points to a TRS level around 136.4 kg/t, which would constrain final sugar and ethanol production volumes.

Regarding the sugar mix, there was considerable discussion until mid-July about the possibility of increased ethanol diversion. However, sugar prices have remained attractive, even with only marginal gains in the international market, and the sugar mix has been surprisingly strong, even breaking records. The past few Unica report already indicated that our previous estimate of 51.2% for the season was too conservative. Given current prices and the increasing difficulty of shifting production, we’ve revised our expectation back to the early-year market consensus: mills will push to reach a 52% level.

Image 5: Crushing Behaviour per Fortnight (Mt)

Source: UNICA, Hedgepoint

Image 6: Crop Estimates Summary

Source: UNICA, Hedgepoint

This shift implies tighter ethanol stocks, not critically so, but enough to suggest higher prices during the intercrop period, which could reduce demand and lend additional support to sugar prices.

Taking all revisions into account, our sugar production forecast has been reduced by approximately 650 kt to 40.9 Mt. This also lowers our export projection to 31.9 Mt, bringing it in line with the results from the 24/25 season. This directly impact our trade flows expectations, making the surplus a little less strong and, therefore, supporting a price level above 16c/lb.

Summary

The 25/26 season is underperforming relative to expectations, largely due to the lingering effects of 2024’s fires and early-2025 dryness, despite the beneficial rains received late last year. These conditions have pressured both TCH and TRS results so far. However, the Vegetation Health Index has shown improvement as crushing progressed, hinting at possible yield resilience ahead. Historical seasons such as 12/13, 15/16, and 22/23 displayed similar VHI trends and experienced TCH recovery in later stages. These years also saw higher crushing volumes after the end of July compared to the long-term average. Despite discussions in June around ethanol diversion, mills are now pushing a record-breaking sugar mix, expected to reach 52%. As a result of lower TRS expectations, slightly reduced TCH, and a stronger sugar mix, sugar output is now forecast at 40.9 Mt, down 650 kt, with exports estimated at 31.9 Mt, closely aligning with 24/25 levels.

Crop Update - Sugar and Ethanol

Written by Lívea Coda

livea.coda@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Reviewed by Gustavo Costa

gustavo.costa@hedgepointglobal.com

gustavo.costa@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without intending to create obligations or commitments to third parties. It is not intended to promote or solicit an offer for the sale or purchase of any securities, commodities interests, or investment products. Hedgepoint and its associates expressly disclaim any liability for the use of the information contained herein that directly or indirectly results in any kind of damages. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests, such as futures, options, and swaps, involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgment and/or consult advisors before entering into any transactions. Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately. Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only). Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets. “HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.